Home / Labor Law / Vacation / Administrative

Back

Published: 06/21/2016

Reading time: 7 min

0

10162

The death of a relative makes it possible for an employee to qualify for certain financial assistance in connection with such a tragic event. Such assistance is usually provided one time and, naturally, does not apply to incentive payments related to the employee’s direct work activity.

The basis for accrual and provision of assistance are the provisions of regulatory local documents in force in a particular organization or enterprise.

That is, such assistance should be provided for in collective agreements or labor contracts. It is accrued only from the profit of an organization or enterprise, and for this reason, special tax benefits apply when calculating such payments.

- Legislative norms

- Categories of workers eligible for assistance

- What does size depend on and how is it determined?

- Design features

- Taxation

The legislative framework

According to paragraph 1 of Art. 10 of Law No. 8-FZ, any citizen of the Russian Federation who undertakes obligations to implement the funeral procedure for the deceased can receive a funeral payment. Neither the degree of relationship nor its presence are determining factors in the calculation. Accordingly, the following may apply for assistance:

- Spouse).

- All close relatives. This is mother, father, grandmother, grandfather, brothers, sisters, etc.

- Representatives of the deceased who have legal grounds for guardianship.

- Any other persons who bear the funeral expenses.

The amount of financial assistance for funeral is determined based on the fact of contacting social services.

It is simply impossible to calculate its value in advance. As of January 1, 2021, it was 5,227 rubles. More accurate information can only be obtained upon registration. What is the reason for this amount? Legislative bodies annually recalculate the amount of payments based on the built-in cost of guaranteed services. It is worth noting that in some regions of the Russian Federation you can receive additional one-time compensation, which is combined with financial assistance for burial. It is assessed by local social security authorities.

Financial assistance for burial is issued at the branch of the Pension Fund where the pensioner received his pension. It is there that you need to take the entire collected package of documents. It is worth remembering that payment is possible only if the deceased was a pensioner and did not work. In addition, financial assistance for funeral expenses may be provided by the employer. To do this, you must submit a corresponding application to the legal entity, as well as a certain package of papers. Read more about how to enter into an inheritance.

You can learn more about the general concepts and aspects of funeral benefits in the video:

Legislative norms

The procedure for taxation of amounts accrued in connection with the death of an employee’s closest relative (family member) is reflected in Federal Law No. 117, which has undergone changes this year. The new edition came into force in June 2021. In 2017, it is she who regulates this issue. The provisions of this law reflect, among other things, all exceptions to the general rules or legal grounds for tax exemption.

The accrual and payment of financial assistance is also available not only to employees, but also to persons who were dependent on the deceased employee and who are his closest relatives (according to Article 141 of the Labor Code).

In this case, the payment includes not only one-time assistance from the employer, but also unpaid wages, bonuses, vacation pay and other amounts to the employee. The possibility of providing such assistance should be included in the local documents of the organization or enterprise.

And the fact of being supported by a relative must be proven through the court by providing the relevant documents (for example, a medical report establishing a disability group).

Required documents

In order to receive payment, the applicant must prepare the following package of documents:

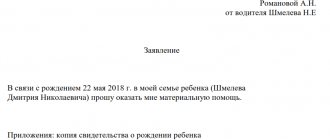

- Statement

. It is drawn up in the name of the head of the enterprise and contains a brief request for financial assistance. The paper is filled out in the following order: full name and position of the manager, full name of the relative of the deceased employee, full name of the deceased employee, as well as the position he held, request for assistance, signature and date.sample application for financial assistance in .doc format (Word)

- Death certificate

. This document is necessary to confirm the fact of the employee’s death. - Certificate of relationship

. It can be represented by a marriage certificate, birth certificate, etc.

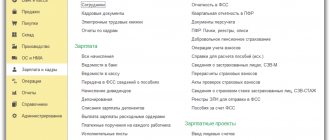

Based on all the documents described above, the manager must draw up an order, according to which you can receive the required funds from the accounting department.

