In order to register a declaration of conformity, the product applicant must submit documents to the certification body that reflect compliance with all existing safety requirements. Such a set of documentation should be generated based on the declaration principle, in which two options are distinguished (depending on the type of product):

Proprietary safety confirmation and independent confirmation of compliance.

When declaring according to the first method, the applicant’s materials are used in the form of documents. This may be technical documentation, the result of our own measurements and research, and other documents that served as the basis for recognizing the safety of the product.

Composition of the declaration

The special declaration may include the following:

- Page 001 – title page with information about the declarant;

- Page 002 – continuation of Page 001 with detailed information about the declarant;

- Sheet A is used to declare a property;

- Sheet A1 is filled in with information about the vehicle;

- Sheet B is required to fill out information about participation in the authorized or share capital of the organization and shares;

- Sheet B is used for declaring securities (except for those indicated in Sheet B);

- Sheet D is filled out if assets owned by the nominal owner were declared in the previous sheets;

- Sheet D is required to reflect information about controlled organizations;

- Sheet E is filled out for controlled structures without forming a legal entity;

- Sheet G is used to declare information about accounts and deposits in a bank outside the Russian Federation;

- Sheet 3 includes data on accounts and deposits in relation to the owner of which the declarant is the beneficial owner;

- Sheet Z1 is used to fill out information about the owner of accounts and deposits in respect of which the declarant is the beneficial owner;

- Sheet I is auxiliary; it is used to disclose additional information to the remaining sheets of the special declaration.

Pages 001 and 002 are required. Fill out the remaining sheets only when declaring some property or accounts. The general rule is this: a separate Declaration Sheet is filled out for each object. If it is missing, then the remaining information is entered into a new Sheet. Usually all information is provided in Russian. For Sheets in which the nominal owner is indicated, fill out Sheet D. Wherever you want to indicate additional information, additionally attach Sheet I. Place both auxiliary sheets (“G” and “I”) immediately after the sheet in which you are adding information.

Please attach to the declaration:

- copies of contracts for nominal ownership of property, certified by a notary, with translation into Russian. This is mandatory if in the declaration you declare your property, which is registered in the name of a nominal owner;

- other documents and information that will confirm the declaration data. This is optional. Translate the documents into Russian and have the translation certified by a notary;

- a list of documents and information attached to the declaration. It is necessary. Compose it in any form with a brief description of the details and characteristics of the documents. The inventory is required in two copies.

This is stated in paragraphs 1–7 of Article 3 and Article 5 of the Law of June 8, 2015 No. 140-FZ.

Page 001

Start filling out the special declaration from Page 001.

In the “Information about the declarant” field, indicate the full last name, first name, patronymic, without abbreviations. Check your passport or other identification document. Foreigners can fill out this information using letters of the Latin alphabet.

In the “TIN” field, enter the code that is indicated in your registration certificate.

Be sure to write down the number of pages in the declaration and sheets of attachments. If the declaration is submitted by an authorized representative, then also consider a notarized power of attorney, which confirms his authority. When accepting the declaration, the tax inspector will recalculate the pages in the declaration and the sheets of appendices to it. The data must match, otherwise the declaration will be refused.

Certify Page 001 with your personal signature. Please indicate the date of signature. If the declaration is submitted by a representative, then it is he who signs.

Do not fill out the section “Information on submission of the declaration”. The tax inspector will do this when accepting the declaration.

Such rules are written down in parts 11–18 of the Procedure from Appendix 2 to the Law of June 8, 2015 No. 140-FZ.

How to fill out a special declaration

Issues of deoffshorization and tax transparency occupy a key place on the tax agenda of the G20, OECD and EU member countries. Systematic work is being carried out to review and improve international and national tax rules, aimed at eliminating opportunities for concealing assets and financial accounts

The Federal Tax Service of Russia already today has the ability to send requests to more than 90 countries and jurisdictions, including so-called offshore companies. The information obtained will be used to implement tax control measures against persons relying on the opacity of foreign assets and financial accounts.

WHAT SOLUTION IS OFFERED FOR RUSSIAN TAXPAYERS? On March 1, 2021, the Federal Tax Service began stage 2 of accepting special declarations. In accordance with the amendments made by Law No. 33-FZ of February 19, 2018 to the provisions of Federal Law No. 140-FZ, any individual who is a citizen of the Russian Federation, a foreign citizen or a stateless person has the right to submit a special declaration from March 1, 2021 to February 28, 2021. It is submitted on paper to any tax authority, including the central office of the Federal Tax Service of Russia. The declarant provides it personally or through his authorized representative acting on the basis of a notarized power of attorney. Persons filing a tax return receive the following benefits: 1. Transactions involving the transfer of property by its nominal owner to the actual owner of the property are exempt from taxation in accordance with the legislation of the Russian Federation on taxes and fees. 2. The declarant or the person whose information is contained in the special declaration are exempt from tax collection in the event of non-payment or incomplete payment of the tax, if the obligation to pay such tax arose for the declarant and (or) other person as a result of transactions performed before January 1, 2018 related to the acquisition (formation of sources of acquisition), use or disposal of property and (or) controlled foreign companies (CFC), information about which is contained in a special declaration, or with the opening and (or) crediting of funds to accounts (deposits), information which are contained in a special declaration. 3. Exemption from the following criminal offenses committed before January 1, 2021, if these acts are related to the acquisition (formation of acquisition sources), use or disposal of property and (or) controlled foreign companies (CFC), information about which is contained in a special declaration , and (or) with the opening and (or) crediting of funds to accounts (deposits), information about which is contained in a special declaration (this list is exhaustive): • Article 193 of the Criminal Code of the Russian Federation “Evasion of obligations to repatriate funds in a foreign country” currency or currency of the Russian Federation"; • Article 194 of the Criminal Code of the Russian Federation (part 1 and 2) “Evasion of customs duties levied on an organization or individual” (on an especially large scale, by prior conspiracy by a group of persons); • Article 198 of the Criminal Code of the Russian Federation “Evasion of taxes and (or) fees from an individual”; • Article 199 of the Criminal Code of the Russian Federation “Evasion of taxes and (or) fees from an organization”; • Article 199.1 of the Criminal Code of the Russian Federation “Failure to fulfill the duties of a tax agent”; • Article 199.2 of the Criminal Code of the Russian Federation “Concealment of funds or property of an organization or individual entrepreneur, at the expense of which taxes and (or) fees should be collected.” 4. Exemption from administrative liability in the event of a violation of the legislation of the Russian Federation during the acquisition (formation of sources of acquisition), use or disposal of property and (or) controlled foreign companies, information about which is contained in the declaration, as well as when making currency transactions and (or ) crediting funds to accounts (deposits), information about which is contained in the declaration, on the grounds provided for in Article 14.1 of the Code of Administrative Offenses “Carrying out business activities without state registration or without special permission (license)”; 5. Exemption from liability for tax offenses, if these offenses are related to the acquisition (formation of sources of acquisition), use or disposal of property and (or) controlled foreign companies, information about which is contained in the declaration, and (or) with the opening and (or) crediting funds to accounts (deposits), information about which is contained in the declaration. Can the Federal Tax Service use the information presented in a special declaration for tax audits or transfer it to third parties without the consent of the person who submitted the special declaration? The information contained in the special declaration, as well as the very fact of filing an updated declaration, cannot be the basis for conducting a desk or on-site inspection. It is a tax secret and is not used as evidence. Disclosure of information specified in a special declaration is prohibited by law (Article 183 of the Criminal Code of the Russian Federation).

