From January 1, 2021, a progressive tax rate for personal income tax is applied. Based on Federal Law 372 of November 23, 2020, the following rates are now used:

- if the amount of income (tax bases) for the tax period is less than or equal to 5 million rubles. - 13%

- if the amount of income for the tax period is more than 5 million rubles. — 650 thousand rubles (5,000,000 * 13%) and 15% of the amount of tax bases (NB), over 5 million rubles.

List of codes in the 2-NDFL certificate in 2021. Explanation.

The main information contained in the certificate is salary calculations by types that have a special coding. The list of such codes can be found in Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected] (as amended on October 24, 2017). In addition, this legal document also contains codes for deductions provided in accordance with the law, which must also be included in the certificate.

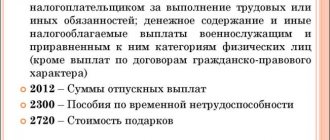

The most common codes:

- code 1010 - dividends;

- code 126 - deduction for the first child;

- code 127 - deduction for the second child;

- code 2000 - remuneration for labor activity;

- code 2002 - bonuses;

- code 2003 - remuneration from profit;

- code 2010 - remuneration under civil and process agreements;

- code 2012 - vacation payments;

- code 2013 - compensation for vacation not provided;

- code 2300 - sick leave benefits (except for maternity benefits);

- code 2510 - payment by the employer of property rights or services for an employee;

- code 2720 - gifts;

- code 2760 - financial assistance to employees and retired employees;

- code 2762 - one-time assistance from the employer at the birth (adoption) of a child;

- code 4800 - other income;

- code 503 - deduction from financial assistance to employees and retired employees.

- code 501 - deduction indicates receiving a gift from an organization or entrepreneur

What income will not be subject to increased personal income tax?

When calculating the tax base the following will not be taken into account:

- sale of property, except securities - house, plot, apartment;

- gifts in the form of property, except for securities - a car, a share in a house.

- payments under insurance contracts.

For example, when selling an apartment for RUB 7,200,000. 15% rate will not be applied. If you were given a house for 10 million rubles. the rate will be 13%.

Consumer loan in cash from Raiffeisenbank - up to 2 million for 5 years!

Apply now

What are the differences between the 2021 certificate and the 2021 certificate?

In 2021, to generate 2-personal income tax for 2021, you need to use the certificate form approved by the Order of the Federal Tax Service of the Russian Federation dated October 2, 2018 No. ММВ-7-11/ [email protected] It differs from the form that was used for certificates created in 2021 for 2021

The main changes in the certificate include the following points:

- The document form has two forms depending on who the user is - the tax office or an employee. At the same time, employees are presented with a form that is similar to the 2017 form, but information is excluded from it - the certificate number, its sign, adjustment number, Federal Tax Service code, information about confirming the right to reduce personal income tax, fixed advance payments. It’s called “Certificate of income and tax amounts of an individual.”

For the Federal Tax Service, a modified form on two sheets is used:

- the first sheet is called “Certificate of income and tax amounts of an individual (form 2-NDFL)”;

- the second sheet is called “Appendix. Information on income and corresponding deductions by month of the tax period";

- the first sheet contains basic information about the certificate, personal information about the employee and employer, general data on the amount of accrued income and withheld tax. The second sheet is intended for monthly reflection of information on income and deductions according to the corresponding codes;

- Some columns were added to the document for the Federal Tax Service, namely information about the reorganized company, taxpayer status, deductions provided by the employer;

- columns concerning the taxpayer’s registration address were removed from the document for the Federal Tax Service;

- in the certificate, all deductions, including standard ones, are combined into one block;

- the certificate for the Federal Tax Service must indicate a document according to which the powers of the signing official are confirmed.

Attention! According to the certificate for employees, the information was reduced by removing unnecessary fields, and for the Federal Tax Service, the information was combined, which, by changing the structure, is now contained not in 5, but in 3 blocks and an Appendix.

New form, rules and form 2 personal income tax in 2021

The certificate in 2021 has a new format according to Order of the Federal Tax Service of the Russian Federation dated 10/02/2018 No. ММВ-7-11/ [email protected] , which is applied from the moment it comes into force, namely from 01/01/2019.

