Interest on loans must be reflected in the VAT return. These transactions bring the company that issued the loan non-sale income, which should be recorded in tax reporting. In relation to income tax, these amounts should be included in non-operating income receipts.

When filing a VAT return, you must use the report template from the Federal Tax Service order dated October 29, 2014 No. ММВ-7-3/ [email protected] (as amended on December 20, 2016). The document is submitted to the Federal Tax Service only in electronic form via TKS channels (only tax agents who are not VAT payers or are exempt from payment have the right to report on paper).

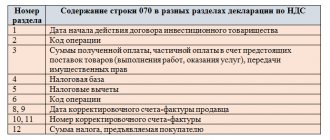

Section 7

Section 7 must be filled out and submitted if during the tax period the organization carried out transactions not subject to VAT, or received an advance payment on account of upcoming deliveries of products, the list of which was approved by Decree of the Government of the Russian Federation of July 28, 2006 No. 468. At the same time, the production cycle of such products is more than six months.

From January 1, 2014, in respect of transactions that are not subject to VAT on the basis of Article 149 of the Tax Code of the Russian Federation, invoices are not drawn up (clause 3 of Article 169 of the Tax Code of the Russian Federation). However, the exemption from issuing invoices is not related to filing tax returns. Such transactions still need to be reported in section 7 of the VAT returns. For example, commercial medical organizations must fill out this section in relation to the medical services they provide as part of the compulsory health insurance program (subclause 2, clause 2, article 149 of the Tax Code of the Russian Federation).

When filling out section 7 of the declaration, use the transaction codes given in Appendix 1 to the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. Since some transactions exempt from taxation are not codified in Appendix 1, the tax service supplements this list with its letters. In particular, in letter dated April 22, 2015 No. GD-4-3/6915, the Federal Tax Service of Russia established a code for reflecting transactions on the sale of property of debtors declared bankrupt - 1010823. From January 1, 2015, such transactions are not recognized as subject to VAT ( subparagraph 15, paragraph 2, article 146 of the Tax Code of the Russian Federation).

An example of reflection in section 7 of the VAT return of operations provided for in subparagraph 15 of paragraph 2 of Article 149 of the Tax Code of the Russian Federation (restoration work)

The Alpha organization carries out restoration work at cultural heritage sites. The organization has received a license to conduct activities to preserve historical and cultural monuments.

On February 17, 2021, the customer accepted from Alpha the volume of restoration work performed worth RUB 800,000. During the restoration of "Alpha":

- used materials worth 300,000 rubles. (purchased from the organization on a simplified basis);

- used the services of a contractor worth RUB 250,000. (including VAT – 45,000 rubles);

- used transport services worth RUB 50,000. (including VAT – 9000 rubles).

Restoration work on cultural heritage sites is exempt from VAT (subclause 15, clause 2, article 149 of the Tax Code of the Russian Federation). Such transactions are reflected in section 7 of the VAT return for the first quarter of 2016.

In section 7 of the declaration for the first quarter of 2021, Alpha’s accountant indicated:

- in column 1 - transaction code 1010246;

- in column 2 - the cost of restoration work performed - 800,000 rubles;

- in column 3 - the cost of materials purchased for restoration work, excluding VAT - 300,000 rubles. (letter of the Ministry of Finance of Russia dated January 28, 2011 No. 03-07-08/27);

- in column 4 - the amount of tax presented by the contractor and the carrier - 54,000 rubles. (45,000 rub. + 9,000 rub.).

To confirm the right to apply the benefit, the organization submitted to the tax office:

– a certificate confirming that the monument on which restoration work was carried out is classified as a cultural heritage site;

– a copy of the contract for restoration work.

Situation: is it necessary to reflect transactions related to the circulation of Russian and foreign currencies in section 7 of the VAT return?

Yes need.

