FFOMS – contributions for compulsory health insurance. They are paid by all organizations, regardless of their form of ownership. If previously they had to be transferred to the Pension Fund, then from 2021 the Federal Tax Service Inspectorate has become the administrator of contributions. Legal entities pay contributions as a percentage, and individual entrepreneurs - in a fixed amount from the salary of employees.

Important! Compulsory medical insurance contributions for income exceeding RUB 300,000.00 are not calculated and are not payable.

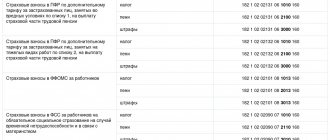

KBK for payment of insurance contributions to the Pension Fund for employees

| TAX | KBK |

| Insurance contributions for pension insurance to the Pension Fund for employees for the payment of the insurance and funded part of the labor pension | 182 1 02 02010 06 1010 160 |

| Insurance contributions to the Pension Fund at an additional rate for insured persons employed in hazardous conditions according to List 1, for the payment of the insurance part of the labor pension | 182 1 02 02131 06 1010 160 |

| Insurance contributions to the Pension Fund at an additional rate for insured persons engaged in heavy types of work on list 2, for payment of the insurance part of the labor pension | 182 1 02 02132 06 1010 160 |

KBK PFR 2013 - 2014 - Pension Fund of the Russian Federation

Home—KBK—

Below are the BCCs for payment of contributions. To pay a penalty or fine in category 14 of the BCC, instead of 1, you should indicate 2 (penalties) and 3 (fines).

| Pension Fund | KBK 2014 |

| Insurance contributions for compulsory pension insurance, credited to the Pension Fund of the Russian Federation for the payment of the insurance and funded* part of the labor pension *Since January 1, 2014, Pension Fund contributions are processed through one payment order, i.e. there is no need to distribute between the insurance and savings parts. The single payment document is valid for payments starting from January 2014. (Federal Law dated December 4, 2013 No. 351-FZ) | 392 1 0200 160 |

| Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund for payment of the insurance part of the labor pension (for billing periods expired before January 1, 2013) | 392 1 0200 160 |

| Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund for the payment of the funded part of the labor pension (for billing periods expired before January 1, 2013) | 392 1 0200 160 |

| Insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund for payment of the insurance part of the labor pension | 392 1 0200 160 |

| Insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund for the payment of the funded part of the labor pension | 392 1 0200 160 |

| Insurance premiums at an additional rate for insured persons employed in hazardous conditions (clause 1, clause 1, article 27 of the Federal Law “On Labor Pensions in the Russian Federation”), credited to the Pension Fund for payment of the insurance part of the labor pension *Subject to change | 392 1 0200 160 |

| Insurance premiums at an additional rate for insured persons engaged in heavy types of work (clauses 2-18, clause 1, article 27 of the Federal Law “On Labor Pensions in the Russian Federation”), credited to the Pension Fund for payment of the insurance part of the labor pension *Subject to change | 392 1 0200 160 |

| Additional insurance contributions to the Pension Fund of the Russian Federation for the funded part of the labor pension, transferred by the employer from the employee’s income****Starting from the 2014 settlement period, the payment of contributions to the Pension Fund for financing the funded part of the pension is carried out in a single settlement document using the CBC, intended for accounting for insurance contributions , enrolled in the Pension Fund for payment of the insurance part of the labor pension (Federal Law dated December 4, 2013 No. 351-FZ) | 392 1 0200 160 |

| Additional insurance contributions to the Pension Fund of the Russian Federation for the funded part of the labor pension, paid by the employer in favor of the insured persons****Starting from the calculation period of 2014, the payment of contributions to the Pension Fund for financing the funded part of the pension is carried out in a single settlement document using the CBC, intended for accounting for insurance contributions credited to the Pension Fund for the payment of the insurance part of the labor pension (Federal Law dated December 4, 2013 No. 351-FZ) | 392 1 0200 160 |

| Contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund of the Russian Federation for the payment of additional payments to pensions | 392 1 0200 160 |

| Insurance contributions for compulsory social insurance against industrial accidents and occupational diseases | 393 1 0200 160 |

| Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity | 393 1 0200 160 |

| Insurance premiums for compulsory health insurance of the working population, credited to the Federal Compulsory Medical Insurance Fund | 392 1 0211 160 |

| Insurance premiums for compulsory health insurance of the working population, previously enrolled in the TFOMS (for billing periods before 2012) | 392 1 0212 160 |