Main changes in the new form:

- for the tax inspectorate, the form is divided into two sheets, and for employees the document is formed on one sheet;

- the field for entering the name of the tax agent has been expanded, and his TIN and KPP have been moved to the “header” of the document;

- New columns have been added to information about the employer regarding its reorganization or liquidation. The legal successor of the business entity must also indicate its information, namely the name, TIN and KPP;

- the block was modified to reflect personal information about the employee, and the columns that indicated information about the place of registration were excluded from the information;

- detailed information on the amounts of income and deductions for each month is transferred to a separate sheet as an appendix;

- the block concerning information on standard, social and property deductions has been expanded;

- A change has been made to the certificate barcode.

Thus, the form of the certificate for submission to the inspection has undergone significant changes, and for transmission to employees the form of the document has been slightly shortened. The coding for income and deductions remains the same for 2021 compared to 2021.

Personal income tax. What is it and what is it based on?

Personal income tax stands for personal income tax. It identifies the mandatory levy applicable to each type of profit. It can be obtained:

- Russian citizen;

- a foreigner who resides in the country for more than 183 days;

- by any entity when receiving income as a result of interaction with Russian sources, regardless of its location.

Where do you need Form 2-NDFL?

2-NDFL is needed by different users, including:

- employers who report to the tax office on accruals and deductions made for each employee. The provided certificates indicate that the business entity has entered into official labor relations with its employees and pays the amounts due to them in accordance with the requirements of labor legislation. In addition, the document confirms the 2-NDFL income codes for 2021, the calculation of personal income tax on them and its payment to the state budget;

- tax inspectorate, which checks employers' compliance with labor and tax laws. According to regulatory legal acts, the employer must submit the 2-personal income tax forms generated for employees within the established time frame. If the employer does not do this, the inspectorate applies penalties to him;

- employees who have the right to a tax deduction and use 2-NDFL with deduction codes for children to generate a 3-NDFL declaration. In addition, they need the document when applying for a loan, since many banks require salary information on this form. A certificate is also needed when applying for a new job, since the new employer needs data to provide deductions.

When to submit your certificate for 2021?

The deadline for submitting 2-NDFL depends on the characteristics of the document. Certificates for 2018 are submitted to:

- until 04/01/2019 for documents with attribute “1” (issued for all employees);

- until 03/01/2019 for documents with sign “2” (issued if there is income for which personal income tax is not withheld).

If the organization does not submit the certificate within the specified period, the tax authorities impose a fine. According to Article 126, Part 1 of the Tax Code of the Russian Federation, if information necessary for control is not provided, a fine will be issued to the legal entity. face 200 rub. and 300-500 rub. to the official for each document not submitted. In addition, a fine of 500 rubles may be imposed on the employer. for a document if it contains false information.

Important! It will be possible to avoid penalties only if the employer independently finds an error in the certificate and submits a corrective version before the start of an audit by the tax service.

How and where to submit a certificate for 2021

The form for 2021 is regulated by Order of the Federal Tax Service of the Russian Federation dated October 2, 2018 No. ММВ-7-11/ [email protected] , and it is mandatory for use by all employers. A different form of certificate will be considered erroneous, since the officially registered sample is a unified reporting form.

The legislation provides two ways to submit certificates to the tax office:

- on paper, if the employer made payments to employees of less than 25 people;

- in electronic format through telecommunication channels, if the employer has made payments to 25 employees or more.

In the second case, the organization must enter into a formal agreement with the data transmission operator and obtain an electronic signature indicating the accuracy of the information and the signature of documents by an official of the company. In such a situation, it is considered that the certificates are transmitted via the Internet through a specialized company.

Important! Documents must be sent to tax authorities at the registered address of the business entity, where other reporting is also submitted.

What are the features of tax calculation in 2021 and 2022?

2021 and 2022 are considered transition years. To simplify calculations, tax calculation rates will be applied to each tax base separately. That is, even if the sum of all tax bases for 2021 is more than 5 million rubles, and each base individually is less than the threshold, then a rate of 13% will be applied.