This is explained as follows. The legislation does not contain a clear list of operations related to the circulation of Russian and foreign currency. Therefore, in practice, they include transactions whose subject is money. In particular, these are:

- purchase and sale of foreign currency;

- issuing and receiving loans, loans in cash;

- gratuitous transfer and receipt (donation) of funds (see, for example, letter of the Department of Tax Administration of Russia for Moscow dated February 1, 2001 No. 02-11/5550, resolution of the Federal Antimonopoly Service of the Volga District dated January 18, 2007 No. A49-3757/ 06-222A/17);

- transfer and receipt of funds in the form of compensation (see, for example, resolution of the Federal Antimonopoly Service of the Moscow District dated June 16, 2004 No. KG-A40/4584-04-P).

The order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558 does not regulate the procedure for reflecting transactions related to the circulation of Russian and foreign currencies in the VAT return.

Transactions related to the circulation of Russian and foreign currencies (except for transactions carried out for numismatic purposes) are not recognized as subject to VAT (clause 3 of Article 39, subclause 1 of clause 2 of Article 146 of the Tax Code of the Russian Federation). Therefore, in section 7 of the VAT return they must be reflected using code 1010801.

However, many transactions related to the circulation of currency are exempt from taxation on the basis of Article 149 of the Tax Code of the Russian Federation. And for them, Appendix No. 1 to the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. MMV-7-3/558, provides other codes. For example, a loan operation is exempt from VAT on the basis of subparagraph 15 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation. Therefore, it must be reflected in section 7 of the VAT return under code 1010292.

In this situation, in order to avoid duplication of information, when filling out section 7 of the VAT return, you should adhere to the following rule.

Information on transactions related to the circulation of Russian and foreign currencies, which are directly named in Article 149 of the Tax Code of the Russian Federation, should be reflected in columns 1–4 of Section 7 of the VAT declaration according to the codes of Appendix No. 1 to the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Other transactions that are not subject to VAT in accordance with subparagraph 1 of paragraph 3 of Article 39 of the Tax Code of the Russian Federation should be reflected in column 1 of section 7 of the VAT return using code 1010801. For such transactions, in column 2, indicate the transaction amount, and in columns 3 and 4, enter dashes.

Such rules follow from paragraphs 44.2–44.5 of Section XII of the Procedure, approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Situation: is it necessary to reflect in section 7 of the VAT return the receipt of interest that the bank accrues on the balance of funds in the organization’s current account?

No no need.

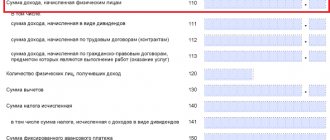

Section 7 of the VAT return reflects:

- transactions not subject to taxation;

- transactions that are not subject to taxation;

- operations for the sale of goods (works, services), the place of sale of which Russia is not recognized;

- advances received for upcoming deliveries of goods with a long production cycle.

This follows from Section XII of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Transactions that are not subject to taxation (exempt from taxation) are listed in Article 149 of the Tax Code of the Russian Federation. Transactions that are not recognized as subject to VAT are listed in paragraph 2 of Article 146 of the Tax Code of the Russian Federation. These, in particular, include the operations specified in paragraph 3 of Article 39 of the Tax Code of the Russian Federation (subparagraph 1, paragraph 2, Article 146 of the Tax Code of the Russian Federation). Among them are operations related to the circulation of Russian or foreign currency (except for numismatic purposes) (subclause 1, clause 3, article 39 of the Tax Code of the Russian Federation). The accrual of interest on the balance on the current account is a condition of the banking service agreement. Consequently, receiving interest is not associated with the organization carrying out any operations: it is enough for it to simply be the owner of a current account in a particular bank. Therefore, the receipt of interest cannot be considered either as a transaction subject to VAT or as a transaction that is not subject to taxation. Chapter 21 of the Tax Code of the Russian Federation does not regulate such relations.

Taking into account the above, in section 7 of the VAT return it is not required to reflect the amount of interest accrued by the bank on the balance in the current account.

Situation: does the purchasing organization need to reflect in section 7 of the VAT return the receipt of a cash bonus from the supplier for achieving a certain volume of purchases? The premium is not related to changes in the price of the product

No no need.

Section 7 of the VAT return reflects:

- transactions not subject to taxation;

- transactions that are not subject to taxation;

- operations for the sale of goods (works, services), the place of sale of which Russia is not recognized;

- advances received for upcoming deliveries of goods with a long production cycle.

This follows from Section XII of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Transactions that are not subject to taxation (exempt from taxation) are listed in Article 149 of the Tax Code of the Russian Federation. Transactions that are not recognized as subject to VAT are listed in paragraph 2 of Article 146 of the Tax Code of the Russian Federation. Bonuses paid by suppliers for achieving a certain volume of purchases, although not subject to VAT, are not related to the transactions listed in section 7 of the tax return. Therefore, buyers do not need to reflect them in this section.

Situation: is it necessary to reflect transactions for the provision of cash loans in section 7?

Yes need. But only when providing interest-bearing loans.

“Body” of the loan and interest. Providing and repaying a loan are operations related to money circulation. The circulation of currency (except for numismatic purposes) is not a sale and is not recognized as subject to VAT (subclause 1, clause 3, article 39, subclause 1, clause 2, article 146 of the Tax Code of the Russian Federation). This means that the amounts of issued cash loans (“the body of loans”) are not taken into account when determining the tax base and do not affect the calculation of VAT.

Loan services may be paid or free. The fee is set in the form of interest, the amount of which is determined by the parties in the contract. If the lender charges a fee for using his money, the loan is considered interest-bearing. If the lender refuses to pay, then the loan is interest-free. This procedure follows from the provisions of paragraph 1 of Article 807 and paragraph 1 of Article 809 of the Civil Code of the Russian Federation.

The interest that the lender receives as payment for a loan is exempt from taxation (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation).

What to show in the declaration. Section 7 of the VAT return must reflect both transactions that are exempt from taxation and transactions that are not subject to taxation. However, tax return forms cannot include information not related to the calculation and payment of taxes (Clause 7, Article 80 of the Tax Code of the Russian Federation). Since the loan amounts themselves do not affect the calculation of VAT in any way, they are not required to be reflected in section 7. Neither when issuing interest-bearing nor when issuing interest-free loans.

Thus, when filling out a VAT return, in section 7 you should show only the cost of the financial service of providing a loan, that is, the amount of accrued interest. Naturally, this requirement applies only to interest-bearing loans. If an interest-free loan was provided, there is no need to include this operation in section 7 at all.

The validity of the above is confirmed by letters from the Ministry of Finance of Russia dated June 22, 2010 No. 03-07-07/40, Federal Tax Service of Russia dated April 29, 2013 No. ED-4-3/7896, dated November 8, 2011 No. ED-4-3 /18637.

Interest in section 7. All transactions in section 7 are reflected with the codes that are given in Appendix 1 to the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. Operations providing loans in cash and securities, as well as financial services for their provision, are assigned code 1010292.

Thus, in section 7 of the VAT return for those tax periods in which the lending organization accrued interest on the loan, you must indicate:

- in column 1 - transaction code 1010292;

- in column 2 - the amount of interest on the loan accrued (receivable) for the tax period.

Such rules are provided for in paragraphs 44.2–44.5 of the Procedure approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

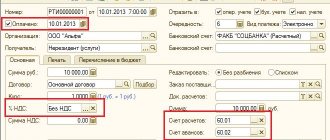

An example of how transactions involving the provision of an interest-bearing loan are reflected in a VAT return

On February 17, 2021, Alpha LLC issued a cash loan in the amount of 500,000 rubles to Torgovaya LLC. For the use of borrowed funds, a fee of 12 percent per annum is charged. Hermes repaid the loan within the period established by the agreement - April 14, 2021.

Alpha’s income from the loan operation amounted to RUB 9,344, including:

1967 rub. (RUB 500,000 × 12 days × 12%: 366 days) in February;

5082 rub. (RUB 500,000 × 31 days × 12%: 366 days) in March;

2295 rub. (RUB 500,000 × 14 days × 12%: 366 days) in April.

