Payment of financial assistance at the initiative of the employer

The most common cases of financial assistance payments are the assignment of financial assistance at the discretion of the employer. The provision of the amount is targeted in nature, providing for registration in each specific case. The list of grounds is stipulated in the collective agreement, regulations on remuneration or other internal act. In order to avoid disputes with the Federal Tax Service, the provisions on the provision of assistance must specify the procedure for applying, grounds, amounts, and a list of supporting documents.

Terms of assistance:

- The amount of financial assistance paid by order of the manager up to 4,000 rubles is not subject to contributions. Any amount over the limit is taxed as usual.

- When assigning financial assistance that is not subject to contributions within the limit, the number of tranches within one order or the number of payments under several orders of the employer does not matter. The amount of money and the valuation of non-monetary assistance is determined on an accrual basis during the calendar year.

- The maximum non-taxable amount of 4,000 rubles does not depend on the number of months worked by a person in the billing period.

The provision of financial assistance is not mandatory and is a payment based on a voluntary decision of the manager or other person authorized to manage the funds of the enterprise. The amount of the amount is not limited by law, with the exception of the tax position.

Social payments are

The legislation does not have a clear definition of what social payments are. The main features of social payments can be found in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 14, 2013 No. 17744/12 in case No. A62-1345/2012:

- are not a form of remuneration for employees;

- are not stimulating;

- do not depend on the qualifications, level, skills and professionalism of employees;

- do not depend on the complexity, quantity, conditions of the work itself;

- carried out on the basis of a collective agreement.

Based on these characteristics, it turns out that social payments are payments that are not directly related to the performance by employees of their job duties, do not depend on the quantity and quality of work, are not incentives or compensation and are included in the social package.

The list of payments that can be classified as social is quite large. This:

- severance pay upon dismissal of an employee;

- compensation for travel costs to and from work;

- financial assistance paid in connection with the difficult financial situation of an employee due to family circumstances;

- one-time bonuses to employees for participation in competitions, competitions, marathons, bonuses in connection with holidays and anniversaries;

- subsidies for food for employees;

- reimbursement of employee expenses for treatment and purchase of medications;

- payment to employees and families for sanatorium vouchers;

- payment for children in preschool institutions;

- payment under personal, property and other voluntary insurance contracts in favor of employees;

- compensation for rental housing costs;

- other.

Previously on the topic:

Payments from which contributions are not required

One-time payments to employees due to special reasons

Separately, the legislation stipulates a list of grounds for providing one-time financial assistance, in which exemption arises regardless of the amount of the amount (clause 3, clause 1, article 422 of the Tax Code of the Russian Federation). The occurrence of special social reasons must be documented.

| Grounds for payment of financial assistance | Additional terms |

| Damage resulting from a natural disaster, terrorist attack or other emergency circumstances | Payment is made to compensate for financial loss or harm to health. Types of assistance include the provision of items in kind, specified by order |

| Death of a close relative | We consider relatives who are considered close in accordance with the RF IC - spouses, parents, children and those equivalent to them. Under certain conditions (cohabitation), brothers and sisters are considered family members |

| Birth of a child, adoption, appointment of guardianship | The payment is made to each parent or person equivalent to him. Assistance is provided up to 50,000 rubles for each child when applying within a year after the occurrence of the event |

In February of this year, employee K. of Vympel LLC received financial assistance for vacation in the amount of 7,500 rubles from the company. In May of this year the employee was provided with a one-time payment of 35,000 rubles in connection with the birth of a child. When determining the base for assessment of contributions, assistance at the birth of a child is not taken into account in connection with payment on another basis. Taxation is subject to 3,500 rubles - part of the amount of vacation assistance exceeding 4,000 rubles.

What is not subject to insurance premiums under the Tax Code of the Russian Federation

In accordance with Article 421 of the Tax Code of the Russian Federation, the base for calculating insurance premiums for organizations is determined at the end of each calendar month as the amount of payments and other remunerations provided for in paragraph 1 of Article 420 and accrued separately for each employee from the beginning of the billing period on an accrual basis. All exceptions to this rule are given in Article 422 of the Tax Code of the Russian Federation. Here is an extensive list of payments that are not subject to insurance premiums:

- state benefits, including unemployment benefits and compulsory social insurance benefits;

- compensation established by law:

- compensation for damage caused to health by injury or other occupational disease;

- reimbursement of expenses for housing, food, fuel, utility bills;

- compensation or payment in kind;

- payment of the cost of food, sports equipment, equipment, sports and dress uniforms to sports workers;

- severance pay upon dismissal of an employee exceeding 3 times the monthly salary for all or 6 times the monthly salary for workers in the Far North, with the exception of compensation for unused vacation;

- reimbursement of expenses for professional training, retraining and advanced training of employees;

- compensation for the cost of moving to work in another area;

- one-time financial assistance to employees not exceeding 4,000 rubles;

- insurance payments for compulsory insurance of employees under voluntary personal insurance contracts for a period of at least one year;

- amounts of one-time financial assistance paid by the organization to employees upon the birth of a child during the first year after birth, in the amount of no more than 50,000 rubles per child;

- additional insurance contributions for a funded pension, but not more than 12,000 rubles per year;

- the cost of travel for the employee to the place of vacation and back;

- amounts paid by election commissions;

- cost of uniforms and uniforms;

- cost of travel benefits;

- payment for training of employees under vocational education programs and additional professional programs;

- reimbursement of interest payments on loans for the purchase or construction of housing;

- monetary allowance, food and clothing provision for military personnel, law enforcement officers, customs and fire service personnel;

- payments under employment contracts and civil agreements, including under copyright contracts for foreign employees;

- reimbursement of actually incurred and documented employee expenses related to the performance of work and provision of services under contracts.

Previously on the topic:

The nuances of paying insurance premiums from compensation payments

One-time nature of assistance provided for social reasons

When issuing an order and making payments for the reasons specified in paragraphs. 3. clause 1 art. 422 of the Tax Code of the Russian Federation, attention must be paid to the one-time nature of the provision of assistance. A one-time payment refers to settlement transactions performed under one order. If payments are made in installments under different orders, the exemption for subsequent issuance or transfer of funds will apply to an amount not exceeding 4,000 rubles.

An example of taxation of contributions for amounts paid in different installments

At the beginning of the year, the company Novost LLC had a collective agreement provision for the payment of assistance at the birth of a child in the amount of 25,000 rubles. In March, grounds arose for payment to employee M., which was made in the specified amount in accordance with the order of the manager. In June, the team revised the terms of the contract, increasing the amount of assistance in connection with the birth of a child to 35,000 rubles. Employee M. was given an additional payment in the amount of 10,000 rubles. Since the amount was transferred in installments on the basis of different orders, contributions were assessed for the payment of 6,000 rubles, despite the fact that the specified amount does not exceed the limit of 50,000 rubles in accordance with paragraphs. 3. clause 1 art. 422 of the Tax Code of the Russian Federation.

