Businessmen are looking for ways to optimize the tax burden, but they forget that there are no legal methods of paying 500 rubles instead of 1000. If you can't pay less, then what is this article about? About how to do everything right and not pay more than you could.

In the article about “black” methods of tax optimization, we talked about what not to do so as not to get into trouble with the law, and today we’ll talk about how to legally reduce taxes.

Find out:

- How are the form of ownership and the amount of taxes related?

- How to optimize income tax

- Optimization tips for VAT payers

No time to read? Check out the article summary

Hiring self-employed

Starting in 2021, a new tax regime for self-employed citizens began to operate throughout the country. It allows many “private traders” to legalize their activities, but at the same time it is extremely inconvenient for reducing the company’s salary taxes. The following restrictions apply to the self-employed:

- The tax rate when working with individual entrepreneurs and legal entities is 6% of income (similar to the rate on the simplified tax system “Income”).

- A small list of activities - you cannot sell labeled and excisable products, as well as resell goods. It is prohibited to engage in intermediary activities, which means that it is impossible to conclude agency agreements with self-employed people.

- A small limit on annual income is 2.4 million rubles.

- It is impossible to provide services or perform work under civil contracts when the customer, in the past or present, is the employer of a self-employed person. You will be able to cooperate with your employer only 2 years after leaving the workforce.

Nevertheless, resorting to the services of the self-employed under a civil contract instead of registering an employee as a staff member is much more profitable. The employer does not need to submit unnecessary reports, pay personal income tax and contributions, and the costs of paying for specialist services can be included in expenses.

You can use this method of optimizing salary taxes only if the applicant has not previously been an employee of this company or individual entrepreneur, or if he has previously worked unofficially. But you shouldn’t abuse hiring the self-employed - you can come under close attention from tax authorities. If the Federal Tax Service seems dubious about numerous payments made by an employer to a specialist, the business owner may be summoned to the tax office for an interview.

Losses of the organization

In paragraph 2 of Article 265 of the Tax Code of the Russian Federation there is information that income tax can be reduced by writing off expenses for losses. If in the current reporting period you have only identified losses that the organization incurred earlier, they can be included in the expense item.

There are no restrictions regarding the amount of losses. Losses are extinguished in chronological order, starting with the oldest and ending with the most recent. If you suffered a loss in the current tax period, then, by law, you can carry the loss forward, but not more than 10 years.

Cooperation with individual entrepreneurs

This is still one of the most popular methods for optimizing payroll taxes. Although numerous court proceedings challenging contracts with individual entrepreneurs, as well as serious charges of splitting a company with the help of individual entrepreneurs and tax evasion prove this, this must be done very thoughtfully.

The benefit for the employer is that, for example, when collaborating with an individual entrepreneur on the simplified tax system “Income”, the tax amount will be only 6% of income plus mandatory annual contributions for compulsory health insurance of 32,448 rubles and for compulsory medical insurance 8,426 rubles. For an employee of an enterprise who began working as an individual entrepreneur, this is also beneficial - he most often receives the full amount of wages, and the taxes are reimbursed by the employer. However, in this case, the employee-entrepreneur is deprived of all guarantees provided for by the Labor Code.

If you thoughtlessly divide sequential business processes into the activities of different individual entrepreneurs or transfer all your employees to the status of entrepreneurs, you can receive fines and additional charges from the tax office. Engaging an individual entrepreneur must have business goals that are clear to tax authorities, and the entrepreneur must be independent of the customer. There should be no signs that the individual entrepreneur, together with full-time employees, daily performs his duties in the company’s office and uses the employer’s equipment and materials.

Algorithm for checking the legality of tax optimization. Tax inspector's opinion

- Every deal made must have a business purpose. Along the way, the tax is reduced - please, but business is at the forefront.

- The transaction price must be justified and must not contradict Chapter 40 of the Tax Code of the Russian Federation.

- Any transaction within a group of companies must fit into business logic.

- For each transaction, all documents must be drawn up: contracts, acts, invoices, invoices, etc.

- The parties entering into a transaction with a tax reduction effect must not be related.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

8-804-333-11-40 (We work throughout Russia)

It's fast and free!

IP manager

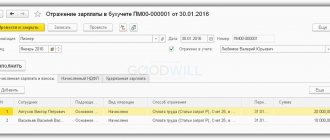

Companies on OSNO can hire an individual entrepreneur. Since these employees have fairly high salaries, the amount of salary taxes is quite large.

Similar to the previous method, you can reduce salary taxes if the manager is registered as an entrepreneur on the simplified tax system “Income” and is obliged to pay 6% of income. For example, if a hired manager receives 100,000 rubles a month, then the LLC is obliged to pay 30,000 rubles in insurance premiums for him every month. If the manager were a hired individual entrepreneur, then the insurance amounts would be equal to only 40,874 rubles per year.

Trademark fee

A trademark is a mandatory attribute of branding. It is created by professional designers, and then it is used everywhere: in advertising, on business cards, on products, indoors. Creating and using a trademark costs money. Have you included this item in your expenses? If not, this can be done in the current period. According to sub. 37 clause 1 art. 264 of the Tax Code of the Russian Federation, fees for the use of intellectual property can be considered legal expenses. There are several more items that are most often included in the expense item:

- purchasing rights to computer programs;

- purchasing a brand name under a license agreement;

- acquisition of rights to know-how.

In order to take into account all possible expenses associated with intellectual property, it is better to contact professional lawyers. In clause 3 of PBU 14/2000 “Accounting for intangible assets” there is information that the logo, as well as a number of other intellectual property objects, can be classified as intangible assets and costs can be deducted after their purchase or registration.

High director salary

In order not to pay salaries to several employees at once and not to pay taxes on each, you can pay for the services of one top manager. The essence of the method lies in the limits of insurance bases.

In 2021, the maximum base for insurance contributions for compulsory pension insurance is 1,465,000 rubles; if this amount is exceeded, a reduced rate is applied - 10% instead of the usual 22%. The payment limit for compulsory insurance in case of temporary disability is 966,000 rubles, and contributions for amounts exceeding the limit are not charged at all.

When using this method, you need to be able to convincingly prove to the tax authorities that the work of one employee is much more profitable for the company than hiring several qualified employees. It will also be necessary to prove that the top manager’s high pay is truly related to his unique abilities and extensive experience.

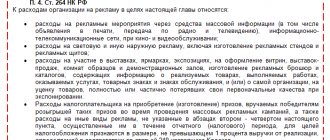

Marketing job

In sub. 15 clause 1 art. 264 of the Tax Code of the Russian Federation there is information about such an expense item as “expenses for consulting and other similar services.” If you work with a marketer or other consultants, you can include their fees as an expense and reduce your income taxes.

It is important that the work of a marketer and the payment for the research he does relate to the direct activities of the company. Another nuance is the relevance of the research. If the company is on the rise, justifying the need to analyze the market, study competitors and find new strategies for increasing profits will be more problematic.

How the level of payroll taxes is controlled

In 2021, the Federal Tax Service issued a Letter “On the work of the commission on the legalization of the tax base and the base for insurance premiums,” which regulates the activities of salary commissions. The purpose of such a body is to increase the amount of insurance premiums through the prevention of violations of tax legislation. It should be noted that the commission carries out its activities quite actively, so when optimizing salary deductions, businesses are recommended to:

- avoid a sharp increase in wages - this may be regarded as an attempt to legalize payments that were previously made “in envelopes”;

- avoid a sharp reduction in insurance premiums - if the level of personal income tax remains unchanged, this will be regarded as the introduction of a system for optimizing payroll taxes.

- In addition, many banks also monitor trends in salary payments. They are guided by the Bank of Russia Methodological Recommendations of 2021 and draw the attention of the Federal Tax Service to:

- paying employees wages below the subsistence level;

- the company or individual entrepreneur does not have payment for social, pension and health insurance contributions.

In recent years, there has been an increase in the number of workers who agree to be employed only with a “white” salary and a full social package. Therefore, many options for optimizing labor taxes can only be applied if there are good relationships with the team. In addition, social benefits will attract more qualified employees to the business and highlight vacancies in the labor market.

Thus, there are several ways to reduce the tax burden without resorting to illegal methods or salary “in an envelope”.

Rental and operation of premises

There are a number of expense items that are difficult to thoroughly check by the tax service. Companies take advantage of this and increase the amounts they supposedly spend on renting offices, removing garbage, or maintaining the premises in working order.

Artificially increasing costs is considered illegal, so it is better not to inflate prices three times, but to thoroughly check whether all costs related to the premises and their operation have been taken into account and included in the reporting. Professional lawyers will help you make correct calculations and go through all expense items.

VAT gaps

The Federal Tax Service draws the attention of inspectors to the fact that deductions cannot be withdrawn only because the counterparty has not paid taxes. This is only possible if it can be proven that the taxpayer knew about the violations committed by the counterparty and received benefits from it.

Reconcile invoices with counterparties and find discrepancies before tax

Try for free

At the same time, a taxpayer can know about such violations not only if there is interdependence and other control. Inspectors will make similar conclusions if they discover that the parties agreed on these actions and deliberately allowed a break.

Money is getting cheaper

Any modern accountant understands that the value of money paid in the future is not equal to the value of the same amount spent now.

By the present moment, based on the classical ideas about short-term and long-term periods, we mean the next 12 months. For those who left the institute long ago and do not have the opportunity to attend modern trainings and courses, we will remind you of the truth that if a company managed to delay the outflow of cash resources into the future, then it received two big pluses in its treasury of values: a) it will pay in the future less due to the factor of money depreciation over time (as a result of inflation);

b) the company currently has free cash that can be used to increase its internal value and other purposes more useful for the development of the company than paying taxes.

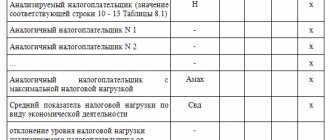

In our country, in addition to the temporary factor of the value of money, one more thing should be taken into account - we must try to “create” such reporting, the indicators of which will not attract undue attention from tax inspectors. Agree, not a single manager or accountant will be extremely happy to see representatives of the Federal Tax Service visiting them for a surprise inspection; not a single business executive will be attracted by the prospect of being questioned about jumps in the financial performance of the company. So our accountants work day and night during reporting periods so that the figures not only do not contradict the Tax Code, but also are not interesting to inspectors. Moreover, it is equally dangerous to show a sharp profit or a loss.

The dangers of false information

The bank may refuse monetary transactions or the issuance of a loan.

In the bank account agreement, the client undertakes to indicate reliable information, in particular about the location. If the bank becomes aware that the organization’s address is different, it will refuse the transaction or terminate the agreement through the court. If the actual and legal addresses of the company differ, the bank will closely monitor monetary transactions and transmit information to Rosfinmonitoring. An inaccurate address in the Unified State Register of Legal Entities means the risk of not receiving correspondence, including from government agencies. Any agency, if necessary, sends a letter to a legal entity, looks for its address in the Unified State Register of Legal Entities. It is assumed that the organization will receive mail at the address indicated in the state register of legal entities. If a company misses important information, it will not be able to provide an answer. For example, without receiving a notice to draw up an administrative protocol or a subpoena, an organization or its official will not be able to protect its interests. Or, having not received a requirement from a government agency, a legal entity cannot fulfill it on time and may be fined. And it is the management of the legal entity that is to blame for the failure to receive correspondence. For providing false information, the director of the company faces from 5 to 10 thousand rubles. fine under Art. 14.25 Code of Administrative Offenses of the Russian Federation. For a repeated offense, the Federal Tax Service may disqualify management from 1 to 3 years in court.

The presence of false information is grounds for liquidation of the enterprise. The tax office goes to court with a claim if the company cannot be found at its address indicated in the Unified State Register of Legal Entities. An organization is excluded from the Unified State Register of Legal Entities six months after entering information about unreliability.

The director or founder of a company who owns half of the shares in it will not be able to open a new organization if the Unified State Register of Legal Entities lists an organization in which this person is a director or founder.

Bonus costs

Of course, there is an area in which company management can show its own unique creativity in minimizing the tax burden - this is the area of expenses that reduce taxable income. Additional costs will not free up free funds here and now, but will undoubtedly increase the value of the company. Let's consider several interesting, in our opinion, options.

The company can reduce taxable profit for expenses associated with personnel training if such training is economically justified and feasible, that is, if employees can apply the knowledge acquired during the training process in their professional activities. Do you need an assistant payroll accountant, but an administrative assistant with a higher education has been asking for a long time to be transferred to the financial service of the company? So, instead of paying an agency to recruit a new specialist, why not transfer the current one by paying for accounting courses for him? As a result, you receive three bonus points for the company in the form of:

a) a motivated, qualified and satisfied employee,

b) costs under the item “Staff Training” rather than “Consulting”, which attracts less attention from the tax inspector and is easier to justify,

c) reducing the tax base for these expenses.

A company can outsource any internal function, for example, an accounting service, paying not just wages, but services for maintaining accounting and tax records. At the same time, control over operations does not extend beyond the company, but allows you to somewhat “distribute” profits across several organizations, helping to achieve the goal of reducing the strength of the negative reaction of the tax service to profit growth. In this regard, we can talk about managing cash flows over time, paying for the services of this service organization at a “convenient” time.

Another interesting option for justified costs during a crisis can be considered payment for the services of crisis management consultants. Do you need to optimize internal business processes, and paying for overtime of internal staff is associated with complex personnel administration, or are there simply no such specialists on staff? Then it would be a sin not to use the services of an external company, counting this type of expense against taxable profit. By the way, it’s worth mentioning that the tax inspectorate will not allow remuneration to members of your board of directors (if you have one) for solving anti-crisis problems to be taken into account when calculating taxes - what a paradox!

Illegal tax reduction schemes

Not all entrepreneurs and organizations are ready to conduct business honestly. Some are interested not only in legal ways to optimize taxes, but also in options that violate the law. All of them are punishable, threatening the dishonest taxpayer with a fine, arrest and even imprisonment. Their use cannot be considered as one of the ways to reduce taxes, because this is fraud.

The most popular option is to reduce profits in order to reduce taxes. More precisely, not to reduce real profits (no company is interested in this), but to reflect in the documents underestimated revenues or indicate expenses that actually did not exist. To do this, entrepreneurs spend part of their turnover past the cash register, in cash, without issuing a cash receipt.

Larger businesses wishing to bear less of the tax burden can create a network of companies. It splits one enterprise into a network of one-day companies that do not operate for long, artificially go bankrupt or simply close down. In this way, it is possible to cut payments to the budget and avoid the general taxation system.