Since the water tax is one of the most difficult for the average person to understand, a calculator for calculating it will be useful to everyone. This budget obligation appeared quite a long time ago, but many still cannot master its calculation, which is associated with a large number of difficulties. But thanks to the Pravio website, it became possible to do the procedure virtually. In addition, if the funds were not deposited on time, on the same resource you can calculate the amount of the penalty that the person who is late with the payment will have to pay. This allows you to always be fully armed and avoid mistakes and inaccuracies, both for legal entities and individuals who find themselves in trouble.

Water intake

If you use a water body to collect water, the tax base corresponds to the volume of water collected per quarter. Determine the volume based on the data from the measuring instruments. Record the same readings in the primary water use log. The form of the journal was approved by order of the Russian Ministry of Natural Resources dated July 8, 2009 No. 205.

But what if there are no water measuring instruments? Then determine the volume of water based on the actual operating time and productivity of the technical equipment. For example, when water is collected by a pump, the tax base depends on the pump’s performance (the volume of water taken per unit of time) and its operating time. Also take into account the height of the water rise (water column), its characteristics, which depend on time and depth, as well as the condition of the well.

If it is impossible to determine the volume using this method, use water consumption standards. The limit is specified in the license. It is established for each water body and purpose of use.

Such rules are contained in paragraph 2 of Article 333.10 of the Tax Code of the Russian Federation.

Calculation and payment: fill out the declaration correctly

In accordance with the provisions on the water tax of the Tax Code of the Russian Federation, the responsibility for calculating the amount of tax to be paid rests with the payer himself.

Based on the provisions of the law, he must independently:

- calculate the tax base;

- determine what bet size he needs to use;

- calculate the amount to be paid.

The payer enters the results obtained into the water tax declaration.

The tax period for the water tax is both for its submission and the deadline for payment of the water tax is a quarter.

That is, the document must be submitted to the Federal Tax Service 4 times a year and money must be transferred to the budget with the same frequency.

The legislation established the deadline for submitting the declaration and paying the tax on the 20th day of each month following the end of the quarter. are recognized as the tax period for water tax :

- April;

- July;

- October;

- January.

The declaration is submitted to the Federal Tax Service branch that is located at the payer’s location.

There are certain requirements for filling it out :

- The declaration can be submitted either in written or electronic form (the latter form is required for enterprises with more than 25 employees).

- If the document is submitted in writing, it must be filled out with a ballpoint or fountain pen, black or blue ink, or printed on a computer.

- The tax amount displayed in the declaration must be indicated in rubles and as a whole number.

- One cell can contain only one character - a number, a period, a comma, etc. A zero or a dash is placed in empty cells.

- Corrections made must be certified by the signature of the person submitting the document and the seal of the organization (if it is the payer).

- The presence of the date of completion, the signature of the individual, as well as the seal and signature of the head of the organization are mandatory details of the declaration.

- At the top of each page of the document, the TIN (for an individual) or TIN and KPP (for a legal entity) must be indicated.

Procedure for filling out a water tax declaration.

The declaration itself contains data about the organization, individual entrepreneur or individual who are the payers.

It also provides a calculation for each tax base and the total amount due.

If during the reporting period the payer did not use the water body and there is no base for calculation, he is still not exempt from submitting the declaration.

In this case, he is obliged to submit a zero declaration. The procedure for submitting this document is no different from other similar ones: it can be taken to the Federal Tax Service in person, through your legal representative, sent by mail or submitted electronically.

The video explains how to calculate and pay water tax.

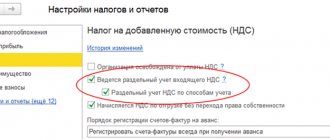

Readers will be interested to know what VAT is and how to return it, in what cases is it possible to refund VAT from the budget, what is the difference between a desk and field tax audit of individual entrepreneurs, and how to pay dividends to the founders of an LLC using the simplified tax system.

Use of water bodies for the purpose of rafting wood in rafts and purses

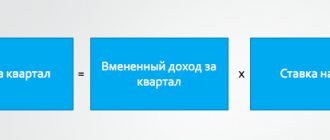

When using a water body for rafting wood in rafts and purses, calculate the tax base using the formula:

| The tax base | = | Volume of wood rafted in rafts and purses (thousand cubic meters) | × | Rafting distance (km) : 100 |

This procedure is contained in paragraph 5 of Article 333.10 of the Tax Code of the Russian Federation.

