A desk audit is carried out by tax authorities and allows for an analysis of the reliability of reports and the accuracy of their completion by taxpayers. This difficult step is necessary to obtain a tax deduction. During the process, the tax inspector registers and analyzes reports and documents of citizens; the correctness and accuracy of their completion affects the possibility of providing funds.

A desk tax audit takes place according to the rules, they are regulated by law. The article contains tips on how to view the progress of a desk audit in a taxpayer’s personal account, and find out what status it has been assigned and the results.

Tracking the progress of the tax return verification on the Federal Tax Service website in your personal account. Viewing information on the Federal Tax Service portal is impossible for those who have not received a password to log into the system. Anyone who has authorization data from their personal account will be able to log in and find out the status of personal income tax check 3 in their personal account.

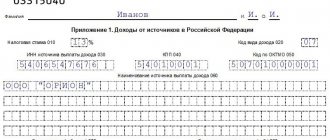

We will tell you further how to check the progress of the desk audit of 3 personal income tax. If a taxpayer needs to check online at what stage his declaration to the Federal Tax Service is at, then the information is available in the LC. Details are visible if you click on her number. When you click on the link, the following data will be presented:

- The number that the declaration was assigned during registration with the tax office or on the website.

- Day of registration of the declaration.

- At the bottom of the page there is a button that can be clicked to add additional documents.

This will be needed by someone who forgot something or received a call from the tax office asking to add it.

When passing a desk check, a message is sent to your personal account on the same day it is completed. Detailed data is also indicated there by clicking on the link of the check you are interested in:

- Tax authority and registration number.

- Dates of admission and registration, as well as the end of verification.

- Desk audit status: “registered”, “completed”, “in progress” and others.

- The amount of tax deduction, which must coincide with that specified in 3-NDFL.

Features of logging into your personal account in the updated version

If a taxpayer does not know how to view the progress of a desk audit on the updated website, there are several tips below. The user needs to go to the Federal Tax Service website and fill out the fields in the form: “login”, “password”. To change the login parameters, select the appropriate section to the right of the login button: Digital signature, State services. Further details.

The updated version of the Personal Account became available to all citizens in August 2018. From now on, it is no longer possible to use the old version. The login algorithm is not complicated, the main thing is to obtain and save authorization data for the tax.ru website. The list contains three methods for obtaining a secret character set:

- Registration in person at the tax office. Personal appeal to the inspectorate. Upon presentation of your passport and Taxpayer Identification Number, an employee of the Federal Tax Service fills out an application and provides a login and password. They provide access to the taxpayer’s new personal account. If you lose your authorization data, you must contact the INFS and get it again.

- EDS stands for electronic digital signature. There is a condition for this option. The organization that issues the key certificate to confirm the digital signature must be accredited by the Ministry of Telecom and Mass Communications of the Russian Federation. Any electronic media will do, but for accurate operation you need to use the CryptoPro CSP software, version 3.6 or later.

- Profile on the State Services portal. If the taxpayer registered earlier and received the password by mail or at the MFC, then from the personal page on the State Services website you can go to the tax inspectorate’s personal account. Access to your personal account opens in one or two days.

To enter the updated account on the nalog.ru portal, you must select the “Individuals” section and go to the “Login to your personal account” tab. These actions will lead to a form for entering your login and password. A distinctive feature of the new version is a dark blue background and an updated interface. The process of the inspection itself has also changed. Now you can find out about the status only by contacting the LC message service, or wait until the tax authorities themselves send a notice. Federal Tax Service employees warn you about each step in messages.

Determining the 3-NDFL inspection number

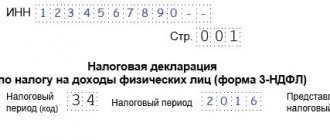

The title page of the tax form includes all the most important information - it is on the first page that you must indicate the inspection number so that it is immediately clear where the documents are being submitted.

The inspection code consists of four digits: 2 initial digits are the number of the region of the Russian Federation in which the authority is located, the last digits speak directly about the inspection.

So, for example, the city of Moscow corresponds to code 77.

How can I find out the inspection number?

Everyone understands perfectly well that the majority of Russian residents are not interested in the tax inspectorate unless necessary. And when the need to submit a declaration arises, they immediately begin to panic: where and how to get this number?

Especially for such cases, a separate section dedicated to inspection numbers has been created on the official website of the Federal Tax Service. Here is a link to a special service on the Federal Tax Service website. By clicking on the link, you should enter your address of stay - street name, house number, building, apartment, etc.

