An invoice is an accounting document certifying the fact of shipment of goods or provision of services and their cost. It is necessary to confirm the amount of VAT both on the sale of products (services), and to confirm the fact of purchase and incoming VAT. Based on the invoice data, Purchase and Sales Books are formed to account for VAT with the tax authority.

An invoice is issued (sent along with the goods or by mail) by the seller to the buyer (customer) after receiving the goods or services. The invoice has a strictly defined format, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137.

Concept and meaning of an invoice

An invoice is a regulatory act of declaration , which not only establishes the procedure and confirms the legal accrual and reimbursement of VAT , but can also provide unique information regarding certain services , goods , for the second party to the participants in these legal relations - buyers.

That is why this consolidated settlement document or declaration , and in particular the rules for its preparation and execution, are strictly controlled by the norms of the tax legislation of the Russian Federation.

As for direct taxpayers - individuals or legal entities who have the right to sign invoices , for them the importance of this document is generally difficult to overestimate, as is its absence , even if they use a single simplified taxation system or a zero tax rate.

In this case, the maximum value will be not so much outgoing as incoming agent invoices, which must be accepted within a certain period .

The legislation of the Russian Federation qualifies VAT as an indirect tax, sometimes also a customs , the calculation , re-invoicing and reimbursement of which is carried out on the basis of the total, existing amount of revenue from the past from the sale of goods , the provision of certain services , etc.

This means that VAT is extremely inconvenient in relation to the tax planning and implementation .

It is for such cases that the legislation of the Russian Federation determines the general procedure for issuing , processing and using invoices for the sale of certain goods or services , including their export , reimbursement , maintenance , or the calculation of a tax such as VAT .

Accounting and legal services

Analytical accounting for account 62 in Stimul-2 LLC is maintained for each invoice presented by the buyer or customer, and for settlements in the order of scheduled payments - for each buyer or customer. The construction of analytical accounting provides data on debt secured by: bills of exchange for which the receipt of funds has not arrived; bills discounted (discounted) in banks; bills for which funds were not received on time.

Please note => In what year did contributions to the pension fund begin?

Adjustment invoice and invoice requirements

The rules and regulations of the tax legislation of the Russian Federation introduced a new concept of “ adjustment invoice ”, and also established the rules for its issuance , implementation , registration , existing types , as well as the permissible period and size of the period for direct issuance .

A document such as an adjustment invoice in relation to specified services , or goods and accrued VAT , is a special settlement , consolidated tax act, for example, customs , export , the formation and issuance of which for the supplier can only be carried out in special cases.

The most common situation in which an adjustment invoice , as well as its export , calculation , formation and issuance will be legal, is a change in prices for certain goods or services , by additional agreement of the parties - the supplier and the buyer, or his agent .

At the same time, a change in the price of a particular item of goods or services can occur for many reasons: the appearance of additional discounts, markdowns on certain types supplier goods , which can be placed by an authorized person, or services , an unexpected rise in price, re-invoicing , etc.

In this case, a document such as an adjustment invoice must be issued to the supplier or seller, as well as his agent, within the prescribed period.

Its absence makes the export and registration of new prices of the supplier , agent , or seller invalid.

The main requirements of the tax legislation of the Russian Federation for an invoice relate to its direct generation, issuance and implementation in relation to a supplier , agent , or seller of certain goods , services or work .

The title of the document must include all data on the buyer , as well as on the physical quantity of certain goods and services under the contract, the established period , etc.

Columns 2 and 6: special attention

In Part 1 of the journal there is column 2 “Date of issue” and column 6 “Date of invoice”. Column 2 contains the actual date of preparation indicated in line 1 of the invoice.

As for column 6, the procedure for filling it out is defined only for electronic invoices. This column indicates the date of receipt of the invoice file, reflected in the confirmation of the specialized operator, but only if there is a notification of receipt from the buyer. Because without notification, the invoice is not registered at all. However, the dates in the confirmation and notification may be different. When an invoice is issued but not issued, this column is not filled in (for example, when receiving amounts related to payment for goods, works or services sold).

The procedure for filling out this 6th column for paper invoices is not established.

