When conducting a desk audit, Federal Tax Service specialists rely on data from declarations and calculations submitted by the taxpayer, and other documents at the disposal of the tax service. This rule is established by paragraph 1 of Article 88 of the Tax Code of the Russian Federation.

Based on paragraph 1 of Article 31 of the Tax Code of the Russian Federation, the Federal Tax Service may request from the taxpayer documents that serve as the basis for the calculation and payment of tax, as well as documents confirming the correctness of their calculation and timely payment. The taxpayer’s obligation, which, among others, is imposed on him by Article 23 of the Tax Code of the Russian Federation, is to provide such documents within the established time frame.

What documents and in what cases can the tax service require from a company during a VAT audit? In August of this year, the Federal Tax Service provided clarifications on this issue, which are contained in the department’s letter No. ED-4-15/ [email protected]

How to find out from the counterparty

Often during the verification process, a potential partner is asked to provide

official confirmation from the Tax Inspectorate that his organization is a VAT payer. This request puts the taxpayer in a difficult position.

The fact is that there is no special form of information letter that would confirm the fact of application of the general system of taxation and payment of VAT to the budget. Only simplified taxpayers can receive such a letter and thereby confirm the legality of issuing invoices without allocated VAT.

But you can request other documents from the counterparty that officially indicate its status as a VAT payer.

This:

- a copy of the last submitted VAT return/its cover page with a mark from the Tax Inspectorate on its acceptance;

- a copy of the Sales Book (not all partners are ready to provide this document and declassify the list of their partners and turnover);

- registration documents (including an extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs).

You can also ask your potential partner for a letter on her letterhead about the applicable tax system. This letter is drawn up in free form and contains the details of the organization, contact information and the beginning of work at OSNO. The document is signed by the chief accountant or manager.

Additional confirmation of the fact that the counterparty is not one of the fly-by-night companies is a certificate of absence of debt to the budget, received by it from the Federal Tax Service at the place of registration.

It is important to understand that the provision of all specified information by the counterparty is carried out on a voluntary basis. But usually in the business community they treat such requests with understanding when concluding an agreement and provide the documents they have only if they do not contain information that constitutes a trade secret.

How value added tax will be checked in 2021

Most often, tax authorities' claims are related to gaps in VAT. Let's imagine a situation: you have found a counterparty, carried out an audit, but the automatic control system detects a break in the VAT chain that occurred not with you, but with your counterparty. They check the payment of VAT and gaps in this tax automatically. ASK VAT is an automatic control system that in a short time will track the path of goods and payments - from the manufacturer to the final consumer through a chain of intermediary sellers. ASK VAT-3 will immediately show the settlement procedure, reveal the reality of the economic activities of the parties to the transaction and establish signs of interdependence of the counterparties. If we add the automatic downloading of information about transactions from the books of purchases and sales of counterparties, then it becomes obvious that there is no chance of success for a company that, without sufficient grounds, filed a VAT return with the amount of tax claimed for refund.

Since 2021, the VAT Control software package has been used, which allows you to:

- using more advanced control methods, “catch” taxpayers who previously managed to pass automated control without criticism;

- track indicators in the VAT return for taxpayers who violate laws;

- exchange information and reporting forms between Federal Tax Service departments.

At this stage, banks join the information collection and processing system. This means that, in addition to books of purchases and sales, cash movements in the company’s account will also be displayed online. At the same time, banks and the tax authority control all types of settlements with: individuals, legal entities, entrepreneurs, and self-employed people.

Unloading a VAT tree of the 5th–6th generation with a small number of counterparties physically takes 40–50 minutes. Thus, a tax official can look at the chains of connections of several companies in a short time and find errors and gaps in VAT. Indeed, in practice, no matter how ideally you try to conduct your business, no matter how you collect documents, it is simply impossible to check all counterparties. Both technically and due to the lack of necessary resources.

Technical changes include the following. A separate module “Special Control Operations” has appeared. First of all, it is designed to identify those who directly use optimization schemes, although it may also affect those who do not resort to them, but in one way or another work with counterparties who use these schemes.

Several operations fall under special control of the tax authorities:

- discrepancies between journals;

- violation of control ratios;

- questionable charges;

- non-comparable transactions (splitting invoices for different periods, using invoices before 2015, etc.).

Now the VAT tax gap is only 0.43%, although four years ago it was at 8%. And with new software products it is implied that the verification will be more thorough.

