The legislative framework

Financial assistance in connection with marriage is a dispositive category that officially employed citizens can apply for if:

- The employer has a reserve fund in case of significant events in the life of employees or the team as a whole;

- Local regulations of the employing organization provide for the possibility of receiving these payments.

It is important to understand that additional financial support on behalf of the employer is provided solely on a voluntary basis. There is no norm in legislative acts obliging an employer to pay other funds to his employee (not related to remuneration for work) who wishes to get married.

An application for financial assistance in connection with marriage can be submitted:

- Directly to the name of the employer;

- To the trade union organization operating at the employer.

How to apply for financial assistance to an employee in connection with marriage

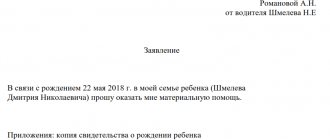

Upon marriage, an employee must submit an application requesting financial support.

Sample application

The application has the simplest, most common form. At the top right you should indicate:

- full name of the position of the first manager of the enterprise where the employee is employed;

- company name;

- surname and initials of the official to whom the application is addressed;

- from whom the application is coming (your full name, position).

In the center you need to write “Application”, and below the paragraph a specific request: “I ask you to provide financial assistance in connection with marriage.” Below, the applicant must put the date the document was drawn up and a personal signature (with full name).

It is important to know that newlyweds have the right to apply for financial support only after completing the procedure at the registry office and receiving a marriage certificate.

Required documents

In each specific case, different documents will be required. In the case when an employee got married (or an employee got married), the only paper that can confirm that the marriage is not only de facto, but also de jure is a marriage certificate. A copy of this document is attached to the application.

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

Who is entitled to payment?

Financial support in connection with entering into a marriage relationship is not related to production processes and is not regulated by the norms of the Labor Code of the Russian Federation. When assigning payments, the following are not taken into account:

- Experience;

- Position held;

- Labor merits of the employee;

- Level of education and qualifications.

By offering the above assistance to its employees, the employer, as a rule, does not pursue the goal of improving the quality of the work performed, since there are a sufficient number of alternative ways to motivate the team. The main reason for providing a material payment is the occurrence of a significant event in the life of a subordinate, accompanied by significant costs.

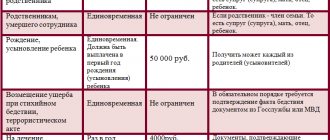

Form and amount of payments

Since money acts as a universal commodity equivalent, this form of payment is considered preferable and most common. However, the employer can offer another form of support - in kind (especially if it is more convenient for him due to the activities he carries out).

In-kind assistance includes:

- Food;

- Medicines;

- Essential items;

- Clothes, shoes;

- Other non-food products.

The amount of payments is determined by the employer independently. The total amount depends on:

- Company capabilities;

- Individual circumstances of the applicant;

- Objectivity and feasibility of providing assistance.

When drawing up an application, the employee has the right to indicate a specific amount, which can serve as a guideline when the employer makes a decision.

How is the amount of payment to an employee in connection with marriage registration determined?

The amount of financial assistance paid to the newlywed may vary; usually its amount is stipulated in a collective agreement (Article 40, Article 41 of the Labor Code of the Russian Federation) or an employment contract.

If such an internal document does not exist, then the amount of financial assistance upon marriage is determined based on the capabilities of the company. The minimum amount of assistance is usually 4,000 rubles, the upper limit is not limited by anything other than the well-being of the company and the attitude of management.

If the employer’s financial situation is difficult, assistance may be refused or a smaller amount may be paid.

Who and where the newlywed works also matters. Full-time students who are married also have the right to receive financial assistance, but the amount depends on the charter of the educational institution or a document agreed upon with the trade union committee of the university or institute. At the university, a married student or a spouse receiving higher education can count on an amount from 4 to 7 thousand rubles . It should be understood that a budget educational institution cannot afford large payments.

