Financial assistance for the birth of a child from an employer: taxation

According to Letter of the Ministry of Finance dated July 15, 2016 No. 03-04-06/41390, there is no need to pay personal income tax and insurance premiums for amounts up to 50,000 rubles for each child. This is provided for in paragraph 8 of Article 217 of the Tax Code of the Russian Federation and paragraph 1 of Article 422 of the Tax Code of the Russian Federation. As the Ministry of Finance explained (see Letter No. 03-15-06/29546 dated May 16, 2017), insurance premiums are not charged even if both parents received the maximum possible amounts. The situation with personal income tax is slightly different: for tax purposes, a total limit is provided for both parents, adoptive parents or guardians. This limit is 50,000 rubles. If both the father and mother receive such payments, one of the employers will have to act as a tax agent and withhold personal income tax on an amount exceeding RUB 50,000.

Taxation

From a taxation point of view, material assistance is considered as an economic benefit, and therefore is subject to tax (Articles 208, 209, 210 of the Tax Code). However, the social nature of the targeted income made it possible to exempt from taxation certain types of financial assistance, or certain amounts within the established limit. We wrote about this in the article “Maternity assistance in 6-NDFL”.

When financial assistance is calculated for the birth of a child, taxation allows you to exclude an amount of up to 50,000 rubles from the personal income tax base. for each of the children (clause 8 of article 217 of the Tax Code). This limit is exempt from personal income tax during the first year from the date of birth (adoption). Moreover, the maximum permissible amount of 50,000 is set for each parent. This is the opinion of officials (letter of the Ministry of Finance of the Russian Federation dated 08/07/2017 No. 03-04-06/50382). Let us remember that previously the limit was set for both parents.

Order of the Federal Tax Service of the Russian Federation dated September 10, 2015 No. ММВ-7-11/ [email protected] establishes special codes for income and deductions, they are reflected in the reporting forms for personal income tax:

- income code 2762 - the amount of one-time financial assistance provided by the employer;

- deduction code 508 - deduction from the amount of financial assistance.

These codes must be indicated in the reporting forms: certificate 2-NDFL and form 6-NDFL.

Application for financial assistance at the birth of a child and other necessary documents

To receive additional payment from the employer, the employee must provide:

- statement;

- a copy of the birth certificate (about establishing guardianship, about adoption);

- a document confirming that the spouse did not receive any money for the baby (from the Letter of the Ministry of Finance dated July 1, 2013 No. 03-04-06/24978, it follows that such documents may include a 2-NDFL certificate from the second parent, and if he is not employed - a copy of the employment record or confirmation from the employment service);

- if there is no second parent, the employer is provided with documents about divorce, death or other papers confirming the fact that the child is being raised by a single parent.

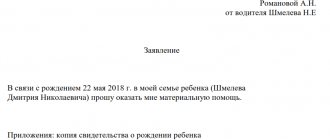

Sample application from an employee

The employer’s “reaction” to the application should be an order to pay the stipulated amounts. Here's what it might look like:

What documents are needed

As previously noted, financial assistance is paid after the issuance of an order by management or at the request of an employee, if there is a positive resolution from the boss.

This order, which is drawn up in free form, must indicate:

- recipient's passport details;

- the reason on which the lump sum benefit is paid;

- size of the amount.

It must also be accompanied by a copy of a document confirming the fact of birth (or adoption).

Regarding the need to obtain a certificate confirming that the second parent at his place of work did not receive financial assistance, it is worth pointing out the letters from the Ministry of Finance with the numbers:

- 03-04-06/6-367;

- 03-04-05/8-67.

They, in particular, contain an explanation of this point. It notes that personal income tax is not withheld from one-time material assistance, the amount of which does not exceed 50 thousand rubles. It can be accrued to either one of the parents or both, but in the totality its volume should not exceed the previously mentioned non-taxable maximum.

From all this it follows that exemption from personal income tax for financial assistance applies only to an amount of 50 thousand for one specific child, and only once. At the same time, either one parent or both can take advantage of this benefit, if the total amount of payments does not exceed the previously specified ceiling.

Meanwhile, lawyers note that this explanation from the Ministry of Finance is incorrect. The whole point is that there are no requirements in the Tax Code according to which an employee, upon the birth of a child, has the right to receive assistance only if the other parent was not given it. There is also no mandatory condition for submitting a certificate of payment (non-payment) of financial assistance to the other spouse.

At the same time, another letter from the Finance Ministry numbered 03-04-06/8-346 indicates that despite the absence of the requirement to provide a certificate in Form 2-NDFL from the second parent, the responsibility lies with the organization that has the status of a tax agent, and this means that on her part this demand is completely justified. This will allow you to avoid troubles with the Federal Tax Service if something happens.

Thus, if an employee has not presented a certificate from his spouse, the management of his organization has the right to request it independently.

At the same time, sometimes it is impossible to submit a certificate in form 2-NDFL for reasons beyond the control of the second parent (he may not work anywhere, for example).

