What is a power of attorney for the right to sign documents, and what types exist?

The Civil Code states that a trust document can be considered official only if it is drawn up on paper. Here it is necessary to note the powers and duties assigned to the attorney. One party transfers this document to the other to present a power of attorney to a third party. Here you need to indicate which documentation is allowed to be signed by an authorized employee. The power of attorney has three options:

- One-time . It is used in cases where there is a need to carry out a specific transaction by proxy. After signing the document, this power of attorney ceases to be valid automatically. It may indicate the period after which the document will be cancelled. It is also allowed to enter an action after which the power of attorney will automatically lose its legal force.

- Special . This power of attorney can be used more than once. Typically, this type is drawn up for signing various documents within the same order.

- General . This document gives the attorney broad powers. If he must represent the interests of his company in various areas, he cannot do without a general. The owner is allowed to work with important documentation when making large transactions.

( Video : “How to transfer the right to sign primary documents”)

Who and to whom can issue a power of attorney for the right to sign

Absolutely anyone has this opportunity. The document can be issued by a private person. But such situations are not common compared to organizations. Most often, a power of attorney is issued by a legal entity. Employees of the organization usually act as attorneys. Often these are responsible persons, for example, an accountant, head of a department, etc. Although the function of an attorney can be performed by any employee. Filling out the form is often the responsibility of the secretary. After entering the data, the form is submitted to the director for signature.

Cases cannot be excluded when the representative himself is forced to write out a power of attorney. However, these powers can only be granted by the manager. Permission to transfer is indicated in the permit document. Of course, the head of the company is allowed to do this. But this opportunity is used extremely rarely. This is due to the fact that the document authorizing the transfer of trust must be notarized. Naturally, in this case the director will have to personally visit the notary’s office, which is not always convenient.

If a transfer of authority is needed, the manager just needs to issue a new document for the second employee. In order not to think about it, you need to write out a power of attorney; several of them are issued at once, for each of the employees. Typically, the responsibilities of each employee are spelled out here.

Power of attorney to manage a bank account

The paper provides the opportunity for the official representative to dispose of the deposit or r/account at his own discretion in the interests of the principal. The document is prepared in two ways.

Design methods:

- In a financial company;

- At the notary's office.

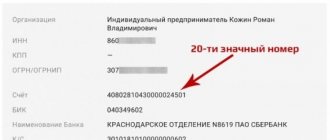

A power of attorney can be one-time or special. Any of them contains the exact information of the originator and the authorized person, the name of the organization, account number, and a list of operations that the authorized person can carry out.

One principal may have several legal representatives. The main requirement is the sanity and legal capacity of each of them. Their number is not limited by law.

If an organization has several details, then a power of attorney is issued for the disposal of each of them.

If several accounts are registered in one institution, then a single power of attorney is issued, which lists the current accounts. The paper comes into force only when employees of the financial company verify its validity. To do this, they send a request to the notary office where the registration took place.

Main features of a power of attorney for the right to sign

It is customary for this power of attorney to be confirmed by a notary. It is usually used to receive goods, equipment, and other valuables transferred between partner companies. But under certain circumstances, you cannot do without visiting a notary. For example, such a need arises when a representative plans to visit the police, court, and various budget institutions. Sometimes an organization asks the manager to draw up a notarized power of attorney. This happens when the director of the company cannot appear in person, and his representative will take part in a transaction for a fairly large amount.

As for the filling rules, here you can use a template approved by the head of the company, or simply draw up a document on a sheet of paper. Here you can also use computer typing, or filling out the document manually. Regardless of which option was chosen, a live autograph of the manager is required. Do not forget that the more powers the attorney has, the more information is provided.

How to write a power of attorney for the right to sign documents

When filling out the form, you need to take into account all the important information:

- Document number assigned by internal document flow;

- Name;

- Date and place of compilation;

- Information about the granting organization;

- Information about the general director;

- Full information about the representative;

- Validity;

- Documents permitted for signature;

- Is a representative allowed to draw up a deed of power for third parties;

- Signatures with transcripts, date of completion.

The law does not provide for the attorney's autograph to be present here. In fact, he is simply assigned certain responsibilities and that’s it. But if you carefully understand this issue, you can understand that if the attorney is not aware of such actions, or he does not want to accept such obligations, then there is simply no point in drawing up a power of attorney. That is why the attorney’s signature is usually affixed to the power of attorney. This means that the employee assumes certain obligations.

How to compose correctly

The power of attorney agreement for signing invoices is drawn up by the company’s in-house lawyer or an invited specialist. In the second case, a legal professional will charge an appropriate fee for processing the document, and this must be taken into account.

The power of attorney template for signing accounts must be drawn up in the presence of both parties - the principal and the representative. Since the paper concerns financial issues, the assistance of the organization’s chief accountant is also necessary.

The completed power of attorney form for signing accounts is given to the director of the company for signature. It must also be signed by the person to whom the authority is transferred.

How to apply

When the head of the company is going to entrust the right of signing to one of the employees, he first issues a corresponding order. Based on it, the secretary begins to fill out the power of attorney, entering into it the necessary information. The document is then submitted to the director for verification and signature. Many companies use letterhead for this purpose, although this is optional.

There are no strict rules for the preparation of this document. You just need to fill in all the important details. Essentially, this is a written confirmation that an employee is authorized to perform the duties of a manager. Here you should indicate information about the attorney in such a way that the person reading the document can easily identify him.

Instructions for filling

As already mentioned, there are no special requirements for drawing up the document. But don’t forget that this is business documentation, after all, so when drafting it, it is recommended to adhere to generally accepted rules:

- The business style of the document requires you to fill out a “header” here, which indicates the name of the company and detailed information about it. Legal form and address at which the organization is registered;

- Below, in the center of the line, the name of the document is written, namely, “Power of Attorney”. Typically, the document flow of an enterprise assigns a number to the power of attorney, which is written in the document. The date of issue and city are also indicated here;

- Then the text of the power of attorney itself is written. Here the position of the manager, his full name and passport details are noted. It is worth indicating which document gives him the right to occupy a leadership position;

- Below is information about the principal;

- The following are the powers assigned. If there are a lot of them, you can indicate them in bullet points for better perception. It would not be amiss to list exactly what documentation the employee is allowed to sign;

- The validity period is indicated. You can simply indicate that the power of attorney will become invalid after some event, for example, after completing a certain task. It is also allowed to mark a specific date until which the document can be used;

- It would be useful to note that the attorney has the right to draw up a power of attorney, or he does not have such powers;

- At the bottom of the document, both parties sign with transcripts.

Power of attorney for depositing money into the Current Account

Peculiarities:

- Can be one-time or long-term.

- Compiled by the manager of a commercial organization for his employees.

Since replenishing accounts is a financial transaction that involves financial responsibility, such powers are vested not only on the basis of a power of attorney.

An agreement is drawn up within the organization, under the terms of which the employee is assigned financial responsibility.

It lists the list of operations that the employee has the right to perform, and the liability that he will incur as a result of non-compliance with the clauses of the contract.

Sample power of attorney for the right to sign documents

Power of attorney for the right to sign documents for the director

Power of attorney for the right to sign primary documents

Power of attorney for the right to sign documents of an individual

Power of attorney for the right to sign documents as an individual entrepreneur

Power of attorney for registration of bank details

To determine the algorithm of actions for issuing a power of attorney for registering bank details, you need to find out the conditions under which financial organizations provide such a service.

In most cases, an application for account registration can be submitted via the Internet. You will have to appear in person to open an account.

The financial organization assumes permission for the following actions by proxy:

- Providing documentation;

- Signing an agreement to use the services of a financial organization;

- Signing papers;

- Replenishment of balance.

In order for the account to function, it is necessary to top up the balance with an amount equal to the cost of service.

The official representative must provide a passport when registering bank details.

An individual is not considered by a credit institution as a representative if the details are registered in the name of a private entrepreneur. He will have to present an identification document and a document confirming the status of a businessman (individual entrepreneur, for example).

Duration of power of attorney

When filling out a document, it is customary to indicate its validity period. However, this cannot be said to be mandatory. Even if it is absent, the document will also be considered valid. However, in this case, its validity period is automatically equal to one year. The period starts from the date of registration. Naturally, if it is not indicated, the document is considered invalid. You can indicate not only the date, but also the period during which the document has legal force.

You also need to know that regardless of what period is specified in the document, the principal is allowed to cancel its validity at any time. To do this, you just need to inform your authorized representative about your intention and take the document from him. If the power of attorney was notarized, its revocation should also be executed with the help of a notary. There is no need to explain the reason for your decision. It is advisable to notify not only the representative, but also the persons to whom this document was presented, about the cancellation of the power of attorney.

There are also certain circumstances under which the power of attorney automatically loses its legal force:

- The person who wrote the power of attorney has died;

- Death of a representative;

- The company was declared invalid and liquidated;

- Changes in the details of the organization;

- Dismissal of an authorized employee, or change of his position;

- The manager changed his position or resigned.

A power of attorney is quite important not only for the head of a company or a private entrepreneur. It is possible that a private individual may also need it. It is advisable that even an ordinary person at least have an idea of how to correctly draw up documentation of this kind. Often this document gives quite serious powers. Therefore, experts recommend almost always having it certified by a notary. Today the cost of such services does not exceed 2000 rubles. Depending on the region of registration, the price of notary services may vary.