Checking the purchase book by turnover

A purchase ledger is a large table maintained electronically or in paper form and in which invoices and documents are recorded that confirm the correct determination of the amount of VAT to be deducted or refunded in the manner prescribed by the Tax Code.

If all primary income is reflected correctly in the accounting program, the purchase book will be generated without errors.

To ensure that the log is filled out correctly, you must do the following:

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

- Check the availability of invoices and their details. Are all documents reflected in the book, are their details entered correctly (date, number, names, amounts).

- Sign reconciliation reports with counterparties. This event always reduces the likelihood of errors.

- Reconcile data from the book, balance sheet and declaration. This will be discussed further.

These actions apply to both the purchase book and the sales book.

How to check your purchase book

To do this, you must check for one reporting period:

- the amount of deductions in the VAT return;

- the amount on the debit of account 68.02.

If these amounts coincide with the purchase book, then everything is formed correctly; if not, you need to look for errors.

In the 1C program, discrepancies in VAT accounting can be found using the tax register “VAT of purchases” by selecting analytics for suppliers and source documents.

The correctness of filling out the purchase book is checked using the formula: If there are errors, you need to generate an analysis of account 68.02 and check the equality:

Subscribe to our newsletter

Credit turnover for the period minus paid tax (entry Dt 68 Kt 51) = VAT in the purchase book

You also need to check:

- compliance of accounts 60.01 and 60.02: so that there are no debit and credit balances for the same counterparty and the same agreement;

- the balance on account 76.BA for a specific counterparty and a specific agreement (subject to the conditions specified in clause 9 of Article 172 of the Tax Code of the Russian Federation) should be no more than the balance on account 60.02 for the same counterparty and agreement, multiplied by the settlement rate of 20 /120.

Subconto analysis

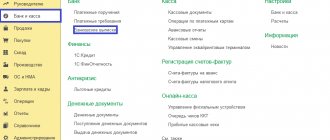

If routine operations have been completed, an express check has been carried out, everything is in order with account 19, you can look in the “Subconto Analysis” report in the “Reports” menu.

In the window that opens, you need to set the period. Click the “Show settings” button in the “Grouping” tab. In the “Types of subconto” tab, select “Counterparties and “Agreements”. Generate a report by clicking on the button of the same name.

It is necessary to check whether there is a cross-balance for any clients, primarily for account 62. In the example presented, it can be seen that the receipt was made under the agreement “With the buyer” (account 62.01), and the payment was made under the agreement “Untitled” (account 62.02) . Accordingly, at the end of the period, the balance is reflected in both debit and credit, that is, we have both prepayment and debt under different agreements.

In such cases, the program registers invoices for advance payments and takes into account VAT on prepayments. Then the sale takes place and the tax payable is calculated again. If these are really two different agreements under which mutual settlements are carried out, then everything is in order. If this is a mistake, and judging by the name of the agreement “Untitled”, this is what it is, then adjustments need to be made.

Most likely, the wrong contract was selected when entering the document. Or, when downloading a bank statement, the program automatically entered the wrong agreement. Accordingly, mutual settlements are currently reflected incorrectly.

Having indicated the agreement “With the buyer” in the bank statement, it is clear that the cross-balance for the store has disappeared.

Next, after the changes have been made, it is necessary to re-carry out the regulatory operations for generating records of purchase and sales books, depending on what was corrected.

How the sales book is checked

The sales book is a tax register that serves to reflect all documents for calculating VAT.

The correctness of filling out the sales book is checked using the formula: How to check the sales book by turnover

For this purpose, a turnover balance sheet (TSL) is generated for account 90.01. If there are no transactions not subject to VAT and transactions at a rate of 0%, then the credit turnover on this account, multiplied by the calculated rate of 20/120, should be equal to the debit turnover on account 90.03 (Dt 90.03 Kt 68.02).

How is the sales book checked if this equality is not satisfied? In this case, you need to check the following:

- If there are no transactions not subject to VAT and transactions at a rate of 0%, then the balance of account 19 at the end of the tax period should be equal to 0.

