Registration of the act

Based on the results of the on-site inspection, the official of the control body undertakes to prepare a certificate of the results of the work. Both parties leave their signatures under the document. In the event of a refusal by the person in respect of whom the inspection was carried out, the employee of the inspecting authority is obliged to enter this point into the report.

After a five-day period of time, a completed report with the results of the inspection must be sent to the inspecting party. The document is presented personally to the policyholder or his authorized representative.

Provided that the party being inspected does not agree with the facts that were set out in the reporting documentation, the option of drawing up written objections is possible. Claims may relate to individual provisions or the result of the entire audit as a whole. If there are documents confirming the validity of such objections, they are attached to the completed application. This type of objection will only be valid if it is provided no later than 15 days later.

You can read about the period for which the FSS checks here.

Unaccountable advances. What are the consequences of not having advance reports?

1. What liability is provided if during a tax audit it is discovered that part of the advance reports is missing?

2. Which body sets the subsistence level in the Sverdlovsk region, where is it published and what is the frequency of its determination?

1.

According to

paragraphs

8 clause 1 art. 23 of the Tax Code of the Russian Federation, taxpayers are obliged to ensure

the safety of accounting and tax accounting data

and other documents necessary for the calculation and payment of taxes, including documents confirming expenses (for organizations and individual entrepreneurs)

for four years

.

Expense reports

are primary accounting documents (the unified form of primary accounting documentation No. AO-1 “Advance report” was approved by Resolution of the State Statistics Committee of the Russian Federation dated August 1, 2001 No. 55).

Art. 120 Tax Code of the Russian Federation

of fines

from taxpayers for gross violation of the rules for accounting for income and expenses and objects of taxation.

At the same time, in gross violation of the rules for accounting for income and expenses and objects of taxation for the purposes of Art. 120 Tax Code of the Russian Federation

means, in particular,

the absence of primary documents

.

The amount of the fine under clause 1 of Art. 120 Tax Code of the Russian Federation

can be 5 thousand rubles. (if the tax base was not underestimated).

And if, as a result of a gross violation of the rules for accounting for income and expenses and objects of taxation, the tax base was underestimated, then the fine will be 10% of the amount of unpaid tax, but not less than 15 thousand rubles

. (

clause 3 art. 120 Tax Code of the Russian Federation

).

In your case (if the tax authorities discover the absence of advance reports), we will most likely talk about an understatement of the tax base

.

After all, according to paragraph 1 of Art. 252 Tax Code of the Russian Federation

Expenses are recognized as justified and

documented

expenses incurred by the taxpayer.

Documented expenses mean expenses supported by documents drawn up

in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in the foreign state in whose territory the relevant expenses were incurred, and (or) documents indirectly confirming the expenses incurred (including a customs declaration, business trip order , travel documents, report on work performed in accordance with the contract).

And according to the Instructions for the use and completion of the unified form “Advance report”, this form is used to account for funds issued to accountable persons

for administrative and business

expenses

.

Based on the data of the approved advance report, the accounting department writes off the accountable amounts.

.

In addition, in accordance with paragraphs. 5 paragraph 7 art. 272 Tax Code of the Russian Federation

It is

the date of approval of the expense report

that is recognized under the accrual method

as the date of expenses

for business trips, maintenance of official transport, entertainment expenses, and other similar expenses.

Thus, in the absence of advance reports, tax authorities will certainly exclude from the tax base

those expenses that should have been confirmed by these advance reports and, accordingly, will charge you additional tax and penalties.

Of course, you can try to defend your right to take into account these expenses by presenting other documents confirming expenses to the inspectors (for example, cash and sales receipts, tickets, etc.).

tax authorities in the absence of advance reports

(see, for example, resolution of the Federal Antimonopoly Service of the Ural District dated September 17, 2007 No. F09-7512/07-S3, resolution of the Federal Antimonopoly Service of the Northwestern District dated April 27, 2007 No. A56-27875/2005).

For non-payment or incomplete payment of tax amounts as a result of underestimation of the tax base, other incorrect calculation of taxes or other unlawful actions (inaction) Art. 122 Tax Code of the Russian Federation

fine of 20%

is provided .

