Should a private entrepreneur pay property tax? Many “out of old memory” think that an individual entrepreneur is in most cases exempt from this tax if he uses real estate in business. Today this is no longer relevant. A businessman needs to understand in which cases he can take advantage of a legal benefit, and when he needs to prepare for additional contributions to the budget.

- 5.1 Video: The Federal Tax Service provides information on property taxes

Should an individual entrepreneur pay property tax?

Whether an entrepreneur is obliged to pay tax on property involved in his activities is determined by the taxation system he has chosen.

If a businessman works under the general (basic) regime (OSNO or ORN - different abbreviations of the same tax regime), he must pay tax contributions to the budget for the property of his private enterprise, as well as property tax for an individual. The objects of property taxation of individual entrepreneurs on the OSN include all real estate of the entrepreneur, regardless of the capacity in which it is used: for private life (housing, dacha) or for conducting business activities (office, store). Property tax for an individual entrepreneur operating under OSNO includes all types of property of the entrepreneur.

If an individual entrepreneur operates under one or combines several preferential regimes: “simplified tax” (USN), imputed income (UTII), agricultural (Unified Agricultural Tax) or patent regime (PNS), the businessman may be exempt from state tax on the real estate that he uses in your business. For individual entrepreneurs working under light (special) regimes, property tax is included in the single tax under the simplified tax system, unified agricultural tax and federal tax system.

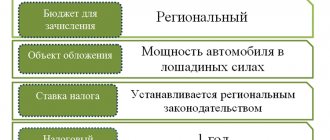

Real estate tax is regional. Tariffs and the type of determination of the cost of objects are regulated by the municipality where the property is registered (council, village council, etc.). Therefore, tax rates in each region may be different. This depends on the location of the building, as well as on the accounting system - inventory or cadastral value of the object. The tax rate depends on the valuation of the property and varies from 0.1 to 2%.

A private entrepreneur is not required to calculate tax and submit a declaration; this is done by the Federal Tax Service. An individual entrepreneur must, based on the requirements of the tax service, pay a property tax. This can be done from the moment you receive the notification, but strictly until December 1.

For late payment, penalties are charged, or the amount is automatically (without warning) deducted by the regulator from the account of the individual entrepreneur or individual. At the same time, if there are not enough funds in the account, it may be blocked, and this entails serious problems for the business.

To avoid problems, entrepreneurs need to make tax payments on time

A notification from the Federal Tax Service with the amount to be paid can be sent to an entrepreneur in several ways:

- Russian Post;

- in electronic form through your Personal Account (if the individual entrepreneur is registered on the website of government services or the Federal Tax Service of the Russian Federation);

- upon a visit to the Federal Tax Service (or issued to a representative of the individual entrepreneur).

An individual entrepreneur must not report to the property tax inspectorate. Here, a private entrepreneur appears before the budget as an individual (individual).

In 2015, Federal Law No. 382 came into force, depriving the preferences of individual entrepreneurs who operate real estate in business, if it is included in the List of commercial properties; the tax base for such buildings is determined as the cadastral value. This register is ratified annually by the executive branch of the district where the property is located. Notices on these objects are posted on the official websites of the administrations of settlements.

Therefore, entrepreneurs who worked under special regimes and previously enjoyed property tax benefits for individual entrepreneurs may now be deprived of this privilege.

The property included in the cadastral list includes business buildings. Moreover, to be included in this list, it is enough that 20% of the total area of the premises is used for commercial infrastructure. The register includes:

- administrative and business centers;

- shopping complexes (and premises in them);

- office premises, retail facilities, catering and consumer services;

- real estate objects of foreign organizations that do not operate in the Russian Federation.

As a result, if a private entrepreneur owns or leases the above-mentioned objects, regardless of the tax regime, he is obliged to pay property tax (Article 378.2 of the Tax Code of the Russian Federation).

The municipality where such an object is located may provide an individual benefit for individual entrepreneurs for real estate.

Individual entrepreneur property tax can be charged for all tax regimes, including simplified tax system, UTII, PSN, unified agricultural tax.

Basic provisions

Since the beginning of 2015, a gradual transition to a new form of collecting mandatory payments for real estate has begun throughout the Russian Federation. At the same time, innovations affected not only citizens, but also individual entrepreneurs.

