At first glance, resolving the problem is not difficult. To do this, it is enough to include in the contract with the supplier (or contractor) a condition according to which the latter is obliged to issue an invoice issued in accordance with the requirements established by law. And for failure to comply with the instructions in the same contract, sanctions should be provided, for example, the accrual of penalties, the amount of which will be equal to the amount of the “lost” VAT.

It is really easy to set such conditions. But will they “work” if, due to the partner’s violations, the tax authorities actually deny the company a VAT credit? Alas, there is no clear answer to this question. The problem is that the obligation to issue an invoice and the collection of damages are, so to speak, in different “legal fields”. The first concept is from the field of public law relations, i.e. those in which one of the parties is the state, and the second is from the field of private law. Therefore, by stipulating the above condition in the contract, business partners, i.e. subjects of private law, try to regulate public law relations. It is from this “place” that disagreements between lawyers, tax authorities and judges begin.

note

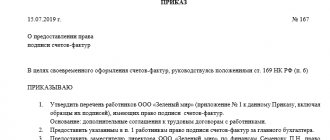

If the supplier does not issue an invoice, but the taxpayer still has time to claim a refund, the latter has the right to file a claim with the arbitration court and oblige the business partner to do this as soon as possible. The Supreme Arbitration Court announced this back in 2004 (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 30, 2004 No. 101/04). However, it should be remembered that such a dispute will be resolved positively only if the corresponding obligation of the counterparty was enshrined in the contract.

Some experts believe that the amount of VAT transferred to the budget cannot be considered a “civil” loss. Because a subject of private law cannot require the counterparty to comply with the rules of another area of law. Accordingly, there cannot be “civil compensation” on the basis of Article 15 of the Civil Code of the Russian Federation. For example, in one of the decisions, the arbitration judges directly stated that such “...the claim of the plaintiff arises from tax legal relations, since the issues of applying a tax deduction are the subject of tax law and are not regulated by civil law...” (Resolution of the Federal Antimonopoly Service of the Ural District dated April 27, 2010 No. A07-14206/2009; similar practice - decisions of the Federal Antimonopoly Service of the Volga-Vyatka District dated September 24, 2008 No. A11-11888/2007-K1-9/605-40 and dated June 9, 2008 No. A17-4226/13 -2007, FAS of the East Siberian District dated September 26, 2006 No. A19-9546/06-16-F02-4769/06-S2, FAS of the Far Eastern District dated January 24, 2005 No. F03-A51/04-1/3254 ; FAS Moscow District dated November 19, 2009 No. KG-A40/11937-09, FAS Ural District dated April 27, 2010 No. F09-2837/10-S2; as well as the resolution of the Sixteenth Arbitration Court of Appeal dated December 29, 2008. No. 16AP-2481/08, etc.).

Read also “Indication of VAT in the contract”

The counterparty does not issue an invoice. How to get a VAT tax deduction

Why do the courts refuse to force counterparties to issue an invoice? How to formulate an agreement in order to receive an invoice from the counterparty. What documents can replace an invoice?

Attention! You are on a professional website for trial lawyers. Registration may be required to read this article.

| Natalya Aleksandrovna Chikunova, lawyer at DS Law Law Firm |

The taxpayer can reduce the total amount of value added tax by the amount of tax deductions (Article 171 of the Tax Code of the Russian Federation).

To receive such a deduction, a number of conditions must be met: the goods (work, services) purchased by the taxpayer, property rights must be intended for carrying out transactions subject to VAT; the taxpayer must accept goods (work, services), property rights for accounting; and finally, the VAT taxpayer must have a properly executed invoice and relevant source documents. If the first two conditions depend entirely on the taxpayer himself, then difficulties may arise with the invoice through no fault of his own. For example, the counterparty may not issue an invoice, and contacting him with such a request may be ineffective. Is it possible that in this case the taxpayer will be deprived of the right to a tax deduction? The law does not give a direct answer to this question, however, judicial practice has developed a certain mechanism of action in case the counterparty refuses to issue an invoice.

Useful documents for trial lawyers

An invoice is the basis for the buyer’s acceptance of goods (work, services), property rights presented by the seller (including the commission agent, agent who sell goods (work, services), property rights on their own behalf), tax amounts to be deducted (clause 1 Article 169 of the Tax Code of the Russian Federation).

Regulatory legal acts regulating the procedure for issuing and processing invoices are the Tax Code of the Russian Federation and Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations for value added tax” (hereinafter referred to as the Resolution No. 1137).

When selling goods (work, services), transferring property rights, as well as upon receiving amounts of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, appropriate invoices are issued (Article 168 of the Tax Code of the Russian Federation) .

