Download a free example of an LLC accounting policy using the simplified tax system for 2021

As the initial sample, we chose the organization’s accounting policy - sample 2021 for an LLC operating in the catering industry and using the simplified tax system “Income minus expenses” (15%). Then we analyzed the proposed example of accounting policy for changes that come into force on 01/01/2021. The resulting result can be downloaded from the link.

In the Ready-made solution from ConsultantPlus, you can familiarize yourself with a sample accounting policy for a trading organization on the OSN; production organization at OSN. And to see the procedure for drawing up an accounting policy for VAT, refer to this Ready Solution. If you do not have access to K+, sign up for a trial demo access for free.

Why does a company need management accounting?

Management accounting itself is a system for collecting, analyzing and presenting the results of a study of information about a company’s business, its areas of activity and structure of functioning in order to ensure effective management of the company, making the right strategic and tactical decisions, as well as planning its development.

As follows from this definition, the meaning of maintaining management accounting at an enterprise is to timely provide business management with the necessary information: quantitative, qualitative, forecast, factual, etc.

PAY ATTENTION! It should be remembered that performance indicators in management reports may differ significantly from the totals reflected in the financial statements.

At the same time, the effectiveness of decisions made by a business largely depends on the figures in management reports, since for each management link, as a rule, the company generates specific reports aimed specifically at the functions of such a link.

In particular, for the top management of the company (whose function is strategic business development), the reports compiled should be integrated, consolidated, without a high degree of detail. Typically, such reports are generated for a certain time period in the past; plan/fact correspondence is provided, which serves as the basis for developing a long-term development plan for the company.

For department heads, the state of the company’s subordinate structures at the current time is more important. For this purpose, management reporting for them usually includes indicators of the department/department at a specific point in time, as well as forecast values of indicators for the short-term period.

In summary, the tasks of management accounting in a company can be summarized as follows:

- Analysis of the availability and movement of various resources (material, financial, labor) in the company, the results of which in the form of reports are sent to the management level of the organization.

- “Plan-actual” analysis of the value of business revenue, as well as production costs. At the same time, depending on the purpose of compiling reports (for senior executives or for managers), different degrees of detail are permissible: in the context of structural divisions of the company, departments, product groups, etc. Separately, in a number of cases, cost analysis is highlighted here.

- Analysis of the final indicators of the financial position. These can be either indicators of the company as a whole, or financial results for each specific department/department of the company.

- Planning and forecasting business results for the short and long term in the context of the company as a whole or its individual structural division.

- Final generation of reports and their presentation to target management levels.

When companies approve accounting policies

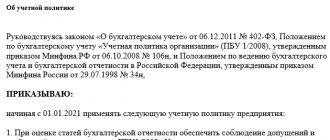

First, let's dispel the long-standing myth that accounting policies need to be approved annually. In fact, if there are no changes, then the adopted policy must be consistently applied from year to year - Art. 8 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

The following deadlines apply for organizations regarding the development and approval of accounting policies:

| Situation | Accounting policy | |

| for used | for NU | |

| Creation of a new organization | Within no more than 90 days from the date of registration (clause 9 of PBU 1/2008, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n) | No later than the end date of the organization’s first tax period (Clause 12, Article 167 of the Tax Code of the Russian Federation) |

| Making changes to accounting policies | As a general rule, a new accounting policy is approved in the current year and applied from the beginning of the next year (clauses 10, 12 of PBU 1/2008) |

|

| Making additions to accounting policies | At the moment when the additions became necessary (clause 10 of PBU 1/2008) | In the tax period when the changes became necessary (Article 313 of the Tax Code of the Russian Federation) |

NOTE! Changing and supplementing accounting policies are two different things! The changes entail the need for a retrospective recalculation of data for the years preceding the change in order to display in accordance with them incoming accounting balances and display data from previous years in mandatory accounting, while additions are needed primarily for the correct reflection of current accounting information.

Section 2. Simplified taxation system.

Goods accounting. Goods are written off when they are sold: - select the option - at the average cost (according to a weighted estimate) at the average cost (according to a moving estimate) at the cost of the first acquisitions (FIFO) at the cost of a unit of goods With a weighted estimate, we proceed from the average monthly actual cost when calculating which takes into account the quantity and cost of goods at the beginning of the month and all receipts for the month. This is the easiest way to write off.