- Compliance of accounts 62.01 and 62.02: so that there are no debit and credit balances for the same counterparty and the same agreement.

- The balance of account 76.AB should be equal to the balance of account 62.02 multiplied by 20/120. If advances have been made in foreign currency or in conventional units, then you need to add the balance of these accounts as well.

Additional “manual” check

There are often situations when no errors are found during the express check. Next, you should generate “VAT reporting” through the “Reports” menu. Set a period, select an organization and see if all regulatory operations are ticked. If this is so, then the program believes that there are no errors in tax accounting. If there is no checkmark against any of the operations, then it needs to be performed.

Let's assume that all operations are completed and the express check is passed, however, manual analysis will be able to find additional distortions. Therefore, when checking VAT, we recommend that you independently reconcile the indicators for accounts 76.AB and 62.02, for example.

You need to create a balance sheet for account 19, click in the “Reports” menu, in the “Standard Reports” section, on the “Account balance sheet” hyperlink. Set the quarter, in our example this is the 1st quarter of 2021. Select account 19 and the name of the organization. In the settings, set the details for invoices received and check the “By subaccounts” checkbox.

Account 19 is value added tax on purchased assets. If account 19 reflects the balance at the end of the period, it means that your organization did not accept some part of the VAT for deduction. Consequently, there is input tax, but it is not accepted for deduction.

Don’t forget to get statements from all your banks

There are spare (reserve) current accounts, in case one bank gets sick, you can try to transfer funds to another bank in time (“transfer of your own funds”).

Yes, and this happens - after all (as it turns out in fact) the fact that you use a current account in some bank and store some money there - it is you who are at risk, not the bank. These are today's realities.

Don’t forget to download the statements there, because the commission is most likely being charged, i.e. there is movement.

Buyers 62.01 62.02

62.01 K remainder = 0 62.02 D remainder = 0

do not forget to create sales ledger entries and create purchase ledger

Look in “VAT reporting”. I have a document created by 1C itself once at the end of the quarter.

This is where interesting moments arise in accounting. In fact, VAT from the buyer’s advance payment falls into the document “formation of the purchase book”. This is how things are - it’s like you’re buying VAT.

don't forget to make a count. in advance to buyers!

1C can do this automatically. Look in “VAT reporting”.

76.AB K balance = 0 Remember balance debit 76.AB = 62.2*0.18/1.18. We do SALT exactly 62.2 (i.e. under subaccounts we divide from 62.1 and 62.2)

Note: during the transition from 18% to 20%, this formula will not work.

Incorrectly formed records

Similarly, according to the CP, it is necessary to check the completeness of receipt of the tax return, the compliance of the amounts of tax taken for deduction when offsetting advances, in accounting and the VAT accounting subsystem. And also check everything related to the accounting and distribution of tax on purchases.

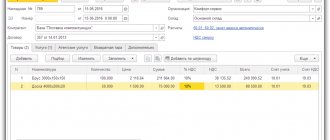

In our example, during an express check of LLC Trading House "Complex" for the first quarter of 2021, an error was identified in the presence of the document "Creating purchase book entries." We talked about this regulatory operation in the article about purchase and sales books.

By clicking on the icon next to the line, you can expand the details.

Do not forget that before submitting a tax return, two regulatory documents must be generated:

- generating purchase ledger entries;

- generating sales ledger entries.

In the case described above, one of the most common inaccuracies in the CP is an incorrectly formed entry.

When creating entries in the CP, the accounting employee presses the “Fill in” button while on the “Purchased Assets” tab. And he forgets to go to the “Advances Received” tab.

Accordingly, the tax on prepayments received does not fall into the CP.

To correct it, you need to go to the next tab and also click “Fill”.

In the example below, only a single entry related to tax restoration is generated according to the CPR.

A similar situation occurs, for example, when your company made an advance payment to the supplier, and according to the presented s/f, VAT was accepted for deduction. Further, when the contractor supplies goods, work or services, your organization’s accountant must restore the tax previously accepted for deduction.