For a long time, small firms operating as UTII did not pay property tax at all, and other individual entrepreneurs calculated it based on the inventory value noted in documents from the BTI. This year new rules come into force, namely:

- The number of real estate tax payers includes all individual entrepreneurs without exception, including those working within the framework of UTII and the simplified tax system;

- The calculation of the mandatory payment will be carried out at the cadastral price, which is more close to the market value of real estate;

- Only real estate is subject to taxation.

The administration of property tax has been transferred to the regional level, which means that rates, benefits and the cadastral list of objects will be compiled by local authorities.

An entrepreneur will be required to pay tax to the treasury only if he is the owner of the property. Tenants will not be affected by this mandatory payment. If the property is in shared ownership of several persons at once, then they will pay it jointly: in proportion to their shares of the real estate.

Real estate tax for individual entrepreneurs as an individual

Having acquired the status of a businessman, an individual entrepreneur continues to bear the burden of paying all property taxes to the budget as an individual. A complete list of taxes payable by every citizen of the Russian Federation:

- personal income tax (NDFL) - withheld from earnings; accrued from the profit received from leasing or selling real estate;

- transport tax - if you own a car;

- land tax - if the plot is registered;

- FL property tax - if a person owns real estate (dacha, apartment, garage, outbuildings, etc.).

A citizen in whose name any property is registered is obliged to make a property tax payment to the state budget by December 1. The tax amount is calculated by the INFS, the tax amount is reflected in the notice.

If for some reason the payment document with the amount of property tax is not received before November 1, do not worry, you must take into account that it is possible:

- the payment was not generated by the Federal Tax Service, since the payer has benefits and is exempt from tax payments;

- payment is less than 100 rubles;

- the citizen has a personal account on the government services portal or the Federal Tax Service of the Russian Federation, in this case a paper receipt is not provided.

If tax information has not been received, and you think that you have a debt to the budget, you can make an appointment with the inspectorate and resolve the issue in person.

When receiving a notice, it is recommended that you carefully check the tax rate, the status of the property and the assessed amount. It often happens that the Federal Tax Service calculates the tax by “confusing” the rates: taking private ownership for commercial real estate, it takes into account already sold property, etc.

Real estate that is subject to taxation:

- house, apartment, room, cottage - all these objects are assessed at a single rate, the regulator does not divide a house intended for permanent residence and garden buildings;

- a garage, a separate place for a car - everything that is registered. Chamber, is considered an object of real estate and the property of the individual;

- real estate complex - any buildings, if the complex contains at least one residential building;

- “unfinished” - buildings at any stage of construction, it can be a frozen object, an unfinished house, the main condition is registration with the State Chamber;

- other buildings - outbuildings, bathhouses, etc.

If a person participates in shared construction, property tax should not be charged from the moment the property is registered with the registration chamber, but from the beginning of the second year after receiving the right to property.

Since 2015, in the Russian Federation, both the cadastral and inventory value of the property can be used to determine the amount of property tax. This depends on the schedule for the transition of constituent entities of the Russian Federation to calculating taxes based on the cadastral value of real estate, established for all municipalities of the Russian Federation.

Knowing your rights, responsibilities and benefits is a vital necessity for every citizen

Tax for the inventory valuation method

If the local government uses an inventory valuation of real estate, the following tariffs apply according to the standard scheme when calculating property tax:

- for all objects worth up to 300 thousand rubles - up to 0.1% (inclusive);

- residential premises from 300 thousand rubles to 500 thousand rubles - 0.2%;

- housing costing over 500 thousand rubles (inclusive) - 0.6%;

- garage, parking space, real estate complex, unfinished construction, other buildings and structures up to 500 thousand rubles (inclusive) - 0.3%;

- garage, parking space, complex, unfinished construction, buildings and structures from 500 thousand rubles - 2%.

If there are no fixed tax rates in municipal acts, the following applies:

- tariff for real estate up to 500 thousand rubles - 0.1%;

- for other real estate - 0.3%.

It is worth considering that differentiation of tax tariffs is possible based on the total assessment of all property of the individual, its types and location.

Calculation of personal property tax based on cadastral valuation

Today, most regions of the Russian Federation use the calculation of the taxable property base based on cadastral valuation of real estate. This process began in 2015; by 2021, all of Russia will be transferred to this assessment system.

