We will analyze where to get a certificate of income for an individual entrepreneur, what information must be included in it and what documents to attach. Ordinary people engaged in wage labor are constantly faced with the need for a certificate of income. Especially in the age of bank loans. Such a document no longer surprises anyone; everyone knows that you just need to request it from your boss or the accounting department.

Well, what about the income certificate of an individual entrepreneur? Where can he get this certificate from? And what exactly will it reflect? The questions are interesting.

What is a book of income accounting for individual entrepreneurs under a patent?

Despite the fact that working on a simplified method of paying taxes, which involves obtaining a patent for a certain type of activity, does not represent a complex accounting of income or expenses, it does require maintaining certain documents. The most important of them is a book on accounting for the income of individual entrepreneurs using a patent. The procedure for its circulation and maintenance is provided for in such regulatory legal acts as Order of the Ministry of Finance of our country No. 135 of October 22, 2012, and the Tax Code of our state, namely Art. 346.53 subparagraphs 2 - 5. The latest changes are provided for 2015 - 2021.

According to their provisions, the income book of a sole proprietor must have the following details:

- title page, which indicates its name, as well as the full name of business entities, in our case individual entrepreneurs;

- mandatory fields to be filled in, where the dates of financial transactions, the names of business transactions, and the amount of funds received, confirmed by various financial documents, are entered;

- all sheets of this book must be stitched and numbered;

- on the last sheet, the total number of pages should be indicated, and the thread with which the book is stitched should be sealed with a small piece of paper, where there will be an imprint of the seal, or a signature if there is no seal.

A sample of this document can be viewed and downloaded here.

It is important to remember that this document is maintained by private entrepreneurs who use a patent in their business activities, which is issued for a specific type of activity and is valid for a certain period.

When do you need a certificate of income of an individual entrepreneur?

There are several main cases when an individual entrepreneur may need such a document:

- It may be requested when approving a loan from a credit institution or bank.

- It may be required when the individual decides to visit another country.

- When deciding on subsidies, there is also a need for a certificate.

- There are also cases when you need to apply for benefits. For example, child benefit. Or when receiving the status of a low-income family. In these cases, a certificate will be required.

And if an individual, when asking his accounting department at his place of work for a certificate of income, immediately talks about such a form as 2-NDFL, then in the case of an individual entrepreneur, the form to fill out will be 3-NDFL. There is no standard establishing a different form of certificate of income for an entrepreneur. And 3-NDFL will definitely be needed. So the entrepreneur provides a tax declaration using this form.

In addition, due to the lack of a mandatory certificate form, it will not be possible to simply go to the tax office and request it there.

The easiest way to avoid troubles with income confirmation is to periodically register your tax return in triplicate with the fiscal service. (The service is free, provided by tax service employees).

Banking organizations can also help you obtain a certificate. Many of them, if necessary, obtain information about the income of an individual entrepreneur, provide their copies of certificates, where you only need to enter information and sign.

Also, as an attachment you can use not only the tax declaration document, but also primary documents. This is especially useful for those individual entrepreneurs who work under the UTII and PSN forms.

In case of concealment of cash proceeds, criminal liability follows under Article 199.2 of the Criminal Code of the Russian Federation.

Procedure

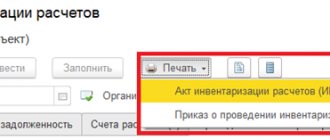

Despite the fact that the above income book for individual entrepreneurs who operate on a patent tax system has mandatory fields and columns to fill out, it can be maintained in two ways:

- on paper sheets, in the form of a stitched and numbered book;

- electronic.

In the first case, income accounting is recorded in the designated columns, and after the end of the tax period, or the term of the patent, individual entrepreneurs must take it to the tax office at the place of registration of the individual entrepreneur to check the correctness of maintaining and paying taxes.

In the second case (electronic version), special files are created on the computer, which contain the necessary columns and columns where the individual entrepreneur enters income from his activities. When, again, the tax period ends, or the validity period of the patent, the business entity must print out the electronic version on paper, after which all sheets are bound, properly executed, and submitted to the tax office for verification.

It should also be noted that all individual entrepreneur records must be kept in Russian. If the activity involves working with foreign business entities, or supporting documents were written in a language used by residents of different subjects of the Federation, then they must be translated into Russian. Usually the translation is written in the next column, after the document or entry in another language. The translation must be signed by the entrepreneur and stamped with a date. If the latter is not available, then a signature is sufficient.

Here you can familiarize yourself with such a book in electronic form, and immediately create your own electronic version, which can then be easily printed.

It is important to know that all transactions that are subject to accounting must be recorded in chronological order. At the same time, filling out such a book must be clear and without corrections. If any errors are made that need to be corrected, this is done carefully, after which the reason and confirmation that the accounting was done incorrectly is indicated in the column opposite the correction. This fact must be confirmed by a relevant financial document, with the signature of the entrepreneur, as well as a stamp. If it is not there and never was, it is enough to put a signature on it.