Table. Operation type codes

| No. | Name of the type of operation | Operation type code |

| 1 | Shipment (transfer) or acquisition of goods, works, services (including intermediary services), property rights, with the exception of transactions listed under codes 03, 04, 06, 10, 11, 13 | 01 |

| 2 | Payment, partial payment (received or transferred) for upcoming deliveries of goods (performance of work, provision of services (including intermediary services)), transfer of property rights, with the exception of transactions listed by codes 05, 06, 12 | 02 |

| 3 | Return of goods by the buyer to the seller or receipt by the seller of goods returned by the buyer | 03 |

| 4 | Shipment (transfer) or acquisition of goods, works, services (except for intermediary services), property rights on the basis of a commission agreement (agency agreement, if the agent acts on his own behalf), with the exception of transactions listed under code 06 | 04 |

| 5 | Payment, partial payment (received or transferred) for upcoming deliveries of goods (performance of work, provision of services (except for intermediary services)), transfer of property rights based on a commission agreement (agency agreement, if the agent acts on his own behalf) , with the exception of operations listed under code 06 | 05 |

| 6 | Operations performed by tax agents listed in Article 161 of the Tax Code | 06 |

| 7 | Operations listed in subparagraph 2 of paragraph 1 of Article 146 of the Tax Code | 07 |

| 8 | Operations listed in subparagraph 3 of paragraph 1 of Article 146 of the Tax Code | 08 |

| 9 | Receipt of amounts specified in Article 162 of the Tax Code | 09 |

| 10 | Shipment (transfer) or receipt of goods, works, services, property rights free of charge | 10 |

| 11 | Shipment (transfer) or acquisition of goods, property rights listed in paragraphs 3, 4, 5.1 of Article 154, in subparagraphs 1–4 of Article 155 of the Tax Code | 11 |

| 12 | Payment, partial payment (received or transferred) for upcoming deliveries of goods, transfer of property rights listed in paragraphs 3, 4, 5.1 of Article 154, in subparagraphs 1–4 of Article 155 of the Tax Code | 12 |

| 13 | Carrying out capital construction, modernization (reconstruction) of real estate by contractors (customers-developers) | 13 |

Therefore, duplicating the date of the invoice in this column will not be a violation.

Part 2 of the journal also has two columns - column 2 “Date of receipt” and column 6 “Date of invoice”. In this case, the date of receipt of the electronic invoice is considered to be the date of sending the seller’s invoice to the buyer, indicated in the operator’s confirmation. Please note that there must also be a notification to the buyer about receipt of the invoice.

When registering paper invoices, there are no guidelines in the rules. But when filling out column 2, do not forget that the date of receipt of the invoice affects the determination of the tax period in which the buyer has the right to deduct VAT.

Procedure for drawing up and conditions for drawing up an invoice

The rules of existing tax law establish a certain procedure for issuing an invoice, as well as additional conditions and requirements under which the formation , registration , maintenance , export and provision of a document to another person will be possible, and it will be possible for him to accept it.

The current requirements and general procedure provide for such an important aspect as a deadline that must be observed when generating, maintaining , exporting , issuing an invoice and providing it to another person who must accept it.

The generation and issuance of an invoice, its reconciliation and processing must be carried out within 5 calendar days from the date of direct shipment of the seller’s goods to the buyer or his agent representative, provision of services, or performance of certain work.

At the same time, in addition to issuing an invoice, the taxpayer must also maintain all necessary reporting and comply with the rules for filling out the invoice, in the event that the objects under the contract , the name of which is indicated, are subject to VAT .

The immediate conditions for issuing and drawing up invoices depend, first of all, on the types of objects themselves under the contract of the supplier or agent , or the seller to the buyer , who must accept the goods.

The name of these goods , work , or services involved in the sale to the buyer must necessarily be a legal object of taxation and VAT .

VAT postings for accounting

Documentary recording of the receipt and issuance of invoices is important not only for tax reporting, but also for accounting of deductions received and the turnover of funds within the organization. To calculate VAT, two accounts are used:

- account 68 “Calculations for taxes and fees”, the credit of this account reflects the accrued VAT, and the debit the amount of compensation;

- Account 19 “Value added tax on acquired assets” reflects the input tax.