WHAT ELSE IS USEFUL TO KNOW ABOUT VOLUNTARY DECLARATION? On the official website of the Federal Tax Service of Russia www.nalog.ru, a section “Special declaration” and a banner “Voluntary declaration of assets and accounts - stage 2” have been created, containing important information for declarants, including the form of the special declaration, the procedure for filling it out, and a link to the software to fill out a document automatically. The necessary information is also posted in the electronic service of the “Information Stands” website, as well as in the operating rooms of territorial tax authorities in the constituent entities of the Russian Federation. You can also get answers to your questions using the Unified Contact Center of the Federal Tax Service of Russia 8-800-222-22-22. In an accessible form, the specifics of paying taxes in the Russian Federation when doing business abroad or in the presence of foreign assets are also set out in an information brochure specially prepared by the Federal Tax Service of Russia (https://www.nalog.ru/rn77/about_fts/brochure/). It also explains how to avoid double taxation, what information must be disclosed, and many other issues regarding the declaration of foreign assets and accounts.

Declaration, Tax Service

Share

Share

Share on whatsapp

Comments

Page 002

After completing Page 001, move on to the second.

In the section “Information about the declarant – an individual”, enter the details of the identity document. In the “Citizenship” field, write down the declarant’s status code:

- “1” – citizen of the Russian Federation. If a citizen of the Russian Federation has another citizenship, still indicate the number “1”;

- “2” – foreign citizen;

- “3” – stateless person.

In the “Information about identity document” section, please indicate:

- document type. For example, “passport of a citizen of the Russian Federation”;

- document details. Series, number, date of issue and name of the authority that issued it.

Fill in “Address of residence (place of stay) on the territory of the Russian Federation” if the declarant does not live abroad. Enter the corresponding number in the special box:

- “1” – place of residence;

- “2” – place of stay.

When the declarant is a foreigner (code 2), he must indicate “Name of country of citizenship (nationality) for a foreign citizen” and “Taxpayer code or equivalent (if available) for a foreign citizen.”

Those who permanently reside abroad fill out the field “Address of residence in the country of permanent residence of a foreign citizen (stateless person).”

These rules are established by parts 19–24 of the Procedure from Appendix 2 to the Law of June 8, 2015 No. 140-FZ.

Why in 2021 Is it important to know exactly the circle of persons who have the right to file a special declaration?

The reasons for the appearance of Law 140-FZ, and its additions in 2021, are the upcoming exchange of tax information by tax authorities of the Russian Federation with other countries. At the same time, the law “on amnesty of capital” contained provisions on amnesty for both tax and currency violations.

According to the tax legislation of the Russian Federation, paying taxes is the responsibility of both residents of the Russian Federation and non-residents. The status of a “tax resident” of the Russian Federation is not related to the status of a citizen of the Russian Federation or a foreigner, and depends only on the length of stay of a particular individual on the territory of Russia (Article 207 of the Tax Code of the Russian Federation).

That is, a foreigner who has been in Russia for a long time, for example, with a residence permit in Russia, can become a tax resident of the Russian Federation.

The Law “On Currency Regulation and Currency Control” uses a similar concept – “Resident”, but until 2021. the procedure for determining the status of “Tax resident” and “Currency resident” differed significantly.

In December 2021 Amendments were made to the Russian Federation Law on “Currency Regulation and Currency Control” (173-FZ). For Russian citizens, the procedure for determining resident status for the purposes of currency regulation and currency control has been fundamentally changed - now for currency control, a citizen of the Russian Federation = resident. From 2021 For Russian citizens, this status cannot be changed.

At the same time, fundamental changes to the law freed resident Russian citizens who actually live outside the territory of the Russian Federation for more than 183 days during a calendar year from the obligation to notify about the opening of foreign accounts, their closure, changes in details, as well as the submission of reports on the movement of funds. Also, for such resident citizens of the Russian Federation, restrictions on conducting currency transactions on their foreign accounts have actually been lifted.

In connection with the stated features, questions arise: can a citizen of the Russian Federation permanently residing until 2021. in another state, living in 2021, 2021 outside the territory of the Russian Federation for more than 183 days a year, provide a special declaration in accordance with the capital amnesty law regarding his foreign accounts, which, due to the peculiarities of his “currency status”, were not previously declared in the Russian Federation?

A literal reading of the capital amnesty law (140-FZ) is beyond doubt: the declarant, that is, the person who has submitted a special declaration in accordance with the capital amnesty law, can be an individual citizen of the Russian Federation, a foreign citizen or a stateless person.

At the same time, from a literal reading of Part 1 of Article 7, as well as paragraphs 3, 4 of Part 1 of Article 3 of the law on capital amnesty, we can conclude:

“Capital amnesty” applies to “undeclared accounts” specified in the special declaration, if the declarant was obliged to notify about their opening, closing, or changing account details, but in violation of the law on “Currency Regulation and Currency Control” did not do this in a timely manner.

Accordingly, a citizen of the Russian Federation who permanently resided outside the Russian Federation until 2017. for at least a year (not a resident), as well as a citizen of the Russian Federation in 2021, 2018. a person living outside the Russian Federation for more than 183 calendar days cannot submit a special declaration on foreign accounts about which he did not notify the authorities in the Russian Federation, due to the absence of such an obligation.

From the rules of Part 1 of Article 7, as well as paragraphs 3, 4 of Part 1 of Article 3 of the law on capital amnesty, a different conclusion follows for owners of foreign accounts opened by them as currency residents of the Russian Federation, and who subsequently lost this status, or eligible for benefits from 2021 by duration of residence outside the Russian Federation more than 183 days in a calendar year.

If a resident of the Russian Federation opened a foreign account and did not notify the authorities of the Russian Federation about its opening, and in 2021, 2021. a resident permanently resides outside the Russian Federation, he has the right to take advantage of the capital amnesty and submit a special declaration with information about undeclared foreign accounts.