With a rolling estimate, the actual cost of the goods at the time of sale is determined, while the calculation takes into account the quantity and cost of goods at the beginning of the month and all receipts until the moment of sale.

Standards moving forward from 2021 (point by point)

The following provisions of the proposed example enterprise policy for accounting purposes have remained unchanged from previous years and continue to be applied consistently:

- preamble and paragraphs. 1–3, since the main regulatory documents, principles and assumptions for the formation of accounting policies have not changed;

- pp. 4-6, since the applied standards for accounting for inventories in these aspects have not changed;

- pp. 7-14, since the applicable OS standards in these aspects have not changed;

- pp. 15-18, since it was decided not to change the rules set out in them regarding intangible assets;

- pp. 19, 20, because the procedure for accounting for special equipment and clothing used by the enterprise has not officially changed and is still relevant for accounting purposes;

- pp. 31–34, since the organization forms and discloses reserves for doubtful debts in the reporting for accounting purposes, and the applied procedure remains relevant;

- pp. 37–41, since the organization still does not apply some accounting provisions due to the specifics of its activities and the status of a small enterprise;

- pp. 42–44, since the current procedure for recognizing and correcting errors, as well as making changes to accounting policies remains relevant;

- pp. 46–47, 49-50, since the applied procedure and forms of document flow generally remain relevant;

- clause 51, since the special procedure for the inventory of certain accounting objects used by the organization remains relevant;

- pp. 52–62, since the organization continues to use the adopted organizational procedure in terms of signature rights, internal control, document flow and the declared ability to make changes to this accounting policy.

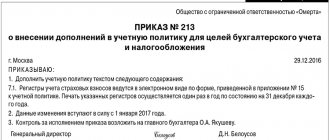

For a version of the document approving the accounting policy, see the article “Form of the order for approval of the accounting policy” .

Legal requirements

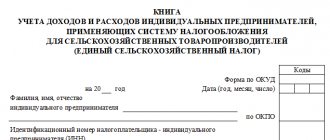

Federal Law No. 402-FZ, which regulates relations in the field of accounting, obliges business entities to formulate accounting policies. To do this, the management of the enterprise issues an order on the accounting policy of individual entrepreneurs.

Accounting methods are chosen by the businessman independently based on the provisions of the law.

Accounting policy is a set of methods for conducting economic activities.

An economic entity independently chooses methods for grouping and analyzing facts that affect the cash flow of an enterprise, develops methods for documenting transactions, and using accounts. Information on the methods of conducting economic activity is entered into a separate document on the basis of an order approving the accounting policy.

Information on the methods of conducting economic activity is entered into a separate document on the basis of an order approving the accounting policy. Is an entrepreneur required to draw up an order on the accounting policies of an individual entrepreneur?

Yes. It is formed by each business entity on a general basis. The only caveat is that micro-enterprises and non-profit institutions have the right to maintain documentation in a simpler way (using a simple accounting entry). Why does an entrepreneur need an order on accounting policies?

Each entity must choose methods of economic activity and methods for reflecting them in documents.

This is necessary for tax and accounting purposes. Although small enterprises are exempt from the obligation to record economic transactions on paper, the fiscal authority can check the movement of material assets and the income of a businessman. Therefore, individual entrepreneurs must maintain accounting policies. For accounting purposes, entrepreneurs accept documents based on OSNO and simplified documents.

For accounting purposes, entrepreneurs accept documents based on OSNO and simplified documents.

An order on the accounting policy of individual entrepreneurs on the simplified tax system is necessary for business owners who use the tax calculation form using the formula income minus costs. For accounting, the document is also needed by businessmen who combine modes of conducting business on a patent, UTII, and simplified tax system (income).

Thus, in order to ensure the correct recording of economic facts, each business entity issues an order on the accounting policy of individual entrepreneurs. It is drawn up by the entrepreneur independently and cannot contradict the law on accounting activities and the order of the Ministry of Finance No. 106n, adopted in 2008. On video: Individual Entrepreneur Accounting Policy

Changes that need to be taken into account if accounting for 2021 is being formed (item by item)

In the proposed example of an enterprise’s accounting policy for 2021, the following have been changed (added):

- Clause 6, 19, 21 - inventory accounting in accordance with the new FSBU 5/2019 “Inventories”.

