Registration of a unit

An OP is registered only when financial and economic activities are carried out through it. This is done within one month from the opening of a new separate structure (clause 4 of article 83 of the Tax Code of the Russian Federation). If there is no activity at the time of creation of the OP, there is no need to register the branch. But the moment the parent company begins to conduct operations through the OP, it will have to be registered within the prescribed period.

IMPORTANT!

The fine for failure to inform about the opening of a separate unit is up to 40,000 rubles.

When does the obligation to register a separate subdivision arise?

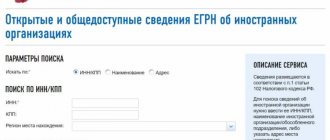

For the purposes of registration with the Federal Tax Service, the Pension Fund of the Russian Federation and the Social Insurance Fund, a separate division is any division of an organization that simultaneously meets four criteria (clause 1 of Article 11 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated January 18, 2012 N 03-02-07/1-20 , dated 10/12/2012 N 03-02-07/1-250, dated 02/18/2010 N 03-02-07/1-67, Federal Tax Service dated 01/19/2012 N PA-4-6/ [email protected] ):

- the address of the separate division differs from the address of the organization indicated in the Unified State Register of Legal Entities (Letter of the Ministry of Finance dated August 18, 2015 N 03-02-07/1/47702);

- at the location of a separate unit for a period of more than a month, at least one stationary workplace is equipped (Letters of the Ministry of Finance dated January 18, 2012 N 03-02-07/1-20, dated October 12, 2012 N 03-02-07/1-250, dated 02/18/2010 N 03-02-07/1-67, Federal Tax Service dated 01/19/2012 N PA-4-6/ [email protected] );

- the premises (object, territory) where the workplace is located is under the control of your organization, i.e. is in your ownership, lease or on another legal basis (Letters of the Ministry of Finance dated 10/05/2012 N 03-02-07/1-238, dated 02/03/2012 N 03-02-07/1-30);

- the organization began to operate at the location of the separate division, i.e. a person has already been hired who will work there temporarily or permanently (Letter of the Ministry of Finance dated 02/19/2016 N 03-02-07/1/9377).

A workplace is considered to be the place where the employee should be, or where he should arrive in connection with the performance of duties (Article 209 of the Labor Code of the Russian Federation).

In this case, it does not matter at all how the employees will work and how often they will appear at the created workplace. Whether the employee will be there permanently, or will come only on a business trip, or come for a few hours a week, if you have created a workplace, then it does not matter how much time the employee actually spends in it. If employees will use the new working month for more than one month, then it is necessary to register a separate division. Both the finance department and judges insist on this approach (see letter of the Ministry of Finance of Russia dated November 13, 2015 No. 03-02-07/1/65879, resolution of the Arbitration Court of the North Caucasus District dated June 19, 2015 No. F08-3514/2015).

Please note that for the purposes of registration, it does not matter whether the creation of a separate division is reflected in the constituent documents or not.

At the same time, the condition for creating jobs is not met if your employee works in a workplace equipped and provided to him by your counterparty: at security posts at facilities guarded by private security companies, in premises and territories served by cleaning companies, etc. And if these are warehouses and jobs have been created in them, for example, for watchmen, and the warehouse is located separately from the organization, then the warehouse meets all the characteristics of a separate unit (letter of the Ministry of Finance of Russia dated 08/18/15 No. 03-02-07/1/47702).

The division must be registered within a month from the date of its creation (subclause 3, clause 2, article 23, clause 4, article 83 of the Tax Code of the Russian Federation).

If the created division is allocated to a separate balance sheet, independently accrues payments in favor of individuals and has a current account, then in addition to the tax organization, it must register with the Pension Fund of the Russian Federation and the Social Insurance Fund at the location of the separate division (clause 2 of the Letter of the Ministry of Finance dated 02.06.2005 N 03- 06-01-04/273, paragraphs 6, 9, 10 of Order No. 202n, Letter of the Social Insurance Fund dated March 23, 2010 N 02-03-13/08-2496, paragraph 3 of Article 11 of Law No. 167-FZ, clause 1 of Order No. 296p). At the same time, a separate division must also be registered with the Social Insurance Fund within 30 calendar days from the date of its creation.

