Purpose of line 070 in the VAT return

Of the huge mass of tax reports, the VAT return is one of the most voluminous in terms of the number of sections. And in most sections you can find a line with code 070:

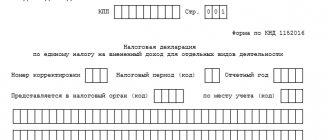

In almost each of these sections, line 070 has its own specific purpose and is filled out according to certain rules approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. MMB-7-3/ [email protected]

NOTE! From the reporting for the 1st quarter of 2021, the declaration is applied as amended by the Federal Tax Service order dated December 28, 2018 No. SA-7-3/ [email protected] Read more about the latest changes in the VAT declaration here.

Companies or individual entrepreneurs preparing a declaration do not always need to fill out all its sections and lines. In this case, most often when filling out a VAT return you have to deal with line 070 from section 3. We will decipher the procedure for filling it out further.

VAT return, line 170: filling procedure

The rules for the formation of this position provide for the equality of its data with the information in line 070. This means that only VAT amounts accrued from advances and recorded in line 070 can be claimed for reimbursement.

Thus, filling out line 170 of the VAT return is possible only after the seller has carried out a sequential set of actions:

- receiving an advance on future supplies;

- issuing an invoice specifying the amount of VAT on the prepayment received;

- the emergence of the right to receive a tax refund upon shipment.

Accordingly, suppliers who do not work on a prepayment basis do not generate line 170 of section 3 of the VAT return.

Let us remind you that in 2021, the VAT return is prepared using an updated form, approved. By Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 No. ММВ-7-3/ [email protected] (as amended on December 28, 2018).

Line 070 of Section 3: requirements for filling out the Federal Tax Service order

You can see what line 070 of section 3 of the VAT return looks like and how the Federal Tax Service order No. MMB-7-3/ [email protected] instructs you to fill it out, you can see in the figure:

Before advance VAT is included in line 070 of section 3, the buyer must:

The following publications will introduce you to the nuances of filling out other lines of the VAT return:

Example of filling out line 070

We will show you how to fill out line 070 of section 3 of the VAT return using an example.

LLC "PolyTekhProm" is engaged in the wholesale supply of metal structures according to customer orders. The company concludes contracts with the condition of prepayment (from 10% to 50% of the contractual delivery amount).

In the second quarter of 2021, PolyTechProm LLC:

- sold metal structures in the amount of RUB 24,000,000. (including VAT = RUB 4,000,000);

- received an advance payment in the amount of 12,000,000 rubles. (VAT = 12,000,000 rubles × 20 / 120 = 2,000,000 rubles);

- purchased metal and components from suppliers in the amount of RUB 13,200,000, including VAT = RUB 2,200,000.

Thus, in the first quarter:

- accrued VAT amounted to RUB 6,000,000. (RUB 4,000,000 + RUB 2,000,000);

- VAT deductible: RUB 2,200,000;

- VAT payable: RUB 6,000,000. – 2,200,000 rub. = 3,800,000 rub.

How PolyTechProm LLC will fill out section 3 (including line 070) of the VAT return, see the sample (only completed lines are shown):

Sellers who receive advances from buyers towards the upcoming shipment, when filling out the VAT return, are required to fill out line 070 of Section 3 - enter the amount of the advance payment received and the tax calculated from it. In this case, the seller must issue an advance invoice to the buyer and determine the VAT payable by calculation.

In other sections of the declaration, lines with code 070 have a different purpose and are filled out according to different rules.

What is reflected in line 070 of the VAT return?

Recently, several of my clients received similar requests for clarifications on their VAT returns. “The excess of tax deductions on line 170 of section 3 over the amount of tax calculated on line 070 of section 3 of the VAT tax return,” says the letter from the tax office. There is also a clause about the amounts that have been reflected in these lines since the formation of the organization (!) . What are we talking about in this requirement, and how to find out whether an error was made in your reporting?

Line 070 of Section 3 reflects the amount of VAT calculated on advances paid by customers. Then, at the time of sale of goods (works, services), the advance payment is offset and this VAT is claimed for deduction. Line 170 reflects the amount of tax previously calculated on advances from buyers and subject to deduction when offset against these advances in the current tax period. At the same time, it is obvious that we cannot claim for deduction more “advance” VAT than we previously paid.

If we analyze the data for one quarter, we can assume a situation where the amount to be deducted (line 170) will be greater than the amount of calculated VAT on advances (line 070). This occurs if the organization previously received a large number of advances that were offset in the reporting quarter. But for the period from the moment of formation of the organization, of course, the amount of calculated VAT on advances must be greater than or equal to the amount claimed for deduction.

How to find an error? It is best to start by checking the most recently submitted return and move to earlier reports if the error is not discovered immediately. I recommend checking in 2 stages:

1) Check the amounts on lines 070 and 170 in the declaration with the turnover between accounts 68.02 and 76.AB. In order to do this, we generate the “Account Analysis” report and select account 68.02.