Registration of financial assistance

To receive payment to an employee or former employee, you must write an application in any form. In the text part of the application, describe the circumstances in as much detail as possible. Attach documents confirming your life situation (certificate from the Ministry of Emergency Situations about a natural disaster, death certificate of a relative, birth or adoption certificate of a child, extract from the medical history, doctor’s report).

The manager, having considered the employee’s appeal, makes a decision on the amount of financial assistance based on the financial situation and complexity of the employee’s life situation.

Payment of financial assistance is made on the basis of an order (instruction) of the manager. The material may be divided into several parts and paid in several payments, for example, due to financial difficulties in the organization. But only one order is made. It should indicate the frequency of transfers. If several orders are created for one reason, then tax authorities recognize only the payment under the first order as financial assistance, and the rest are recognized as remuneration for work.

Conditions and procedure for receiving financial assistance

The provision of financial assistance to an employee and personal income tax is not related to entrepreneurial or other activities. To receive financial assistance from regional or federal authorities, as well as an employer, grounds are required.

The main role is played by obtaining the status of a low-income family, in which:

- The family member is not employed.

- A close relative retired. According to the new rules of pension reform, the return for women is 60 years, for men - 65.

- The citizen has the status of “pensioner” and lives alone from his family.

- The person has a disability group, i.e. with limited capabilities.

- The family has several young children.

Thus, only truly needy citizens have the right to receive financial assistance. To complete the procedure, social protection authorities are involved, and the level of income and living conditions are checked.

Applicants send a package of documentation and an application to the relevant departments. Based on the results of the review, the institution announces a verdict on the provision or refusal to receive financial assistance payments. In a situation where the application is not satisfied, the agency is obliged to provide legitimate reasons for the refusal in writing.

Tax on financial assistance

Please note: funds for one-time support are transferred when appropriate circumstances arise. At the same time, assistance has no connection with the person’s performance of any functions or actions and does not entail the imposition of obligations.

How to reflect receipt of financial assistance in tax reporting?

To understand how and when material assistance is reflected and whether it is subject to personal income tax, an example should be given.

Semenov Yu. G. officially contacted the employer on June 1, 19 with an application for payment of financial assistance in the amount of 50,000 rubles. The manager made a decision on June 4, 19 to transfer funds to the applicant in full. The accounting department made the appropriate accrual, transferred the money to the account and reflected the posting in the tax reporting.

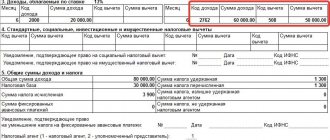

Form 2-NDFL

To reflect financial assistance, personal income tax and insurance contributions, it is necessary to take into account that the amount of up to 4,000 rubles transferred to the employee’s account must have code 2760, and the deduction is shown as 503 (Article No. 217, paragraph No. 28 of the Tax Code of Russia). For financial assistance provided at the birth of a child, the income code will be 2762, the deduction will be 504 - order of the Federal Tax Service No. ММВ-7-11/387.

Non-taxable support, regardless of the volume, is not indicated in form 2-NDFL. For example, the amount does not need to be shown in the certificate issued to the employee if there is a fire in his house. However, the causes of the emergency should not relate to the actions of the employee. The payment is quoted as assistance in connection with the occurrence of emergency circumstances. In this situation, the payment is not subject to reflection, and therefore is not subject to tax.

How to get a?

The procedure for receiving the specified payment must also be recorded in the local acts of the enterprise (organization).

Any type of support provided is provided on the basis of an application from the employee, which is drawn up in any form.

Both a printed version of the document and a handwritten one are acceptable.

The application must indicate in whose name it is being drawn up, as well as the details of the applicant himself (last name, first name, patronymic of the employee, his position).

The main part should indicate the reason for which the appeal is being submitted.

You can familiarize yourself with the procedure for receiving financial assistance in the accounting department of the enterprise (organization). The completed application is submitted to the manager directly or through the accounting department.

The specified document must be accompanied by papers confirming the reason for its submission. If financial assistance is requested in connection with an anniversary, you must submit a photocopy of your passport.

The Directorate reviews the application and issues a rejecting or approving visa. When deciding to provide a payment, the boss issues a separate order, which contains information about the purpose of the payment, its amount, as well as the grounds for payment.

Financial assistance can be paid in cash through the company's cash desk or transferred to the employee's bank account.

Are all employees paid for the holidays?

Enterprises (organizations) independently decide to provide employees with whom labor agreements have been concluded with financial assistance on certain grounds.

Most employers stipulate in local regulations the provision of the specified incentives in connection with holidays and significant dates.

The list of such celebrations may include:

- International holidays (New Year, Mother's Day);

- National holidays (Constitution Day, Independence Day);

- Professional holidays (teacher's day, lawyer's day, banking day, etc.);

- Personal events (birthday, wedding, etc.).

For public sector employees, the right to financial assistance can be enshrined in law.

For example, Federal Law No. 79 (Article 50) provides for the payment of this type of support to civil service employees from the wage fund.

Financial assistance for holidays can be a one-time payment (for example, for an anniversary) or have a systematic nature (timed to coincide with a professional holiday).

The amount of financial assistance is determined independently by the employer and may differ depending on the employee’s position, his length of service at the enterprise and salary.

Taxation – are personal income tax and insurance premiums subject to tax?

In accordance with tax legislation, all income of citizens is subject to tax payments. Material assistance is classified as incentive payments, which relate to the income of working citizens.

Depending on the basis for providing financial support, it may be partially or completely exempt from insurance premiums and personal income tax.

Financial assistance for an anniversary or holiday is not subject to taxes if its amount does not exceed 4 thousand rubles in one reporting period (calendar year).

In case of a payment exceeding 4 thousand rubles, insurance premiums and personal income tax will be collected only from the excess amount.

Important! For tax purposes, financial assistance provided to an employee in one reporting period is summed up - i.e. if a worker received 4,000 in anniversary benefits in April, and 4,000 in October for a professional holiday, only the April payment will be exempt from taxes.

Financial assistance: taxation 2021, insurance premiums

Is financial assistance subject to insurance premiums in 2020? Since financial assistance does not relate to income related to the employee’s performance of his work duties, it cannot be subject to contributions. However, this provision has a number of limitations. That is, the manager cannot pay his employees any amount as financial assistance. Since 2021, issues related to fees for employee insurance are explained in Chapter 34 of the Tax Code of the Russian Federation. Situations when you do not have to pay are contained in Art. 422 codes. Amounts from one-time financial assistance paid under the following circumstances are not calculated:

- the employee received money to compensate for damage caused by a natural disaster or emergency;

- the victim of a terrorist attack on the territory of the Russian Federation was compensated for damage to health;

- the employer helped with money in the event of the death of a member of his family;

- an amount of up to 50,000 rubles was paid as support for the birth of a child. Not only each parent, but also the adoptive parent and guardian have the right to it;

- the amount of financial assistance does not exceed 4,000 rubles during the year.

