Taxpayer category code in the 3-NDFL declaration: what does it mean

This code takes the following values depending on the category of the payer submitting the 3-NDFL declaration (approved by Order of the Federal Tax Service of Russia dated October 3, 2018 N ММВ-7-11/ [email protected] ):

| Taxpayer category in 3-NDFL | Code |

| An individual registered as an individual entrepreneur | 720 |

| Notary engaged in private practice, as well as other persons engaged in private practice | 730 |

| Lawyer who established a law office | 740 |

| Arbitration manager | 750 |

| Another individual declaring income subject to personal income tax or submitting a 3-personal income tax declaration in order to obtain deductions or for another purpose | 760 |

| An individual registered as an individual entrepreneur and who is the head of a peasant (farm) enterprise | 770 |

That is, for example, an ordinary “physicist” (not an individual entrepreneur) declaring income from the sale of an apartment must put “760” in the “Taxpayer Category Code” field.

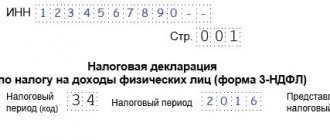

How to correctly enter information into the declaration

The indicator for the title page line “Taxpayer Category Code” in 3-NDFL 2021 consists of three digits entered in the corresponding cells of the line. One number fits into each cell.

There are two ways to fill out this field:

- Using a special program that can be installed on a PC or used online.

- Entering the code by hand. When filling out the declaration manually, you should strictly use black or blue ink; the numbers should not go beyond the cells allocated for them. You cannot make corrections or make blots.

What it is

The taxpayer category code in the 3-NDFL declaration is a digital designation that is written on the title side of the 3-NDFL declaration.

Tax reporting in form 3-NDFL is prepared and submitted by individuals and individual entrepreneurs upon receipt during the reporting period and to obtain a state tax deduction for income tax.

You can submit reports in person at a tax office branch or remotely by mail or via the Internet.

The document can also be brought by a relative or friend of the taxpayer. To do this, you need a power of attorney certified by a notary. The 3-NDFL declaration form is available.

And relatives can do this for the taxpayer by providing a document that confirms the relationship.

Results

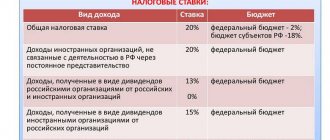

The indication of the type of income code is provided in two sheets of form 3-NDFL: appendices to section 2. Different code numbers are used for these sheets. They are taken from different places of the same source: appendices No. 3 and No. 4 to the Procedure for filling out 3-NDFL, respectively.

Sources:

- tax code of the Russian Federation

- Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Decoding common numbers

The code takes the value of the category of each individual citizen of the Russian Federation.

- 720

– indicates a person who is a tax entrepreneur. - 730

– a category of citizens who are engaged in private practice. - 740

– a lawyer who owns an office. - 750

– code of the arbitration manager. - 760

– an individual whose activities are subject to tax or a citizen submitting a declaration in order to obtain a deduction. - 770

the code corresponds to an individual entrepreneur whose head is the owner of the farm.

Filling out a document using code 760

A larger number of taxpayers who prepare a declaration go under code 760. This includes the following categories of citizens:

- those who received income not from a tax agent, but for any other reason (rent, legal or employment contract, etc.);

- persons who executed the document after the sale of the property;

- those who received income outside the country;

- winners of lotteries, various gambling games and their organizers;

- individuals who fill out a certificate in order to apply for the right to standard, social and other deductions.

Where is the taxpayer category code filled in in the 3-NDFL declaration?

Structurally, the 3-NDFL certificate can be divided into two parts: the first will include sections that are required to be completed for each person; the second includes those sheets that need to be completed in individual cases. Thus, each individual who submits a tax return to the Federal Tax Service of Russia fills out the title page and sections I and II. Other sheets (A, B, C, D, D1, D2, E1, E2, G, G, I) are filled in optionally.

The 3-NDFL certificate opens with the title file, which includes basic data about the taxpayer: last name, first name and patronymic, registration address, identification document details - series and passport number. An important point is that the declaration is supplied with a signature, which certifies the completeness and accuracy of the data presented. In addition, the title page indicates:

- code of the Federal Tax Service - the local tax office to which 3-NDFL is submitted;

- taxpayer country code;

- code of the type of document certifying the identity of the payer;

- taxpayer category code.

We will dwell in more detail on the main codes indicated in the tax return. The Federal Tax Service Inspectorate code hides a specific tax office to which an individual submits documents at the place of residence or registration. For example, for inspection No. 25 in Moscow, the code “7725” is used. The country code indicates the state of which the taxpayer is a citizen. The Republic of Belarus owns the combination of numbers “112”, Kazakhstan – “398”; Russians enter the code “643” in their declaration.

Types of taxpayer codes

Another code to be filled out in the certificate indicates the category of the individual paying the tax. There are six such categories in total, and every taxpayer filling out 3-NDFL can include himself in them.

The table below shows the characteristics of a taxpayer with their corresponding numeric code:

For example, a tutor is a person who gives private lessons and is subject to registration as an individual entrepreneur. When filling out a tax return in form 3-NDFL, the tutor enters the code “720”. As for paying tax on additional income, in 3-NDFL the taxpayer category code is “760”. The same numerical value is indicated by persons claiming tax deductions.

