Author: Ivan Ivanov

Overpayment of insurance premiums may occur in the event of an incorrect calculation or indication of an inappropriate amount in the payment order. To regulate such issues, the following regulations are provided:

- Federal Law of July 24, 2009 No. 212-FZ;

- Articles 18-23 and 25-27 No. 212-FZ.

Article 26 of the Federal Law states that overpayments for insurance premiums for compulsory health insurance, compulsory medical insurance, in the event of maternity, an accident at work or temporary disability, as well as penalties to the state budget, are subject to offset against future insurance accruals, repayment of debts for fines or refund in cash equivalent.

Thus, forms 21 and 22 are used to return an overpayment on a legal basis or take it into account for the purpose of paying future contributions. In addition, you need to understand how the credit is made and what the requirements for the forms are.

Reconciliation with the Pension Fund of Russia

To return the accrual, reconciliations with the fund are always required.

To do this, the head of the organization is recommended to contact the insurance premium administrator working at the Pension Fund, then the presence of arrears and the imposition of fines will be excluded. This reconciliation by the administrator is necessary for high-quality preparation of a report on the results of the year and mutual settlements with the Pension Fund. Payments are verified with the data of the Pension Fund in order to generate annual financial statements. This condition is a mandatory requirement for mutual settlements with him.

Before reconciling the contribution of the overpaid amount to the Pension Fund and the fund details, the insurer will need to request from this body either a certificate or information about the status of the settlement. Their difference lies in the fact that information about the status of the settlement includes a breakdown of incoming charges with a full breakdown of each contribution for a certain time period. The certificate and information about the account status contain information about the final indicators for calculations.

How to check via the Internet

The traditional way to submit a request to the fund is to apply in person. At the Pension Fund of the Russian Federation, the head of the organization draws up a statement, the text of which states a request to provide one of the documents.

You can quickly obtain a certificate or information about your account status via the Internet. You can request a statement of contributions using an electronic digital signature (EDS). Then the required document in electronic form will be provided within 24 hours or the next business day if the request was sent on a weekend or holiday.

You can also request a document through your personal account on the official website of the Pension Fund. This requires registration. Having gained access to the history of their insurance premiums, the payer requests a document, which will also be received electronically during the business day.

After receiving the document and detecting overpayments or arrears, they begin a reconciliation carried out by the policyholder together with the insurer. As a result, a reconciliation act is formed, regulated by Federal Law No. 212-FZ. This document records information about accrued payments.

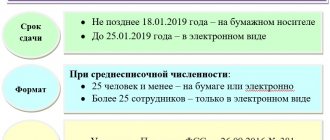

How to pass 22-ZhKH through Kontur.Extern

The external internship helps you submit reports to Rosstat, tax authorities, funds and other regulatory authorities via the Internet. To do this, you need to register in the system and obtain an electronic signature. New users can sign up for a test drive for 3 months and use all the features of the service absolutely free.

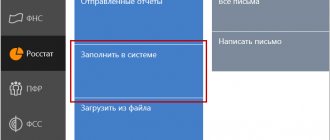

To submit form 22-ZhKH, log in and go to the “Rosstat” section. Choose a convenient way to prepare a report - fill it out in the Externa interface or download a ready-made report.

To fill it out in the system, find the appropriate form in the search and click “Edit”. Extern will fill out the title page automatically, based on your organization’s data. Fill out the remaining sections yourself.

Before sending the report, Extern will automatically check the indicators. If the system detects errors in logic or calculations, it will ask you to correct them. This can be done in editing mode; you do not have to create a new report.

Sign the completed form with an electronic signature and send it to Rosstat. Once the statistical office receives the form, you will receive an acceptance notification.

Offset of overpayment

After the Pension Fund employees receive an application for offset or return of the amount of money, as well as upon completion of the reconciliation and signature of the act, the offset period begins. The decision on a refund or credit is made within 10 working days from the date of:

- signing the reconciliation report;

- if this has not been carried out, receive an application for credit.

