Briefly about the procedure for calculating alimony

Alimony is transferred by the employer within 3 days from the date of payment of income to the employee on the basis of a writ of execution or an agreement of the parties on the payment of alimony (Article 109 of the RF IC).

From 06/01/2020, in field “24” of a payment slip for the payment of income to an individual debtor, information about the amount of the collected amount is indicated. For example, the entry “Payment of wages for June 2021 to Ivan Ivanovich Ivanov //VZS//5000-00//” means that the employer withheld 5,000 rubles from the amount of payment to the employee according to the writ of execution. This is how withheld alimony is now indicated in payment slips for the transfer of wages (or other income) to the debtor.

When calculating alimony for minor children, it is not allowed to recover more than 70% of the employee’s income after withholding personal income tax, in other cases - no more than 50% (Article 138 of the Labor Code of the Russian Federation, Article 99 of Law No. 229-FZ dated 02.10.2007).

What is the procedure for withholding money?

According to the rules, the transfer of alimony from the organization’s current account is made on two grounds - at the initiative of the employee (application) and according to a writ of execution.

Alimony payments are calculated from the following income (Government Decree No. 841 of July 18, 1996):

- salary;

- additional payments, allowances and compensations;

- bonuses;

- vacation pay;

- sick leave.

The regulations state that such payments should be transferred by payment order from all income after deduction of income tax.

They do not pay money for the maintenance of children (Article 101 229-FZ):

- from travel and accountable funds;

- from compensation for the use of personal property and equipment for work purposes;

- from all social benefits, except sick leave, and financial assistance.

IMPORTANT!

An employee’s application for payment of salary is voluntary, and deduction according to the writ of execution in the payment order is mandatory - the amount of compensation and the bank details of the recipient must be indicated in the expenditure document.

Deductions under a writ of execution (IL) are terminated when the child reaches the age of majority or in the event of dismissal of the payer.

Use free instructions from ConsultantPlus experts to collect alimony:

- for minor children;

- for adult children.

Payment of alimony: payment order

Registration of alimony payments is subject to the rules established by Bank of Russia Regulation No. 383-P dated June 19, 2012.

When drawing up a document, the payer enters the following information:

- No., document date;

- amount transferred (in numbers and words);

- payer details: name, tax identification number, checkpoint, current account;

- details of the payer's bank: name, BIC, correspondent account;

- recipient details. It can be a division of the FSSP (details can be found in the documents on the basis of which alimony will be collected, or can be checked with the FSSP) or an individual in whose favor alimony is paid (details should be checked with the recipient);

- payment type – 01 (i.e. by payment order);

- if alimony is transferred directly to the individual recipient, from 01.06.2020, code “2” is entered in field 20, meaning that this payment cannot be levied (Article 101 of Law No. 229-FZ), clause 1 of the Bank of Russia Directive dated 14.10. 2019 No. 5286-U). If the recipient is the FSSP, this field is not filled in;

- priority of payment: if there is a writ of execution - 1, and if payments are made on the initiative of the employee (upon his written application) - 3, because the application is not recognized as an executive document (clause 2 of Article 855 of the Civil Code of the Russian Federation);

- the purpose of the payment contains information that allows the payment to be identified. For example, when transferring alimony to FSSP accounts: “Alimony from the wages of Ivanova I.I. for June 2020 according to the writ of execution dated 02/10/2020 No. 5845/1. Case 7686/alim/20. Amount 5000-00 rub. Without VAT".

The remaining fields of the document are not filled in.

Filling out the payment purpose from June 1

The introduction of a new coding in field 20 has led to the fact that the accountant now fills out separate payments for different types of income. For example, salary and travel allowances to one employee cannot be transferred in one order. The innovation also applies to salary registers, so accountants create different registers for payment, for example, of salaries and child benefits.

Also, in the “Purpose of payment” detail in the payment slip (in the salary register - a detail intended for this purpose), you now need to indicate the amount of deductions for writs of execution that were made from the employee’s income. From June 1, 2020, this obligation is relevant for all employers (clause 5 of Article 1 of Law No. 12-FZ dated February 12, 2019).

