Financial assistance: taxation 2019 and insurance premiums

In most cases, the law does not provide for a specific period for payment of money.

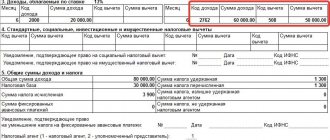

For example, it is not established for the payment of funds to assist an employee in connection with the death of a family member, due to injury or accident. But there is a limitation when providing funds to new parents - within the limit, they are not taxed if received during the first year of the baby’s life. If you carefully read this article, it will become clear that income tax for individuals is not withheld in the same cases when insurance premiums are not collected. We are talking about the payment of money upon the birth of a child or the death of a family member, amounts up to 4 thousand rubles (for any purpose). At the same time, we must remember that the 2-NDFL certificate will have different income codes and deduction codes each time - depending on the type of financial assistance provided and taxation or collection of insurance premiums (Order of the Federal Tax Service of Russia dated September 10, 2015 N ММВ-7-11 / [email protected] ).

Calculation of the base for insurance premiums

IMPORTANT!

If payments are reflected in one of the reporting forms, then, based on clause 3 of the inter-document control relationships, prepare explanations for discrepancies in the forms. For example, non-taxable income not indicated in the 2-NDFL certificate and reflection of the dates of transfers for the specified payments in the 6-NDFL form.

Finally, let’s figure out whether financial assistance is subject to insurance contributions or not.

When determining the base of insurance premiums, support amounts are legally excluded on the same grounds as the base for calculating personal income tax.

Personal income tax with financial assistance in 2019

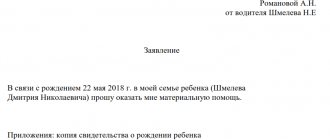

Employees of institutions are provided with financial assistance if they find themselves in a difficult life situation. If a force majeure situation occurs, the employee must contact the institution with an application for financial assistance. It can be written in free form, however, if the organization has a described procedure for providing financial assistance, you should be guided by it.

- 2710 - financial assistance (except for that provided by employers to their employees, as well as former employees who resigned due to retirement due to disability or age, disabled people, public organizations of disabled people and one-time financial assistance to employees (parents, adoptive parents, guardians) upon the birth or adoption of a child) ;

- 2760 - financial assistance provided to employees, including former employees who resigned due to retirement due to disability or age;

- 2770 - compensation (payment) by employers to employees, their spouses, parents and children, their former employees (age pensioners), as well as disabled people for the cost of medications purchased by them (for them), which were prescribed to them by their attending physician.

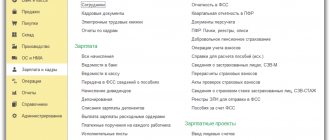

Accrual and payment of financial assistance, reflected in 6-NDFL

4000 rubles is a personal income tax-free amount. 1000 rubles is the amount of excess of the non-taxable limit by which it is necessary to withhold. Consequently, the amount of personal income tax on financial assistance will be 130 rubles (1000 * 13%). The material assistance issued should be shown in the 6-NDFL report, since income tax was withheld and transferred to the budget.

We recommend reading: Amount of income to receive compensation for kindergarten 2021 Irkutsk

Question No. 4. On October 12, the employee was paid financial assistance for vacation in the amount of 4,500 rubles and vacation pay of 12,000 rubles. From October 15 to October 30, the employee was granted regular leave. Is it possible to reflect information on lines 100-140 for these payments together?

Financial assistance 4000 rubles: taxes, contributions in 2021

Subp. 11 clause 1 art. 422 of the Tax Code of the Russian Federation establishes a limit on the amount of financial assistance that is not subject to insurance contributions. It is similar - 4,000 rubles. per employee per calendar year. True, there is no longer any connection with the amount of financial assistance received by an individual from all employers. In the case of insurance contributions, even if the employee had previously received financial support from another employer, this fact does not affect the exemption of the new amount of financial assistance from insurance contributions from the current employer.

For various reasons, an employee may need some kind of financial support, for which he has the right to turn to the employer. The law allows you to support your employee in this way, but there are restrictions on the amount that will not be taxed. In the article we will consider issues related to financial assistance to an employee and its taxation in 2019.

Taxation of financial assistance

The main question that an accountant asks is whether financial assistance is subject to personal income tax?

Each type has its own distinctive characteristics and accounting features for determining the personal income tax base, as well as insurance premiums. The personal income tax and contribution base depends on the basis for which financial assistance was provided. It is indicated in the employee’s application. Taxation of financial aid follows the same principles. At the same time, monetary support from the employer is either completely tax-free or not taxed up to an amount limit, which depends on the basis.

How is financial assistance taxed?

In the company's accounting documentation, financial assistance is reflected as an expense. These payments are usually made from net profits, including those received in previous years. In 2021, it is not possible to reduce the corporate income tax base by such amounts. The ban is established by Article 270 of the Tax Code of the Russian Federation.

The current legislation of the Russian Federation does not contain prohibitions or restrictions on the provision of financial support to employees. Organizations and entrepreneurs can transfer funds in favor of employees in excess of their actual earnings. When calculating such payments, it is necessary to take into account that, as a general rule, material assistance is subject to personal income tax and is income. Although the provisions of Article 217 of the Tax Code of the Russian Federation provide for special cases regarding the calculation and withholding of tax from it.