Accessed May 26, 2021

Moscow

Sheet A

Fill out Sheet A if you are declaring real estate. Fill out the lines in paragraph 2 “Information identifying real estate” as follows:

- “Registration number” – enter numbers (marks) here: registration, cadastral, conditional, inventory or other identification number. It all depends on where the property is located: in Russia or abroad;

- “Share in property” – if the property is entirely yours, indicate 100%, if there are several owners, indicate the percentage of the share;

- “Address of the location of the real estate” – take it from the title documents. If there is no official address, write down the details of the property's location. If you are declaring aircraft and water vessels, then write down the state registration address as the location according to Russian or foreign rules. If there is no such information, write down the address of the owner’s place of residence.

All rules are established by paragraphs 25–30 of the Procedure from Appendix 2 to the Law of June 8, 2015 No. 140-FZ.

At the same time, technical documentation includes:

- main characteristics, description and parameters of the product;

- necessary measures to ensure the required level of product safety at different stages of their life cycle, from design to disposal;

- a list of technical regulations, technical conditions, standards and other documents in the field of standardization, in compliance with the requirements of which products were created.

In addition to the specified details, the documentation may also include a general description of the product, its technological and design documentation, operating diagrams of components, circuits, assemblies and detailed explanations for them, plus the results of design calculations and other materials that are used as confirmation of compliance.

Sheet A1

Fill out this sheet with information about your vehicles that you own as of the date of filing the declaration.

In the “Information identifying the vehicle” field, enter the following data:

- on the line “Name of vehicle” – the name, make and model of the declared vehicle. For example, a GAZ M-20 Pobeda passenger car;

- In the line “Registration number”, indicate the one assigned to the vehicle during registration under Russian or foreign legislation. Even if the number is assigned by the manufacturer. Here enter the identification number (VIN), state and identification marks of aircraft, ships, small boats and others;

- on the line “Registration address” - the location of the vehicle according to registration documents or at the place of residence (stay) of the owner.

All these rules are stated in paragraphs 31–35 of the Procedure from Appendix 2 to the Law of June 8, 2015 No. 140-FZ.

Where to submit the declaration

The documentation package is submitted to Rostrud (state labor inspectorate) at the place of registration of the organization. If an enterprise has separate branches and representative offices, then the results of their inspection must be provided at their registration address. If the additional divisions are not separate, then the declaration is sent to the registration address of the enterprise’s head office.

You can use one of the following methods to provide documentation:

- personal visit to a Rostrud branch by an authorized employee of the organization;

- use of post office services;

- sending reports online using the capabilities of the official Internet resource of the Federal Labor Service.

IMPORTANT! When using the method of sending documentation via the Internet, it is necessary to take into account that the document must contain an electronic signature of the head of the organization or an employee with the appropriate authority.

Sheet B

Fill out Sheet B when you directly participate in the authorized (share) capital of Russian and foreign organizations. That is, you own shares, interests and interests in the authorized (share) capital of such organizations as of the date of submission of the declaration. It is not necessary to indicate only data on controlled foreign companies.

Filling out the field “Information about the organization in which the declarant participates” is not difficult. It is enough to indicate everything exactly as in the Charter (constituent agreement). There are several features for foreign organizations:

1. “Registration number”, write down the one assigned in the country of registration (incorporation);

2. “Taxpayer code...” write down if it was assigned abroad;

3. “Address...” write down in full, the one in the country of registration (incorporation).

In the “Information identifying participation in the authorized (share) capital” field, write down the share of participation as a percentage, the number and par value of shares. In the latter, make an entry in the currency established by the issuer.

You can also record other information. For example, indicate the category or type of shares (securities), the procedure for their accounting, the persons carrying out such accounting, and other information.

Such rules are established by parts 36–43 of the Procedure from Appendix 2 to the Law of June 8, 2015 No. 140-FZ.

Sheet B

Here, indicate the securities (except shares) that you own as of the date of filing the declaration.

If you are declaring Russian securities, fill out the field “Information about the organization that issued the securities” in accordance with the constituent documents. Please provide full name, OGRN, INN and address.

When declaring foreign securities, fill out the field “Information about the organization that issued the securities” in the following order:

1. indicate the full name;

2. “Registration number”, write down the one assigned in the country of registration (incorporation);

3. “Taxpayer code...” indicate if available. Usually it is assigned in the country of registration (incorporation), or an equivalent;

4. Write down the full address in the country of registration (incorporation).

In the “Information identifying securities” field, enter the quantity and par value of securities, expressed in the currency established by the issuer.

In addition to this information, you can record other information identifying securities on Sheet B. For example, details of securities, if available.

All this is established by parts 44–51 of the Procedure from Appendix 2 to the Law of June 8, 2015 No. 140-FZ.

Sheet G

Sheet G is special. Fill it out if you indicated on sheets A, A1, B and C that the owner’s rights to the property belong to the nominal owner.

In the “Nominal Owner” field, indicate:

- number “1” – for legal entities;

- number “2” – for individuals.

Fill in “Information about a legal entity” line by line with the following data:

- full name;

- “Registration number” is the one assigned in the country of registration (incorporation);

- Fill in the “Taxpayer code...” if it is assigned in the country of registration (incorporation);

- full address in the country of registration (incorporation).

Fill out “Information about an individual” according to the document proving his identity, line by line:

- write down the surname, first name, patronymic in full without abbreviations;

- “Name of country of citizenship (nationality)” indicate the one in which the individual is a citizen or national;

- “Taxpayer code...” indicate if it is assigned at the individual’s place of residence.

When filling out the “Information about the identity document”, indicate:

- its type, for example “passport of a citizen of the Russian Federation”;

- series and number of the document, name of the authority that issued it, and the date on which this occurred. In this case, use the data that is indicated in the document itself.

In the “Nominee Ownership Agreement” field, write down its name and details - date, as well as number. If there is no name and number, it is acceptable not to indicate them.

Such rules are enshrined in parts 52–59 of the Procedure from Appendix 2 to the Law of June 8, 2015 No. 140-FZ.

Sheet D

Fill out sheet D “Information about a foreign organization recognized as a controlled foreign company” about foreign organizations controlled on the date of filing the declaration. The exception is foreign organizations in which you directly own shares. Indicate them on Sheet B.

Start with the full name of the KIO. Next, fill out the “Organization Information”:

- “Registration number” indicate the one assigned to the CIO in the country of registration (incorporation);

- “Taxpayer code...” enter if it is assigned to the KIO in the country of registration (incorporation), or an equivalent;

- Indicate the full address of the CIO in the country of registration (incorporation).

Start filling out the “Grounds for recognition...” field with the type of participation. There are two options here - indirect or mixed participation. Specify the share as a percentage.

In case of mixed participation, write down the amount of direct and indirect participation shares. Indicate the grounds on which you control the CIO, and the name and details of documents (if any) confirming your rights.

You have the right to indicate other information characterizing the grounds for recognizing a foreign organization as controlled and (or) identifying such an organization.

This is established by parts 60–66 of the Procedure from Appendix 2 to the Law of June 8, 2015 No. 140-FZ.

The second version of the list of documents required for the adoption of a declaration of conformity.

