All organizations that pay income tax submit a profit declaration. This declaration contains a large amount of information, in particular about the organization’s intentions to make advance payments for the above tax. Information about such advances is entered in line 210 of the income tax return. From this article you can glean the following information about filling out this line:

- In what order is data entered in line 210;

- What features and nuances should be taken into account when filling out line 210;

- What mistakes can be made when filling out line 210.

The procedure for filling out line 210 when making quarterly advance payments

Quarterly advance payments for income tax are reflected in line 210 of the reporting document as follows:

- In the first quarter, a dash is placed in the field;

- In the second quarter (when filling out a semi-annual declaration), data from sheet 02 of line 180 of the declaration for the previous, that is, the first quarter is transferred to the specified line;

- In the third quarter (in the declaration for 9 months), information from line 180 of the semi-annual reporting is entered into line 210;

- In the annual declaration, line 210 is filled out from line 180 of the reporting for 9 months.

Advance payment is paid quarterly

In cell 210 they indicate what advance payment was accrued and planned to be paid for the previous reporting period. The information is generated based on previous reports. Here's how to fill out line 210 in your income tax return for the year for quarterly settlements:

- 1st quarter - not filled in;

- 2nd quarter (half year) - information from column 180 of sheet 02 of the form for 1st quarter;

- 3rd quarter (9 months) - cell 180 of page 02 of the half-year form;

- 12 months (year) - column 180 of page 02 of the form for 9 months.

The procedure for filling out line 210 when making monthly advance payments for income tax

When making monthly advance payments, the procedure for filling out line 210 differs from the previous method. In this situation it looks like this:

- In the declaration for the first quarter, line 210 is filled in with data from line 320 of the declaration for 9 months of the previous reporting period.

- In the half-year declaration, line 210 is filled in with the sum of lines 180 and 290 taken from the declaration for the first quarter.

- Line 210 of the declaration for 9 months is filled in with the sum of lines 180 and 290 of the previous declaration;

- The annual declaration on line 210 is filled out similarly to the previous two, that is, the sum of lines 180 and 290 of the declaration for 9 months is taken.

Data entered into line 210

The new form and procedure for filling out line 210 in the income tax return for the 2nd quarter of 2021 is enshrined in the order of the Federal Tax Service of Russia No. ММВ-7-3 / [email protected] dated 09/23/2019. In the KND form 1151006 there are several columns 210:

- In section 1 - KBK. In 2021, the KBK for the transfer of profitable contributions to the budget of the constituent entities of the Russian Federation is 182 1 0100 110.

- Sheet 02 contains advances accrued for the reporting period.

- Appendix 3 to sheet 02 contains transactions for the sale of fixed assets, assignments, trust management, etc.

- Sheet 06 contains investments in untraded securities.

- In the appendices to sheet 09 - the profits of foreign companies.

For all taxpayers, it is mandatory to fill out line 210 of the income tax return for 9 months and other periods - KBK and line 210 of sheet 02.

Column 210 of sheet 02 indicates information about the calculated and accrued advance payment for the previous reporting period. The procedure for filling out line 210 in the income statement for the first quarter, half a year, 9 months and a year depends on the method of paying the advance to the budget - monthly, quarterly or based on actual profit.

IMPORTANT!

Taxpayers with quarterly advances do not fill out cell 210 of sheet 02 in the declaration for the 1st quarter.

Line 210 is a summary of tax advances, that is, the total amount of the contribution of 20%. The payment is divided into:

- contribution to the federal budget in the amount of 3% (filling out line 220 is required);

- contribution to the regional budget in the amount of 17% (fill out page 230).

The procedure for filling out line 210 when calculating advance payments from the actual profit of the enterprise

The principle of filling out line 210 when calculating advance payments from the organization’s actual profit is similar to the principle of indicating quarterly payments in the declaration, however, there is still a slight difference. Since profit-oriented enterprises calculate advance payments on a monthly basis, and accordingly fill out an income tax return on a monthly basis, the scheme for entering information in line 210 during the year looks like this.

| Reporting period | The procedure for entering information in line 210 |

| January | A dash is placed in the line |

| January February | The data from line 180 of the previous declaration is inserted into the line |

| January March | Information is entered from line 180 of the previous declaration (for the period January-February) |

| January – April | Indicate information transferred from the declaration January - March on line 180 |

| January – May | The amount specified in line 180 of the previous declaration is transferred |

| January June | The value of line 180 of the declaration for January - May is noted |

| January – July | Indicate data from line 180 of the declaration January - June |

| January – August | Line 180 of the declaration for the previous months of the reporting period (January - July) is transferred to the specified column |

| January – September | Information from line 180 of the declaration for January - August is transferred to line 210 |

| January – October | The data from line 180 of the previous declaration is indicated |

| January – November | The value of line 180 is transferred from the January-October declaration |

| January December | Stock 210 is filled with data from line 180 of the declaration January - November |

The advance is paid monthly and additionally paid quarterly

For monthly calculations with quarterly additional payments, the amount of accrued advance payments for income tax in line 210 for the 1st quarter and other periods is reflected as follows:

- 1st quarter - transfer of information from column 320 of the declaration for 9 months of the previous year;

- half-year (2nd quarter) - the sum of lines 180 and 290 of page 02 of the form for the 1st quarter of the current tax period;

- 9 months - the amount of 180 and 290 pages 02 of the form for half a year;

- year - the sum of 180 and 290 pages 02 of the report for 9 months.