Cash flow check

Checking the flow of funds is carried out with the help of banks, which upload information regarding the payment process. The software product does not reconcile payments and invoices. In addition to legal entities, individuals are checked automatically. From September 1, 2021, no. 1.1 art. 86 of the Tax Code of the Russian Federation obliges banks to report to the tax authorities about the opening (closing) of individual accounts. From June 1, 2021, banks, at the request of tax authorities, are also required to provide certificates of individuals’ accounts in precious metals.

In relation to direct transactions and operations with VAT, it is necessary to remember that in the absence of payment or payment for the goods in the minimum amount, this fact indicates an unjustified tax benefit. But often the lack of payment indicates a lack of money or non-standard forms of payment. For example, in the form of a bill or compensation.

Checking bank guarantees

Checking bank guarantees is used when applying the application procedure for VAT refund. When checking bank guarantees received by the tax authorities, including those signed by an authorized representative of the bank, the tax authorities may request a power of attorney confirming the authority of the person who signed the bank guarantee on behalf of the bank. As well as powers of attorney connecting the principal with the authorized person who signed this bank guarantee, and a sample signature card of this person, if the above documents have not been requested and submitted earlier or are not contained in the information resources of the tax authorities.

A general license of the bank to carry out banking operations may also be requested, and if a guarantee is issued by a bank branch, an order may be sent to provide a copy of the bank branch’s regulations, providing for the possibility of the branch issuing a bank guarantee, in order to establish the reality of its issuance.

At the same time, the norms of civil and tax legislation will also apply to bank guarantees, and therefore it is necessary, in the case of signing an electronic bank guarantee by an authorized person, simultaneously with the electronic bank guarantee, to additionally submit powers of attorney in scanned form with UKEP, connecting the principal with the authorized person who signed this electronic bank guarantee person (Letter of the Federal Tax Service of the Russian Federation dated November 6, 2020 No. EA-4-15/18187).

Checking VAT returns

Verification of VAT returns is one of the types of tax audits - a type of desk audit. The declaration is verified automatically by checking the control ratios. At the same time, it is advisable to pay attention to the Letter of the Federal Tax Service of the Russian Federation dated October 6, 2020 No. ED-20-15/ [email protected]

The first thing that regulatory authorities pay attention to is the date of submission of the declaration. The day of submission of a VAT tax return is understood to be the 25th day of the month following the expired tax period (the deadline provided for in paragraph 5 of Article 174 of the Tax Code of the Russian Federation for the submission of a tax return), or the day of submission of an updated VAT tax return. Accordingly, failure to submit a return on time will result in tax penalties.

The second thing the tax return is checked for is the application of the declaration procedure for VAT. No later than 10 calendar days from the date of submission of the VAT return, an assessment is carried out for compliance with the following conditions:

a) an application for application of the application procedure for VAT refund has not been submitted;

- the taxpayer, in accordance with the data of the software “VAT Control”, belongs to a low, medium or uncertain (for individual entrepreneurs) level of risk;

- VAT reimbursement from the budget of the Russian Federation was declared in the period preceding the tax period for which the VAT tax return was submitted and, according to the decision on reimbursement, confirmation of the amount of VAT to be reimbursed amounted to more than 70% of the tax amount claimed to be reimbursed;

- more than 80% of VAT deductions from the total amount of deductions declared by the taxpayer in the audited VAT tax return fall on counterparties of low, medium or uncertain (IP) risk levels and at least 50% of the amount of VAT tax deductions fall on counterparties specified in tax return for the previous tax period;

b) the amount of taxes paid for the three years preceding the tax period for which the VAT return was submitted exceeds the amount of tax claimed for reimbursement from the budget under such a return.

Third, the tax authority evaluates compliance with the following conditions:

- the absence of errors in the tax return and (or) contradictions between the information contained in the submitted documents, or inconsistency of the information provided by the taxpayer with the information contained in the documents available to the tax authority and received by it during tax control, leading to a change in tax obligations;

- the absence of contradictions or inconsistencies between the information on transactions contained in the VAT tax return submitted by the taxpayer and the information on these transactions contained in the VAT tax return submitted to the tax authority by another taxpayer (hereinafter referred to as discrepancies), or the discrepancies do not indicate an understatement the amount of tax payable to the budget of the Russian Federation or an overstatement of the amount of tax declared for reimbursement from the budget of the Russian Federation;

- absence of signs of violations of the legislation of the Russian Federation on taxes and fees, leading to an overestimation of the amount of tax declared for reimbursement from the budget or to an understatement of the amount of tax payable to the budget of the Russian Federation.

