What is reflected in off-balance sheet accounts

The balance sheet takes into account the property of third-party enterprises that were temporarily in the use of the organization, as well as written-off expensive materials.

Despite the fact that by law there are only 11 off-balance sheet accounts, it is allowed to add new accounts and sub-accounts to existing accounts. “1C” allows you to do this “painlessly”, in user mode, without fear of disrupting the correctness of accounting in the program. Such changes must be recorded in accounting policies.

There is no specifically established responsibility for the lack of off-balance sheet accounting, but this does not mean that it is not necessary to maintain it. For incomplete reflection of information in accounting for indicators (if more than 10% of the value is distorted) there is administrative liability under Art. 15.11 Code of Administrative Offenses of the Russian Federation. - an official may receive a fine in the amount of 5,000 to 10,000 rubles.

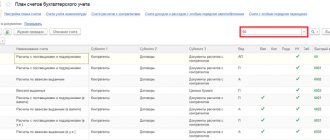

Off-balance sheet accounts have a three-digit designation, which can consist not only of numbers, but also of letters and alphanumerics.

They are divided into active, passive and active-passive. Off-balance sheet accounting is used for auxiliary accounting purposes by the program itself and for maintaining any quantitative and total additional types of user accounting.

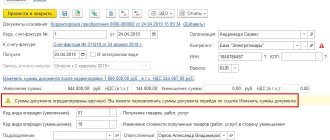

Receipts and debits from an off-balance sheet account can be carried out using 1C documents, if such an operation is provided, or through manual transactions.

To obtain information on off-balance sheet accounts, you can use standard 1C reports: on turnovers and transactions, on subaccounts, and receive details (explanations) from report cells. To view the balance sheet for off-balance sheet accounts, do not forget to select the appropriate flag “Display off-balance sheet accounts”.

What other possibilities are there when working with OSV?

Sometimes, when analyzing SALT, it becomes necessary to calculate the final turnover or balance only for some accounts. For example, the organization’s funds, cash and non-cash. You can calculate the amount by highlighting with the cursor the accounts for which you want to get the total and clicking the icon:

When generating SALT for a specific account, on the Grouping tab, more options appear when choosing the frequency of data presentation: for a period, by day, by month, by quarter, etc.:

In addition, the available analytics for a given account can be combined and arranged in the required order. For example, when you select account 60, the fields Counterparties and Agreements, Documents for settlements with counterparties are available. They can be swapped using the blue arrows:

This is what a fragment of SALT looks like for account 60 with the selected frequency by month and by counterparty:

On the Selection tab, you can select a specific subconto value using the comparison type Equals and others.

The generated OSV in 1C 8.3 can be printed, sent by email, certified with digital signature and saved in a separate file.

How to get details for each account in SALT in 1C 8.2 (8.3) is discussed in the following video:

Give your rating to this article: (

4 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Off-balance sheet accounts for someone else's property

Often accountants are faced with a problem: at what cost to take into account property that does not belong to the company. There are several ways to solve this issue:

- request information from the organization that provided these objects (in practice, such information is rarely provided);

- take for accounting the market value, which was confirmed by an independent appraiser (labor-intensive and expensive);

- reflect objects in a conditional or quantitative assessment (the simplest option).

Regardless of the method, you need to consolidate it in your accounting policy.

Formation of the balance sheet in 1C 8.3

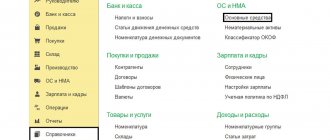

The 1C Accounting 8.3 program allows you to generate and analyze SALT for all accounts at once and for a selected account separately. Depending on your goal, you should select the appropriate lines in the Standard reports menu:

Having selected the period of interest, let’s move on to other settings that will help visualize the status of accounts in 1C 8.3 accounting in different ways.

Off-balance sheet accounts to secure obligations

Off-balance sheet accounts of the second group are intended to secure obligations and payments issued and received.

Such security may include a pledge, a bank guarantee, a surety, a deposit and others. A logical question arises: at what cost should these collateral be taken into account? For example, it is necessary to reflect the collateral on the balance sheet. In this case, do we indicate the amount of the mortgagor's obligation or the value of the pledged property? These amounts will not always be equal. Since if the pledgor does not repay his obligation to the organization, the pledgee will be able to compensate himself for losses in the amount of the pledged property, so it would be more logical to reflect the security at the cost of the pledged property on the balance sheet.

Working clothes and special equipment

Workwear issued to employees is written off as accounting expenses at the time of issue and actually falls out of accounting, but is essentially used by the employee throughout the year.

In this case, it would be advisable to use an off-balance sheet account, with which you can track the availability of these workwear. The transfer of workwear (special equipment) from the warehouse to production is documented in the document “Transfer of materials for operation.”

Materials, the cost of which is repaid upon transfer to operation, are accounted for in special off-balance sheet subaccounts MTs.02 “Working clothes in operation” and MTs.03 “Special equipment in operation” until actual disposal.

Settlements with suppliers and contractors

Watch on youtube || on INTUIT quality: high

The presentation for this lecture can be downloaded here.

Purpose of the lesson:

highlight the main issues of accounting for settlements with suppliers and contractors.

General provisions

After the enterprise is created, the authorized capital is registered, it is time to purchase equipment, fixed assets, materials, and goods. All these, as well as many other operations, require settlement transactions with suppliers. Above, we already touched upon settlements with suppliers, when we considered operations for the acquisition of materials, fixed assets, and intangible assets. In this lesson we will talk in more detail about payments to suppliers and contractors. The fact is that the processes of settlements with suppliers have some features, in particular of a legal nature, which must be taken into account by the accountant.

Suppliers are usually called organizations from which we purchase various values. Contractors are usually those organizations that perform some work or provide services for us. Often, both are simply called suppliers - the accounting and legal regulation procedures for both are practically the same. Differences are observed only at the level of primary documents and the procedure for concluding transactions. In accounting, both suppliers and contractors look similar.

Agreement and invoice

Before any goods enter an organization or services are provided, an agreement must be concluded with a supplier or contractor. Only after the contract is concluded do actions begin to supply products, work begins, and so on. An agreement is not the only form of legal substantiation of relations with suppliers and contractors. The law will also be observed if, for example, you did not enter into an agreement with the supplier organization based on the invoice issued to you.

As a rule, large, important transactions are formalized using contracts. Moreover, usually the organization has a lawyer who is involved in drawing up and checking these contracts. The fact is that an error or inaccuracy in a contract can be very expensive and lead to very undesirable consequences. Typically, the contract reflects the type of obligation, for example, the delivery of goods, the timing of the contract, the procedure for acceptance and payment, and the responsibility of the parties. In accordance with Art. 432 of the Civil Code of the Russian Federation, an agreement is concluded by sending an offer (offer to conclude an agreement) by one of the parties and its acceptance (acceptance of the offer) by the other party. The agreement is considered accepted, that is, accepted, if it is signed by the heads of organizations or authorized persons and sealed by the parties participating in the agreement. If the requirements specified in the contract are met, but the contract itself is not signed, it is considered that the contract has been accepted (Article 438 of the Civil Code of the Russian Federation).

If the terms of the agreement have changed, an additional agreement may be concluded. Typically, an additional contract refers to certain clauses of the original contract, changing their meaning.

The basis for accounting entries for a particular agreement are documents confirming its implementation. For example, these could be acts of acceptance of goods or work, invoices.

As we have already said, relations with a supplier can be formalized not only through a contract. Often the supplier simply issues an invoice to the buyer. The buyer accepts the supplier's products, pays the invoice and the transaction is considered completed.

The procedure for accounting for settlements with suppliers and contractors

To account for relationships with suppliers and contractors, account 60 “Settlements with suppliers and contractors” is provided. This is an active-passive account, the debit of which reflects the amounts paid to suppliers, and the credit - goods and services accepted from suppliers. The credit balance of this account is the organization's accounts payable - it shows the number of capitalized but unpaid assets. The debit balance of the account is the organization's receivables, which arise, for example, when paying an advance for goods or services.

The Chart of Accounts and the Instructions for its use provide the following characteristics of the objects accounted for on account 60:

Account 60 “Settlements with suppliers and contractors” is intended to summarize information on settlements with suppliers and contractors for:

- inventory items received, accepted work performed and services consumed, including the provision of electricity, gas, steam, water, etc., as well as for the delivery or processing of material assets, payment documents for which are accepted and subject to payment through the bank;

- inventory items, works and services for which payment documents were not received from suppliers or contractors (so-called uninvoiced deliveries);

- surplus inventory items identified during their acceptance;

- transportation services received, including calculations for shortfalls and overcharges of the tariff (freight), as well as for all types of communication services, etc.

When accepting goods and services on the basis of invoices, acts, invoices, contracts, the following entries are made on the credit of account 60:

| D10 K60 - materials accepted for accounting |

| D41 K60 - goods accepted for accounting |

| D08 K60 - fixed assets, intangible assets received from the supplier are accepted for accounting |

| D20 K60 - goods or services received from a supplier or contractor are accepted for accounting and included in the cost of production |

Typically these entries are accompanied by an entry relating to accounting for incoming VAT:

D19 K60

— for the amount of VAT in accordance with the supplier’s invoice

Payment for goods and services is reflected in the following entries:

| D60 K51 - goods or services were paid from the current account |

| D60 K50 - paid for goods or services from the cash register |

We said above that account 60 may have a debit balance, which reflects the amount of advance payment to the supplier, in fact, before the receipt of goods or services, this is the amount of his debt to our organization. The issuance of an advance is recorded as follows:

D60-A K51

— the supplier was given an advance from the current account

In this case, subaccount D60-A is used to account for advances issued to suppliers.

After, for example, the goods for which an advance was issued arrive, they are received in the usual way:

D41 K60

— goods were capitalized as an advance payment

And the advance payment itself is closed with the following entry:

D60 K60-A

— the advance previously issued to the supplier is taken into account.

Various situations are possible in relationships with suppliers and contractors. We looked at some of them in the lesson on materials accounting. There, low-quality goods were received from the supplier, which, until the circumstances were clarified, we took into account on account 76 (sub-account “Settlements for claims”) with the following entry:

D76 K60

— received materials are taken into account, the quality of which does not correspond to the declared one.

These materials are taken into account in account 76 until the parties decide how to deal with them.

It is also possible that goods, materials, work or services were received, but our organization for some reason did not pay the invoice. For example, upon receipt of materials the following entry was made:

D10 K60

— materials received from the supplier

We did not pay for these materials. If the supplier does not take any action to collect the debt within three years (three years is the general statute of limitations established by Article 196 of the Civil Code of the Russian Federation), we have the right to write off accounts payable with the following posting:

D60 K91

— accounts payable with expired statute of limitations are written off

Written off accounts payable is the organization's income. After all, previously this debt arose after the assets were received by the organization.

A similar entry can be made after taking inventory of accounts payable, in accordance with the order of the head of the organization to write off the debt.

This situation arises not only if the purchasing organization is unwilling or unable to pay the supplier's invoice. It is possible that the buyer is ready to pay the invoice, but the supplier organization is no longer there. For example, the organization went bankrupt or ceased to exist. In this case, there will be no one to pay and the debt can also be written off against the income of the purchasing organization.

You might think that all you have to do is not pay your supplier invoices for three years and those invoices will automatically be cancelled. But it's not that simple. In particular, the Civil Code of the Russian Federation provides many grounds for suspending or interrupting the limitation period. Thus, if the supplier decides to file a claim before the expiration of this period, the period is interrupted. If the supplier decides to file a claim after the expiration of the specified period - that is, three years - the court will have all the grounds for refusal - in accordance with Art. 199 of the Civil Code of the Russian Federation, which states that the expiration of the limitation period, the application of which is declared by a party to the dispute, is the basis for the court to make a decision to reject the claim. However, here too, everything is very ambiguous - in the same Civil Code of the Russian Federation there are provisions that, if they are skillfully applied by the supplier’s lawyers, will make it possible to collect the debt in almost any case. From here we can draw a simple conclusion: if an organization has the opportunity to pay suppliers’ bills, it is better to do this before the supplier sues.

![My business [CPS] RU](https://nvvku.ru/wp-content/uploads/moe-delo-cps-ru-330x140.jpg)