The applicant must familiarize himself with the order itself. His signature must serve as evidence of the fact of familiarization. sample order for the payment of financial assistance in .doc format (Word) The order for the payment of financial assistance for the funeral of an employee does not have any unified form, so it is drawn up by the employer in free form.

Conditions for receiving financial assistance

Federal Law “On burial and funeral business” dated January 12, 1996 No. 8-FZ established the rule according to which each person involved in the funeral of a deceased person is guaranteed the provision of financial assistance. This rule is implemented through the payment by the state of a funeral benefit in the established amount.

Thus, any person who has undertaken the obligation to bury a deceased relative can receive this type of assistance.

The opportunity to receive financial assistance can be exercised by an employee at the enterprise only once. These funds are provided at the expense of the Social Insurance Fund.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

In addition to this financial assistance, an employee can apply for additional payment from his employer.

The following list of grounds is identified in the presence of which an employee has the right to claim payment, and the employer has the right to provide it:

- the possibility of receiving financial assistance in connection with the death of a relative is indicated in the employment agreement concluded with the employee;

- the possibility of providing funds is determined by the collective agreement at the enterprise;

- the provision of funds is specified in local regulations adopted by the organization.

The payment of these funds is not an obligation for the employer.

Watch the video. Financial assistance and compensation payments:

Financial assistance upon the death of a close relative

Upon the death of a close relative, citizens of the Russian Federation may be awarded financial assistance for burial. But in this case, the question may arise about who should be considered close relatives. In accordance with the Family Code of the Russian Federation, these include:

- spouses;

- children of the deceased;

- parents of the deceased.

In addition, in practice, this list is supplemented by a number of persons, which include sisters and brothers, grandparents, as well as adopted children, but the difference is that in the case of spouses, children and parents, you will be able to receive financial assistance without any or additional certificates and papers. It is enough to simply submit a standard package of documents to the social service or employer. This is due to the fact that according to the Family Code they are close relatives.

Categories of workers eligible for assistance

The main problem for employers is often the wording “close relative”. This concept has different interpretations, but by default the definition from the Tax Code (its reference to family law) is used, since the issue concerns finance and its taxation.

Article 217 of the Tax Code provides a direct reference to Article 14 of the Family Code, according to which close relatives include:

- persons who are related by blood in the ascending line (mother, father, grandmother, grandfather);

- persons who are related by blood in a descending line (children, grandchildren, brothers and sisters, including stepsisters).

But, according to an already established tradition, many employers also classify wives or husbands as relatives, although they are not blood relatives.

And according to the order of the Ministry of Finance (letter number 03-05-01-04/234 dated August 2006), relatives also include adoptive parents and the citizens they have adopted.

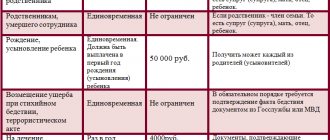

Accordingly, assistance is accrued in the event of death:

- the employee himself (paid to his family members);

- a former employee who is already retired (money is also paid to his family members);

- his immediate family (the assistance is issued to the employee).

Financial assistance upon the death of a grandparent

Despite the fact that in the Family Code of the Russian Federation grandparents are not classified as close relatives, in practice, the issuance of maternity capital for them is carried out according to the standard procedure, which is defined for close relatives.

Accordingly, funds can be obtained both from social institutions and from the employer. The only thing is that to confirm your relationship, you will need to provide an additional certificate indicating that your grandmother is your relative. You also need to take care to prove that you were the one who paid the funeral expenses.

Financial assistance in connection with the death of an employee

If an employee who officially worked at the company dies, his relatives can receive one-time financial assistance from the employer himself.

It is worth noting that the employer is not legally required to pay any compensation. The possibility of obtaining it is determined by internal documents and instructions appearing within the enterprise.

Depending on the internal charter of the company, financial assistance for funeral may be awarded to persons with the following status:

- an employee who worked at the company before his death;

- former employees who have already retired.