Restoration is automatically carried out using the routine operation “Creating sales ledger entries”.

Fool's method

There is a cool method when, without understanding anything about the algorithms for calculating VAT payable, we focus only on the fact that 1C knows what it is doing.

We take it as a fact that, for example, “Express check of accounting (VAT)” checks everything correctly.

We do this:

We remove one line from the formation of the purchase book and see that “Express VAT check” noticed and began to swear. Aha - that means everything is correct in the document for creating the purchase book.

Next, we’ll post one invoice for the advance in the same way and see what “Express VAT Check” noticed and started swearing. The conclusion and invoices for advance payments are also correct.

It's cool isn't it.

And so on …

Errors in VAT accounting

Error types can be divided into two parts:

- those related to the calculation of VAT directly

- technical, identified when filling out a VAT return.

To identify the former, you should use a tool such as an express accounting check. Essentially, this is the company's "internal auditor".

To use the tool, in the “Reports” menu in the “Accounting Analysis” section, select “Express Check”. In the window that opens, select a period, for example, the 4th quarter of 2021, and click “Show settings.”

In the settings, check the boxes “Maintain a sales ledger for value added tax” and “Maintain a purchase ledger for value added tax.” Then perform the check by pressing the button of the same name.

The program generates errors separately for the purchase book (CP) and for the sales book (KPR). By clicking on the icon next to the corresponding lines, information about the detected inaccuracies should be revealed.

The example reveals a miscalculation when analyzing the formation of advance invoices in the presence of received prepayments. Now we recommend clicking on the icon next to the line and revealing the details of the mistake made.

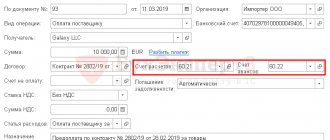

The result of the analysis and the cause of the error are indicated here, as well as recommendations for action. To correct this, you need to click on the hyperlink “Registration of advance invoices”.

In the window that opens, set the period, select an organization, and click “Fill.”

The table will be filled with information about unregistered documents. Click the “Run” button. A message will appear indicating that the s/f registration has been completed.

It is important to check the completeness of the personal statement; the program will show which document is missing or not posted. Such accounting errors are also possible as a result of the human factor. And as a result of incorrect data transfer, for example, from “Trade and Warehouse” to “Accounting 8.3”.

Consequently, when generating a declaration, the counterparty will have information about the document. But your company does not, which will lead to tax audits and additional assessments.

Care should be taken to identify compliance in the accounting of sales revenue with accrued tax (account 90), incl. for other income (account 91). For example, fines are not subject to VAT, however, the program mistakenly took into account fines.

Thus, using the tool in question, check how your real activity is reflected in the system.

Invoice: Reflect the VAT deduction in the purchase book by the date of receipt

If payment and shipment (receipt) are in the same period, then everything is taken into account very simply: all my documents “Receipt of goods” in the Invoice received have a checkbox “Reflect VAT deduction in the purchase book by the date of receipt.” Those. here we immediately make postings for VAT refund ( 68.02 All shipments are similar and there are postings accordingly (90.03

Thus, as a result, the document formation of the purchase book and sales book is almost empty. And all sorts of advances and other evil spirits ended up there, which makes the life of an accountant bright and eventful. The problem is that if you give up and don’t deal with the advances, then it will all come out anyway. Therefore, we are looking for algorithms for checking advances.

Reasons for inaccuracies under Article 19

This may be done on purpose in order to apply deductions later, in the next reporting period, or it may simply be a miscalculation. For example, when posting a receipt, there is no invoice information. If indeed it has not yet been received, then everything is in order. There is no original, but it will appear in the future, for example, in the next quarter. In the same period, the tax will be deducted.

Sometimes it happens that you forgot to register an invoice. In this case, looking at the balance on account 19 in the context of documents, you need to open the document and see what inaccuracies it contains. If the invoice is not registered, but came from the contractor, then you need to enter the information into the system.