The student must contact the trade union committee for help by submitting:

- statement;

- copy of passport, TIN;

- a copy of the marriage certificate.

If a civil servant got married, then financial assistance for the wedding will be paid to him, subject to the presence of such a clause in the service contract (Law of the Russian Federation of July 27, 2004 No. 79-FZ “On the State Civil Service of the Russian Federation” - subparagraph 8, paragraph 3, art. 24 and paragraph 4 of Article 50).

Expert opinion

Irina Vasilyeva

Civil law expert

Employees of the Ministry of Internal Affairs have the right, as stated in paragraph 2 of Art. 3 of the Law of the Russian Federation No. 247-FZ, to receive financial assistance in the amount of at least 1 salary per year. And financial support on the occasion of a marriage, like other types of compensation, is not mandatory for a police officer: as stated in Order of the Ministry of Internal Affairs No. 1260, assistance is paid within the limits of funds allocated for monetary allowances by the federal budget.

A police officer can submit an application, and the result will depend on the availability of budget funds.

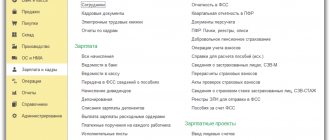

Payment processing algorithm

To receive financial support for a wedding from an employer, an employee will need to follow the steps below:

- Familiarization with the internal documents of the organization (if there are none at all in the company, the subordinate should still send a corresponding application to the employer, since the latter can act as an exception);

- Drawing up a written application addressed to the head of the organization or the chairman of the trade union organization;

- Registration of the application with the secretary in the journal of incoming documents;

- Providing the document for review to an authorized person;

- Consideration of the request and issuance of a positive verdict;

- Drawing up an order for the payment of financial support;

- Transferring the order to the organization’s accounting department;

- Issuance of funds in hand or non-cash transfer on the day of salary payment.

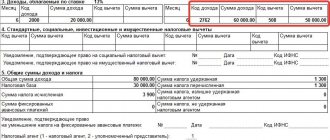

Taxation of financial assistance issued in connection with a wedding

The employer acts as a tax agent when paying financial aid due to an employee’s marriage. The company is obliged to calculate, withhold personal income tax and transfer the withheld amount to the budget. In accordance with paragraph 28 of Art. 217 of the Tax Code of the Russian Federation, the amount of assistance up to 4 thousand rubles per year is exempt from tax; personal income tax is withheld from the rest of the funds at a rate of 13% (30% for non-residents). It should be noted that the approved limit applies to all amounts of financial assistance received during the year and are taxed according to the same rules.

Insurance premiums are assessed for financial assistance in the same manner - amounts over 4,000 rubles are taxed. for the year (clause 11, clause 1, article 422 of the Tax Code of the Russian Federation). Insurance premiums are not charged only if a former employee applies for financial assistance, with whom the employer no longer has an employment relationship.

Peculiarities

- The duration of consideration of the application by the employer is regulated and cannot take more than 1 month;

- An application for voluntary financing for a wedding is drawn up in free form, if the employer’s local regulations do not establish a sample document;

- Financial assistance can be requested after the official registration of the union, then a marriage certificate should be attached to the application;

- In accordance with the law, a cash payment for a wedding will be subject to income tax if the requested amount is greater than the current limits;

- A special situation arises for military personnel who, on the basis of a resolution of the Ministry of Defense, have the right to claim a cash payment equal to two salaries (but not more than once a year), if one of the following circumstances occurs:

- Financial difficulties;

- Death of a family member;

- Onset of pregnancy;

- Deterioration of health;

- Entry into marriage;

- Going on vacation;

- A similar opportunity arises for students getting married. To receive payments for your wedding, you should contact the university administration. If the application is approved, the scholarship fund will transfer the amount of the allocated support.