It is clear that in comparison with the inventory assessment of the object, its value during the cadastral quotation increases sharply, and accordingly, the tax also increases. Therefore, the Russian Government has introduced several benefits that will help the population adapt to this procedure.

The main feature of cadastral calculation is that when assessing an individual’s real estate, tax deductions are legally established, which reduce the taxable value of the property. The deduction applies to real estate as a whole and is not affected by the number of owners of the premises. This compensation is provided automatically; there is no need to contact the Federal Tax Service regarding this issue.

The standard property tax deduction for real estate tax is determined by the Tax Code of the Russian Federation:

- for an apartment - the cost of the tax property is reduced by the price of 20 m²;

- for a room - the cost is reduced by 10 m²;

- house - minus 50 m² from the total living area;

- for a complex of real estate objects - the cost of the object is reduced by 1 million rubles. There is a condition here: the complex must include at least one residential building.

Tax deduction for property taxes allows entrepreneurs to save money and use it to expand their business

The amount of cadastral deduction can be further increased by municipal authorities.

In the absence of an application to select an object subject to preferential treatment, the tax authority will select it independently based on the larger amount of the calculated tax. If the taxpayer previously submitted an application for a benefit to the tax authority, resubmission of the application is not required.

Federal Tax Service of the Russian Federation

https://www.nalog.ru/

The second relaxation when introducing cadastral valuation is that when a region enters this system, for the first 3 years, reducing factors are included in the tax tariff when assessing real estate for individuals:

- first year - coefficient 0.2 on the amount of property tax;

- second year - a multiplier of 0.4 is applied;

- third period - 0.6.

These benefits do not apply to commercial real estate included in the cadastral list of municipalities (administrative buildings, retail sites, public catering outlets, consumer services).

You can clarify the cadastral value of a specific property, as well as challenge its price in Rosreestr.

Competencies and responsibilities of cadastre authorities:

- MFCs can answer questions regarding the property tax of a private individual, taking into account its cadastral value (it is easier to solve this problem on the website of the Federal Tax Service of the Russian Federation).

- Rosreestr provides information on the characteristics of objects.

- The Federal Tax Service Inspectorate works on tax calculation issues.

When cadastral valuation of real estate, the tax for individuals ranges from 0.1 to 2%.

At the same time, tax rates (this applies only to rates of 0.1% and 0.5%) can be reduced to zero or increased, but not more than 3 times, by regulatory legal acts of representative bodies of municipalities (Article 406 of the Tax Code of the Russian Federation). Starting from the tax period of 2015 and until 2021, at the choice of a constituent entity of the Russian Federation, the cadastral value or inventory value calculated taking into account the deflator coefficient, which is established by the Ministry of Economic Development of the Russian Federation, is used as the taxable base for the property tax of individuals.

Federal Tax Service of the Russian Federation

https://www.nalog.ru/

Table: personal property tax rates for cadastral valuation

| Type of object / Cadastral value | Bid, % |

| 0,1 |

| 0,2 |

| 0,3 |

| objects whose value exceeds 300 million rubles | 2 |

| other objects of taxation | 0,5 |

Website of the Federal Tax Service of the Russian Federation - an assistant for individual entrepreneurs and individuals who are payers of property taxes

Property tax benefits, who is entitled to them

There are general (federal property) benefits and “local” ones (they are regulated by municipalities within their territorial jurisdiction; these can be benefits for orphans, poor people, minor children with disabilities, etc.).

Features of federal benefits for real estate for individuals:

- the preference applies to certain property: housing;

- garage and parking lot;

- household buildings on land for individual housing construction, summer cottages and vegetable gardens (with an area of no more than 50 m²);

- premises used for creative workshops, museums, galleries, etc.;

The following have the legal right to property benefits:

- All citizens of the Russian Federation who own outbuildings on summer cottages and individual housing construction projects with an area of no more than 50 m². A discount is provided for this property.

- Pensioners.

- Persons professionally engaged in art and creativity, if they conduct their activities in premises equipped for this. The following benefits apply to: studios, museums, galleries, libraries - any creative houses.

- WWII participants, partisans, combat veterans, blockade survivors, etc.

- Disabled people of groups I and II, as well as people with disabilities since childhood.