We remind you that 4000 rub. - this is tax-free financial assistance (2020). If payments are higher, they are subject to insurance premiums. In this case, the goals may be different, for example, for partial compensation of expenses for additional education, to cover the costs of purchasing medicines, for vacation. Note that the situations listed apply to all existing types of compulsory insurance: pension, medical, social, as well as injuries. In addition, they apply to assistance in both in-kind and cash forms. So, 4000 rubles for financial assistance. (taxation 2020) insurance premiums are not charged

What is subject to insurance premiums according to the Russian Ministry of Finance

If some type of payment is not expressly specified in Article 422 of the Tax Code of the Russian Federation, the Ministry of Finance insists on paying insurance premiums.

According to the Ministry of Finance, the list of payments exempt from insurance premiums is specified in Article 422; it is exhaustive and is not subject to expanded interpretation.

The Ministry of Finance annually issues several letters explaining whether a particular type of payment is subject to contributions.

In accordance with letters of the Ministry of Finance of the Russian Federation dated January 12, 2018 No. 03-03-06/1/823, dated June 1, 2016 No. 17-3/B-214, compensation payments in the form of the cost of reimbursement of expenses of an employee who moved to work in another locality, for renting housing or the amount of rent paid by the organization for its employee is not provided for by Article 169 of the Labor Code of the Russian Federation.

In letters of the Ministry of Finance of the Russian Federation dated May 16, 2018 No. BS-4-11/9257, dated April 12, 2018 No. 03-15-06/24316, dated March 13, 2018 No. 03-15-06/15287, dated September 14, 2018 No. 03- 04-05/66019 states that payment for employees’ meals is an initiative of the employer, and not a compensation payment, and it is subject to insurance premiums in the generally established manner.

Previously on the topic:

The Federal Tax Service of Russia clarified the nuances of levying contributions for compensation for food and rental housing

Compensation for food and housing for employees is subject to contributions, says the Federal Tax Service

The letter of the Ministry of Finance dated April 23, 2019 No. 03-15-06/29511 states that contributions are subject to:

The letter of the Ministry of Finance of the Russian Federation dated December 14, 2020 No. 03-15-06/109203 states that insurance premiums are subject to:

- a one-time bonus upon retirement exceeding 3 times the employee’s monthly earnings (for the Far North 6 times);

- one-time incentives in connection with holidays and anniversaries;

- reimbursement of fees for children in preschool institutions;

- one-time remuneration upon entry to work for employees under the age of 35;

- partial compensation to employees for the cost of vouchers;

- payment for food for donors on the days of blood donation;

- additional payments to the employee during his wife’s maternity leave, a monthly additional allowance for child care up to 3 years.

According to the letter of the Ministry of Finance of the Russian Federation dated February 15, 2021 No. 03-15-06/10032, insurance premiums are subject to:

- subsidies for food for workers employed in jobs with harmful and difficult working conditions, as well as workers employed in multi-shift work;

- compensation for workers for travel to and from work;

- one-time bonus for participation in professional skills competitions;

- bonuses in connection with holidays and anniversaries.

Moreover, in the case of the transfer of gifts to an employee under a gift agreement, the object of taxation with insurance premiums on the basis of paragraph 4 of Article 420 of the Tax Code does not arise.

As we see, along with those payments that are not actually specified in Article 422 of the Tax Code of the Russian Federation, the Ministry of Finance of the Russian Federation seeks to impose insurance premiums on those that are directly specified in it.

Top 10 practical situations that cause disputes regarding the payment of insurance premiums:

Gifts for employees: should there be insurance premiums?

Taxes and contributions for forgiveness of debt to an employee

Accountable money without documents

Is additional compensation for early dismissal subject to contributions?

Business trip + vacation: what about personal income tax and insurance premiums?

Should I pay personal income tax and insurance premiums on financial assistance to an employee due to coronavirus?

Payment of personal income tax and contributions for financial assistance at the birth of a child

Compensation for payment for kindergartens, vouchers and meals is not subject to insurance premiums

Personal income tax and advance payments under a civil contract

The company feeds employees on its own initiative. Should insurance premiums be calculated?

Financial assistance up to 4000 (taxation 2020)

Let's consider the taxation of financial assistance to an employee in 2021. Is financial assistance subject to personal income tax (2020)? The withholding of personal income tax is indicated in Chapter 23 of the Tax Code of the Russian Federation, and Article 217 of the Tax Code of the Russian Federation specifies whether financial assistance is subject to personal income tax. If you carefully read this article, it will become clear that income tax for individuals is not withheld in the same cases when insurance premiums are not collected. We are talking about the payment of money upon the birth of a child or the death of a family member, amounts up to 4,000 rubles (for any purpose). At the same time, we must remember that the 2-NDFL certificate will have different income codes and deduction codes each time - depending on the type of financial assistance provided and taxation or collection of insurance premiums (Order of the Federal Tax Service of Russia dated September 10, 2015 No. MMV-7-11).

Here are some more interesting points:

- According to the Ministry of Finance, monthly financial assistance to a person on maternity leave can be subject to personal income tax, taking into account standard tax deductions, the amounts of which are contained in paragraphs. 4 clause 1 of Article 218 of the Tax Code of the Russian Federation (Letter dated 02/17/2016 No. 03-04-05/8718). In other words, if an employer pays extra every month to a woman on maternity leave, he can reduce the amount of the extra payment by the so-called child deduction. Since this form of support may be a general type of financial assistance, and not a one-time payment in connection with the birth, although one reason is the birth of a baby;

- financial assistance, tax-free in 2021, is provided by the employer to family members of a deceased employee or former employee who previously retired due to disability, age or old age, or to the employee (pensioner) himself if one of his family members has died (Letters from the Ministry of Finance dated 16.12 .2014 No. 03-04-05/64847, dated 12/02/2016 No. 03-04-05/71785);

- if the fact of an emergency or terrorist act is not confirmed, the employer takes personal income tax from compensation (Letter of the Ministry of Finance dated January 20, 2017 No. 03-04-06/2414).

Taxation of financial assistance

Author: L. V. Karpovich, expert of the magazine “Topical Issues of Accounting and Taxation”

Probably, almost each of us has more than once received financial assistance from an organization for a variety of purposes: in the form of additional payment for vacation, for treatment, for the purchase of property, in connection with the death of relatives, etc. From a tax point of view, all these payments raise many questions among accounting workers. In what cases and on what grounds should financial assistance be subject to personal income tax, unified social tax and other taxes? Should it be included in labor costs? What to do if financial assistance was provided to a person who is not an employee of the organization? What documents must confirm its payment in each specific case? This article is intended to help the accountant understand these issues and take into account, if possible, all the nuances of the legislation on taxes and fees.