How to apply the updated FSBU 5/2019 “Inventories” was explained in detail by ConsultantPlus experts. If you do not have access to the K+ system, get a trial online access for free.

- Paragraph 45 indicates the use of updated financial reporting forms for 2021 and the use of control ratios from the Federal Tax Service.

- Clause 48 - it includes an indication of the approval of mandatory requirements for the preparation of primary accounting documents. Let us remind you that as of June 9, 2019, the chief accountant cannot be fined for errors made in accounting due to the fault of third parties, including due to their incorrect preparation of primary documents. And from July 26, 2019, the Law “On Accounting” introduced an indication of mandatory compliance with the requirements of the chief accountant (another person responsible for accounting) for registration of primary accounts by all employees of the organization. In this regard, it is recommended to draw up such written requirements as an appendix to the accounting policy and familiarize them with all employees involved in working with documentation, against signature.

Section 2. Corporate income tax.

Reporting periods.

Reporting periods for income tax are: - select an option - I quarter, half a year and 9 months of the calendar year, month, 2 months, 3 months and so on until the end of the calendar year, while monthly advance payments are calculated based on the actual profit received Income and expenses. Income and expenses for tax purposes are recognized: - select the option - on the accrual basis on the cash basis. It is possible to determine income and expenses on the cash basis only if, on average, over the previous four quarters, the amount of revenue from the sale of goods, works and services excluding VAT did not exceed 1 million rub. for every quarter. Income from the rental of property is recognized: - select an option - non-operating income as income from sales Accounting for fixed assets.

Depreciation of fixed assets is accrued: - select option - linear method non-linear method for fixed assets belonging to the 1st-7th depreciation groups Depreciation bonus: - select option - not accrued according to ... (indicate for which fixed assets and what % is accrued) For fixed assets, used, the depreciation rate is determined (in the case of calculating depreciation using the straight-line method): - select the option - taking into account the service life of the fixed assets by the previous owners without taking into account the service life of the fixed assets by the previous owners Increasing and decreasing coefficients to the basic depreciation rate: - select the option - not applicable are applied (which and to which groups of fixed assets) - select an option - decreasing coefficients are applied; increasing coefficients are applied - select an option - decreasing coefficients are applied; increasing coefficients are applied - select an option - decreasing coefficients are applied; increasing coefficients are applied - select an option - decreasing coefficients are applied; increasing coefficients are applied. The use of increasing coefficients in tax accounting is possible only in a number of cases, for example during leasing. For fixed assets operating in an aggressive environment and (or) increased shifts, the increasing factor can only be applied to objects that were registered before January 1, 2014.

In this case, it is not allowed to simultaneously apply more than one special coefficient to the basic depreciation rate.

Investment tax deduction for fixed assets from the third to seventh depreciation groups: - select option - does not apply The right to apply an investment deduction is established by the law of the subject of the Russian Federation at the location of the organization (OP). The investment deduction is applied to all fixed assets belonging to the third to seventh depreciation groups, at the location of the organization and (or) at the location of its separate divisions. An organization may change a previously made decision on the use (refusal to use) of the right to an investment deduction after three consecutive years of application of such a decision, unless a different period is determined by a decision of a constituent entity of the Russian Federation.

Materials accounting. Materials are written off: - select the option - at average cost using the FIFO method (at the cost of the first materials purchased in time) at unit cost Accounting for goods and transportation costs. The purchase price of goods is determined: - select an option - based on the price established by the contract and the costs associated with the purchase of goods without taking into account the costs associated with the purchase of goods To bring tax accounting closer to accounting, it can be established that the purchase price of goods includes the same costs as and in accounting.

In particular, the costs of transportation, unloading, and intermediary fees.

Goods are written off: - select the option - at average cost using the FIFO method (at the cost of the first materials purchased at the time) at unit cost Accounting for other property that is not depreciable. The cost of tools, fixtures, equipment, devices, special clothing and other personal and collective protective equipment, other property that is not depreciable, is included in material costs: - select the option - in full amount as the property is put into operation, evenly throughout the period of use of this property over more than one reporting period in the following order: Work in progress (WIP). Direct expenses associated with the production and sale of goods (works, services) include: expenses for the purchase of raw materials and materials used in the production of goods (works, services); expenses for remuneration of production personnel, as well as the amounts of insurance premiums related to them; accrued depreciation of production fixed assets expenses for the purchase of works and services of a production nature other types of expenses Tax accounting of reserves The organization creates a reserve: for doubtful debts for upcoming payment of vacations to employees for the payment of annual benefits based on the results of work for the year and length of service for warranty repairs and warranty maintenance expenses for repairs of fixed assets When creating certain reserves in the accounting policy, it is necessary to fix individual elements of these reserves - for example, the maximum amount of contributions to the reserve.

Revenue (income) from performing work (providing services, selling products) with a long technological cycle.

If the terms of concluded contracts do not provide for the stage-by-stage delivery of work (services), revenue (income) is recognized: - select the option - evenly (monthly or quarterly) during the term of the contract in proportion to the share of actual expenses of the reporting period in the total amount of expenses provided for in the estimated method. assignment of claims.

The loss from the assignment of the right of claim, which was made to a third party before the payment deadline stipulated by the contract for the sale of goods (works, services), is determined: - select the option - based on the maximum interest rate established for the corresponding type of currency, clause.

1.2 Art. 269 of the Tax Code of the Russian Federation, based on the interest rate confirmed in accordance with the methods established by Section. V.1 Tax Code of the Russian Federation

Provisions not included in the finished document

Due to the fact that these areas of activity and accounting objects are not involved in any way in the activities of a particular enterprise, this accounting policy does not disclose the following procedures:

- recognition of revenue for work (services) with a long cycle (clause 13 of PBU 9/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n);

- recalculation and presentation in reporting of items denominated in foreign currency (clauses 6, 7 of PBU 3/2006, approved by order of the Ministry of Finance of Russia dated November 27, 2006 No. 154n);

- accounting for budget financing and other targeted financing (PBU 13/2000, approved by order of the Ministry of Finance of Russia dated October 16, 2000 No. 92n);

- accounting for R&D (PBU 17/02, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 115n);

- accounting of financial investments (PBU 19/02, approved by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n).

For information on what aspects you should pay attention to if an enterprise is also developing a policy for management accounting, read the article “Accounting policies for management accounting purposes .

What should a software package for OSNO contain?

(for accounting purposes).

(for tax accounting purposes).

This is the most extensive version of the accounting policy, since the most stringent requirements for accounting, preparation and submission of reports are applied to companies on OSNO.

The accounting policy on OSNO can be drawn up in a single document containing parts for accounting and tax accounting, or in two separate parts. At the same time, tax policy is the most important here, since it determines the process of forming the base and calculating the main types of taxes, and especially the income tax.

Key points to consider in the accounting part of the document:

- List of regulatory documents that are used for accounting. If a company uses IFRS in some area, then this must be stated;

- Accounting chart of accounts;

- Preparation of financial statements - a list of prepared forms (for example, small businesses are given the right to draw up a simplified balance sheet), details of disclosed indicators, preparation of explanatory notes to the balance sheet and annexes. This section also indicates if the company prepares interim reporting;

- Primary documents - here it is necessary to mention which forms are used in the standard form and which in your own. The latter will need to be enabled as applications.

- Who in the organization has the right to sign primary documents, bills, invoices, etc.;

- How exactly is the accounting of incoming materials carried out, how is the assessment carried out upon receipt and write-off;

- How exactly will exchange rate differences for assets in currency terms be determined?

- How exactly are administrative and commercial expenses written off, how is revenue recognized for products that have a production cycle of more than 12 months, how is work in progress accounted for;

- Income tax for accounting purposes - it is necessary to indicate whether the entity uses PBU 18/02, exactly how the amount of tax is determined for the report on financial results;

- The process of creating reserves - how exactly a reserve for doubtful debts is created (all companies are required to have one), whether a reserve fund is created (it is optional);

- Accounting for fixed assets - this section establishes how the useful life of fixed assets is determined, what depreciation method is used, how fixed assets with a price of up to 40 thousand rubles are written off, and the method of revaluation. For small businesses, it is possible to charge depreciation once a year, and this also needs to be canceled in the document.

In the tax part of the document, there is no need to indicate accounting and calculation methods if they are clearly indicated in the establishing documents. However, if it is proposed to choose one of several methods, then this must be included in the document.

In particular, the following points must be reflected:

- Which of the two methods is used to calculate depreciation?

- What method will be used to determine the price of materials and raw materials;

- If advance payments of income tax are made, how often are they made?

- How often are income tax returns filed?

- Which of the two ways will income be recognized?

- If the accrual method is selected in the previous paragraph, then how will payment for work be indicated, which started in one period and completed in another;

- Which of the expenses specified in the Tax Code will be considered direct;

- How tax accounting will be carried out - in accounting registers or separate ones.

You might be interested in:

Outsourcing of accounting services: what is it, pros and cons, review of offers

Results

A ready-made accounting policy has a set of aspects characteristic of the organization for which it was drawn up. Using a ready-made document from another enterprise as a sample for preparing an accounting policy, you should compare and adjust the provisions for each item. And also take into account those provisions that may not be used (not disclosed) in the accounting policies of one enterprise, but should be included in a similar document of another.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Separate VAT accounting for taxable and non-taxable transactions

A company may carry out various transactions, some of which are subject to VAT, and others are exempt from this tax. The law says that in this case, records are kept separately. In addition, separate accounting is carried out if part of the transactions is subject to a 0% VAT rate. The block dedicated to separate accounting will be the largest.

How to keep separate records

In the absence of separate accounting, you do not have the right to accept “input” VAT for deduction. Therefore, in the accounting policy, indicate the procedure for its maintenance. Here are the main options.

Option 1: separate accounting of VAT on accounting subaccounts

For separate accounting of “input” VAT, the following sub-accounts are opened to account 19:

- VAT on taxable transactions (VAT deductible);

- VAT on non-taxable transactions (VAT included in the price);

- VAT on taxable and non-taxable transactions (VAT on distribution).

In addition, separate accounting of transactions is kept in account 90. The following subaccounts are opened for subaccount 90.1:

- revenue from sales subject to VAT;

- revenue from sales not subject to VAT.

And for subaccount 90.2 these are:

- cost of sales subject to VAT;

- cost of sales not subject to VAT.

These are only recommended subaccounts. You can develop your own that will suit the nature of your business.

Option 2: separate accounting and use of registers

Separate accounting registers are internal documents of the company, with the help of which the accounting department separates taxable and non-VAT-taxable transactions. Examples of such documents are: certificates, calculations, statements, tables, and so on. Fix their form and content in the accounting policy. Remember that any register must contain:

- Title of the document;

- name of the organization that uses it;

- start and end dates of register maintenance;

- chronological and systematic grouping of accounting objects;

- units;

- Full name and position of the person responsible for maintaining the document.

In addition, for separate accounting purposes, you can use the purchase and sales ledger and the invoice journal.

List of goods and VAT on which is distributed by calculation method

Let's consider a simple situation. The company purchased materials with VAT that it will use in taxable activities. “Input” VAT can be deducted to reduce the VAT payable. But if materials were purchased with VAT, but for non-taxable activities, the amount of VAT will be included in their cost and charged to expenses. This “input” VAT cannot be deducted.

But there are more complicated situations when values and services purchased with VAT are used in both types of activities at once. This applies to expenses accounted for on accounts 25, 26 and 44. In this case, the share of VAT that can be deducted is calculated using the formula:

Share of VAT deductible = Revenue from sold goods and materials and services subject to VAT / Revenue from sold goods and materials and services

Therefore, the share of VAT that we include in the price is calculated using the formula:

Share of VAT deductible = Revenue from sold goods and materials and services, not subject to VAT / Revenue from sold goods and materials and services

To calculate the proportion, we use the amount of revenue minus VAT, even for income from operations subject to VAT. Do not include income that is not revenue, for example, interest on deposits or dividends on shares.

In your accounting policy, reflect the types of expenses that cannot be attributed to a specific type of activity and the “input” VAT on which will be considered a distribution of revenue.

Criteria for classifying expenses as taxable and tax-exempt activities

Tax authorities should not have any questions about why this expense is classified as a VAT-taxable activity, but this one is not. The more detailed you write down the logic for allocating expenses, the easier it will be to prove the correctness of the decision made.

Application of the 5% rule

Above we talked about expenses that need to be distributed using the calculation method. However, if for a quarter the share of expenses for the purchase or production of goods and services not subject to VAT does not exceed 5% of total costs, then the amount of “input” VAT can be fully deducted.

In your accounting policy, indicate whether you use the 5% rule or not.