The Central Bank recommends using the following record structure when filling out the payment purpose (information letter dated February 27, 2020 No. IN-05-45/10): symbol “//”, “VZS” (that is, the amount collected), symbol “//”, amount numbers, symbol “//”.

Note! When specifying the amount, rubles must be separated from kopecks with the symbol “-” rather than a comma. If the withholding amount is without kopecks, then enter “00” after this sign.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

For example, //VZS//2600-00// or //VZS//5240-75//.

A ready-made solution from ConsultantPlus will help you correctly fill out the “Purpose of payment” details in the payment order. If you don't already have access to the system, get a free trial online.

Why were new rules introduced?

Previously, bailiffs could not determine the type of income of a citizen. Therefore, any payments were collected. Such actions caused numerous disputes, since the Law “On Enforcement Proceedings” No. 229-FZ of October 2, 2007 prohibits the withholding of debt from certain incomes.

On June 1, 2020, Federal Law No. 12-FZ of February 21, 2019 came into force, on the basis of which changes were made to the procedure for penalties in enforcement proceedings. In particular, Article 70 of Law No. 229-FZ was supplemented with clause 5.1, obliging persons making payments to citizens to indicate a certain income code in payment documents. The value entered in the payment slip will allow you to recognize the type of payment. Bailiffs will not be able to seize funds from which the debt cannot be collected under enforcement proceedings.

Questions and answers

Q: Is it possible to transfer alimony to a Sberbank card? A: Yes, this is in no way limited by law and this method is very popular and convenient for both payers and recipients of alimony. You can pay both through ATMs and through the Internet bank Sberbank Online.

Q: How much does alimony go to a Sberbank card ? A: The transfer is carried out within three days, but in fact, if the correct details are indicated, within 2 hours.

Sample payment form for issuance of accountable funds

To avoid errors during transfer or return of payment, it is important to fill out payment documents correctly. Here are step-by-step instructions for processing the issuance of funds against a report at the request of an employee.

Let's look at how to indicate the payment purpose code when transferring to an accountable person using an example:

- Horse riding teacher of the GBOU DOD SDYUSSHOR "ALLUR" Petrov P.P. wrote an application for an advance payment for postal services in the amount of 1,500 rubles.

- The director approved the submitted application and issued an order to issue it to the employee for reporting.

- Based on the order, the accountant made a transfer to the individual’s card.

Similarly, the “salary” code is indicated in payments for reimbursement according to the advance report with attached documents confirming the expense.

Details for paying debts at the bailiff service of the Pervomaisky district

In addition, in the menu that appears as a list of payment options, you can familiarize yourself with all the ways to repay the debt to the FSSP for your enforcement proceedings. Perhaps you can find a payment option that is more convenient and economical for you.

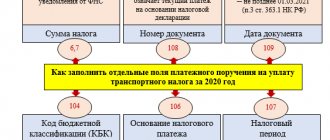

The signs “No” and “–” are not indicated in field 108. If the individual’s TIN is filled in, the value “0” is allowed in this field.

- In fields 106 “Base of document”, 107 “Tax period” and 109 “Date of document” enter 0.

Sample of filling out a payment order to bailiffs For clarity, let’s look at filling out a payment order to the FSSP using a conditional example.

Methods of transferring alimony and documents

There are several options for paying alimony depending on the method of collection:

- Handing over cash. For the payer, this is the most unsafe option: if the recipient turns out to be unscrupulous and decides to receive the money again, he can file a lawsuit, and then the amounts actually paid will have to be transferred again. To prove the fact of transfer of funds, it is recommended to draw up a receipt each time indicating the date, time, place, purpose and amount of payment, as well as the basis - writ of execution, resolution, etc.