If the fund makes a positive decision, based on Articles 26 and 27 of Law No. 212-FZ, the amount is credited within 30 calendar days. If, after approving the application, the PRF has not returned the overpaid amount 30 days later, it will be possible to recover interest from this body, accrued daily at a refinancing rate of 1/300.

Also, upon approval of the application for offset, the enterprise can recover from the Pension Fund an amount in the amount of excess penalties and fines with interest at the same refinancing rate (1/300). But if a company has debts on these fines, it will first have to pay them, and then the Pension Fund of Russia will return the excess amount.

There may also be a case in an organization when an accountant made an error in the details, discovered it, compiled and paid for the correct report and submitted a letter to the bank. Then the organization overpays, and Social Insurance becomes a debtor.

The FSS informs the debtor of the discovery of an error after the expiration of the payment period for insurance payments within 10 working days. But it would be much better for the insurer not to wait for the fund to discover the error, but to independently contact the authorities and request a reconciliation.

Test Rules

Each billing period is a calendar year, within which the offset is made.

For previous offsets in the current billing period, overpaid amounts are not refunded. Article 10 No. 212-FZ indicates the timing of the reporting and billing periods. One calculation report consists of four reports - not quarterly, but for 1 quarter, half a year, 9 months and a year. Interim reports are submitted to the FSS of the Russian Federation and the Pension Fund on a quarterly basis. If, after repaying the debt in the next quarter, the policyholder becomes the debtor, then the settlement period may extend until the end of the current year.

The amount of money is fully returned only after the policyholder has paid off all debts on fines and penalties. Money from the Social Insurance Fund is also returned by the territorial authority within 10 working days from the date of submission of the full package of documents, which is established by Article 4.6 No. 255-FZ. The amount is indicated in column 7 of Table 3 of the 4-FSS reporting.

Requirements for forms

If a desk inspection report is required, its form is determined by the regulatory authorities. There are a number of requirements for it:

- the act is drawn up in Form 17-FSS;

- blots and corrections are not allowed in it;

- consists of introductory, descriptive and summary parts;

- details of the introductory part - number and date of drawing up the document, full name of the person who carried out the inspection, name of the regulatory body, insurer's organization or full name of the entrepreneur, registration number, Taxpayer Identification Number/KPP, address where the enterprise is located, period of the desk inspection, start and end date and list of provided documentation;

- in the descriptive part, information about the arrears and confirmation of a violation of the law during the inspection is recorded;

- the final report contains the conclusion of the supervisory authority, proposals for paying premiums or holding the insurer liable, changes in accounting documentation;

- signed by the insurer and the fund employees who conducted the inspection;

- each party receives 1 copy of the act;

- the fund has the right to group violations on the part of the insurer into tables, statements and other documents attached to the act.

There is no unified application form today, but each fund has a template according to which these documents are drawn up. If you do not know this, you can submit an application in any form.

A 4-FSS report is attached to the application, but the fund may require other documents depending on the type of benefit. In case of temporary disability, you will need a corresponding certificate from a medical institution.

List of policyholder documents required by the fund in case of pregnancy and childbirth:

- certificate of incapacity for work;

- application for leave due to pregnancy and childbirth;

- order;

- a one-time benefit for a woman registered in a maternity hospital or other medical center during pregnancy up to 3 months;

- child's birth certificate;

- certificate from the spouse’s place of work;

- EDV for child care.

How to fill out form 22-PFR yourself - in this video.

Which companies submit form 22-ZhKH (housing)

Organizations that work in the field of housing and communal services must report using this form. These are the following companies:

- providing services in the field of housing and communal services;

- all homeowners associations, management companies, housing and communal services, housing cooperatives;

- information and settlement centers and companies that charge fees for housing and communal services;

- reoperators who are responsible for carrying out major repairs and reconstruction of apartment buildings.

The form of ownership does not matter. The only thing that matters is belonging to the housing and communal services sector.

If a company is liquidated or reorganized or has temporarily suspended operations, it must still submit this form. If there is no activity, then a zero report must be sent, since there are no indicators.