These documents are issued no later than 5 calendar days from the date of shipment of goods (performance of work, provision of services), transfer of property rights or from the date of receipt of payment amounts, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

Thus, the seller has 5 days to issue the appropriate invoice to the buyer.

The invoice form, as well as the rules for filling out, are approved by Resolution No. 1137.

At the same time, neither the Tax Code of the Russian Federation nor Resolution No. 1137 provide for a mechanism by which the buyer has the right to require the seller to issue an invoice.

Thus, if the counterparty fails to issue an invoice, the only way to oblige the counterparty to fulfill its obligations is to go to court to protect its violated rights. Judicial practice on this issue has developed ambiguous.

In some judicial acts, courts indicate that the buyer has the right to make a demand to the counterparty to provide an invoice. This approach is based, first of all, on the fact that the requirement is aimed at suppressing violations of civil rights related to the execution of the contract.

For example, the court satisfied the company’s demands that the counterparty be obliged to issue an invoice. The decision of the court of first instance was also supported by higher courts (resolution of the Federal Antimonopoly Service of the Moscow District dated February 10, 2012 in case No. A40-24857/11-62-213). The judges applied the provisions of Art. Art.

12, 309–310 of the Civil Code of the Russian Federation and came to the conclusion that there are grounds for considering the claim as a requirement stated within the framework of civil obligations. The buyer was issued an invoice for the real estate being sold, in which VAT was not indicated in the purchase price.

The court indicated that this circumstance, in essence, does not reflect reliable information about the contract price agreed upon by the parties and is actually aimed at artificially inflating the value of real estate in favor of the seller.

The possibility of presenting demands for the provision of an invoice as a requirement aimed at suppressing violations of civil rights related to the execution of a contract is confirmed by judicial practice (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 30, 2004 No. 101/04).

In this resolution, the Supreme Arbitration Court of the Russian Federation indicated that an interested person has the right to apply to an arbitration court for the protection of his violated or disputed rights and legitimate interests in the manner established by the Arbitration Procedure Code of the Russian Federation (Part 1 of Article 4 of the Arbitration Procedure Code of the Russian Federation). The arbitration court has jurisdiction over cases of economic disputes and other cases related to the implementation of entrepreneurial and other economic activities (Part 1 of Article 27 of the Arbitration Procedure Code of the Russian Federation).

The dispute regarding the committee’s obligation to issue an invoice for the apartment transferred to the plaintiff, since such an obligation is provided for in the contract, is related to the agreement of the parties and arose in connection with the implementation of economic activities.

Some courts refuse to apply the provisions of the Civil Code of the Russian Federation to tax relations

There is also the opposite judicial practice, according to which the methods of protecting rights established by civil law are not applicable to tax legal relations. Therefore, arbitration courts sometimes refuse a buyer who requires the seller to issue an invoice.

For example, the court declared the company’s demand to oblige the counterparty to issue an invoice to it to be unlawful (resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated September 24, 2008 in case No. A11-11888/2007-K1-9/605-40).

As a basis for refusal, the court indicated that the norms of the Tax Code of the Russian Federation do not establish the seller’s obligation to transfer the invoice, and tax legislation does not regulate civil legal relations and does not apply to them.

An invoice is not a document related to the goods (works) and subject to transfer to the buyer in fulfillment of the terms of the contract.

In another case, the company also went to court with a demand to oblige the counterparty to issue an invoice (resolution of the Federal Antimonopoly Service of the East Siberian District dated September 26, 2006 in case No. A19-9546/06-16).

The court refused, citing the fact that civil legislation does not apply to property relations based on administrative or other power subordination of one party to the other, including tax ones (Part 3 of Article 2 of the Civil Code of the Russian Federation).

Source: https://www.arbitr-praktika.ru/article/121-red-kontragent-ne-vystavlyaet-schet-fakturu-kak-poluchit-nalogovyy-vychet-po-nds

Acceptance of VAT deduction based on a cash receipt

In its letter 07/02/2018 N 03-07-14/45605, the Russian Ministry of Finance indicated that for VAT purposes, a cash receipt cannot replace an invoice, even if it contains separate invoice details and the VAT amount.

The financiers referred to the fact that, in accordance with paragraph 2 of Article 171 and paragraph 1 of Article 172 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), the amounts of value added tax presented to taxpayers when purchasing goods (work, services), property rights on the territory of the Russian Federation, in in case of their use for carrying out transactions subject to value added tax, they are subject to deductions after the acceptance of these goods (works, services), property rights for registration on the basis of invoices issued by sellers of goods (works, services), and in the presence of relevant primary documents . And as a result, taking into account the above norms of the Code, a cash receipt that partially contains invoice details cannot be a document on the basis of which value added tax is deducted.