It happens that the operator who prepares documents from companies delivering goods or providing services does not understand the difference between the date of issue and the date of receipt. Accordingly, the SF could be issued in the reporting period, but received in the next one.

For example, the date SF is 03/28/2020, but it was received on 04/05/2020, while the operator o.

Indeed, the date of receipt may differ from the date of the invoice. This happens, for example, with a late “primary”. Let's assume that the report is generated when the s/f has already been received. Then, you need to decide whether it is worth leaving a reflection of the deduction by the date of receipt or not. If the company is not going to transfer the deduction to the next period, then this miscalculation needs to be corrected. For example, set the receipt date to 03/31/2020.

As you can see, errors occur that cannot be detected when automatically detected, so you should check the reflection of data on account 19, identify inaccuracies and correct them manually.

During the transition to VAT 20% (2018/2019)

We analyze invoice 90.03 and see if we issued invoices with VAT 18% in 1Q. 2021 — We correct it by 20%.

What follows is old nonsense, it’s better not to read:

What logic first tells us (or the amateur is delusional) is that all options (where there are 2 periods, in one payment, in the other shipment) are divided into:

- 1.1 client prepayment

- 1.1a счф. for advance payment (76АВ

- 1.2 shipment of goods to the client + regular invoice (there are no postings here, but see its shipment 90.03

- 1.2a we cancel the SCHF. for an advance payment (occurs when creating a purchase book - oddly enough).

- 2.1 shipment of goods to the client

- 2.2 payment by the client

- 4.1 receipt of goods from the supplier (19.03

- 4.2 payment to the supplier

Please note that for paragraphs. 2 and 4 no SCHF is created. for advance They only appear if payment is made first.

76AB This appears as a result of creating an invoice for the advance payment. The verification algorithm is as follows: according to 62.2, we look at the total amount at the end of the period, highlight from it how much VAT there will be, and this amount is the total according to 76.AB. This is provided, of course, that all goods have the same VAT.

God, how can I check all this crap with contractors, since since 2015. Each invoice must contend with the counterparty's accounting department.

Let's look at what the document “formation of a purchase book” contains. Attention ! : The document can only be found through this path: Operations - Regulatory VAT reports (it is not in the log of all operations).

- “Creating a purchase book” - there is a division here:

- acquired values 68.02

- advances received 68.02

- Let’s look at what the document “formation of a sales book” contains:

- recovery on advances 76VA

First conclusions:

1. If the transaction has gone through 2 stages (shipment and payment) in full, then logically this can be seen in account 62 (there are no balances there) and, as a result, all advances are on the account. 76 of this counterparty must close, i.e. There should also be no leftovers.

3. If we made an advance payment to the supplier, then by law he must make an invoice. for an advance payment and send it to us, but usually this does not happen for obvious reasons: the supplier has made an SSF for himself. for an advance payment (paid VAT), but he doesn’t care about you - your problems, you need it - come for the SCHF yourself. for advance And it can also be understood - invoice documents and regular invoices are handed over with the delivery of goods, usually in boxes. If, after all, there is such a financial system. for an advance payment from the supplier, then it must be handled in Purchases - Invoices received - Invoice for advance payment.

4. If there were schf. for an advance from the supplier, then after the full cycle the balance is on the account. 60 of our supplier is empty and, accordingly, the balance of 76.VA for our supplier is empty.

That's all, miracles don't happen. Everything is very simple! And by the way, having calmly spent 1 day getting to grips with the meaning of VAT charges and another 1-2 days sorting out mutual settlements with suppliers and customers, as well as re-processing documents + re-closing months 30 times, I had noticeable confidence (turning into euphoria ) that we did VAT correctly.

We reclose sequentially January, February, March through “close month”. In the same place, see the formation of a book of purchases and sales; by the way, the creation of these documents must be controlled manually, since it has been noted that they may not be created automatically.

We prepare a VAT return for the 1st quarter. It appears in Reports - Regulated reports - list (VAT Declaration). There is a sequence for filling out the Sections - see the icon on the right? .

Below are some errors: 1. If OKTMO is not automatically substituted in Section 1, then we stupidly re-select “tax authority” on the Title Page.

Accounting for tax on advances

In general, one of the common mistakes associated with this tax is the incorrect generation of invoices for advance payments. Here it is necessary to clearly understand how such operations are formalized. Upon receipt of an advance payment, an advance payment account is issued, and VAT is taken into account. Further, when goods or services are received, the document reflects the full cost, respectively, when accepting the SF for the goods or tax for accounting. To prevent this from happening, a “reverse” recording is carried out. Tax accepted for accounting from an advance payment is “returned” to the previous account.

For example, at the time the advance payment is received, entry D76.AV K68.02 is generated for the amount of VAT payable on the advance payment of RUB 15,200.

At the time of shipment, posting D62 K90.1 is generated. VAT on sales of 76,000 rubles has been assessed for payment to the Federal Tax Service. – D90.3 K68.2. And the creation of entries in the CP creates posting D68.02 K76.AV in the amount of 15,200 rubles. (restoration of VAT on advances).

In the same way, transactions are made for prepayment and receipt of goods from the supplier.

For example, at the time of payment of the advance and receipt of the SF from the counterparty, entry D68.02 K76.AV is generated for the amount of VAT deductible 22,300 rubles.

At the moment of goods receipt, posting D41 K60 is generated. VAT on sales of 101,000 rubles has been assessed for payment to the Federal Tax Service. – D19 K60. And the creation of entries in KPR will create posting D76.AV K68.02 in the amount of 22,300 rubles. (restoration of VAT on advances).

It is the creation of entries in the books of purchases and sales that allows you to correctly take into account the tax on advances.

How to check VAT (VAT reconciliation)

To check the correctness of tax calculation, you should determine the organization’s total turnover for transactions subject to VAT. If you compare them with accounting data, it will become clear whether all goods have been taken into account.

To determine the turnover associated with the sale of products, the following types of information sources are used:

- bank statements for the company's current account;

- incoming and outgoing cash orders;

- statements of settlements with counterparties;

- invoices issued to customers and buyers.

When examining the sales statement, it becomes obvious which amounts were received in the form of an advance and which in the form of actual payment. Errors made during tax calculations are made obvious. Check all the lines of the document and check each calculation so as not to miss anything. Subsequently, representatives of the Federal Tax Service will use the same algorithm.

Having identified any shortcomings, the accountant can submit clarifications to the tax office. This must be done no later than the due date, otherwise fines will be imposed on the organization. If inaccuracies are identified during a desk audit, the underpaid tax amounts will be subject to penalties.

VAT check: algorithm of actions

To check the correctness of the indirect tax calculation, you can use information from the general ledger. Study every line of it. Check whether the numbers and amounts of the primary documents are indicated correctly, and whether VAT is calculated correctly. If there were errors in the entries, correct them. It is advisable to do this before submitting the declaration to the Federal Tax Service.

Create balance sheets for 60 and 62 accounts (settlements with suppliers and customers, respectively). Check that the wiring is correct. To do this, it is enough to track one point: 60.2 and 62.1 can only be used for debit, 62.2 and 60.1 for credit. If the rule is violated, you need to check the accounting data and identify when the incorrect posting was made.

Pay attention to the “turnover” balance. It must match the figures indicated in the Sales and Purchase Books. If this is not the case, review the transactions and look for where the incorrect amount is indicated.

Form “turnover” for account 41 “Goods”. Pay attention to where the remaining stock is located. They must be positive and go through debit. If this is not the case, pull up the primary documents and find out at what point the misgrading occurred.

Check the statement of account 19. At the end of the period there should be no balance in debit or credit. If present, incorrect entries were made during the quarter.

Examine the account of advances received from buyers and customers. The final balance reflected in the “turnover” of the loan should be equal to the product of the balance in account 62.2 and the tax rate.

Create a sub-account report in your accounting program for all counterparties. Check whether all amounts are posted to accounts according to the primary documentation. You should not have “stuck” amounts. If a supplier or buyer has several contracts, it makes sense to consider the report in the context of each of them.

How is VAT reconciliation carried out by tax authorities?

When checking the tax accounting data of enterprises, the Federal Tax Service specialists first of all pay attention to the correctness of the formation of the tax base (TB). They look at several significant points:

- When NB goods and services are sold, their value, free of taxes, is recognized. If we are talking about excisable goods, then excise taxes are added to the price.

- If an organization sells fixed assets reflected in the balance sheet including VAT, then the NB will be considered the difference between the sales price and the residual value of the property.

- If an organization operates under an agency agreement, then the tax is calculated not on the entire amount of funds received from the counterparty, but on the amount of the agency fee.

- If a product is transferred free of charge, the tax base is calculated as its value based on the average price level on the market.

- When it comes to assignment of financial claims, a standard calculation algorithm is used.

Checking accrued VAT is an important element of an accountant’s work. Analysis of accounting program data and their reconciliation with primary documents allows us to promptly identify errors and inaccuracies. If they are “revealed” after submitting a declaration or during a desk audit, the company may face lengthy proceedings with the tax authorities.

, please select a piece of text and press Ctrl+Enter.

How can you check the balance sheet?

How to check the balance sheet? Is this question relevant for a modern accountant? Taking into account the opportunities that accounting software programs provide, checks of certain control ratios in accounting registers are increasingly taking place on “autopilot” - with full trust in the program. Following the principle of “trust, but verify,” we suggest recalling the basic rules and types of control relationships when forming OCB.

General information about the balance sheet

Checking the balance sheet

Results

General information about the balance sheet

The balance sheet is a consolidated accounting register that summarizes information on all synthetic accounts for the reporting period.

The statement reflects data on the balance at the beginning and end of the reporting period, debit and credit turnover for the period for each accounting account.

When compiled correctly, the statement contains more voluminous information about the financial condition of the organization than its balance sheet. The statement also includes aggregated indicators of the financial results statement.

Due to its information content, the use of the balance sheet is possible for various purposes, such as: the formation of financial statements, independent reports for the purposes of making management decisions.

Important! When preparing a statement for accounting purposes, it is necessary that its indicators be presented in analytics by subaccounts, and if there is an active-liability balance for a subaccount or account, the balance must be reflected in expanded form. The prohibition on offset between asset and liability items is established in clause 34 of PBU 4/99.

For example, account 70 “Settlements with personnel for wages” may have a debit balance for one employee (group of employees) and a credit balance for other employees; These amounts should be included in the financial statements, both as assets and liabilities, in expanded form. Only when prepared in expanded form can the statement serve as a direct source for the preparation of financial statements.

Subscribe to our accounting channel Yandex.Zen

Subscribe

Balance sheet items for which offset is allowed can be found, for example, in this material.

Checking the balance sheet

After drawing up the OCB, it is necessary to check it. During this process, 3 types of errors are detected:

- technical;

- brain teaser;

- methodological.

To identify technical errors, it is necessary to check the following relationships:

- compliance of the account balance at the beginning of the reporting period with the end of the previous period - during this check it is necessary to ensure that the initial data is correctly transferred from the SALT of the previous reporting period;

- compliance of data with analytical accounting registers for the corresponding accounts - for each account it is necessary to compare the initial amounts, turnover and final balance with the register data for the corresponding account.

The presence of methodological errors can be determined using the following indicators:

- The equality of the amounts of assets and liabilities at the beginning and end of the reporting period, as well as the equality of the amount of turnover on the asset to the amount of turnover on the liability for the reporting period. This equality is explained by the fact that all accounting transactions are reflected simultaneously in the debit of one account in correspondence with the credit of another - the principle of “double entry” provided for in paragraph 3 of Art. 10 of the Federal Law of December 6, 2011 No. 402-FZ. If equality is satisfied for all reporting dates and turnover for the reporting period, there are no errors in reflecting transactions based on the “double entry” principle.

- Negative balances on accounts/sub-accounts, that is, the presence of asset balances on passive accounts and liability balances on active accounts. Such cases are the result of methodological errors.

- Availability of balances on accounts 90, 91, 99 at the beginning and end of the financial year. At the end of the financial year, they are closed and have no balances. The presence of balances at the end of the year is a signal of an error when closing accounts.

In order to identify logical errors, you can perform the following calculations:

- Turnovers in account/subaccount 90-3 “VAT” should be a proportion of 18/118 of the turnover in account 90-1 “Revenue”. This ratio must be met in the absence of revenue subject to VAT at a rate other than 18%.

- In most cases, the ratio must be met: the balance of account/subaccount 76 “VAT on advances issued” is a proportion of 18/118 of the balance of account 62 “Advances received from customers”. An exception is operations for receiving advances for the activities listed in paragraph. 3–5 p. 1 tbsp. 154 Tax Code of the Russian Federation.

For more information about cases when VAT is not calculated on advances, see the material “What is the general procedure for accounting for VAT on advances received?”

Results

The balance sheet is the most important report in which the data of all accounting registers is grouped and summarized. The report can be considered as the last step in the preparation of financial statements.

In addition, we can say that SALT is an independent type of reporting that is capable of fully conveying the information reflected in the financial statements.

Despite the ease of forming OCB with modern accounting programs, an accountant should not forget the basics of its construction and the verification procedure.

See also materials on SALT:

How to calculate VAT on a balance sheet

The task of accounting employees is to fully and correctly reflect in accounting all business transactions occurring in the enterprise. Practice does not always correspond to theory, so no one is immune from various errors and inaccuracies.

To monitor your work in a timely manner, it is useful to know how to check VAT.

Subsequently, even small mistakes can become fatal for the organization - lead to lengthy proceedings with the tax authorities, including judicial proceedings, and the imposition of fines.

We check the tax ourselves

To check the correctness of tax calculation, you should determine the organization’s total turnover for transactions subject to VAT. If you compare them with accounting data, it will become clear whether all goods have been taken into account.

To determine the turnover associated with the sale of products, the following types of information sources are used:

bank statements for the company's current account;

incoming and outgoing cash orders;

statements of settlements with counterparties;

invoices issued to customers and buyers.

When examining the sales statement, it becomes obvious which amounts were received in the form of an advance and which in the form of actual payment. Errors made during tax calculations are made obvious. Check all the lines of the document and check each calculation so as not to miss anything. Subsequently, representatives of the Federal Tax Service will use the same algorithm.

Having identified any shortcomings, the accountant can submit clarifications to the tax office. This must be done no later than the due date, otherwise fines will be imposed on the organization. If inaccuracies are identified during a desk audit, the underpaid tax amounts will be subject to penalties.

How to check the correctness of VAT calculation: methods, calculation, formulas and examples

Small errors in the calculation of VAT on the part of an organization may be perceived by the tax inspectorate as an attempt to deceive the state. A trivial, even minor, error in accrual can result in penalties and fines for the enterprise. Serious underpayments may result in legal proceedings.

That is why accounting staff try to especially carefully monitor the accuracy of accruals. They use various methods to check. And today we will tell you how to check VAT online and without using the Internet, who checks statistics on import VAT in the Russian Federation, how to check the registration of a payer in the database and other important nuances.

How to check VAT yourself

You can conditionally check the calculation of VAT in two ways: independently and during a tax audit. Regulatory authorities have their own methods. Internal accounting uses several methods.

You need to independently check the correctness of the calculation of value added tax in the following ways:

- For advance payments

- Sales check

- According to the balance sheet

- Analysis of calculations from purchase books.

Timely monitoring of the correctness of calculations allows you to avoid many problems. This is the right approach, but it does not promise to be simple and fast.

