Current as of February 13, 2021

According to the rules in force today, amounts of sick leave and benefits related to maternity are paid in one of two ways:

- At the expense of the employer with subsequent reimbursement. This method is used in all regions, with the exception of participants in the FSS pilot project (point 2).

- Directly from the fund. We are talking about the “Direct Payments” project, which is carried out in some regions of Russia (Resolution of the Government of the Russian Federation dated April 21, 2011 No. 294).

Everything said below applies only to payers of insurance funds from point No. 1.

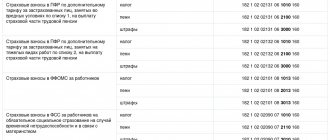

When filling out the DAM form, benefits should be reflected in Appendix 2 to Section 1 :

- line 080 reflects the amount of compensation received by the policyholder from the Fund;

- on line 090 - the difference between the amount of benefits paid to insured persons and the amount of accrued contributions.

The Tax Service explained exactly how the amount of contributions is reflected in line 090 in a letter dated 08/23/17 No. BS-4-11/ The calculation is made using the following formula (indicators are taken from the corresponding lines of Appendix 2 to Section 1):

Amount in line 090 = Line 060 - Line 070 + Line 080

The result is interpreted as follows:

- If it is positive , it means that the policyholder has a debt. In the column “Total from the beginning of the billing period” of line 090 the calculated value is indicated, and in the column “Characteristic” - 1.

- If the result is negative , then the Fund is in debt. In the column “Total since the beginning of the billing period” the value without the “-” sign , and in the column “Sign” - 2.

As a result, it turns out that line 090 reflects a balance that does not correspond to the accounting data. Because of this, accountants have doubts about whether they filled out the above DAM lines correctly.

In fact, a discrepancy does not mean there is an error at all. It arises due to the specifics of the DAM form - it does not contain cells in which the incoming and outgoing balances should be reflected. Therefore, the amount by which benefits paid in 2021 exceed the amount of contributions is not reflected in the DAM for the 1st quarter of 2021. Accordingly, if in the 1st quarter a refund was received from the Social Insurance Fund, then from the calculation it will not be clear that it compensates for the difference between benefits and contributions for the previous year.

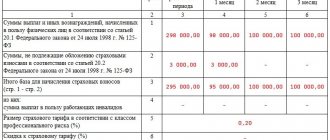

Let's explain with an example. In 2021, the positive difference between benefits paid and assessed contributions amounted to 25 thousand rubles. It is reflected like this:

- In the DAM for 2021, line 090 of Appendix 2 to Section 1 indicates the amount of 25 thousand rubles with attribute 2.

- In accounting, in the debit of account 69, the subaccount “Social Insurance Settlements” at the end of the year there remains a balance of 25 thousand rubles.

In the 1st quarter of 2021, the company did not charge contributions or pay benefits, but received compensation for last year’s expenses from the Social Insurance Fund in the amount of 25 thousand rubles. The reflection is like this:

- In the DAM for the 1st quarter of 2021: on line 080 of Appendix 2 to Section 1 - the amount is 25 thousand rubles;

- on line 090 of Appendix 2 to Section 1 - the amount is 25 thousand rubles with sign 1.

Conclusions: according to accounting data, there is a zero balance, and the DAM form indicates that the policyholder owes 25 thousand rubles. However, all data is correct.

How to reflect reimbursement of expenses from the Social Insurance Fund in the DAM is indicated in the Procedure for filling out the Calculation of Insurance Contributions (Appendix No. 2 to the Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/).

The amounts of employer expenses reimbursed by the territorial bodies of the Social Insurance Fund for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity are indicated in line 080 “Reimbursed by the Social Insurance Fund for expenses for the payment of insurance coverage” of Appendix No. 2 to Section 1 of the RSV (clause 11.14 of the Procedure, approved by Order of the Federal Tax Service of October 10, 2016 No. ММВ-7-11/).

The amounts of benefits received from the Social Insurance Fund are shown on line 080 with the following details:

- from the beginning of the calendar year;

- for the last 3 months;

- for the 1st, 2nd and 3rd months of the last three months.

It is important to keep in mind that in the DAM for the current year you must show any reimbursement of benefits from the Social Insurance Fund that was received this year, even if this is reimbursement of expenses from the previous year.