The term of the agreement covers two tax periods, so the Alpha accountant reflected the loan operations in the VAT returns for the first and second quarters of 2021.

In section 7 of the declaration for the first quarter, Alpha’s accountant indicated:

- in column 1 - transaction code 1010292;

- in column 2 - the amount of accrued interest in the amount of 7049 rubles. (1967 rubles + 5082 rubles).

In section 7 of the declaration for the second quarter, Alpha’s accountant indicated:

- in column 1 - transaction code 1010292;

- in column 2 - the amount of accrued interest in the amount of 2295 rubles.

Alpha did not have any expenses associated with the loan, so the accountant added dashes in columns 3 and 4.

Situation: how to reflect in the VAT return transactions related to the assignment of the right of claim under a loan agreement and the repayment by the borrower of its obligations to the new lender?

Reflect such transactions in section 7 of the VAT return.

Transactions related to the assignment of the right of claim under a loan agreement (credit agreement) and the repayment by the borrower of its obligations under such agreements to the new lender are not subject to VAT (subclause 26, clause 3, article 149 of the Tax Code of the Russian Federation). If the organization carried out such operations during the quarter, they must be reflected in section 7 of the VAT return. Please use code 1010258.

Deposit interest and VAT reporting: how they are related

By placing funds in a deposit account of a banking institution, the business entity remains their owner. The money must be returned by the bank upon expiration of the agreement. In accordance with Art. 39 of the Tax Code of the Russian Federation, such an operation is not recognized as sales. This means that interest accrued on the deposit is not subject to VAT, like amounts not related to sales. This is precisely the opinion expressed by officials of the Ministry of Finance in letter dated 10/04/2013 No. 03-07-15/41198. Thus, interest on deposit agreements does not need to be included in the VAT report.

You can read about how to prepare VAT tax reports correctly and without errors in this article.

Sections 8 and 9

Section 8 reflects information from the purchase book. That is, data on received invoices. But only those for which the right to deduction arose in the reporting quarter.

This section is completed by taxpayers and tax agents. An exception is tax agents who sell seized property by court decision, as well as goods, work, services, property rights of foreign organizations that are not tax registered in Russia (clauses 4 and 5 of Article 161 of the Tax Code of the Russian Federation). They do not fill out section 8.

Section 9 reflects information from the sales book. That is, data on issued invoices. But only for those transactions that increase the tax base of the reporting quarter.

This section is to be completed by taxpayers and tax agents. In the TIN and KPP fields, indicate the TIN and KPP of the organization, respectively. In the "Page" field – page serial number.

The order of filling out the lines of sections 8 and 9 is given in the table.

Appendix No. 1 to sections 8 and 9

Appendix No. 1 to section 8 of the declaration is filled out if changes are made to the purchase books of expired quarters (for which declarations have already been submitted). Like Section 8, Appendix 1 to Section 8 is completed by all taxpayers entitled to a tax deduction. As well as tax agents, except those named in paragraphs 4 and 5 of Article 161 of the Tax Code of the Russian Federation.

Appendix No. 1 to section 9 of the declaration is filled out if changes are made to the sales books of expired quarters (for which declarations have already been submitted). Like Section 9, Appendix No. 1 to Section 9 is filled out by all taxpayers and tax agents who have the obligation to charge VAT for payment.

In the TIN and KPP fields, indicate the TIN and KPP of the taxpayer (tax agent), respectively. In the "Page" field – page serial number.

This follows from sections XIII–XI of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

The procedure for filling out Appendix No. 1 to sections 8 and 9 is given in the table.

When you do not need to complete sections 8 and 9

Sections 8 and 9 may not be included in the declaration if during the reporting quarter you did not register a single invoice in the purchase book or sales book. This follows from the provisions of paragraph 3 of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

In addition, sections 8 and 9 do not need to be completed in amended VAT returns if there are no changes to these sections. For example, if section 8 is relevant in the primary declaration, then in the updated declaration on line 001, indicate “1”. In this case, put dashes on lines 005, 010–190.