New in 2014

In 2014, the general insurance premium rate remained at 30 percent (until the end of 2021). In the Pension Fund of the Russian Federation - 22%, in the Federal Compulsory Medical Insurance Fund - 5.1% and the Federal Social Insurance Fund of the Russian Federation - 2.9% (Article 1 of the Federal Law of December 2, 2013 No. 333-FZ). Tariffs for injuries have not changed. Contributions to social and compulsory health insurance (to the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund) must be accrued until payments in favor of the employee, accrued from the beginning of the year on an accrual basis, do not exceed a certain limit (Part 4 of Article 8 of the Federal Law of July 24, 2009 No. 212-FZ). In 2014 it will be 624,000 rubles. For comparison: in 2013 - 568,000 rubles. Everything that you accrue to employees during the year in excess of this amount does not need to be included in the base for calculating contributions to the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund. And contributions to the Pension Fund will have to continue to be accrued. But you will calculate them at a rate of 10%, and not 22% (Article 58.2 of Law No. 212-FZ). In 2014, some individual entrepreneurs must calculate a fixed contribution based on one minimum wage, and not a double one as in 2013. Based on this, the amount of payment to the Pension Fund is now 17,328.48 rubles (5,554 rubles x 26% x 12 months). This is the minimum contribution. It is paid by those businessmen whose income during the billing period did not exceed 300 thousand rubles. Entrepreneurs who earned more in 2014 will have to pay an additional 1 percent of the revenue received in excess of the limit to the Pension Fund. But not more than 138,627.84 rubles, calculated from eight times the minimum wage: (5554 rubles x 8 x 12 months x 26%). In addition, entrepreneurs continue to pay their own contributions to the Federal Compulsory Medical Insurance Fund. In 2014, the fixed contribution for compulsory health insurance is 3399.05 rubles. (RUB 5,554 x 5.1% x 12 months).

| Pension Fund | KBK 2013 |

| Insurance contributions for compulsory pension insurance, credited to the Pension Fund of the Russian Federation for payment of the insurance part of the labor pension | 392 1 0200 160 |

| Insurance contributions for compulsory pension insurance, credited to the Pension Fund for payment of the funded part of the labor pension | 392 1 0200 160 |

| Additional insurance contributions for the funded part of the labor pension for persons who independently pay additional insurance contributions for the funded part of the labor pension, credited to the Pension Fund of the Russian Federation | 392 1 0200 160 |

| Contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund for the payment of additional payments to pensions | 392 1 0200 160 |

| Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation to pay the insurance part of the labor pension | 392 1 0200 160 |

| Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund for the payment of the funded part of the labor pension | 392 1 0200 160 |

| Insurance premiums for compulsory medical care. insurance of the working population, credited to the budget of the Federal Compulsory Health Insurance Fund | 392 1 0211 160 |

| Insurance premiums for compulsory medical care. insurance credited to the budgets of territorial compulsory health insurance funds (for billing periods expired before January 1, 2012) | 392 1 0212 160 |

| Contributions paid by coal industry organizations to the budget of the Pension Fund of the Russian Federation for the payment of additional payments to pensions | 392 1 0200 160 |

| Insurance contributions in the form of a fixed payment, credited to the Pension Fund budget for the payment of the insurance part of the labor pension (for billing periods expired before January 1, 2010) | 392 1 0900 160 |

| Insurance contributions in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods expired before January 1, 2010) | 392 1 0900 160 |

| Fines for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation | 392 1 1600 140 |

| Fines imposed by the Pension Fund of the Russian Federation and its territorial bodies in accordance with Articles 48 - 51 of the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund, the Federal Compulsory Medical Fund. insurance and territorial compulsory medical funds. insurance" | 392 1 1600 140 |

Companies that use the simplified tax system or UTII can reduce the amount of tax (advance payment) for the first quarter of 2013 by insurance premiums paid in January, even if they were transferred for December 2012. Or to pay off last year's debt.

To do this, the tax regime of the company must remain the same as it was. For example, if in 2012 you used UTII, and since 2013 - on a simplified basis, then you will not be able to take into account last year’s contributions. Explanations can be found in the letter of the Ministry of Finance of Russia dated December 29, 2012 No. 03-11-09/99. There you will also find in what order entrepreneurs can write off insurance premiums. Thus, an individual entrepreneur on a simplified or imputed basis, who does not have employees, can take into account insurance premiums for himself in his expenses without any restrictions.

If an entrepreneur hires workers, then it is no longer possible to write off the contributions he pays for himself based on the insurance year. The single tax can be reduced by the amount of insurance premiums for employees and in an amount of no more than 50 percent of the tax amount.