Tax authorities will refuse to apply a VAT tax deduction if, after making a decision to reimburse the amount of value added tax claimed for reimbursement from the budget of the Russian Federation, circumstances are established that indicate:

- there are signs of a taxpayer reducing the tax base and (or) the amount of tax payable as a result of distortion of information about the facts of economic life;

- identifying objects of taxation that are subject to reflection in tax and (or) accounting or tax reporting of the taxpayer (clause 1 of article 54.1 of the Tax Code of the Russian Federation);

- failure to comply with at least one of the two conditions defined in paragraph 2 of Art. 54.1 of the Tax Code of the Russian Federation within the framework of transactions concluded by the taxpayer;

- the presence of other signs of violation of the legislation on taxes and fees, indicating an overstatement of the amount of tax declared for reimbursement from the budget of the Russian Federation to the tax authorities in accordance with the provisions of the recommendations of the Federal Tax Service of the Russian Federation on planning and preparation of on-site tax audits dated 02/12/2018 No. ED-5-2/ 307dsp@, immediately organize activities to conduct a pre-audit analysis in order to send its results to the department to consider the issue of including the taxpayer in the Plan for conducting on-site tax audits.

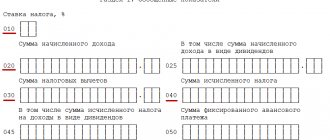

When checking declarations, the tax authority also uses control ratios (Letter of the Federal Tax Service of the Russian Federation dated March 23, 2015 No. GD-4-3 / [email protected] , as amended dated February 13, 2020 “On the direction of control ratios of tax return indicators for value added tax”) , with which you can double-check yourself.

Application of the new VAT inspection regulations

Tax audits are carried out in strict accordance with regulatory procedures. But regulations also do not stand still. Based on the VAT verification regulations, it is necessary to pay attention to the fact that the regulations highlight the following special control operations:

- Discrepancies between journals. Now discrepancies of the “gap” type are tracked not only under section 3 of the declaration, but also under section 11 “Recording log of received invoices”.

- Control ratios. Attempts to reflect tax deductions without accruing corresponding tax liabilities are monitored.

- Questionable charges. The buyer's deductions generated in the absence of payment of obligations by the seller are considered. In this case, there are no breaks in the chain of companies, but there is no tax payment.

- Unmatched transactions. Transactions in declarations with risk characteristics, the purpose of which is to avoid automated control. Cases of splitting invoices (partial deductions in different periods) will be closely monitored.

According to the new procedure, within 15 days after the deadline for submitting the VAT return, two lists are formed in the Federal Tax Service database with:

- inconsistencies and contradictions of a “technical nature”;

- signs of “scheme” violations.

The system of coloring taxpayers in the VAT-2 ASK will be replaced (supplemented) by a system of points assigned according to more than 30 criteria contained in the new regulations. The criteria for assigning points will be the size of non-current assets, the average number of employees and the amount of remuneration, the availability of facilities for carrying out activities, records of unreliable information, information on current accounts, the share of VAT deductions in the total tax amount.

Application of operational control

Cash desks transmit the following information about the taxpayer to the tax office: date and time of purchase, place of transaction, name of the product or service. And also much more. Using online cash registers, you can analyze revenue for any period for a specific company, industry, city, etc. Accordingly, the cash register shows the volume of your sales and VAT, which corresponds to the products sold.

Operational control is a type of control when using cash register equipment. However, at the same time, operational control makes it possible to identify cases of non-accrual of VAT. The Tax Code of the Russian Federation is being supplemented with a new section - “Operational control”. Operational control is planned to be carried out both in the form of monitoring and operational inspections:

Monitoring of settlements will be carried out by the Federal Tax Service using an automated information system.

During operational inspections, tax control measures will be carried out, including surveillance and test purchases. When conducting an operational audit, tax authorities will be able to involve the FSB authorities. An operational inspection may be scheduled regardless of the time of the previous operational inspection for the same period if the tax authority receives applications from individuals and organizations.

That is, in fact, the FSB will conduct an additional VAT check by checking cash discipline. Also, when checking cash register equipment and VAT, the tax authority will have an additional way to suspend the company’s activities. If an organization repeatedly violates the obligation to record settlements within a year and the amount of unrecorded settlements exceeds 1 million rubles, its activities may be suspended for up to 90 days, as well as access to its websites, mobile applications, pages on social networks, messenger accounts that are used to provide information about goods and services online, as well as their purchase.