Similarly with section 9. If you do not need to clarify it, then on line 001 indicate “1”. And on lines 005, 010–280, put dashes. This is indicated in paragraphs 45.2 and 47.2 of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

In this case, in the appendices to sections 8 and 9 of the updated declaration, in column 3 on line 001, indicate “0”.

This is indicated in paragraphs 45.2 and 47.2 of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated March 21, 2016 No. SD-4-3/4581.

And further. Tax agents who do not have the right to deduct the VAT they paid are exempt from completing Section 8. These are tax agents who are specified in paragraphs 4 and 5 of Article 161 of the Tax Code of the Russian Federation. Namely:

- organizations that sell confiscated and ownerless property by court decision;

- intermediaries who sell goods (work, services) of foreign organizations that are not tax registered in Russia.

This is stated in paragraph 45 of the Procedure, approved by order of the Federal Tax Service of Russia dated December 29, 2014 No. ММВ-7-3/558.

In all other cases, include sections 8 and 9 in your VAT return.

An example of filling out annexes to sections 8 and 9 of a VAT return

Organization "Alpha" is a VAT payer. In the first quarter the organization:

- accepted for deduction of VAT on the basis of the supplier’s invoice - LLC “Torgovaya” dated February 16, 2015 No. 1237. Cost of goods - 100,000 rubles. (excluding VAT), the amount of tax accepted for deduction is 18,000 rubles;

- accrued VAT payable on the invoice issued to the buyer - Beta LLC dated March 5, 2015 No. 21. Cost of goods - 150,000 rubles. (excluding VAT), the amount of accrued tax is RUB 27,000.

The total amount of VAT deductible in the purchase book for the first quarter was 1,423,510 rubles, VAT accrued in the sales book was 1,753,252 rubles. The amount of VAT payable for the first quarter is RUB 329,742.

In the second quarter, the organization needed to compile additional sheets of the purchase book and sales book for the first quarter due to the fact that:

- Torgovaya LLC sent Alpha a corrected invoice No. 1237 for the first quarter. The correction is dated May 14, 2015, correction number is 001. The cost of goods is corrected by 90,000 rubles, the correct amount of the tax presented is 16,200 rubles;

- The accountant noticed an error in the invoice issued in the first quarter to Beta LLC and issued a corrected invoice No. 21 (correction number - 001, date - June 23, 2015), changing the cost of goods shipped. New data: cost of goods – 155,000 rubles. (excluding VAT), the amount of accrued tax is RUB 27,900.

Accordingly, the total amounts have changed (taking into account additional sheets):

- according to the purchase book - 1,421,710 rubles. (RUB 1,423,510 – RUB 18,000 + RUB 16,200);

- according to the sales book - 1,754,152 rubles. (RUB 1,753,252 – RUB 27,000 + RUB 27,900).

The accountant reflected these changes in the appendices to sections 8 and 9 of the updated VAT return for the first quarter. In addition, he transferred these data to section 3, reducing the amount of VAT deductible (line 190 of section 3) and increasing the accrual tax (line 110 of section 3 ).

The amount of tax payable also changed and amounted to RUB 332,442. (RUB 1,754,152 – RUB 1,421,710). The accountant reflected it in section 1 of the updated VAT return for the first quarter.

Advice: before filling out sections 8 and 9, it makes sense to check with your counterparties the number and details of invoices, information about which you include in the declaration. In the future, this will help avoid claims from inspectors.

Take the data for reconciliation from the purchase book or sales book and format it in the form of a summary report for each counterparty. These reports can be sent to your suppliers or customers and invite them to check if everything is in order and if there are any discrepancies.

Results

The accrual of interest on deposits and issued loans is non-operating income for taxpayers on the OSN. This income is taken into account when calculating the income tax base.

Transactions to receive the specified interest will not be subject to value added tax.

In one case, due to the fact that the amounts are not related to sales, therefore deposit interest is not reported in VAT reporting, and in the other, due to the fact that the operation is exempt from VAT due to the norms of the Tax Code of the Russian Federation, interest on loans issued will be reflected in section 7 of the VAT tax report. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.