Please note that tax authorities, in case of underestimation of the tax base, can hold your company liable either under clause 3 of Art. 120 Tax Code of the Russian Federation

, or according to

Art.

122 Tax Code of the Russian Federation .

do not have the right to fine a taxpayer under both of these articles at once for the same violation.

(this was indicated by the Constitutional Court of the Russian Federation in its ruling dated January 18, 2001 No. 6-O).

Taking into account the above, you should take measures to restore missing advance reports in order to avoid additional taxes, penalties and fines.

2.

The cost of living in the Sverdlovsk region is established by decrees of the Government of the Sverdlovsk region, which are published in the Regional Newspaper.

According to Art. 5 of the Regional Law of the Sverdlovsk Region dated January 4, 1995 No. 15-OZ “On the living wage in the Sverdlovsk Region”, the cost of living in the Sverdlovsk Region is determined quarterly

and is established by the Government of the Sverdlovsk Region for the next quarter no later than 15 days before its start.

Required documents

The main task of the on-site inspection is to study the details of payment of insurance premiums. Special attention is paid to the study of documentation and expenses for payments to insured persons. The frequency of such procedures does not exceed once every three years. In order for the inspection to be carried out legally and in compliance with all established rules, the inspecting party must first prepare the following package of documents:

- requirement to provide documents;

- decision to extend the deadline for providing documents (if necessary);

- decision in case of refusal to extend the deadline for submitting documents (if necessary);

- decision to request the necessary documentation.

In the event of liquidation of the payer's organization, the inspected party must provide the opportunity to familiarize itself with the documentation.

When the last day of the inspection arrives, the inspecting party must provide a document on the results of its conduct.

A situation in which the payer refuses to receive a certificate of inspection results in person obliges representatives of the control body to ensure delivery of the notification by registered mail. In this case, it is considered delivered after a six-day period has passed from the moment the document was sent.

The inspection report includes introductory, descriptive and final parts. If violations are identified, the following information must be additionally attached to the report:

- about violation of deadlines for settlement of payments;

- about complete or partial non-payment of insurance premiums;

- about deliberate underestimation of the basis for accrual;

- about other facts of violation of the legislation of the Russian Federation.

The final part summarizes the conduct of this event. This part of the act is drawn up in a similar way when drawing up a desk audit.

Read more about reporting to the Social Insurance Fund.

Three standard reasons for an unscheduled inspection of the Social Insurance Fund

The inspection of the Social Insurance Fund can be desk-based and on-site, as well as scheduled together with the Federal Tax Service Inspectorate and unscheduled.

An on-site scheduled inspection can occur a maximum of once every three years (Article 4.7 of the Federal Law of December 29, 2006 No. 255-FZ). The period for an on-site inspection is two months from the date of the decision on its appointment (Part 1, Article 4.7 of Law No. 255-FZ, Clause 2, Article 26.15, Clause 9, Article 26.16 of Law No. 125-FZ).

There are three standard reasons for an unscheduled inspection:

- requesting money for benefits;

- employee complaint;

- reorganization or liquidation of the company.

You can reduce the amount of insurance contributions for compulsory social insurance by the costs of paying benefits paid from the funds of the Federal Social Insurance Fund of the Russian Federation.

What benefits are paid from the Social Insurance Fund?

If the amount of accrued benefits does not exceed the amount of insurance contributions, then there is no need to apply for their reimbursement to the Social Insurance Fund. It is enough to reduce the monthly payment by the amount of accrued benefits.

How to calculate sick leave according to the 2021 rules and reflect the accrual of benefits in accounting

There is no need to write an application for credit to the tax office. Costs for benefits must be reflected in Appendix No. 3 to Section 1 of the calculation of insurance premiums.

How to fill it out

Having received the calculation, the tax authorities will report the details of the claimed compensation to the Social Insurance Fund. The fund will request documents from the company and, most often, based on the results of a desk audit, will decide whether to approve the offset or not. If the result is negative, the Federal Tax Service will send the policyholder a demand for payment of the missing contributions. If the result of the audit is positive, the expenses will be accepted, and the Federal Tax Service, if necessary, will offset or return the difference between contributions and expenses (Part 1.1, 5.8, Article 4.7 of the Federal Law of December 29, 2006 No. 255-FZ).

If the amount of benefits paid for any month of the reporting period is greater than the contributions accrued for the same month, the company has the right (clause 9 of Article 431 of the Tax Code of the Russian Federation):

- or offset the excess against upcoming payments of contributions to the Social Insurance Fund within the billing period;

- or contact the FSS department for the allocation of the necessary funds to pay insurance coverage.

Is it possible to count contributions “with transition” through the billing period?

In order to receive money into your current account for reimbursement (payment) of expenses for benefits, you must contact your branch of the Federal Social Insurance Fund of Russia during the inter-payment period (the period between submission of reports) (Clause 2, Article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ ).

To do this, you need to collect documents (approved by Order of the Ministry of Health and Social Development of Russia dated December 4, 2009 No. 951n as amended by Order of the Ministry of Labor of Russia dated October 28, 2021 No. 585n). The period for the desk audit is three months from the date of submission of the application and documents.

See the list of documents and an example of how to fill out an application

The fund will transfer money to the current account only after the verification is completed. But the accrued benefit must be paid to the employee within ten days, regardless of whether the FSS transferred the money or not.

The amounts that the fund will reimburse will need to be reflected in the next calculation of insurance premiums for the Federal Tax Service.

An unscheduled inspection is always targeted. It is carried out every time a company applies for reimbursement of the costs of specific benefits for which there was not enough money to pay. But what kind of inspection it can be - desk or field - the fund decides for itself.

An unscheduled inspection based on an employee’s complaint will always be on-site. Its purpose is to verify a specific request, and the reason is indicated in the decision to conduct an audit. But it may be that the benefit was calculated and assigned in the previous period. And then the auditors require documents not only for the current year, but also for the previous year.

An unscheduled inspection due to the liquidation or reorganization of a company is carried out regardless of the fact that an on-site inspection has already taken place at the company. In this case, re-checking is allowed.

Making a decision based on the results of the inspection

The control body must notify the person in respect of whom such an inspection was carried out of the time and place. If desired, the party being inspected can directly participate in the verification procedure. However, the payer’s failure to appear is not an obstacle to carrying out the procedure as usual. Particular attention is paid to studying the following issues:

- Whether the party being inspected committed actions that are interpreted as a violation of the legislation of the Russian Federation.

- Do the identified offenses constitute a crime?

- Are there grounds for holding him accountable?

- Circumstances are identified that exclude the guilt of the party being inspected.

Based on the studied documentation, a decision is made whether to hold the person accountable for the offenses committed or to refuse to do so. In the first case, the inspecting party must document the violations committed, indicate the amount of arrears and the amount of the fine to be paid. In case of refusal to hold the payer liable, all circumstances confirming this fact must be additionally stated. The decision comes into force upon expiration of a ten-day period from the moment it is delivered to the verifying party.

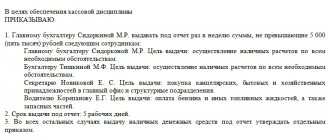

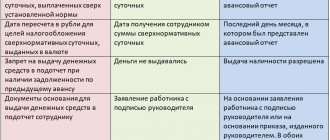

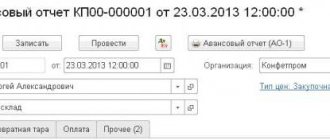

How to draw up an advance report without supporting documents. Settlements with accountable persons in 1C:ERP

Contents: 1. In what cases is it not possible to attach supporting documents to the expense report. Examples. 2. Settlements with accountable persons in 1C:ERP Examples of the inability to attach supporting documents to the advance report

An advance report

is a document that

reflects the organization’s expenses

, therefore the advance report becomes

the object of inspection by auditors or a tax inspector

.

When preparing an advance report, the responsible person was always guided by Resolution of the State Statistics Committee of Russia dated 01.08.2001 No. 55, where the form of the advance report was approved (Form No. AO-1).