Operational control will become faster than other forms of tax control. Organizations are required to provide the requested documents during an operational inspection within three days from the date of receipt of the relevant request. Only five days are provided for providing the necessary explanations or ten days for making appropriate corrections after a message received from the tax authority that during the monitoring, contradictions or inconsistencies were identified in recording calculations.

VAT verification in transactions with related parties

Interdependent persons are subject to special control, which is not surprising, since in this case there are greater risks of unjustified tax benefits. However, within the framework of a family business, a business built on the development of entrepreneurial initiatives among staff, variants of interdependence occur quite often.

The audit is carried out on the basis of a notification of controlled transactions or a notice from the territorial tax authority conducting an on-site or desk tax audit, tax monitoring of the taxpayer, as well as when a controlled transaction is identified as a result of the Federal Tax Service conducting a repeated on-site tax audit in order to monitor the activities of the tax authority that conducted the tax audit , tax monitoring.

According to sub. 4 p. 4 art. 105.3 of the Tax Code of the Russian Federation, one of the taxes for which the completeness of calculation and payment is checked in this situation is VAT, provided that one of the parties to the transaction is an organization (IP) that is not a VAT payer or is exempt from fulfilling the duties of a payer for this tax.

The claims of tax authorities include the need to adjust the tax base, which can be identified by the tax authority when checking the completeness of calculation and payment of income tax or personal income tax (for individual entrepreneurs). In this case, it does not matter whether the other party to the transaction is recognized as a VAT payer (Resolution of the Eleventh Arbitration Court of Appeal dated June 16, 2015 No. 11AP-5243/2015 in case No. A72-1222/2014). Therefore, it is better not to abuse transactions with interdependence, as this will automatically be a tax risk criterion.

Inspection of premises

Let’s imagine a situation: you have claimed VAT for deduction, but the goods are on the way or you have not picked them up from the seller’s warehouse, or maybe your product is unique and has not yet been produced, but you have already claimed VAT for deduction. After conducting an inspection, representatives of the tax authority will not see the goods, therefore, they may conclude that the transaction is fictitious and, as a result, will refuse to deduct VAT.

The inspection is carried out only after notification of the taxpayer. Only objects and territories that belong to the person being inspected and not to third parties are inspected.

The inspection can be carried out:

1) as part of the inspection:

a) traveling – in any case;

b) desk - if a VAT return is checked, in which (either or):

— the right to a tax refund has been claimed;

— there are inconsistencies or information that contradicts the information in the counterparty’s declaration;

2) outside the scope of the inspection - documents and objects may be inspected if (either):

- they were received by the inspection as a result of previously carried out control activities;

- with the consent of the owner of these items to examine them.

Article 92 of the Tax Code of the Russian Federation does not mention what exactly inspectors can inspect. This gap is filled in subparagraph. 6 clause 1 art. 31 of the Tax Code of the Russian Federation, which states that in accordance with Art. 92 inspectors can inspect any production, warehouse, retail and other premises and territories used by the taxpayer to generate income or related to the maintenance of taxable objects, regardless of their location, as well as conduct an inventory of property owned by the taxpayer.

Additionally, the tax authority may seize documents and items. If company representatives or any other persons do not allow inspectors into the office, then they can be punished under Part 1 of Art. 19.4.1 Code of Administrative Offenses of the Russian Federation with a fine of 10 thousand rubles.

In conclusion, it should be noted that the tax authority has quite a lot of grounds for checking the payment of VAT. It should be noted that taxpayers are in a more disadvantageous position, since the taxpayer cannot check the entire chain of counterparties, guarantee the delivery of goods to the warehouse on time, and the absence of debt. But all non-standard situations may be grounds for additional VAT assessment and refusal of tax refund.

Independent verification of the counterparty

What measures can a company take to protect itself from unscrupulous counterparties and what is important to check the counterparty for?

Among the criteria that are worth paying attention to are:

- the correctness of the details in the invoice received from the company;

- the validity of its registration data (whether the company has been excluded from the register of legal entities and individual entrepreneurs), whether the company is on the list of liquidated ones;

- checking senior management for disqualification;

- whether the company is a shell company;

- existence of debts on taxes and fees;

- form of taxation.

Today, a significant amount of information about a legal entity can be obtained from the electronic services of the Federal Tax Service (they are combined in the block “Check if your business is at risk?”).