For example, an employee’s salary is 250,000 rubles. For 12 months of 2021, the base will be 3 million rubles. Also in 2021, he was paid dividends in the amount of 3.7 million rubles.

The amount of bases for 2021 is equal to 6.7 million rubles. But each base is less than 5 million rubles, that is, a rate of 13% will be applied to both salaries and dividends.

Certificate 2-NDFL for tax authorities

Certificate form

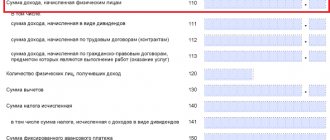

The document for the tax office contains information of a different nature, divided into blocks:

First sheet:

- “document header”, in which the tax agent’s tax identification number and checkpoint are entered. It is especially important that the order on the basis of which this form was put into effect must be indicated in the right corner;

- information about the document - number, year of submission, sign, correction number, inspection number;

- information about the tax agent by which the business entity is identified (name, OKTMO code, INN and KPP of the reorganized organization, telephone number);

- information about the employee, including full name, tax identification number, date of birth, taxpayer status, citizenship, document type code, series and number;

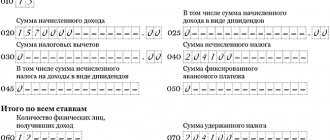

- generalized information on the amount of income received for the entire period, the amount of calculated, withheld and transferred tax, the amount of excessively withheld and not withheld personal income tax, the amount of advance payments;

- information about standard, social and property deductions received through the employer. This also includes information about the notification received from the tax office;

- information about the agent (full name of the manager, information about the document confirming authority, date and signature);

Second sheet:

- indicate the TIN and checkpoint of the agent;

- information is provided about the certificate number, reporting period, personal income tax rate, as well as specific information by month about income or deduction codes and the amounts for them.

Important! The main information in the document is the codes in the 2-NDFL certificate, which are directly related to filling out 2-NDFL according to the rules and reflecting the calculation of wages in accounting.

Rules for filling out the certificate

(Appendix No. 2 to the order of the Federal Tax Service of Russia dated October 2, 2018 N ММВ-7-11/ [email protected] )

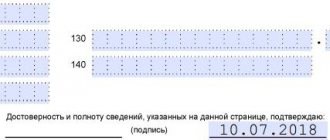

The stages of filling out a certificate to the inspectorate can be presented in the following order:

- indicate basic information regarding the certificate itself, the tax agent and the taxpayer;

- enter general information about income, personal income tax and deductions provided by the employer;

- sign the first page of the certificate;

- enter monthly information about the codes and amounts of income and deductions;

- sign the second sheet of the certificate.

Sample filling for the Federal Tax Service

Certificate 2-NDFL for individuals

Certificate form for issue upon request

If an employee requests a 2-NDFL certificate from the accounting department for 2018 or 2021, it must be generated according to the following rules:

- indicate the date of the certificate and the year for which it was generated;

- indicate the details of the tax agent (employer), including OKTMO code, name, INN, KPP, telephone number, information on the reorganized company;

- enter personal information about the employee (full name, tax identification number, status, citizenship, date of birth, passport details)

- reflect the codes and amounts of income and deductions by month;

- enter information on the provided standard, social and property deductions;

- reflect the total amounts of accrued income, calculated, withheld and transferred personal income tax amounts;

- sign the certificate and indicate the name of the signatory.

Rules for filling out a certificate in 2019

The stages of filling out a certificate for an employee can be presented in the following order:

- enter basic information on the certificate, employer and employee;

- fill out information about income;

- reflect data on tax deductions received;

- enter general information about income and personal income tax;

- sign a document.

Sample of filling out a certificate for employees

Regulations for submitting to the tax office

The regulations for submitting a certificate to the inspection are enshrined in Appendix 4 to the Order of the Federal Tax Service of the Russian Federation dated October 2, 2018 No. ММВ-7-11/ [email protected] It contains the following information:

- who submits the documents;

- how they can be transmitted;

- what is the date of submission of certificates to the Federal Tax Service;

- how to submit certificates on paper;

- how to transmit certificates in electronic format via telecommunication channels.