However, since 2013, changes have been made to the regulatory documents, where the mandatory use of the unified form AO-1 was abolished. Today, many organizations continue to use the old form for drawing up the “Advance Report” document, where two sides of the printed form are filled out: the title side and the back side.

When preparing an expense report, there are cases when an employee, for objective reasons, cannot attach documents to the report that confirm these expenses:

1.

Let's say

a company took part in a forum

, and during transportation to the demonstration site,

an exhibition piece of equipment was damaged

.

The company employee notified his management. And to fix the problem, the employee received permission to pay cash to a third-party specialist

. The employee wrote a memo about where the money was spent, adding the amount for personal income tax and reflected in the memo that the documents were lost. The expense reflected in the expense report cannot be accepted by the company to reduce profits, since there are no supporting documents. In this case, the money paid to the employee is considered his income, from which personal income tax must be withheld. 2.

Here is another case where an employee received money to buy office supplies

.

The employee brought the goods, all the office supplies were recorded in the warehouse, but he cannot provide a receipt for their purchase, since the receipt was lost

.

In this case, the personal income tax of the reporting person is calculated from the accountable amounts, the organization pays insurance premiums from its own funds, and the accountant cannot take into account the costs of purchasing office supplies to reduce the tax base. 3.

The company holds a meeting with a buffet for partners

who may be interested in the company's activities.

To carry out this event, the accountable person purchased food and drinks, which was reflected in the employee’s advance report

.

In this case, the Company will not be able to attribute such a purchase to expenses that reduce income tax. What can be done is to write an order to hold the event, and the expenses will be considered representative, or to make an order to write off such expenses as advertising costs. When generating an expense report, if all expenses have documents confirming these expenses, and it is these expenses that will bring profit to the organization in the future, then these expenses can be accepted by the organization to reduce profits.

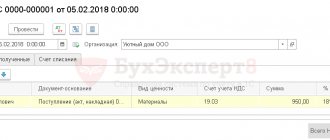

Settlements with accountable persons in 1C:ERP

When

money is given

to an accountable person,

accounting

entry is generated for

the debit of account 71 and corresponds with the DDS accounting accounts

.

And when reflecting the advance report, a posting is generated on the credit of account 71 and corresponds with cost accounts or accounting accounts for acquired values.

In order to

issue cash or non-cash

funds to an accountable person, it is necessary to draw up the document

“Cash expenditure order”

(Dt 71.01 – Kt 50.01) or the document

“Write-off of non-cash DS”

(Dt 71.01 – Kt 51) with the obligatory selection of the type of operation “Issue to the accountable”, and this money can be spent for any purpose.

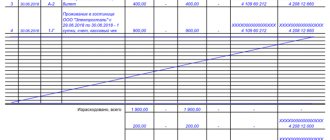

The reporting entity reflects all expenses in the “Advance Report” document in the tabular parts of the “Expenses” section and the “Payment to suppliers” section.

To reflect the purchase of inventory items

, you need to fill out the document

“Receipt of goods and services”

with the type of operation

“Purchase through an accountable entity”

, where transactions will be generated for the receipt of goods and materials at the warehouse (Dt 10, 41 - Kt 71.01).

To reflect entertainment and other expenses

(Dt 25, 26, 44 – Kt 71.01) it is necessary to draw up the document “

Receipt of goods and services”

with the obligatory indication

of the type of transaction “Purchase through an accountable entity”.

Using the document “Receipt of services and other assets” with the obligatory selection of the transaction type “Purchase through an accountable entity”, you can reflect in the system the transaction for the acquisition of non-current and intangible assets or reflect other services.

Both in the document “Receipt of goods and services” and in the document “Receipt of services and other assets” it is possible to print the AO-1 form.

The possibility of two-step input of information about the amounts spent has been implemented. In this regard, for the document “Advance report” the following statuses are used: “Prepared” and “Approved”. The use of statuses is determined by a functional option when configuring the system.

Elena Chernenko is a consultant-analyst at Koderline LLC, a certified 1C specialist.