Everyone knows that when considering a client’s request for a loan, the lending bank pays increased attention to assessing the applicant’s solvency. For any financial institution, the main source of relevant data is an official document certifying the actual earnings of the borrower. Russian banks are often guided by information from a citizen’s income certificate, prepared according to standard 2 personal income tax. For a bank that issues loans to the public, this information is considered reliable and reliable. However, any paper of this kind can be counterfeited. Some applicants sometimes resort to such measures in an attempt to embellish the reality and fraudulently obtain a loan. You should know how banks check personal income tax certificate 2 to avoid fraud.

How does a bank evaluate a borrower?

Before giving you a loan, the bank will check you against its list of requirements:

- Your age must meet the bank's conditions: many credit organizations issue loans from the age of 21, and stop issuing if the client is over 65-70.

- Your credit history must be in good order: no outstanding delinquencies in the last three years.

- Lack of obligations to other banks or their insignificance (if you already have five loans, the sixth bank will not give you a sixth one. But if you have almost paid off your mortgage, welcome).

- Your income must correspond to the scheme: the cost of living for each family member plus the monthly loan payment.

In what cases may a bank certificate be needed?

The most common cases of using such a document are confirmation of the client’s solvency when receiving a loan, leasing and other borrowed funds. A sample of filling out a certificate in the bank form is always presented on the official website of the credit institution and there is always a note about the amount of funds received.

The meaning of introducing such a certificate for a bank is simple: no organization wants to lose a solvent client just because he cannot provide sufficient justification for his solvency from the state. For this reason, the bank also accepts certificates issued simply by the employer and not confirmed in terms of contributions to the budget.

The result suits everyone: both the bank itself and the person who indicates all his income, including those that greatly diverge from the “official” ones. We all understand that there are much more such people than it seems at first glance.

Why can’t you buy a 2-NDFL certificate?

Previously, a 2-NDFL certificate could only be obtained at the place of work or by visiting your tax office. Now banks have the opportunity to check your income online. It is enough to enter the index of the provided document in a special window.

Any citizen can independently check how his employer pays taxes for him. To do this, you should go to the tax office website and log into your personal tax account using an electronic key or authorization through the government services website. It reflects the amount of taxes paid by employers over the past years.

The certificate can be printed directly from the website, but the bank may not accept it - the paper copy must be certified by the employer.

Where are loans issued against a bank certificate?

Most large Russian banks offer loan products that are issued on the basis of an income certificate. For individuals who receive wages within the bank, institutions offer even more favorable conditions and most often do not require a certificate. Receipts into the accounts of salary clients are visible to the credit institution, so such borrowers are offered a reduced interest rate or other benefits. And among the documents they can only request the original passport at the time of signing the loan agreement.

Loans are provided against a certificate of income in the form of a bank in:

- Sberbank;

- VTB;

- Alfa-Bank;

- FC Otkritie;

- Raiffeisenbank;

- Eastern Bank;

- Gazprombank and other banks of the Russian Federation.

Additional ways to confirm income without a certificate on a bank form or a 2-NDFL report are provided to the lender:

- a copy of the employment contract concluded with the employer;

- a copy of the work book, with a record of the last place of work and a certificate from the employer confirming that the citizen is still working in this company;

- a bank statement of the account, where regular receipts are visible, while the purpose of payment contains information for what the funds were paid, and the name of the employer is indicated in the “payer” field.

Before receiving a loan, it is important to compare similar banking products and choose the most favorable one in terms of interest rate and minimum package of documents. After this, you can submit applications and wait for approval. Experts do not recommend sending applications to 5-6 banks at the same time. This behavior can have a detrimental effect on the impression of the borrower. Credit institutions will refuse because they will create the impression of an emergency need for money. Therefore, it is better to request a loan from two or three banks and wait for a decision from them.

The article was supplemented by the author Evgeny Nikitin

A certificate in the form of a bank often appears in the list of documents for obtaining a loan, but not everyone uses it, limiting themselves to the standard 2-NDFL. However, in order to decide whether this certificate is suitable for a particular person or not, you should consider what it is and what it looks like for different banks. Only by understanding in what cases it is used and how it may be better than 2-NDFL, the client can decide exactly how much it is required in his case. Read more in Brobank.

How does a bank check an income certificate?

Bank managers have instructions for checking 2-NDFL certificates. First of all, this is a visual inspection. The 2-NDFL certificate is printed in a single form through one program - the signature of the general director and the seal must be in place and be readable. If the seal covers the signature, the bank may return the 2-NDFL certificate and demand that it be redone.

The next point of verification is the correct code names: each deduction is indicated by its own numerical font. The bank will definitely check whether the tax agent’s TIN matches the TIN indicated on the seal. There are often cases when certificates are returned to the owners because something was mixed up in the accounting department.

What information does the certificate contain?

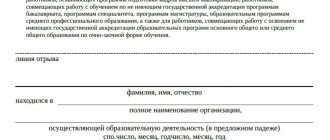

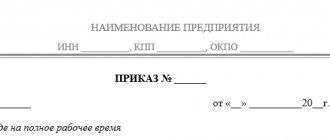

A certificate form to confirm the income of a potential borrower can be obtained at a bank branch or downloaded from the official website.

The second option is most convenient for the client, because he will be able to personally visit the credit institution only once. With a ready package of documents. Some lenders may even suggest using a free form of certificate. The main thing is that it reflects the mandatory information and data about the employer and the borrower.

Certificates in the bank form must contain:

- personal data of an individual;

- name of the employing company;

- identification information about the employer - TIN, current account number, contact details, telephone numbers, website, legal address;

- the name of the position, how long the citizen has been working at it, and the total period of work with this employer;

- salary for a certain period - 3 months, six months or a year;

- Full name of the head and chief accountant of the organization, their signatures;

- employer's stamp.

The certificate is signed by two authorized persons of the employer - the director and the chief accountant. In a situation where the staffing table does not include the position of chief accountant, the manager makes a corresponding note. And he definitely puts his signature and seal.

Certificate 2-NDFL without employer

When checking your solvency, the bank manager can call your employer, boss, or immediately contact the tax and pension fund.

If earlier applications to departments were semi-legal, then from 2021 credit institutions have the right to legally request information on clients from departments. However, for this they need to obtain the client’s consent.

Without the client's consent, you can check the legality of the certificate itself using the document index. In any case, fake documents will not pass inspection. And the one who brought them faces serious punishment.

What are the difficulties in preparing a certificate in the bank form?

Not all employers are willing to issue bank certificates to employees. The reasons may be the same as for refusal to fill out 2-NDFL. Managers often fear that an employee's actual income level may be reported to the tax service. This will reveal the fact of the discrepancy between the real and nominal wages.

In some cases, by agreeing to an alternative option to confirm the client’s solvency, the bank also takes risks. Because a citizen can enter into an agreement with an employer and “ask” to inflate his salary, which is indicated in the certificate on the form of a credit institution. As a result of such risks, a loan is not issued at the most attractive interest rate or additional guarantees are requested. For example, they offer to issue a deposit or bring a guarantor.

Each creditor sets its own validity period for the certificate according to the bank’s form. On average, values range from 2 weeks to 1 month. Information about the period of relevance of the data, as a rule, is on the form itself, or it can be clarified by calling the bank’s hotline.

What happens if the income certificate turns out to be fake?

If the bank finds out that it has received a fake 2-NDFL certificate, it can contact the police. In this case, the owner of the fake faces criminal penalties and charges of fraud.

Also, the person who brought a fake certificate may end up on the bank’s blacklist. Considering that now the lists of suspicious citizens are in a single database, a loan will not be given not only in this bank, but also in any other.

The easiest consequence of submitting a fake 2-NDFL certificate to the bank is denial of a loan.

When to use a bank certificate and who issues it

Not all working citizens can receive 2-NDFL. The reasons may be different: management is located in another city or not all of the employee’s income is officially recorded. Therefore, banks are accommodating and offer to bring a certificate in the bank’s form as a document confirming your salary. Each financial institution approves its own version of the form. But the general rules for filling out and required details are the same in all banks.

Certificates in the form of a lender can serve as confirmation of the income of a potential borrower when drawing up an agreement for:

- consumer credit;

- non-targeted loan;

- credit card;

- purchasing goods in installments.

This type of confirmation is practically not used when applying for a mortgage or loan for large amounts and a long period.

An alternative document confirming solvency when receiving a loan is beneficial to both parties:

- for the client - because the employer more easily agrees to issue a certificate in the bank form than to fill out 2-NDFL;

- to the lender - because the number of clients is many times greater due to the ease of preparing the certificate.

The certificate in the bank form is filled out by the employer’s responsible employee from the HR or accounting department.

Other ways to verify income

Confirmation of solvency can occur not only through certificates, but also through account statements, providing evidence of the client’s possession of luxury goods, a car, an apartment, trips abroad, and other things.

But a financial institution is much more active in approving loans when they have certificates that confirm income in figures. Therefore, it is recommended to take a certificate in the bank’s form if it is not possible to provide 2-NDFL. This will simplify the process of proving trustworthiness, as it will not require collecting a lot of personal information about the property.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Reasons for refusal

The following are the reasons why the Bank may not accept a certificate:

- the document does not contain the signatures of managers or the employer’s seal in the indicated columns;

- The income column is not drawn up according to form. The table does not show total amounts; the bank details are incorrect;

- the borrower's stated salary does not correspond to his actual salary;

- Self-issued certificates are not accepted.

The Alfa Bank organization is today a major financial player in the market. All this is due to the fact that the company’s management strives to improve its service and provide the highest quality product to its customers.

Filling process

The employer fills out the certificate according to the bank form. Any of them must contain the following details:

- Full name and position of the employee to whom the certificate was issued.

- Details of the company that issues the certificate to the client, including TIN, full name and other data.

- Full name of the director and chief accountant, as well as their signatures.

- Work experience of the future bank client.

- The amount a person receives while working. If the employee has been working for more than 1 year, then the amount for the last one is written.

- They also sometimes require the average monthly salary.

All this data is filled out strictly by the chief accountant of the company, after which his signature is placed on the certificate, as well as the signature of the head of the company (director or individual entrepreneur).