Financial assistance and sources of its payment

Material assistance refers to payments of a non-productive nature and is not related to the results of the organization’s activities. An organization can provide financial assistance to both employees and third parties for various reasons.

In one case, financial assistance is paid to all or most employees, for example, when going on another vacation. And then, according to clause 12.7.5. Resolution of the Federal State Statistics Service dated October 18, 2004 No. 49 “On approval of the Procedure for filling out and submitting the federal state statistical observation form No. 1-T “Information on the number and wages of employees by type of activity”

, it will relate to one-time incentive payments.

According to others, financial assistance is provided under special circumstances to individual employees or other persons upon their application, for example, for the purchase of medicines, burial, and other household needs. In this case, in accordance with clause 13.20

of the above resolution, it will be a social payment

[1]

.

The amount of financial assistance in general cases is usually specified in the employment (collective) agreement in absolute terms or in an amount that is a multiple of the official salary. In individual cases, it is set by the head of the organization. Financial assistance is paid based on the employee’s application with the permission of the manager and the order. The order for payment of financial assistance must indicate the reason and amount of payment.

The procedure for providing financial assistance can be established in the employment agreement (contract) with the employee or in the collective agreement. In the latter case, it is one of the methods of material incentives for the employee and is included in the payment for his labor. In accordance with clauses 5, 7 PBU 10/99 [2]

Labor costs are recognized as expenses for ordinary activities and must be recorded in production cost accounts.

If material assistance is not provided for by an employment (collective) agreement, then it is considered a non-operating expense (clause 12 of PBU 10/99)

and is taken into account in account 91-2 “Other expenses”.

From what sources can financial assistance be paid? There are two such sources: either retained earnings from previous years or income from the current activities of the organization. Here you need to remember that only the owners of the organization can decide to pay financial assistance from net profit. This decision must be approved at a general meeting of company participants (shareholders) and recorded in the minutes. This procedure is established by Art. 28 of the Federal Law of 02/08/98 No. 14-FZ “On Limited Liability Companies”

for limited liability companies,

etc.

11 clause 1 art. 48 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies” for joint-stock companies. If there is a written decision of the owners, then in accounting the amount of financial assistance is written off from account 84 “Retained earnings (uncovered loss).”

In practice, financial assistance, of course, is most often paid out of current expenses. In this case, as mentioned above, it, depending on the terms of the labor (collective) agreement, will be considered either an expense for ordinary activities or a non-operating expense.

It may happen that the organization's activities are unprofitable. What to do with financial assistance in this case? If its amounts are specified in labor and collective agreements, then they will have to be paid. But before submitting the annual financial statements, the founders must decide to pay off expenses not covered by the source of financing, either through direct investment in the enterprise, or by attracting investments from outside for these purposes, or through additional contributions when increasing the authorized capital.

note

on such an important point: when calculating income tax, material assistance, regardless of the purpose of issuance, is not included in the organization’s expenses.

This is clearly indicated by paragraph 23 of Art.

270 Tax Code of the Russian Federation . It does not matter whether the payment of financial assistance is provided for by the labor (collective) agreement or not.

Obviously, in order to avoid discrepancies in accounting and tax accounting, it is advisable not to include financial assistance in the documents regulating the procedure for remuneration.

So, we have found out from what sources material assistance is paid, how it is reflected in the accounting accounts and why it does not reduce the tax base for profits. Next, we will analyze in what cases and what taxes should be charged on its payment. All this, first of all, will depend on the purposes for which financial assistance is provided.

Personal income tax

As stated in Art. 210 Chapter 23 “Tax on personal income” of the Tax Code of the Russian Federation

, when determining the tax base, all income of the taxpayer received by him, both in cash and in kind, is taken into account.

The only exceptions are income referred to in Art.

217 Tax Code of the Russian Federation . Financial assistance is provided for several reasons. Classifying these grounds, the amounts of financial assistance can be divided into two groups:

– material assistance, completely exempt from taxation, regardless of the amount ( clause 8 of article 217 of the Tax Code of the Russian Federation

);

– material assistance, partially exempt from taxation, limited to the amount of 2,000 rubles ( clause 28 of article 217 of the Tax Code of the Russian Federation

).

Let's take a closer look at these groups. Based on clause 8 of Art. 217 Tax Code of the Russian Federation

One-time financial assistance can be issued in any amount:

1. By employers to an employee in connection with the death of a member (members) of his family or to family members of a deceased employee. In this case, the application with the manager’s permission must be accompanied by a copy of the death certificate of the employee or his family member, and, if necessary, copies of documents confirming the relationship: marriage or birth certificate.

For your information:

of

the Ministry of Finance of the Russian Federation dated September 15, 2004 No. 03-05-01-04/12

clarifies who the employee’s family members are.

According to this document, on the basis of Art.

2 of the Family Code of the Russian Federation, family members include the employee’s parents (both retired and working), as well as the employee’s children, regardless of age (both students, non-working and working). The parents of the employee's spouse are not family members, and the fact that they live together does not matter.

2. An organization for persons affected by terrorist attacks on the territory of the Russian Federation. This fact must be confirmed by relevant documents, for example a certificate from the Ministry of Internal Affairs, etc.

3. Russian and foreign charitable organizations to citizens in the form of humanitarian or charitable assistance (both in cash and in kind), provided in accordance with the legislation of the Russian Federation on charitable activities[3]

.

Please note: Federal Law of December 30, 2004 No. 212-FZ

eliminated the contradiction contained in paragraph four

of clause 8 of Art.

217 Tax Code of the Russian Federation .

Its essence is that until January 1, 2005, humanitarian and charitable assistance was exempt from personal income tax only if the organization providing it was included in the corresponding list approved by the Government of the Russian Federation. However, this list was never approved by the government. Therefore, the question of taxation of such material assistance remained open, that is, it should have been subject to personal income tax on a general basis (explanations on this matter were given in Letter of the Ministry of Finance of the Russian Federation dated December 22, 2003 No. 04-04-06/222

).

From January 1, 2005, this requirement was abolished, and now the activities of charitable organizations are regulated only by the Federal Law of August 11, 1995 No. 135-FZ “On Charitable Activities and Charitable Organizations”

, as well as acts of the constituent entities of the Russian Federation. Thus, from this year, amounts of material assistance provided by organizations that meet the provisions of Russian legislation on charity are exempt from personal income tax.

4. Citizens on the basis of decisions of legislative and executive authorities in connection with a natural disaster or other emergency circumstance in order to compensate for material damage or harm to health caused to them.

In this case, Federal Law No. 68-FZ dated December 21, 1994 “On the protection of the population and territories from natural and man-made emergencies”

.

According to this law, an emergency situation is recognized as a situation that has arisen in a certain territory as a result of an accident, a dangerous natural phenomenon, a catastrophe, a natural or other disaster that may result or has resulted in human casualties, damage to human health or the environment, significant material losses and violation of conditions life activities of people.