In what cases is it not necessary to submit

For some employees, the employer does not have to file 2-personal income tax, which is specifically stated in the regulations. So, documents do not need to be sent:

- if the employee received payments not subject to personal income tax. According to Art. 217 of the Tax Code of the Russian Federation, an employee may be paid income that is not subject to taxation, and, accordingly, if only such accruals are present, then a certificate is not submitted to the tax authorities. Such income can be state benefits (unemployment benefits, child care benefits, maternity benefits), compensation for harm, pensions, benefits in kind, payment for food or accommodation, etc.;

- if an individual in accordance with Art. 227, 228 of the Tax Code of the Russian Federation are obliged to calculate and pay personal income tax themselves - individual entrepreneurs, notaries, lawyers, etc.;

- if the individual received payments specified in Art. 226.1 Tax Code of the Russian Federation. This point concerns income from transactions with securities, financial instruments, repo transactions and securities lending.

Recommendation! It is necessary to clearly determine what type of income it is, and whether it is necessary to withhold and transfer tax on it, and, accordingly, submit a 2-NDFL certificate to the tax office. If you have any doubts on this issue, it is better to contact the hotline in order to take action in accordance with the legislation of the Russian Federation and not receive a fine.

Additional points

There are several additional points regarding 2-NDFL:

- the validity period of the deduction certificate is 3 years, since it is during this period that the taxpayer can exercise his right to the benefit;

- the validity period of the loan certificate is set by the bank itself, and, as a rule, this period is no more than six months;

- if the employee does not have taxable income, he does not need to submit a certificate to the tax office. In addition, such an employee will not be able to receive a deduction;

- certificate of income of an individual 2-NDFL - the main document reflecting final information on income and deductions for a specific employee.

To find out what the codes in the 2-NDFL certificate mean and in general what codes are present in the 2-NDFL certificate, see the link.

2-NDFL for tax deduction

To receive a deduction through the tax office, for example, property or social, you need to take 2-NDFL from the employer and submit it to the tax authorities. Information from this document is entered into the 3-NDFL declaration indicating the employing organization, its tax identification number and checkpoint, as well as monthly information about income. In addition, data on deductions provided directly by the employer must also be reflected in the declaration for the correct calculation of personal income tax for refund.

The tax office compares the information from the submitted document with information previously received from the employer and identifies any inaccuracies or establishes the accuracy of the document.

Attention! Tax authorities do not accept a paper declaration unless 2-NDFL is attached to it, and this must be the original document, and not a copy. If a taxpayer submits an electronic calculation through his personal account on the Federal Tax Service website, then, as a rule, the 2-NDFL certificate is uploaded automatically when the employer submits it in accordance with the submission deadlines. In this case, tax authorities may not request 2-NDFL from the person himself.

Why do you need 2-NDFL when applying for another job?

When applying for a new job, it is necessary to submit 2-NDFL from the previous place to the accounting department, and at the same time it must be formed for the calendar year, that is, from the beginning of the year until the employee’s dismissal.

The need to transfer the document is due to the fact that this information is needed to provide a person with standard deductions for himself or for children, social or property deductions, if the person has such a right. According to Art. 218 of the Tax Code of the Russian Federation, standard deductions are provided to the employee until his total income for the calendar year reaches 350 thousand rubles. When the specified limit is reached, no deduction is provided, and therefore the accountant needs to know exactly what payments and in what amount the employee received at his previous job.

If a person does not claim deductions, then 2-NDFL does not need to be submitted to the accounting department at the new location.

2-NDFL and credit

When receiving a loan, many banks require official confirmation of income - either 2-NDFL, or a certificate in the form of the credit institution itself. If it is necessary to submit 2-NDFL, then it is ordered from the accounting department in the usual manner, and there is no need to enter any additional information into it, since it is a unified accounting register.