Let's consider the features of transactions when the invoice is issued, and also received from the supplier and paid.

For more details on how to issue an invoice if it arrives late, read this material.

Upon receipt

Legal entities can receive a tax deduction for “input” VAT, that is, for the tax they paid when purchasing goods for sale. In this case, the accrual occurs on two accounts:

- The debit of account 19 – The credit of account 60 reflects VAT on the purchase of fixed assets, the posting is made on the basis of the input SF.

- The debit of account 68 VAT – The credit of account 19 reflects VAT deductible.

When selling

For the SF, which is issued from you, the following transactions are made:

- Debit 90 Credit 68 – accrual of sales tax, document for posting – outgoing SF.

- Debit 76 Credit 68 – tax accrual on received advance payments, posting is done on the basis of the advance tax return (read more about how to reflect an invoice for an advance payment and other “primary items” in the purchase and sales book, read here).

- Debit 68 Credit 76 – registration of VAT on the advance payment upon completed shipment. The basis for posting is the outgoing invoice (for more details on how to conduct an advance report, read this material if there is no invoice and VAT is highlighted in the check).

- Debit 91 Credit 68 – VAT accrual for the gratuitous transfer of material assets (provision of services, work). The basis for the posting is the outgoing invoice.

Types of invoices and invoice registration

The norms and requirements of tax law, as well as the current procedure, establish certain types of invoices that can be lawfully used by taxpayers, depending on the conditions of the supplier’s agreement with the buyer, as well as other conditions, the types of which may be set by the Tax Code of the Russian Federation.

Existing types and forms of invoices include the following:

- regular consolidated invoice. Its types and form are the most common and are used in most cases in the absence of additional circumstances;

- invoice for advance payment. These types are used in the case when item the settlement account of the supplier or seller within a specified period ;

- or adjustment invoice Sent to the buyer within a certain period of time , if the price of the name and types of certain goods has changed. The corrected invoice must contain all the necessary data and requirements - the name of the corrected product, its types and form , new cost, reconciliation and processing , etc.

Registration of an invoice is a special procedure when all data about a document is entered into the appropriate reporting - accounting books, etc. If the relevant data was not entered into the documents within the prescribed period , this will be considered a violation of tax laws.

How a document is recorded - rules and instructions

Fact of receipt

The receipt of an invoice by the buyer must be entered in the purchase ledger in compliance with the following rules:

- the document is filled out by a manager or an employee authorized by him;

- document number (SF);

- date of entry in the accounting document;

- date of payment for goods according to payment documents;

- name of the seller, TIN/KPP;

- country of origin of the product;

- numbers of customs declarations, if the goods are foreign;

- funds paid for the goods (including VAT);

- tax rate;

- the amount of products without VAT (for more information about in which cases an invoice without VAT is necessary, read this material);

- signature of the responsible person.

Exhibition of SF

The sales book includes:

- date of entry on the Federation Council;

- invoice number;

- name of the purchasing organization, TIN/KPP;

- actual date of payment for the goods;

- cost of products including VAT;

- VAT rate;

- cost of goods excluding tax;

- tax amount;

- result;

- signature of the responsible person.

Important! Books of purchases and sales must be laced and their pages must be numbered.

Information contained in invoices and information indicated in the adjustment invoice

The formation of any invoice also includes such a stage as indicating all the necessary information there. It should include:

- the exact name , form and quantity of services, goods, or types of work of the supplier that are included in the sale to another individual - the buyer ;

- the estimated period within which the registration , printing and signing of the invoice is carried out, as well as the period within which all the conditions specified there must be met;

- settlement account of the supplier , or his agent , as well as another authorized person who has the right to sign invoices ;

- all necessary and mandatory invoice details, the absence of which is a serious violation that can be identified by any organized inspection .

According to the provisions of the current tax legislation, the adjustment invoice must also indicate certain data. These include:

- exact name of services, goods, or work , their quantity , processing , general order of execution, deadline VAT amount , etc.;

- the specific name of the service, work , or product for the sale of which there was an increase or decrease in price;

- summary calculation , verification , processing and reconciliation VAT amount ;

- stamp of an authorized person.

When another person has received an adjustment invoice , the reconciliation , verification and processing of which have been carried out, all conditions for changing the price are considered fulfilled.