- Transfer through a bank cash desk, electronic wallets or terminals. The most important thing here is to indicate the purpose of the payment - alimony. If this is not done, it will be problematic to prove that the money was transferred specifically for the maintenance of the child. In the future, during legal proceedings, the payer will be able to use a bank statement containing the purpose, date and amount of payment.

- Transfer by accounting department at the place of employment. This method is the most common: the accountant issues a payment order on the basis of a writ of execution, an order or a statement from the employee himself, if he decides to transfer money voluntarily. To confirm payment, the payer only needs to order a corresponding certificate from the accounting department. It is recommended to take it at least once a year, and also be sure to fill it out upon dismissal.

Results

Payments to the FSSP are a transfer there of funds withheld by the employer from the employee’s salary under a writ of execution. Non-tax and tax debts can be paid in this way. In the second case, the payment document will be drawn up according to the rules applied for budget payments, but taking into account some of the features of entering data into certain fields.

Sources

- https://clubtk.ru/forms/bukhgalteriya-v-kadrakh/alimenty-kak-zapolnit-platezhnoe-poruchenie

- https://raszp.ru/spravochn/platezhnoe-poruchenie-na-alimenty-v-2021-godu-obrazets.html

- https://allo.tochka.com/zapolnyat-platyozhku

- https://AlimentOff.ru/alimenty/platezhnoe-poruchenie-na-vyplatu-alimentov

- https://bankigid.net/obrazec-zapolneniya-platezhki-na-alimenty-v-sberbanke-v-2021-godu/

- https://aliment24.ru/raschet/sposoby-vyplat/perevod-alimentov-cherez-sberbank.html

- https://prozakon.guru/semejnoe-pravo/alimenty/platezhnoe-poruchenie-na-perechislenie-obrazets.html

- https://alimentypro.ru/naznachenie-platezha-pri-perechislenii-alimentov/

- https://nalog-nalog.ru/bank/platezhnoe_poruchenie_sudebnym_pristavam_-_obrazec/

Kbk for paying alimony to bailiffs 2021

For example, this could be transport tax, debts to the Federal Tax Service, etc. and so on. It is worth noting that it will most likely not be possible to clarify this information with FSSP employees or your bailiff directly. They do not and should not have the necessary accounting skills.

A convenient (relatively) electronic service appeared only at the end of last year. As a result, I received an angry letter from the Pension Fund of the Russian Federation, I knew how much money should be left on the PC, and after 2-3 weeks they wrote it off from there themselves.

Payment order

If the employing organization is in charge of filling out a payment order for alimony, many questions arise regarding the order of payment. The fact is that enterprises not only pay money for the maintenance of their employees’ young children from their salaries, but also make other contributions: insurance, taxes, etc.

While government payments are important, alimony is a priority. If there is not enough money in the account for all contributions at once, they must be transferred in any case. This is explained by the fact that the main goal of the state is to protect the Constitutional rights and interests of people, especially children.

If the organization pays the fees first and has no money left for alimony, the child’s rights will be significantly violated, which should not be allowed.

How to correctly indicate the purpose of payment in a payment order for alimony?

For any payment order, it is very important to enter the “Purpose of payment” field, especially if the transfer has a specific purpose. This field must contain the following information:

- The purpose of transferring money is alimony;

- To whom – Ivanov D.S.;

- For what period – month, year;

- If alimony is paid officially, then you need to indicate the grounds - the number of the writ of execution, court order or alimony agreement;

- VAT/excl. VAT. When alimony is always written without VAT, since this type of collection is not taxed.

For example, the assignment is as follows: “Child support for D.S. Ivanov, for January 2021, according to writ of execution No. 135-67, excluding VAT.” If you have indicated everything correctly, then the transfer of funds usually occurs on the same day, and the saved receipt, if necessary, will serve as proof of regular alimony payments.

That is, you understand how important it is to correctly indicate all the information in the order, and especially in the “Purpose of payment” field. With an irresponsible attitude, an incorrectly drawn up payment order may become a reason for the accrual of penalties, even though the funds will be transferred to the recipient’s account, they will not apply to the intended purpose, that is, alimony.