The fact of the occurrence of this event must also be confirmed by relevant documents (decisions of government authorities, certificates from the EPD, SES, etc.).

5. At the expense of budgets of different levels and extra-budgetary funds in accordance with programs approved annually by the relevant government bodies, low-income and socially vulnerable categories of citizens in the form of amounts of targeted social assistance, both in cash and in kind.

6. Trade union committees to members of trade unions at the expense of membership fees.

In accordance with paragraph 28 of Art. 217 Tax Code of the Russian Federation

material assistance issued for any other reason to employees and former employees of an enterprise who resigned due to retirement due to disability or age is not subject to income tax if the

amount does not exceed 2,000 rubles per tax period (calendar year)

. The grounds for payment may include, for example, additional payment for the next vacation, difficult financial situation, treatment, acquisition of property and other social needs.

The same limit on the amount is established for material assistance provided to disabled people by public organizations of disabled people[4]

.

Example 1.

In March 2005, I.A. Petrov, an employee of Vympel LLC. filed an application asking for financial assistance for treatment. The manager reviewed his application and decided to provide assistance to the employee in the amount of 4,000 rubles. Salary of Petrov I.A. for March amounted to 5,000 rubles. For three months from the beginning of the year, his total taxable income did not exceed 20,000 rubles. When withholding personal income tax from his salary for March, he was given a standard tax deduction in the amount of 400 rubles. [5]

Personal income tax was: (5,000 - 400) x 13% = 598 rubles.

Personal income tax will be withheld from the amount of financial assistance in the amount of: (4,000 - 2,000) x 13% = 260 rubles.

In accounting, the issuance of financial assistance will be reflected in the following entries:

| Contents of operation | Debit | Credit | Amount, rub. |

| Financial assistance accrued to the employee | 91-2 | 70 | 4 000 |

| Personal income tax withheld (13%) | 70 | 68-1 | 260 |

| Financial assistance paid from the cash register | 70 | 50 | 3 740 |

For your information:

in addition to the amounts of financial assistance,

clause 28 of Art.

217 of the Tax Code of the Russian Federation exempts from taxation, limiting the amount to 2,000 rubles:

– reimbursement or payment by employers of the cost of purchased medications prescribed by the attending physician, their employees, their spouses, parents and children, as well as their former employees (age pensioners) and disabled people. Tax exemption is provided upon presentation of documents confirming actual expenses for the purchase of these medicines. This can be a doctor’s prescription, a cash receipt when paying for medicines in cash, a payment order when paying by bank transfer;

– the value of gifts received from organizations or individual entrepreneurs and not subject to inheritance or gift tax in accordance with current legislation. It is important that, according to Art. 128, 130 and 572 of the Civil Code of the Russian Federation

Gifts also include monetary amounts.

This explanation is given in the Letter of the Ministry of Finance of the Russian Federation dated 07/08/04 No. 03-05-06/176.

Thus, to summarize the above, it is necessary to remember that when paying financial assistance to employees or former employees, the accountant from all amounts exceeding 2,000 rubles (except for those specified in paragraph 8 of Article 217 of the Tax Code of the Russian Federation

), withholds personal income tax.

In all other cases, in particular when providing financial assistance to citizens who are not employees of the organization, and paying amounts not subject to clause 8 of Art.

217 of the Tax Code of the Russian Federation , personal income tax is withheld from the total amount.

Unified social tax and insurance contributions to the Pension Fund of the Russian Federation

When considering this issue, it is necessary to pay attention to the fact that clause 1 of Art. 236 Tax Code of the Russian Federation

clearly defines the object of UST taxation: these are payments and other remuneration to employees of the organization, as well as to citizens working in the organization under a civil law agreement, the subject of which is the performance of work, provision of services, and an author's agreement.

It turns out that financial assistance is included in such payments. However, as mentioned earlier, amounts of financial assistance, regardless of its form and purpose of issuance, do not reduce the organization’s tax base for profits. Therefore, according to paragraph 3 of Art.

236 of the Tax Code of the Russian Federation , they are not subject to unified social tax.

They will not be charged contributions to the Pension Fund of the Russian Federation, since in accordance with Art.

10 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation”, pension contributions are calculated on the same base as the Unified Social Tax.

But financial assistance can also be provided to individuals who are not connected with the organization by an employment or civil law contract (for example, family members of an employee, former employees). In these cases, according to paragraph 1 of Art. 236 Tax Code of the Russian Federation

, it is also not subject to unified social tax and pension contributions.

Additional clarifications on this matter were given in Letter of the Ministry of Finance of the Russian Federation dated 04/03/03 No. 04-04-04/32 “On payments to citizens who do not work at the enterprise

.

In addition, in Art. 238 Tax Code of the Russian Federation

The grounds on which material assistance, regardless of the source of payment, are not subject to UST and, accordingly, contributions to the Pension Fund are separately defined. These are the amounts of one-time financial assistance provided by the organization:

– to individuals in connection with a natural disaster or other emergency in order to compensate for material damage caused to them or harm to their health, as well as individuals who suffered from terrorist acts on the territory of the Russian Federation; – family members of a deceased employee or an employee in connection with the death of a member (members) of his family.

At the same time, the fact of the event is confirmed by the same documents that were listed earlier - when considering the taxation of material assistance with personal income tax in similar cases.

I would especially like to draw your attention to paragraphs. 15 clause 1 art. 238 Tax Code of the Russian Federation

.

It concerns the payment of material assistance from budget sources by organizations financed from budget funds. According to the Tax Code of the Russian Federation, from January 1, 2005, amounts of material assistance issued from such sources are exempt from taxation in an amount not exceeding 3,000 rubles per individual per tax period [6]

. It should be borne in mind that this norm applies only to persons working in the organization.

note

: in

the Letter of the Ministry of Taxes of the Russian Federation dated September 22, 2004 No. 05-1-05/501 “On the use of arbitration practice,”

representatives of the tax department insist that

paragraphs.

15 clause 1 art. 238 of the Tax Code of the Russian Federation cannot be applied to employees of state extra-budgetary funds.

They explain their position by the fact that the funds of these funds are not included in the budgets of all levels of the budget system of the Russian Federation ( clause 4 of Article 143 of the Budget Code of the Russian Federation

). State non-budgetary funds will have to defend the opposite point of view in court.

If an organization financed from the budget is also engaged in entrepreneurial activities, receiving income from it, then it has the right to provide financial assistance from these incomes, applying clause 3 of Art. to these payments. 236 Tax Code of the Russian Federation

, that is, not subject to unified social tax.

At the same time, the limitation of financial assistance in the amount of 3,000 rubles, provided for in paragraphs.

15 clause 1 art. 238 of the Tax Code of the Russian Federation will no longer be valid. In this case, the organization must keep separate records of both income received from the budget and from business activities, and expenses for these types of activities.

Contributions for compulsory social insurance against accidents at work and occupational diseases

When determining on what grounds these contributions should be calculated for financial assistance, one should first of all be guided by the Rules for the calculation, accounting and expenditure of funds for the implementation of compulsory social insurance against industrial accidents and occupational diseases,

approved

by Decree of the Government of the Russian Federation dated March 2, 2000 No. 184

.

Paragraph 3

of this resolution states that insurance premiums are levied on the amounts of wages accrued on all grounds for the organization's employees (including freelance, seasonal, temporary, and part-time workers). Thus, material assistance provided to persons who are not in an employment relationship with the enterprise is completely excluded from the tax base.

As for financial assistance provided to employees, only payments named in the list approved by Decree of the Government of the Russian Federation No. 765 [7]

. Financial assistance is provided on the following grounds:

– material assistance provided to employees in connection with emergency circumstances in order to compensate for harm caused to the health and property of citizens, on the basis of decisions of state authorities and local governments, foreign states, as well as governmental and non-governmental interstate organizations created in accordance with international treaties Russian Federation ( clause 7

);

– financial assistance provided to employees in connection with a natural disaster, fire, theft of property, injury, as well as in connection with the death of an employee or his close relatives ( clause 8

).

Consequently, for all other reasons, it is necessary to accrue contributions for compulsory social insurance against industrial accidents and occupational diseases on the amounts of financial assistance paid to employees.

Example 2.

Let's use the data from example 1. In the case under consideration, contributions for compulsory social insurance against industrial accidents and occupational diseases must be calculated on the amount of financial assistance and the following entries must be made:

| Contents of operation | Debit | Credit | Amount, rub. |

| A contribution for insurance against industrial accidents and occupational diseases in the amount of 0.3% (RUB 4,000 x 0.3%) has been assessed. | 91-2 | 69-11 | 12 |

An organization can save on this tax by paying financial assistance (for example, for treatment, due to a difficult financial situation) not to the employee himself, but to members of his family.

In this case, a statement from a family member of the employee must be attached to the manager’s order for the payment of financial assistance. Features of taxation of material assistance under special tax regimes (USNO and UTII)

Let us recall that under special tax regimes, income tax, property tax and unified social tax are replaced by the payment of a single tax. Contributions to the Pension Fund are calculated in accordance with the current legislation of the Russian Federation. According to paragraph 2 of Art. 10 of Federal Law No. 167-FZ [8]

Pension contributions are calculated in the same amounts as the Unified Social Tax.

As mentioned earlier, material assistance is not included in expenses, that is, it is paid from funds that remain at the disposal of the organization after paying a single tax. It would seem that in accordance with paragraph 3 of Art. 236 Tax Code of the Russian Federation

amounts of financial assistance are not subject to taxation of pension contributions.

However, in the Letter of the Ministry of Finance of the Russian Federation dated 07/05/04 No. 03-03-05/2/44 “On payments to individuals, withholdings, assessments of taxes and contributions from them in a simplified taxation system,”

representatives of the financial department explain their point of view:

“It should be taken into account that the provisions of paragraph 3 of Article 236 of the Code do not apply to organizations that are not payers of income tax, including organizations that apply a simplified taxation system.

Thus, for payments in favor of individuals made from funds after payment of the single tax, insurance contributions for compulsory pension insurance are charged in the generally established manner without applying paragraph 3 of Article 236 of the Code.”

. As follows from the text of the letter, they apply the same approach to companies using the taxation system in the form of a single tax on imputed income.

Once again this opinion was confirmed in a later Letter of the Ministry of Finance of the Russian Federation dated October 26, 2004 No. 03-03-02-04/2/5 “On the issue of payment of insurance contributions for compulsory pension insurance by an organization applying a simplified taxation system”

.

It states that payments and other remuneration specified in paragraph 1 of Article 236 of the Code, accrued by an organization applying a simplified taxation system in favor of individuals, in particular financial assistance for vacation, gifts, rewards for long service, are subject to insurance contributions for compulsory pension insurance without applying the provisions of paragraph 3 of Article 236 of the Code

.

According to the Ministry of Finance, insurance contributions to the Pension Fund are not charged only for amounts of one-time financial assistance, regardless of its size, on the grounds specified in paragraphs. 3 tbsp. 238 Tax Code of the Russian Federation

(see

Letter of the Ministry of Finance of the Russian Federation dated May 12, 2004 No. 04-04-04/57 “On taxation of an organization using a simplified taxation system”

).

It is possible to argue with this point of view only in court, relying, for example, on Letter of the Supreme Arbitration Court of the Russian Federation dated July 12, 2000 No. 55

. The court decision states that insurance contributions to the Pension Fund are levied on amounts accrued to an employee for a certain work result in accordance with an employment contract, as well as remuneration under civil contracts, the subject of which is the performance of work and services. Financial assistance is a payment of a non-productive nature, so it should not be subject to the calculation of pension contributions.

The validity of this opinion is confirmed by arbitration practice. Thus, in the Resolution of the Federal Antimonopoly Service of the North-Western District dated 08.25.04 No. A44-2004/04-C9

it is indicated that in accordance with

paragraph 1 of Art.

236 and

paragraph 1 of Art. 237 of the Tax Code of the Russian Federation, the basis for calculating insurance premiums for compulsory pension insurance is payments and rewards in favor of individuals related to wages

. Payments that are one-time in nature are not classified as such, therefore contributions to the Pension Fund should not be accrued on them.

Thus, if you decide to defend your position in court and not pay pension contributions with financial assistance, then be sure to make sure that it clearly relates to one-time payments not related to wages. In other words, so that it is not mentioned in the labor (collective) agreement.

In conclusion, we present to our readers a table that clearly reflects the main aspects of taxation of financial assistance. We hope that it will help the accountant in his practical work. [9]

.

| Grounds for payment of financial assistance | Types of taxes and contributions | |||

| Personal income tax | UST | PF | SNSP*> | |

| Financial assistance is paid to an employee of the organization | ||||

| Due to the death of an employee or his family members | – | – | – | – |

| Victims of terrorist attacks on the territory of the Russian Federation | – | – | – | – |

| In connection with a natural disaster or other emergency (except by decision of government authorities) | From an amount of more than 2,000 rubles | – | – | – |

| Other reasons (additional payment for vacation, treatment, other household needs) | From an amount of more than 2,000 rubles. | – | – | + |

| Financial assistance is paid to an employee of an organization that uses special tax regimes | ||||

| Due to the death of an employee or his family members | – | – | – | – |

| Victims of terrorist attacks on the territory of the Russian Federation | – | – | – | – |

| In connection with a natural disaster or other emergency (except by decision of government authorities) | From an amount of more than 2,000 rubles | – | – | – |

| Other reasons (additional payment for vacation, treatment, other household needs) | From an amount of more than 2,000 rubles. | – | + | + |

| Financial assistance is paid to a person who is not an employee of the organization | ||||

| In connection with the death of an employee, family members | – | – | – | – |

| Victims of terrorist attacks on the territory of the Russian Federation | – | – | – | – |

| In connection with a natural disaster or other emergency (except by decision of government authorities) | + | – | – | – |

| Other reasons (treatment, other household needs) | + | – | – | – |

| Former employees who left due to retirement or disability | From an amount of more than 2,000 rubles. | – | – | – |

Contributions to social insurance against accidents at work. [1]

For small enterprises, the Decree of the Federal State Statistics Service dated 02/09/05 No. 14 “On approval of the Procedure for filling out and submitting the federal state statistical observation form No. PM “Information on the main indicators of the activities of a small enterprise” is used, clause 16.7.5. and 17.21 respectively.

Accounting Regulations “Organization Expenses” PBU 10/99, approved. By order of the Ministry of Finance of the Russian Federation dated 05/06/99. No. 33n.

New edition of clause 8 of Art. 217 of the Tax Code of the Russian Federation, which applies to legal relations arising from January 1, 2005. Changes were made by Federal Law No. 212-FZ of December 30, 2004.

The changes were introduced by Federal Law No. 103-FZ of August 20, 2004, which applies to legal relations that arose from January 1, 2005.

Federal Law No. 203-FZ dated December 29, 2004 changed the amount of the standard tax deduction provided to the taxpayer for child support. From 01/01/05 it amounts to 600 rubles per month for each child and is valid until the taxpayer’s income exceeds 40,000 rubles.

Amendments to the Tax Code of the Russian Federation were introduced by Federal Law No. 70-FZ dated July 20, 2004. The effect applies to legal relations arising from January 1, 2005.

Decree of the Government of the Russian Federation dated 07.07.99 No. 765 “On the list of payments for which insurance contributions are not charged to the Social Insurance Fund of the Russian Federation.”

Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation.”

In the table: “+”—tax is charged, “-”—tax is not charged.

When financial assistance is subject to insurance premiums

In all other cases not specified in the previous paragraph, financial assistance, if provided to employees, becomes subject to insurance contributions. This norm is contained in subsection. 11 clause 1 art. 422 of the Tax Code of the Russian Federation.

The deadlines for making contributions are as follows: according to clause 3 of Art. 431 of the Tax Code of the Russian Federation, the payer of insurance premiums is obliged to transfer them to the budget no later than the 15th day of the month following the month of accrual.

Example:

The collective agreement of Omega LLC contains a provision according to which employees of the organization have the right to receive financial assistance. The decision to allocate it is the prerogative of the manager, whose order indicates the corresponding amounts.

In February 2021, in accordance with his application, the employee of the enterprise, A.S. Chizhikov, was provided with financial assistance in the amount of 29,000 rubles. for paid treatment of the spouse during pregnancy.

In May 2021, another financial assistance was allocated to him, but already in connection with the birth of a child - in the amount of 30,000 rubles.

As a result, contributions to compulsory social insurance will be charged only from 25,000 rubles. (29,000 – 4,000), since the non-taxable amount in the first case is 4,000 rubles. And financial assistance issued at the birth of a child is not subject to contributions at all, if it does not exceed 50,000 rubles. In this case, it is equal to 30,000 rubles.

Is the employee entitled in connection with the anniversary date?

Payment of financial assistance for the anniversary is the right of the employer, and not its obligation.

The possibility of receiving additional cash benefits in connection with a special celebration is fixed at the level of local regulatory regulation and is prescribed in the collective labor agreement, the Procedure for providing financial assistance to employees or individual labor agreements.

If the list does not include the basis for the corresponding payment, the directorate has the exclusive right to make a decision on its provision.

The possibility of receiving financial assistance in connection with the anniversary depends on:

- The employee’s length of service and his labor merits at the enterprise (organization);

- The financial position of the company itself;

- Material income of the employee - applicant, etc.

Local acts can establish only certain anniversaries that will serve as a reason for the payment of financial assistance, for example, the 50th anniversary.

Both active workers and workers who have retired have the right to this support.

In addition to assistance from the enterprise, such a payment in connection with the anniversary can be received from a trade union (if you have a membership card and systematically pay the prescribed fees).

How is financial assistance paid to an employee?

Is it necessary to subject insurance premiums to payments made to employees who have already resigned?

In some cases, an organization needs to pay financial assistance to former employees, for example, due to difficult life circumstances. In this case, there is no need to accrue insurance premiums, because the base for calculating insurance premiums includes remunerations paid in favor of individuals subject to compulsory insurance under employment contracts or civil contracts (clause 1 of Article 420 of the Tax Code of the Russian Federation). Since there are no of the above agreements between the former employees and the organization, there are also no grounds for calculating contributions.

The position of the courts on the taxation of insurance premiums on payments to employees

Renting housing

The judges did not agree with the imposition of insurance premiums to compensate for the cost of moving to another area and renting housing in the Resolution of the Volga District Court of November 21, 2021 in case No. A49-2007/2018.

Compensation for expenses for maintaining children in a preschool institution

Payments related to compensation paid for maintaining the children of employees in a preschool institution are social payments. They relate to income received by the employee within the framework of the employment relationship and are therefore not subject to insurance contributions. The conclusion of the judges set out in the Resolution of the AS PO dated November 24, 2020 No. F06-67251/2020 in case No. A12-47264/2019.

Sanatorium and resort vouchers for an employee and his children

The judges did not recognize the cost of vouchers for health-improving vacations for the employee’s family as subject to insurance premiums in the rulings:

AS PO dated November 20, 2020 in case No. A12-3728/2020.

AS VSO dated December 9, 2020 No. F02-6381/2020 in case No. A33-4184/2020,

AS VSO dated August 31, 2020 No. F02-3477/2020 in case No. A19-29685/2019.

AS ZSO dated August 15, 2018 No. F04-3263/2018 in case No. A27-912/2018

Payment for employee meals

Court decisions on the payment of insurance premiums from the cost of compensation payments for food, most often in favor of companies. Judges agree that compensation paid to workers for food is not subject to insurance premiums. The judges set out their position in the Resolution of the Supreme Court of the Russian Federation dated January 26, 2021 No. F02-5844/2020 in case No. A19-6508/2020, and in the Resolution of the Supreme Court of the Russian Federation dated November 2, 2020 in case No. A19-29229/2019.

Financial assistance partially subject to insurance contributions

In some cases, contributions are assessed in excess of the established limit.

- Lump sum payments to each parent related to the birth, adoption of a child, establishment of guardianship, assigned during the first year of the baby’s life (within a year after adoption, establishment of guardianship), in the amount of up to 50,000 rubles, are not subject to insurance premiums. A non-taxable amount is established for each child.

Example

The spouses work in the same organization.

The collective agreement of this company states that upon the birth of a child, the employee is paid financial assistance in the amount of 40,000 rubles. Both spouses wrote an application to receive funds. Is financial assistance given to the father and mother subject to insurance premiums? Despite the fact that the total amount of assistance is 80,000 rubles. exceeded the established limit, the funds are not subject to insurance premiums, since the amount paid at a time to each parent is less than 50,000 rubles.

- Contributions for other financial assistance to an employee in a total amount of up to 4,000 rubles issued during a calendar year are not charged.

Example

In 2021, the employee was given financial assistance twice due to his difficult financial situation: the first time in February in the amount of 2,000 rubles, the second time in June in the amount of 3,000 rubles.

Is financial assistance provided to an employee subject to contributions? The accounting department did not impose fees on the first payment, since the amount issued was less than the limit established by law (2000In June, the company assessed contributions from the amount of financial assistance that exceeded the limit: (2000 + 3000) – 4000 = 1000 rubles. – the amount of financial assistance subject to contributions.

Employers should take into account that for financial assistance over 4,000, insurance premiums are charged in full.

Example

The organization decided to provide the employee with financial assistance for vacation - in the amount of 80,000 rubles. The accounting department will charge insurance premiums for an amount exceeding 4,000 rubles:

80,000 – 4000 = 76,000 rub. The accounting department will calculate contributions from 76,000 rubles.

When assessing insurance premiums on amounts of financial assistance issued, the limit for its different types is taken into account separately.

Example

During the year, the employee received financial assistance from the organization twice - the first time in connection with the adoption of a child in the amount of 30,000 rubles, the second time - for vacation, in the amount of 20,000 rubles.

Maternity assistance in the amount of 30,000 rubles, issued upon adoption, is not subject to contributions, since its amount is less than the limit of 50,000 rubles.

With financial assistance for vacation in the amount of 20,000 rubles. Only the amount of the annual limit - 4000 rubles - is not taken into account, and the remaining part of the payment is subject to insurance premiums. Contributions will be calculated by the accounting department of the employing company from the excess of the limit:

200 00 – 4000 = 16 000 rub. – financial assistance subject to insurance contributions.

General information about trade unions and the formation of a fund of funds for such associations

By virtue of Art. 2 Federal Law “On trade unions, their rights and guarantees of activity” dated January 12, 1996 No. 10-FZ, a trade union is an association of citizens bound by common professional interests, created to protect such interests. Trade unions can operate in various forms, in particular, within one organization, within a region, or an entire country (union of trade unions).

Organizations of this kind operate on the basis of the charters they adopt and can be registered as legal entities, but this is not mandatory. If more than half of the company’s employees are members of a trade union, then the association has the right to represent the interests of all employees (Part 3 of Article 37 of the Labor Code of the Russian Federation).

The trade union's fund is formed from membership dues. Employees who are members of a trade union have the right to demand that the employer transfer part of their wages towards membership dues (Part 5 of Article 377 of the Labor Code of the Russian Federation). In addition, the employer, on the basis of a collective agreement (Article 40 of the Labor Code of the Russian Federation), has the right to finance the activities of a trade union organization.

Financial assistance for pensioners in 2021

Many pensioners are interested in the question of whether the government will repeat the one-time payment of 5,000 rubles, as it did in 2017. No, no such payment is planned. This was a single measure taken by the government in order to compensate for losses from rising prices.

From January 1, 2018, insurance pensions were indexed; the increase was 3.7 percent. In monetary terms, this is approximately 300-500 rubles.

Social pensions, received by those who do not have a single day of work experience (disabled people, disabled children, those who have lost their breadwinner, etc.), have increased by 4.1 percent since 04/01/2018. Depending on the disability group, this ranges from 175 to 500 rubles. Pensioners who are officially employed may not count on indexation in 2021.

Financial assistance to low-income families in 2021

Financial assistance to low-income citizens of the Russian Federation is currently provided in several forms. The most common option is cash payments that the state makes monthly. In addition, there is one-time monetary assistance in the form of a grant for training, a scholarship, assistance for the purchase of basic necessities, assistance in kind (food, medicine, etc.). A low-income family may be exempt from paying all taxes and fees when calculating material assistance in the form of benefits and subsidies.

Children who are raised in a family with low-income status have the right to receive education in higher and secondary educational institutions, taking part in a general competition for applicants. They can also count on help from the state, but for this at least one of the following conditions must be met:

- if the child is raised by only one parent who is recognized as a disabled person of the second or first group;

- if a child from a low-income family has scored the minimum number of points based on the exam results, which allows him to take part in the competition, since the exams are considered to have been passed successfully;

- the age of the child who wishes to enter a higher education institution does not exceed 20 years.

There are a number of innovations specifically for children raised in low-income families:

- out of turn children must be admitted to educational preschool institutions;

- in schools, children must have two meals a day, which are paid for by the state;

- Children should receive both a uniform for school and clothing for sports free of charge;

- Children under 6 years of age can receive the necessary medications for free, but only with a doctor’s prescription.

Parents who are part of a low-income family can count on the following benefits:

- preferential employment;

- lowering the retirement age;

- exemption from paying registration fees;

- obtaining a garden or summer cottage plot out of turn;

- obtaining a mortgage loan on preferential terms.

Financial assistance 4000 rub. - income code in certificate 2-NDFL

Financial assistance paid in connection with the death of an employee or a member of his family is not subject to personal income tax, therefore, it does not need to be reflected in the 2-NDFL certificate.

Financial assistance paid for other reasons is reflected in 2-NDFL in full amount according to the codes:

- 2762 - at the birth of a child;

- 2760 - for treatment, anniversary, for other reasons.

At the same time, a deduction for financial assistance is indicated with the following codes:

- 508 - at the birth of a child (maximum 50,000 rubles);

- 503 - for other reasons (RUB 4,000).

How many times a year can financial assistance be given in 4000

The number of financial assistance payments to one employee is not limited in any way. But you need to keep in mind that the deduction is only provided in the amount of 4,000 per year for all payments. For example: Ivanov I.I. financial assistance paid:

- in March - 2000 rubles;

- in June - 5,000 rubles;

- in August - 1000 rubles.

Material assistance paid in March will not be subject to personal income tax; in June, 3,000 rubles will need to be taxed. (that is, the balance of the annual deduction in the amount of 2000 rubles has been provided), and financial assistance in August will be taxed in full.

How to ensure that tax authorities do not assess additional contributions

Taking into account the legal position of the Supreme Arbitration Court of the Russian Federation, set out in Resolution No. 17744/12 of May 14, 2013, social payments provided for in the local regulatory act of the employer are not subject to contributions. Such payments:

- should not depend on the qualifications of workers;

- should not depend on the complexity, quality, quantity, conditions of the work itself;

- cannot be qualified as part of employee remuneration (i.e. cannot be paid monthly in a fixed amount), including because they are not provided for in employment contracts.