Checkpoint for individual entrepreneurs

Despite the fact that contractors often require individual entrepreneurs to indicate checkpoints, this is not necessary.

Such a request only indicates insufficient legal literacy of the requesting person, since the individual entrepreneur does not and cannot have a checkpoint. Instead, they use a personal TIN in the details and this information is enough for any documents. However, there are situations when partners are persistent and, despite the law, urgently demand that the code for the reason for registration be indicated in the details of the contracts. In this case, if all reasonable arguments have already been exhausted, some entrepreneurs have become wiser to draw up a checkpoint on their own.

This little trick allows them to conclude the necessary transactions, but does not give them the right to enter the checkpoint into the official papers required for submission to government services - here in this column, individual entrepreneurs are always required to put a dash.

To independently compile a checkpoint combination, entrepreneurs take the following data:

- numerical designation of the region where the individual entrepreneur is registered;

- code of the tax service where the individual entrepreneur was registered (at his place of residence);

- The most common code number, which is usually used for legal entities when registering with the tax office: 001.

This information is usually sufficient for counterparties and the desired transactions are concluded.

Thus, we can conclude that for legal entities, the checkpoint is an important part of the organization’s details. Without this number, they do not have the right to carry out document flow with business partners, much less transfer documents to regulatory government agencies - civil servants simply do not recognize them as valid

But individual entrepreneurs do not have a reason code for registration, so there is no need to require a checkpoint from the individual entrepreneur. And even if the individual entrepreneur meets halfway with a persistent counterparty and “draws” a checkpoint for himself, it is important to remember that this combination of numbers does not carry any legal or legal burden.

Reasons and procedure for change

The reason for assigning a code to one or another organization on the territory of the Russian Federation is registration with the tax authorities in accordance with:

- its location, and a TIN is assigned;

- new location (the address of the organization changes, and it geographically begins to belong to a different tax division);

- with the address of each of the OPs that relate to the organization;

- with the new address of one of the OPs, if it has become part of a different tax division;

- with the location of its movable and immovable property;

- with grounds of a different kind noted in the Tax Code.

For foreign companies, the assignment of a code occurs simultaneously with the registration of the organization with the tax authorities and in accordance with:

- the location of each of the OPs belonging to the organization;

- the new location of the OP, if it begins to belong to a different tax division;

- where the movable and immovable property belonging to her is located;

- other reasons specified in the Tax Code.

How can you find out the checkpoint of an organization?

The checkpoint is necessary because some companies are registered with several tax inspectorates: not only at their legal address, but also at the location of separate divisions, real estate and taxable vehicles.

Since everyone must have the same TIN, the tax authorities introduced an additional code - KPP.

This code shows why the company is registered with this inspection.

One company may have several checkpoints.

A reason code for registration is assigned for each basis for registration, including the location of the organization itself, its separate subdivisions (SU), land plots and other real estate, and transport.

Unlike the TIN, the reason code for registering an organization may change.

So, if an organization changes its address to another address that belongs to a different tax office, the company will be assigned a new checkpoint.

The value of the checkpoint can be found out from the certificate or notification of registration.

The checkpoint of the organization at its location is also indicated in the Unified State Register of Legal Entities (USRLE).

The first four digits of the checkpoint represent the code of the tax authority with which the organization is registered.

Of these, the first two digits are the region code, and the third and fourth digits are the tax office code (number).

For example, a checkpoint starting with 7713 means that the organization is registered with the Federal Tax Service No. 13 for Moscow.

The fifth and sixth digits of the checkpoint indicate the reason for registration.

numbers 01 mean that the checkpoint was assigned to the organization in connection with registration at its location;

numbers 02, 03, 04, 05, 31 or 32 mean that the checkpoint is assigned to the organization at the location of the separate division of the organization;

numbers 06-08 mean that the checkpoint is assigned to the organization at the location of the real estate it owns (thus, vehicles are not affected), depending on the type of property;

numbers 10-29 - mean that the checkpoint is assigned to the organization at the location of its vehicles, depending on the type of vehicle;

the numbers 50 mean that the checkpoint was assigned in connection with registration as the largest taxpayer.