In addition to safety evidence, the list of documents includes materials that were obtained with the assistance of a certification body accredited by a testing center or laboratory.

The following are accepted as evidence of safety:

- documents and reports from tests that were carried out in an accredited laboratory;

- management system certificates (if necessary);

- other documents that indirectly or directly confirm the compliance of manufactured products with all existing requirements.

Among other things, the main components in the set of evidentiary materials can be clarified depending on the type of product. In this case, the requirements for documents are determined in special technical regulations or other acts on products.

Sheet E

Fill out sheet E “Information on a foreign structure without the formation of a legal entity, recognized as a controlled foreign company” if you control foreign structures without the formation of a legal entity on the date of filing the declaration. Such structures are called the same as in Sheet D, controlled foreign organizations (CFC).

“Name of the structure” – write down the full name of the KIO. If it is not there, then provide information identifying the legal form of the CIO. You can take this data from the personal law of the CIO or its constituent documents.

Fill out the “Structure Information” field in the following order:

1. “Registration number...” indicate if it exists;

2. “Taxpayer code...” indicate the one assigned to the KIO in the country of registration (incorporation), or an equivalent;

3. write down the date of establishment and (or) registration of the CIO;

4. indicate “Name of the country of establishment (registration) of the structure.”

In the “Grounds for recognition...” field, indicate the name and details of the documents (if any) confirming the status of the declarant. Additionally, you can specify a unique digital number from the CIO notification. It is also permissible to indicate other information characterizing the grounds for recognizing the declarant as a controlling person of the CIO or identifying such a structure.

All this is enshrined in parts 67–74 of the Procedure from Appendix 2 to the Law of June 8, 2015 No. 140-FZ.

Which CFCs to include in a special declaration

The Capital Amnesty Law does not disclose which CFCs to include in a special declaration. The concept of a CFC is also not disclosed in the law, except as the status of the declarant in relation to a given foreign organization, as a controlling person.

At the same time, on the basis of Part 2 of Article 2 of the law, according to which: “The concepts of civil legislation, the legislation of the Russian Federation on taxes and fees and other branches of legislation of the Russian Federation, used in this Federal Law, are applied in the meaning in which they are used in these branches of legislation, unless otherwise provided by this Federal Law.”, we apply the rules of the Tax Code of the Russian Federation.

The concepts of a CFC and a person controlling a foreign company are given in Article 25.13 of the Tax Code of the Russian Federation. So, according to Part 1 of Art. 25.13 of the Tax Code of the Russian Federation, a controlled foreign company (CFC) is a foreign organization that simultaneously satisfies all the following conditions:

1) the organization is not recognized as a tax resident of the Russian Federation;

2) the controlling person of the organization is an organization and (or) an individual recognized as tax residents of the Russian Federation.

The simplicity, obviousness and accessibility of the given formulas of the Tax Code of the Russian Federation can easily mislead CFC declarants within the framework of the capital amnesty law.

- To conclude “Non-recognition as a tax resident of the Russian Federation”, the mere fact of creating an organization outside the territory of the Russian Federation is not enough. The fact is that in the Tax Code of the Russian Federation there is no such procedure in relation to organizations.

A literal reading of the above formula, Part 1, Article 25.13 of the Tax Code of the Russian Federation allows us to conclude that any foreign organization is a tax resident of the Russian Federation, and “recognition as a tax non-resident” is necessary, that is, an analysis of the tax status of the foreign organization is necessary.

It is interesting that there is no “general” concept of “foreign non-resident organization” in the Tax Code of the Russian Federation, and in relation to income tax from 2021. Article 246.2 applies: “Organizations recognized as tax residents of the Russian Federation.”

From the very name of which it follows that all foreign organizations are tax non-residents of the Russian Federation for income tax purposes.

Those. the formulas of Articles 25.13 and 246.2 of the Tax Code are contradictory.

In addition, a Person is not recognized as a controlling person of a foreign organization if his participation in this foreign organization is realized exclusively through direct and (or) indirect participation in one or more public companies that are Russian organizations.

Sheet J

Fill out Sheet G “Information about an open account (deposit) in a bank located outside the Russian Federation” if you want to declare your own accounts (deposits) in banks outside the Russian Federation. Those that are open on the date of submission of the declaration.

Fill out “Bank details” in the following order line by line:

1. name of the bank in which the account (deposit) is opened;

2. CODE (SWIFT) or BIC;

3. address of the bank's location. Here, provide information not only in Russian, but also in the language of the country where the bank is located, according to the documents and (or) information about the account (deposit) attached to the declaration.

Here are some features of filling out the “Account (Deposit) Details” field:

1. Indicate the “Name of the contract” if it exists. It must match the data in the documents and (or) account (deposit) information attached to the declaration;

2. In the “Agreement details” field, write down the number (if any) and date of the agreement on the basis of which the account (deposit) was opened.

This procedure is provided for by parts 75–79 of the Procedure from Appendix 2 to the Law of June 8, 2015 No. 140-FZ.

Sheet Z

Sheet 3 “Information about the account (deposit) in the bank, if in relation to the owner of the account (deposit) the declarant is recognized as the beneficial owner,” fill out if you are declaring accounts and deposits in the bank when you are recognized as the beneficial owner of their owner on the date of filing the declaration.

In the “Bank Details” field, indicate the name of the bank, its CODE (SWIFT) or BIC, and location address in Russian only.

Fill out “Account (deposit) details”, indicating the account (deposit) number and the date of its opening. Write down the “Name of the agreement”, if there is one. Everything must match the data from the annex to the declaration. In the “Agreement details” field, write down the number (if any) and date of the agreement on the basis of which the account (deposit) was opened.

In the field “Grounds for recognizing the declarant as a beneficial owner,” list those provided for by Law No. 115-FZ of August 7, 2001. That is, indicate that you have a predominant participation, directly or indirectly, of more than 25 percent (write down exactly how much) in the capital of the owner of the declared account or deposit (paragraph 13 of article 3 of the Law of August 7, 2001 No. 115-FZ).

In this case, two options are possible.

Option 1 . If you are recognized as the beneficial owner due to participation in the authorized (share) capital of the organization that owns the account, indicate the type of participation (direct, indirect, mixed), as well as the size of the share as a percentage. In the case of mixed participation in the organization, it is necessary to show the total shares of direct and indirect participation in the organization.

Option 2 . When you are recognized as the beneficial owner due to control over the organization that owns the account or deposit, indicate the extent of your rights. Those related to the implementation of control. In addition, it is necessary to record the grounds for control in relation to the account (deposit) owner, including the name and details of documents confirming the provision of the appropriate scope of control rights in relation to the account (deposit) owner, of course, if any.

This is established by parts 80–85 of the Procedure from Appendix 2 to the Law of June 8, 2015 No. 140-FZ.