Example of filling out new document forms

To illustrate how to fill out the invoice journal forms, as well as the purchase ledger and sales ledger, let’s look at an example.

Example 1.

On January 14, 2012, Alpha LLC received from Beta LLC an advance payment for goods in the amount of 118,000 rubles.

In this regard, in part 1 of the invoice book, the company records with serial number “1” invoice No. 001 dated January 14, 2012 in the amount of 118,000 rubles, including VAT - 18,000 rubles. Since the invoice was drawn up on paper, the organization will enter code “1” in column 2 of the book; in column 4 “Operation type code” it is necessary to indicate “02”, since this is an advance payment. The remaining columns of the book are filled in in accordance with the data specified in the invoice. Since this is a primary invoice, columns 7–10 and 16–19 are not filled in. The invoice issued for the prepayment received from Beta LLC must be registered in the sales book. In this case, columns 1a, 1b and 1c are not filled in. 2.

On January 24, 2012, Alpha LLC, according to invoice No. 002 dated January 24, 2012, shipped Mir LLC goods in the amount of 236,000 rubles, including VAT of 36,000 rubles.

The terms of the contract stipulate that when paying for goods within 10 days, a discount of 10 percent of the cost is provided. Mir LLC fulfilled this condition and received a discount. As a result, there was a change in value. Therefore, Alpha LLC needs to issue an adjustment invoice. On January 27, 2012, an adjustment invoice No. 003 dated January 27, 2012 was issued (correction No. 1 dated January 27, 2012 to invoice No. 002 dated January 24, 2012) (downward adjustment by RUB 23,600 ., including VAT 3600 rub.). Thus, for transactions with Mir LLC, the company must make the following entries in the invoice journal: – in the line with serial number “2”, the primary invoice No. 002 dated January 24, 2012 is recorded (columns 7–10 and 16–19 remain blank); – the line with serial number “3” reflects the adjustment invoice No. 003 dated January 27, 2012. At the same time, columns 5 and 6 indicate the number and date of the primary invoice. Column 7 indicates the number of the adjustment invoice - No. 003, column 8 reflects the date of preparation of the adjustment invoice - January 27, 2012, and then in column 9 indicates “1” (correction number) and in column 10 - January 27, 2012 (date of correction). Columns 11 to 13 are filled out in the same way as when registering a regular invoice. Columns 14–15 are not filled in when registering an adjustment invoice. Since there has been a decrease in the cost of goods, columns 16 and 18 are filled in, which indicate, respectively, the difference in the cost of the adjustment invoice including VAT and the difference in the VAT itself. Column 16 will reflect the following difference of 23,600 rubles, and column 18 - 3,600 rubles. The following entries are made in the sales book: the primary invoice No. 002 dated January 24, 2012 is recorded. Since the invoice is primary, columns 1a, 1b and 1c are not filled in. Since Alpha LLC issued an adjustment invoice and a decrease in value occurred, the organization has the right to deduct VAT. Therefore, the downward difference must be reflected in the purchase book of Alpha LLC. This is stated in paragraph 6 of the Rules for maintaining a purchase book. Accordingly, the following entries are made in it: in the line with the serial number “1” we register the adjustment invoice No. 003 dated January 27, 2012. At the same time, in columns 2 and 2a of the purchase book the corresponding data from line 1b of the adjustment invoice is indicated. Since in our case there were no corrections to the adjustment invoice, column 2a of the purchase book will be empty. Please note that in column 7 of the purchase book the data from the line “Total reduction (sum of lines D)” of column 9 of the adjustment invoice is indicated, that is, it is necessary to reflect the amount of the reduction in value - 23,600 rubles. Columns 8a and 8b are filled in similarly, only data from columns 5 and 8 of the adjustment invoice are transferred to these columns, respectively. 3.