The last three digits of the checkpoint represent the serial number of the organization's registration with the Federal Tax Service on the basis for which this checkpoint was assigned to it.

Organizations must indicate TIN and KPP in all documents intended for tax inspections.

in all tax returns and calculations;

in payment orders, including payment orders for the payment of taxes and insurance premiums;

in invoices and other documents where the checkpoint must be indicated.

Since an organization may have several checkpoints, the document indicates the code assigned by the tax office, which is intended for this document.

Still have questions about accounting and taxes? Ask them on the accounting forum.

Grade:

What is a checkpoint number

In the fields where the payer's tax identification number and checkpoint are indicated, you must indicate the company's data. for an individual, the checkpoint details indicate zero (“0”); in field. “Purpose of payment” is indicated by the INN and KPP of the enterprise that makes the payment. There. etc.), for example: “TIN of the payer//KPP of the payer//Name of the taxpayer for whom.

No more than 5 days after receiving Form No. C-09-3-1, the tax inspectorate sends a Notification to the parent company, which contains information about the registration of the unit and the assignment of the corresponding checkpoint to it.

How to find out the checkpoint of a separate division by TIN

The division's checkpoint differs from the code assigned to the parent organization - which means that most methods for determining the checkpoint by the organization's TIN cannot be used in this case. So how can you find out the checkpoint of a branch of an organization if you have its TIN?

To do this you need to do the following:

- Determine the exact name of the organization using the tax service service located at: egrul.nalog.ru. To obtain the necessary information, simply enter the TIN of the legal entity in the window that opens.

- Create a request for an extract from the Unified State Register of Legal Entities using one of the following methods:

- using the service offered by the Federal Tax Service, for which you need to go to the address: service.nalog.ru/vyp and order an extract from the Unified State Register of Legal Entities in electronic form absolutely free of charge (the document is generated within a day from the moment the request is submitted and is available for downloading within 5 days).

- by personally visiting the territorial office of the Federal Tax Service and leaving a request for the preparation of a document.

In addition, on the Internet you can find a considerable number of services that provide services for online determination of checkpoints by TIN for a fee. At the same time, free and demo versions, as a rule, allow you to find out the checkpoint only of the parent organization (such information can also be obtained on the official website of the tax service). Only some versions of specialized commercial software have the option to determine the checkpoint of a separate unit.

Another way to determine the checkpoint is to create a query in a search engine indicating the organization’s TIN. As a rule, the pages that appear in the results contain the required information, but it is worth remembering that the information on them is not updated with the same frequency as the tax service databases, so the information found may not be current.

Sample notification of the opening of a separate division in the Federal Tax Service

The tax office prepares 2 copies of applications, but it is acceptable to provide the second copy as a copy of the first copy. This copy will serve to confirm the fact that the application was accepted by the tax office; the Federal Tax Service employee will put a corresponding receipt mark on it.

Each legal entity that has registered its activities in Russia has the right to open branches, representative offices, and other divisions, while maintaining its previous legal status, i.e. According to Article 55 of the Civil Code, a division in itself cannot be recognized as a separate legal entity.

Assigning a checkpoint to a separate unit

The basis for assigning a code to a separate division is its tax registration at its location. After registering the division, its head will be issued a corresponding paper certificate, which, in addition to the TIN, which matches the number of the parent organization, will indicate the checkpoint assigned to this particular branch or representative office.

There is no need to submit an application for the formation of a checkpoint for a new unit - the code will be generated automatically. After the registration procedure for the unit is completed, the inspector of the territorial branch of the Federal Tax Service transfers all the necessary information (including checkpoints) to the tax service with which the parent organization is registered.

IMPORTANT! The checkpoint of a unit can be changed if it changes its legal address and moves to the territory under the jurisdiction of another inspection. All banking organizations that provide services to the unit, as well as counterparties, must be notified of such changes.

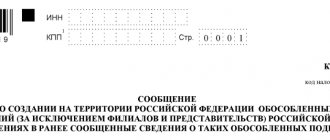

Form S-09-3-1

Any actions with separate units, i.e. representative offices with narrow powers on the territory of the Russian Federation must be reflected in form S-09-3-1. This document allows you to notify the tax authorities about the opening of a new division, the closure of an existing one, or a change of address or name.

S-09-3-1 is submitted at the place of registration of the unit no later than 30 days after the opening of the representative office (a). However, in general, it is permissible to submit the form at the place of registration of the main legal entity. At the time of submitting the application, the new entity must have an assigned address and must have at least 1 employee on staff. As a rule, the day of registration of the first hired person is considered the day of registration of the OP.

PP code of a foreign company

Foreign enterprises in Russia are required to undergo the same procedure for obtaining a TIN and an additional reason code as Russian ones. Therefore, you can find the necessary information on a company with foreign origin using exactly the same methods as described above. Along the way, the following features can help in the search:

- non-Russian companies are separately accounted for by the Federal Tax Service of the Russian Federation, on the basis of which the company is issued a KIO - the code of a foreign organization, which occupies the last 5 cells of the TIN;

- One KIO is appointed for all branches of a foreign enterprise;

- in the PP code of a non-Russian association, digits 5 and 6 always have a range from 51 to 99;

- The TIN of a foreign company registered as taxpayers in Russia always starts with 9909;

- A foreign company is not necessarily required to have an IIN number on Russian territory, but it must have a checkpoint requisite.

Finding information about any foreign company listed in the Unified State Register is simple and accessible through the open source portal of the Federal Tax Service of the Russian Federation on the page https://service.nalog.ru/io.do. It is enough to enter the TIN, address or name in the proposed fields, and all information on the object from the tax registers will be displayed on the screen.

Search for information on the Unified State Register of Real Estate on the website https://service.nalog.ru/io.do

For example:

- the address of the association has changed;

- the status has changed (branches have appeared or disappeared);

- special units were formed;

- other reasons determined by the Tax Code.

Therefore, before using information about a company’s software code obtained a long time ago, you need to carefully find out all the available changes to it that have occurred in the last few years. And compare all other key attributes with the results obtained.

Didn't find the answer to your question? Find out,

Answers to questions about separate divisions:

Question: Is it necessary to register a separate division with the Social Insurance Fund if it does not have a separate balance sheet, its own personal account and accrual of payments to individuals?

Answer: According to clause 2 of Art. 2.3 of Law No. 255-FZ of December 29, 2006, if a separate division does not have its own current account and will not make accruals, then registration of a separate division and registration with the Social Insurance Fund is not required.

Question: I have a desire to open an online store. Logistics and warehouses will be outsourced. I am not the owner of the warehouses; couriers and warehouse workers are not my employees. The sale of goods will take place in Moscow, but for certain reasons I want to register the organization in the Moscow region. There will be no real store or other retail outlet from which the goods will be sold. The receipt for the goods will be issued at the warehouse. Under such conditions, is registration of a separate enterprise necessary?

Answer: In this case, you do not have the main criterion for registering an EP – a stationary workplace. If the check is issued by an outsourcing company, this cannot be considered a sign of the existence of an employment relationship. Under such conditions, a separate enterprise is not required.

Question: Hello. I would like to get some advice. At the moment, an LLC is being created with a general tax regime. Registration of the organization will be carried out at the place of registration of the founder. The main activities of the organization will be carried out in another region with the creation of a separate enterprise. In this regard, several questions have arisen that require clarification:

Should a separate division and organization have separate current accounts?

What deductions will need to be made at the place of registration of the LLC if all employees will be registered in the OP in another region?

What reporting and primary documents will need to be submitted at the place of registration of the LLC if all activities will be carried out only by a separate division?

Answer:

- To carry out the activities of an OP, having your own bank account is not a mandatory factor. All transfers can be made from the organization's current account.

- If the OP has a current account and all payments to employees will be made from it, then registration with the Pension Fund, the Social Insurance Fund and the Federal Tax Service at the place of business is required. According to Art. 431 of the Tax Code of the Russian Federation, all necessary insurance premiums are paid at the location of the OP.

- All reporting and primary documents are prepared at the place of registration of the main office.

Archival extract

| OGRN | 1067759959585 |

| TIN | 7726554107 |

| OKPO | 98257015 |

| OKATO | 45296561000 |

| Registration date | November 21, 2006 |

| Registrar | Interdistrict Inspectorate of the Federal Tax Service No. 46 for MOSCOW |

| Property type | Private property |

| Organizational and legal form | Limited Liability Companies |

| Authorized capital | 10,010,000 rub. |

| CEO | Kuznetsova Lyudmila Borisovna |

Mini-information about KPP LLC

KPP LLC, registration date - November 21, 2006, registrar - Interdistrict Inspectorate of the Federal Tax Service No. 46 for MOSCOW. The full official name is LIMITED LIABILITY COMPANY “KPP”. Legal address: 117105, MOSCOW, VARSHAVSKOE highway, 33. The main activity is: “Wholesale trade of alcoholic and other beverages.” The company is also registered in such categories as: “Wholesale trade through agents (for a fee or on a contractual basis)”, “Wholesale trade of agricultural raw materials and live animals”, “Wholesale trade of non-food consumer goods”. General Director - Lyudmila Borisovna Kuznetsova. Organizational and legal form (OPF) - limited liability companies. Type of property - private property.

Contacts

| Address | 117105, MOSCOW, VARSHAVSKOE highway, 33 |

| Phones | 495-348-39-19 |

| Faxes | 348-39-19 |

Other companies in the region

“BIZNESTORG”, LLCOther wholesale trade125373, MOSCOW, YAN RAINIS boulevard, 2, bldg. 3

“LIGA”, LLC, MOSCOW Other wholesale trade 127081, MOSCOW, DEZHNEVA Ave., 38A, building 1

“TRADE CONSULTING”, LLCConsulting on commercial activities and management109316, MOSCOW, st. TALALIKHINA, 41, building 9, room. I, room 12

“CONSULT PLUS”, LLCProduction of general construction works127254, MOSCOW, OGORODNY pr-d, 5, building 7

“KRISMASH” JSC Other wholesale trade 109428, MOSCOW, st. STAKHANOVSKAYA, 20, building 11A

“BEST KO”, LLC Non-specialized wholesale trade of food products, including drinks, and tobacco products 117218, MOSCOW, st. KRZHIZHANOVSKOGO, 24/35, bldg. 4

“TONZHET”, LLC Activities of agents for wholesale trade of a universal assortment of goods 103001, MOSCOW, st. SADOVAYA-KUDRINSKAYA, 32, building 2

“AGROPLEMSOYUZ”, LLC, MOSCOWFinancial intermediation, not included in other groups107139, MOSCOW, st. SADOVAYA-SPASSKAYA, 13, building 2

“FEXIMA”, ZAO Activity of agencies for real estate transactions 125040, MOSCOW, LENINGRADSKY Ave., 8

“CONNECT LINE”, LLC Activities in the field of telecommunications 109451, MOSCOW, st. BRATISLAVSKAYA, 5

“VMS-OKTAN”, CJSC, MOSCOWWholesale trade in fuel103062, MOSCOW, MAKARENKO st., 2/21, building 1

“BUILDING SYSTEMS”, LLC, MOSCOWPreparation of construction site 109144, MOSCOW, st. BRATISLAVSKAYA, 19, bldg. 2

“PROMSTROYPOLYMERY”, LLC Activities of agents in the wholesale trade of building materials 105062, MOSCOW, per. LYALIN, 4, building 1

“FRAY”, LLC, MOSCOWWholesale beer trade121165, MOSCOW, KUTUZOVSKY Ave., 35, office. 1

“TSARITSYNO-DENT”, LLC Dental Practice 115516, MOSCOW, KAVKAZSKY boulevard, 58, building 1

The department’s own seal: is it necessary or not?

Here everything depends on the desire of the head of the parent company and the separate division. The legislation does not indicate the obligation or prohibition of a separate seal for a separate unit. If the head of the parent company allows it, the division can order its own seal

.

The Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies” and the Federal Law of 12/26/1995 No. 208-FZ “On Joint-Stock Companies” indicate that companies can

(

but are not required

) to have their own seal, emblem, stamps.

However, separate divisions cannot be classified as independently operating companies, since, according to paragraph 3 of Article 55 of the Civil Code of Russia, they are not recognized as a legal entity. This is due to the fact that divisions and branches do not have their own property.

If a separate division concludes all contracts (supply of goods, provision of services, labor, civil law and others) on behalf of the parent company, then there is no point in spending money on making a seal

. But if the division has a separate balance sheet or is located in another area and enters into contracts on its own behalf, then the seal can be made by agreement with the general director of the parent company.

But it is worth paying attention to the fact that, for example, bank branches are required to have their own seal

on the basis of Bank of Russia Instruction No. 135-I dated April 2, 2010 “On the procedure for the Bank of Russia to make decisions on state registration of credit organizations and issuance of licenses for banking operations.” The imprint of such a seal must contain the full name of the banking institution, legal address, name of the branch and its actual location.

What you need to know about checkpoints

- Credit institutions often do not indicate checkpoints in their documents.

- Individual entrepreneurs do not have a checkpoint.

The Federal Tax Service and banks know about this and do not require you to fill out the checkpoint, but sometimes misunderstandings arise between counterparties. In this case, you need to refer to the registration procedure for individual entrepreneurs and the Tax Code.

The largest taxpayers are assigned an additional tax at the place of registration as the largest taxpayer.

The first digits of this checkpoint are 99, they show that the company is registered with the interregional inspectorate for the largest taxpayers.

The checkpoint of the largest taxpayer is indicated in documents related to federal tax payments.

The checkpoint at the location of the organization is indicated in documents related to other payments to the budget and other settlements.

CPR in legislation

According to Article 83 of the Tax Code, separate divisions (hereinafter referred to as OP) are subject to tax control at the location of each of them. In this case, the registration is carried out by the department itself on the basis of a message from the enterprise about the opening of an OP. Article 23 of the Tax Code of the Russian Federation, in addition to the obligation to register, sets an enterprise a period of one month for registering an OP.

Read more: Documents required to apply for a Finnish visa

According to Article 55 of the Civil Code, the OP is not a legal entity. This means that it acts on behalf of the head of the enterprise by proxy, is endowed with the company’s property and is not assigned a TIN. But he is assigned a checkpoint. This is done on the basis of Order of the Federal Tax Service of Russia dated June 29, 2012 N ММВ-7-6/ [email protected] .

How to find checkpoints in documents, for example, an invoice of a separate division

An invoice is one of the most important tax documents, which certifies the fact of shipment of goods (provision of services), and also contains information about its cost. It contains information about the name and details of both parties to the concluded agreement, so it will not be difficult to find the checkpoint of a separate unit in this document.

In accordance with the explanations given by the Ministry of Finance of the Russian Federation in the letter “On the preparation of invoices...” dated 04/03/2012 No. 03-07-09/32, when forming this document by separate divisions, the checkpoint of the division, and not the parent organization, is indicated in line 26. This means that you can obtain the most relevant and factual information by reading the invoice issued by the department of interest.

Important Division Codes

Careful attention to the choice of a commercial partner - no financial penalties from regulatory authorities. Rule number one when checking a counterparty is to obtain confirmation from government authorities of the competence of its actions. Information about registration in the All-Russian Classifier of Enterprises and Organizations (OKPO) shows the legal validity of the supplier (buyer) and the line of activity in which he has the right to engage.

OKPO of a separate division: how to find out when concluding contracts, checking received primary documents?

- On ]]>the official website of the Federal Tax Service of Russia]]> this information is open, just enter the TIN;

- The OKPO code is the same for the company and its branches.

When starting to work with a new partner, requesting all registration documents will save you from trouble.

Archival extract

| OGRN | 1097746395174 |

| TIN | 7703702479 |

| OKPO | 62172881 |

| OKATO | 45268554000 |

| Registration date | July 20, 2009 |

| Registrar | Interdistrict Inspectorate of the Federal Tax Service No. 46 for MOSCOW |

| Property type | Private property |

| Organizational and legal form | Limited Liability Companies |

| Authorized capital | 12,000 rub. |

| CEO | Kimsanov Saparbek Sabirovich |

Mini-information about KPP LLC

KPP LLC, registration date - July 20, 2009, registrar - Interdistrict Inspectorate of the Federal Tax Service No. 46 for MOSCOW. The full official name is LIMITED LIABILITY COMPANY “CROISSANT PARIS-PARIS”. Legal address: 121059, MOSCOW, UKRAINSKY boulevard, 7. The main activity is: “Production of bread and flour confectionery products for non-durable storage.” The company is also registered in such categories as: “Wholesale trade of sugar”, “Wholesale trade of sugary confectionery products, including chocolate, ice cream and frozen desserts”. General Director - Kimsanov Saparbek Sabirovich. Organizational and legal form (OPF) - limited liability companies. Type of property - private property.

Contacts

| Address | 121059, MOSCOW, UKRAINSKY boulevard, 7 |

Other companies in the region

“BIZNESTORG”, LLCOther wholesale trade125373, MOSCOW, YAN RAINIS boulevard, 2, bldg. 3

“LIGA”, LLC, MOSCOW Other wholesale trade 127081, MOSCOW, DEZHNEVA Ave., 38A, building 1

“TRADE CONSULTING”, LLCConsulting on commercial activities and management109316, MOSCOW, st. TALALIKHINA, 41, building 9, room. I, room 12

“CONSULT PLUS”, LLCProduction of general construction works127254, MOSCOW, OGORODNY pr-d, 5, building 7

“KRISMASH” JSC Other wholesale trade 109428, MOSCOW, st. STAKHANOVSKAYA, 20, building 11A

“BEST KO”, LLC Non-specialized wholesale trade of food products, including drinks, and tobacco products 117218, MOSCOW, st. KRZHIZHANOVSKOGO, 24/35, bldg. 4

“TONZHET”, LLC Activities of agents for wholesale trade of a universal assortment of goods 103001, MOSCOW, st. SADOVAYA-KUDRINSKAYA, 32, building 2

“AGROPLEMSOYUZ”, LLC, MOSCOWFinancial intermediation, not included in other groups107139, MOSCOW, st. SADOVAYA-SPASSKAYA, 13, building 2

“FEXIMA”, ZAO Activity of agencies for real estate transactions 125040, MOSCOW, LENINGRADSKY Ave., 8

“CONNECT LINE”, LLC Activities in the field of telecommunications 109451, MOSCOW, st. BRATISLAVSKAYA, 5

“VMS-OKTAN”, CJSC, MOSCOWWholesale trade in fuel103062, MOSCOW, MAKARENKO st., 2/21, building 1

“BUILDING SYSTEMS”, LLC, MOSCOWPreparation of construction site 109144, MOSCOW, st. BRATISLAVSKAYA, 19, bldg. 2

“PROMSTROYPOLYMERY”, LLC Activities of agents in the wholesale trade of building materials 105062, MOSCOW, per. LYALIN, 4, building 1

“FRAY”, LLC, MOSCOWWholesale beer trade121165, MOSCOW, KUTUZOVSKY Ave., 35, office. 1

“TSARITSYNO-DENT”, LLC Dental Practice 115516, MOSCOW, KAVKAZSKY boulevard, 58, building 1

Other search services

As an alternative to government websites, there are also private sources that offer similar, but more advanced functions. Services such as finding out the organization’s checkpoint, OKPO, ID number, OGRN, name, official location, key OKVED are available free of charge. For a fee, it is proposed to identify personal information about the owner (key manager), financial situation, registration data on PF funds, Social Insurance Fund, etc., authorized capital and much more.

To use such services, you need minimal initial data. The search results are taken from the same official directories of checkpoint organizations, and the sites themselves are easy to find upon request. An example of such a resource is the sites Kontur-Focus, PPT.ru, and so on.

Does the checkpoint change when the legal address of an organization changes: letter, reasons, notification

If for some reason an enterprise has to change its legal address, then the territorial branch of the Federal Tax Service changes. Accordingly, the organization’s checkpoint changes, since this code, among other things, includes the details of the Federal Tax Service branch to which the organization is linked.

Does the checkpoint change when changing the legal address?

If you change your legal address, you do not need to change your TIN; this number is assigned forever. The OGRN does not change either. There is no need to remove yourself from tax registration and register in a new place. INFS and other organizations carry out these actions without the participation of the enterprise itself.

The tax service is obliged to deregister the organization within 5 days after information about the new address is entered into the Unified State Register of Legal Entities (Article 84 of the Tax Code of the Russian Federation). Then all documentation is sent to the tax office at the new address. This is also the responsibility of the Federal Tax Service. This process usually takes about 1 month.

- To ensure that the translation of documentation does not take too long, before changing the address, it is necessary to make an advance reconciliation of tax calculations.

- After registration, the Federal Tax Service is obliged to send a notification about this to the Pension Fund, Social Insurance Fund and Rosstat within 5 days (Government Decree No. 1092 of December 22, 2011).

- The enterprise also receives a notification in Form No. 1-5-Accounting.

Sometimes there is more than one checkpoint for one subject, it is important to be able to find it.

In what cases does the code change?

The checkpoint of an organization or legal entity may change in the following cases:

- The organization receives a new checkpoint certificate.

- The Federal Tax Service is undergoing a reorganization.

- The address of a separate division of the organization is changed if the new location is located in the territory under the jurisdiction of another tax authority.

- An organization may be assigned a new checkpoint at the location of its real estate and vehicles.

- The organization makes a decision to change the accounting policy in relation to a separate division in terms of vesting or depriving it of the authority to pay taxes; the relevant department of the Federal Tax Service is notified about this with the relevant documents attached.

What to do in this case

- The first step is to eliminate all tax arrears. Then invite representatives of the tax office to carry out a reconciliation. This is a necessary procedure to clarify all cases of overpayments, arrears and payments. It is necessary to ensure that the data in the enterprise documentation coincides with the tax indicators. If there is a complete match, the documents will be transferred to the new tax office.

- After changing the legal address, changes are made to the constituent documents and the Unified State Register of Legal Entities. After this, the tax service will receive a notification about the change of address from the Unified State Register of Legal Entities along with extracts from the State Register.

- After changing the checkpoint, the parent organization or independent organization contacts the service center for a certificate to receive new details. After this, you should go to a special program and get new details there, which will be immediately saved in electronic documentation.

- After changing the checkpoint, the enterprise must notify all organizations with which it cooperates and with which it has contractual relations that the organization has changed its address and checkpoint.

- It is mandatory to report this to banks and other financial institutions. You will need to change bank cards. There is no need to notify the pension fund and the Social Insurance Fund; they will be sent extracts from the Unified State Register of Legal Entities.

- To update statistics codes, you need to take documents to the State Statistics Committee, where they will issue new codes.

Sample change notice

Such notification must be sent in advance so that the terms of delivery and payments are not violated, since delivery of the letter and making changes take some time, which may suspend the activities of the parties.

Sample filling

Why doesn't the tax office report the change?

- Notification of a change in the checkpoint is sent if an additional checkpoint is given to the enterprise: the parent largest organization, a separate division at the new location, at the location of vehicles or property.

- If an enterprise moves to a new address or the address of the tax office changes, the person is obliged to receive a notice of deregistration at the old place of registration with the INFS; the new tax office issues a new certificate, which contains the previous TIN and a new checkpoint.

You can receive a notification to receive new details, receive them and make changes via the Internet.

How to change the code in 1C

To change the checkpoint, you first need to go to the organization’s card.

- In the “Organizations” directory, find the “Enterprise” menu.

- In the “Basic” tab, find the “Registration” line. Click on the downward arrow.

- Click on the line “add registration information to INFS”.

- New information is entered into the field that opens.

- Click OK, which will save the information.

Then return to the organization card and click “OK”.

This video will tell you how to change the details of an organization in 1C programs (using the example of 1C: Accounting 3.0):

Source: https://uriston.com/kommercheskoe-pravo/dokumentatsiya/kpp/kogda-menyaetsya.html