This video will tell you how to check a VAT payer:

By total turnover of product sales

With this method of verification, it is easy to identify errors in VAT calculations. The process itself is not complicated, but it requires a lot of time, care and perseverance. It is required to analyze all records of the following operations:

- documentation of advance payments

- return of registered goods

- information on the fulfillment of their obligations by tax agents

- documents confirming receipt of any funds increasing the tax base

- data on receipt of funds during the sale, provision of services or performance of work, including for one’s own needs, during the transfer of property rights.

Transactions that are not subject to tax deductions are not taken into account. All other data must be carefully calculated. Analysis of sales ledger data should always be performed in conjunction with purchase documentation.

According to the purchase book

When calculating VAT using a purchase ledger, you can determine the amount of funds to be deducted. For VAT payers, this document is required, and when checking independently, the accountant needs to take into account the following items:

- Advance documentation

- Travel expenses

- Invoices from sellers

- Adjustment invoices

- Expenses for construction and installation works for own needs

- Customs declaration and related documents

- Application for import of goods and payment of indirect taxes.

Next, we will tell you how to check the VAT return using the balance sheet (“turnover”, SALT).

According to the balance sheet

It is necessary to calculate the volume of VAT amounts to be paid to the budget and determine the amount of funds to be reimbursed (for example, for construction, in case of overpayment from the budget, etc.). It is also necessary to take into account the paid amounts from advances received and sent to counterparties.

For correct calculation, you need to compare the debit data on subaccounts 60.2 and 62.1, take into account credit calculations (60.1 and 62.2). Determine the balance of the listed accounts at the end of the tax period, check with the books of purchases and sales.

Additionally, you need to check the VAT on advances and purchased valuables. If calculated correctly, the data on the debit and credit subaccounts will coincide with sales and purchases.

Otherwise, you need to check the correctness of the information entered in sales, purchases and advance payments.

Let's find out how to check VAT on advances received.

For advance payments

Advance payments subject to VAT require special attention. Accounting departments often have questions regarding calculations. This happens especially often if the advance payment and shipment of the goods occurred in the same tax period.

A number of orders of the Ministry of Finance imply separate calculations for the advance payment and the remaining amount to be paid. In some cases, it is acceptable not to issue an invoice for the advance payment. This occurs in the case of advance payment and shipment of goods on the same day. It is also sometimes practiced to refuse to calculate VAT on an advance payment if the difference with shipment is no more than 5 days.

The Federal Tax Service of Russia recommends avoiding this practice in order to eliminate unnecessary questions during the inspection. The tax base does not increase from the timely calculation of VAT, so its correct documentation prevents controversial situations with regulatory authorities. In this case, it is necessary to take into account not only advances paid, but also received.

We will tell you below how tax authorities (tax authorities) check the VAT return.

This video will tell you how to get a VAT deduction and then check its accrual:

Check through the tax office

When drawing up VAT documentation, you need to be extremely careful; they are carefully studied by the tax authorities. Declarations will also be verified during a desk audit. First of all, specialists check the submitted declarations and determine how correctly the tax base is formed, paying special attention to deductions for shipments.

The following nuances must be taken into account:

- Sale and purchase of debts

- Agreements for the assignment of financial rights

- Free transfer of property

- sale of property subject to VAT

- Receiving profit under contracts with counterparties

- Price of products not subject to taxation.

These data are compared with the information from the submitted declaration. The correspondence of the numbers, dates and other data of the organization’s invoices with their entries in the relevant documents must be examined. All advance payments and the final correctness of filling out the declaration are also subject to analysis.

All enterprises paying VAT need to know that the powers of tax inspectors have expanded. Now, according to Law No. 134-FZ, they can conduct an in-depth audit when providing documents for tax reimbursement from the budget. To prevent unpleasant consequences, it is necessary to conduct a thorough independent check of the correctness of VAT calculations before submitting documentation to the tax office.

The video below will tell you how to check VAT and how to apply tax codes: