In 2021, insurers submit calculations in Form 4-FSS for contributions for “injuries” to the Social Insurance Fund. From the beginning of 2021, sections on insurance premiums for “temporary disability and maternity” have been excluded from the Calculation - this information is included in the calculation of insurance premiums, which is submitted to the Federal Tax Service.

In this article, we will look at what form 4-FSS for the 1st quarter of 2018 will be filled out by policyholders, within what time frame it must be submitted to the FSS, and will also provide a sample for filling it out.

4-FSS 1st quarter 2021 - due date

All organizations, as well as entrepreneurs, are required to submit quarterly form 4-FSS to social insurance, except for individual entrepreneurs without employees who are not registered with the Social Insurance Fund as policyholders.

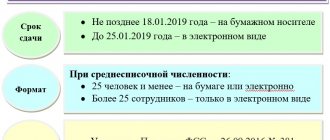

The reporting periods based on the results of which the Calculation is compiled are 1st quarter, half a year, 9 months and a year. The deadline for submitting 4-FSS for the 1st quarter, as well as for other periods, depends on the number of employees for whom contributions for “injury” are deducted, and on the form of submission:

- if the average number of employees in 2021 exceeded 25 people, in 2021 you can only report to the Social Insurance Fund electronically. Electronically 4-FSS is submitted by the policyholder no later than the 25th day of the month following the reporting period;

- if the average number of employees last year did not exceed 25 people, then submit a 4-FSS report for the 1st quarter of 2021. and subsequent reporting periods are allowed in “paper” form. The deadline for submitting the Calculation “on paper” is no later than the 20th day of the month following the reporting period.

For the Calculation of 4-FSS for the 1st quarter, the deadlines for submission in 2021 will be as follows:

- electronically – until April 25, 2018 inclusive;

- “on paper” - until April 20, 2018 inclusive.

Are there sanctions for late reporting?

If the report is submitted later than the established deadline, the policyholder will face a fine of 5% of the unpaid premiums for the last quarter for each overdue month (full and incomplete), but not more than 30% of the established amount. If the report is not submitted, but insurance premiums have been paid or not accrued, the minimum amount of sanctions will be 1 thousand rubles.

We recommend that you do not leave the payment until the last day, since the social insurance fund has the right to refuse to accept it. The grounds for such a refusal are listed in clause 16 of the FSS Administrative Regulations, approved. by order of the Ministry of Labor of the Russian Federation dated March 20, 2017 No. 288n:

- The calculation is presented on a form different from that established by Order of the Social Insurance Fund dated September 26, 2016 No. 381.

- The report is submitted by an unauthorized person.

- The electronic report file is signed with an invalid enhanced digital signature.

Form 4-FSS for the 1st quarter of 2021: general requirements for preparation

“Paper” Calculation 4-FSS can be filled out either manually or on a computer. However, you cannot use colored inks other than blue and black. All text fields must be filled in block letters.

Each line/column is intended to reflect only one digital indicator. If there is no data to reflect, the corresponding field is crossed out. All monetary indicators are indicated in rubles and kopecks.

Having discovered an error when submitting the 4-FSS for the 1st quarter of 2021, carefully cross out the incorrect value, enter the correct indicator next to it, and certify the correction with your signature and seal (if any) indicating the date. The use of corrective agents for corrections is prohibited.

All pages are numbered. On each page of the 4-FSS report for the 1st quarter of 2021, the signature of the policyholder (his representative) and the date of signing are placed.

Methods for filling out the calculation

Filling out 4-FSS in 2021 is possible electronically or on paper. The second method is used by companies whose average number of employees is no more than 25 people. It assumes that data is entered using Word, a specialized service, or by hand in legible block letters. Next, the document is printed, certified by a handwritten signature of an authorized person of the company, and a seal imprint.

If the completed 4-FSS form is new and submitted on paper, you cannot use double-sided printing of the document. Corrections with a corrector or blade are prohibited. If there is a need to eliminate an error, incorrect data is crossed out and certified with the handwritten signature of the head of the company (or other official) and its seal.

If the report is submitted electronically, you can use specialized programs for filling out 4-FSS, for example, 1C or “Kontur”. The advantage of this option is that such services automatically control the document for the absence of internal errors, contradictions, and compliance with the formal requirements of the Fund.

According to the provisions of Order 381, regardless of its economic situation, the company is obliged to include at least four sections in the calculation: title page, tables 1, 2, 5. The remaining parts of the report are filled out optionally, if the company has data to indicate in them.

How to fill out 4-FSS for the 1st quarter of 2021.

The procedure for filling out Form 4-FSS for the 1st quarter of 2021 is the same as last year - it is described in detail in Appendix No. 2 to FSS Order No. 381. Features of filling out the Calculation for policyholders in the regions where the FSS pilot project operates are given in the FSS Order RF dated March 28, 2017 No. 114. In our publications, we have more than once given a detailed description of the process of filling out the Calculation, for example, in this article.

When filling out the title page of form 4-FSS for the 1st quarter of 2021, pay attention to the following points:

Reporting period code - for the 1st quarter the code is “03”, and the calendar year is “2018”. For the initial Calculation, indicate the adjustment code - “000”, and if you need to submit an “adjustment”, in this field put the serial number of the updated calculation “001”, “002”, etc.

Company name or full name. IP is written in full without abbreviations. In addition to the address and details of the policyholder, the main OKVED code is indicated on the title page (from the second year of activity, the code confirmed by the policyholder in the Social Insurance Fund is indicated).

You can find and download a completed sample for 4-FSS for the 1st quarter of 2021 at the end of this article.

For the period from the beginning of the year, only the average number of employees must be indicated, and the number of disabled employees or those who work in “harmful and dangerous” conditions is reflected as of the reporting date - as of March 31, 2018.

After completing the Calculation, indicate the total number of its pages and the number of pages of attachments on the title page.

For 4-FSS for the 1st quarter of 2021, the calculation form must contain, in addition to the title page, the required sections:

- table 1 with calculation of the base for contributions,

- table 2, in which contributions for “injuries” are calculated,

- Table 5, about the special assessment of working conditions.

In the listed composition, 4-FSS reporting for the 1st quarter of 2021 must be submitted even in the complete absence of indicators (for example, when the enterprise has no employees, and its director, being the only founder, does not pay his own salary).

You need to fill out the remaining sections of Form 4-FSS for the 1st quarter of 2021 in the following cases:

- table 1.1 - filled out by policyholders who in the 1st quarter of 2018 sent their employees to third-party employers for temporary work (clause 2.1 of Article 22 of Law No. 125-FZ of July 24, 1998);

- table 3 - if in the 1st quarter of 2021 sick leave related to injuries and occupational diseases of employees was paid, if employees were paid leave for sanatorium-resort treatment, or when the insurer participated in the financing of preventive measures;

- table 4 - if industrial accidents or occupational diseases occurred during the reporting period.

If the policyholder does not have the data to fill out these tables, then they do not need to be presented as part of the Calculation.

How to send a report to the fund

You can submit reports to the fund by sending a document by mail or telecommunication channels (VLSI, Kontur-Extern, AstralReport) or by going to the FSS yourself and handing over the completed report to the insurance inspector assigned to your organization. Of course, the best option is to submit the report yourself, since by being present in person, you will be able to explain and comment on the controversial situation. After the inspector accepts the documents, you will have one copy of the report with the seal of the insurance authority, confirming the transfer of the report.

Filling out 4-FSS 1st quarter 2021: example

Let's look at the following example, filling out form 4-FSS for the 1st quarter of 2021.

At Almaz LLC in the 1st quarter of 2021, the amount of payments to employees amounted to 900,000 rubles, including: in January 300,000 rubles, of which 5,000 rubles. – non-contributory financial assistance (included in the list of clause 1 of Article 20.2 of Law No. 125-FZ of July 24, 1998); in February and March 300,000 rubles were paid. taxable remuneration. At the beginning of 2021, there is an unpaid debt on contributions for December 2021 in the amount of 600 rubles.

In the 1st quarter, Almaz LLC transferred to the Social Insurance Fund: for December 2021 - 600 rubles. (subclause No. 5 of 01/09/2018); for January 2021 – 590 rub. (clause No. 82 dated 02/02/2018) and for February 2021 – 600 rubles. (subclause No. 102 of 03/02/2018).

Insurance rate – 0.2%. There was no special assessment of working conditions, and there were no payments for “injuries” or occupational diseases.

What to pay attention to when filling out the report

Title page

Carefully fill out the “Average number of employees” indicator.

We remind you that the SSC does not include pregnant employees, employees who went on maternity leave, and other categories of employees specified in clause 2.4.1. Order of Rosstat dated November 27, 2019 No. 711.

Table 1

Line 1 contains information about payments to staff for the reporting period on an accrual basis.

All report totals are indicated in rubles and kopecks.

Line 2 reflects amounts that are not subject to contributions. For example: payment to an employee on sick leave due to illness for the first three days of illness.

In line 3, the base for calculating contributions is calculated as the difference between lines 1 and 2.

The rate of insurance premiums for injuries is indicated taking into account all discounts and allowances (if any).

An example of how sick leave is reflected in Table 1:

The company has 4 employees. The monthly wage fund is 100 thousand rubles (amounts are rounded for clarity of calculations). In January, one of the employees was sick. As a result, the total amount of payments for this month amounted to 98 thousand rubles, including sick leave benefits for the first three days of illness - 3 thousand rubles. The company applies a standard contribution rate of 0.2%.

Table 1 will be filled out like this:

table 2

The table reflects information on accrued and paid contributions for the 1st quarter of 2021.

Line 1 indicates the debt at the beginning of the year. And in line 19 the debt at the end of the 1st quarter.

Please note: in 2021, due to the transition to direct payments, line 15 no longer needs to be filled out.

Example of filling out table 2:

Drawing up a payment order for the transfer of contributions to the Social Insurance Fund NS and PZ

The Table shows the procedure for filling out the fields of the payment order when paying monthly insurance premiums to the Social Insurance Fund for National Insurance and Social Security:

Attention! Details for payment of insurance contributions must be found in your Social Insurance Fund or on the official websites of the Social Insurance Fund. For Moscow, you can use the website www.mrofss.ru

Sample payment order for payment of contributions to the Social Insurance Fund for compulsory social insurance from the National Tax Service in production and labor protection

On the PROFBUKH8 website you can read other free articles and video tutorials on the 1C Accounting 8.3 (8.2) configuration:

Full list of our offers:

Please rate this article:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?