Advantages of switching to simplified tax system

For small enterprises, the use of “simplified” is, as a rule, quite profitable. There are several reasons for this.

1. The tax burden under this special regime is very gentle. After all, the company does not need to transfer such (unaffordable for many) budget payments as profit tax, VAT and property tax (however, there are certain exceptions - see clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

2. The ability to choose the object of taxation (“income” or “income minus expenses”), which allows the company to adapt the fiscal burden to the indicators of its business activities. Moreover, if the company made a mistake in its choice, the object of taxation can then be changed (from the beginning of the new calendar year).

3. Not so high tax rates (6 and 15 percent), which regional authorities can also lower (Article 346.20 of the Tax Code of the Russian Federation). It must be said that many subjects of the Russian Federation actively use this right (for example, in the capital, a 10 percent rate is provided for a number of “income-expenditure” simplifications - Moscow Law No. 41 dated October 7, 2009).

4. The cost of fixed assets and intangible assets acquired during the period of application of the simplified tax system is included in expenses during the year (clauses 1 and 2 of clause 3 of Article 346.16 of the Code, letter of the Ministry of Finance of the Russian Federation dated June 14, 2017 No. 03-11-11/36922 ). That is, much faster than in the general mode.

5. Tax accounting of a company using the simplified tax system is carried out in a book of income and expenses, which is quite simple to fill out and does not have to be certified by the Federal Tax Service. And the declaration is presented as “simplified” only based on the results of the tax period (that is, the calendar year), which also cannot but arouse interest.

Recently, legislators significantly increased the “simplified” limits, which makes it possible for a much larger number of organizations to apply this special regime next year. Let's talk about how to competently switch to the simplified tax system and what nuances should be kept in mind.

We are switching to the simplified tax system in 2021

The simplified taxation system is a legal way of tax optimization, because the simplified taxation system allows you to save on income tax and VAT. It is important to take into account the specifics of the transition to the simplified tax system, including the restoration of VAT.

Before switching to the simplified tax system, you need to understand whether you meet the requirements established by tax legislation.

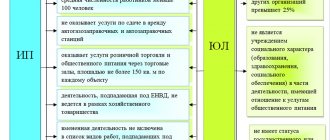

To apply the simplified tax system, certain conditions must be met:

Employees < 100 people

Income < 150 million rubles.

Residual value of fixed assets < 150 million rubles.

Separate conditions for organizations:

- the share of participation of other organizations in it cannot exceed 25%;

- prohibition of the use of the simplified tax system for organizations that have branches;

- An organization has the right to switch to the simplified tax system if, based on the results of nine months of the year in which the organization submits a notice of transition, its income does not exceed 112.5 million rubles. (Article 346.12 of the Tax Code of the Russian Federation).

Secondly, you need to understand at what point it is possible to switch to the simplified tax system.

If the taxpayer used UTII, but this regime was abolished, then it is possible to switch to the simplified tax system from the month in which the obligation to pay the single tax ceased (paragraph 2, clause 2, article 346.13 of the Tax Code of the Russian Federation).

If the taxpayer used the general taxation system, then in this case the simplified taxation system can be applied from January 1, 2021 (clause 1 of article 346.13, clause 1 of article 346.19 of the Tax Code of the Russian Federation).

GOOD TO KNOW

The transition of taxpayers to the simplified tax system is carried out through a notification procedure. To do this, no later than December 31 of the year preceding the year from which taxpayers switch to the simplified tax system, a notification must be submitted to the tax authority at their location.

Thirdly, it is important to write an application to the Federal Tax Service.

Let's give an example of a statement.

Notification of the transition to a simplified taxation system. Submitted upon transition to the simplified tax system from OSN, Unified Agricultural Tax. Form No. 26.2-1

What should you pay attention to?

The application must indicate:

- the amount of your income as of October 1 of the year in which the notification is submitted;

- the residual value of fixed assets as of October 1 of the year in which the notification is submitted.

If you plan to switch to the “simplified system” from the new year, then you submit the application no later than December 31 of the year preceding the year from which you plan to apply the simplified tax system.

Fourthly, a notification must be sent to the tax authority at the place of registration.

An application can be submitted:

- personally;

- electronic;

- by mail.

IMPORTANT IN WORK

The taxpayer, before submitting a notice of transition to the simplified tax system, must assess whether all the criteria established by the Tax Code of the Russian Federation are met to allow the application of this special tax regime.