What should be reflected in the income certificate of an individual entrepreneur?

When a document confirming income is required, it is important to clarify with the requester what form this certificate must be in to meet their requirements. Because often it is free form. Specific and necessary information is also indicated, but the format of filling out this document is not important.

Information that must be indicated in the individual entrepreneur’s income certificate:

- Personal information of the individual entrepreneur (full name, address, contacts, INN, OGRN)

- If the individual entrepreneur has a current account, information about it and the bank that services it is indicated.

- Indicate the date, month and year of the certificate and the city

- If you write “certificate” in the document, then do not forget that you need to put a clarification next to it that reflects the purpose of receipt (note: certificate of income for receiving benefits)

- The amount of income must be indicated for the period required by the requester. You can list them by month of this period (table), but this is not necessary. Information about the individual entrepreneur is also written, indicating passport details.

- The certificate indicates the documents attached to it. (Don’t forget to check with the person requesting the certificate which package of documents should be attached to the certificate).

- If an accountant is listed among the employees of an individual entrepreneur, you need to give him a completed certificate for approval. The individual entrepreneur himself puts his signature with the transcript.

What financial transactions are not included in the income book?

Economic activity under a patent provides for certain restrictions on accounting for income and expenses, which will be discussed. Individual entrepreneurs carrying out activities under a patent and, in connection with this, applying a simplified taxation system need to be aware that various expenses should not be indicated in it.

Expenses mean such financial transactions that do not bring profit (purchase of materials, payment for related services, etc.), but lead to the waste of money for the needs of the business entity, in this case individual entrepreneur.

What is proof of income accounting?

In order to understand which transactions constitute income, in the case of activities under a patent, it is necessary to understand what kind of financial documents will confirm the profit, and they are as follows:

- cash receipt orders, if a cash book is maintained and the business entity works with cash;

- agreements under which financial resources are received as an advance or prepayment;

- invoices, excluding expenses;

- checks and various payment orders that confirm the receipt of money to the account of a business entity, excluding any expenses incurred;

- financial documents according to strict reporting, without taking into account expenses.

Other documents that are not in the above list may also be used, but they can also serve as confirmation of income rather than expenses.

Particular attention should be paid to this type of payment as an advance. There are cases when, for the reporting period, an advance was received and was reported as profit. But for the next period, it had to be returned, in which case he will position the amount of profit with a minus (expense) for the next reporting period and will pay less taxes.

Such accounting does not contradict individual entrepreneurs using a patent form of entrepreneurial activity.

For a more detailed acquaintance, you can read the book on income and familiarize yourself with its sample.

Confirmation of individual entrepreneur’s income on OSN and simplified tax system

For business entities that are in the main tax regime, confirming net profit for a mortgage is not difficult. It is enough to provide a tax return 3-NDFL with a mark from the fiscal service. Moreover, entrepreneurs annually report on their profits to the Federal Tax Inspectorate.

This document contains the following information:

- all profits;

- expenses that affect the size of the tax base;

- personal data of the entrepreneur.

But how can an individual entrepreneur confirm his income to the bank when receiving a mortgage if the entrepreneur is under a different tax regime? Because it is not always enough for banks to provide a tax return for the previous year or for the reporting period.

Let's try to figure out how to confirm the income of an individual entrepreneur using the simplified tax system. Business entities that are on the simplified tax system are required to maintain their own book of income and expenses. Information is displayed here that helps determine the real profit of a businessman. A notarized copy of the book is suitable for the bank.

Additionally, payment documents may be needed:

- incoming and outgoing cash orders;

- bank account statement;

- agreement.

If an entrepreneur works without a cash register, then the first two documents are not needed. For the tax inspectorate, individual entrepreneurs who are on the simplified tax system also submit annual reports. The bank may require a second copy of the declaration as an additional document.

On video: Investing in real estate documents/nuances

Procedure for filling

Business entities using the simplified (patent) taxation system must fill out the following columns, thus:

- the first column will indicate the order number of the financial transaction that is subject to registration;

- the second column will indicate the number and date of the mandatory financial document, which is the basis for the transaction that is subject to recording;

- in the third column, in a mandatory case, a brief content of the financial transaction that is subject to the necessary registration will be described;

- the fourth column will indicate the profit received from carrying out business activities, which is stated in the patent giving the right to such activities.

There is valuable advice on this matter, which is as follows. As stated earlier, the income book for patent activities is used only to record those monetary transactions that take place in the types of activities specified in the patent. No other operations can be indicated in it and this is strictly prohibited. If an entrepreneur conducts part of his activities under a patent, and the other part under the general taxation system, then he will submit two reports, the first for the patent, and the second for another type of activity.