Accordingly, the indicator of line 090 of Appendix No. 2 to Section 1 will be determined as follows (clause 11.15 of the Procedure, approved by Order of the Federal Tax Service dated 10.10.2016 No. ММВ-7-11/, Letter of the Federal Tax Service dated 23.08.2017 No. BS-4-11/) :

Line 090 = Line 060 – Line 070 + Line 080

In this case, on line 090 the indicator is always reflected in a positive value. In the “Sign” field you will need to indicate:

- “1” - “amount of insurance premiums payable to the budget”, if the amount calculated according to the above formula is ≥0;

- “2” - “the amount of excess of expenses incurred by the payer for the payment of insurance coverage over the calculated insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity”, if the amount is according to the formula for the 1st half of 2021.

How to fill out the DAM for the first quarter of 2021: read the explanations of the Federal Tax Service

To reimburse expenses for social benefits , you first need to understand the amount of such benefits and the desired option for compensating the expenses incurred. There can be two options:

- offset of incurred social expenses against upcoming accruals for insurance premiums for temporary disability;

- refund from social insurance of expenses incurred upon application.

However, it is not possible to offset benefits against contributions if the policyholder is a participant in the Social Insurance Fund pilot project.

In addition, you should understand for which year benefits are reimbursed. If we are talking about expenses incurred before the end of 2021, then the procedure for interaction with government agencies will be different.

To keep records of benefits, use our Simplified 24/7 . It prepares documents and HR reports in one click. Take a trial access to the program for 30 days. Consultation on all accounting issues is available to users 24 hours a day, 7 days a week.

In 2021, compensation is directly provided by Social Insurance (FSS). The algorithm of actions depends on when the positive balance appeared on your 69 account.

If the overpayment occurred on January 1, 2021, then an application for a refund is submitted to Social Insurance. For this purpose, an application is used in Form 23-FSS of the Russian Federation, approved by Order No. 49 dated February 17, 2015.

Social insurance may order an inspection at this stage. Upon completion of the audit, confirmed data on the overpayment is transferred to the tax authorities, who in turn transfer money from the budget.

In this case, the refund will be made by the Social Insurance Fund itself.

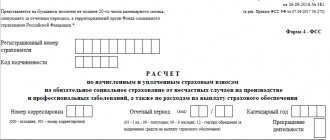

When filling out the ERSV report, you can pay attention to line 001 of Appendix No. 2 of the reporting form. This line implies an indication of which method is used to reimburse social security expenses - direct payments or an offset system.

Most policyholders use an offset system. Direct payments can only be used by those legal entities or entrepreneurs that are registered in the regions where the FSS pilot project operates. In this case, benefits are paid directly to employees based on documents submitted by the employer to Social Security.

In 2021, the list of participants in the Social Insurance pilot project includes 33 regions of Russia.

Since with direct payments, accrued insurance premiums cannot be reduced by the amount of benefits paid, they are not reflected in the ERSV report.

This section contains personal data of the insured persons, so it must be filled out for each such person. The section consists of several subsections.

Subsection 3.1 should reflect your full name, date of birth, gender, INN and SNILS codes, country code 643 (for Russia), document code (Appendix No. 6 to the Procedure) and its details. When filling out the calculation for the period for the first time, column 010 is crossed out.

Subsection 3.2 is for pension contributions. Its first part 3.2.1 reflects payments. You must indicate the amounts for the last three months of the reporting (calculation) period. In this subsection we fill in the lines:

- 130 – category code of the insured person from Appendix No. 7 to the Procedure (do not forget about the new codes, which are mentioned at the beginning of the article);

- 140 – total amount of payment to the employee;

- 150 – base for contributions;

- 160 – including paid under GPC;

- 170 – amount of contributions (base x tariff).

Contributions for SMEs should be calculated according to two tariffs: basic tariffs are applied to payments within the minimum wage, and preferential tariffs are applied to payments above the minimum wage. Accordingly, if the payment in the company exceeds the minimum, there will be 2 subsections 3.2.1 for each insured person. The first is filled in regarding payments up to the minimum wage. The amount of 12,130 rubles is prescribed, the amount of contributions is 2,688.6 rubles (this is 22% of the minimum wage), and the code “NR” is also entered.

The second time, subsection 3.2.1 should be completed in relation to payments above the minimum wage and use the code “MS”. A 10% contribution rate will apply to this portion. If the payment is not more than the minimum, then there will be only one subsection 3.2.1.

Let's give an example for filling out the DAM for the 4th quarter of 2021. Let the employee’s salary be 65,000 rubles per month. In this case, we will fill out the subsection separately for the amount of 12,130 (22% contribution rate) and for the amount of 65,000 - 12,130 = 52,870 (10% rate).

When calculating contributions at an additional tariff, you must fill out subsection 3.2.2.

This application calculates pension and medical contributions. It is filled out in terms of tariffs, so SMEs create two attachments 1. The first time in column 001 you need to indicate the tariff code “01”, which means the basic tariff applied to payment within the minimum wage. The second time Appendix 1 is filled out regarding part of the payments above the minimum wage with code “20”.

Subsection 1.1 reflects the number of insured persons, including those from whose payments deductions are made. Payment amounts should be reflected on a cumulative basis from the beginning of the billing period, as well as for the last 3 months separately.

For example, the company employs only a director who receives a salary of 65,000 rubles per month. For 2021, he was paid 780,000 rubles. The basic tariff base will be:

- for January-March – 65,000 * 3 = 195,000 rubles;

- payment within the minimum wage for April-December – 12,130 * 9 = 109,170 rubles;

- the base at the 22% tariff is equal to 195,000 + 109,170 = 304,170 rubles.

Thus, the amount of contributions at the 22% tariff will be 66,917.4 rubles.

Payments to the manager for April-December exceeding the minimum wage are taxed at a 10% rate: (65,000 – 12,130) * 9 = 475,830 rubles. The amount of contributions at the 10% tariff will be 47,583 rubles.

Further, in subsection 1.1 you should indicate: the amounts of payments that are not subject to contributions, the amounts that are subject to deduction, the calculated base and the amount of contributions from it (separately from the base within the limit and above).

Medical contributions are calculated according to the same principle - subsection 1.2 of Appendix 1 is intended for them. More detailed calculations can be seen in the sample of filling out the DAM for the 4th quarter of 2021.

How to check the correctness of filling

Knowing how to reflect reimbursement of expenses in the DAM, do not be alarmed by discrepancies with accounting, but check yourself using control ratios.

Most accounting software automatically checks these ratios and prevents you from filling out rows with incorrect numbers. If you fill out the calculation yourself, then the control ratios are given in >Letter of the Federal Tax Service of Russia dated December 20, 2018 N BS-4-11/ [email protected]

You can also order a reconciliation of calculations with the budget from the tax service, this will help ensure that the form is filled out correctly: if the accounting data coincides with the results of the reconciliation, then everything is correct.

It is important that tax authorities and inspectors from the Social Insurance Fund receive information not from the final lines of the DAM, but from the budget payment cards, where all the data is transferred. And in these cards, as we have already indicated above, overpayments and arrears are reflected differently.

>

Switching to direct payments: filling out the RSV for the 1st quarter of 2021

Appendix 2 calculates contributions for temporary disability and in connection with maternity. The filling principle is similar, but there are important nuances:

- in column 002 you should enter the payment indicator (direct payments or offset system);

- on the second page you need to reflect the costs of paying insurance coverage and the amounts received from the Social Insurance Fund.

Most of the innovations approved by this order of the Federal Tax Service concern amendments made to the current Tax Code. Changes affecting the calculation of insurance premiums (DAM) should help tax services provide more complete control over the correct use of reduced and zero tariffs by small businesses. They were introduced in the spring of this year in connection with the COVID-19 pandemic.

In the coming year, accountants will no longer be required to provide separate data on the average number of employees of a business. According to the adopted adjustments, from now on this information is reflected in the DAM. A separate column appears on the title page of the Calculation in which it is necessary to indicate the average number of employees for the past year.

Especially for companies engaged in the IT field, Appendix 5.1 appears. It is intended for calculating compliance with the conditions for applying the reduced tariff of insurance premiums by taxpayers specified in paragraph 3 of paragraph 1. Art. No. 427 NKRF. This application was introduced in connection with the reduction of rates to 7.6% , instead of the previously used 14%.

The accounting department of IT companies must fill out a new application with information from section No. 1 of the DAM starting from the reporting period for the first quarter. 2021 In the reporting for 2021 You do not need to fill out this application.

Other changes expected by accountants in the coming year include updating insurance coding. The following codings are introduced for insured persons, depending on their categories:

- KB – employees whose insurance contributions from their income are calculated at a zero rate, in accordance with Federal Law No. 172.

- MC – employees of the organization, insurance contributions from the cash payments they receive are calculated by payers classified as SMEs.

- EKB - employees whose insurance contributions from their income are calculated by enterprises specializing in the field of high technology. These are designers and developers of computer databases and radio-electronic products.

New DAM for - 2nd and - 3rd quarter - 2021

To avoid errors when filling out and to enter all information correctly, when filling out the form, we recommend that you first create a calculation for each employee for whom insurance premiums were paid during the year. Thus, the next step is to fill out personalized accounting data for each employee in section 3.

In the “Place of Submission Code” field, enter the numbers that indicate who is submitting the report and to which tax office. The Federal Tax Service Inspectorate previously approved the codes, which can be found in Appendix No. 4 to the Procedure, approved. By Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551.

We recommend reading: Certificate of ownership of the garage

Filling out RSV when receiving compensation from the Social Insurance Fund 2021

In 2021, due to the coronavirus pandemic, a number of business sectors were, according to the classifier, recognized as affected. As a result, such enterprises were given the opportunity to pay insurance premiums at reduced or zero rates. For the IT industry, a tax maneuver was carried out to reduce the rate to 7.6% .

For the listed organizations that have received the right to preferences, separate codings are introduced:

- For small and medium-sized enterprises (SMEs) - code 20.

- For SME organizations that, according to the OKVED classifier, belong to the industries most affected by restrictions due to COVID-19. They, in accordance with Federal Law No. 172, received the right to apply zero tariffs for insurance contributions from April to June 2021 inclusive - code 21.

- For insurance premium payers employed in the high technology sector - code 22.

Innovations in the procedure for recording the payment of insurance premiums will allow the Federal Tax Service to exercise closer control over enterprises receiving benefits. Thus, the range of opportunities for abuse of the preferences provided to them by the state will be reduced.

If you find an error

Please select a piece of text and press Ctrl + Enter

CTRL + ENTER

A new field for indicating the SCH has been added to the RSV title page. ATTENTION : An independent report on the average number of employees in 2021 is not submitted!

In Appendix No. 5 “Insurance premium payer tariff codes”:

- 20 – SMEs that apply reduced rates of insurance premiums (the code is used in relation to amounts subject to contributions at reduced rates);

- 21 – organizations and individual entrepreneurs that are exempt from insurance premiums for the second quarter of 2021;

- 22 – Russian organizations engaged in the design and development of radio-electronic products.

In Appendix No. 7 “Insured Person Category Codes”:

- MS (VZhMS, VPMS - for foreigners) - in relation to individuals receiving payments from SMEs;

- CV (VZHKV, VPKV - for foreigners) - in relation to individuals receiving payments from organizations and individual entrepreneurs exempt from paying contributions for the second quarter of 2021;

- EKB (VZhEK, VPEC - for foreigners) - in relation to individuals receiving payments from organizations involved in the design and development of radio-electronic products.

Despite the fact that changes to the DAM form have only just been made, the payer’s tariff codes (20, 21) and the insured person’s category codes (MS, CV) are already used when filling out calculations for reporting for the half year of 2021.

In Appendix No. 6 “Codes of types of documents proving the identity of the insured person,” the code has been changed to indicate a certificate of temporary asylum on the territory of the Russian Federation.” Starting with reporting for 2021, it is necessary to use the digital designation “19”.

Section 1 was supplemented with Appendix 5.1. From the first quarter of 2021, it will be filled out by IT companies and electronics developers and designers to confirm compliance with the conditions for applying the reduced tariff.

Since 2021, reduced insurance premium rates have been applied to Russian organizations of these categories (Article 427 of the Tax Code of the Russian Federation as amended by Federal Law No. 265-FZ of July 31, 2020): OPS - 6%, VNiM - 1.5%, Compulsory Medical Insurance - 0, 1 %.

Conditions for applying a reduced tariff (Article 427 of the Tax Code of the Russian Federation):

The share of income from core activities at the end of the billing period is at least 90% of the total income for the period; The organization has state accreditation or is included in the register of organizations providing services for the design and development of electronic products, which is maintained by the Ministry of Industry and Trade; The average number of employees for the billing period is at least 7 people. In field 001 of Appendix 5.1 the payer code is indicated:

“1” - payers from paragraphs.

3 p. 1 art. 427 Tax Code of the Russian Federation; “2” - payers from paragraphs. 18 p. 1 p. 427 Tax Code of the Russian Federation. The remaining lines are identical, except for line 060. It is not filled in if the code “2” is specified in field 001. Table of reporting deadlines in 2021

| For what period do we rent? | Deadline |

| for 2021 | 01.02.2021 |

| 1st quarter 2021 | 30.04.2021 |

| half year 2021 | 30.07.2021 |

| 9 months 2021 | 02.11.2021 |

| for 2021 | 31.01.2021 |

If expenses for payment of benefits were taken into account last year, and compensation was received in the current year

In this case, the filling order is also observed and the above formula is used. Regardless of the period for which the Social Insurance Fund reimburses costs, for the previous quarter or for the previous year, this must be reflected in the calculation directly in the month of receipt.

This is stated in the explanatory Letter of the Federal Tax Service of Russia dated 04/09/2018 No. BS-4-11/ [email protected]

In addition, such a conclusion can be drawn from the norms of Chapter 34 of the Tax Code of the Russian Federation, which, starting from January 2021, provides for the offset of expenses spent on VNIM benefits against upcoming payments.

Changes in the form of calculation of insurance premiums

Let's look at filling out the first sheet of the new DAM form, which is valid from 2021. Here you need to indicate:

- adjustment number – “001” (primary calculation);

- settlement period code - taken from Appendix No. 3 to the Procedure for filling out the DAM form for 2021, which is contained in Order No. MMV-7-11/ (hereinafter referred to as the Procedure). In the calculation for the year, code “34” is indicated;

- calendar year – 2020;

- tax authority number;

- code for the place of submission of the form from Appendix No. 4 to the Procedure. For an organization – usually “214”, for an individual entrepreneur – “120”;

- name of the organization or full name of the entrepreneur;

- average number of employees. This is a new field that has been added to the form in 2021 in place of the headcount report. It must be filled out in the DAM for 2021 and further in all forms for the following periods;

- main OKVED;

- phone number;

- number of pages of the DAM report and copies of documents, if attached.

In the lower part on the left, the accuracy of the information is confirmed.

Section 3 must be completed for each insured person. Subsection 3.1 indicates personal data: TIN, SNILS, last name, first name and patronymic, date of birth, country of citizenship code (RF - 643), gender, document code (Appendix No. 6 to the Procedure), its series and number.

Column 010 is not filled in - code “1” is entered in it only when information is corrected or canceled.

Subsection 3.2.1 should indicate the amounts paid to this person for the last three months of the period. The following data is entered in the columns:

- 130 – category code of the insured (Appendix No. 7 to the Procedure). Here new MS, HF and EKB codes appeared, which were mentioned above;

- 140 – amount of remuneration paid;

- 150 – amount subject to pension contributions;

- 160 – amounts under civil contracts (included in line 150);

- 170 – calculated amount of OPF contributions. It is calculated as the contribution base (column 150) multiplied by the tariff.

If the policyholder is a SME and pays the employee a salary above the minimum wage (12,130 rubles), two subsections 3.2.1 should be completed:

- first in relation to payments within the minimum wage. The code “NR” is indicated, the amount is 12130 and the amount of contributions is 2668.6;

- then in relation to payments exceeding the minimum wage. For example, if an employee’s salary is 55,000 rubles, then you should indicate: code “MS”, payment amount - 42870 and the amount of pension contributions at the 10% rate - 4287.

If the payment does not exceed the minimum wage, then subsection 3.2.1 is filled out as when calculating contributions at the basic tariff in the singular.

Subsection 3.2.2 is completed only by those employers who pay pension contributions at the additional rate.

The application is intended for calculating pension contributions and contributions to compulsory medical insurance.

Column 001 is intended to indicate the tariff code - it must be taken from Appendix No. 5 to the Procedure. SMEs with payments above the minimum wage fill out this application 2 times: with code “01” for the part of the payment within 12,130 rubles and with code “20” for the part exceeding this amount.

In subsection 1.1, you must indicate the number of insured persons, including those from whose payments contributions are calculated. The following indicates the amount of payments from the beginning of the billing period and for each of the last three months.

✐ Example ▼

For example, the company has 1 employee (director) with a salary of 55,000 rubles per month, there were no other payments. The total amount since the beginning of the billing period (2020) is 660,000 rubles. At the same time, at the basic tariff of 22% payments are subject to contributions:

- entire salary for January-March – 55,000 * 3 = 165,000 rubles;

- Salary within the minimum wage for April-December – 12130 * 9 = 109170 rubles.

Payments for April-December above the minimum wage are taxed at a reduced rate of 10%:

(55000 – 12130) * 9 = 385830 rubles.

Further in this subsection, in the same order (total from the beginning of the year and for the last 3 months) are reflected:

- amounts not subject to contribution;

- amounts to be deducted;

- calculated base (including those exceeding the limit value);

- the amount of contributions (including separately from the base within the limit and above it).

In subsection 1.2 of Appendix 1, medical contributions are calculated in a similar way. The difference is in the size of the tariff, and also in the fact that in this subsection there are no fields relating to amounts exceeding the maximum base value, since it is not established for medical contributions.

Appendix 2 to Section 1 calculates contributions for illness and maternity. It is filled out similarly to Appendix 1 with a slight difference. Column 002 indicates the payment attribute depending on which scheme is used. These can be direct payments or an offset system.

In addition, the second page of Appendix 2 indicates the costs of paying insurance coverage and the amounts reimbursed from the Social Insurance Fund (under the credit system).

Section 1 is final. In field 001, code “1” is entered if payments were made to individuals in the last 3 months. If there were none, code “2” is set. In line 010 OKTMO is written.

Next, in the lines of the section for each type of contribution you need to indicate:

- KBK;

- the amount of contributions for the reporting period;

- monthly contribution amounts.

This completes filling out the RSV form for 2021. Please note that the new section 5.1, intended for the IT sector, must be completed starting in 2021 when reporting for the 1st quarter. Those who send the DAM electronically should remember that the format for its presentation has also been changed.

RSV, current in 2021

The deadline for submitting calculations remains the same - no later than the 30th day of the month following the end of the quarter. You must submit the DAM for 2021 by February 1: the deadline is being moved, since January 30 is a Saturday.

Filling out RSV for 2021 with maternity payments sample

Important! When the average number of employees of a company for the last billing period is more than 25 people, only the electronic form of filling out the ERSV is acceptable. But if the average number of employees is 25 or less, both electronic and paper options for submitting the report are possible.

The report must be submitted even if no activity was carried out during the reporting period and wages were not accrued. Calculation of insurance premiums for the 2nd quarter of 2021 (that is, for the first half of 2021) must be sent to the Federal Tax Service no later than July 30, 2019.

How to fill out the RSV in connection with the transition to direct payments

From the age of 21, accounting department employees are not required to submit information on the average number of employees separately. In connection with the adopted adjustments, they are included in the DAM. For this purpose, a separate column is now placed on the title page. It is in it that the average number of “staff employees” for the year is written down. That is, reporting has become somewhat simpler.

Completion of this application is required from IT companies , as well as developers and designers of electronics that have received state accreditation and have a standard average number of employees. This rule has been in effect since the first quarter of 2021. It is necessary to exercise the right to a reduced rate for insurance premiums of taxpayers (in paragraph 3 of paragraph 1 of Article No. 427 of the NKRF). This implies a reduction in the rate from 14% to 7.6% (Article 427 of the Tax Code of Russia as amended by Federal Law No. 265 of July 2020).

In column “ 001 ” it is necessary to indicate the payer code: 1 or 2. Categories of payers that fit these designations are listed in Art. 427 Tax Code of the Russian Federation. The remaining lines are filled in by analogy with the previously existing Appendix 5. An exception here may be line 060. It is not filled in if code “2” is indicated in the “payer type” field.

When calculating the amount of insurance premiums, preferential rates “06” and “22” are entered in column “001”. Relevant for partially or fully tax-exempt payers.

You must fill out the application very carefully. If errors are detected, the Federal Tax Service may accept it and request an explanation. Or they will notify you of an error and demand that you redo the RSV (depending on the category of the error made). In the latter case, there will be only five days to send a correctly completed document.

Another important change for 2021 is the update of insurance coding. Encodings are introduced for different categories of insured citizens working at the enterprise.

New encodings:

- citizens working in the field of small and medium-sized businesses: MS, VZhMS, VPMS ;

- persons working in SME industries affected by coronavirus: KV, VZhKV, VPKV ;

- workers in the electronics design and production industry: EKB, VZhEK, VPEC .

We are talking about citizens of the Russian Federation and foreign persons, as well as stateless persons. The last two categories are visitors temporarily residing in Russia. Their employers (small or medium-sized businesses, organizations) charge insurance premiums on part of the income of these citizens.

The full table with a breakdown of all codes can be found in Appendix No. 7 to the Procedure for filling out the calculation form for insurance premiums (approved by order of the Federal Tax Service of Russia in September 2021 and updated in October 2021).

In 2021, due to the difficult economic situation in the country, many business sectors were recognized as affected. Against this background, many enterprises were allowed to make insurance contributions at reduced rates of 7.6% or zero.

For which subjects are the new codes legally established:

- organizations of small and medium-sized businesses (SMEs) - code 20 (an employee’s salary within the minimum wage is subject to a cumulative contribution of 30%, if the minimum wage is exceeded - at a rate of 15%);

- SME organizations that, according to the OKVED classifier, belong to the industries most affected by COVID19 (and applied zero tariffs for several months in 2021) - code 21.

These categories were introduced back in 2021, but now the designated procedure has begun to work on a permanent basis. It applies to non-profit organizations only if they are socially oriented.

A change that was introduced only in 2021 is the appearance of code 22 for insurance premium payers working in the high-tech sector.

Let's consider an example of calculating insurance premiums in 2021 for a budget organization. GBOU DOD SDYUSSHOR "ALLUR" uses OSNO. General tax rates are established for the calculation. The average number of employees is 22.

For the reporting 6 months of 2021, payroll accruals amounted to (in rubles):

- July - 253,000.00;

- August - 253,000.00;

- September - 253,000.

We calculate insurance monthly to fill out RSV-1.

July:

- Pension Fund of the Russian Federation: 253,000.00 × 22% = 55,660.00 rub.

- Compulsory medical insurance: 253,000.00 × 5.1% = 12,903.00 rubles.

- VNiM: 253,000.00 × 2.9% = 7337.00 rub.

August:

- Pension Fund of the Russian Federation: 253,000.00 × 22% = 55,660.00 rub.

- Compulsory medical insurance: 253,000.00 × 5.1% = 12,903.00 rubles.

- VNiM: 253,000.00 × 2.9% = 7337.00 rub.

September:

- Pension Fund of the Russian Federation: 253,000.00 × 22% = 55,660.00 rub.

- Compulsory medical insurance: 253,000.00 × 5.1% = 12,903.00 rubles.

- VNiM: 253,000.00 × 2.9% = 7337.00 rub.

There was no excess of the base for insurance accruals in favor of employees for 2021.

For information on filling out the calculation of insurance premiums: in the 1st half of 2021, wages accrued amounted to 759,300.00 rubles:

- Pension Fund of the Russian Federation: 759,300.00 × 22% = 167,046.00 rubles.

- Compulsory medical insurance: 759,300.00 × 5.1% = 38,724.00 rub.

- Social Insurance Fund: 759,300.00 × 2.9% = 22,019.00 rubles.

Estimated data for the 3rd quarter (in rubles):

- Accrued salary - 759,000.00.

- Contributions to the Pension - 166,980.00.

- Compulsory medical insurance - 38,709.00.

- FSS - 22,011.00.

Final data for filling out the calculation of insurance premiums for 9 months of 2021:

- accruals - 1,518,300.00 rubles;

- contributions to the Pension Fund of the Russian Federation - 334,026.00 rubles;

- Compulsory medical insurance - 77,433.00 rubles;

- FSS - 44,030.00 rubles.

The detailed procedure for filling out the calculation of insurance premiums for 2021 is set out in the Order of the Federal Tax Service No. ММВ-7-11/551. Taking into account the provisions of the Order, we will give an example of the design of the RSV-1 form for the 3rd quarter of 2021.

On the title page of the single calculation we indicate information about the organization: INN and KPP (reflected on all pages of the report), name, economic activity code, full name.

manager, phone number. In the “Adjustment number” field we put “0” if we provide a single report for the first time during the reporting period, or we set the next adjustment number.

We indicate the Federal Tax Service code and location code.

Organizations and individual entrepreneurs, if errors are detected in the primary DAM, must make adjustments and submit an updated report according to the rules of Art. 81 Tax Code of the Russian Federation. If the data for 2021 is adjusted, the report is submitted to the tax service, if for 2021 and the periods preceding it, the report is submitted to the Pension Fund.

The corrective calculation must be submitted in the form that was used at the time of submission of the primary report (clause 1.2 of the Procedure for filling out the DAM, approved by the Federal Tax Service of the Russian Federation by Order dated October 10, 2021 No. ММВ-7-11/ - Procedure): for 2021 the DAM is specified by KND form 1151111, for 2021 and earlier, adjustments are made to the RSV-1 Pension Fund.

It is also necessary to submit an updated DAM if the base for the previous period has been recalculated downwards. The recalculation amount is not reflected in the current period because, from October 2021, a report with negative amounts is considered to be inconsistent with the format.

If errors in the primary DAM are not related to the recalculation of the contribution base, then an updated calculation must be submitted taking into account the situation. The personal details of the insured person are entered incorrectly. Errors in full name and SNILS are corrected as follows:

- In the “Adjustment number” field of section 3, the serial number of the clarification is entered, in the lines Full name and SNILS (subsection 3.1) data from the primary DAM is reflected, in subsection 3.2 a “two” is entered in lines 160-180 and “zero” in 190–300.

- At the same time, another third section with the correction number “0” is filled out for the same insured individual, the correct full name and SNILS are entered in subsection 3.1, and the amounts are entered in subsection 3.2.

Errors in the following fields of subsection 3.1 are corrected in the usual manner: TIN, date of birth of an individual, citizenship, gender, code of the type of identification document, its details, the attribute of the insured person OPS, compulsory medical insurance and compulsory social insurance.

Corrections in the specified fields are made by including in the corrective calculation section 3 with the correct data and current indicators of subsection 3.2 - the correction number, except “0”, but the same serial number as in the primary DAM.

An extra employee is indicated in the calculation. In this case, the clarification includes section 3, which contains information about excess individuals. In this section: a correction number other than “0”; in subsection 3.2 “zeros” are entered. At the same time, the data in section 1 is corrected.

The employee was not included in the calculation. In this situation, the adjustment contains section 3 with information about non-included individuals with a zero adjustment number (primary information). If necessary, the data in section 1 is clarified.

Part of the calculation with line “040” Features of entering information into line “040” Basis Section 1 The proper BCC is recorded for compulsory payments for health insurance for the period from 2021: 182 1 0213 160, 182 1 0213 160 (when paying a fixed amount of IP);

According to the written code in line “040”, compulsory medical insurance contributions will be calculated. Federal Tax Service Procedure, part 5, clause 5.6 Subsection 1.1. attachment 1 first section The line contains the total indicators: payments not subject to compulsory health insurance contributions in accordance with Art. 422 of the Tax Code of the Russian Federation (compensations, state benefits, etc.

); made and documented expenses related to the extraction of income from the author's order and other sources (in accordance with clause 7.6 of the Procedure); expenses that do not have documentary evidence, but are accepted for deduction in accordance with Art. 421, p.

9 of the Tax Code of the Russian Federation on an accrual basis. The procedure of the Federal Tax Service, part 7, clause.

The calculation for the current reporting period does not reflect the amount of recalculation made for the previous period.

When filling out calculation line indicators, negative values are not provided (section II “General requirements for the procedure for filling out the Calculation” of the Procedure).

Beginning with 9-month reporting, files containing negative amounts will be considered inconsistent with the format.

New DAM form for the 3rd quarter of 2019

The DAM for the 3rd quarter of 2021 (“new form”) is being clarified and supplemented in accordance with the draft order of the Federal Tax Service. The draft order is posted on the Unified Portal of Draft Regulatory Acts. The new form is not fundamentally new, but makes some changes to the previous version. However, this order has not yet been approved and the calculation must be submitted in the form approved by Order of the Federal Tax Service No. ММВ-7-11/551 dated 10.10.2016. This form was used when submitting calculations for insurance premiums for the previous period.

You must report to the tax office on a quarterly basis, no later than the 30th day of the month following the reporting period. Therefore, the calculation for 3 sq. must be submitted no later than October 30, 2021.