Checking the VAT return on accounting accounts

First of all, the declaration is checked against the accounting accounts. To do this, balance sheets are formed and analysis is carried out on the following accounts:

- 90 and 91 - to check sales in terms of VAT rates;

- 60, 62 and 76 - to check the amounts of advances and VAT;

- 19 - to check the amounts of VAT declared for deduction;

- 68 - to check the total amount of tax payable.

Checking the score 19

We start with an analysis of the postings Dt 68.02 Kt 19. The amount for these postings is the amount of VAT claimed for deduction. In the declaration, this number must be reflected in line 120 of Section 3.

Checking the score 76

We analyze the wiring Dt 76.AV Kt 68.02. Here we see VAT calculated on advances received from buyers. The amount for debit 76.AB falls into line 070 of Section 3 of the declaration. In addition, there are also postings Dt 68.02 Kt 76.AB. This is the amount of VAT on credited advances from buyers. Credit turnover 76.AB should fall into line 170 of Section 3.

Checking the account 90.03

Let's look at the postings Dt 90.03 Kt 68.02. This is the amount of VAT charged on sales. See these postings in the context of applicable VAT rates. If you only use the 20% rate, you will see this amount on line 010 of Section 3 of the VAT return.

Checking the score 62

Information on account 62 must be correlated with turnover on other accounts and the corresponding lines in the declaration. To check the ratio, use the formulas:

- Dt 62.1 * 20/120 = Dt 90.03 = line 010 of Section 3;

- Kt 62.2 * 20/120 = Dt 76.AB = line 070 of Section 3;

- Dt 62.2 * 20/120 = Kt 76.AB = line 170 of Section 3.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Checking the score 60

For this account, check only one ratio:

Kt 60 * 20/120 = Dt 19.03, which in turn should be equal to line 120 of Section 3.

Checking the account 68.02

We compare the debit and credit turnover of account 68.02. The loan balance is the amount of tax due. It appears in line 200 of Section 3. The debit balance is VAT refundable. It is reflected in line 210 of Section 3.

We check the execution of all purchase and sales documents

Check that all sales and purchase documents have been completed. If you do not have enough sales documents, you will underestimate the amount of tax payable in your return. If purchase documents are not posted, you will not claim part of the VAT for deduction.

Score 76. AB

]]>]]>

76 accounting account is an account that accumulates information about financial settlements with counterparties that are not permanent and do not directly relate to the organization’s activities. Relationships with such persons are usually irregular.

Account 76.AB in accounting

Account 76 used in accounting is called “Settlements with various debtors and creditors.” With its help, transactions are recorded that are incorrectly recorded using other records. On the account 76 entries are generated for certain types of business activities, including:

- insurance operations;

- claims settlements;

- deposited amounts of unpaid wages of employees;

- operations on executive documents;

- settlements on advances issued and received;

- accounting for mutual settlements with other counterparties.

Postings to account 76 are generated if it is necessary to fix the amount of legal costs on the basis of administrative documents. If it is necessary to calculate and withhold alimony amounts collected from employees, account 76 is also used.

Count 76 – active or passive?

The final balance for these entries can be of a debit or credit nature, depending on the specified conditions. Debit records any debt owed to the company. The loan collects information on the debts of the enterprise itself to third parties. Therefore, the account belongs to active-passive.

76 account in the balance sheet can be taken into account both in the active part and in the passive part. To do this, its expanded balance is analyzed. Debit balances constitute the asset item “Debit Accounts”. The credit balance increases the liability of the balance sheet under the item “Accounts payable”.

Analysis of account 76

Analytical accounting is maintained separately for transactions. Postings to account 76 form the final balance for each fact of mutual settlements with debtors and creditors. On account 76, subaccounts have many meanings, the most used among them are the following:

- 76.01 - calculations for property and personal insurance. This takes into account operations on life and health insurance of employees and contracts on insurance of enterprise property. Voluntary (within permissible limits permitted by law) and compulsory insurance are taken into account.

- Account 76.02 is used to generate cash flows for claims that have arisen, including the accrual of fines, penalties, and penalties for unfulfilled obligations. Account 76 of subaccount 02 can be applied both in relation to agreements with counterparties and in the event of an outstanding tax debt.

- Using subaccount 76.03, accrued and paid dividends to the founders of the organization are recorded based on the results of the financial year.

- Subaccount 76.04 shows reserved funds for unpaid salaries.

- Account 76.5 in accounting assumes the reflection of other settlements with suppliers and contractors that are not related to the main activities of the enterprise. Account 76.5 includes amounts such as settlements with a notary and the accrual of duty payments. Analytical accounting of account 76.5 is formed separately for each case.

- Account 76.09 in accounting is other settlements with various debtors and creditors, also not related to the main activities of the company. Account 76.09 forms transactions for settlements with auditors, third-party law firms, and reflects the amounts of sponsorship and charitable payments.

- Calculations for third-party debts of employees based on writs of execution, for example, alimony payments, are made using subaccount 76 41.

- Account 76.49 is intended for settlements with the employee for other deductions in accordance with the rules of the organization. Provided that these deductions do not apply to the main ones. Such amounts may include costs for mobile communications and assets purchased within the enterprise.

- Subaccounts 76.AB and 76.VA contain VAT amounts on advances issued and received, respectively. The used account 76 VAT allocates separately from the amounts of advance payment received or on the transferred advances against future deliveries.

The list of presented subaccounts can be supplemented, depending on the nature of the activity and operating conditions of the enterprise, not limited to the movement of funds through subaccount 76.09.

Standard entries to account 76 are used to record transactions that are not involved in the main activities of the enterprise and are of an irregular nature. On the contrary, the balance sheet for account 76 gives an idea of the status of settlements under individual contracts. To simplify the analysis of mutual settlements with other counterparties, the use of various sub-accounts is allowed, including account 76.05 or 76.09 (account for mutual settlements with other counterparties).

Account 76.AB

The used accounting account 76 is a reflection of other calculations of a legal entity. In cases of receipt of prepayments from counterparties or transfer of advances to suppliers, account 76.AB or account 76.VA is intended for accounting for VAT amounts.

If the payment received precedes the fact of shipment of the goods, then an advance invoice must be generated for the buyer within the next 5 days. In accounting, the use of posting 76.AB will mean reflecting the amount of allocated VAT:

- Dt 51 - Kt 62 - advance amounts received from buyers

- Dt 76.AV - Kt 68 - allocated VAT on prepayment

How to write off 76.AB? After shipment of the goods, it is possible to apply a deduction for the previously accrued advance tax. Accordingly, the entry in the purchase book will look like:

By analogy, correspondence from account 76.VA is used for advance payments transferred to the suppliers’ account:

- Dt 60 - Kt 51 - prepayment is made to the supplier;

- Dt 68 - Kt 76.VA - claimed VAT deduction on the advance invoice;

- Dt 76.VA - Kt 68 - reflection of the tax amount after offset of the prepayment in the sales book.

Receiving an advance payment obliges the seller to calculate tax on the amounts received to the budget with subsequent offset upon shipment. Accounting for the allocated amount of tax in the advance invoice by the buyer is his right.

Source: https://spmag.ru/articles/schet-76-av

Checking the VAT return using control ratios

When checking the declaration, the inspector is guided by control ratios. Any taxpayer can find out these ratios in the Federal Tax Service Letter No. GD-4-3/ [email protected] dated March 23, 2015 and the Federal Tax Service Letter No. SD-4-3/ [email protected] dated March 19, 2019.

The letter indicates which article is violated if the ratio is not observed, and what measures the tax authorities will take.

The formulas given in the letter are needed to compare indicators both within and between sections 1-7 of the Declaration, and in conjunction with information from sections 8-12. Here are some of them:

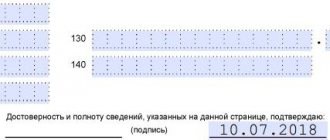

- line 190 of column 3 of Section 3 must be equal to the sum of lines 120, 130, 135, 140, 150, 160, 170, 180, 185 in column 3 of Section 3, if the left side of the equality is greater than the right;

- line 020 of Appendix 1 to Section 9 must be equal to line 230 of Section 9;

- if line 050 of Section 1 is greater than 0, then line 190 of Section 8 is (line 260 + line 270 of Section 9) greater than 0, and so on.

In practice, accountants do not reconcile control ratios manually. All this is done by the accounting program in which they keep their books. Sometimes the check can be performed by the service through which the declaration is submitted to the tax office.

Checking the correctness of filling in invoices

In addition to checking control ratios and information on accounting accounts, pay attention to the correctness of invoices. If this document is filled out incorrectly, VAT cannot be deducted. The rules for maintaining documents used in calculating VAT are enshrined in Decree of the Government of the Russian Federation No. 1137 of December 26, 2011.

First of all, check that the seller’s TIN and KPP are filled out correctly. The official service of the Federal Tax Service has been developed for this purpose. If the service indicates that the TIN and KPP are not in the database, request the correct information from the counterparty.

Check the details of issued and issued invoices. When checking, the tax office correlates your Sections 8 and 9 of the VAT Declaration with the corresponding sections of the declarations of your customers and suppliers. If it turns out that you indicated an invoice from a supplier, but he did not register it, the tax office will require clarification or an updated declaration. This function is performed by the automated system ASK VAT-3. Therefore, a difference in even one number or letter in the invoice number will lead to the system not finding the invoice from the buyer or supplier.

Account 76 av

Synonyms for account are: account 76.AB, account 76-AB, account 76/AB, account 76 AB, account [email protected] AB

Account type: Active

see also other accounts in the chart of accounts:

entire chart of accounts

see also PBU: all PBU

Account characteristics/description:

Subaccount 76.AV “VAT on advances and prepayments” is intended to summarize information on calculations of value added tax amounts from advance payments.

Analytical accounting is maintained for buyers and customers from whom advance payment has been received for the upcoming shipment of goods, products, performance of work and provision of goods) and documents for receipt of advance payment (sub-account “Invoices issued”). Each buyer and customer is an element of the “Counterparties” directory.

Description of the parent account: Description of account 76 “Settlements with various debtors and creditors”

“Deduction of VAT on advance payment previously received from the buyer (advance payment)”

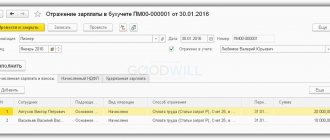

What document is used in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Generating purchase ledger entries

in the “Purchase — Maintaining purchase ledger” menu

“Entering initial balances: VAT on advances and prepayments received from buyers and customers”

What document is used in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Entering initial balances

in the “Enterprise” menu, type of operation: “

VAT on advances (accounts 76.AB, 76.VA)”

“Calculation of VAT on advance payment received from the buyer (advance payment)”

What document is used in 1c:Accounting 2.0/1c:Accounting 3.0

: -

Invoice issued

in the menu “Sales - Maintaining a sales book”

1. Credit turnover on account 90.01 (in the absence of sales at a rate of 0% and transactions not subject to VAT) * 18/118. It should be equal to the debit turnover on account 90.03 in correspondence with account 68.02.

Reconciliation with the tax office for VAT

After submitting the declaration and paying the tax, check with the inspectorate. To do this, ask the tax office for a reconciliation report or a certificate about the status of settlements with the budget. Documents are prepared within 5 working days.

In the act you will see whether your VAT calculations coincide with the information from the Federal Tax Service. If everything is correct, the act can be signed and submitted to the inspection. If not, sign the deed with Fr. After this, the tax office will ask you to provide evidence confirming the correctness of your calculations.

We recommend you the cloud service Kontur.Accounting. When filling out a VAT return, our program automatically checks all control ratios. And the report lines are filled in in accordance with the accounting accounts. We give all newbies a free trial period of 14 days.

Examples of entries for accounting for VAT on advances

Example of an operation for advances received

Harmony LLC, under an agreement with the buyer Amalgama LLC, must supply a consignment of goods in the amount of 212,400 rubles, incl. VAT — 32,400 rub. 07/10/2016 "Amalgam" transfers an advance payment of 50% of the contract amount: 106,200 rubles. VAT on advance: 106,200 * 18/118 = 16,200 rub.

We reflect in the postings VAT on advances received from the buyer:

| Dt | CT | Wiring Description | Amount, rub. | Document |

| 51 | 62.2 | Reflection of the advance received | 106 200 | Bank statement |

| 76.AB | 68 (VAT) | VAT charged on advance | 16 200 | SF issued |

In August, Harmony ships a consignment of goods to Amalgam. Sales transactions and deduction of VAT from advances received:

| Dt | CT | Wiring Description | Amount, rub. | Document |

| 62.1 | 90.1 | Sales of goods reflected | 212 400 | Act |

| 90.3 | 68 | VAT charged on sales | 32 400 | SF |

| 62.2 | 62.1 | The offset of the buyer's advance is reflected | 106 200 | Accounting information |

| 68 | 76.AB | VAT on advance payment is deductible | 16 200 | Book of purchases |

Transactions on advances issued

Let's consider the same operation from the buyer's side. The accountant of Amalgama LLC will reflect VAT on advances issued by postings:

| Dt | CT | Wiring Description | Amount, rub | Document |

| 60.2 | 51 | Advance paid to supplier | 106 200 | Payment order ref. |

| 68(VAT) | 76.VA | VAT on advance payment is deductible | 16 200 | Invoice, purchase book |

| 41 | 60.1 | Goods receipt reflected 0) | 180 000 | Invoice |

| 19 | 60.1 | Incoming VAT reflected | 32 400 | SF |

| 60.1 | 60.2 | The offset of the advance is reflected | 106 200 | Accounting information |

| 76.VA | 68(VAT) | Recovered VAT from advance payment | 16 200 | Sales book |

After receiving the goods, VAT is deducted from the delivery:

| Dt | CT | Operation description | Sum | Document |

| 68 | 19 | VAT deduction upon receipt of goods | 32 400 | Book of purchases |

Sales book sheet form with explanations:

>14. VAT check cheat sheet

An amateur's cheat sheet regarding filing a VAT return (quarterly). What should you immediately remember to watch in the next quarter?