Based on the entered data, the site itself will scan the entire list and provide the address and code of the inspection the citizen needs. By clicking on the link pointing to the inspection, you can read information about the Federal Tax Service branch. Addresses, contact numbers, and bank details for paying taxes to the state will be located there.

Main features of the service

- Contains information from citizens.

- taxpayer's property: land, real estate, vehicle and their value, date of registration of property, etc.;

- benefits to which the applicant is entitled;

- the conditions of settlements with the state budget: the amount of accrued taxes, payment deadlines, information about debt.

- Communication with a tax inspector via the Internet.

- Tracking the progress and status of the desk audit using Form 3-NDFL.

- Reception of notices and receipts with the specified tax amount.

- Online payment or printing a receipt for tax payment.

- Obtaining the necessary information without a personal visit.

Deadlines and how to find out the results of the verification of reports and documents for tax refunds? You can submit documents for a tax refund on the day you submit your 3-NDFL declaration. It is allowed to submit a declaration without filling out an application for a refund, but not on the contrary. The reason is that the surplus is calculated based on paid tax receipts. If your personal account indicates that there is no data on the result of the desk audit, then the details must be clarified with the tax office.

The Tax Code sets a period of one month for payment and three for verification. This means that after three months the taxpayer will receive a decision:

- providing a tax deduction;

- refusal of payments and its reason.

If the tax office has decided to pay the funds, they will be credited to the account within a month from the date of registration. The period may differ if the application for a deduction is submitted after the completion of the inspection, which acquires the status “Completed”.

The results of checking reports and documents for tax refunds are tracked in the taxpayer’s personal account on the official website of the Federal Tax Service on the “3-NDFL” tab. This electronic service contains all the necessary information about registration, progress and confirmation or refusal of property deduction payments.

You can find out the details in person by contacting the tax authority by presenting your Taxpayer Identification Number (TIN) and your passport. If on the day of filing the tax return the current account for transferring the refund amount was not indicated, an application for its assignment is submitted after the completion of the desk audit.

The verification period may increase if an error is found in the submitted documents. You can track this in your personal account. If there are no errors, then the audit and its result can only be delayed by the demand for clarification from the taxpayer.

What is a certificate of conformity and when is it needed?

A Certificate of Conformity (CC) is a document issued by a specially accredited body based on the results of laboratory tests. In other words, this is evidence that the products comply with the declared technical regulations and quality standards. The presence of a certificate of conformity for a particular product is a guarantee of its safety for the consumer. But not all products are subject to mandatory certification. The list of items for which this document is required is specified in the Decree of the Government of the Russian Federation No. 982 dated December 1, 2009 “List of goods subject to mandatory certification and declaration.”

It is necessary to certify goods not only for their legal sale, but also for smooth customs clearance.

A document of equal legal force—a declaration of conformity (DC)—is also drawn up to confirm product compliance with established standards. The register of declarations of conformity of the Eurasian Economic Union allows you to check its availability. But there are some differences in these documents:

- the certificate is issued on a special form, and the DS is on A4 sheet. Both of them have registration numbers and their data is entered into the electronic register of RosAccreditation;

- Both documents are stamped and signed by the head of the body that carried out the accreditation, but the DS still bears the stamp and signature of the recipient of the document.

How do you know what type of paper to get? Refer to Government Decree No. 982. If the product is included in the list of goods subject to declaration of conformity, a DS is issued. If the product is on the certification list, a certificate is issued.

How to track the status of a 3-NDFL tax audit

You can find out what status is assigned to the 3-NDFL declaration by phone, indicating your TIN. When you call you will receive the following information:

- document verification stage;

- whether any difficulties arose (for example, a counter check);

- are there any errors in the paperwork, etc.

On the Federal Tax Service hotline, the call is redirected to the required department of the tax office, which accepted the documents from the applicant.

You can send an official written request, but this will take even more time - it will last a month at best. The fastest way is to go to the Federal Tax Service portal in the Personal Account to the tab with personal messages, where information about the progress of the desk tax audit of the declaration has been received. The method is considered convenient for the user; he can independently monitor the progress of execution.

At the first stage, the status of the desk audit is “registered,” which means the documents have been accepted for consideration. From this moment the countdown of the time required for document inspection begins.

The desktop audit status “In Progress” is displayed after the “Started” status. In your personal account you can see the completion percentage. In reality, this indicator does not characterize the state of the inspection by the authorities; only the amount of time until its results is traced as a percentage.

