Salaries accrued in 2015, but not paid

The crisis has made adjustments: more and more individual entrepreneurs and organizations cannot pay wages to employees on time. According to Rosstat, the total wage debt for the month increased by 21.3%.

In this case, the accountant naturally asks the question: should the accrued but not issued salary in 2015 be reflected in the 2-NDFL certificate? If yes, what information should I provide?

The accountant reflects the accrued wages in the 2-NDFL certificate, regardless of whether it was issued or not.

It seems that there is no need to fill out a 2-NDFL certificate before repaying the debt to the employee. Since sections 3 and 5 of the certificate indicate information about income accrued and actually received by an individual. And in this case we are talking about actual income received.

The accrued salary is indicated in the certificate. This is explained by the fact that the date of receipt of income in the form of wages is the last day of the month for which the salary was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). Conclusion, the accrued salary is considered received, even if the money has not been received by the employee.

How to indicate accrued but not paid wages?

When filling out the 2-NDFL certificate if the salary is accrued but not paid, follow the rules:

- The amount of accrued salary is indicated in section 3 in the “Amount of Income”

.

After which the accrued amount will be included in the final indicator and will be reflected in section 5 in the field “Total amount of income”

.

The accrued salary minus deductions will be included in the final figure in section 5 in the “Tax base”

. - The tax is shown as part of the final indicator in section 5 in the field “Calculated tax amount”

. - Do not fill in the fields “Tax amount withheld”

and

“Tax amount transferred”

in section 5. - The accountant fills out only the certificate with attribute “1”

.

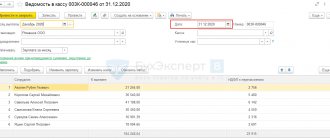

Salary accrued but not paid: how to fill out certificate 2-NDFL

Not so long ago (until 04/01/2011 inclusive) all employers were required to submit to their tax office information in Form 2-NDFL about income paid to employees for 2010 <1>.

And one of our subscribers had questions. What to do in a situation where, due to financial difficulties, the organization has not yet paid employees wages for November and December 2010 at the time of submitting the certificates? Was it necessary to show this salary in the 2-NDFL certificates for 2010? Or will this income have to be shown in 2-NDFL certificates for 2011, when the salary debt is repaid?

Salary is considered received at the time of accrual

The date of receipt of income in the form of salary is considered to be the last day of the month for which it was accrued <2>. And it doesn’t matter whether the employer paid her or not.

In the 2-NDFL certificate, income in the form of wages is reflected in section 3, broken down by the months in which it was accrued. This means that in the 2-NDFL certificate for 2010 for each employee you must show the accrued salary for November and December <3>.

Personal income tax is withheld only when paying wages

Clause 5.1 of Section 5 of the certificate indicates the total amount of income received by the employee for the year and reflected in Section 3 of the certificate. And in clause 5.2 - the amount of income subject to personal income tax. This is the difference between the income received (clause 5.1) and the deductions provided (indicated in the “Deduction Amount” columns in sections 3 and 4)3. So accrued but unpaid wages for November and December had to be reflected among other income in paragraphs. 5.1 and 5.2 certificates.

Clause 5.3 of the certificate indicates the amount of personal income tax calculated from taxable income, that is, including from accrued but not paid wages <4>.

WE WARN THE EMPLOYEE

If the 3-NDFL declaration for the purpose of receiving deductions has already been submitted to the Federal Tax Service and the originally received 2-NDFL certificate is attached to it, then after receiving the updated certificate, you need to submit an updated 3-NDFL declaration to the Federal Tax Service.

Now about the reflection of the amount of withheld tax in clause 5.4 of the certificate. From Ch. 23 of the Tax Code of the Russian Federation it follows that personal income tax must be withheld when paying income to an employee <5>. If the salary is not paid, then no tax is withheld from it. Therefore, in paragraphs. 5.3 and 5.4 of the certificate will show different amounts, since the calculated tax is greater than the withheld tax. In addition, the amount of unwithheld personal income tax for November and December must be reflected in clause 5.7 of the certificate “Amount of tax not withheld by the tax agent.” The Ministry of Finance confirmed to us that this procedure for filling out certificates is correct, and also told us how to proceed in the future.

FROM AUTHENTIC SOURCES

STELMAKH NIKOLAY NIKOLAEVICH — Deputy Head of the Department of Taxation of Personal Income of the Ministry of Finance of Russia

“Since the tax was not withheld, the indicator in clause 5.3 “Amount of tax calculated” of the 2-NDFL certificate will not coincide with the indicator in clause 5.4 “Amount of tax withheld.” In this form, the organization is obliged to submit certificates to the tax authority no later than April 1, 2011. After the salary is paid in 2011, the organization will be required to withhold tax and submit it to the tax authority (with the same number with which the initial certificates were submitted) 2-NDFL certificates for 2010 for those employees whose information has been adjusted.

Accordingly, in such 2-NDFL certificates, the indicator under clause 5.3 “Tax amount calculated” will coincide with the indicator in clause 5.4 “Tax amount withheld”.

By the way, the Federal Tax Service also allows the submission of an updated certificate, but in a situation where the employee’s personal income tax for previous years was recalculated in connection with the clarification of his tax obligations <6>.