Financial assistance for a wedding: when is it issued, how to get it

Assistance to an employee for a wedding due to the fact that it is not part of the salary and is not mandatory, by virtue of Art. 8 and 40 of the Labor Code of the Russian Federation must be enshrined in the internal legal acts of the enterprise (which also includes the collective agreement between representatives of the employer and the work collective). The detailed procedure for making such payment should be regulated in the specified documents.

However, in any case, receiving financial assistance is of an application nature, therefore a person getting married and having an employment relationship with this organization must write an application addressed to its management. It should indicate:

- date of registration of marriage;

- details of the document (certificate) confirming the creation of a family;

- the requested amount (if it is set in a fixed amount and does not depend on the will of the employer);

- a list of attached documents (including a copy of the marriage certificate);

- date of preparation and signature of the applicant.

Based on the application (if a positive decision is made), the employer must issue an appropriate order, which, among other things, must indicate all the information that allows defining this payment as financial assistance for the wedding (details of the marriage certificate are required).

Sample application

Despite the absence of generally accepted requirements for the application form for assistance in connection with marriage, the document must look like this:

- Full name of the head of the organization;

- Full name of the employee joining the official union;

- A detailed description of the reason for contacting;

- Grounds for providing assistance with reference to the provisions of the organization’s local documents;

- The desired amount of payment and procedure, form of its purpose (cash/in-kind, cash/non-cash);

- Request to allocate funds from the company’s reserve fund;

- Application documents (marriage certificate, counterfoil from the registry office with a note about the date of the upcoming event).

Download a sample application for assistance in connection with marriage

Basic information

The legislation does not oblige managers to provide financial assistance to every employee who registers a marriage. But at some enterprises there is a practice of providing support to newlyweds, provided by management at their own discretion.

Despite the fact that the legislation of the Russian Federation does not define the conditions for the provision of financial assistance, there are several articles that in one way or another touch on this topic. For example, the Labor Code ( Articles 40, 41, 129 ) establishes that compensation in connection with marriage registration should socially protect the subordinate, and the type of his activity is not important.

The Tax Code ( Articles 209, 210, 421, 422 ) determines the fact that financial assistance is subject to personal income tax and insurance contributions. The responsibility for paying taxes lies with the employer, and the subordinate will receive financial assistance after all the deductions have been made.

As for military personnel, they have the right to receive financial assistance in the amount of 2 salaries once a year. The basis for transferring funds can be not only registration of marriage, but also pregnancy of the wife, death of a loved one, serious illness, or going on vacation.

In the case of civil servants, if there is no information about financial assistance in the local acts of the organization, only the manager can allocate funds. Civil servants will also need to draw up an application and attach documents to it that confirm the existence of grounds for receiving financial assistance.

If you have any questions, you can contact us for free at the following phone numbers:

- Moscow ext. 143

- St. Petersburg ext. 702

- RF ext. 684

If you have any questions, you can consult for free by chatting with a lawyer at the bottom of the screen or by calling the following phone numbers:

- Moscow ext. 143

- St. Petersburg ext. 702

- RF ext. 684

Taxation

As a general rule, financial assistance provided to an employee due to marriage is his profit, and therefore subject to taxation. However, if the amount of support is less than 4 thousand rubles, personal income tax will not be withheld.

Rules for withholding tax on financial assistance:

- Tax is withheld only from the amount that exceeded the maximum limit of 4 thousand rubles (if an employee is assigned support in the amount of 15 thousand rubles, the tax base will be a multiple of 11 thousand rubles);

- If monetary assistance is assigned in non-cash form, then the employee must receive the amount minus personal income tax into his account;

- The listed material support cannot be less than the amount approved in the employee’s application. If the employer endorsed an amount of 8 thousand rubles, then this is the amount that should be given to the applicant, since personal income tax is calculated and paid separately.

Results

Financial assistance to an employee upon marriage can be provided by the employer as an additional social guarantee and enshrined in a local legal act or collective agreement.

Its amount can be any, but in accordance with tax legislation, only 4,000 rubles per reporting period are not subject to income tax. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.