Restoration of VAT upon transition to the simplified tax system

According to the rule formulated in Art. 170 of the Tax Code of the Russian Federation, when a taxpayer switches to special tax regimes, the amounts of tax accepted for deduction by the taxpayer on goods (works, services), including fixed assets and intangible assets, and property rights in the manner prescribed by this chapter, are subject to restoration in the tax period , preceding the transition to the indicated modes.

POSITION OF THE MINISTRY OF FINANCE

When a taxpayer switches to a simplified taxation system, the amounts of value added tax accepted for deduction by the taxpayer on fixed assets are subject to restoration in the tax period preceding the transition to a simplified taxation system. These provisions apply to persons who are taxpayers of value added tax.

— Letter dated January 12, 2017 No. 03-07-11/536.

Accordingly, the question arises: how should VAT be restored?

Firstly, it is necessary to understand in respect of which property and intangible assets it will be necessary to restore VAT.

Secondly, it is necessary to calculate the amount of tax that is subject to restoration to the budget.

If you purchased inventories or goods, then the amount of VAT will be equal directly to the amount that you took for deduction.

If you bought a fixed asset or intangible asset, then use the formula:

VAT to be recovered = VAT to be deducted x on book book value : book cost

Amounts of value added tax paid on goods (work, services) used by organizations that have switched to a simplified taxation system when carrying out operations for the sale of goods (work, services) not subject to value added tax are not subject to deduction (letter from the Ministry of Finance of the Russian Federation dated 04/01/2010 No. 03-03-06/1/205).

Upon receipt of an advance payment for the upcoming shipment of goods, the seller is obliged to calculate and pay the corresponding amount of tax to the budget (clause 2, clause 1, article 167, clause 1, article 168, clause 1, article 173 of the Tax Code of the Russian Federation). However, “advance” VAT is accepted for deduction only after the goods have been shipped to the buyer (clause 8 of Article 171, clause 6 of Article 172 of the Tax Code of the Russian Federation). Obviously, if this happens after the transition to the simplified tax system, you can forget about the deduction, because it is applied only by VAT taxpayers, which the “simplified” ones are not.

Example 1. Shipment and payment were made in the same period before the transition to the simplified tax system.

IP Smirnov will switch to the simplified tax system from 2021. In December 2017, he shipped goods worth 118,000 rubles, including VAT of 18%, or 18,000 rubles. Payment for these products was received in the same month.

In this situation, the moment when the VAT tax base will arise will be in the fourth quarter of 2021. IP Smirnov will accrue VAT according to the general procedure in the fourth quarter of 2021, being on the general taxation system.

Example 2. Payment was made after the goods were shipped.

Under the same basic conditions, assume that payment for goods shipped in December 2021 was received only in January 2018.

Similar to the situation in the previous example, the tax base for VAT is formed in the fourth quarter of 2021, therefore, IP Smirnov will generally charge VAT in the fourth quarter of 2021, being on the general taxation system.

Example 3. Payment and shipment were made after the transition to the simplified tax system.

Individual Entrepreneur Smirnov, who is switching to the simplified tax system in 2021, shipped goods worth 118,000 rubles in January, payment for which was received in the same month.

There is no tax base for VAT in this case, since according to clause 2 of Art. 346.11 of the Tax Code of the Russian Federation, taxpayers using the simplified tax system are exempt from paying value added tax.

The third step will be additional payment of VAT to the budget.

The fourth step is to submit an updated VAT return.

POSITION OF THE MINISTRY OF FINANCE

The tax period for VAT is a quarter. Thus, the restoration of VAT amounts must be carried out in the last tax period before the transition to the simplified tax system, that is, in the fourth quarter of the year preceding the transition. If VAT in connection with the acquisition of property was not deducted for any reason, the taxpayer does not have the obligation to restore it.

— Letter dated February 16, 2012 No. 03-07-11/47.

Inventory balances and tax base

In terms of inventory, it is important to understand what inventory remains in our warehouse. This is necessary for correct accounting, as well as in order to correctly restore VAT.

Material expenses paid by these taxpayers before the transition to the simplified tax system for the purchase of raw materials and supplies, which are included in the balances of inventory items on the date of transition to the simplified tax system, are included in the expenses taken into account when calculating the tax base for the tax, as the balances of raw materials and materials are written off for production .