The deadline for submitting an application for registration with the Pension Fund of the Russian Federation is not established by law, but it is advisable to do this before the separate division begins to pay contributions to the Pension Fund for payments to employees of the separate division.

If you don't report the opening

In addition to registration, the parent organization is obliged to notify the territorial tax service office about the opening of a separate division. This must be done in any case, regardless of whether the activity is carried out through the OP or not. Violation of deadlines and failure to comply with the rule on mandatory notification entails penalties.

Here is a table of all possible fines for failure to report discovery. What penalty will be imposed on the parent company depends on the decision of the inspectors of the Federal Tax Service.

| Amount of fine | Norm | Base |

| 10,000.00 rubles | Clause 1 Art. 116 Tax Code of the Russian Federation | Violation of the deadline for filing an application for registration with the Federal Tax Inspectorate |

| 10% of income received during the entire period of activity of the OP, but not less than 40,000.00 rubles | Clause 2 Art. 116 Tax Code of the Russian Federation | Conducting activities by an organization or individual entrepreneur without registration with the Federal Tax Service |

| 5000.00 rubles | Clause 1 Art. 129.1 Tax Code of the Russian Federation | Late reporting of mandatory information to the Federal Tax Service |

| 200 rubles | Clause 1 Art. 126 Tax Code of the Russian Federation | Failure to submit required documents to the Federal Tax Service within the prescribed period |

For failure to provide information about the opening of an OP, a fine is imposed under clause 1 of Art. 126 of the Tax Code of the Russian Federation in the amount of 200 rubles. But there are cases when controllers took a different position and determined the maximum fine in the amount of 10% of revenues lost to the regional budget. The logic is simple: a branch has opened, activities are carried out in a specific region, but taxes do not go to the regional budget, since the OP was not registered with the territorial department of the Federal Tax Inspectorate.

If you do not report the closure of a separate division

The closure of the OP is reported within three days from the moment such a decision is made (clause 3.1, clause 2, article 23 of the Tax Code of the Russian Federation). If this is not done, the parent company will receive a fine for failure to report the closure of a separate division. There is a special form No. S-09-3-2 for notifying the territorial Federal Tax Service. If you do not send a message within three days, the organization will be fined 200 rubles under clause 1 of Art. 126 of the Tax Code of the Russian Federation. The manager will receive a fine of 300 to 500 rubles.

In addition to the S-09-3-2 form, a notification must be submitted in form R 13002. If you do not submit it on time, the fine will be 5,000.00 rubles (clause 1 of Article 129.1 of the Tax Code of the Russian Federation).

Specifics of tax accounting in the presence of separate divisions

simplified tax system

Contrary to popular belief, registration of a separate unit does not prevent the use of the simplified tax system. The simplified tax system cannot be used only if you have a branch (subclause 1, clause 3, article 346.12 of the Tax Code of the Russian Federation), that is, a separate division that is named a branch in the Unified State Register of Legal Entities (letter of the Federal Tax Service dated June 2, 2008 N CHD-6-6 / [email protected ] ).

If there are other OPs, incl. representative offices, the organization can apply the simplified tax system.

Registration of separate divisions entails a change in the specifics of accounting and the procedure for paying taxes and fees: the entire amount of tax is paid at the location of the parent organization.

Personal income tax

The Tax Code requires personal income tax to be paid to the inspectorate of each branch (clause 7 of Article 226 of the Tax Code of the Russian Federation) on income received by individuals from the specified separate division. In addition, it will be necessary to submit income certificates to the inspectorate of the separate unit, as well as the calculation of 6-NDFL based on the income of the unit’s employees (clause 2 of Article 230 of the Tax Code of the Russian Federation).

At the location of the organization itself, personal income tax is still paid on income received by individuals from the head division of the Organization.

If a company pays tax to one tax office, inspectors do not have the right to charge penalties and fines (letter of the Ministry of Finance of Russia dated October 10, 2014 No. 03-04-06/51010). But in practice they do this and it is possible to cancel additional charges only in court (see, for example, the resolution of the Arbitration Court of the West Siberian District dated December 11, 2014 No. F04-12919/2014).

If a company submits 6-NDFL calculations for all employees to the head office, the tax authority can block the current account (clause 3.2 of Article 76 of the Tax Code of the Russian Federation) and fine 200 rubles for each unsubmitted certificate or calculation of 6-NDFL (Article 126 of the Tax Code of the Russian Federation ).