Taxation of transport

Ship owners are interested in calculating the water transport tax in 2021 using a calculator. It is regulated by Ch. 28 of the Tax Code. In fact, it has nothing to do with water intake, but is also calculated virtually.

You can calculate the water transport tax on the Pravio website. Here you will also find instructions on exactly how to do this, and what indicators need to be entered to get a reliable result. If the accrual of penalties has already begun, using the resource in question it is possible to find out its exact size.

Tax rates

Water tax rates are listed in Article 333.12 of the Tax Code of the Russian Federation. They are different and depend on:

- from the object of taxation;

- from river basins, lakes, seas;

- from economic regions.

See the table for a list of all possible bets.

If different rates are established for one water body, determine the tax base separately for each rate. For example, if an organization collects water from the Volga River in the Northern and Northwestern economic regions, the tax base must be calculated separately. Despite the fact that there is only one water body - the Volga River, different water tax rates apply in these areas.

This is indicated in paragraph 1 of Article 333.10 and subparagraph 1 of paragraph 1 of Article 333.12 of the Tax Code of the Russian Federation.

Please note that a coefficient is applied to water tax rates. Its size is set for each year. For example, in 2016, bets are applied with a coefficient of 1.32.

In addition, rates need to be increased additionally in two cases .

The first is when drawing water:

- by a factor of 1.1, if you do not have special instruments to measure the amount of water that is withdrawn from the water body;

- five times for an over-limit fence.

The second is for the extraction of groundwater for its processing, packaging and sale by a factor of 10. This case does not apply to the extraction of industrial, mineral and thermal waters.

Such rules are provided for in paragraphs 1.1, 2, 4 and 5 of Article 333.12 of the Tax Code of the Russian Federation.

When multiplying bets by odds, round them to the nearest ruble. This is stated in the letter of the Federal Tax Service of Russia dated January 22, 2015 No. GD-4-3/721.

Responsibility for non-payment of tax and failure to submit a declaration

The absence of a declaration or failure to pay the tax amount to the budget is a violation of the law, for which certain liability is provided. The punishment for this type of violation is determined in the general manner, as for other similar offenses:

- In case of failure to submit a declaration, the payer will have to pay a fine - from 1000 rubles. up to 30% of the amount payable in accordance with this declaration (in general cases - 5% of this amount).

- For submitting a declaration in electronic form in violation of the established method for such document submission, a fine of 200 rubles is imposed.

- For tax, the amount of which was not paid partially or in full, a fine of up to 20% of this amount is imposed - if the actions were committed unintentionally, and up to 40% of the amount - in case of deliberate deception.

The characteristic of water tax is one of the types of payment for subsoil and the obligation to pay it applies to all entities that use water resources in the manner prescribed by law.

Regulation of the calculation and payment of this tax is carried out using two main documents - the Tax Code and the Military Code of the Russian Federation.

The Tax Code of the Russian Federation establishes an exhaustive list of situations in which water tax must be paid, and also specifies the procedure for determining the base and rate for its calculation.

However, the size of the rates may vary significantly depending on the specific body of water.

Water tax: postings

In accounting, account 68 is used to reflect water tax. For the convenience of analytics, a special sub-account is opened on it for a specific budget obligation, for example, 68.5. If a company has several water bodies for use, it can reflect fiscal obligations in the context of each separately. For this, third-order subaccounts are opened: 68.51, 68.52, etc.

Costs associated with the transfer of fiscal payments are classified as ordinary activities and reflected in accounts 20, 21, 23 or 25, depending on the accounting policy of the enterprise.

Important! The amount of water tax is calculated by the taxpayer independently for a specified period - a quarter. Benefits for this obligation are not provided for by law.

Tax accrual is reflected on the last day of the quarter. The accountant makes the posting:

D 20 (21, 23, etc.) – K 68.5.

If accounting is carried out across several objects, the postings look like this:

- D 20 – K 68.51 – accrual for object “A”;

- D 20 – K 68.52 – accrual for object “B”.

The supporting document for the accrual transaction is an accounting statement.

The transfer of the calculated amount of the obligation to the budget is reflected by the posting:

D 68 – K 51.

Supporting document – bank statement.