This means that personal income tax will not be withheld from financial assistance after receiving a personally written statement from him, which indicates that this benefit was not given to him.

Financial assistance for the birth of a child: 2021

Since additional money is paid at the initiative and desire of the employer, disputes often arise between him and his subordinates about who is entitled to what amount. If the LNA of an organization provides support for young parents, then all employees without exception who have given birth to children or who have taken custody or adopted children can count on it. The amount and terms of payment are also specified in the company documents.

We must remember that one-time financial assistance for the birth of a child is an optional payment; you cannot demand it from your superiors. But if this payment is fixed in the LNA, labor or collective agreements, you can contact the trade union and labor inspectorate. If the problem cannot be resolved peacefully, it is also possible to go to court.

What is financial assistance to an employee?

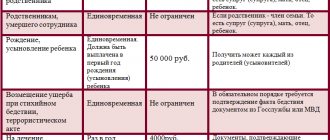

Financial assistance to an employee is a one-time financial payment, which is provided in a number of exceptional cases, such as:

- assistance with the treatment of an employee’s relative;

- assistance at the birth of a child;

- funeral assistance.

Belongs to the category of SOT (labor remuneration system), paid at the discretion of the employer. Before applying for financial assistance, an employee should inquire whether such a payment is included in the list of SOT of the organization in which he works.

Financial assistance to mother and father

A mother can count on 2 benefits: a benefit for early contact with an antenatal clinic and the one-time benefit described above. The father can also count on some support. To receive such assistance, he will need to provide the following documents:

- a copy of the birth document;

- a certificate stating that the mother did not receive similar assistance for this child;

- income certificate.

If the mother received financial assistance at her place of work, the father can still apply for assistance to management, who may decide to pay certain funds. However, such payment is entirely at the discretion of the manager.

Insurance premiums

Federal Law No. 212, enacted in 2009, states that contributions must be paid on all income or other remuneration assigned to an employee under the following agreements:

- labor;

- author's order;

- provision of services;

- civil law;

- licensed;

- on alienation of exclusive rights, etc.

Article 9 of the above legislative act contains a list of payments for which insurance premiums are not charged. Among others, it also mentions the financial assistance given to an employee on the occasion of the birth (or adoption) of a child.

There is also a certain condition: if the assistance is paid within a year after the birth of the baby, in an amount not exceeding 50 thousand rubles.

In a situation where such material support was accrued later than the previously mentioned period, the rule becomes relevant in which insurance premiums are not taken from a one-time payment of assistance if its amount does not exceed 4 thousand rubles per employee per year.

Consequently, in this case, financial assistance for the birth of a child in the amount of 19 thousand is not subject to fees in:

- FSS;

- Pension Fund;

- MHIF.

The main thing is not to forget the basic requirement - the interested person must receive it within a year after the birth of the child. In this case, it is also worth noting that the year expires on the eve of the child’s 1st birthday.

Otherwise, the entire amount exceeding the minimum (4 thousand) is subject to contributions.

When is the tax payment due?

According to the conditions and rules enshrined in Article No. 226 of the Tax Code of Russia, tax payment must occur on the day the funds are transferred to the account of the person in need. The operation can be carried out within 24 hours. In this case, the payment date is taken as:

- the moment of issuing cash through the organization’s cash desk;

- date of receipt of funds to the employee’s personal bank account;

- the day of receiving assistance in the form of property.

Please note: the personal income tax return period differs from the tax payment period.

The total time from the date of sending the application to the Federal Tax Service is about four months. In this case, the period includes:

- 90 days to conduct a desk audit;

- 30 calendar days for delivery of notification of results.

The current regulations document situations where personal income tax is not charged on financial assistance in 2021. In other circumstances, a citizen or organization is obliged to pay the rate within the established time frame. Otherwise, penalties will be imposed.

Conditions and procedure for receiving financial assistance

The provision of financial assistance to an employee and personal income tax is not related to entrepreneurial or other activities. To receive financial assistance from regional or federal authorities, as well as an employer, grounds are required.

The main role is played by obtaining the status of a low-income family, in which:

- The family member is not employed.

- A close relative retired. According to the new rules of pension reform, the return for women is 60 years, for men - 65.

- The citizen has the status of “pensioner” and lives alone from his family.

- The person has a disability group, i.e. with limited capabilities.

- The family has several young children.

Read also: How to do a DNA paternity test

Thus, only truly needy citizens have the right to receive financial assistance. To complete the procedure, social protection authorities are involved, and the level of income and living conditions are checked.

Applicants send a package of documentation and an application to the relevant departments. Based on the results of the review, the institution announces a verdict on the provision or refusal to receive financial assistance payments. In a situation where the application is not satisfied, the agency is obliged to provide legitimate reasons for the refusal in writing.

Tax on financial assistance

Please note: funds for one-time support are transferred when appropriate circumstances arise. At the same time, assistance has no connection with the person’s performance of any functions or actions and does not entail the imposition of obligations.