Author: Mainfin.ru Team

Related terms

- How to fill out the 3-NDFL declaration - instructions, sample filling

- 3 Personal income tax in 2021 - sample of filling out a declaration

- How to submit a 3rd personal income tax return through State Services

- Certificate 2-NDFL - what is it and why is it needed?

- Income codes in personal income tax certificate 2 in 2021

- How to fill out a 2-NDFL certificate - sample and procedure

16:03 09/03/2020 Credit card Certificates Installment plans Deposits Loans Current account Microloans Banks Benefits Salaries Mortgage Debit card Money transfers

Subscribe to Yandex.Zen

Section 1 codes in 3-NDFL

You should be especially careful when filling out the codes in this section. The likelihood of a tax refund may directly depend on the correctness of their entry:

- Budget classification code (or BCC) is a 20-digit code that identifies a budget revenue or expenditure item. If you are an individual who wants to return the tax withheld by tax agents, indicate in Section 1 of the declaration KBK 18210102010011000110. If you are an individual who needs to pay additional personal income tax to the budget (that is, you enter the value on line 040) - enter KBK 18210102030011000110.

Please note: in the application for personal income tax refund you must also indicate the KBK. The same as indicated in Section 2 of the filed declaration.

- OKTMO code is the identifier of the territory of the municipality. It is needed more for state statistics, but it is very advisable to enter it correctly too. The first thing you should know is that when returning tax paid by a tax agent, the OKTMO code of the tax agent is entered in Section 1 of the 3-NDFL declaration. Since it was he who transferred the tax withheld from you to the budget. Typically, the agent's OKTMO is included in the certificate of income and tax amounts that must be taken before filling out the declaration.

Please note: if you have several certificates from several tax agents with different OKTMOs and all of them are refunded, you need to reflect each OKTMO separately in the declaration. It is allowed to fill out several sheets with Section 1 if necessary.

If you need to reflect the tax payable in Section 1, put “your” OKTMO. That is, the municipality in which they are registered. The easiest way to do this is at your registration (registration) address on a special resource for Federal Tax Service addresses.

Detailed transcript (760, 720)

Each tax payer belongs to a certain group, which is determined by law.

Taxpayers often wonder when preparing their return what the symbols on the first page mean.

When drawing up the title page in 3-NDFL, the responsible person must register the CCI in the reporting. Information can take on different meanings.

This depends on the position of the person providing the declaration. KKN may have the following designation:

| 720 | A private person who is entered in the register as an individual entrepreneur. Individual entrepreneurs using a special regime do not file an income tax return, because VAT and personal income tax are replaced by one tax, which corresponds to a certain regime. Moreover, if an entrepreneur receives income from activities that do not fall under the special regime, then he must file an income tax return as an individual, taking into account the rules of Chapter. 23 Tax Code of the Russian Federation |

| 760 | Other persons who declare income that is subject to tax |

Rules for submitting form 3-NDFL

The document must be submitted to the tax office at the end of the year during which the funds subject to the interest rate were spent. If the form is submitted for the purpose of deducting social or other payments, it must be submitted at least once every 3 years, because After this time, the tax authority will not accrue the required benefits. If a taxpayer files a document claiming child care compensation, it can be submitted at any time.

Taxpayer category code in the 3-NDFL declaration

Taxpayer category code in the 3-NDFL declaration - what is it?

Other codes on the title page of the 3-NDFL form

In addition to the above encodings, the KND 1151020 form also uses other values that must be indicated. The statuses are unified by order No. ММВ-7-11/671:

- tax service code. The completed KND form 1151020 is submitted to the service at the location of the organization. The code of the latter is written on the title card 3-NDFL. Inspection codes are indicated on the official service of the Federal Tax Service of Russia;

- the code of the regions that are approved by the decree are in Appendix 3;

- types of documentation indicate which document is used when drawing up the KND form 1151020. The manual containing this information is in Appendix 2;

- the type of profit on which duty is levied is specified in Appendix 4;

- the objects from which the income came are encrypted, and the codes are located in Appendix 5;

- Citizens have the right to request a refund. Such persons are also encrypted with numbers that are prescribed in Manual 6.

When preparing the title page of the 3-NDFL form, you need to indicate a lot of information, so many indicators are encrypted in numbers. This makes it easier to fill out the form and check the return with the tax office.

Submission rules

There are certain rules that apply to all 3-NDFL tax returns:

- You can compose the form by hand or using computer typing.

- Information is entered into the document manually in black or blue ink.

- Each symbol must be entered in a separate cell.

- Numeric values are equal on the right side.

- Corrections are not allowed.

- Monetary amounts are rounded to the nearest ruble.

- Only those sheets that are needed are changed.

- Empty cells must include dashes.

There are three empty cells on the form for writing the taxpayer category. Since the codes that encrypt categories are usually three-digit, there should not be a single empty cell left.

The code itself must be entered into the document carefully and ensure that each digit is entered into the cell and does not go beyond its boundaries.

If an individual decides to complete the declaration manually, then the entire document must be filled out in ink of the same color.

It should be noted that if the tax payer mistakenly enters the wrong code, then corrections in the form are not allowed. In this situation, you need to print the page again and enter the correct KKN numbers.