Share a link to us

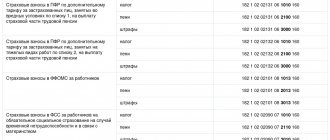

KBK for payment of penalties on insurance contributions to the Pension Fund for employees

| PENES, FINES | KBK | |

| Penalties, fines on insurance contributions for pension insurance to the Pension Fund for employees for the payment of the insurance and funded part of the labor pension | penalties | 182 1 02 02010 06 2110 160 |

| fines | 182 1 02 02010 06 3010 160 | |

| Penalties and fines for insurance contributions to the Pension Fund of the Russian Federation at an additional rate for insured persons employed in hazardous conditions according to List 1, for the payment of the insurance part of the labor pension | penalties | 182 1 02 02131 06 2100 160 |

| fines | 182 1 02 02131 06 3000 160 | |

| Penalties and fines for insurance contributions to the Pension Fund of the Russian Federation at an additional rate for insured persons engaged in heavy types of work on list 2, for the payment of the insurance part of the labor pension | penalties | 182 1 02 02132 06 2100 160 |

| fines | 182 1 02 02132 06 3000 160 | |

In FFOMS

KBK for payment of penalties on insurance contributions to the Social Insurance Fund for employees

| PENES, FINES | KBK | |

| Penalties and fines on insurance contributions to the Social Insurance Fund for employees for compulsory social insurance in case of temporary disability and in connection with maternity | penalties | 182 1 02 02090 07 2110 160 |

| fines | 182 1 02 02090 07 3010 160 | |

| Penalties and fines for insurance contributions to the Social Insurance Fund for workers from industrial accidents and occupational diseases | penalties | 393 1 02 02050 07 2100 160 |

| fines | 393 1 02 02050 07 3000 160 | |

FILES

Summing up the application of these BCCs

An entrepreneur who employs employees must make mandatory contributions for them to extra-budgetary funds. Which BCC should I indicate in the relevant payment orders? The amount of deductions, as well as coding, depend on the conditions in which employees work.

Contributions to employee pension insurance

The budget classification code does not depend on whether the employer’s income from the use of the labor of hired employees exceeds the maximum base value (300 thousand rubles). Deductions for employees with a base value both less and more than the maximum must be paid according to the following BCC: 392 1 0200 160. Separate codes for this type of payment have been cancelled. According to this BCC, the following types of contributions to the Pension Fund for the payment of an insurance pension are credited:

- main payment;

- outstanding principal payment;

- debt on canceled payment;

- the resulting arrears;

- recalculation payment.

Sanction payments for insurance contributions to the Pension Fund of Russia

- Fines - must be transferred according to KBK 392 1 02 02010 06 3000 160.

- Penalties are credited according to KBK 392 1 0200 160.

If employees work under special conditions

For employers who provide employees with harmful and/or dangerous working conditions, there is an additional rate of contributions to the Pension Fund, since the law will allow employees “for harmfulness” to retire earlier than the age prescribed. It is the deductions of these additional contributions that will help in the future to calculate the moment from which employees will be entitled to early retirement.

1. Hazardous work requires deductions for employees according to KBK 392 1 0200 160.

- Penalties for late payments are according to KBK 392 1 02 02131 06 2100 160.

- Fines for such contributions are according to BCC 392 1 0200 160.

2. For those employed in difficult working conditions, KBK 392 1 02 02132 06 1000 160.

- Peni – KBK 392 1 0200 160

- Fines – KBK 392 1 0200 160.

Contributions for hired employees to the Federal Compulsory Compulsory Medical Insurance Fund

Deductions for compulsory health insurance for employees are required by KBK 392 1 0211 160.

Penalties for this payment are according to KBK 392 1 0211 160.

Fines, if any, are assessed - according to KBK 392 1 0211 160.

Payment Features

Fill out the payment according to the general rules, but take into account three key features:

- Payer status - field 101. The value of the detail depends on the category of the insured. So, if an organization pays compulsory medical insurance contributions, then in field 101 you need to enter code “01”, for individual entrepreneurs - code “09”, for the head of a peasant farm - “12”. All codes are enshrined in Appendix No. 5 of Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013 (as amended on April 5, 2017).

- The recipient of the payment is the Federal Tax Service, that is, the territorial branch of the Tax Inspectorate. Please note that the recipient's name must be entered correctly. So, according to the current rules, first indicate the name of the Federal Treasury body, and only then, in brackets, write the name of the Federal Tax Service, and also indicate the Taxpayer Identification Number (TIN) and checkpoint of the territorial branch of the inspection.

- KBK Compulsory Medical Insurance 2021 - 182 1 0213 160 to pay the insurance premium for employees, regardless of the category of the insured. If the payment is made by an individual entrepreneur for himself, then you need to indicate a different budget classification code - 182 1 0213 160.

Example of a completed payment order, KBC for compulsory health insurance: