What is needed to submit a beer declaration in 2021

To submit a beer declaration for 2021, you will need to withdraw balances in EGAIS at the end of the quarter ; how to withdraw EGAIS balances at the end of the quarter to submit a beer declaration is written here.

Upload your receipts into your EGAIS program , or order data on your receipts (data by deciliter) from your suppliers .

Where to watch TTN

Heads of organizations, as well as authorized persons, have access to viewing EGAIS invoices. To do this, you need to go to the official egais website. You can check your TTN status through your personal account. To do this, specify the following data set:

- TIN of the sending holding company;

- ID of the recipient enterprise;

- number of the invoice that is being searched.

If any of the information offered is not known, you can contact the official FSRAR resource.

Note!

A recipient who actually accepted the goods, but did not confirm receipt in the system within 60 days, may be held liable for In

addition to official portals, special applications have been developed to track the status of the document. It is important to use the services of only trusted software developers. Otherwise, it is difficult to guarantee the confidentiality of personal data with third parties.

Has the declaration form for beer sales changed in 2021?

Yes, the beer declaration form has changed from form 12 to form 8 in accordance with Order 396 of 12/17/2020. Now, starting from the 1st quarter of 2021, beer declarations are submitted in form 8. Beer declarations form 12 and form 8 are almost the same, only in the new beer declaration form section 3 (returns) has appeared, and movement columns have been added in section 1. Everything else remains the same.

Penalties

Due to the tightening of deadlines for the formation and confirmation of invoices in the Unified State Automated Information System, we should expect increased inspections by regulatory authorities. If deadlines are not met, offenders will face fines.

In 2021 their sizes are as follows. For violating the procedure for recording data in the Unified State Automated Information System, officials face a fine of 10 to 15 thousand rubles. At that time, for legal entities - heads of organizations, the sanctions were more serious. They will have to pay from 150 to 200 thousand rubles to the state treasury. The amounts of these fines are regulated by Art. 14.19 Code of Administrative Offenses of the Russian Federation.

The fines imposed on officials also apply to individual entrepreneurs.

In addition to fines, items of the offense are subject to confiscation. We are talking about alcoholic products. This entails additional financial losses.

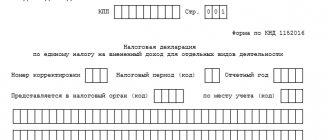

What does the 8th Beer Declaration look like in 2021?

This is what the title page of the Form 8 beer declaration looks like. It contains information on the organization by place of activity

Declaration 8 beer (declaration of retail sale of beer) includes 3 sections:

Section 1 of the beer declaration includes a generalized table broken down by the manufacturer’s product codes, its tax identification number, checkpoint, your balances at the beginning of the quarter, how much was received, what beer sales were, returns and the balance at the end of the quarter of beer, beer, drinks, cider, poiret, mead .

The beer declaration is filled out with 261 cider, 262 poiret, 263 mead, 500 , 510 beer, 520 beer drinks in accordance with the FSRAR product type classifier.

Section 2 of the beer declaration includes data on receipts broken down by product codes, manufacturers of checkpoint tax identification number, checkpoint tax identification number suppliers, date and number of invoice by receipt and number of deciliters.

Section 3 of the beer declaration of Form 8 includes data on returns to the supplier by product codes, manufacturers of checkpoint tax identification number, checkpoint tax identification number suppliers, date and invoice number by receipt and number of deciliters.

Rules for issuing an invoice

The goods delivery note is prepared by the supplier of the goods. The document is presented in paper form and also duplicated in electronic format for entering information into the Unified State Automated Information System. It's worth noting that both options will not necessarily have identical content. A paper consignment note, in addition to alcohol, may contain data about other products that “went” to the sender. As for the electronic TTN, it is generated exclusively for EGAIS, therefore it contains information only about alcoholic products.

A paper invoice is intended for accounting purposes. Electronic - for goods accounting in EGAIS. This is the same primary document on the basis of which acts on the TTN are drawn up.

What you need to fill out and submit a beer declaration

To submit a beer declaration in a year you need:

1. Fill out a beer declaration (form here are instructions. If you are unable to do this yourself, you can contact us, we will prepare a beer declaration for you using the new form 8

here are instructions. If you are unable to do this yourself, you can contact us, we will prepare a beer declaration for you using the new form 8

2. Sign the beer declaration with an electronic signature and encrypt it with encryption certificates from Rosalkogolregulirovaniya - here are the instructions (how to sign a beer declaration)

3. Submit an alcohol declaration for beer to Rosalkogolregulirovanie on the FSRAR portal service.fsrar.ru - here are the instructions (how to submit a declaration for beer to Rosalkogolregulirovanie)

If you find it difficult to figure out how to prepare and submit a declaration for beer to FSRAR, or you don’t have enough time filling out and drawing up a beer report.