Keep in mind that if employees asked you for a 2-NDFL certificate for 2010, then they will also need to be issued an updated certificate <7>.

* * *

Thus, in 2-NDFL certificates for 2011, the salary paid for 2010 is not reflected in section 3 as income, and the personal income tax withheld from this salary is also not shown in section 5. All this should be reflected in the updated certificate for 2010. And for the future, keep in mind that if at the time of submitting the certificates you paid off last year’s salary debt and withheld personal income tax from it, then paragraphs. 5.3 and 5.4 of the certificates must match.

——————————-

<1> approved By order of the Federal Tax Service of Russia dated November 17, 2010 N ММВ-7-3/ [email protected] ; clause 2 art. 230 Tax Code of the Russian Federation

<2> clause 2 art. 223 Tax Code of the Russian Federation

<3> section II Recommendations for filling out form 2-NDFL... approved. By order of the Federal Tax Service of Russia dated November 17, 2010 N ММВ-7-3/ [email protected]

<4> clause 3 art. 226 Tax Code of the Russian Federation

<5> clause 4 art. 226 Tax Code of the Russian Federation

<6> Letter of the Federal Tax Service of Russia dated February 24, 2011 N KE-4-3/2975

<7> clause 3 art. 230 Tax Code of the Russian Federation

First published in the magazine "General Book" N08, 2011

Salaries accrued in 2015 and paid in 2021

The situation when salaries are accrued in 2015 and paid in 2021 arises in several cases:

- The employer issues the December salary in January;

- In the new year, wage arrears for several months of last year are repaid.

In any case, the accountant withholds and transfers income tax to the budget. Then how is this reflected in the 2-NDFL certificate?

Certificate 2-NDFL must contain all information about last year’s income

Federal Tax Service specialists believe that the 2-NDFL certificate should reflect any information that relates to last year’s income

. This rule also applies if the tax from last year’s salary is transferred in the new year. If the 2-NDFL certificate has already been submitted, the employer will have to submit an adjustment.

The corrective certificate must contain duplicate data from the original document with the amount of personal income tax, which is withheld next year. This figure will be included in the totals in section 5 in the fields “Amount of tax withheld” and “Amount of tax transferred.”

GLAVBUKH-INFO

In October last year, a Letter from the Federal Tax Service was published on the procedure for filling out 2-NDFL certificates, which puzzled many accountants. It talks about a situation where an organization pays salaries with a large delay, namely, the salary for December 2012 was paid in April 2013. So, the Federal Tax Service explained that in the 2-NDFL certificate, income is reflected in those months of the tax period in which these incomes are actually paid. And in the situation under consideration, the accrued salary for December 2012, actually paid in April 2013, must be taken into account as income of 2013. (1) However, the Federal Tax Service previously said that the salary paid in January for December of last year should be taken into account as income of the previous year (2). What happens: has the position of the tax department changed?We contacted the Ministry of Finance for comments and received the following response.

FROM AUTHENTIC SOURCES

STELMAKH NIKOLAI NIKOLAEVICH - Advisor to the State Civil Service of the Russian Federation, 1st class “Firstly, the Letter of the Federal Tax Service dated 10/07/2013 N BS-4-11 / [email protected] sets out a position that relates to a specific situation. Secondly, the answer is formulated a little incorrectly. Thus, according to the Labor Code, the employer pays wages at least every half month - on the day established by the employment contract (internal labor regulations, collective agreement) (3). That is, the employer does not have the right to violate the requirements of the Labor Code of the Russian Federation regarding the timing of salary payments. But if this happens, then wage arrears arise. According to the Tax Code, the date of actual receipt by an employee of income in the form of wages is the last day of the month for which he was accrued income for work duties performed (4). Situations like the one under consideration arise because there is a gap established by the Tax Code of the Russian Federation between the deadline for calculating tax in one month, for example in December, and its withholding and transfer in another month, for example in January of the next year. Moreover, the same thing happens throughout the year: the tax is calculated, for example, in January, but is withheld and transferred in February. And this is a normal situation. After all, organizations calculate personal income tax amounts on an accrual basis from the beginning of the year based on the results of each month in relation to all income accrued to an employee for a given period, for which a rate of 13% is applied, with the offset of the personal income tax amount withheld in the previous months of the current year (5). Thus, if the salary accrued for December is paid to employees in January of the next year (for example, salaries are paid on the 5th of each month), then in Sec. 3 certificates 2-NDFL, the organization must reflect all income accrued to the employee for performing work duties, including income for December paid in January of the next year. At the same time, in paragraphs. 5.4 “Amount of tax withheld” and 5.5 “Amount of tax transferred” of certificate 2-NDFL indicate the amount of tax transferred for the tax period, including the amount of personal income tax transferred in January for December. This was done so as not to break the information in the 2-NDFL certificate about the amounts of income and tax for one calendar year. However, in a situation where the employer pays arrears, for example, for December of the current year in April of the next year, such arrears, in my opinion, should be reflected in the income of April of the next year.” Well, the position is clear, but here another question arises: at what point should wage arrears for the previous year be repaid in order for the salary to be included in the 2-NDFL certificate, as it should be, in the month it was accrued, and not in the month it was paid to the employee. It is logical to take as the starting point the day the organization submits 2-NDFL certificates to its Federal Tax Service. And if at this moment the employee’s salary for last year has been paid and personal income tax has been withheld from it and transferred to the budget, then it must be reflected as income for 2013, and not 2014. After all, on the day of submission of the 2-NDFL certificates, wage and personal income tax arrears are due there is no organization. In the certificate, the amounts of personal income tax calculated, withheld and transferred (clauses 5.3, 5.4, 5.5 of the certificate) will be equal.

Note. This is also more convenient for employees claiming any deductions for personal income tax (for the purchase of housing, training, treatment). By submitting such a 2-NDFL certificate, the employee will receive deductions in the correct amount (taking into account the December salary) and will return the entire amount of personal income tax for the year (taking into account the December personal income tax).

But if at the time of submitting 2-NDFL certificates there is arrears of wages for the previous year, the Ministry of Finance recommends doing so.

FROM AUTHENTIC SOURCES

STELMAKH NIKOLAY NIKOLAEVICH, Ministry of Finance of Russia “If on the day an organization submits 2-NDFL certificates to the Federal Tax Service, wage arrears for the previous year have not been repaid, it is possible to reflect such arrears as income in the month in which it was paid.”

It is clear that the procedure recommended by the Ministry of Finance and the Federal Tax Service is aimed at ensuring that organizations, after paying off debts on wages and personal income tax from it, do not have to submit updated 2-NDFL certificates to the Federal Tax Service. However, this still contradicts Chap. 23 Tax Code of the Russian Federation. Indeed, in relation to wages, a special date for receiving income is established - the last day of the month for which it is accrued (6). And the moment of its payment does not matter (that is, it does not matter whether it is paid to employees on time or not). So in 2-NDFL certificates, income in the form of wages must be reflected in the months in which it was accrued. Moreover, even if it is not paid on the day the 2-NDFL certificates are submitted to the tax office. Of course, then in the 2-NDFL certificates, the amount of tax calculated (including from the salary accrued for December) will be greater and it will not coincide with the amount of personal income tax withheld and transferred to the budget (precisely for the amount of the December personal income tax). But it will be correct to fill out 2-NDFL certificates in this form. But after paying the salary, you will need to submit updated 2-NDFL certificates to the Federal Tax Service, where you need to reflect in paragraphs. 5.4 and 5.5 new amounts of withheld and transferred tax (taking into account the amounts withheld and transferred in 2014). If you have repaid the entire amount of your salary debt, then in section. 5 updated certificates, the amounts of calculated (clause 5.3), withheld (clause 5.4) and transferred (clause 5.5) personal income tax will be the same. Keep in mind that updated 2-NDFL certificates must have the same numbers as the originally submitted certificates, but new dates (7).

* * * In conclusion, we note that if it is more convenient for you to reflect last year’s salary debts in 2-NDFL certificates for the current year, then you can follow the recommendations of the Ministry of Finance and the Federal Tax Service. Although they contradict the Tax Code, you will not face fines for incorrectly filling out 2-NDFL certificates. There will also be no fines or penalties if you transferred personal income tax from late paid wages to the budget on time (for example, on the day you received money from the bank for wages) (8).

——————————— (1) Letter from the Federal Tax Service dated 10/07/2013 N BS-4-11/ [email protected] (2) Letter from the Federal Tax Service dated 02/03/2012 N ED-4-3/ [email protected] ] , dated January 12, 2012 N ED-4-3/74 (3) part 6 art. 136 Labor Code of the Russian Federation (4) clause 2 art. 223 Tax Code of the Russian Federation (5) clause 3 art. 226 Tax Code of the Russian Federation (6) clause 2 art. 223 Tax Code of the Russian Federation (7) section. I Recommendations, approved. By order of the Federal Tax Service dated November 17, 2010 N ММВ-7-3/ [email protected] (8) paragraphs. 4, 6 tbsp. 226, articles 75, 123 of the Tax Code of the Russian Federation

Magazine "General Book" N 2, 2014 Sharonova E.A.

| Next > |

The employee's standard deduction exceeded his income

If an employee with a small salary receives a large deduction (for example, for several children), many difficulties arise in filling out form 2-NDFL. This is due to the limitations of accounting programs, which do not allow you to indicate the amount of deductions that exceeds income.

This problem can be solved quite simply:

- In section 4, fill in the amount of deductions so that for all codes it is equal to the amount of income;

- In section 5, enter zeros in the following fields: “Tax base”, “Tax amount calculated”, “Tax amount withheld”;

- Issue a certificate only with sign “1”.

The inspectorate did not accept the 2-NDFL certificate the first time

If the inspection did not accept some 2-NDFL certificates the first time and sent them for revision, the accountant must re-send only the rejected certificates

.

Repeated certificates in this case are not corrective, so enter “00” in the “Adjustment number” field. For a corrected certificate, only the date (when the corrections were made) changes.

What did you encounter when filling out form 2-NDFL? Leave comments under the article and get a response from experts.