A desk audit is carried out by tax authorities and allows for an analysis of the reliability of reports and the accuracy of their completion by taxpayers. This difficult step is necessary to obtain a tax deduction. During the process, the tax inspector registers and analyzes reports and documents of citizens; the correctness and accuracy of their completion affects the possibility of providing funds.

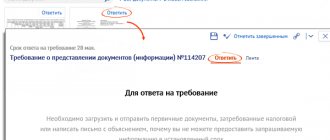

A desk tax audit takes place according to the rules, they are regulated by law. The article contains tips on how to view the progress of a desk audit in a taxpayer’s personal account, and find out what status it has been assigned and the results.

Tracking the progress of the tax return verification on the Federal Tax Service website in your personal account. Viewing information on the Federal Tax Service portal is impossible for those who have not received a password to log into the system. Anyone who has authorization data from their personal account will be able to log in and find out the status of personal income tax check 3 in their personal account.

We will tell you further how to check the progress of the desk audit of 3 personal income tax. If a taxpayer needs to check online at what stage his declaration to the Federal Tax Service is at, then the information is available in the LC. Details are visible if you click on her number. When you click on the link, the following data will be presented:

- The number that the declaration was assigned during registration with the tax office or on the website.

- Day of registration of the declaration.

- At the bottom of the page there is a button that can be clicked to add additional documents.

This will be needed by someone who forgot something or received a call from the tax office asking to add it.

When passing a desk check, a message is sent to your personal account on the same day it is completed. Detailed data is also indicated there by clicking on the link of the check you are interested in:

- Tax authority and registration number.

- Dates of admission and registration, as well as the end of verification.

- Desk audit status: “registered”, “completed”, “in progress” and others.

- The amount of tax deduction, which must coincide with that specified in 3-NDFL.

Features of logging into your personal account in the updated version

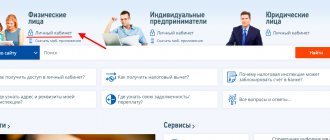

If a taxpayer does not know how to view the progress of a desk audit on the updated website, there are several tips below. The user needs to go to the Federal Tax Service website and fill out the fields in the form: “login”, “password”. To change the login parameters, select the appropriate section to the right of the login button: Digital signature, State services. Further details.

The updated version of the Personal Account became available to all citizens in August 2018. From now on, it is no longer possible to use the old version. The login algorithm is not complicated, the main thing is to obtain and save authorization data for the tax.ru website. The list contains three methods for obtaining a secret character set:

- Registration in person at the tax office. Personal appeal to the inspectorate. Upon presentation of your passport and Taxpayer Identification Number, an employee of the Federal Tax Service fills out an application and provides a login and password. They provide access to the taxpayer’s new personal account. If you lose your authorization data, you must contact the INFS and get it again.

- EDS stands for electronic digital signature. There is a condition for this option. The organization that issues the key certificate to confirm the digital signature must be accredited by the Ministry of Telecom and Mass Communications of the Russian Federation. Any electronic media will do, but for accurate operation you need to use the CryptoPro CSP software, version 3.6 or later.

- Profile on the State Services portal. If the taxpayer registered earlier and received the password by mail or at the MFC, then from the personal page on the State Services website you can go to the tax inspectorate’s personal account. Access to your personal account opens in one or two days.

To enter the updated account on the nalog.ru portal, you must select the “Individuals” section and go to the “Login to your personal account” tab. These actions will lead to a form for entering your login and password. A distinctive feature of the new version is a dark blue background and an updated interface. The process of the inspection itself has also changed. Now you can find out about the status only by contacting the LC message service, or wait until the tax authorities themselves send a notice. Federal Tax Service employees warn you about each step in messages.

How to check the status of tax deductions for government services

How can I find out my tax deduction status?

The most proven way to find out the status of a tax deduction was to call the branch of the Federal Tax Service. Inspectorate employees have the right to provide information to the applicant by phone if he gives his last name, first name and patronymic. Although sometimes additional information is required for clarification:

How to find out your tax deduction status

First, enter the login and password that are in the registration card issued by the Federal Tax Service. To get a card, you need to come to the tax authorities with your passport and the original certificate with TIN. If a taxpayer has lost his login and password, it is easy to restore them by contacting the Federal Tax Service office again with the same documents as during registration.

How to apply for a tax deduction through the State Services portal

It often happens that due to the lack of proper financial education in our country, some citizens miss the opportunity to exercise their rights in certain areas of life. In this article we will talk about ways to return part of the taxes paid to the state from your official salary.

How to find out when the tax deduction for an apartment will be transferred

From the moment of filing the declaration, the government agency is given three months for a desk check of the attached papers. After this period, the inspection is obliged to make a decision on granting a property deduction for the purchase of housing or refuse to provide the benefit. Whatever the decision of the government body, the taxpayer receives a notification.

[1]

Find out the tax deduction status

Secondly, you can enter your “Personal Account” using a Universal Electronic Card (more precisely, an electronic signature attached to it). You can obtain a key with an electronic digital signature at one of the certification centers (as a rule, their functions are performed by regional branches of Sberbank). One of the advantages of the second method is that you can set and change the password yourself.

The procedure for filing a tax deduction through State Services

Since 2015, users of the State Service can submit reports to the Federal Tax Service directly through the portal. All information will be transferred directly to the Federal Tax Service of Russia. Moreover, this service can be used not only by residents of large cities and regional centers, but also by people living in small towns remote from the capital. The opportunity to receive a tax deduction electronically through gosuslugi.ru will be appreciated by those who cannot contact the department in person, for example, people who often leave the city or have a busy work schedule.

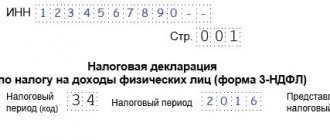

How to apply for a tax deduction and submit a 3rd personal income tax return through the taxpayer’s personal account

If you want to control what is happening with your declaration, in what form it has reached the Internal Revenue Service, then you need to go to the section: Declaration in form 3-NDFL (see step 8-9). Below you see the section my declarations. Once there is a status with a green checkmark and the phrase: “receipt of acceptance received,” you can be sure that the set of documents has reached the Federal Tax Service.

We issue tax deductions through government services

- Go to the website gosuslugi.ru and log in;

- Go to the “Service Catalog” section;

- Select the “Taxes and Finance” category;

- Select the item “Acceptance of tax returns”;

- Select ;

- Read the terms of service and click on the “Get service” button;

- Fill out the declaration, confirm the application with an electronic signature and send it to the tax office for consideration.

How to get a tax deduction through the MFC or the taxpayer’s personal account on State Services

The video has been deleted.

The state also removes part of the tax burden if the taxpayer spent his funds on the purchase of an apartment, a house for the whole family, invested money in housing construction, or took out a mortgage loan to purchase an apartment or land plot for the construction of a house. The benefit also applies to the purchase of part of a residential premises in an apartment building or private building.

How to find out when the tax deduction for an apartment will be transferred

The maximum period for paying a tax deduction for an apartment and other purchased property is 3 calendar months, after this period the money should arrive in your account from the tax service. You can control this process by registering in your personal account on the website of the Russian tax service.

Main features of the service

- Contains information from citizens.

- taxpayer's property: land, real estate, vehicle and their value, date of registration of property, etc.;

- benefits to which the applicant is entitled;

- the conditions of settlements with the state budget: the amount of accrued taxes, payment deadlines, information about debt.

- Communication with a tax inspector via the Internet.

- Tracking the progress and status of the desk audit using Form 3-NDFL.

- Reception of notices and receipts with the specified tax amount.

- Online payment or printing a receipt for tax payment.

- Obtaining the necessary information without a personal visit.

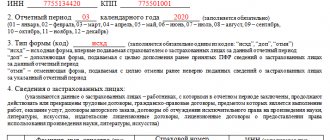

Deadlines and how to find out the results of the verification of reports and documents for tax refunds? You can submit documents for a tax refund on the day you submit your 3-NDFL declaration. It is allowed to submit a declaration without filling out an application for a refund, but not on the contrary. The reason is that the surplus is calculated based on paid tax receipts. If your personal account indicates that there is no data on the result of the desk audit, then the details must be clarified with the tax office.

The Tax Code sets a period of one month for payment and three for verification. This means that after three months the taxpayer will receive a decision:

- providing a tax deduction;

- refusal of payments and its reason.

If the tax office has decided to pay the funds, they will be credited to the account within a month from the date of registration. The period may differ if the application for a deduction is submitted after the completion of the inspection, which acquires the status “Completed”.

The results of checking reports and documents for tax refunds are tracked in the taxpayer’s personal account on the official website of the Federal Tax Service on the “3-NDFL” tab. This electronic service contains all the necessary information about registration, progress and confirmation or refusal of property deduction payments.

You can find out the details in person by contacting the tax authority by presenting your Taxpayer Identification Number (TIN) and your passport. If on the day of filing the tax return the current account for transferring the refund amount was not indicated, an application for its assignment is submitted after the completion of the desk audit.

The verification period may increase if an error is found in the submitted documents. You can track this in your personal account. If there are no errors, then the audit and its result can only be delayed by the demand for clarification from the taxpayer.

Deadlines

The period for conducting an audit begins from the date of registration of the declaration with the tax authority. This should be taken into account when sending documentation by registered mail. Control measures last no more than 3 calendar months.

If during the examination of documents violations or inaccuracies in the information provided were revealed, the inspector has the right to request from the individual. faces explanations. The taxpayer must provide written explanations within 5 business days or send a clarifying declaration to the Federal Tax Service.

When sending an updated 3‑NDFL, the previous check is canceled and the reporting period begins anew.

The taxpayer cannot speed up the process of carrying out control measures. But, if the Federal Tax Service office is not very busy, the inspection may be completed before the deadline.

How to track the status of a 3-NDFL tax audit

You can find out what status is assigned to the 3-NDFL declaration by phone, indicating your TIN. When you call you will receive the following information:

- document verification stage;

- whether any difficulties arose (for example, a counter check);

- are there any errors in the paperwork, etc.

On the Federal Tax Service hotline, the call is redirected to the required department of the tax office, which accepted the documents from the applicant.

You can send an official written request, but this will take even more time - it will last a month at best. The fastest way is to go to the Federal Tax Service portal in the Personal Account to the tab with personal messages, where information about the progress of the desk tax audit of the declaration has been received. The method is considered convenient for the user; he can independently monitor the progress of execution.

At the first stage, the status of the desk audit is “registered,” which means the documents have been accepted for consideration. From this moment the countdown of the time required for document inspection begins.

The desktop audit status “In Progress” is displayed after the “Started” status. In your personal account you can see the completion percentage. In reality, this indicator does not characterize the state of the inspection by the authorities; only the amount of time until its results is traced as a percentage.

When a review is completed, it is assigned the status “Completed.” If there is no audit status, the tax inspector should answer the questions; the reasons must be found out individually.

How to get a personal income tax deduction

Individuals have the right to receive standard, social, property and investment deductions when calculating and paying personal income tax (clause 3 of Article 210 of the Tax Code of the Russian Federation).

Some types of deductions can be provided by the employer, that is, when deducting personal income tax from the salary, the accountant will immediately take into account the deduction and reduce the tax base for it. He will do this if the employee submits the appropriate application and documents, that is, receiving a deduction at work is of a declarative nature. The main document for issuing a standard deduction is the employee’s application; in other cases, it is a notice of the right to deduction, which is issued by the Federal Tax Service after checking the supporting documents submitted by the taxpayer to the regulatory authority. How to fill out the 3-NDFL declaration for investment deduction, we wrote here

That is, the deduction when calculating wages is not always applied. In this case, you can independently declare your right to deduction and return the overpaid personal income tax from the budget by sending a 3-personal income tax declaration at the end of the year to the tax office. This can be done either in person at the inspectorate or through the taxpayer’s personal account (PA) by registering on the official website of the tax office. The second option saves a lot of effort and time, and also provides undeniable advantages, which we will discuss below.

How to fill out 3-NDFL to receive a property deduction for a mortgage is described in the article provided in ConsultantPlus. You will find even more useful information if you sign up for a free trial access to K+

Status of verification 3 personal income tax information missing

If there is no data on the result of the desk audit, what this means, the tax inspector will tell you at the place where the declaration was registered or by telephone. The main reason is the lack of necessary information from the taxpayer. If the inspector detects a violation, he draws up a report and recalculates the amount of tax.

The inspector does not have the right to extend the three-month inspection period allocated by law. The taxpayer is notified of a pause in inspection by sending the following to his address:

- notification add clarifying documents;

- notice to appear at the tax office.

The inspector can contact the applicant using the phone number that is filled in during the paperwork process. If the period allocated for verification has expired, the payer has not received instructions, there is a reason to personally contact the tax office.

Three months is the final inspection period and if it is violated, the inspection cannot impose a fine on the client. The taxpayer must personally monitor the receipt of funds into his own current account. They are accrued within a month after the last day of verification. If the period established by law is exceeded, interest will be charged on the amount of the tax deduction for each day of delay.

What is a desk audit and why is it needed?

It does not matter for what purpose a citizen submits a declaration - with a deduction, on a mandatory basis, or for other reasons. The Federal Tax Service inspector, receiving the data in the document, must know whether the taxpayer has violated the legislation of the Russian Federation, including tax law.

A desk audit is a set of measures carried out by Federal Tax Service inspectors in order to check the real state of affairs of the declarant. The check has several tasks:

- Find out whether everything that is stated by the taxpayer in 3-NDFL is true; Check whether the citizen has money, securities or other assets hidden from taxes and, in general, from the state.

Features of the event

Verification activities begin from the moment the 3rd personal income tax is received by the Federal Tax Service, without additional notification to the person who sent the declaration. To carry out control activities, the inspector does not need additional instructions or orders from senior management.

In order to protect the rights of taxpayers when conducting an inspection, the inspector has a number of restrictions:

- control activities are carried out only for the period for which the declaration is sent, that is, for 1 calendar year;

- the official does not have the right to initiate a re-inspection or analyze additional documents not related to the declaration;

- the inspector cannot request from individuals. persons and other documents not included in the list of mandatory documents for filing a declaration.

If these restrictions are violated, the test will be terminated and its results will be cancelled.