On February 10, 2012, Alpha LLC shipped goods in the amount of 177,000 rubles, including VAT of 27,000 rubles, according to invoice No. 004 dated February 10, 2012 to Pozitiv LLC. But on February 13, the cost of goods changed upward. Consequently, Alpha LLC needs to draw up an adjustment invoice No. 005 dated February 13, 2012 for an increase of only 59,000 rubles, including VAT of 9,000 rubles. In this case, entries are made in the accounting journal similar to point 2 of the example (primary invoice No. 004 dated February 10, 2012 and adjustment invoice No. 005 dated February 13, 2012 are registered). Since there was an increase in cost, then, according to paragraph 7 of the Rules for maintaining the sales book, in column 4 of the sales book the data from the line “Total increase (sum of lines B)” of column 9 of the adjustment invoice is indicated, that is, 50,000 rubles. Columns 5a and 5b are filled in similarly, only data from columns 5 and 8 of the adjustment invoice are transferred to these columns, respectively. Thus, Alpha LLC’s invoice journal, purchase book and sales book will look like this:

D. Nacharkin, expert editor

The form of the invoice, the procedure for filling it out, as well as the accounting of invoices

Tax rules establish several types of invoices, each form of which has its own characteristics and nuances. The first form is the usual, printed one .

A printed form is a familiar document , which is created on a computer and then stamped and signed by an authorized person. In most cases, tax reporting and documents are in printed form.

electronic invoices , which also represent full-fledged tax reporting , are also gaining increasing popularity . This reporting is submitted via an electronic communication channel, the calculation , processing , reconciliation , verification and export of which is carried out by an authorized person.

In this case electronic documents will not have a seal signed using an electronic signature. Electronic invoices and their export can be carried out in relation to any product, work or services .

Processing and reconciliation of invoices also includes such a stage as their accounting, which is financial reporting, the maintenance of which is a prerequisite.

Data on each invoice is entered into the appropriate accounting book, which bears the seal and signature of the organization.

The list of information may include the following: documents relating to the invoice, name of services and agent , goods or work , corrective percentage of cost, if any, extract , export , current account, VAT agent , mandatory invoice details , etc. .d.

In addition, the type to which the document , for example, return invoice , corrected invoice , etc.

Correction of books

Resolution No. 1137 clarified the procedure for making corrections in the purchase book and sales book. The old rules were not clear on how they would be adjusted in situations where invoices were corrected in the same period in which they were recorded. Previously, it was required that the cancellation of an invoice be recorded on an additional sheet of the purchase ledger in the period in which the original invoice was recorded. The same procedure was established for changes made to the sales book.

Now additional sheets are issued if changes need to be made for past tax periods. Adjustments for the current period are made directly in the book, and not on an additional sheet. To do this, the cost and tax amount of the canceled invoice are entered with negative signs. Positive values are written for the registered invoice.

This is interesting

In the case of simultaneous reflection of several transactions in the invoice, several codes are indicated simultaneously through a separating sign.

Also, according to the old rules, it was not specified whether it is necessary to indicate on additional sheets information about canceled invoices with a negative sign. Now this requirement is contained in paragraph 5 of the Rules for filling out an additional sheet of the purchase book and paragraph 3 of the Rules for filling out an additional sheet of the sales book.

Previously, the question was not resolved in which tax period should a corrected invoice be registered in the purchase book: in the period of receipt of the original or corrected document? The Russian Ministry of Finance provided clarifications on this matter in a letter dated November 3, 2009 No. 03-07-09/53. The corrected invoice had to be recorded in the purchase ledger at the time it was received.

This requirement is now reflected in the new rules: corrected invoices, including adjustment ones, are recorded in the purchase ledger as the right to tax deductions arises.

If previously, in order to register a corrected invoice in the period when the original one was received, it was necessary to issue an additional sheet, now this cannot be done.

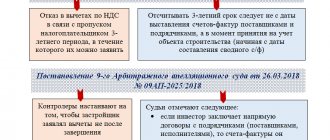

At the same time, the courts have repeatedly recognized that the right to a deduction does not depend on the period in which the invoice was corrected (resolutions of the FAS Volga District dated April 12, 2011 No. A55-14064/2009, FAS Moscow District dated June 8, 2011 No. KA-A40/7029-11). This issue remains controversial to this day.

Another controversial provision of the new procedure can be considered the requirement that invoices that do not comply with the established form and the rules for its completion are not registered in the purchase book. That is, the company will not be able to apply a VAT deduction on an invoice that is not drawn up in the prescribed form.