The service “Information on state registration of legal entities, individual entrepreneurs, peasants/farms” (https://egrul.nalog.ru) allows you to understand whether the company is registered in principle, information about its management, etc. An extract from the Unified State Register of Legal Entities is also available for download here/ EGRIP.

The invoice verification service (https://npchk.nalog.ru) allows you to check the correctness of the submitted invoice. Since, according to the new rules, starting from 2015, information in the VAT return must contain data from the Book of Purchases and Sales, this resource will save time on identifying errors in the declaration.

The search can be conducted using the organization's INN/KPP.

If a deduction is claimed

Value added tax is not only one of the most significant for the budget, but also the most difficult to calculate and control. Therefore, when conducting a desk audit for VAT, special rules apply. Even if the submitted declaration does not contain any errors or discrepancies with other participants in transactions, tax specialists may request additional documents from the company to verify the legality of the tax deduction. Of course, if this deduction was declared in the declaration.

According to paragraph 1 of Article 172 of the Tax Code of the Russian Federation, tax deductions are made on the basis of invoices issued by sellers, as well as documents confirming payment of tax to the budget. Consequently, it is these documents that the tax inspector will request if he decides to check the company’s right to apply the deduction.

Searching for information in the register of disqualified persons

(https://service.nalog.ru/disqualified.do) allows you to check by full name, name and details of a legal entity whether the manager is on the list of disqualified persons.

You can also look for the leader in the list of those who are prohibited from leading the organization.

Some of the signs that a company is a one-day company are: the fact that several legal entities are registered at its legal address (so-called “mass registration addresses”; verification according to this criterion can be carried out at https://service.nalog.ru /addrfind.do); the fact that its director is the founder of several legal entities at the same time (you can check this data at https://service.nalog.ru/mru.do).

The service “Information on legal entities that have tax arrears/do not submit reports” allows you to identify legal entities with arrears to the budget. If a company is on this list, this increases the risk that it will not remit VAT and it will be impossible to offset it in the future.

Tax traffic light

And now some information about what colors taxpayers appear in in the tax program.

Tax officials are not particularly imaginative in this regard - they use the colors of traffic lights. The color of a particular company is not assigned forever; the color can change every quarter (usually after the camera room). What does their tax traffic light mean for inspectors?

1. Red - companies with signs of being ephemeral. This is a classic - companies that, as a rule, do not have an office, staff, landline telephone, do not pay taxes or the amounts of payments are insignificant.

2. Green – organizations with real activities, turnover, assets, personnel. Such companies pay taxes, submit reports, and respond to requests and demands from tax authorities. The accounting department of such organizations actively responds to claims from tax authorities, communicates with them, and eliminates violations.

3. Yellow – all other companies that have errors in their invoice details and tax returns. Such companies can claim a deduction for the counterparty, which is marked in red or yellow by the tax authorities. As a rule, declarations of large companies that defend the right to a tax deduction are painted in this color even when the tax authorities have claims against their counterparties.

Contacting the tax office

Contacting the Federal Tax Service in order to clarify whether the supplier is a VAT payer and how conscientiously he fulfills his obligations to pay taxes and submit reports will be a common waste of time. The Federal Tax Service is not obliged to disclose such information at the request of taxpayers and will most likely ignore the request. Confirmation of this position of the tax authorities is the letter they distributed in 2015 about the availability of all information that does not constitute a commercial secret in the public domain.

In 2021, the Tax Inspectorate announced its plans to make information about the special regimes applied by the company publicly available. Those. the service will allow you to find out whether the taxpayer pays VAT or is legally exempt from it. But this resource is not yet available to ordinary taxpayers.

The use of public land is regulated by the legislation of the Russian Federation.

Which banks offer mortgages for the purchase of land? Find out about this by reading our article.

Sometimes, when purchasing a plot of land, it is necessary to draw up an advance payment agreement. You can find out how to do this in the material.

VAT discrepancies: what inspectors see

Discrepancies regarding VAT cause a nervous reaction among both chief accountants and tax officers.

As mentioned above, tax authorities do not send endless requests themselves - they are compiled by the tax monster - ASK VAT-2. It is precisely this that is configured in such a way that all counterparties throughout the chain must pay VAT. I bring to your attention information about how this monster works and tell you how to reduce the number of requirements in order to avoid an on-site inspection from the company.

So, what do inspectors see in their VAT camera program?