For your information! List of OKVEDs for companies that need to send 22-ZhKH (housing): 68.20.1; 68.32.1; 81.10; 81.21; 81.22; 43.21; 43.22; 43.29; 81.29.2, 81.30.

Filling samples

Some policyholders do not know how to fill out an application for a credit or refund of the overpaid amount. To understand how to do this, two cases should be considered:

- When the amount is offset by the policyholder, the company submits an application in Form 22-FSS.

- To return the overpayment of insurance premiums, an application is submitted in Form 23-FSS. Based on this document, a refund is made within 30 months from the date of submission.

Documents for download (free)

- Form 21-PFR

- Form 22-PFR

- Form 22-FSS

- Form 23-FSS

- Sample of filling out form 21-PFR

- Sample of filling out form 22-PFR

To simplify the process of resolving the issue of offset or return, the pension fund has developed and published samples of filling out the act and application.

Application form 22-fss

Update: March 1, 2021

Form 22-FSS

Every domestic enterprise or entrepreneur using hired labor is required to pay contributions to the Social Insurance Fund of the Russian Federation.

The size and procedure of such deductions are described by the norms of the rule-making acts of Russia. However, despite strict regulation, cases of overpayment in favor of Social Insurance are possible.

In order to resolve the described disagreements, form 22-FSS of the Russian Federation is used. The form and sample for filling out the form in 2021 are given below.

Contributions to the Social Insurance Fund

Starting from January 1, 2021, some changes are being made to the system for regulating relations with the Social Insurance Fund. Thus, the procedure and amount of contributions to be transferred by subjects of economic legal relations in favor of the Social Insurance Fund are regulated by the requirements of the Tax Code of the Russian Federation.

However, these innovations do not concern the procedure for offsetting overpayments of contributions to the Social Insurance Fund. Clause 1 of Article 26 of Federal Law No. 212-FZ of July 24, 2009 provides for the possibility of offsetting overpayment amounts against future deductions.

In 2021, similar provisions will be contained in Article 431 of the Tax Code of the Russian Federation.

To register and carry out this operation in 2021, form 22-FSS of the Russian Federation is used. You can download the form from the Social Insurance Fund resource or other official sources on the Internet, as well as using the website of the Consultant+ legal reference system.

Form 22-FSS RF //www.consultant.ru/cons/cgi/online.cgi?req=doc&base=LAW&n=208308&div=LAW&dst=100093%2C0&rnd=0.47485107763554435 approved by Order of the Social Insurance Fund of the Russian Federation dated 02/17/2015 No. 49 When registering, you must fill in all the required details.

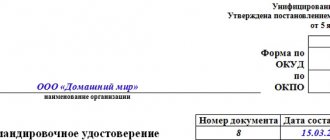

Form 22-FSS RF

Sample of filling out form 22-FSS of the Russian Federation

The Social Insurance Fund, by its Order No. 49, only approved the application form for offset of overpaid contributions. The procedure and methods for document execution have not been officially approved or developed.

In order to eliminate possible errors when filling out the form, you can use a sample of its design.

In addition, you should also take into account some features of entering information into the document form. As a general rule, applications on the territory of the Russian Federation can be filled out in two ways:

- by hand;

- using typewritten and computer means.

All information must be entered accurately, clearly, without blots, errors, or inaccuracies. Cross-throughs, etching, erasing and painting over the text of the document are unacceptable. If any field is not filled in, then it is advisable to put a dash in it.

Black ink is permitted.

It must be especially emphasized that in order to correctly fill out the application in Form No. 22-FSS of the Russian Federation, the registration number and subordination code assigned to each policyholder upon registration with the Fund should be indicated in the appropriate column of the document. Ignoring this requirement may be grounds for refusal to satisfy the application by the Social Insurance authority.

The Social Insurance Fund of Russia brought the contents of the application in Form No. 22-FSS of the Russian Federation in accordance with the norms of civil legislation. In 2021, a seal should be affixed to the form only if the policyholder has one. If such details are missing, then the signature of an authorized person is sufficient.