However, it is worth noting that the basis for refusal of a deduction can only be a violation of the requirements of clauses 5, 5.2, 6 of Article 169 of the Tax Code (clause 2 of Article 169 of the Tax Code of the Russian Federation). And the provision that the form of the invoice is established by the Government of the Russian Federation is contained in paragraph 8 of Article 169 of the Tax Code. In addition, there is no liability for violation of paragraph 3 of the Rules for maintaining a purchase ledger.

If you are not ready to argue with the tax authorities, register in the purchase book only those invoices that comply with the current form and the rules for filling it out.

The procedure for issuing and receiving invoices, as well as their features

The legislation of the Russian Federation imposes special requirements for the issuance and receipt of invoices, regardless of whether their printed form or electronic invoices are exported .

However, the printed form still has more nuances and features, including the necessary reporting and relevant documents . Any invoice, be it a customs declaration , or a summary or corrective other document , must be drawn up within 5 days from the end of the period for fulfilling the terms of the contract.

In this case, the second party is obliged to accept the invoice, put a stamp on the document and enter data about this into the appropriate reporting .

In the event that one of the parties refuses to accept this document within a specified period of time, he must still post it, but note this fact.

The invoice can be sent either personally to the second party or through his agent , within a specified time period .

Mandatory provision and maintenance of invoice data is an established feature of this document.

Invoice export In this case, the accompanying documents must contain all the necessary information about the provision of services , the absence of prepayment, the declaration , etc.

Author of the article

What it is?

First, you need to decide what the invoice itself (hereinafter referred to as the invoice) is and what data should be contained in this document. According to the Tax Code of the Russian Federation and by-laws, an invoice is a document issued to a counterparty by the party that actually transfers the goods, performs work or provides services . It is needed for two main purposes:

- Accurately determine the actual cost of payments under the contract. Therefore, the invoice is sent to the counterparty after the obligations of the seller (performer) under the contract have already been fulfilled.

- Determine the amount of tax payments for VAT (Articles 168 and 169 of the Tax Code of the Russian Federation).

The invoice itself is a document of strict form. Its form and rules for filling out were approved by Decree of the Government of the Russian Federation No. 1137 in 2011 and, according to the Federal Law “On Accounting”, are mandatory for use (read about accounting for invoices here). According to Art. 169 of the Tax Code of the Russian Federation, it must contain the following information:

- number and date of compilation;

- names, addresses and tax identification numbers of both parties to the agreement;

- details of the payment document, if advance payments were made;

- name and quantity of goods supplied or work performed with units of measurement (if they can be specified).

In the event that the counterparty has already transferred funds to the taxpayer who issued the invoice, the data of the payment and settlement document must be reflected.

For more information about what an invoice is and when this document is used, read this article, and what this document is needed for can be found here.

What should be understood by the term “payment and settlement document”?

Clause 1.12 of the Regulations on the Rules for Transferring Funds” (approved by the Bank of Russia in 2012, No. 383-P) provides a list of such documentation. Each of its types has its own requirements, and each has its own area of application.

Most of them are used exclusively in the banking sector, so in practice, the invoice can contain data from two main types of documents :

- Payment requirements.

- Money orders.

Important. A collection order can also be used as a separate type of payment order, however, due to its complexity, it is usually not used in “advance delivery” type calculations.

The difference between payment orders and demands is as follows:

- Using a payment order form according to OKUD No. 0401060, the organization (or individual entrepreneur) that has entered into a banking service agreement instructs its bank to transfer funds from the current account using the details of the counterparty. Therefore, when making payments under contracts with partial or full prepayment, payment orders are the most common form of documentation used. You can find out about the invoice for individual entrepreneurs here.

- With a payment request (OKUD No. 0401061), the contractor invites the payer to transfer funds according to the specified details in payment of the debt available under the contract. Such documents are usually used for cash settlement services, and they are also often used in monetary relations with government agencies.

Thus, usually in the invoice after goods and materials have been shipped, services have been provided, and work has been completed, the payment order will be indicated . Therefore, it is its number and date that must be entered in column 5 of the invoice form.

Only after the invoice has been accepted and signed can VAT be deducted according to the rules established by Chapter. 21 Tax Code of the Russian Federation.