- Military personnel with 20 or more years of experience.

- Family members of military personnel who have lost their breadwinner; parents and spouses of military personnel and government employees who died in the line of duty.

- Those who performed international duty in Afghanistan.

- Chernobyl victims; people exposed to radiation at the Mayak PA in Semipalatinsk, as well as people who took part in the liquidation of other nuclear accidents.

- Persons who have received radiation sickness as a result of any nuclear testing.

- Heroes of the Soviet Union, Heroes of the Russian Federation, as well as persons awarded the Order of Glory of three degrees.

You can submit an application about your desire to take advantage of the tax benefit in any of three ways:

- through your Personal Account on the government services portal or the resource of the Federal Tax Service of the Russian Federation;

- send by mail;

- Apply in person to the Federal Tax Service.

If you want to receive a property tax benefit, despite the fact that the Tax Code of the Russian Federation does not regulate the deadline for filing such an application, it is recommended to submit it to the Federal Tax Service before May 1. So that the regulator can timely and correctly calculate the tax deduction.

It is better to use a standard form where you must indicate the taxpayer’s information, information about the object for which you plan to receive a preference, and also attach a copy of the document confirming your right to the benefit.

With regard to the property tax of individuals, in addition to the application for the grant of a benefit, a separate Notification on the selected taxable objects in respect of which a tax benefit is provided is filled out, according to the form approved by order of the Federal Tax Service of Russia dated July 13, 2015 No. ММВ-7–11/ [email protected]

If the taxpayer fails to submit such a Notification, a tax benefit is provided in respect of one taxable item of each type with the maximum calculated amount of property tax for individuals.

Federal Tax Service of the Russian Federation

https://www.nalog.ru/

If you have submitted a notification to the Federal Tax Service for a benefit, where you indicated a specific object, after November 1 you are deprived of the opportunity to submit an updated notification and change the object to which the property benefit should be applied. The Federal Tax Service will refuse you this.

If a taxpayer entitled to a tax benefit fails to provide notice of the selected taxable item, the tax benefit is granted in respect of one taxable item of each type with the maximum calculated tax amount.

Federal Tax Service of the Russian Federation

https://www.nalog.ru/

There is no need to claim the benefit every year. If in your application you did not limit the period of using the preference, the benefit will be valid indefinitely (taking into account the legal norm).

Recalculation of the amount of property tax is done no more than 3 years before submitting the application. Therefore, if you do not apply for benefits on time, you will only receive benefits for the previous 3 years. For example, if you received disability in 2012 and filed an application in 2021, you will receive the right to benefits starting in 2015.

Property tax benefits are available to almost every citizen

How can an individual entrepreneur write an application for tax exemption using the simplified tax system?

For applications to provide benefits to individuals, a single form is provided according to KND 1150063, approved by appendix. Federal Tax Service No. ММВ-7-21/ [email protected] dated November 14, 2017 (as amended on March 21, 2020). To receive a property tax benefit, you must fill it out correctly.

On the first page, indicate the TIN and fill out the first three sections.

- The tax authority code corresponds to the inspectorate where the application is submitted. You can find it out using the section “Determination of the details of the Federal Tax Service” on the tax website.

- In information about the taxpayer, it is enough to indicate the last name, first name, patronymic and contact telephone number. The date and place of birth and passport data do not need to be entered; the individual entrepreneur will be identified by the TIN number.

- As a method of information, you need to select code “1” to receive a response on paper in person, or “2” - by mail.

The application is signed by you personally or by your representative acting on the basis of a notarized power of attorney.

Section 6 is provided for information about real estate objects. Several objects can be indicated in one application. If necessary, fill out several sheets. Here you need to indicate:

- type of object;

- its cadastral, conditional or inventory number;

- Grace period;

- supporting document (their list is below).

The benefit can be provided either indefinitely or for a limited period. The individual entrepreneur has the right to choose any of the options. However, we recommend that you request an exemption directly for the previous calendar year by submitting your application annually.

The right to a benefit is confirmed by a lease agreement, employment contracts with employees, letters from contractors, advertising materials and other documents that can confirm the commercial purposes of using the premises. An individual entrepreneur using the simplified tax system is not required to provide them along with the application, but most likely they will be additionally requested by the tax authority.