Water tax in tax accounting

The reflection of water obligations in tax accounting depends on the tax regime chosen by the company. Let's consider two situations:

General tax regime

Art. 264 of the Tax Code of the Russian Federation allows water obligations to be included in other expenses associated with the manufacture and sale of products. In accounting they are written off to account 91.2. When determining the tax base, they can be fully deducted.

The moment at which costs for paying water tax are accounted for depends on the cost recognition method chosen by the company:

- Cash – accrued amounts are recognized as an expense on the day of actual payment of funds to the state treasury.

- Accrual method - expenses are recognized on the last day of the corresponding quarter. For example, liabilities for the 2nd quarter reduce the tax base in the second quarter.

The amounts of budget transfers for water obligations are reflected in the income tax return.

simplified tax system

The special tax regime does not relieve the company from the obligation to remit water tax. If a commercial structure operates under the “Revenue” object, the amounts of “water” transfers to the budget do not affect the amount of “simplified” obligations.

If a company or individual entrepreneur has chosen the object “Income reduced by expenses,” “water” transfers must be included in the latter. They will reduce the tax base when calculating the “simplified” tax.

Rates for 2021

As noted, the size of water tax rates directly depends on the purposes of water use. For example, the water tax rate for water supply to the population (residential buildings):

- from 01.01.2017 to 31.12.2017 was 107 rubles per 1000 cubic meters. m of water resources;

- from 01/01/2018 to 12/31/2018 – is 122 rubles per 1000 cubic meters. m.

Water intake

When taking water within the limits of standards from surface and underground water bodies, the tax rate of water tax in 2018 is:

| Economic region | River basin, lake | Tax rate <*> in rubles per 1 thousand cubic meters. m of water taken from | |

| surface water bodies | underground water bodies | ||

| Northern | Volga | 300 | 384 |

| Neva | 264 | 348 | |

| Pechora | 246 | 300 | |

| Northern Dvina | 258 | 312 | |

| Other rivers and lakes | 306 | 378 | |

| Northwestern | Volga | 294 | 390 |

| Western Dvina | 288 | 366 | |

| Neva | 258 | 342 | |

| Other rivers and lakes | 282 | 372 | |

| Central | Volga | 288 | 360 |

| Dnieper | 276 | 342 | |

| Don | 294 | 384 | |

| Western Dvina | 306 | 354 | |

| Neva | 252 | 306 | |

| Other rivers and lakes | 264 | 336 | |

| Volgo-Vyatsky | Volga | 282 | 336 |

| Northern Dvina | 252 | 312 | |

| Other rivers and lakes | 270 | 330 | |

| Central Black Earth | Dnieper | 258 | 318 |

| Don | 336 | 402 | |

| Volga | 282 | 354 | |

| Other rivers and lakes | 258 | 318 | |

| Povolzhsky | Volga | 294 | 348 |

| Don | 360 | 420 | |

| Other rivers and lakes | 264 | 342 | |

| North Caucasian | Don | 390 | 486 |

| Kuban | 480 | 570 | |

| Samur | 480 | 576 | |

| Sulak | 456 | 540 | |

| Terek | 468 | 558 | |

| Other rivers and lakes | 540 | 654 | |

| Ural | Volga | 294 | 444 |

| Ob | 282 | 456 | |

| Ural | 354 | 534 | |

| Other rivers and lakes | 306 | 390 | |

| West Siberian | Ob | 270 | 330 |

| Other rivers and lakes | 276 | 342 | |

| East Siberian | Amur | 276 | 330 |

| Yenisei | 246 | 306 | |

| Lena | 252 | 306 | |

| Ob | 264 | 348 | |

| Lake Baikal and its basin | 576 | 678 | |

| Other rivers and lakes | 282 | 342 | |

| Far Eastern | Amur | 264 | 336 |

| Lena | 288 | 342 | |

| Other rivers and lakes | 252 | 306 | |

| Kaliningrad region | Neman | 276 | 324 |

| Other rivers and lakes | 288 | 336 | |

<*> Tax rates for water withdrawal from surface water bodies for technological needs within established limits, in relation to taxpayers operating thermal power and nuclear power facilities using a direct-flow water supply scheme, for the period from January 1 to December 31, 2005 inclusive coefficient 0.85 (Article 2 of the Federal Law of July 28, 2004 N 83-FZ).

