Who are maternity leavers?

If this is your first time encountering the preparation of an SZV-M report, the question may naturally arise: is it necessary to include an employee on maternity leave in the SZV-M? Or another, but no less important question: should an employee be shown in SZV-M during parental leave?

Before answering the question of whether to include women on maternity leave in SZV-M, let’s figure out what is included in the concept of “maternity leaver”?

This term usually refers to pregnant women who are on maternity leave (maternity leave), as well as citizens on maternity leave.

For more information about these categories of citizens and maternity periods, see the figure:

You will find even more information about maternity leave in the following materials:

- “When they give sick leave for pregnancy and childbirth”;

- “How to pay maternity benefits if there is no money in the accounts”;

- “The procedure for paying sick leave to disabled people.”

As you can see, the concept of “maternity leave” is quite arbitrary: not only women can fall into this category (during pregnancy and after childbirth, including maternity leave), but also men (if they have taken out “children’s” leave for themselves and baby care).

The legislation allows taking out parental leave not only for the mother, but also for the father, grandmother, grandfather and some other relatives (clause 39 of the Procedure, approved by order of the Ministry of Health and Social Development dated December 23, 2009 No. 1012n).

However, not all citizens from these categories need to be indicated in the SZV-M. We'll tell you why later.

Who is filling out the SZV-M and what points should be taken into account

The new form was developed by the Pension Fund of the Russian Federation and it must reflect complete information about employees, namely: the employee’s full name, his SNILS, INN (not necessarily from 2021). To get a general idea of filling out the form, you can consider the following example:

The names of employees who have an employment agreement of any form and type with the employer must be included in the general list of employees. It doesn't matter what the term is in the agreement. Each act must be reflected in a new report. SZV-M is a report required for all companies and enterprises, with the exception of individual entrepreneurs without hired employees, who are exempt from this obligation.

The form is filled out by the responsible person - an accountant or manager. The document is submitted to the Pension Fund office at the place of registration of the company every month, until the 15th. In case of violation of the deadlines, a fine of 500 rubles is imposed on the employer. for each employee.

Should maternity leave be indicated in SZV-M?

Now we can begin to answer the main question of our material: is it necessary to indicate maternity leavers in the SZV-M?

Let's start with the fact that SZV-M is a monthly report from employers to the Pension Fund of Russia. It requires listing information (full name, SNILS, Taxpayer Identification Number) for those employees with whom this employer had, in the reporting month, concluded, terminated, or continued to operate an employment contract or civil service agreement.

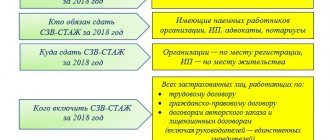

The specific types of contracts in question are listed in the figure:

As you can see, for SZV-M the main thing is the existence of labor or civil law relations between citizens and a specific employer in the reporting period. Or the fact of the occurrence of one of the events during this period: termination or conclusion of these contracts. But the gender of the individual (male or female), degree of relationship with the baby, presence/absence of payments in the reporting period and other factors do not play a role.

Note! While employees are on maternity leave or child care leave (up to 1.5 or 3 years), employment contracts with them continue to be valid (Articles 81, 261 of the Labor Code of the Russian Federation).

So should women on maternity leave be included in SZV-M? Yes, turn it on. But only if, during the reporting period, employment contracts or civil service agreements were in force with them, concluded or terminated.

An employee from the “maternity/maternity leave” category, who voluntarily terminated his employment relationship in the previous period (or the GPC agreement expired), does not need to be reflected in the SZV-M for the reporting month.

And one more clarification. If citizens who fall into the category of maternity leave, foreigners are highly qualified specialists temporarily staying in the Russian Federation, they are not reflected in the SZV-M. The fact is that such employees are not insured in the compulsory pension insurance system (Article 7 of Law No. 167-FZ of December 15, 2001).

Who should provide SZV-M and when?

According to clause 2.2 of Art. 11 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system”, the policyholder, on a monthly basis, no later than the 15th day of the month following the reporting period - month, submits information about each person working for the person, (including persons who have entered into civil law agreements, the subject of which is the performance of work, the provision of services, copyright contracts, agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use a work of science, literature, art, including agreements on the transfer of rights management powers concluded with a rights management organization on a collective basis) the following information:

- insurance number of an individual personal account;

- last name, first name and patronymic;

- taxpayer identification number (if the policyholder has data on the taxpayer identification number of the insured person).

It is not necessary to provide information about individual contractors only in exceptional cases:

| Contractor | A comment | Normative act |

| Individual entrepreneur | Individual entrepreneurs are recognized as payers of insurance premiums | clause 1 art. 419 Tax Code of the Russian Federation |

| Foreign citizens and stateless persons | Payments and other remuneration in favor of individuals who are foreign citizens or stateless persons under employment contracts concluded with a Russian organization for work in its separate division, the location of which is located outside the territory of the Russian Federation, are not recognized as subject to insurance premiums for payers. . | Art. 420 Tax Code of the Russian Federation |

| Full-time students | The base for calculating insurance benefits does not include remunerations made in favor of students in professional educational organizations, educational institutions of higher education in full-time education for activities carried out in student groups (included in the federal or regional register of youth and children's associations receiving state support) under employment contracts or under civil law contracts, the subject of which is the performance of work and (or) the provision of services. | clause 3 art. 422 Tax Code of the Russian Federation |

According to Art. 8 of the Federal Law of April 1, 1996 No. 27-FZ, information for individual (personalized) accounting submitted in accordance with this Federal Law to the bodies of the Pension Fund of the Russian Federation is presented in accordance with the procedure and instructions established by the Pension Fund of the Russian Federation.

This information may be presented as follows:

| Method of reporting | Conditions |

| In the form of written documents | Provided that the number of insured persons (including those who have entered into civil contracts for which insurance premiums are calculated in accordance with the legislation of the Russian Federation) does not exceed 25 people |

| In electronic form (on magnetic media or using public information and telecommunication networks, including the Internet, including a single portal of state and municipal services) with guarantees of their accuracy and protection from unauthorized access and distortion | The policyholder provides information on 25 or more insured persons working for him (including persons who have entered into civil contracts) for the previous reporting period in the form of an electronic document signed with an enhanced qualified electronic signature in the manner established by the Pension Fund of the Russian Federation. |

When submitting information in electronic form, the relevant body of the Pension Fund of the Russian Federation sends to the policyholder confirmation of receipt of the specified information in the form of an electronic document.

Each policyholder must submit to the Pension Fund on a monthly basis, before the 10th, information about each insured person working for him (including those who have entered into civil contracts for which insurance premiums are charged). A form for submitting this information (form SZV-M) was previously approved.

Is it necessary to enter information about maternity leavers into SZV-M?

Maternity maids are employees on maternity leave. These include:

- Women on maternity leave.

- Employees who are on vacation and caring for children. In this case, maternity leave can be taken out not only by the mother, but also by the father, and the child’s immediate or distant relatives (depending on the circumstances). (Ministry of Health and Social Development Ave. No. 1012 N).

Employers submit information about those employees who officially work in the organization or work on the basis of a contract of any nature.

If such an agreement is concluded with a maternity leaver, then throughout the entire period of child care, the employer is obliged to enter information about her in the SZV-M form. If an employee is on maternity leave, it means that the person is listed as working for that company. And it doesn’t matter whether the employee was paid for this period.

Responsibility for failure to provide SZV-M

For violation of the submission of the SZV-M form, the insurer is held liable:

| Offense | Penalties | Normative act |

| SZV-M is not represented | Fine 500 rubles for each insured person | Art. 17 Federal Law dated April 1, 1996 No. 27-FZ |

| Failure of the policyholder to comply with the procedure for submitting information in the form of electronic documents | Fine 1000 rubles | Art. 17 Federal Law dated April 1, 1996 No. 27-FZ |

Who should fill out the SZV-M report

This form was developed by the Pension Fund of the Russian Federation. It reflects all information about employees. The last name, first name, patronymic of the employees, their SNILS, and if data is available, the TIN are indicated. It looks like this:

Only employers who have employees or have entered into at least one employment contract fill out such a document. This may be a contract for one day or a one-time performance of work, but if a contract of a legal nature is concluded, then it is necessary to submit the SZV-M form to the pension fund.

You will have to submit and fill out the form until the organization closes. Even if there are no more employees left, but the company continues to operate, the form is filled out for one head of the company. In this case, there is no need to be confused: an individual entrepreneur who does not have employees does not submit a report! So, who submits the SZV-M report:

- An individual entrepreneur who has entered into an employment contract with at least one employee.

- Organizations and firms that have also entered into contracts and have one or more employees on staff.

- When signing contracts for one day or for seasonal work.

- All employers who have employees.

For details on filling out and submitting the SZV-M, watch the video:

Errors in the reporting form

If the Pension Fund detects errors, the fund will send a corresponding “chain letter”, and here you need to pay attention to the error code in the form.

| Check result code | Deviation characteristic | Actions of the policyholder |

| Errors 10, 20 | Report accepted | There is no need to correct information about the insured for whom a warning was received. |

| Errors 30,40 | The report was partially accepted | It is necessary to provide correct information about the insured persons in respect of whom errors have been recorded |

| Error 50 | Report not accepted | You need to correct errors and resubmit the report. |

There are a number of common mistakes that you need to pay attention to.

1. Error. If the employee was not included in the SZV-STAGE form.

SZV-STAZH must be submitted for all persons with whom employment or civil law contracts were valid during the reporting period.

How to fix the error. To add data on a missing employee to the report, you must submit the SZV-STAZH form with the “supplementary” type. There is no need to re-list the entire staff.

2. Error. If the original form contained incorrect employee data (full name-SNILS, or errors in the filling procedure).

A notification was received regarding the elimination of errors with the reporting verification protocol in the status “document partially accepted”, “result code 30.40”.

How to fix the error. It is necessary to correct the errors according to the received protocol and submit the SZV-STAZH form with the “supplementary” type only for those employees for whom there were errors.

3. Error. If errors are found in the length of service of an employee whose report was accepted.

It is necessary to submit the SZV-KORR form with the “corrective” type. In it, indicate the correct information about the employee whose information initially contained an error. There is no need to re-list the entire staff.

Example: The policyholder submitted the SZV-STAZH form with the “original” type, checking the information did not reveal any errors, the information was recorded on the personal accounts of the individual. The policyholder identifies an error in the insurance policy (the length of service indicated is incorrect, for example, 01/01/2017-12/31/2017, but should be 01/01/2017-03/01/2017). The policyholder submits the SZV-KORR form (form type - corrective) reflecting the correct length of service for the insured person.

4. Error. If an extra employee is indicated in SZV-STAZH.

How to fix the error. To remove an employee from the SZV-STAZH, it is necessary to submit the SZV-KORR with the “cancelling” type. Include in it only the extra employee who was indicated in the report by mistake. There is no need to re-list the entire staff. Otherwise, all previously submitted information about employees will be canceled (cancelled).