The inspector sees discrepancies between the data of counterparties, which are of two types:

- a discrepancy in the “VAT” type indicates that the counterparties did not agree on the tax amounts;

- a discrepancy of the “gap” type signals to the inspectors that the counterparty either did not report at all, or submitted zero reports, or maybe it simply is not in the Unified State Register of Legal Entities. This discrepancy is a very serious indicator for tax authorities.

It is clear what the tax authorities’ reaction will be - in any case, the company will receive a requirement to provide explanations or provide clarification.

The first type of discrepancy can usually be leveled out with explanations, but regarding the “gap” you will have to submit a clarification. If this is not done, then the consequences are, in principle, predictable: either additional tax assessments on camera, or the company will be directly included in the on-site inspection plan. According to this discrepancy, it often happens that it arises not due to the failure to reflect the tax of one of the parties to the transaction, but because the counterparties reflect the transaction in different quarters. The taxpayer will also receive a “Letter of Chain” when, as a buyer, he reflects the deductions later than the seller reports the sale. And this, despite the fact that the transfer of deductions is the legal right of the taxpayer (clause 1.1 of Article 172 of the Tax Code of the Russian Federation).

If you have made a reconciliation with the counterparty, everything comes together, but the tax office still insists on its way, then contact the inspector, since only they can see in their program what the error is, what details did not match.

When the company responds to the request, it is closed in the inspector program as completed. If there were claims for gaps and additional tax charges, and the taxpayer submitted the amendment on time and paid the tax, then the declaration is automatically marked in green.

What is a camera room?

The concept of a desk audit has long gone beyond monitoring the calculation of the amount of tax and the deadline for its payment. Today, almost any “camera room” includes the following procedures:

- comparison of declaration data for the last and previous reporting periods;

- linking the information of the verified form with other declarations, calculations and forms of financial statements;

- analysis of all data available to the tax service to determine the reliability of the tax return indicators.

If the taxpayer is classified as a large taxpayer, as part of the desk audit the following is additionally carried out:

- analysis of revenue indicators, profitability, tax burden of the company, as well as their comparison with the average values of the corresponding indicators in the field of activity and other similar taxpayers;

- identifying the reasons for reducing the tax burden;

- comparison of the company’s tax base in the current and past tax periods;

- analysis of transactions that led to a decrease in the tax base;

- identifying “problem” partners of the company.

When an error is detected

So, VAT reporting has been accepted by the Federal Tax Service. However, this is not yet a reason to relax, because the desk audit process begins after receiving the reporting forms.

First of all, the control relationships between the various sections of the declaration are checked automatically. If an error is identified, the Federal Tax Service sends a request to the company to provide explanations on the control ratios . It is necessary to confirm its receipt within 6 working days (clause 5.1 of Article 23, Article 88 of the Tax Code of the Russian Federation). In the case of a VAT audit, receipt of the requirement and confirmation of this fact is carried out through an electronic reporting system.

Now the company has 5 working days to prepare and send a response to the received request to the tax service. There are two possible options:

- the company admits errors, corrects them and submits an updated declaration ;

- the company still believes that these declarations are correct and provides an appropriate explanation (either electronically or on paper).

The second stage of verification is the comparison of information from counterparties’ reporting forms. If inconsistencies are identified in the data of transaction participants, the company receives an electronic request to provide explanations for the discrepancies . The requirement is generated in two formats - pdf and xml. Each of these files contains a table of invoices that contain discrepancies. Each type of error has its own code: for example, code 1 corresponds to the absence of a counterparty, and code 4 to a detected discrepancy. In this case, an entry of the form 4 (2,3) means that there are inconsistencies in the data in the 2nd and 3rd columns of the form.

As at the previous stage, you must respond to this request within five days . The answer must contain two tables: the first includes data that the taxpayer confirms, and the second - which is corrected. The second table, in turn, consists of two columns, the first of which contains the old information, and the second contains the changed information. There is an important point here: it is permissible to make changes only to those data, the change of which will not affect the amount of VAT. Otherwise, it is necessary to draw up an updated declaration. The answer can be generated either electronically or on paper.

How to minimize the risk of discrepancies

The best way to reduce the likelihood of data inconsistencies is to first check with each counterparty . This can be done through special services, for example, Kontur.Extern, which contains the VAT+ (Reconciliation) module . Checking the compliance of your forms with your partners’ data, identifying and correcting discrepancies before filing a declaration are the main, but not all, capabilities of the module. With its help, you can assess the trustworthiness of a potential partner, receive expert advice on the preparation of VAT reporting, and if you receive a request from the Federal Tax Service, quickly draw up and send a response.