The amount of compensation itself does not depend on what position the employee held, what salary he was paid, etc. As is the case with the categories of persons who may be paid, the issue of the amount is regulated exclusively by the internal procedures of the enterprise itself.

The employer has the full legal right to set any size, focusing not only on the company’s profit, but also on his own beliefs and views. However, when determining the amount, the employer must not forget that the legislative resolution sets a specific limit for payment - no more than 2 months' salary.

What does size depend on and how is it determined?

The amount accrued as assistance is not affected by the position held by the employee or his salary. The amount of financial assistance is determined solely on the basis of local documents, which not only allow for the calculation of payments of this kind, but also stipulate their amounts.

The employer has the right to independently set any amount, coordinate it with the trade union organization, and fix it in a local regulatory document (for example, in a collective agreement).

That is, in fact, the amount of accruals may be affected by:

- social policy pursued by management at a particular enterprise or organization;

- financial capabilities of an organization or enterprise, namely profit margins.

However, in reality, management needs to focus not only on local documents, but also on current legislation.

According to the order of the Ministry of Finance, issued in 2007, a one-time financial payment due to an emergency situation (this can also include the death of a loved one) should not exceed two months’ salary.

There is also a tax-free limit that must be taken into account. Otherwise, the employer will have to pay insurance and tax amounts.

Financial assistance for funerals for military personnel

Military personnel, as well as a number of other persons, have the right to financial compensation for burial according to a special scheme:

- State fire service employees;

- military veterans;

- citizens called up for military training;

- customs officers;

- police officers.

For the above-mentioned citizens, financial compensation for funerals is accrued at an increased rate. In accordance with the law, it is 18,250 rubles. In addition, those who live in the Moscow region and St. Petersburg are entitled to receive assistance based on regional compensation. Its size is 25,269 rubles, which is approved by the relevant resolution of the Government of the Russian Federation.

Tax issue

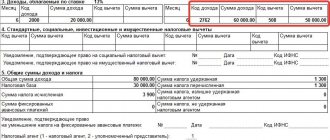

For everyone who expects to receive financial assistance for a funeral, as well as the employers who pay it, the question of taxation of this kind of financial transactions remains relevant. As of 2021, the legislative framework of the Russian Federation provides for the following procedures:

- The amount of financial assistance that must be paid to an employee or members of his family for a funeral is not taxable if it is a one-time payment.

- One-time financial assistance for a funeral is also exempt from payment of insurance premiums.

Thus, employers and recipients of financial assistance are completely exempt from any additional payments when receiving and paying funds for a funeral.

It is worth remembering that in cases where material assistance is paid to former employees and exceeds 4 thousand rubles, it is subject to income tax in accordance with the law.

Let's look at a small example. An employee who has retired receives 5,000 rubles in financial assistance. Accordingly, 4 thousand rubles. are considered non-taxable, and from 1 thousand rubles. income tax is charged at 13%. We have:

1000*13%=130 rub.

As follows from the above calculations, the recipient will be able to receive only 4,870 rubles. You can avoid such tax deductions by being an official employee of the enterprise at the time of payment of financial assistance.

Payment terms

Unfortunately, there are no restrictions on the timing of payment of financial assistance for funerals at the legislative level. This is due to the fact that compensation itself is not included in mandatory payments, but is regulated exclusively by internal acts of the enterprise.

In most cases, if the employer implies the possibility of receiving financial assistance, then the documents must specify specific terms and the amount that the employee can receive if necessary.

When applying for a job, if you want to be sure of the possibility of receiving financial assistance for a funeral, you need to clarify the fact of its availability in the employment contract and internal regulations of the company.

When contacting social services to receive payments, they must transfer the entire amount to the applicant within 10 days. But this is only possible if you submit the correct and complete package of documents the first time. It is worth noting that the application for financial assistance must be submitted no later than six months from the date of death.

Financial assistance for a funeral is a payment that every citizen of the Russian Federation can receive, so in the event of the death of your loved one, you can safely contact social services or your employer. This does not require collecting a huge package of documents, as well as any fees - the whole procedure is quite simple.