Controlling person of the CFC

According to the rules of Part 2 of Article 2 of the law on capital amnesty, the controlling person of a CFC is determined using the norms of Article 25.13 of the Tax Code of the Russian Federation. Attention: The declarant needs to take into account that these signs are “smeared” throughout the article.

To qualify a person as controlling a foreign company, use the criterion of the Tax Code of the Russian Federation on the distribution of income of an organization (Part 7, Article 25.13 of the Tax Code of the Russian Federation):

Exercising control over an organization for the purposes of this Code is recognized as exerting or being able to exert a decisive influence on decisions made by this organization regarding the distribution of profit (income) received by the organization after tax due to direct or indirect participation in such an organization, participation in a contract (agreement), the subject which is the management of this organization, or other features of the relationship between the person and this organization and (or) other persons.

Signs of a controlling person (according to the Tax Code of the Russian Federation), which a person must have at the same time:

1) an individual is recognized as a tax resident of the Russian Federation;

2) an individual whose participation in this organization is more than 25 percent;

3) an individual whose share of participation in this organization (for individuals - together with spouses and minor children) is more than 10 percent, if the share of participation of all persons recognized as tax residents of the Russian Federation in this organization (for individuals - together with spouses and minor children) is more than 50 percent.

4) if an individual does not participate in a foreign organization personally or through family members, but at the same time this individual actually exercises control over such an organization in his own interests or in the interests of his spouse and minor children.

Filing a special declaration on the ownership of a CFC in the form of a foreign organization:

According to the rules of the law on capital amnesty (clause 2, part 1, article 3), the signs of a person controlling a foreign company, specified in clauses 2 and 3, are not taken into account.

To be reflected in the special declaration on sheet “D” - “Information about a foreign organization recognized as a controlled foreign company”, the simultaneous presence of the following signs is important: 1 – an individual is a tax resident of the Russian Federation, and in paragraph 4 – the possibility of “unofficial control” of a foreign company in own interests or those of family members.

Filing a special declaration on the ownership of a CFC in the form of foreign structures without forming a legal entity

When filing a special declaration on a CFC in the form of a foreign structure without forming a legal entity, similar to the above approach, the declarant must be guided by the rules of the Tax Code of the Russian Federation (Part 8 of Article 25.13 of the Tax Code of the Russian Federation):

Signs of control by a foreign structure: Exercising control over a foreign structure without forming a legal entity, for the purposes of this Code, is recognized as exerting or being able to exercise a decisive influence on decisions made by the person managing the assets of such a structure in relation to the distribution of profit (income) received after taxation in accordance with personal law and (or) constituent documents of this structure.

According to the rules of tax legislation, the controlling person of a foreign structure without forming a legal entity is the founder (founder) of such a structure (Part 9 of Article 25.13 of the Tax Code of the Russian Federation).

At the same time, according to tax legislation, the founder (founder) of a foreign structure without forming a legal entity may lose control over it.

In such cases, the founder (founder) is not recognized as a controlling person.

Signs that together indicate a loss of control over management:

1) the founder (founder) does not have the right to receive (demand to receive) directly or indirectly the profit (income) of this structure in whole or in part;

2) the founder (founder) does not have the right to dispose of the profit (income) of this structure or part of it;

3) the founder (founder) did not retain the rights to the property transferred to this structure (the property was transferred to this structure on an irrevocable basis).

The condition established by this subparagraph in relation to the person who is the founder (founder) of a foreign structure without forming a legal entity is considered fulfilled if this person does not have the right to receive the assets of such a structure in whole or in part into his own ownership in accordance with personal law and (or) constituent laws documents of this structure throughout the entire period of existence of this structure, as well as in the event of its termination (liquidation, termination of the contract);

4) such person does not exercise control over this structure in accordance with paragraph 8 of this article.

Sheet Z1

Sheet H1 “Information about the owner of the account (deposit) in the bank in respect of which the declarant is recognized as the beneficial owner” fill in with information about the owner of the account (deposit) in the bank in respect of which you are recognized as the beneficial owner on the date of submission of the declaration. Submit sheet Z1 after the corresponding sheet Z of the declaration.

In the “Account Owner” field, enter one of the following numbers:

- “1” – if the owner is a legal entity;

- “2” – when the owner is an individual.

The field “Information about a legal entity”, when the owner of the account (deposit) in the bank is a Russian organization, fill out in the following order:

- Indicate the “Name of the organization” according to the constituent document. You must write down the full name;

- in the “Registration number” field, enter the OGRN of the account owner;

- in the “Taxpayer code...” field, enter the TIN;

- “Address in the country of registration (incorporation)” indicate according to the data from the Unified State Register of Legal Entities.

If the owner of the account or deposit is a foreign organization, then fill out the “Information about legal entity” field differently:

- “Name of organization” please indicate in full;

- “Registration number”, write down the one assigned to the foreign organization in the country of registration (incorporation);

- “Taxpayer code...” indicate if it was assigned in the country of registration (incorporation), or an equivalent;

- Please indicate “Address…” in full (in Russian only).

If you are reporting about the owner of an account or deposit – a citizen of the Russian Federation, then fill out the “Information about an individual” field in the following order:

1. last name, first name, patronymic of the account owner. Write them down in full without abbreviations according to the individual’s identity document;

2. “Name of country of citizenship (nationality)” indicate “Russian Federation”;

3. “Taxpayer code...” – indicate the TIN of the account owner (if available);

4. in the “Information about the identification document” field, indicate not only the type of document, but also its details - series and number, name of the authority that issued the document, and the date of its issue.

When reporting about the owner of an account or deposit - a foreigner, provide information line by line:

1. last name, first name, patronymic;

2. “Name of country of citizenship (nationality)”;

3. “Taxpayer code...” – indicate the taxpayer code or an equivalent (if any) assigned to the foreigner at the place of residence;

4. in the “Information about the identification document” field, indicate the type of document and its details - series and number, name of the authority that issued the document, and the date of its issue.

This is provided for by parts 86–92 of the Procedure from Appendix 2 to the Law of June 8, 2015 No. 140-FZ.

Rules for drawing up a declaration of assets and liabilities of an individual (form 250.00)

Chapter 1. General provisions

1

. These Rules for drawing up a declaration of assets and liabilities of an individual (Form 250.00) (hereinafter referred to as the Rules) were developed in accordance with paragraph 2 of Article 206 of the Code of the Republic of Kazakhstan dated December 25, 2021 “On taxes and other obligatory payments to the budget” (Tax Code) ( hereinafter referred to as the Tax Code) and determine the procedure for drawing up a declaration of assets and liabilities of an individual (hereinafter referred to as the Declaration).

2

. The Declaration is submitted by the following individuals who are present on December 31 of the year preceding the year of submission of the Declaration:

1) from 2021:

- persons holding a responsible public position and their spouses;

- persons authorized to perform government functions and their spouses;

- persons equated to persons authorized to perform state functions, and their spouses;

- persons entrusted with the obligation to submit a Declaration in accordance with the Constitutional Law of the Republic of Kazakhstan “On Elections in the Republic of Kazakhstan” dated June 28, 1999 and the laws of the Republic of Kazakhstan “On Banks and Banking Activities” dated August 31, 1995, “On Insurance Activities” dated December 18, 2000, “On the securities market” dated July 2, 2003, “On combating corruption” dated November 18, 2015;

2) from 2023:

- employees of government agencies and their spouses;

- employees of quasi-public sector entities and their spouses;

3) from 2024:

- managers, founders (participants) of legal entities and their spouses;

- individual entrepreneurs and their spouses.

3

. The Declaration is submitted by the following individuals who are present on December 31 of the year preceding the year of submission of the Declaration:

- from 2025:

1) adults;

- citizens of the Republic of Kazakhstan;

- kandasami;

- persons with a residence permit;

- foreigners or stateless persons who are residents of the Republic of Kazakhstan;

2) foreigners or stateless persons who are non-residents if, as of December 31 of the year preceding the year of submission of the Declaration, one of the conditions exists:

- property for which rights and (or) transactions are subject to state or other registration on the territory of the Republic of Kazakhstan;

- participation shares in housing construction on the territory of the Republic of Kazakhstan;

3) one of the legal representatives of any of the following persons:

- an adult who has been declared incompetent, has limited legal capacity and belongs to the category of persons specified in subparagraphs 1) and 2) of this paragraph;

- a person who has not reached the age of eighteen (the age of majority) when this person, as of December 31 of the year preceding the year of submission of such Declaration, experiences any of the following cases:

- the presence of ownership of property subject to state or other registration, property for which rights and (or) transactions are subject to state or other registration outside the Republic of Kazakhstan;

- the presence of a share in the construction of real estate under an agreement on shared participation in construction, including outside the Republic of Kazakhstan;

- presence in bank accounts in foreign banks located outside the Republic of Kazakhstan, an amount of money cumulatively exceeding for all bank deposits a thousand times the monthly calculation index established by the law on the republican budget and valid as of December 31 of the year preceding the year of submission of the Declaration;

- the presence of the amount of debt of other persons to this person (accounts receivable) and (or) the amount of debt of this person to other persons (accounts payable) in the presence of an agreement or other document that is the basis for the emergence of an obligation or claim, notarized (certified).

4

. When filling out the Declaration, corrections, erasures and blots are not allowed.

5

. If there are no indicators, the corresponding cells of the Declaration are not filled in.

6

. Appendices to the Declaration are not drawn up in the absence of data to be reflected in them.

7

. The declaration is drawn up:

1) on paper – with a ballpoint or fountain pen, black or blue ink, capital printed characters or using a printing device;

2) on electronic media – through the system for receiving and processing tax reporting.

8

. A declaration drawn up on paper is signed by an individual or his representative.

A declaration drawn up on electronic media is certified by:

- electronic digital signature of an individual;

- using a one-time password.

9

. When submitting the Declaration:

- by registered mail with a notification on paper - the taxpayer receives a notification from a postal or other communications organization;

- in electronic form – the taxpayer receives a notification about the acceptance or non-acceptance of tax reporting by the tax reporting acceptance system of state revenue authorities;

- in person on paper - drawn up in two copies, one copy is returned to the taxpayer.

Chapter 2. Drawing up a Declaration (Form 250.00)

10

.

In the “ Select taxpayer category

” section, cell A or B is marked, taking into account the taxpayer category:

- cell A

:

- persons who are candidates for an elective position, as well as their spouses, draw up a Declaration on the first day of the month of the beginning of the nomination period;

- persons who are candidates for a government position or a position related to the performance of government or equivalent functions, as well as their spouses, persons wishing to become major participants in a bank, insurance (reinsurance) organization, investment portfolio manager, draw up a Declaration on the first day of the month of submission of the Declaration ;

- cell B

:

persons not belonging to category “A” draw up a Declaration as of December 31 of the year preceding the year of submission of the Declaration.

In section A “General information about the taxpayer”

indicated:

- in line 2

– the individual identification number (IIN) of the individual is indicated;

- in line 3

– the box is marked, in the case of an individual drawing up the Declaration, who is a legal representative and the IIN of the represented person (a minor and (or) incapacitated or partially capable) is indicated;

- in line 4

– indicate the last name, first name, patronymic (if any) of the individual in accordance with identification documents, telephone number and email address (optional);

- in line 5

– the type of Declaration is indicated.

The corresponding box is marked taking into account the classification of the Declaration as one of the following types of tax reporting:

- initial – a Declaration submitted by an individual due to the fact that the established obligation to submit such a Declaration arose for the first time;

- next – Declaration submitted by an individual in accordance with the Constitutional Law of the Republic of Kazakhstan “On Elections in the Republic of Kazakhstan” dated June 28, 1999, the laws of the Republic of Kazakhstan “On Banks and Banking Activities” dated August 31, 1995, “On Insurance Activities” dated 18 December 2000, “On the Securities Market” dated July 2, 2003, “On Anti-Corruption” dated November 18, 2015 after the submission of the initial Declaration by such an individual;

- additional – a Declaration submitted by an individual when making changes and (or) additions to the previously submitted Declaration, to which these changes and (or) additions relate;

- additional by notification - a Declaration submitted by an individual when making changes and (or) additions to a previously submitted Declaration, in which the state revenue authority identified violations based on the results of desk control of the assets and liabilities of the individual.

The number and date of the notification are filled in in the case of submitting an additional Declaration regarding the notification.

5) in line 6 – the sign of residence is indicated:

- cell A is marked by a resident taxpayer of the Republic of Kazakhstan;

- cell B is marked by a non-resident taxpayer of the Republic of Kazakhstan.

In section B “Questionnaire on income and liabilities”

the corresponding cells are indicated taking into account the submitted applications according to the availability of information (all indicators are noted if they are available on the reporting date):

01) about real estate registered in a foreign state;

02) about vehicles registered in a foreign state;

03) about money in bank accounts in foreign banks located outside the Republic of Kazakhstan, in an amount that cumulatively exceeds for all bank deposits a thousand times the monthly calculation index;

04) on the share of participation in the authorized capital of a legal entity (except for joint-stock companies) created outside the Republic of Kazakhstan;

05) on equity participation in the construction of real estate, including outside the Republic of Kazakhstan;

06) about the availability of investment gold;

07) about securities, derivative financial instruments (DFI), including outside the Republic of Kazakhstan;

08) about shares in mutual investment funds (UIF), including outside the Republic of Kazakhstan;

09) about objects of intellectual property, copyright, including outside the Republic of Kazakhstan;

10) about the presence of other property, including outside the Republic of Kazakhstan, the estimated value of a unit of which exceeds a thousand times the monthly calculation index;

11) on accounts receivable/payable, including outside the Republic of Kazakhstan;

12) about property transferred to trust management.

In section C “Information about cash in an amount not exceeding the limit of ten thousand times the monthly calculation index”

indicated:

1) in column A

– serial number of the line to be filled in;

2) in column B

– currency code, which is indicated in accordance with the three-digit alphabetic encoding established in Appendix 23 “Currency Classifier”, approved by decision of the Customs Union Commission dated September 20, 2010 No. 378 “On classifiers used to fill out customs declarations” (hereinafter referred to as CCC decision No. 378) (for example, KZT – Kazakhstani tenge, EUR – euro, USD – US dollar, RUB – Russian ruble, CNY – Chinese yuan);

3) in column C

– the amount of cash is indicated.

In Section D “Taxpayer Responsibility”

indicated:

- in field “Last name, first name, patronymic of the taxpayer/legal representative”

– last name, first name, patronymic (if any) of the taxpayer/legal representative in accordance with identification documents;

- in field "date of filing the Declaration

» – date of submission of the Declaration to the state revenue authority of the Republic of Kazakhstan;

- state revenue body code – code of the state revenue body at the taxpayer’s place of residence;

- in field "Last name, first name, patronymic (if any) of the official who accepted the Declaration

» indicate the last name, first name, patronymic (if any) of the employee of the state revenue body;

- date of receipt of the Declaration - the date of submission of the Declaration in accordance with paragraph 2 of Article 209 of the Tax Code;

- incoming document number – registration number of the Declaration assigned by the state revenue authority;

- postmark date – the date of the postmark affixed by a postal or other communications organization.

Subparagraphs 4), 5), 6) and 7) of this paragraph are filled out by the employee of the state revenue authority who accepted the Declaration on paper.

Chapter 3. Drawing up Form 250.01 (Appendix 1) to the Declaration of Assets and Liabilities of an Individual

11

.

Appendix 1 to the Declaration consists of the section “Information on the availability of real estate registered in a foreign state”

and the section

“Information on the availability of vehicles registered in a foreign state

.

12

.

The section “Information on the availability of real estate registered in a foreign state”

is filled out if line 01 in the Declaration is marked.

On line 01

reflected:

- in the column A

– serial number of the line to be filled in;

- in the column IN

– a type of real estate under the right of ownership (including shared or joint ownership), for which rights and (or) transactions are subject to state or other registration or which is subject to state or other registration (land plot, building, house, garage, dacha , commercial building, part of a building, apartment, office, parking space in a covered parking lot, building, aircraft, sea vessel, inland waterway vessel, river-sea navigation vessel);

- in the column WITH

– code of the country of registration of real estate. The country code is indicated in accordance with the two-digit alphabetic encoding established in Appendix 22 “Classifier of countries of the world”, approved by the decision of the CCC No. 378 (for example, KZ - Republic of Kazakhstan, DE - Federal Republic of Germany, GB - United Kingdom of Great Britain and Northern Ireland);

- in the column D

– identification (cadastral) number of the real estate specified in column B, based on title documents;

- in the column E

– location (address) of real estate registered outside the Republic of Kazakhstan or not having an identification number, in terms of indicating the name of the country of location of this property, locality and street (avenue, alley), house number (building, building), apartment number ( office, room). In relation to a plot of land, a building (house, garage, cottage, commercial building). For a part of a building (apartment, office, parking space in a covered parking lot), structure, the address of the location is indicated. In relation to an aircraft, sea vessel, inland water navigation vessel, river-sea navigation vessel, the address of the location or port of registration is indicated.

13

.

The section “Information on the availability of vehicles registered in a foreign country”

is filled out if line 02 in the Declaration is marked.

Line 02 reflects:

- in column A – the serial number of the line to be filled in;

- in column B - the type of vehicle (for example, a car, motorcycle, truck) registered in a foreign country. This line does not reflect aircraft and sea vessels, inland navigation vessels, river-sea navigation vessels;

- in column C - the make and model of the vehicle under ownership;

- in column D – code of the country of registration of the vehicle. The country code is indicated in accordance with the two-digit alphabetic encoding approved by CCC decision No. 378;

- in column E – identification (state) number of the vehicle specified in column C, based on title documents;

- in column F - VIN code (body number) specified in the vehicle registration certificate (other title document) for motor vehicles, serial number of rolling stock for railway transport, engine number.

Chapter 4. Preparation of Form 250.02 (Appendix 2) to the Declaration of Assets and Liabilities of an Individual

14

. Appendix 2 to the Declaration consists of sections “Information on money in bank accounts in foreign banks located outside the Republic of Kazakhstan, in an amount that collectively exceeds for all bank deposits a thousand times the monthly calculation index” and “Information on the share of participation in the authorized capital of a legal entity (except for joint stock companies) created outside the Republic of Kazakhstan.”

15

.

The section “Information on money in bank accounts in foreign banks located outside the Republic of Kazakhstan, in an amount that collectively exceeds for all bank deposits a thousand times the monthly calculation index”

is filled in if line 03 is marked in the Declaration.

Line 03 reflects:

- in column A – the serial number of the line to be filled in;

- in column B - the identification number of a banking institution registered outside the Republic of Kazakhstan or its equivalent, which makes it possible to identify such a banking institution as a separate taxpayer;

- in column C - the name of the banking institution (for example, Royal Bank of Canada);

- in column D – code of the country of registration of the banking institution. The country code is indicated in accordance with the two-digit alphabetic encoding approved by CCC decision No. 378;

- in column E - the code of the currency in which there is money in bank accounts. The currency code is indicated in accordance with the three-digit alphabetic encoding approved by the decision of the CCC No. 378;

- in column F - the total amount of money in bank accounts in the currency specified in column E. Information is filled in only about money in bank accounts in foreign banks located outside the Republic of Kazakhstan.

16

.

The section “Information on the share of participation in the authorized capital of a legal entity (except for joint-stock companies) created outside the Republic of Kazakhstan”

is filled out if line 04 in the Declaration is marked.

Line 04 reflects:k

1) in column A – the serial number of the item to be filled in;

2) in column B - identification number of a legal entity created outside the Republic of Kazakhstan in which there is a participation interest;

3) in column C – the name of the legal entity (for example, Profit Canada);

4) in column D - the code of the country in which the legal entity in which there is a participation interest is registered. The country code is indicated in accordance with the two-digit alphabetic encoding approved by CCC decision No. 378;

5) in column E - the size of the participation share in percentage, rounded to hundredths.

Chapter 5. Preparation of Form 250.03 (Appendix 3) to the Declaration of Assets and Liabilities of an Individual

17

. Appendix 3 to the Declaration consists of sections “Information on equity participation in the construction of real estate, including outside the Republic of Kazakhstan” and “Information on the availability of investment gold.”

18

. The section “Information on equity participation in the construction of real estate, including outside the Republic of Kazakhstan” is filled out if line 05 is marked in the Declaration.

Line 05 reflects:

1) in column A – the serial number of the line to be filled in;

2) in column B - identification number of the person (developer), registered, including outside the Republic of Kazakhstan, who is a party to the agreement, obligated to provide ownership of a residential building or part of such a building (for example, an apartment);

3) in column C - the name of the person (developer) or the person who is a party to the agreement, obligated to provide ownership of a residential building or part of such a building (for example, an apartment);

4) in column D – code of the country of registration of the developer. The country code is indicated in accordance with the two-digit alphabetic encoding approved by CCC decision No. 378;

5) in column E – the location (address) of the object under the agreement on participation in the construction of real estate;

6) in column F - code of the currency in which money was paid to pay for obligations under the agreement. The currency code is indicated in accordance with the three-digit alphabetic encoding approved by the decision of the CCC No. 378;

7) in column G – the total amount of money contributed to pay for the obligations under the agreement.

19

. The section “Information on the availability of investment gold” is filled out if line 06 is marked in the Declaration.

Line 06 reflects:

1) in column A – the serial number of the line to be filled in; 2) in column C – the weight of investment gold is indicated; 3) in column D – the currency code is indicated in accordance with the three-digit alphabetic coding approved by the decision of the CCC No. 378; 4) in column E – the cost of investment gold is indicated.

Chapter 6. Compilation of Form 250.04 (Appendix 4) to the Declaration of Assets and Liabilities of an Individual

20

. Appendix 4 to the Declaration consists of the section “Information on the availability of securities, derivative financial instruments (DFI), including outside the Republic of Kazakhstan” and “Information on the availability of shares in mutual investment funds (UIF), including outside the Republic of Kazakhstan "

21

. The section “Information on the availability of securities, derivative financial instruments (DEs), including outside the Republic of Kazakhstan” is filled out if line 07 is marked in the Declaration.

Line 07 reflects:

1) in column A – the serial number of the line to be filled in; 2) in column B – the number of securities owned by the submitter of the Declaration; 3) in column C - the code of the country in which the securities were issued, derivatives. The country code is indicated in accordance with the two-digit alphabetic encoding approved by CCC decision No. 378; 4) in column D – code of the currency in which the securities were purchased. The currency code is indicated in accordance with the three-digit alphabetic encoding approved by the decision of the CCC No. 378; 5) in column E – the purchase price of one security, derivatives.

22

. The section “Information on the availability of shares in mutual investment funds (UIFs), including outside the Republic of Kazakhstan” is filled out if line 08 is marked in the Declaration.

Line 08 reflects: 1) in column A – the serial number of the line to be filled in; 2) in column B – the number of shares owned by the submitter of the Declaration; 3) in column C – the code of the country in which the shares were issued. The country code is indicated in accordance with the two-digit alphabetic encoding approved by CCC decision No. 378; 4) in column E – code of the currency in which the shares were issued. The currency code is indicated in accordance with the three-digit alphabetic encoding approved by the decision of the CCC No. 378; 5) in column F – the nominal value of the share per unit.

Chapter 7. Compilation of Form 250.05 (Appendix 5) to the Declaration of Assets and Liabilities of an Individual

23

. Appendix 5 to the Declaration consists of sections “Information on the availability of intellectual property objects of copyright, including outside the Republic of Kazakhstan” and “Information on the availability of other property, including outside the Republic of Kazakhstan, the estimated value of a unit of which exceeds a thousand times the monthly settlement amount indicator. To be completed at the request of the individual.”

24

. The section “Information on the availability of intellectual property objects of copyright, including outside the Republic of Kazakhstan” is filled in if line 09 in the Declaration is marked.

Line 09 reflects: 1) in column A – the serial number of the line to be filled in; 2) in column B – the type of intellectual property object that is copyright (for example, trademarks, programs, applications, books); 3) in column C – patent number – this is the serial number assigned to each patent document by the patent authority or organization (or its/her equivalent abroad); 4) in column D – the code of the country in which the intellectual property object is registered. The country code is indicated in accordance with the two-digit alphabetic encoding approved by CCC decision No. 378; 5) in column E – the date of registration of intellectual property objects of copyright.

25. Section “Information on the availability of other property, including outside the Republic of Kazakhstan, the estimated value of a unit of which exceeds a thousand times the monthly calculation index. To be completed at the request of the individual” is completed if line 10 in the Declaration is marked.

This section reflects property that is not subject to state registration in the Republic of Kazakhstan (for example, a painting, a TV, a diamond).

Line 10 reflects: 1) in column A – the serial number of the line to be filled in; 2) in column B – name of the property; 3) in column C – the amount of property; 4) in column D - the code of the country in which the property specified in column B is registered. The country code is indicated in accordance with the two-digit alphabetic encoding approved by the decision of the CCC No. 378; 5) in column E– the currency code is indicated in accordance with the three-digit alphabetic coding approved by the decision of the CCC No. 378; 6) in column F – the total cost of the object is indicated.

Sheet I

On sheet I “Other information that the declarant has the right to disclose (in any form)” you have the right to indicate in any form other information regarding the declared objects, in particular information identifying the specified objects and specified persons. You can immediately disclose information about the sources of acquisition (formation) of property, sources of funds in bank accounts (deposits), information about which is presented in the declaration.

Sheet I can also be used to fill out the declaration by hand if the provided fields on the corresponding sheets of the declaration are not enough.

Sheet I must be submitted after the corresponding sheet of the declaration, which contains information about the object (person), additional information must be disclosed.

Such rules are spelled out in parts 93–96 of the Procedure from Appendix 2 to the Law of June 8, 2015 No. 140-FZ.

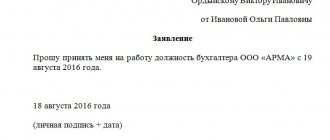

An example of filling out a Special Declaration. A citizen of the Russian Federation declares an account opened in a bank outside Russia

Ivanov Andrey Andreevich is a citizen of Russia. In 2014, I opened a savings account in a Swiss bank. I used it for my own savings. He did not submit a notification within the established time frame either about the opening or about changing the account details in accordance with the current requirements.

In 2021, Ivanov decided to receive an amnesty for these acts by voluntarily declaring his assets.

He filled out three pages of a special declaration: the mandatory Pages 001 and 002 with information about himself, as well as sheet G with data on an account opened in Switzerland. Ivanov did not indicate any additional information other than that provided in sheet G and therefore did not fill out sheet I for him. He attached to the declaration copies of documents confirming his rights to the account, to its opening and a list of attachments to the declaration. In addition, he prepared an account opening notice, which he did not submit on time.

On March 1, 2021, Ivanov submitted a completed declaration, annexes to it, an inventory and a notice of opening an account to the tax office. The declaration and notification were accepted. From this moment on, it is considered that he submitted the notification in a timely manner, and all movements of money in the account were recorded correctly.