Published: 12/02/2019

Updated May 2021

As a rule, all employees of an organization or enterprise receive wages on the card of the bank with which the employer has entered into an agreement. If the terms of the proposed salary card do not suit the client, then he has the right to choose any other card product for these purposes. From this article you can find out what is required to transfer your salary to a card from another bank and what offers you should pay attention to.

Why is there such a need to change the salary project?

- Very often, an employee needs a mortgage or consumer lending, and preferential terms can only be obtained from the bank where the salary project is issued, or there are already loan obligations to another bank.

- There are no branches of the salary bank of the project and ATMs, you have to withdraw your salary with a large commission.

- Expensive card servicing or SMS notifications, inconvenient use of Internet banking, etc.

Advantages of payments to a salary card

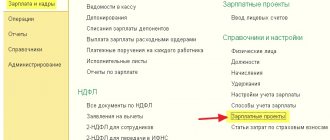

The advantages of paying wages to a card include a simple procedure. The company's accountant does not need to calculate wages, then go to the bank, withdraw large sums, and issue them through the cash register. When issuing wages through a salary card, the scheme of settlements with employees is simplified while maintaining confidential information about the level of wages.

Many companies also prefer to transfer wages to the card for security reasons. Indeed, in this case, the risk that the accountant may be robbed on the way to the bank is minimized. In addition, there may be a shortage in the cash register due to erroneously issued funds. Some banks provide the possibility of lending to users of salary projects.

Along with the salary card, the employee receives additional banking services upon application. These services include free Internet banking, a system of remote payments and bank services. Using Internet banking, you can monitor your account status, card payments, and make payments at any time and anywhere.

In addition, the employee can get access to a line of credit - an overdraft.

The salary payment card is international and can be used both in Russia and abroad.

A salary card makes it possible to use a card account as a way to accumulate funds with interest accrued on the balance amount.

Salaries do not need to be deposited if the employee has not received them within three days.

What should an employee do when changing banks for a salary project?

- Decide on a bank, study the benefits and services provided when using the card.

- Write an application for a debit card.

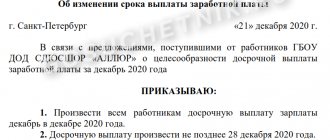

- Find out the exact account details and write a written application addressed to the manager about the transfer of wages using the new details and register it. Important! This must be done no later than 5 working days before the next salary payment, otherwise the funds will arrive with a delay.

- Contact the HR department to conclude an additional agreement to the employment contract, which will contain information about the new salary project and then wait for transfers to the new card.

Interesting article : how to open a current account at Tochka Bank?

Is it possible to receive a salary on a card from another bank?

According to the provisions of the Labor Code of the Russian Federation, in particular Article 136, each employee has every right to independently choose a bank for transferring wages. At the same time, you can express your desire to change your card both during initial employment and at any time during your working life. This law on choosing a bank to receive a salary states that the employer cannot refuse an employee his desire to change financial institution.

If the accounting department at the place of work refuses to accept an application to transfer wages to another bank, then in this case it is necessary to contact the labor inspectorate or trade union. Also, the employee should be prepared for the fact that possible costs for servicing and issuing a new card will have to be paid independently.

In some cases, employers resort to some kind of trick. They do not refuse to accept an application for a salary transfer, but at the same time they report possible delays in transferring payments. This information does not correspond to reality, since the processing of any interbank payments is carried out within 24 hours.

What should an employer do when transferring a salary project to another bank?

- Mandatory informing of each employee about the change of bank.

- Next, all employees must withdraw all funds from the bank card and close their personal account.

- An accountant or other authorized representative of the organization comes to the bank with all the documents and writes an application to terminate the agreement with the current bank.

- You can submit an application to the new bank online or contact the bank office.

- Provide the required list of documentation to the selected bank (application from each employee with photocopies of the passport) and find out the service rates.

- Conclude an agreement with a new financial institution and issue new salary cards to employees.

You can apply to transfer your salary project to another bank here.

Plus your salary!

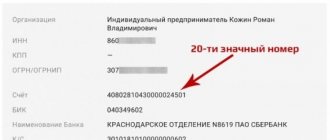

1 The cost of annual service is determined when concluding a salary contract. Read more. Read more about the SberBank debit salary card, the registration procedure, existing restrictions and other conditions here.

2 Find out more about the terms of mortgage lending, required documents and restrictions on the website: . The bank has the right to refuse to provide a mortgage loan without giving reasons.

3 Accrual and write-off of Bonuses is carried out on the basis of the SberSpasibo Program (hereinafter referred to as the Program) and is available to Program Participants. The organizer of the Program is PJSC Sberbank. The program is valid from November 12, 2011 and is not limited in duration. To receive discounts in exchange for Bonuses from Program Partners, the Participant must make a debit transaction on the Card in the amount of at least 1 ruble and write off the required number of Bonuses (at the rate of 1 bonus = 1 ruble discount). Partners have the right to set restrictions on the use of Bonus Rewards. With detailed information about the Program Rules, methods of registration in the Program, conditions for Accrual and Write-Off of Bonuses, the current list of Program Partners, about Partner Promotions, the rules for Promotions, the place and procedure for receiving incentives, restrictions, Privilege Levels, actions (tasks), performed by Participants to assign the appropriate Level can be found on the website: www.spasibosberbank.ru. Up to 30% Bonuses Accrued within the framework of the Basic Promotion (from 09/17/18 and not limited by validity period) of the Organizer - Sberbank-Telecom LLC, OGRN: 1167746305430, Moscow, st. Vavilova, 19, when a Program Participant makes a debit transaction using a Sberbank PJSC card with an activated tariff costing from 750.00 rubles in the SberMobile mobile application (6+). Detailed information can be found here. The SberSpasibo mobile application is available for installation on Members’ mobile devices using the following links: https://play.google.com/store/apps/details?id=ru.sberbank.spasibo or https://apps.apple.com/us /app/spasibo-ot-sberbanka/id899525659 and its logos are trademarks of Apple Inc., registered in the United States and other countries. Google Play and its logos are registered trademarks of Google Inc. Prohibited for children.

4 The cost of notifications (SMS and push notifications about transactions) is charged in accordance with the tariffs. More details

The SberBank Online mobile application is available to holders of SberBank bank cards (except for corporate cards) connected to the Mobile Bank SMS service. To use the SberBank Online mobile application, you must have access to the Internet. For information products there is no age limit. For detailed information about the SberBank Online mobile application, please visit the Bank’s website, in branches or by phone.

PJSC Sberbank. General license of the Bank of Russia for banking operations No. 1481 dated 08/11/2015.

What if an employee refuses to transfer to a salary project at another bank?

Today, an employer cannot legally refuse an employee to move to a chosen bank in accordance with amendments to the Labor Code since 2014.

Therefore, if an employee insists on paying for a salary card from another bank, if the organization has a current salary project, then you do not have the right to refuse him and the employee may not change his card.

In a situation where an individual employee, apart from the team, receives a salary on a card from another bank, the employee himself will pay for the annual maintenance of the card and the commission for transferring funds.

The employer must enter into additional agreements under employment contracts with each employee, where new data on service in another bank will be displayed.

We recommend material : opening a current account in Alfa Bank.

Send your pay

Since 2014, every citizen has the right to choose a credit institution where he will receive his honestly earned money. There are two ways to do this. The first is when you get a job and enter into an employment or collective agreement. It is in the agreement that the credit institution will be stipulated.

It is proposed that imposing a specific bank on a person is actually equated to a delay in salary: if management refuses to transfer the employee’s salary to another bank, he will pay a fine

The second option: change one bank to another at any time. To do this, you must write an application and submit it to your manager 5 days before payment of wages.

The Russian government has submitted a bill to the State Duma increasing this period to 15 days. The initiative is included in the State Duma agenda for the coming days.

According to the initiators of the bill, this will simplify the work of the accounting department, which sometimes simply does not have time to complete all the necessary documents. So the question of changing the deadlines is purely technical. If an employee comes with an application shortly before his salary, then his next paycheck will be transferred to the old bank, and the next salary will go to the new card.

Management has no right to refuse an application. If the employer does not change the credit institution at the request of the employee, then the latter has the right to contact the regional labor inspectorate, notes Sergei Senchushkin, a member of the Russian Lawyers Association. And then the violator may be punished with an administrative fine or warning.

By the way, the government has submitted another draft to the State Duma on this issue: the initiative equates such violations to delays in wages. It is proposed to establish a fine in the amount of from 10 thousand to 20 thousand for officials, from 1 thousand to 5 thousand rubles for entrepreneurs without forming a legal entity. But legal entities will pay from 30 thousand to 50 thousand rubles.

According to Rostrud for 2021, of all wage violations, 10 percent are violations regarding the choice of place of payment of wages. Projects developed by the government are designed to reduce the number of such violations.

Interesting figures: according to research, 84.4 percent of the adult population have payment cards, including 29.81 percent who only have a bank card to receive wages.

In many cases, the “salary card” is the only one for a citizen. Accordingly, a person who receives a salary through a certain bank often begins to actively use its other services: money transfers, loans, etc.

If you put obstacles in front of a person in choosing a bank, imposing one single bank on all employees of a particular organization, this can limit the competition of financial organizations. Since the benefits will be received by those banks that have agreed with large companies. But it has long been proven: the less competition, the worse the service.