To correctly fill out all fields of your income tax return, use the instructions from ConsultantPlus for free.

to read.

The most common errors in filling out line 210

Accountants of large, medium and small enterprises often submit imperfect declarations. There are different shortcomings, but in this article we will consider the main errors associated with filling out line 210. However, filling out line 210 is incorrect only when other declaration indicators are incorrectly calculated.

Statistics show that often all mistakes made are related to the payment of monthly advance payments. The fact is that when establishing the size of the indicator, the calculation is carried out on the basis of two lines - the amount of monthly advance payments and the amount of accrued and paid taxes in the previous period. Accountants often forget to summarize these indicators. Also, it was previously mentioned that additionally accrued income tax, or rather advance payments, should also be taken into account in this line. If for some reason the report still contains such an error, then it is likely that the tax office will fine you for a violation in the amount of 20% of the amount intentionally unintentionally hidden. Also, based on the results of a desk audit, erroneous information on line 210 may lead to tax authorities demanding additional information, explanations in the form of an explanatory note, as well as documents confirming the amount and timeliness of payment of tax advances.

Tax is transferred based on actual profit

It is filled out in the same way as quarterly mutual settlements, only the information is posted every month.

| Reporting period starting from January | Amount of accrued advance payments for income tax page 210 for the year (continuation of sheet 02) |

| January | Not filled in |

| February | Transfer of cell 180 from the declaration for January |

| March | Count 180 February |

| April | Count 180 March |

| May | April 180 |

| June | May 180 |

| July | June 180 |

| August | July 180 |

| September | August 180 |

| October | September 180 |

| November | October 180 |

| December (year) | November 180 |

The procedure for filling out the income tax return for the first half of 2021

It is mandatory to fill out:

- title page,

- subsection 1.1 and 1.2,

- Sheet 02 and appendices to it: N 1 and N 2.

The remaining sheets, sections and appendices are needed only if you had operations reflected in them. On the title page in the line “Tax (reporting) period” you need to indicate code 31.

In Appendix No. 1 to Sheet 02, it is necessary to reflect revenue and non-operating income for the six months. Appendix No. 2 contains direct, indirect and non-operating expenses and losses.

The total amounts of all income, expenses and losses from the applications should be transferred to Sheet 02. In line 180, calculate the profit tax for the six months, and in line 210, the total amount of advance payments that had to be paid since the beginning of the year. A positive difference between them means an additional payment, a negative difference means a reduction.

The total amount of monthly payments for the 3rd quarter must be reflected in line 290, it is equal to the difference between line 180 of the declaration for the half-year and line 180 of the declaration for the 1st quarter. Line 320 of Sheet 02 does not need to be filled out.

In subsection 1.2, it is necessary to calculate monthly payments for the 3rd quarter according to payment terms. Each payment to the federal budget is equal to 1/3 of line 300 of Sheet 02, to the regional budget - 1/3 of line 310. If the indicators of these lines are not divisible by 3, the balance must be added to the payment for the third term.

In subsection 1.1 you need to indicate the amount to be paid additionally or reduced based on the results of the six months to the federal and regional budgets.

Data entered into line 220

By analogy with column 210, line 220 of the income tax return on sheet 02 is filled out - accrued advances in the amount of 3% for transfer to the federal budget (clause 1 of article 284 of the Tax Code of the Russian Federation). The values for the current reporting period are entered into the cell, taking into account the selected method (frequency) of mutual settlements with the budget.

Column 220 is filled out taking into account information for the previous tax period. Here's how different taxpayers file it:

- For monthly deductions, line 220 includes the advance amount from the form for the previous period and the monthly advance payment to be transferred in each month of the ending quarter of the tax period.

- When paying tax on the actual profit received, information from the form for the previous month is entered into cell 220.

- For quarterly settlements, lines 210 and 220 record the calculated advance according to the previous reporting form and the advances that were additionally accrued based on the results of the desk audit. These payments must be taken into account in the period for which the profit report is submitted.

This is how column 220 is filled in for monthly settlements with the budget:

- Correctly filling out line 220 of the income tax return for the 1st quarter: we transfer page 330 from the report for 9 months of last year.

- Half-year, 9 months, year: p. 220 is defined as p. 300 plus p. 190 minus p. 250 from the previous report.

If the taxpayer calculates the budget from actual profitable income, he fills out column 220 using the formula: line 190 minus line 250 from the previous report. In the form for January, column 220 is not filled in for this payment method.

Normative base

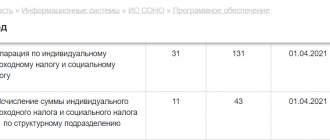

Order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ “On approval of the form of the tax return for corporate income tax, the procedure for filling it out, as well as the format for submitting the tax return for corporate income tax in electronic form”

Order of the Federal Tax Service of Russia dated 11.09 .2020 No. ED-7-3/ “On amendments to the annexes to the order of the Federal Tax Service dated September 23, 2019 No. ММВ-7-3/ “On approval of the tax return form for corporate income tax, the procedure for filling it out, as well as the format providing a tax return for corporate income tax in electronic form""

How to check the data is correct

Correctly filling out line 220 of the profit declaration implies the equality of the following ratios:

- Correctly filling out line 220 of the income tax return for the 1st quarter: line 220 = page 330 of the report for 9 months.

- For half a year, 9 months and annual reporting: page 220 = page 300 + 190 - 250 according to the indicators of the previous report.

When paying advances from actual profits, January is not filled in, but in other periods, column 220 = line 190 - 250 for the previous month.