Separate water tax rates are established for seawater abstraction within the framework of the following standards:

| Sea | Rate (RUB per 1000 cubic meters) |

| Baltic | 8.28 |

| White | 8.4 |

| Barentsevo | 6.36 |

| Azovskoe | 14.88 |

| Black | 14.88 |

| Caspian | 11.52 |

| Karskoye | 4.8 |

| Laptev | 4.68 |

| East Siberian | 4.44 |

| Chukotka | 4.32 |

| Beringovo | 5.28 |

| Pacific Ocean | 5.64 |

| Okhotsk | 7.68 |

| Japanese | 8.04 |

Water area

When using a certain surface water area, the water tax rate for 2021 is as follows:

| Economic region | Rate (thousand rubles per year per 1 sq. km) |

| Northern | 32.16 |

| Northwestern | 33.96 |

| Central | 30.84 |

| Volgo-Vyatsky | 29.04 |

| Central Black Earth | 30.12 |

| Povolzhsky | 30.48 |

| North Caucasian | 34.44 |

| Ural | 32.04 |

| West Siberian | 30.24 |

| East Siberian | 28.2 |

| Far Eastern | 31.32 |

| Kaliningrad region | 30.84 |

In the case of using surface sea waters, tax rates for water tax are set as follows:

| Sea | Rate (thousand rubles per year per 1 sq. km) |

| Baltic | 33.84 |

| White | 27.72 |

| Barentsevo | 30.72 |

| Azovskoe | 44.88 |

| Black | 49.8 |

| Caspian | 42.24 |

| Karskoye | 15.72 |

| Laptev | 15.12 |

| East Siberian | 15 |

| Chukotka | 14.04 |

| Beringovo | 26.16 |

| Pacific Ocean | 29.28 |

| Okhotsk | 35.28 |

| Japanese | 38.52 |

Hydropower and wood alloy

A separate percentage rate of water tax is established for such specific industries as:

- hydropower (RUB per 1000 kW/h);

- tree reference (1000 cubic meters of alloy for every 100 km).

Features of VN payment in 2021: “old” and new.

The circle of obligated persons listed above must pay VN at the end of each quarter by the 20th day of the month immediately following the expired quarter. Payment is made at the location of the object. That is, the procedure for paying VN, in fact, has not changed. However, you should be aware that in 2021 the deadline for the “quarterly” payment of VN falls on the following days.

| Quarter 2021 | 1 | 2 | 3 | 4 |

| The corresponding deadline for payment of VN | until 20.04.2021 | until July 20, 2021 | until 20.10.2021 | until 01/20/2021 |

If the last day of payment falls on a weekend (holiday), then, as before, it is postponed to the first working day that follows it. So, for example, for the 3rd quarter of 2021 you need to pay the water tax by October 20. It's Saturday, a day off. Therefore, the deadline is moved from 20.10 to 22.10, Monday (first working day). Accordingly, the VN must be paid no later than October 22, 2021.

Issues of calculating water tax are regulated by clause 3 of Art. 333.13 Tax Code of the Russian Federation. The liability of payers for tax violations is determined by Art. 119 and art. 120 Tax Code of the Russian Federation.

Meanwhile, as the Ministry of Finance of the Russian Federation informs (see letter No. 03-06-06-02/42833 dated 07/06/2017), for the unlawful use of subsoil (for example, without a license or in violation of license conditions) adm. responsibility. In such situations, the provisions of Art. 7.3 and 7.6 of the Code of Administrative Offenses of the Russian Federation (Federal Law of the Russian Federation No. 195 of December 30, 2001) and violators are fined.

Deputy Director of the Department V.A. Prokaev.

Common mistakes made by declarants when preparing and submitting reports

Error 1. The declaration must be completed and submitted by all VN payers. This norm is defined by the Tax Code of the Russian Federation, has not changed for 2021 and is applied everywhere.

Individuals and foreign organizations are no exception. They are required to submit a copy of the document to the location of the authority that issued their license.

Error 2. Inaccuracies, errors, incompleteness of information or their absence in the declaration are subject to editing and adjustment in a general manner. This means that, as before, the declarant must make appropriate changes to the KND form 1151072 and submit it in an updated form to the Federal Tax Service.

To submit an adjusted declaration, use a form that is approved and used in the period for which the adjustment is made. Since the reporting form for VN has not changed until now, in fact, for 2021, the KND 1151072 form is used in all cases.