Then we can prepare a beer declaration for you! We offer a service for filling out and drawing up beer declarations. Our specialists will quickly and efficiently and in accordance with all the rules prepare a declaration file for you, cheaply for a low price!

Procedure for submitting reports and required software

FSRAR accepts all declarations exclusively in electronic form. In this regard, the reporting entity will need an electronic signature certificate. You also need to register on the single portal service.alcolicenziat.ru. Through this service you can send documents to both the RAR and regional authorities.

To work, you need the CryptoPro program or a similar crypto provider, as well as CryptoARM. You can generate the declaration itself in special programs, for example, in the Alcodeklaratsiya.Kontur service.

You can submit completed declarations through the FSRAR service or through specialized reporting programs.

Four steps to work with the declaration:

- Generate a declaration file using a special program. Don't forget to check the report.

- Use an electronic signature and certify the created document with it.

- Submit the declaration through the Rosalkogolregulirovaniye website or the reporting system.

- Wait for a receipt confirming acceptance of the report.

Deadlines for submitting corrective declarations for beer

If you need to submit a corrective beer return, here are the deadlines for submitting a corrective beer return in 2021.

- for the 1st quarter, the adjustment is due by July 20, 2021.

- for the 2nd quarter, the adjustment is due by October 20, 2021.

- for the 3rd quarter, the adjustment is due by January 20, 2022.

- for the 4th quarter, the adjustment is due until April 20, 2022.

To submit a beer declaration, you will need an electronic signature for the FSRAR; if you do not have one, we can help you get one in your region.

An electronic signature can be obtained anywhere in Russia, production time is 2 days!

For those who do not have time to understand all the nuances of the rules for filling out declarations. We offer a service for filling out and drawing up beer declarations, as well as service in the Unified State Automated Information System. Our specialists will quickly and efficiently and in accordance with all the rules prepare a declaration file for you, cheaply for a low price! Special offer for our clients! Signing encryption of beer declarations for free!

Beer declaration (form  | Electronic signature for submitting declarations to FSRAR | Subscriber service EGAIS fixation of purchases for individual entrepreneurs | Electronic signature for EGAIS |

| from 1000 rub. | 2000 rub. | 1600 rub./month. | 2000 rub. |

Errors with region and country code

The finished file must be opened with a text editor (I use notepad) and checked for the region and country code. For some reason, Declarant-Alco does not add them and FSRAR gives an error while loading on the site:

To eliminate this point even before signing, you need to fill in the tags with the country and region code. In my case these are the following numbers:

643 - number of Russia in OKSM (All-Russian Classifier of Countries of the World) 91 - code for the Republic of Crimea (codes of the constituent entities of the Russian Federation)

Checking xml file for errors

Basic error checking is available in Alco-Declarant. In the main menu, select the “XML Validation” section, specify the file path and data format. After checking, the problems will be described in the “result” field, or an information window will appear indicating that everything is fine:

Next steps: this

- Converting 12 forms to 8.

- Encryption and signing of the alcohol declaration with a digital electronic signature in CryptoArm.

You might also be interested in:

Online cash registers Atol Sigma - how to earn more

How to make a return to a buyer at an online checkout: step-by-step instructions

MTS cash desk: review of online cash register models

Scanners for product labeling

Shoe marking for retail 2021

Online cash register for dummies

Did you like the article? Share it on social networks.

Add a comment Cancel reply

Also read:

Online checkout costs: how much does it cost?

The costs of an online cash register include not only the purchase of the cash register itself, but also the costs of servicing it, as well as the purchase of related devices and accessories.

The price difference in some cases is significant. Let's see how much the purchase will cost based on various factors. Wide range of cash register equipment Wide selection of equipment according to 54 Federal Laws. All cash desks are at manufacturer prices with an official guarantee. Buy a cash register in our… 658 Find out more

How the Federal Tax Service will monitor tax payments in 2021

Tax control by the Federal Tax Service is regulated by Article 54.1 of the Tax Code of the Russian Federation.

Back in March 2021, the Tax Service published a letter in which it clearly outlined the rules for applying this article to entrepreneurs who evade tax payments. But how exactly will tax evasion be controlled? In this article we will try to figure out what questions tax inspectorates may have regarding entrepreneurs and... 652 Find out more

Products subject to labeling in the Chestny ZNAK system

In the article we will consider goods subject to labeling in the “Honest ZNAK” system.

Let us remind you that in 2021 several product groups are tracked through GIS IT. For others, an experiment is already underway, which precedes the introduction of mandatory labeling. By 2024, all goods on the Russian market will have means of identification. Connection to marking with a discount Special offer for registration in the “Honest Sign” Marking system - benefit 1500... 453 Find out more