When a review is completed, it is assigned the status “Completed.” If there is no audit status, the tax inspector should answer the questions; the reasons must be found out individually.

How is a desk audit carried out?

To check the declarations submitted to the inspection, that is, to conduct a desk audit, tax officials do not need any special decision. Three months are allotted for verification from the date of submission of reports. During this time, tax authorities check:

- completeness of the submitted reports;

- timeliness of its submission;

- correctness of reporting;

- correctness of tax base calculation;

- the validity of the tax rates and benefits applied by the taxpayer;

- the correctness of the arithmetic calculation of the final tax amounts.

When checking statements, tax authorities do not have the right to demand additional documents from the company.

But there are exceptions to this rule. For example, if you ask for a refund of value added tax, inspectors may require additional documents from you confirming your right to tax deductions (clause 8 of Article 88 of the Tax Code of the Russian Federation).

Also, controllers have the right to request documents that confirm the correct application of VAT deductions, even if there is no question of tax refund.

Firms enjoying tax benefits must submit papers confirming their right to these benefits.

note

During a desk audit on VAT, controllers are required to make decisions: on refusal of tax refund, on full tax refund and on partial refund. That is, if there are violations on one part of the refunded tax, and the other part does not cause disputes, controllers must make two decisions: one on a partial refund of the tax, which is not disputed, and the other on refusal to refund the remaining amount. This rule applies to decisions made after January 1, 2009.

If tax authorities find inconsistencies in the submitted documents, they may call you to give explanations (clause 4, clause 1, article 31 of the Tax Code of the Russian Federation).

To do this, the inspector must send a written notice to the company about calling the taxpayer (an example of a statement can be found in the “Tax Accounting and Reporting” berator).

Status of verification 3 personal income tax information missing

If there is no data on the result of the desk audit, what this means, the tax inspector will tell you at the place where the declaration was registered or by telephone. The main reason is the lack of necessary information from the taxpayer. If the inspector detects a violation, he draws up a report and recalculates the amount of tax.

The inspector does not have the right to extend the three-month inspection period allocated by law. The taxpayer is notified of a pause in inspection by sending the following to his address:

- notification add clarifying documents;

- notice to appear at the tax office.

The inspector can contact the applicant using the phone number that is filled in during the paperwork process. If the period allocated for verification has expired, the payer has not received instructions, there is a reason to personally contact the tax office.

Three months is the final inspection period and if it is violated, the inspection cannot impose a fine on the client. The taxpayer must personally monitor the receipt of funds into his own current account. They are accrued within a month after the last day of verification. If the period established by law is exceeded, interest will be charged on the amount of the tax deduction for each day of delay.

Authentication of certificates and declarations

Any data you provide, including personal data, on the basis of which we can identify you, is stored and processed in accordance with the Federal Law of the Russian Federation “On Personal Data” No. 152-FZ of July 27, 2006.

The completed online application form will be transmitted over a secure connection.

By leaving your data on the website owned by Gosstandart Expert LLC (hereinafter referred to as the “Company”) by filling out the fields of the online application and/or calling the number indicated on the website, you confirm and acknowledge that you have read the agreement and processing conditions set out below The company provides your personal data that you provide in the fields of the online application; and agree to such terms without reservations or restrictions.

Personal data means information related to the subject of personal data, in particular last name, first name and patronymic, contact details (telephone, email address) and other data referred to by Federal Law of July 27, 2006 No. 152-FZ “On Personal Data” (hereinafter referred to as the “Law”) to the category of personal data.

Placing an application on the website means your consent to the Company’s processing of the personal data provided to the extent in which they were submitted, in the manner and under the conditions determined by the Law in any way provided for by the Company and (or) established by the Law, and also means your consent to receive information e-mail messages.

The purpose of processing personal data is to provide the Company with information and reference services, as well as information about the services provided by the Company, work performed and goods sold.

The storage, processing and transfer of personal data is carried out entirely in accordance with Federal Law-152 “On Personal Data”.

In case of withdrawal of consent to the processing of your personal data, the Company will stop processing it and destroy the data within a period not exceeding three working days from the date of receipt of such withdrawal. You can provide a written revocation of your consent to the processing of your personal data to the Company’s office at the address: 197373, St. Petersburg, Aviakonstruktorov Ave., 12, letter A, room 4-N.

We draw your attention to the fact that this website is for informational purposes only and under no circumstances constitutes a public offer as defined by the provisions of Article 437 of the Civil Code of the Russian Federation. For more complete and detailed information, you can contact us by phone or email listed on the Company’s website.