Based on the information from the certificate, the loan officer calculates the likely amount of the loan provided and also assesses the client’s solvency. At the same time, banks check and analyze the accuracy of the information contained in the certificate using the following methods:

- clarify information about the organization through official sources of information. For example, to determine whether a given organization really exists, you can request an extract from the Unified State Register of Legal Entities, which is provided free of charge to any user;

- information regarding the employee is checked, that is, his full name, passport details, TIN;

- Information related to income reflected on certificates is especially carefully checked and analyzed. In this case, the decoding of income codes in the 2-NDFL certificate is taken into account, allowing you to understand exactly what payments the employee received from the employer. Information related to a sharp increase or decrease in wages is subject to careful analysis, and then an employee of a credit institution may ask for an explanation from the employer as to what is causing such a change in wages;

- banks have the opportunity to request information from inspection authorities and check certificates for the accuracy of the information entered. Employees submit an official request, to which they also receive an official response from the tax service;

- To confirm the amounts specified in 2-NDFL, banks can request from the organization other accounting registers for payroll, for example, pay slips, personal accounts, the availability of writs of execution for the employee, etc.

Common mistakes when filling out

Experts identify the following most common mistakes:

- erroneous indication of the income code in the 2-NDFL certificate. The accountant may make a mistake and assign the wrong number to the code, which will result in an incorrect accrual position being indicated in the certificate;

- for one month, the salary can be divided into two amounts. This error occurs because the employer is obliged to pay the employee at least 2 times a month (advance and basic salary). However, both of these amounts must be summed up and entered as a total for each month;

- errors in the OKTMO organization. If the employer has divisions, then they are assigned their own OKTMO numbers. The certificates must indicate the OKTMO corresponding to the specific department in which the employee works;

- errors in reflecting the amounts of remuneration under GPC agreements. Income must be reported in the month in which it was actually paid, not accrued. This point is one of the main differences between employment contracts and GPC;

- errors in indicating the basic details of the organization or employee, for example, change of name or surname, incorrect TIN, change of passport data.

Important! Identified errors can be corrected by the employer by submitting corrective reports, but this must be done before the tax service checks, so as not to receive a fine.

Personal income tax per employee: 13 or 30

A. Balashova, ch. accountant

The personal income tax rate depends on where the citizen spent more time during the calendar year - in Russia or abroad. However, it is still impossible to determine this indicator at the beginning and even in the middle of the year. How to calculate the tax in this case so as not to violate the law and not offend the employee? You will find the answer in the article.

To calculate personal income tax, it does not matter whether your employee is a citizen of Russia or not. What matters is whether he falls under the definition of a resident of the Russian Federation. These are recognized as individuals who were actually on the territory of the Russian Federation for at least 183 days in a calendar year (Clause 2 of Article 11 of the Tax Code of the Russian Federation). If an individual is a resident, then his income from performing labor duties is taxed at a rate of 13 percent, otherwise a rate of 30 percent is applied (Article 224 of the Tax Code of the Russian Federation).

But how can one determine the status of the employee and, therefore, the correct rate when paying income during the year? As for Russian citizens, it is generally accepted that at the beginning of the tax period they are residents. However, in practice, situations arise when a Russian ceases to be a resident. Then he, like a foreign employee, becomes a headache for the accountant.

In the past year, the Ministry of Finance has paid a lot of attention to this problem: several letters useful for accountants have been written by financial department specialists.

Employee from abroad

The first clarification concerns the situation when a company employs specialists who are citizens of foreign countries (letter of the Ministry of Finance of Russia dated June 30, 2005 No. 03-05-01-04/225).

Let us assume that an organization pays income to individuals on the basis of fixed-term and open-ended employment contracts. Before a citizen can document that he was actually on the territory of the Russian Federation in a calendar year for at least 183 days, the company withholds personal income tax on his income at a rate of 30 percent. Many people ask the question: if an employee has the prospect of becoming a tax resident of the Russian Federation within a year, is it possible to apply a rate of 13 percent even before the expiration of 183 days in the calendar year? And if so, what documents must be submitted for this?

The Ministry of Finance's response pleased many firms and especially their foreign employees. Financial department officials indicated the following. In some cases, foreign citizens may be considered as tax residents of the Russian Federation at the beginning of the tax period and pay personal income tax at a rate of 13 percent. This is possible if the employment contract concluded between a Russian organization and a foreign citizen provides for a duration of work in the Russian Federation in the current calendar year of more than 183 days.

So the accountant has a choice. The first option is this. From the beginning of the year, withhold personal income tax on the income of foreign employees at a rate of 30 percent. Then, if their tax status changes (if employees have been in the Russian Federation for more than 183 days in a calendar year), recalculate tax amounts from the beginning of the calendar year at a rate of 13 percent.

The second option is based on the mentioned letter from the Ministry of Finance and is as follows. If an employment contract is concluded between a foreign worker and an organization for a period of more than 183 days of a given calendar year, then the 13 percent rate is applied immediately from the beginning of the year (or the start of work). And if necessary, the tax amounts are recalculated on the date of actual completion of the foreign citizen’s stay on the territory of the Russian Federation. Obviously, the second option is much more beneficial for the employee.

Russian abroad

The letter of the Ministry of Finance of Russia dated June 30, 2005 No. 03-05-01-04/226 discusses a slightly different situation. A citizen of the Russian Federation worked at a Russian organization at the beginning of the year, and then within a year he quit and moved to work for hire in another country. From the beginning of the year, the Russian employing organization calculated, withheld and transferred personal income tax to the budget at a rate of 13 percent, since on the date of actual receipt of income the employee was a tax resident of the Russian Federation.

After a former employee spent 183 days abroad this year, he ceased to be considered a tax resident of the Russian Federation. This means that his income received before leaving abroad should have been taxed at a rate of 30 percent. What should an accountant do in such a situation?

The Ministry of Finance tried to reassure everyone who found themselves in this situation. Indeed, in the described case, the former employee ceased to be considered a resident of the Russian Federation and the company needs to recalculate personal income tax amounts from the beginning of the calendar year. But at the same time, specialists from the financial department reminded that tax agents are obliged to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment (clause 4 of Article 226 of the Tax Code of the Russian Federation). And if it is impossible to withhold the calculated amount from an individual, then the tax agent must, within one month from the moment such circumstances arise, notify in writing the tax office at the place of his registration about the impossibility of withholding the tax and the amount of the citizen’s debt. At this point, the company’s obligation is considered fulfilled.

The tax service itself will deal with the citizen. In such a situation, inspectors will not require you to submit a declaration in form 3-NDFL, but you will have to pay off the debt. Otherwise, it will be collected from the citizen in court (Article 45 of the Tax Code of the Russian Federation).

Belarusian brother

A separate clarification from the Ministry of Finance is addressed to accountants of companies where citizens of the Republic of Belarus work (letter dated August 15, 2005 No. 03-05-01-03/82).

At the beginning of the letter, employees of the country's main financial department described the general rule for applying the concept of “tax resident” to foreign citizens. Those of them who have received a permanent residence permit or residence permit in our country are considered tax residents of the Russian Federation at the beginning of the tax period. And, therefore, a personal income tax rate of 13 percent is applied to their income from employment. For all other foreigners, a rate of 30 percent is used at the beginning of the year, and after 183 days of an individual’s stay in the Russian Federation, the tax is recalculated.

However, citizens of the Republic of Belarus who have recently arrived in Russia are an exception to this rule. The fact is that an Agreement on the Avoidance of Double Taxation dated April 21, 1995 was concluded between the Government of the Russian Federation and the Government of the Republic of Belarus. In accordance with paragraph 1 of Article 21 “Non-discrimination” of this document, citizens of Belarus should not be subject to more burdensome taxation in Russia than citizens RF in similar circumstances. At the same time, income of Russian citizens under employment contracts is taxed at a rate of 13 percent from the first day of the tax period.

Therefore, for citizens of Belarus from the first day of their stay in our country, the personal income tax rate is 13 percent. However, experts from the Ministry of Finance note that it is necessary to take into account the term of the employment contract concluded with the employee. In other words, the “resident” rate applies only if the employee can potentially stay in the Russian Federation for more than 183 days in the current calendar year.

Attention

Tax deductions (standard, social, property and professional) apply only to those incomes that are taxed at a rate of 13 percent (clause 3 of Article 210 of the Tax Code of the Russian Federation). With respect to income for which other tax rates are provided, deductions are not applied (clause 4 of Article 210 of the Tax Code of the Russian Federation).