In order to carry out a non-cash transfer of funds from one account to another through a bank institution, it is necessary to fill out a package of documents in accordance with the procedure established by the first-tier financial institution - the Central Bank of the Russian Federation. In order to properly prepare documents, you need to know your bank details. This is a fairly voluminous set of numbers. Knowing the list of such codes, the payment system automatically directs clients’ virtual (non-cash) funds in the right direction.

Some nuances of information about bank account details

Correctly specifying encoded bank details is the key to successful payment. Bank clients carrying out fund transfer transactions should remember that the most important information is:

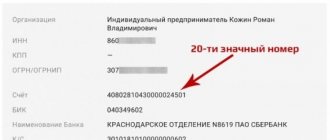

- Current (ruble on demand) or current (for transactions not related to business activities) account. A unique personal client account. Account status data corresponds to the amount of funds that are the client’s asset. The twenty-digit number is divided into data on the balance account of the first order (AAA), the second order (BB), the OKW currency code (BBB), the check digit (G), the bank division code (DDDD), the seven-digit intrabank account number (EEEEEE).

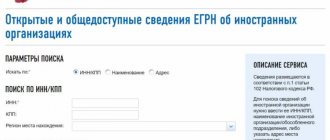

- Taxpayer INN. The number is the payer's registration code assigned by the territorial tax authority of the Federal Tax Service of the Russian Federation. Assigned to individuals, individual entrepreneurs, legal entities (residents or non-residents of the Russian Federation). The first four digits of the TIN are the identifier of the Federal Tax Service from the SOUN code.

- Registration reason code (KPP). A nine-digit code is assigned to legal entities upon registration by the Federal Tax Service as an addition to the TIN. Consists of the tax authority code (NNNN), the reason for registration (HH), and the serial account number (ХХХ).

- Bank identification code (BIC). A specialized set of nine digits, including information about the bank that opened the client’s account. The BIC is unique for each branch or branch of a bank institution.

Reliable storage of encoded information about bank details is the key to successful funds transfer operations. Remember this. Do not give your bank details to random people.

Bank details of an individual

An individual may have several transfer details in one bank. These include: bank card; current account; savings account. A legal entity can transfer money to an individual’s card in the following cases:

- Issuing a loan or credit.

- Payment of wages - within the framework of the salary project.

- Transfer of accountable amounts - travel and entertainment expenses; payment for services of an individual in the presence of an agreement.

In all other cases, checking or savings accounts are used. To complete a transaction, having only an account number will not be enough. Companies and organizations need to know complete bank details: in this case, the money will reach the addressee on time. Full details of the individual:

- Recipient.

- Recipient's account.

- Full name of the bank.

- Correspondent account.

- BIC.

- Checkpoint.

- TIN.

The last five points relate to the transfer recipient's bank. If necessary, these details can be clarified on the official website of the credit institution. It is important to know that transfers in foreign currency are made using other bank details, which must be freely available.

What is the BIC of the recipient's bank?

One of the most important components of bank details is the BIC - bank identification code. This is a unique bank identifier that is used in payment documents - orders, letters of credit, and other types of transactions. The Central Bank of the Russian Federation maintains a classifier of all BICs used in Russia.

This combination is not a random set of numbers. Each block carries certain information. Explanation of the bank's BIC (from left to right):

- 1-2 digits - code of the Russian Federation (04).

- 3-4 categories - All-Russian Classifier of Objects of Administrative-Territorial Division (OKATO).

- 5-6 categories - the conventional number of a separate division of the Bank of Russia.

- 7-9 digits - conditional number of the credit institution (branch).

Therefore, by the BIC number you can determine which branch of the bank the transfer is sent to. Re-use of a unique identifier is allowed after the credit organization is excluded from the RF BIC Directory.

about the author

Anatoly Darchiev - higher education in economics with a specialty in “Finance and Credit” and higher education in law in the direction of “Criminal Law and Criminology” at the Russian State Social University (RGSU). Worked for more than 7 years at Sberbank of Russia and Credit Europe Bank. He is a financial advisor to large financial and consulting organizations. Engaged in improving the financial literacy of visitors to the Brobank service. Analyst and banking expert. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

14.06.2018

Always check the name and bank details of the recipient before sending the transfer. If you specify one of these parameters incorrectly, your money will be temporarily blocked, but as soon as the payment is verified and rejected, it will again be available for use for any purpose. 1. Transfer to account. This option is not suitable if you do not have a personal account with the Bank - for this you must use option 2. With this withdrawal option, regardless of whether your account is called “Personal”, “Settlement” or “Card”, you indicate it in the field "r/s". If your card is attached to a personal account, then you must make a transfer only using this option. Any funds received to the Personal Account will automatically be available on the card attached to this account. When transferring to a card attached to a Personal Account, the card number is not indicated - there is no need to check the “Transfer to a bank card” checkbox. Example of filling out “Transfer to account”: Filling out a payment order for the transfer of funds 3. Payment to the account of a legal entity.

How the payment system works

Society for Worldwide Interbank Financial Telecommunications (SWIFT). This payment system was created to facilitate the movement of non-cash funds. International financial institutions have organized a global system for the exchange of confidential banking information. The founders of SWIFT are more than 250 banking institutions from 20 countries. The system began providing international payment support since 1973.

Members of the community, created under the laws of the Kingdom of Belgium, are over 9 thousand banks, as well as 10 thousand organizations.

Upon entry, the banking institution receives a unique SWIFT code. It is used to make international money transfers. The volume of daily transactions within the SWIFT system is more than a million units. The annual volume of bank transfers through the International Payment System is 4 billion.

By type, messages are divided into financial (between users) and system (service). The message has three parts:

- title;

- text;

- trailer.

Communication with the local system is carried out through CBT terminals and regional RGP processors. After all bank account details have been entered, the message is verified by the operations center. It is assigned a notification code. which can be either positive or negative.

For different categories of bank clients, a different list of details is provided

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Anatoly Darchiev

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Vladlen

03/04/2021 at 04:54 Hello! I am far from the financial sector, but it so happened that I need to pay for an order from an online pharmacy using the Alfa Bank details. I don’t have a bank card, because I can’t use it due to paralysis of my legs, but I have a Web money electronic wallet, but I don’t know how to pay for the order. Please tell me how to do this. With respect to you, Vladlen.

Reply ↓ Olga Pikhotskaya

03/04/2021 at 15:03Vladlen, good afternoon. Not every online store or pharmacy accepts payments through the WebMoney system. When placing an order, you can select the payment upon delivery option. You can also create a Yandex.Wallet (now YuMoney), issue a virtual card for it, top it up with the same WebMoney and pay for the order using the virtual card details.

Reply ↓

Types of bank payments

It is very important that owners of current bank accounts, when filling out payment documents, correctly indicate all codes assigned to a legal entity or individual entrepreneur by various government agencies without exception. If you enter at least one character incorrectly, the system may block the payment. In order to accurately handle payment documents, you need to thoroughly know what bank details are.

First of all, you need to understand the types of bank payments. They come in two types:

- Cash.

This is a type of payment that clients of bank institutions make with cash. The maximum amounts of cash transactions carried out by legal entities, as well as individual entrepreneurs, are established by a first-tier bank using a regulatory document. Most often, such a document is the Procedure for Conducting Cash Transactions.

List of the most frequently carried out cash financial transactions:

- payment of wages, scholarships, pensions, benefits;

- payment for goods, works, services through cash registers;

- international cash payments using letters of credit, collection, advice notes, checks, money transfers.

Control of cash turnover, internal and interstate payments. It is entrusted by the state leadership to the Ministry of Finance.

- Cashless.

In order for the money to reach the recipient, you need to fill out the details correctly

Such payments are made without the use of cash. In order to successfully send and receive non-cash payments, there are global and local payment systems. Using instant payment systems, you can send non-cash funds without opening a bank account. The volume of non-cash payments in a country with an extensive banking system should be at least 80% of the total money turnover. The remaining 20% are payments using cash.

How can an individual transfer money to an organization?

In most cases, payment by bank card is available. A similar function is available in the mobile applications of most Russian banks. For example, in Sberbank Online you can select an organization for a direct transfer, or make a transaction using the details of a legal entity. To do this, you must provide the following information:

- The name of the legal entity is LLC "Company".

- TIN.

- Checkpoint.

- The name of the recipient's bank is the “Central” branch of VTB Bank (PJSC) in Moscow (example).

- Check.

- Correspondent account.

- BIC.

- Purpose of payment - if this is a payment for a loan or loan, then this field indicates the number of the loan agreement (offer) and the date of its conclusion.

Transfers using bank details reach the recipient within three working days. This circumstance must be taken into account when it comes to urgent payment. As a rule, if the money reaches the bank, then the error in the recipient’s account is not critical. The main thing is that the credit institution has the ability to detect the payment.