The amounts of taxes and fees paid by taxpayers after the transition to the simplified tax system for the period of application of the general taxation regime are included in the expenses taken into account when calculating the tax base for taxes in the reporting (tax) periods of their actual payment.

Expenses paid by taxpayers before the transition to the simplified tax system to pay for the cost of goods purchased for further sale, the sale of which will be carried out after the transition to the simplified tax system, are recognized as expenses taken into account when calculating the tax base for the tax on the date of receipt of income from the sale of these goods in the period of application of the simplified tax system.

If income from the sale of purchased but unpaid goods was actually received by taxpayers before the transition to the simplified tax system, the costs associated with the acquisition of such goods paid by them after the transition to the simplified taxation system are not subject to inclusion in the expenses taken into account when calculating the tax base for the tax. .

Insurance premium costs

Insurance premiums are paid under any taxation system. However, if we are talking about individual entrepreneurs, it is important to remember that entrepreneurs can reduce tax taking into account insurance premiums.

“Simplers” with the object of taxation “income” can reduce the calculated advance payments and the tax on insurance premiums from payments to their employees (mandatory insurance contributions). These include contributions (clause 1, clause 3.1, article 346.21 of the Tax Code of the Russian Federation):

1) for compulsory pension insurance (hereinafter referred to as compulsory pension insurance contributions);

2) for compulsory health insurance (hereinafter referred to as compulsory medical insurance contributions);

3) for compulsory social insurance in case of temporary disability and in connection with maternity (hereinafter referred to as VNIM);

4) for compulsory social insurance against accidents at work and occupational diseases (hereinafter referred to as contributions in case of injury).

POSITION OF THE MINISTRY OF FINANCE

When an organization transitions from a simplified taxation system with the object of taxation in the form of income to a general taxation regime, expenses in the form of insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance and compulsory social insurance against accidents at work and occupational diseases incurred in accordance with the legislation of the Russian Federation, accrued during the period of application of the simplified taxation system and paid after the transition to the general taxation regime, the organization has the right to take into account when calculating corporate income tax.

— Letter dated 05/03/2017 No. 03-11-06/2/26921.

Features Affecting Transition

There are a number of features that influence the transition to a simplified taxation system.

1. Voluntary and forced transition.

Oddly enough, the transition to “simplified language” can also be forced.

A change in the tax regime for a UTII payer can be either voluntary or compulsory. However, an organization or entrepreneur paying UTII can voluntarily switch to paying the simplified tax system only from the next calendar year.

A forced transfer from UTII is carried out if the taxpayer has lost the right to apply “imputation”.

When in practice the transition may be forced:

- if a regulatory legal act of representative bodies of municipal districts and city districts, laws of federal cities of Moscow and St. Petersburg (and now Sevastopol) on the taxation system in the form of a single tax on imputed income for certain types of activities will cancel this taxation regime in relation to activities carried out by the taxpayer type of business activity;

- if the UTII payer during the calendar year stopped conducting business activities subject to UTII and began to carry out another type of business activity.

2. Selecting an object of taxation.

Which object under the simplified taxation system is more appropriate to apply depends on the characteristics of the taxpayer’s activities, the amount of income and expenses. It should also be noted that local regulations of the regions of the Russian Federation can establish differentiated tax rates ranging from 5 to 15% depending on the categories of taxpayers or for the entire region, regardless of categories. Also, local authorities can set a differentiated rate for “income” up to 6%.

3. Features of reflecting income and expenses:

1) income is recognized in the amount of proceeds from the sale of goods (performance of work, provision of services, transfer of property rights) during the period of application of the simplified taxation system, payment (partial payment) of which was not made before the date of transition to calculating the tax base for income tax accrual basis;

2) expenses include expenses for the acquisition during the period of application of the simplified taxation system of goods (work, services, property rights) that were not paid (partially paid) by the taxpayer before the date of transition to calculating the tax base for income tax on the accrual basis, if otherwise not provided for in Chapter. 25 Tax Code of the Russian Federation.

When an organization transitions to a simplified taxation system with the object of taxation in the form of income reduced by the amount of expenses, tax accounting as of the date of such transition reflects the residual value of acquired (constructed, manufactured) fixed assets and acquired (created by the organization itself) intangible assets that are paid before transition to a simplified taxation system, in the form of the difference between the purchase price (construction, manufacturing, creation by the organization itself) and the amount of accrued depreciation.

4. Features of transition in the presence of separate structural divisions.

If you have a structural unit, it is possible to switch to the simplified tax system, but if you have a branch and representative office, it is not possible.

Regarding the application of the simplified tax system by organizations that have separate divisions, it should be remembered that in accordance with paragraph 3 of Art. 346.12 of the Tax Code of the Russian Federation does not have the right to apply this special regime to organizations that have branches and (or) representative offices. Since tax legislation does not contain a definition of the concepts “branch” and “representative office” for tax purposes, on the basis of Art. 11 of the Tax Code of the Russian Federation in such a situation, the institutions, concepts and terms of civil and other branches of legislation of the Russian Federation used in the Tax Code of the Russian Federation are applied in the meaning in which they are used in these branches of legislation, unless otherwise provided by the Tax Code of the Russian Federation.

POSITION OF THE MINISTRY OF FINANCE

Separate division - a separate division of an organization is any division territorially isolated from it, at the location of which stationary workplaces are equipped. Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division. In this case, a workplace is considered stationary if it is created for a period of more than one month. The territorial isolation of a subdivision from an organization is determined by an address different from the address of the specified organization.

— Letter dated August 18, 2015 No. 03-02-07/1/47702.

Limits and conditions for applying the simplified tax system

First, you need to understand whether the company can, in principle, switch to a simplified regime next year.

Thus, the company’s income for 9 months of 2021 (excluding VAT) should not exceed 112.5 million rubles (clause 2 of Article 346.12 of the Tax Code of the Russian Federation). For comparison, in order to switch to the simplified tax system from 2021, this figure for 9 months of 2021 should not exceed 59.805 million rubles (letter of the Ministry of Finance of the Russian Federation dated January 24, 2017 No. 03-11-06/2/3269).

Please note that until January 1, 2020, the use of the deflator coefficient for the purpose of calculating this standard is suspended. And one more nuance - to determine this limit, the amount of income from sales and non-operating income is used (Article 248 of the Tax Code of the Russian Federation).

One more threshold value must be observed: the accounting residual value of fixed assets as of January 1, 2018 should be no more than 150 million rubles. It is interesting that in this case we are talking only about those fixed assets that are subject to depreciation and are recognized as depreciable property in accordance with Chapter. 25 of the Tax Code of the Russian Federation (clause 16, clause 3, article 346.12 of the Code). That is, for example, land and other environmental management objects, objects of unfinished capital construction are not taken into account (Article 256 of the Tax Code of the Russian Federation).

Please note: exceeding the 150 million limit as of October 1 or the date of filing the notification is not an obstacle to the transition to the “simplified” system. The main thing is that the residual value of fixed assets does not exceed the legally established standard starting from 01/01/2018.

The general conditions for using the simplified version must also be met. Namely, the enterprise should not have branches, the average number of its employees should not exceed 100 people, and the maximum share of other companies in the authorized capital should be 25 percent. In addition, banks, insurers, non-state pension funds, pawnshops, government and budget institutions, as well as a number of other organizations are not entitled to operate on the simplified tax system.

Terms of use by entrepreneurs of the simplified tax system

In order to use the “simplified system” in running a business, the following conditions must be met:

- Number of personnel – up to 100 employees.

- Residual value of fixed assets – up to 150 million rubles.

- The maximum income is not a constant value.

- Participation shares of other companies – maximum 25%.

- Lack of branches and other separate structural units.

- The company does not relate to insurance, banking and other types of activities.

The size of the first two criteria remains unchanged for a long time. Regarding the amount of income earned, it is adjusted towards growth annually.

We notify tax authorities

To switch to the simplified tax system starting next year, an organization must submit a notification to the Federal Tax Service at its location no later than December 31 of the current year. However, December 31, 2021 falls on a day off - Sunday. This means, according to clause 7 of Art. 6.1 of the Tax Code of the Russian Federation, the deadline for filing a notification is postponed to the 1st working day of the next year - 01/09/2018. The validity of this conclusion is confirmed by the letter of the Ministry of Finance of the Russian Federation dated October 11, 2012 No. 03-11-06/3/70.

It is necessary to report a change in the special regime, since companies that did not promptly notify the tax authorities about the transition to the “simplified system” do not have the right to apply it (clause 19, paragraph 3, article 346.12 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated February 13, 2013 No. 03-11- 11/66). The fairness of this is illustrated by the latest verdict of the highest arbitrators - Ruling of the Supreme Court of the Russian Federation of September 29, 2017 No. 309-KG17-13365. Let's look at it in a little more detail.

A citizen who registered as an individual entrepreneur conscientiously applied the simplified tax system: submitted a declaration and transferred the tax to the budget. However, in the middle of the year, the fiscal authorities demanded a VAT return from him, and until it was submitted, they blocked the businessman’s bank account. The reason is that the individual entrepreneur did not submit a notification about the transition to the special regime before December 31 of the previous year, therefore, he does not have the right to the “simplified” regime.

It is interesting that the court of first instance supported the entrepreneur, pointing out that he actually applied the simplified tax system in the absence of objections from inspectors, which means that the requirement to work under the general regime is illegal. However, all subsequent authorities, including the RF Armed Forces, sided with the controllers, referring to the clear prescription of the norm of paragraphs. 19 clause 3 art. 346.12 of the Code. The same fact that a businessman submitted a simplified taxation system declaration, and the inspection accepted it, without any comments, does not indicate approval of the use of the “simplified tax” by the fiscal authorities. After all, the Federal Tax Service does not have the right to refuse to accept a declaration submitted by the payer (Article 80 of the Tax Code of the Russian Federation).

A similar point of view was expressed by the RF Supreme Court earlier (Determination No. 307-KG16-11322 dated September 20, 2016). The AS of the Moscow District also agrees with her (resolutions dated May 2, 2017 No. F05-3020/2017, dated April 27, 2016 No. F05-4624/2016). Detailed arguments in favor of the considered position can also be found in the Resolution of the AS of the West Siberian District dated December 10, 2014 No. F04-11632/2014.

It is important that in this case there is no need to submit other documents to the inspectorate besides the notification. The auditors also do not have the right to demand any additional information from the organization.

And one more thing - enterprises already operating under the simplified regime do not need to notify tax authorities about continuing to use it next year. This is exactly what the servants of Themis believe (Resolution of the Federal Antimonopoly Service of the Moscow District dated September 19, 2007, September 24, 2007 No. KA-A40/9540-07).

Please note that the transition to the simplified tax system during the year is impossible, including due to the emergence of new types of business activities for the company (letter of the Ministry of Finance of the Russian Federation dated April 21, 2014 No. 03-11-11/18274).

How to submit a notification to the Federal Tax Service

The notification can be submitted to the inspectorate (either or):

- on paper (the recommended form is approved by Order of the Federal Tax Service of the Russian Federation dated November 2, 2012 No. ММВ-7-3/ [email protected] ). Let us note that the company has the right to submit a notification in any form, taking into account the requirements of Art. Code 346.13;

- in electronic form (format approved by Order of the Federal Tax Service of the Russian Federation dated November 16, 2012 No. ММВ-7-6/ [email protected] ).

Let us pay attention to some features of filling out the notification form recommended by the fiscal authorities by an organization switching to the simplified tax system from the general tax regime. In the “Taxpayer Identification” field, enter “3”, and in the line “Switches to a simplified taxation system” - “1”. And do not forget that the amount of income for 9 months of this year is shown without VAT.

A dash is placed in empty lines of the notification. The document is signed by the head of the company and certified by its seal (if any).

In general, the form, consisting of only one page, is quite easy to fill out. There shouldn't be any difficulties with it.

The notification can be submitted to the Federal Tax Service in person, through an authorized representative, or sent by registered mail. In the first and second cases, the filing date will be the day the document is received by the secretariat or inspection office. In the latter - the day indicated on the postmark.

Please note that if the notification is submitted through a representative of the company, its lower field reflects the name of the document confirming the authority of this person. This document (a copy of it) should be attached to the notification.

How to correctly calculate the income limit

The amount containing the enterprise's income consists of two main parts. This is income from:

- implementation;

- non-realization.

VAT is not included in the marginal income.

VAT under simplified tax system

It is important not to make mistakes in calculating income. Not all of their types add up to the total income. Receipts are not taken into account:

- not related to entrepreneurship;

- from the sale of non-commercial real estate that was purchased before the entrepreneur changed his status;

- credit and borrowed funds;

- income from deposits.

Each individual type of business has certain characteristics. This means that the formation and limitation of the amount of income also has its own specifics. It consists of the following:

- When an enterprise currently uses only UTII, the transition to the simplified tax system from 2021 is possible without taking into account income restrictions. It does not apply to such taxpayers.

- Enterprises that combine UTII with SST include only income from activities related to the general regime in their allowable income.

- For individual entrepreneurs, the transfer of business to the simplified tax system occurs regardless of the amount of income. Individual entrepreneurs have the right to make the transition to the simplified tax system in 2021, without taking into account the size of their income. There is no specific income limit for them.

Which object to choose

The notification must indicate the selected object of taxation, the residual value of the fixed assets and the amount of income as of October 1, 2021.

Selecting a taxable object is the most important procedure for an organization. As a rule, the “income” object is more profitable if the company’s expenses are not so significant. If the costs are significant and at the same time it will be possible to reduce the base for the simplified tax system (remember that the list of “simplified” expenses is closed - Article 346.16 of the Tax Code of the Russian Federation), then it is more profitable to use the “income-expense simplification”.

The approximate benefit can be calculated by comparing the tax bases and rates of two simplified taxation system objects, from which it follows: if a company’s expenses are less than 60 percent of its income, it is better to choose the “income” object. If more, then there is an alternative option.

However, for a more accurate calculation, you should take into account a number of other factors, including what single tax rates are set for 2018, depending on the type of activity and category of taxpayer in your region. And only after a detailed analysis, record your choice in a notification.

What if the notification has already been submitted, but a little later the company decides to change the initially selected object of taxation? Then the company can (up to the above-mentioned deadline) submit to the Federal Tax Service a new notification with a different object of taxation, attaching a letter stating that the original one is canceled (letters of the Ministry of Finance of the Russian Federation dated October 14, 2015 No. 03-11-11/58878 and dated January 16, 2015 No. 03-11-06/2/813). If the deadline (in our case - 01/09/2018) is missed, then the company will be able to change the object only from the beginning of the new tax period, that is, from 2019. It will not be possible to do this during 2021 (clause 2 of Article 346.14 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation for Moscow dated 05/07/2009 No. 20-18/2/ [email protected] ).

In practice, there are cases when an organization actually applies a taxation object that is not specified in the notification. The Federal Tax Service will probably consider this unlawful and will recalculate the company’s tax liabilities with all the ensuing consequences. And the judges will most likely agree with the fiscals. For example, in the Resolution of the Sixth AAS dated 01.10.2014 No. 06AP-5107/2014 it is noted: the transition to a simplified regime, the choice of an object of taxation, despite its voluntary nature, is carried out by the payer not arbitrarily, but in compliance with the conditions and procedures clearly specified in Chapter. 26.2 Tax Code of the Russian Federation. And if an organization, in violation of the established procedure, actually changed the simplified tax system object, it will have to answer for it.

Rules for filling out the notification

The form is easy to fill out, it only fits on one page, but you need to know the mandatory requirements:

- Choose object of taxation. In business it is believed that if the company's expenses are more than 60% of her income, it is more profitable to choose “income minus expenses”, if less than 60% is “income”.

The taxpayer has the right to change the object of taxation every year. The tax authority must also be notified of this before December 31 of the previous year. If an organization uses an object that is not specified in the notification, officials may make additional tax assessments.

- Indicate the residual value of fixed assets and the amount of income as of October 1 of the current year.

- If a notification is submitted through a proxy, the application form must indicate a document confirming his authority and attach a copy of it.

- The notification form should be filled out in 2 copies. One is kept by the tax office, the second by the applicant (with a mark of acceptance). Tax inspectors often ask to provide them with both copies; in this case, you can make another copy.

Should I expect a reaction from inspectors?

The transition to the simplified tax system is of a notification nature. And they do not issue any special permission to use fiscal taxes. Therefore, an organization (IP) can conduct activities without receiving confirmation from the Federal Tax Service on the application of the simplified tax system (letter of the Ministry of Finance of the Russian Federation dated February 16, 2016 No. 03-11-11/8396).

At the same time, the taxpayer has the right at any time to send a request to his inspectorate to confirm the fact of his application of the simplified special regime. The recommended request form can be found in Appendix No. 6 to the Administrative Regulations, which was approved by Order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n. However, the request can also be made in any form.

The Federal Tax Service, in accordance with clause 93 of the Administrative Regulations, within 30 calendar days from the date of registration of the request, must send the payer an information letter in form 26.2-7 (approved by Order of the Federal Tax Service of the Russian Federation dated November 2, 2012 No. ММВ-7-3 / [email protected] ) . It also includes the date the payer submitted the notice of transition to the “simplified system” to the inspectorate - but nothing more.

Thus, all responsibility for compliance with the criteria necessary both for the transition to this special regime and for its further application lies entirely with the organization itself.

An independent reaction should be expected from inspectors only in one case: if the company violates the deadline for submitting a notification. Then officials will send a message to the enterprise in form 26.2-5 (approved by Order of the Federal Tax Service of the Russian Federation dated November 2, 2012 No. ММВ-7-3 / [email protected] ), meaning that it is impossible to use the “simplified approach”.

We wanted to switch to the simplified tax system, but then we changed our minds...

It happens that an organization that has expressed a desire to switch to the “simplified” system from next year and has submitted a notification to the Federal Tax Service, for some reason changes its mind and decides to remain in the general tax regime. What should you do in such a situation?

According to officials, the organization is obliged to notify fiscal officials of its new decision before January 15 of the year from which it was planned to apply the simplified tax system. A similar conclusion was made on the basis of clause 6 of Art. 346.13 of the Tax Code of the Russian Federation, despite the fact that this norm refers to payers who are already working under the “simplified tax system” and who want to switch to a different taxation regime from the beginning of the calendar year. So, if the company does not do this, it, according to the departments, will not be able to apply the OSN in 2021 (letter of the Ministry of Finance of the Russian Federation dated May 30, 2007 No. 03-11-02/154, sent for information and use in work by letter of the Federal Tax Service of the Russian Federation dated June 27 .2007 No. ХС-6-02/ [email protected] , letter of the Federal Tax Service of the Russian Federation dated July 19, 2011 No. ED-4-3/11587).

However, the servants of Themis do not support officials in this matter. Take, for example, the Resolution of the AS of the West Siberian District dated 05/06/2016 No. Ф04-1942/2016, which states: the taxpayer has the right to independently, in the absence of approval from the Federal Tax Service, change his decision and remain on the OSN, regardless of the reason, before the application of the simplified tax system begins. . The determining factor is the actual conduct of activities in accordance with the tax regime chosen from the beginning of the year.

In the Resolution of the FAS of the East Siberian District dated November 3, 2010 No. A33-2847/2010, the judges also emphasized: it is of legal significance that the taxpayer, having notified the inspectorate about the transition to the simplified tax system, did not begin to apply it, in fact working under the general tax regime, that is abandoned the “simplified” approach before using it. This approach is also shared by the Federal Antimonopoly Service of the North Caucasus District, which noted that only companies and entrepreneurs who have notified the Federal Tax Service about this and have actually switched to this tax regime are considered to have switched to the simplified tax system (Resolution dated March 14, 2014 No. A53-10176/2013).

However, in order to avoid unnecessary disputes with fiscal authorities, we advise you to notify them of a change in your initial decision. Fortunately, this is not a labor-intensive task, and can save a lot of time and nerves.

Basics of the simplified tax system

The use of the simplified tax system makes it possible to facilitate the preparation of reporting, and also reduces the number and amount of taxes paid. The transition to a simplified system exempts an enterprise from paying taxes such as VAT on profits and property, although there are a number of exceptions. Regional authorities have the right to independently reduce tax rates on the simplified tax system.

When submitting an application, an enterprise can choose an object of taxation

- "Income". Taxes are paid on all proceeds. The standard rate is 6% (at the regional level it can be reduced to 1%).

- "Income minus expenses." The tax rate is set at 15% , but regional authorities can set it at a rate from 5 to 15%. The difference between revenue and expenses is taken into account as the tax base. This means that the more expenses a company has, the less tax it will have to pay. The base is reduced only by the amount of expenses that are prescribed in Article 346.16 of the Tax Code of the Russian Federation. At the end of the year, it may turn out that the tax amount is less than 1% of the amount of income. In this case, you must pay the difference.

You can change the object of taxation starting next year.

In a simplified system, tax accounting must be kept in a ledger for accounting expenses and income , the form of which is approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n. The book does not need to be certified by the Federal Tax Service.

At the end of the reporting year, you must submit a tax return according to the simplified tax system : organizations - before March 31, individual entrepreneurs - until April 30 inclusive.