How to find out the checkpoint of an organization - the main reasons for registration

The company can register with the tax inspectorates at the place of its main activities, as well as where separate divisions and owners of vehicles and property operate. A company has the right to register for a variety of reasons, as well as choose any tax authority. All these actions are confirmed by a specific checkpoint, which means there may be several of them, but they will all be tied to one TIN.

To find out the checkpoint of a specific separate division, you need to make a request to the tax authority. This information is entered into a special notice no later than five working days from the date of registration of the branch, and this document is issued to the authorized representative.

How to find out OGRN?

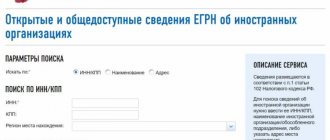

One of the most popular platforms for searching for a company’s OGRN is the Federal Tax Service website.

To obtain the necessary information, you just need to enter the TIN number, the name of the company, and the region of its location into the program. Based on all these parameters, the program will easily highlight the OGRN of the enterprise. In addition, it is possible to obtain an extract from the register. This document can be obtained not only about a legally registered person, but also about an individual entrepreneur. Each such document is signed with a special electronic signature. It is possible to use another method of work. Here you can cite a number of special databases in which it is possible to find data on individuals entered in the register as individual entrepreneurs or legal entities.

It would be appropriate to add that such databases also include some other information, not only from the Unified State Register of Legal Entities. For example, newspaper essays, legal costs. You also need to understand that in some databases it is possible to determine information about a potential counterparty. The collected data is an opportunity to protect yourself from unscrupulous partners. There is always a risk of entering into an agreement with an organization with a bad credit history. The only disadvantage of such platforms is that they are paid. The larger the database that needs to be collected, the greater the amount you will have to pay.

Third in order, but by no means least important, is the method of contacting the tax authority. When applying, an extract about the company’s credit history is immediately made on the spot. But this method is one of the longest, as it can take up to one week. If the operation was performed earlier, the amount of tax paid may be reduced.

How to determine whether a retail outlet is a separate division

On the other hand, there is paragraph 2 of Article 346.28 of the Tax Code of the Russian Federation. According to this paragraph, registration of an organization or individual entrepreneur as a “imputed person” operating in the territories of several municipalities where several tax authorities operate is carried out with the tax authority in whose jurisdiction the place of activity indicated first in the application for registration is located. registered as a single tax payer.

The legal entity is registered in the Oktyabrskaya tax office of the city of Novosibirsk (a chain of retail stores) and as a UTII payer they are registered with the Federal Tax Service No. 13 (Soviet district), since they opened another outlet there. I understand that we had the right and not to stand up like this as a payer of UTII (((, but a fact is a fact. Accordingly, UTII WAS TRANSFERRED TO IFTS No. 13! Now they also demand from me an accrual + payment for personal income tax (ALTHOUGH I REPORTED AND PAID IT TO THE OCTOBER TAX OFFICE, LOCAL ACTUAL REGISTRATION OF A LEGAL ENTITY). HOW SHOULD I CORRECTLY ANSWER THEIR REQUIREMENT, WHICH DOCUMENTS TO REFER TO. THAT I DO NOT HAVE AN OBLIGATION FOR 2-NDFL REPORTING TO THE IRS No. 13. ESPECIALLY AS THE TAX HAS BEEN PAID IN FULL IN ONE MUNICIPALITY PALITET? But we They didn’t register the outlet as a separate division, but only became a payer of UTII.

Who pays contributions for employees of a separate unit?

Briefly: if the department itself issues salaries, pays personal income tax and reports on its own.

If a department has its own current account and it calculates salaries itself, then it itself registers with the pension fund and social insurance fund. And then he pays personal income tax and submits all reports: 2-NDFL, 6-NDFL, SZV-M, SZV-STAZH, RSV.

When the head office deals with salaries, the division is left with only the payment of personal income tax and reports 2-NDFL and 6-NDFL, and the head office does the rest.

Checkpoint of a separate unit

Information about each separate division (with the exception of stationary workplaces) is indicated in the unified state register of legal entities, for which the organization creating them must submit completed applications to the tax office on approved forms No. P13001, No. P13002 or No. P14001.

By virtue of Art. 11 of the Tax Code of the Russian Federation, a separate division must be located at an address different from the address of the main organization, and have stationary jobs, i.e. jobs created for a period of more than one month. A separate division is not only a branch or representative office, but also a separate stationary workplace (Article 55 of the Civil Code of the Russian Federation and Article 11 of the Tax Code of the Russian Federation

Branches and representative offices (Separate divisions)

Representative offices and branches are called separate divisions of a legal entity. According to the Civil Code of the Russian Federation (Article 55): • A representative office is a separate division that is created to represent the interests of the organization and protect them. • A branch is a separate division created to carry out the functions of an organization and represent its interests.

A legal entity creating a separate division must include information about it in the constituent documents. Separate divisions are not independent legal entities. As part of obtaining information about legal entities, when checking Counterparties, it is necessary to know how many separate divisions (branches, representative offices) the company has.

On the CHEST BUSINESS portal, you can search and check for free for the presence of branches and representative offices, as well as find out the number of branches and representative offices of the organization.

The data on the portal is updated daily and synchronized with the nalog.ru service of the Federal Tax Service of Russia*.

To obtain information about separate divisions, you can find an organization by INN / OGRN / OKPO / Full name of the Manager / Company name.

To search, use the search bar:

When to open a separate division

- Representative offices perform the role corresponding to their name: they represent the interests of a legal entity outside its location.

- Branches, as territorially separate parts of the company, have all the functions of the “head” organization.

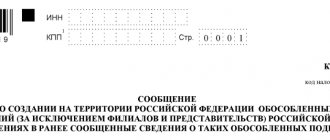

Application for registration of a separate division To register a separate division with the tax office, you must fill out a message in form C-09-3-1. The application form used by organizations when opening an OP and changing their data is approved by Order of the Federal Tax Service No. ММВ-7-6/ dated June 9, 2021.

We recommend reading: Online statistics codes by inn

Where does it appear?

The checkpoint must be indicated as part of the details of the legal entity in all official papers and forms of the organization. It must be reflected in the texts of contracts, various letters and powers of attorney.

There are a number of forms in which checkpoints are a mandatory element. For example, checkpoint in the invoice of a separate division. It is indicated when the OP sells something through himself.

EXAMPLE The sale of goods produced by the parent organization is carried out by its separate division. Then the checkpoint is written on the invoice not of the main office, but of the OP that makes the transaction. The same rule applies if goods are purchased by a separate division.

But the TIN is indicated to the parent organization, since the OP does not have its own.

If you find an error, please select a piece of text and press Ctrl+Enter.

How to find out the checkpoint of a separate division of an organization

Knowledge of the checkpoint allows you to obtain a number of information confirming the integrity of the supplier and protect the organization from concluding a contract with a fly-by-night company. This code, in accordance with clause 5 of the appendix to order No. MMB-7-6/ [email protected] , consists of 9 numeric characters, which are a combination of 3 combinations, each of which carries certain information:

- when participating in tenders and concluding contracts with state and municipal customers - the presence of a code in this case is a mandatory condition for approval of the potential contractor’s application by the competition commission;

- when preparing tax and accounting documentation - many forms of accounting and reporting are unified, so the presence of a checkpoint, among other details, is also mandatory.

How to open a separate division of an LLC: instructions

There is no need to worry too much about the question of how to open a separate branch in another city . Here the registration technology is the same as in the case of opening an OP in the same city as the main organization. Only you will need to submit documents to the local tax office, and not to the one where the parent LLC is registered.

A company can open its own private enterprise only after the highest governing body makes a corresponding decision at a general meeting. If we are talking about creating a branch or representative office, then such a decision can only be made by a general meeting of LLC participants. This requirement is enshrined in Art. 5 of the Law

Is separate accounting necessary in separate divisions?

In short: no.

Separate divisions do not have their own accounting - it is maintained by the company.

Wherever the unit is located, it operates under the same tax regime as the company. The accounting methods used are also the same as in the company. They are prescribed in an internal document - the “Accounting Policy of the Organization”.

Show everything that is written on a yellow background to the accountant, everything is on the accounting sheet.

The organization's working chart of accounts is drawn up so that transactions with separate divisions can be taken into account. For this purpose, the plan provides accounts and subaccounts.

Primary accounting documents are drawn up in the name of or in the name of the company, and not a separate division. Because it is the company that receives the rights and obligations in all transactions.

The accounting policy can specify the procedure for distributing expenses between the company and its divisions.

The company must provide separate analytical accounting of business transactions of separate divisions that do not have a separate balance sheet. To do this, all operations of the division must be accounted for in separate subaccounts of the working chart of accounts, which is prescribed in the accounting policies of the organization.

How to find out the checkpoint of a separate division of an organization

Information about each separate division (with the exception of stationary workplaces) is indicated in the unified state register of legal entities, for which the organization creating them must submit completed applications to the tax office on approved forms No. P13001, No. P13002 or No. P14001.

It is the responsibility of legal entities that have organized, in addition to the head office, a separate premises with staff in another district, city of regional or district scale to have a checkpoint of a separate subdivision (SP). The legislative requirement is formalized in Article 5 of the Federal Law of 08.08.2021 No. 129, Art. 83 Tax Code of the Russian Federation. The number is assigned by the tax inspectorate, which registers changes in the Unified State Register of Legal Entities, Unified State Register of Legal Entities.

Peculiarities

Companies, in accordance with the Civil Code of the Russian Federation, can be created to conduct business activities in general or perform certain tasks. In this they are no different from other entities engaged in economic activities.

A legal entity has the opportunity to open its own separate divisions (hereinafter also referred to as OP). This right is enshrined in Art. 55 of the Civil Code. Let us clarify that merchants are formally deprived of this opportunity.

Opening an OP does not entail the creation of a separate legal entity. It is part of an already registered organization, which means it does not have the same scope of legal rights and obligations.

The Tax Code contains clear features that must necessarily be inherent in “separateness”:

- availability of stationary workplaces;

- different addresses for the head office and the OP.

The absence of at least one of these signs means that there are insufficient grounds for opening a new structure in the OP status. The creation of a “separateness” in this case will contradict Article 11 of the Tax Code. This means that there will not be a separate checkpoint of a separate unit.

The Civil Code mentions only two forms of OP:

- branch;

- representation.

At the same time, Art. 55 of the Tax Code of the Russian Federation provides another type of separate unit - equipped working positions.

The opening of branches and representative offices implies the appearance of data about them in the Unified State Register of Legal Entities (in the case of equipped workplaces with the status of EP, this does not happen). To do this, you must first fill out an application (there are approved forms) and send it to the tax authorities.

For more information about this, see “How to open a separate division of an LLC: instructions.”

How to open a separate division of an LLC in another city

- determine what functions will be assigned to the OP;

- come up with a name for the OP (simply OP, representative office or branch);

- in accordance with Russian legislation, determine the need to include or not include information about the OP in the Charter of the enterprise;

- register an individual enterprise (except for branches and representative offices);

- register a branch/representative office by submitting an application and other required documents;

- register a separate structural unit in extra-budgetary funds.

The specified package must be submitted no later than 1 month from the date of opening the OP to the Federal Tax Service at the place of registration of the LLC. The day of creation of a branch isolated from the company will be considered the day when a stationary workplace was actually created.

How to open a separate division in 2021

It is worth noting that registration with the Federal Tax Service is in the place where this unit is directly opened. Moreover, if several divisions are opened in different cities at once, all of them must be registered independently of each other.

Please note that if you exceed the minimum period for registering a separate division, you will be charged a fine of 15,000 rubles for violating the registration deadlines, and will also be charged 15% of the total income of the separate division for the time you worked outside of registration.

A separate division - what is it? Separate division: form, form and accounting

Taking into account the above, a question arises regarding the moment at which a separate structural unit of the organization is created. This nuance is not explained in the Tax Code. However, it seems that it would be logical to consider the date of commencement of work activities as the moment of formation of the EP. In this case, the relevant information must be obtained not from the address of the main office, but from the geographically separated enterprise opened by it.

We recommend reading: How to become a member of a young family in the city of Togliatti

In Art. 288 of the Tax Code defines the rules for making deductions from the profit of an enterprise to the budget. In accordance with the general procedure provided for in paragraph 2 of this norm, payment of advance and principal amounts is carried out by taxpayers at their address, as well as the location of each unit. The calculation of deductions is carried out in accordance with the shares of profit attributable to these OPs. They are calculated as the arithmetic average of the share of the average (average) number of employees and the residual rate of depreciable property established in Art. 257 (clause 1) of the Tax Code, for the taxpayer as a whole. The share of profits is thus calculated exclusively in the part to be credited to regional budgets (corresponding to a rate of 17.5%).

How can you open a separate division of an LLC without any problems?

Enterprises operating on the territory of the Russian Federation, unlike entrepreneurs, can open structural units (divisions) in any region. The latter do not need this to do business; they, being registered at the place of residence or doing business, have the right to do it anywhere in the country.

The peculiarity of a simple OP is that it is completely managed by the main office of the enterprise, transmits documents there for record keeping, does not have a manager, does not hire employees, does not generate or submit reports, therefore it should not be registered with budgetary and extra-budgetary funds. A simple OP is located on the simplified tax system if the enterprise itself operates on this system.

How to open a separate division in 2021 without changing taxation

Subclause 3 of clause 2 of Art. 23 of the Code establishes that taxpayer organizations are required to report to the tax authority about all separate divisions of a Russian organization created on the territory of the Russian Federation (with the exception of branches and representative offices), and changes to information about such separate divisions previously reported to the tax authority. The specified information is submitted to the tax authority at the location of the organization within one month from the date of creation of a separate division of the Russian organization or within three days from the date of change in the relevant information about the separate division of the Russian organization.

We recommend reading: Filling out application p14001 when changing the position of director

According to Art. 83 of the Code, organizations that include separate divisions located on the territory of the Russian Federation are subject to registration with the tax authorities at the location of each of their separate divisions.

When to open a separate division

- Sending an application via telecommunication channels is possible if the general director has previously generated an electronic signature at the tax office.

- A letter with application S-09-3-1 sent via Russian Post must have a receipt confirmation.

- After 5 days you will receive a notification about the registration of the OP.

- Within one month, submit information about opening an OP to the Pension Fund branch at the place of registration of the company. Required documents: application in any form, notarized copies of the certificate of state registration of the legal entity and its registration with extra-budgetary funds, order to create a remote unit.

- If the branch is opening its own account, register the OP with the local pension fund.

Opening a separate division is necessary, for example, to register a cash register at a location other than the legal address. When submitting your application, we advise you to take with you a copy on which the tax office will make a note that the application has been accepted for processing. Confirmation of the opening of a separate subdivision can be collected from the tax office of the district where the separate subdivision was opened. When opening, your branch will also be assigned a checkpoint. An example of a notification about registering an organization with the tax authority (form No. 1-3-Accounting KND Code 1121029): Deadlines for registering a separate division A separate division must be registered no later than 1 month from the date of its formation. A separate enterprise is registered by the tax office within 5-7 working days.

Right to a reason code

Absolutely any business entity receives certain codes, as stated in the law. They are needed for the following purposes:

- identification in classification systems according to various criteria (territory, industry, etc.);

- maintaining records of subjects (for the purposes of taxes and insurance premiums, statistics, etc.).

And if for the main organization codes are an integral attribute, then separate divisions may have their own or coincide with the codes of the main organization.

Any organization must register with the tax service before starting its activities. This is enshrined in paragraph 1 of Article 83 of the Tax Code of the Russian Federation. But not everyone understands which inspectorate they need to contact in order to register. Belonging to the Federal Tax Service can be determined:

- the address of the organization itself (for an individual entrepreneur - the address of his permanent registration);

- the location of its real estate;

- OP's address.

The organization is required to register with the tax office at the address not only of the head office, but also of all separate divisions.

The company must inform the tax authorities about the opening of a separate division. After this, it is registered.

Despite the fact that the parent organization and all its separate divisions have one TIN, KPP is assigned to each of them. This will happen even if the organization does not submit an application to the checkpoint of a separate unit.

Then information about the checkpoint of a separate division is sent from the local tax office to the one where the parent company is registered.

According to the rules on TIN (approved by order of the Federal Tax Service dated June 29, 2012 No. ММВ-7-6/435), when creating any form of a separate unit, it must be assigned a checkpoint.

How to open a separate division

It is important to note that no structural unit can be physically and legally located at the address of the main company. Such a structure must be separate from the parent company and geographically remote from it. Such a structure must have stationary workplaces with a period of operation of more than one calendar month (Article 11 of the Tax Code of the Russian Federation). A structural unit of a company can be a branch, a representative office or another separate division (Article 55 of the Civil Code of the Russian Federation and Article 11 of the Tax Code of the Russian Federation).

Documents are usually submitted to the Department of Registration and Accounting of Taxpayers, to the tax office at the place of registration of the legal entity (at the legal address of the enterprise). An application for registration must be submitted no later than 1 month after the opening of a separate unit.

Searching with a small amount of information

In some situations, searching on ports is complicated by the fact that the user does not have enough information about the enterprise. When query results are returned, a large number of options are displayed, which are then sorted through manually. It is also important to ensure that all names are written without quotation marks. When the search takes too long, it is best to contact the tax office at your place of residence directly. The client is required to write a statement indicating the search criteria. A request can be made for both a legal entity and an individual. When an organization wants to learn about its history, the search is free. In other cases, the cost of a search operation is 400 rubles, a more urgent search is 200 rubles. It is also possible to receive an electronic statement, but it will not be signed or stamped by the tax service.

Always check your counterparty using BIC, INN, and KPP. This will allow us to build profitable cooperation for both partners.

How to find out the checkpoint of a separate division of an organization

Checkpoint is one of the ways to identify an enterprise and its structural units. It is traditionally used as one of the details when drawing up forms, contracts, powers of attorney and other documents. In addition, this OP attribute is used in the invoice. The invoice form contains fields for indicating the code of the seller and the buyer; the place where the checkpoint of a separate division is indicated in the invoice is marked with red arrows.

According to Article 83 of the Tax Code, separate divisions (hereinafter referred to as OP) are subject to tax control at the location of each of them. The stop is carried out by the department itself based on a message from the enterprise about the opening of an OP. Article 23 of the Tax Code of the Russian Federation, in addition to the obligation to register, sets an enterprise a period of one month for registering an OP.

Basic codes

When the registration of an OP has occurred, it may be assigned special codes. But the parent organization and all its divisions will still have the same TIN. This is due to the fact that the OP is not a legal entity.

Thus, you can find out the checkpoint of a separate division using the TIN of the main enterprise by applying for an extract from the Unified State Register of Legal Entities.

The judgment that there is no need to obtain a separate TIN is based on an analysis of the regulatory document regulating the procedure for obtaining, using and changing the TIN (approved by order of the Ministry of Taxes of Russia dated 03.03.2004 No. BG-3-09/178). And it is valid only when registering or deregistering legal entities and individuals.

A TIN can only be assigned to the organization itself. None of its divisions, including separate ones, have the right to receive their own TIN. Only upon initial registration with the Federal Tax Service does the organization receive its TIN at the place of registration.