What to do if the supplier does not provide documents

| » | Kazakhstan Accounting Forum www.balans.kz |

| altynay | |

| Added: | #1 Sat Mar 19, 2021 12:01:07 |

| The headline of the message: | The supplier has not provided an invoice for six months, what should I do? |

| The supplier has not provided an invoice for six months, what should I do? He does not answer our calls, we are located in different cities |

| Elena T | |

| Added: | #2 Thu Mar 24, 2021 14:43:06 |

| The headline of the message: | |

| altynay, do you have the rest of the documents? Agreement, certificate of completion of work? Does the contract stipulate the issuance of an invoice and penalties? If you have other documents, then post them without taking into account the invoice and, accordingly, without VAT. |

| altynay | |

| Added: | #3 Mon Apr 04, 2021 15:21:07 |

| The headline of the message: |

| Elena T says: |

| altynay, do you have the rest of the documents? Agreement, certificate of completion of work? Does the contract stipulate the issuance of an invoice and penalties? |

There is nothing, only non-cash payment from us in May. Is it possible to contact the tax office and write a complaint somewhere?

| Serikbayeva R. | |

| Added: | #4 Mon Apr 04, 2021 15:35:58 |

| The headline of the message: | |

| altynay, did the supplier deliver the goods/provide the service in full? How is there no agreement, but on what basis was the payment made? Look on the KGD website to see if they are being liquidated. To the legal and actual (if known) addresses, send a pre-trial claim with a registered notification about non-fulfillment of the terms of delivery/provision of services and demands to return the money to the bank account within 15-20 days (indicate the details and be sure to contact information). If you have their email, you can duplicate it there. At the end of the letter, threaten that you will be forced to file a claim with the SIES to collect the amount and penalty for the unlawful use of other people’s money under Article 353 of the Civil Code of the Republic of Kazakhstan. Maybe the gentlemen will come to their senses and at least get in touch. |

| altynay | |

| Added: | #5 Mon Apr 04, 2021 15:47:25 |

| The headline of the message: |

| Serikbayeva R. says: |

| did the supplier deliver the goods/provide the service in full? |

yes, we purchased the goods from him

Added after 54 seconds:

| Serikbayeva R. says: |

| How is there no agreement, but on what basis was the payment made? |

there is no contract, payment was made based on the invoice

Added after 1 minute 52 seconds:

| Serikbayeva R. says: |

| Look on the KGD website to see if they are being liquidated. |

It’s not in liquidation, I looked

Added after 1 minute 31 seconds:

Registration of invoices issued after the due date

The Ministry of Finance of Russia, in letter dated 04/26/2018 N 03-07-09/28450, provided clarification on the issue of registration in Part 2 of the logbook of issued invoices used in VAT calculations (hereinafter referred to as the logbook), invoices drawn up (received ) after the end of the tax period, including after the expiration of the established deadline for submitting a tax return for a given tax, and not previously registered in the specified accounting journal.

The Ministry of Finance pointed to the provision of paragraph. 7 clause 12 of the Rules for maintaining a log of received and issued invoices used in calculations of value added tax (hereinafter referred to as the Rules), approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137. From this provision it follows that when If, in the current tax period, the fact of absence of registration in the journal of an invoice (adjustment invoice) received in the expired tax period or after the end of tax periods is detected, data entries on such an invoice (including an adjustment invoice) are made in a new line of the journal accounting for the tax period in which this invoice (including adjustment) was drawn up.

Primary documents ► agreement, invoice, invoice, invoice, act - Elba

The primary document confirms various events in the business: the sale or purchase of goods, the provision of services to clients, the payment of salaries to employees, and others.

Depending on the event, the list of documents to be completed varies. Let's consider a common situation - a transaction involving the sale of goods and the provision of services. It is customary that the documents are prepared by the supplier or contractor.

Article “how to deceive in contracts”

- The contract is the beginning of the transaction. In it, you and the client determine the terms of cooperation: what, for what price and in what time frame you do. If the client is a regular one, you can draw up one agreement for several transactions.

- The invoice contains the amount to be paid, a list of goods and services and the bank details of the seller. This is an optional document, but is usually used for convenience.

- A cash receipt, sales receipt or strict reporting form confirms payment. Give them to the client who pays in cash or by card. When paying by bank transfer, payment is confirmed by the payment order.

- Invoice is a document that the supplier issues to the buyer when shipping goods.

- An act of provision of services or completed work is a document that the customer and the contractor sign based on the results of the provision of services or completion of work.

- Invoice - usually issued by individual entrepreneurs and LLCs using the general taxation system, because they work with VAT. In rare cases, invoices are issued using the simplified tax system, UTII and patent - read more about this in the article.

Create documents in three clicks

Create contracts, invoices, acts and invoices based on templates. The service will automatically fill in all the necessary document details. It will be more convenient than in Word. Try 30 days free

Agreement

Describes the rights and obligations of the parties to the transaction. Typically, a contract contains the following sections:

- Subject of the agreement: what is the result of the transaction.

- Contract amount and payment procedure: when and how much to pay.

- Rights and obligations of the parties: how the work happens.

- Responsibility of the parties: what happens if you or your partner violate the deadlines.

- The procedure for changing and terminating a contract: how to terminate a contract or accept additional agreements to it.

- Details of the parties: what are your and your partner’s current accounts, INN, OGRN and addresses.

The agreement is usually drawn up in 2 copies and contains the signatures of each party.

If you use a standard contract form with clients and replace the necessary details in Word or Excel, use templates in Elba. Upload your agreement template, and Elba will automatically fill in the details of the counterparty from the directory.

For some transactions, a written contract is not necessary at all. For example, a purchase and sale agreement is considered concluded from the moment a cash receipt, sales receipt or other document is issued to the buyer, which confirms the fact of payment. This does not mean that during a retail purchase and sale it is impossible to conclude an agreement in writing - the law does not prohibit this.

Templates of common agreements:

Service agreement template

Contract agreement template

Supply agreement template

Check

An optional document in which the seller indicates the price, quantity of goods and details for transferring payment.

You can come up with an invoice form for payment yourself or find a ready-made one on the Internet. An invoice can replace a contract if all essential terms of the transaction are included in it.

Invoice template

Elba has a ready-made invoice template. Select the counterparty, indicate the goods or services, their quantity, and the document is ready.

Payment documents

Confirms payment for goods or services. This can be a payment order, a payment request, cash and sales receipts, a strict reporting form.

When you receive payment through a bank by bank transfer, you do not need to issue a payment document. The client retains the payment order . With this document he can confirm that he transferred the funds using your details.

When paying by cash, card or electronic means of payment, you must provide the buyer with a cash receipt, sales receipt or strict reporting form. What you choose depends on the tax system and what you do.

The cash receipt is printed using cash register equipment. It is required to be used by everyone who accepts payment in cash, by card, or by electronic means of payment. Exceptions are listed in paragraph 2 of Article 2 of Law 54-FZ. There is a deferment for entrepreneurs on UTII and patents, and for now they can work without a cash register. Read more in the article “How to use cash register equipment.”

A sales receipt is issued by individual entrepreneurs and LLCs on UTII and patent at the request of the buyer. It replaces a cash receipt, but only until July 1, 2021, and for catering and retail with employees - until July 1, 2021. Then you will need a cash register.

The form of the sales receipt has not been established, so you can develop your own with the required details: name of the document, number, date, name of the LLC or full name of the individual entrepreneur, INN, goods and services, amount of payment and signature with transcript and position.

A strict reporting form is issued by those who provide services to individuals. It replaces a cash receipt, but only until July 1, 2021, and for catering with employees - until July 1, 2021. Forms must be printed at a printing house or through a special service. You can't just print them out on a printer at home. Read more about BSO in the article.

Consignment note (N TORG-12)

Registers the sale of goods to another individual entrepreneur or LLC. It is usually not used for working with individuals.

The invoice is issued in two copies: the first remains with the supplier and records the shipment of goods, and the second is transferred to the buyer and is needed by him to accept the goods.

Usually the invoice is drawn up according to the standard TORG-12 form. But you can use your own template.

Invoice template

In Elba you can create an invoice based on an invoice.

The act of providing services

Signed by the contractor and the customer. The certificate confirms that the services have been provided or the work has been completed, and the customer has no complaints about their quality.

Act template

Draw up a deed in Elba: just select the counterparty and indicate the service, and then send the completed document to the counterparty with a signature and seal.

Invoice

This document is required to be issued only by organizations and entrepreneurs that are VAT payers - mainly those who work on the general taxation system.

Organizations and individual entrepreneurs on the simplified tax system, UTII and patent usually do not pay VAT and therefore are not required to issue invoices. There are a few exceptions, which we covered in a separate article.

The invoice is issued in duplicate and signed by the supplier of the product or service. One copy is given to the buyer, the other remains with the seller. An invoice must be issued no later than 5 days after shipment of goods or provision of services.

An invoice is the basis for deducting VAT, so all organizations treat it with special trepidation.

In order not to study the form and rules for issuing an invoice, use Elba.

The article is current as of 03/11/2021

Organizations and entrepreneurs under special regimes (STS, UTII, etc.) generally do not pay VAT and do not issue invoices. This is directly stated in the Tax Code. But counterparties often ask special regime agents to issue an invoice - out of ignorance or because of their business processes. And the entrepreneur is faced with a choice: issue an invoice or lose a valuable client.

Remember: a VAT invoice entails the obligation to pay the specified tax and submit a VAT return.

An invoice must be issued within 5 calendar days from the date of shipment of goods (performance of work, provision of services) or from the date of receipt of payment. Draw it up in two copies, sign and give one copy to the counterparty.

Sometimes a customer asks to issue an invoice without VAT because his accounting department has the following procedure: for each purchase there is an invoice. In this case, you can issue an invoice, there will be no risk. Despite the VAT exemption, there are cases when the special regime must issue invoices.

You are required to issue a VAT invoice only in the following cases:

- you are a VAT tax agent;

- work under a contract as an agent on your own behalf: purchase goods or services with VAT for a client on OSNO or sell goods or services to another company that works with VAT;

- participate in a simple partnership agreement, trust management of property or a concession agreement.

There is another case when you need to pay VAT - when importing goods from abroad, but then the tax is a customs payment.

In other cases, issuing an invoice is your voluntary matter. Please note: when issuing an invoice, you are obligated to pay VAT to the tax office and submit a VAT report. The income of the simplified tax system takes into account the amount of payment from the client excluding VAT.

How to issue an invoice?

An invoice is a serious document that is fully regulated by law. It is exhibited in a special form in accordance with the rules. In order not to understand laws and complex terminologies, an invoice can be issued through Elba:

When you meet a client halfway and issue an invoice for the sale of goods or services, it is drawn up according to general rules. For other operations there are several nuances.

How to issue an invoice to a VAT tax agent

The invoice is issued on behalf of the seller, not yours. Those. in the lines “Seller”, “Address” and “TIN/KPP of the seller” the data of your counterparty is indicated, and in the buyer’s data - your data. Be sure to fill in the number and date of the payment document used to transfer payment for goods or services.

How to issue an invoice under an agency agreement

When you, as an agent, purchase a product or service for a client on OSNO on your own behalf, you will receive an invoice from the supplier in your name along with supporting documents.

You need to issue your same invoice to the buyer, only indicate your client’s details in the buyer’s data, and leave the supplier’s details in the seller’s data.

The date of your invoice must match the invoice that you received from the supplier, but you assign the invoice number in accordance with your own numbering. Give the buyer a copy of the seller's invoice - he also needs it to receive a VAT deduction.

If you, as an agent, sell goods (services) with VAT on your own behalf, you need to issue an invoice on your behalf in the name of the buyer. Enter your details in the seller's data, and your client's details in the buyer's data.

You need to give one copy of the invoice to the buyer, and keep the second one for yourself. The details of the invoice you issued must be sent to your principal - you can send a copy. The principal will issue his invoice on the same date in the name of the client and transfer it to you.

It must be recorded in the journal of invoices received.

When issuing invoices under an agency agreement, you do not need to pay VAT. Information about issued invoices must be included in VAT reporting.

Try Elba 30 days free

Create and send invoices to your counterparties with Elba!

How to calculate the amount of VAT payable to the budget?

When you sell goods or services with VAT at the request of a client, to calculate the amount of tax, multiply the cost of goods or services by a rate of 20% or 10%. Since VAT deductions cannot be applied under special regimes, at the end of the quarter, transfer the entire allocated amount of VAT to the budget.

VAT rates:

- 20% – general rate from 2021;

- 10% for certain groups of goods: some products, children's products, medical products;

- 0% for rarer operations.

For transactions of a tax agent, the VAT amount is calculated from the payment amount that is transferred to the seller. This may be the amount specified in the contract, or the amount of the monthly payment when renting from government agencies. Important: the amount of VAT must be withheld from the seller, which means that the calculated rate of 20/120 or 10/110 is used to calculate the tax.

When to issue a correction invoice

An adjustment invoice is issued in cases where:

- the parties agreed to change the cost of goods already shipped (work performed, services provided, transferred property rights). This is stated in paragraph 3 of paragraph 3 of Article 168 of the Tax Code of the Russian Federation;

- the seller did not transfer the goods in full (non-delivery of goods) (letters from the Ministry of Finance of Russia dated May 12, 2012 No. 03-07-09/48 and dated March 12, 2012 No. 03-07-09/22, Federal Tax Service of Russia dated March 12, 2012 No. ED-4-3/4100).