The amount of turnover between these accounts, located in the credit column, must be equal to line 070 of section 3 of the VAT return.

And the amount of turnover in the debit column in most cases is equal to line 170.

However, if in a given tax period your organization returned to the buyer an advance payment on which VAT had previously been calculated, then the amount of this VAT will be reflected in line 120 of section 3. Accordingly, a discrepancy will appear in the amount of VAT on such a return between the turnover of accounts 76.AB and 68.02 and line 170.

2) Reconcile the debit and credit turnover of account 62.02 with the turnover of account 76.AB.

I talked in detail about how to do this in the video tutorial Checking VAT on advances in 1C - VIDEO

Thus, we check all submitted declarations until we find the amount of discrepancies specified in the requirement (it can consist of several periods) and find out the reasons for these discrepancies. Please note that in the VAT return form that taxpayers filed before 2015, we need to analyze not line 170, but line 200 (pay attention to the names of the lines if we are working with different versions of the declaration). Then, depending on the situation, we respond to the request or submit updated reports.

If you need more information about filling out and checking the VAT return in 1C, as well as about popular requirements from the Federal Tax Service on this topic, then I highly recommend that you purchase the recording of our webinar “Filling out and checking the VAT return in 1C: Accounting 8 (using practical examples).” You will also receive a recording of the webinar “Analysis of popular VAT accounting errors in 1C: Accounting 8” as a gift. Detailed information is available at the link.

Let's be friends on Facebook

Did you like the article? Subscribe to the newsletter for new materials

Line 170 of the VAT return: how to check

It is not difficult to find out whether the amounts for tax refund have been calculated correctly and the data for declaration has been generated, since the indicators on lines 070 and 170 are closely related. On page 070, the supplier indicates the amount of the advance payment received and the VAT on it, and on page 170 - the amount of tax that after completion of the transaction, partial sale of goods or return of the advance payment, he has the right to claim for deduction.

It must be said that the same figures in these lines are formed only when all operations on receipt of prepayment, determination of VAT on it and actual shipment were carried out in the same quarter, which does not always happen. Often these operations are carried out in different reporting periods, and partial shipments spread over several quarters are not uncommon. For each fact of shipment, VAT is deducted corresponding to the amount of that specific shipment. But ultimately, the amount of compensation in line 170 for each transaction must correspond to the amount of VAT paid on the advance invoice.

When filling out the declaration, it is important to remember that the amount of the deduction indicated on page 170 cannot be higher than the amount of the advance tax indicated on page 070. Amount on page 170:

- or equal to the figure in page 070, if the shipment amount corresponds to the advance payment or exceeds its size;

- or less than in page 070, when the goods are shipped for less than the prepayment amount.

By agreement with the buyer, the supplier company:

- in the second quarter of 2021, she received an advance payment in the amount of 50% of the agreement amount - 500,000 rubles. The company has issued an invoice for the amount of the advance, in which the amount of tax is highlighted. VAT on prepayment amounted to RUB 83,333. (500,000 x 20 / 120);

- The shipment was made in the third quarter immediately for the full cost of delivery - 1,000,000 rubles. including VAT RUB 166,666. (1,000,000 x 20/120).

Let's consider how this data should be prepared in accounting accounts and reflected in quarterly tax returns.

What is section 3 of the VAT return about?

Section 3 is the main part of the VAT return where taxpayers must calculate the tax due or refundable. The algorithm for filling out the lines in section 3 of the VAT return is as follows:

- Lines 010–040 - displays the amount of revenue from sales (based on shipment), which is taxed at the current tax and estimated interest rates.

- Line 050 is required when selling an organization in the form of a complex of accounting assets.

- Line 060 is intended to be filled out by manufacturing and construction companies that carry out construction and installation work for their needs.

- Line 070 “Tax base” displays the funds received for upcoming deliveries. Value added tax is calculated at a rate of 20 or 10% depending on the type of goods, works, and services. If the sale is made within 5 days after the advance payment is made, then the amount should not be indicated as an advance payment.

- Lines 080–100 must contain the amount of tax to be restored.

- Lines 110–118 indicate the VAT amounts.

- Lines 120–190 contain VAT to be deducted.

- Lines 200–210 reflect VAT payable or refundable for the tax period.

Section 3 contains the amounts of value added tax, which is subject to restoration for tax accounting in accordance with clause 3 of Art. 170 Tax Code of the Russian Federation. This applies to amounts that were previously declared in the form of tax deductions on preferential terms (the company applies a special regime that exempts from VAT).

Line 170 of the VAT return: explanation

This position is included in the 2nd part of the 3rd section of the declaration, i.e. it is located in the deductions block. It records the amount of tax refund due to the seller, accrued on advance receipts on account of future deliveries and indicated in a specially issued advance invoice (clause 1 of Article 167, clause 3 of Article 168 of the Tax Code of the Russian Federation). The supplier's right to a VAT refund arises during the shipment of the goods or upon cancellation of the transaction and the return of the advance payment. Deductions for VAT paid on prepayment are indicated in line 170.