Insurance contributions to the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund

Contributions at the location of the separate unit are paid from payments to employees of the OP, which is registered with the Pension Fund and the Social Insurance Fund. For other employees, payments to employees of the head division and those separate divisions that are not registered with the Pension Fund and the Social Insurance Fund are paid at the location of the organization itself. We remind you that, as noted earlier, if the created division is allocated to a separate balance sheet, independently accrues payments in favor of individuals and has a current account, then it must be registered with the Pension Fund of the Russian Federation and the Social Insurance Fund. For other separate divisions, there are no specifics regarding accounting and payment of insurance premiums.

Income tax

At the location of the parent organization itself, the following is paid:

- to the federal budget;

- to the regional budget in the part attributable to the head unit.

To the regional budget in the part attributable to the separate division in proportion to the share of profit attributable to the separate division.

The following indicators are used for the calculation (paragraph 1, clause 2, article 288 of the Tax Code of the Russian Federation):

- average number of employees or labor costs (hereinafter referred to as the labor indicator).

- residual value of depreciable property (hereinafter referred to as the property indicator).

The organization has the right to decide for itself which of these two indicators to use. In this case, the selected indicator is fixed in the accounting policy and does not change during the tax period (paragraph 4, paragraph 2, article 288, paragraph 5, 6, article 313 of the Tax Code of the Russian Federation);

These indicators must be determined both for the organization as a whole and for each separate division.

The share of profit of each separate division (parent organization) is calculated using the following formula:

DP = (Morning + Um) / 2, where

DP - share of profit of a separate division (parent organization);

Utr - the share of the labor indicator (average number of employees or labor costs) of the corresponding separate division (parent organization) in the labor indicator of the entire organization (average number of employees or labor costs);

Um - the share of the residual value of the depreciable property of the corresponding division (parent organization) in the residual value of the depreciable property of the entire organization (clause 1 of Article 257 of the Tax Code of the Russian Federation).

VAT

The presence of a separate division does not affect the procedure for calculating and paying tax. All tax is paid at the location of the parent organization.

Property tax

Property tax on real estate, calculated from both book value and cadastral value, is paid at the location of the property.

Property tax on movable property is paid at the location of the separate subdivision for the value of fixed assets that are listed on the balance sheet of the separate subdivision. According to the head unit, respectively, in the part attributable to it.

Transport tax

Paid at the location of the separate subdivision for cars registered to the separate subdivision. At the location of the organization itself from cars registered to the organization itself (to the head office).

Arbitrage practice

Parent organizations go to court regarding the amount of the fine and the amount of punishment. There are several solutions regarding penalties for failure to report the opening of a separate structure:

- In accordance with Articles 23, 83 and 84 of the Tax Code of the Russian Federation, organizations are required to notify the Federal Tax Service only about the creation of a separate division, but not about the actions of the enterprise to register an enterprise. The violator is fined under Art. 126 of the Tax Code of the Russian Federation (Resolution of the AS UO No. F09-7309/15 dated October 19, 2015 in case No. A76-2261/2015, Resolution of the AS UO No. F09-10484/15 dated December 28, 2015 in case No. A60-4800/2015).

- Some judges impose penalties for late informing the tax authorities about the opening or closing of separate departments under paragraph 1 of Art. 129.1 of the Tax Code of the Russian Federation (Resolution of the AS MO No. F05-11191/14 dated October 30, 2014 in case No. A40-130227/2013).

- In some cases, tax authorities and arbitration judges determine capital punishment under paragraph 1 of Art. 116 of the Tax Code of the Russian Federation. The basis is the conduct of activities without registration with the Federal Tax Service at the location of a separate structure (Resolution of the AS ZSO No. F04-5897/2016 dated January 27, 2017 in case No. A70-2645/2016).

The Supreme Court of the Russian Federation has a clear position on this issue. The Tax Code of the Russian Federation has established an obligation for taxpayers to report to the Federal Tax Service the existence of special structures within a specified period. A violation is the failure to provide documents to the territorial tax authority, which means that violators should be fined under clause 1 of Art. 126 of the Tax Code of the Russian Federation (Determination of the Supreme Court of the Russian Federation No. 303-KG17-2377 dated June 26, 2017 in case No. A04-12175/2015). This decision is the basis for similar cases and resulting verdicts.