Minor defects

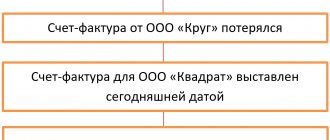

Various inaccuracies in invoices, unfortunately, occur quite often.

When an error is discovered in an invoice from a supplier or contractor, the accountant asks the question: is it possible to deduct VAT on an invoice with an error, or is it necessary to contact the counterparty and ask him to issue a corrected document? The answer depends on what kind of mistake the counterparty made when filling out the invoice. Article 169 of the Tax Code of the Russian Federation contains all the details that an invoice must contain. However, the absence or error in specifying one or another detail is not always fraught with the “withdrawal” of the VAT deduction. The fact is that in paragraph 2 of Article 169 of the Tax Code of the Russian Federation there is one important rule, which, by the way, tax authorities may “forget” during an audit. And it wouldn’t hurt to remind them of him. The rule states: if an error in an invoice does not prevent tax authorities from identifying the seller, buyer, name and cost of goods (work, services, property rights), as well as the rate and amount of VAT, such an error is not an obstacle to deduction.

Therefore, if your inspector, having discovered an inaccuracy in the spelling of, for example, the seller’s address in the invoice, points out that the deduction is illegal, then you have every reason to say the opposite. The Letter of the Ministry of Finance in Letter dated 04/02/2015 No. 03-07-09/18318 will help you. Officials explain that an error in providing an address, if all other important indicators can be identified, is not a reason to deny the deduction. Likewise, indicating the old legal address should not entail negative consequences (Letter of the Ministry of Finance of the Russian Federation dated 08.08.14 No. 03-07-09/39449).

For convenience, we decided to combine all other situations in which refusal to deduct VAT is illegal into a table.

| Description of the situation | Arguments in favor of the legality of VAT deduction | Documents (letters from officials, judicial practice) |

| Violation of the five-day period by the seller when issuing an invoice | Subclause 1 of clause 5 of Article 169 of the Tax Code of the Russian Federation provides that the invoice must indicate the serial number and date of the invoice. However, neither this subparagraph nor any other provisions of Article 169 of the Tax Code of the Russian Federation establish a requirement to comply with the five-day period | Letter of the interdistrict inspectorate of the Federal Tax Service of Russia for the largest taxpayers in the Sverdlovsk region dated 04/08/13 No. 02-31/3364, Resolution of the Federal Antimonopoly Service of the North-Western District dated 10/25/2012 in case No. A26-9024/2011 |

| Columns 2, 2a, 3 and 4 for services are not filled in | If the relevant data cannot be determined, then there is no need to include them in the invoice drawn up for services. In this case, you should put dashes | Letter of the Ministry of Finance of the Russian Federation dated October 15, 2012 No. 03-07-05/42 |

| There is no reference to the contract in the “advance” invoice | The rules approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 do not contain the obligation to indicate contract details in the invoice | Resolution of the Fourth Arbitration Court of Appeal dated 03/19/15 No. A19-15281/2014, left unchanged by resolution of the Administrative Court of the East Siberian District dated 06/19/15 No. A19-15281/2014 |

| The invoice contains additional details not provided for in Article 169 of the Tax Code of the Russian Federation | The Tax Code does not prohibit specifying such additional details of the invoice as the position of the employee who signed it | Letter of the Ministry of Finance of the Russian Federation dated April 10, 2013 No. 03-07-09/11863 |

| There is no (incorrectly specified) checkpoint of the seller or buyer | The checkpoint is not mentioned among the mandatory invoice details listed in paragraph 5 of Article 169 of the Tax Code of the Russian Federation | Resolutions of the FAS of the Volga District dated January 20, 2014 in case No. A55-27704/2012, FAS of the East Siberian District dated June 20, 2013 No. A19-19838/2012, Arbitration Court of the North Caucasus District dated March 10, 2015 No. F08-10982/2014 |

| The invoice does not contain payment order details | The absence of payment numbers does not prevent inspectors from identifying the seller | Letter of the Ministry of Finance of the Russian Federation dated October 31, 2012 No. 03-07-09/147, Resolution of the Federal Antimonopoly Service dated February 17, 2014 No. A12-3794/2013 |

| In column 2 of the invoice there is no code for the unit of measurement of the goods | Such an invoice does not prevent tax authorities from identifying all important indicators (seller, buyer, name of goods, etc.) | Letter of the Federal Tax Service of Russia dated July 18, 2012 No. ED-4-3/ [email protected] |

The product name must be accurate

At the beginning of the article, we indicated errors that may deprive you of the right to deduct VAT on grounds that are completely legal from the Federal Tax Service.

So, the first mistake: an error that does not allow tax authorities to identify the name of a product (work, service, property right). If the invoice shows an incorrect title, then deduction will be made. The Ministry of Finance of the Russian Federation in Letter No. 03-03-06/1/47252 dated August 14, 2015 confirms that in such a situation the refusal to deduct is legal.

In addition, check that the name indicated on the invoice matches the name indicated in the primary document (delivery note, work completion certificate, etc.). If there is a difference in wording, even a court may not help here. For example, in the Resolution of the Twentieth Arbitration Court of Appeal dated November 28, 2011 No. 20AP-4364/11, the dispute was resolved in favor of the Federal Tax Service. The judges considered a situation where the invoice stated “garage repair work,” and the certificate of completion stated “railroad repair.” The arbitrators held that the contractor should have properly corrected the invoice or else the right to deduction would be lost.

It happens that the invoice does not indicate a specific name, but only a link to the contract is given (for example, services under such and such a contract). We would like to immediately warn you that it is better not to allow such formulations. In practice, tax authorities often do not accept such invoices, believing that such design does not allow one to understand the exact name of the goods, works or services. Moreover, even a judicial review of the dispute does not guarantee a decision in your favor. For example, in the Resolution of the Ninth Arbitration Court of Appeal dated January 17, 2013 No. 09AP-38028/2012 in case No. A40-80881/12-91-445, what was important for the court (along with other circumstances) was the fact that the invoices in the column “ name of the product” did not disclose the types of services provided, but contained the general wording “services under a contract.” As a result, the dispute was resolved in favor of the inspection.

Although in arbitration practice one can also find decisions made in favor of companies (Resolutions of the Tenth Arbitration Court of Appeal dated 04/09/12 No. 10AP-301/12 and FAS Moscow District dated 08/24/11 No. F05-8167/11). One of the main arguments is as follows: since the details of the contract are indicated in the invoice, nothing prevents the auditors from opening the contract and finding out the exact name.

What if information about goods (works, services) is provided in the invoice, but it is incomplete? This issue was considered by the Ministry of Finance of the Russian Federation in Letter No. 03-07-09/10 dated 05.10.11. The agency explained that if the invoice contains incomplete information about the goods, but the invoice does not prevent the tax authorities from identifying the above information, then such a document is not a basis for refusing to accept VAT amounts for deduction.

Adjustment invoice

Despite the fact that the adjustment invoice has its own serial number and indicates the date of issue, it is inherently an addition to the original invoice.

Indeed, it, along with previously reflected information about the transaction performed, additionally reflects new cost and quantitative indicators of previously shipped goods, work performed or services rendered, as well as the final result of the adjustment made (that is, an increase or decrease in indicators) (clauses 1, 2 of the Rules for filling adjustment invoice[2]). Tax rules (clause 3 of article 168, clause 10 of article 172 of the Tax Code of the Russian Federation) require the preparation of an adjustment invoice only under certain circumstances (which lead to a change in the price (tariff) and volume (quantity) of shipment) and upon reaching a mutual agreement between the parties to a transaction regarding adjustment of value (quantity or price). Certain circumstances include, but are not limited to:

- an increase or decrease in the cost of shipment (for example, due to the provision of a discount to the buyer or a change in the terms of the transaction);

- return to the seller of goods not received by the buyer[3];

- disposal by the buyer (by agreement with the seller) of registered defective goods[4];

- shortage of goods or discrepancies in information about the quantity of goods (scope of work or services) specified in the shipping documents and invoice[5].

Taking into account the form of the adjustment invoice and the rules for filling it out, we can confidently say that the reason for drawing up such a document is not the correction of significant errors made during its preparation, but the adjustment of the cost (quantity or price) agreed upon by the parties for the transaction performed. In short, the mentioned correction has nothing to do with correcting errors.

Name and TIN of the seller and buyer

Second error: the name of the seller and (or) buyer is missing or incorrectly indicated.

It happens that when issuing an invoice, the company made an inaccuracy in the name of the buyer. For example, capital letters are replaced with lowercase ones and vice versa, or extra symbols (dashes, commas) are added. If other mandatory details are correct and do not prevent tax authorities from identifying the counterparty, then the deduction on such an invoice is legal (letters of the Ministry of Finance of Russia dated 05/02/12 No. 03-07-11/130 and dated 08/15/12 No. 03-07-09/117, Resolution of the Federal Antimonopoly Service of the Moscow District dated January 16, 2006 No. KA-A40/13545-05).

An invoice in which the counterparty mistakenly indicated the letter “e” instead of “e” and vice versa will not be an obstacle to deducting VAT. Such conclusions can be drawn based on the letter of the Federal Tax Service of Russia for Moscow dated 06/08/11 No. 16-15/55909.

Is the absence or incorrect indication of the seller’s (or buyer’s) TIN a sufficient basis for “removing” the deduction? Practice shows that for inspectors this may be a reason to refuse a deduction.

However, if the supplier made a mistake in indicating the buyer’s TIN, or did not indicate his number at all, then such an error does not prevent the tax authorities from identifying the buyer, because it is he who is checking (Resolution of the Arbitration Court of the North Caucasus District dated August 27, 2014 in case No. A32-11444/ 2012, FAS Moscow District dated April 27, 2011 No. KA-A40/2549-11 in case No. A40-160091/09-142-1315).

The same is true if the counterparty made a mistake in writing his TIN, and the error is in the nature of a clerical error or misprint (for example, an extra zero was added, or one digit was “doubled”). The Federal Antimonopoly Service of the Central District in its Resolution dated 04/08/2013 in case No. A14-7612/2011 noted that such a typo does not interfere with the identification of the seller. In the Resolution of the Arbitration Court of the North Caucasus District dated December 30, 2014 No. F08-9625/2014 in case No. A32-26444/2012, the court considered that a typo in writing the TIN should not prevent the taxpayer from deducting VAT.

In other cases, the position of the courts is contradictory. For example, in the Resolution of the Federal Antimonopoly Service of the North-Western District dated July 23, 2012 in case No. A42-2345/2010, the court did not accept the indication in the invoice of an incorrect TIN of the seller as an argument for “withdrawal” of the deduction. The arbitrators noted that the company could not have known about the unreliability of the TIN. Resolution of the Eighteenth Arbitration Court of Appeal dated January 22, 2015 No. 18AP-15113/2014 in case No. A47-7539/2013 was also issued in favor of the companies. But there are also decisions with court conclusions that incorrect indication of the TIN in the invoice deprives the buyer of VAT deduction (Resolution of the Federal Antimonopoly Service of the Central District dated April 5, 2012 No. A68-2733/11).

If arithmetic “suffers”

The cost of goods, works or services, as well as the amount of tax, must be indicated in the invoice without fail.

And errors in these details, including arithmetic or technical ones, may prevent the identification of the value of the goods or the amount of tax during a tax audit. Therefore, such errors can deprive the buyer of VAT deduction on completely legal grounds (Letters of the Ministry of Finance of the Russian Federation dated 09.18.14 No. 03-07-09/46708, dated 05.30.13 No. 03-07-09/19826). In what cases can we talk about an arithmetic error? In particular, when the quantity of goods (work, services) multiplied by the price is not equal to the cost of goods (work, services) without VAT. Another example is that the cost without VAT multiplied by the rate does not equal the tax amount. Moreover, even if there is an inaccuracy in one or two lines, inspectors will cancel the deduction for the entire invoice.

However, it should be taken into account that arithmetic errors may be due to the peculiarities of the supplier's accounting program. For example, in the dispute considered by the Federal Antimonopoly Service of the North-Western District in Resolution No. A56-17988/2011 dated January 19, 2012, the program was configured in such a way that when filling out an invoice, the total cost of the entire delivery without VAT was divided by the quantity, and the result was multiplied on the bet. Since the cost per unit of goods was very small, such an algorithm led to rounding errors. The judges found that minor inaccuracies do not deprive the buyer of the right to a deduction.

Results

Once you receive an invoice and discover an error in it, do not rush to demand that it be corrected. First, check whether this error prevents VAT deduction. You need to contact the counterparty only if the answer to this question is positive. For information about when you need to correct an invoice, read the article “You made a mistake on an invoice - what and how to correct it.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

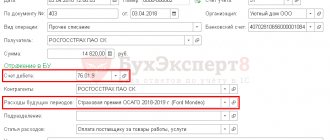

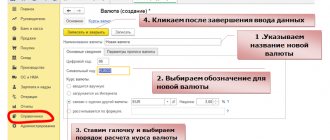

Invalid currency code

The name of the currency is also a mandatory detail of the invoice (clause 6.1, clause 5, clause 4.1, clause 5.1, article 169 of the Tax Code of the Russian Federation).

The name of the currency and its digital code according to the All-Russian Classifier of Currencies OK (MK (ISO 4217) 003-97) 014-2000 are indicated in line 7 of the invoice. So, when issuing an invoice in Russian currency, line 7 of the invoice must be filled out as follows: “Russian ruble, 643”. The Ministry of Finance of the Russian Federation in Letter dated March 11, 2012 No. 03-07-08/68 explains that incorrect indication of the currency code or its absence may prevent the identification of the cost of goods (work, services) and the amount of VAT indicated in this invoice. In this regard, invoices with such errors, according to officials, are not recorded in the purchase book. Therefore, the department adds, they need to be corrected in the manner established by paragraph 7 of the Rules for filling out an invoice, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

critical

See what “critical” is in other dictionaries:

- critical - intense, dramatic, disapproving, negative, unflattering, dramatic Dictionary of Russian synonyms. critically adverb, number of synonyms: 7 • dramatically (6) • ... Dictionary of synonyms

- Critical - I adv. qualities 1. Based on criticism. 2. Criticizing. II predic. An evaluative characteristic of something, a statement, judgment, etc. as containing criticism or self-criticism. Explanatory... ...Modern explanatory dictionary of the Russian language by Efremova

- critical - Adj. to critical I ... Ukrainian Tlumachny Dictionary

- critical - adjective unchangeable word unit ... Spelling dictionary of Ukrainian language

- critical - critically... Spelling difficult adverbs

- I will look at it critically - verb. critics, analyzers, prevaluators... Riverman is synonymous with Bulgarian

- Mironin - Mironin, Sigismund Sigismundovich Sigismund Sigismundovich Mironin pseudonym Birth name: the person does not reveal his real name Occupation: publicist Date of birth ... Wikipedia

- Mountain sickness - I Mountain sickness (morbus montanus) is a pathological condition that develops in people due to low partial pressure of atmospheric gases, mainly oxygen, in high altitude conditions. There are acute, subacute and chronic forms of G. b ... Medical encyclopedia

- CRITICAL - CRITICAL, critical, critical; critical, critical, critical (book). Same as critical in 2 digits. He was not critical enough (adv.) to the statistical material. Ushakov's explanatory dictionary. D.N. Ushakov. 1935 1940 ... Ushakov's Explanatory Dictionary

- Critically - adv. qualities 1. Based on criticism; critical I 1.. 2. Criticizing; critical I 2.. Explanatory Dictionary by Efremova. T. F. Efremova. 2000 ... Modern explanatory dictionary of the Russian language by Efremova

About the signature

The invoice is signed by the head and chief accountant of the organization (clause 6 of Article 169 of the Tax Code of the Russian Federation).

What if there is no chief accountant position on staff? Obviously, not indicating the signature of the chief accountant on the invoice due to the absence of such a position in the staffing table does not prevent tax authorities from identifying the seller and buyer of the transaction, the cost of goods, work, services, the rate and amount of tax (paragraph 2, clause 2, art. 169 of the Tax Code of the Russian Federation). Therefore, the absence of the signature of the chief accountant in such a situation should not be grounds for refusal to deduct VAT. A similar conclusion can be drawn from Letter of the Ministry of Finance of Russia dated July 2, 2013 No. 03-07-09/25296. Judicial practice confirms the legality of deducting VAT on an invoice in which there is no signature of the chief accountant, in the absence of such a position on the supplier’s staff (Resolutions of the Federal Antimonopoly Service of the East Siberian District dated 04.12.11 No. A19-11133/08, FAS Moscow District dated 01.20.12 No. A40-144847/10-98-1227).

To minimize tax risks, the buyer can ask the seller to make an entry in the invoice indicating that she does not have the position of chief accountant.

Instead of the director and chief accountant, the invoice can be signed by a person authorized to do so by an order (other administrative document) for the organization or a power of attorney on behalf of the organization. Please note that the legislation does not provide for the obligation of the supplier to provide the buyer with a copy of the administrative document or power of attorney for the right to sign invoices by authorized persons. Therefore, the tax authority does not have the right to demand from the taxpayer-buyer a certified copy of these seller documents. Similar explanations are given by the Federal Tax Service in Letter No. ШС-37-3/8664 dated 08/09/2010.

And finally, we would like to draw your attention to the fact that in order to avoid tax risks, the signature on the invoice must be affixed personally. That is, it is not advisable for the supplier to sign by using a facsimile (Letter of the Ministry of Finance of the Russian Federation dated 01.06.2010 No. 03-07-09/33, Resolution of the Federal Antimonopoly Service of the North Caucasus District dated 30.05.14 No. A32-2968/2012, Presidium of the Supreme Arbitration Court dated 27.09 .2011 No. 4134/11). True, in judicial practice there are decisions made in favor of the legality of deducting VAT on the basis of invoices signed in facsimile. But most of the disputes were resolved in favor of the Federal Tax Service.