Not taxed

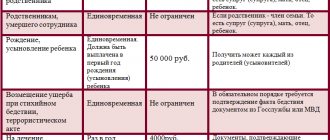

The list of such income is specified in Art. 217 Tax Code of the Russian Federation. In particular, financial assistance, tax-free for 2021, is provided in the following cases:

- death of an employee or a close member of his family;

- natural disaster;

- purchasing sanatorium and resort vouchers on the territory of the Russian Federation (compensation depending on the type of support, for example, for accompanying parents of children with disabilities to a place of recreation and recovery);

- emergency situation (terrorist attack and others).

Financial assistance in 6-NDFL

In the Calculation, there is no need to show non-personal income tax material assistance, which is not named in Appendix No. 2 to the Order of the Federal Tax Service of Russia dated September 10, 2015 No. MMV-7-11 / [email protected] The explanation for this is simple. The amount of calculated tax (line 040) is determined as the difference between lines 020 “Amount of accrued income” and 030 “Amount of tax deductions”, multiplied by the tax rate (line 010). This is one of the main equalities provided for by the Control Relationships, and which is analyzed during a desk audit of the Calculation.

At the same time, as indicated in the Letter of the Federal Tax Service of Russia dated 02/25/2019 No. BS-4-11/ [email protected] , line 030 “Amount of tax deductions” is filled in according to the values of codes for the types of taxpayer deductions approved by Order of the Federal Tax Service of Russia dated 09/10/2015 No. MMV -7-11/ [email protected] “On approval of codes for types of income and deductions” (Appendix No. 2). Therefore, if there is no type of non-taxable financial assistance in Appendix No. 2, then there is no need to reflect it in the Calculation either on line 020 or line 030.

We recommend reading: Create registration in government services

Is financial assistance to an employee subject to personal income tax?

Assistance to employees of a state organization is carried out at the expense of the budget or at the expense of funds received as income from the activities of the organization. Full-time students studying at public universities who need assistance receive funds from a special fund, which amounts to 25% of the scholarship fund.

In order to suppress possible fraud, the purpose of which is to reduce the tax base by placing wages under the heading “material assistance”, cases in which the issued material assistance is not subject to personal income tax are strictly regulated by the tax legislation of the Russian Federation:

Financial assistance as a type of income

Such support, unlike other types of income, does not depend on:

- from the employee’s activities;

- from the results of the organization’s activities;

- from the cyclical nature of work periods.

The grounds for receiving financial assistance can be divided into two: general and targeted. It is provided when any circumstances arise in the employee’s life:

- anniversary, special event;

- difficult financial situation;

- illness of an employee or close family member;

- death of an employee or close family member;

- birth of a child;

- emergencies;

- vacation.

A complete list of grounds for calculating financial assistance, as well as their amounts, are established by the regulatory (local) document of the organization. In some cases, for example, due to illness, the amount of financial assistance will be determined by the decision of the manager.

Is payment of financial assistance subject to personal income tax?

Paid financial aid will not become the basis for calculating personal income tax and deducting insurance premiums from it in cases specified by law. Depending on the annual amount and some special reasons for the assessment, there are several situations where the tax agent does not need to collect regular personal income tax from these amounts and withhold contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund.

By what principle can payments to employees be classified as financial assistance? The Labor Code, like the Tax Code, does not provide such a definition. This is a well-established expression used in business practice. Having analyzed indirect data from the Tax Code and the Labor Code of the Russian Federation, it is possible to define the payment of material assistance as a type of financial social security that does not depend on work activity. This means that when calculating that payment, the following are not taken into account:

How to reflect financial assistance in 6-NDFL

Some of the payments that formally fall under the definition of financial assistance may be elements of the payment system for performing job functions, and therefore, in fact, do not represent financial support from the company to employees, but a type of payment for the performance of official duties.

Financial support in the form of various payments provided to employees is also income, which is also subject to income tax under certain conditions. Accordingly, material assistance should also be reflected in 6-NDFL.

When to transfer personal income tax from financial assistance in 2021

Example 1. A son was born into the Smirnov family. The employer plans to provide financial assistance to both parents in the amount of 50,000 rubles each. Thus, financial assistance in the amount of 50,000 rubles paid to one of the parents will be exempt from personal income tax, and financial assistance paid to the second parent will be subject to personal income tax calculation.

Formally, the legislator does not limit business representatives in the right to provide financial assistance. Money is allowed to be allocated for expensive treatment, in special life situations, etc. However, they will be deductible only within the minimum limit. In 2019 it is only 4,000 rubles. All payments in excess of this amount must be included in the calculation base for personal income tax and insurance premiums.

Taxed over the limit

This applies to support that is of a general nature by providing:

- birth, adoption, establishment of guardianship rights - in the amount of no more than 50,000 rubles for each child when paid within 1 year after birth;

- the amount of partial compensation for sanatorium and resort vouchers in the Russian Federation in the amount of up to 4,000 rubles (taking into account the type of assistance, for example, to support the health of children due to severe environmental and climatic conditions, etc.);

- anniversary, special event (wedding) - up to 4,000 rubles;

- support for an employee in a difficult life situation, vacation - up to 4,000 rubles.

Let us remind you that the limit of financial assistance for the birth of a child is 50,000 rubles per parent. Such clarifications were given by the Ministry of Finance of the Russian Federation in letter dated 08/07/2017 No. 03-04-06/50382. Previously, officials considered the set amount to be the limit for both parents or guardians.

IMPORTANT!

When calculating personal income tax, a deduction for financial assistance on a general basis up to 4,000 rubles is provided once, regardless of how many times the support is provided.