As a conclusion, it should be noted that when submitting a request to offset the overpayment of contributions to the relevant enterprise or individual entrepreneur, it is enough to fill out the application form according to the names of the columns and fields. All information entered must be current and reliable.

Strict adherence to the above procedure will give the policyholder a guarantee that the form will be filled out correctly and, as a result, that the Social Insurance Fund of the Russian Federation will not refuse to offset the overpayment amounts to the social insurance entity.

glaniga.ru

Appendix No. 2. Form 22 - FSS of the Russian Federation “Application for crediting the amounts of overpaid insurance contributions for compulsory social insurance against accidents at work and occupational diseases, penalties and fines to the Social Insurance Fund of the Russian Federation”

See this form in the MS-Word editor and a sample of how to fill it out

Appendix No. 2 to the order of the Social Insurance Fund of the Russian Federation

dated November 17, 2021 N 457

Form 22 - FSS of the Russian Federation

Application for crediting amounts of overpaid insurance contributions for compulsory social insurance against industrial accidents and occupational diseases, penalties and fines to the Social Insurance Fund of the Russian Federation

in the territorial body of the insurer

address of the location of the organization (separate division)/address of permanent residence of an individual entrepreneur, individual

in accordance with Article 26.12 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases” requests the following:

— offset of amounts of overpaid insurance premiums for compulsory social insurance against accidents at work and occupational diseases (hereinafter referred to as insurance premiums)

— interregional offset of insurance premiums

in the following sizes:

Amount (in rubles and kopecks)

Amount (in rubles and kopecks)

Clarification of payment name* ________________________________________

Name of the territorial body of the insurer with which the policyholder is registered **

TIN of the budget revenue administrator**

Budget Revenue Administrator Checkpoint**

Account details of the Federal Treasury authority at the place of registration of the policyholder**

TIN of the Federal Treasury **

Checkpoint of the Federal Treasury **

(position of the head of the organization (separate division)***

Place of seal (if any) of the policyholder

Legal or authorized representative of the policyholder

* To be completed by the policyholder if it is necessary to clarify the purpose of payment.

** To be completed in case of interregional offset of insurance premiums.

*** To be filled in by the head of the organization (separate division).

**** To be completed if there is a chief accountant.

© NPP GARANT-SERVICE LLC, 2021. The GARANT system has been produced since 1990. and its partners are members of the Russian Association of Legal Information GARANT.

base.garant.ru

Related publications

There are not only arrears in contributions to the Social Insurance Fund, but also overpayments. Having overpaid insurance premiums to the Social Insurance Fund, you can offset them against the payment of future contributions or towards the repayment of debt on fines and penalties (Article 26 of the Law of July 24, 2009 No. 212-FZ).

The FSS itself offsets overpayments against future payments, but payers of contributions can also send an application for offset to the fund in Form 22-FSS (Appendix No. 2 to the order of the FSS of the Russian Federation dated February 17, 2015 No. 49).

Let's take a closer look at Form 22 of the FSS of the Russian Federation, a sample of which will be filled out in this article.

Offset of overpayment to the Social Insurance Fund: fill out an application

In the application on Form 22-FSS, select the desired type of offset by checking the appropriate box:

- “offset of overpaid insurance premiums”, when offset occurs between types of payments, and first, the debt on penalties and fines will be offset against the overpayment, and the remaining amount will be offset against future payments,

- “Interregional offset of insurance contributions” is carried out between regional branches of the Social Insurance Fund, if the contributions were transferred using other details, and now they need to be taken into account in your branch of the fund (for example, if the payer was deregistered in one branch of the Social Insurance Fund and registered in another, and mistakenly continued to pay at the old place of registration).

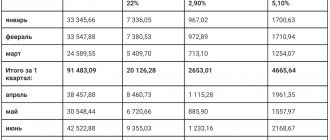

Next, we fill out two tables of form 22-FSS of the Russian Federation (see below for a sample of filling): in one, indicate for which contributions, penalties, and fines the excess amounts were paid, in the other - against which payments you want to offset them.

Source: //new-advocat.ru/zajavlenie-forma-22-fss/