Who is required to use the chart of accounts?

The chart of accounts of accounting (CHAP) and instructions for its use (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n) are required to be used by companies of all forms of ownership and organizational and legal forms that use the double entry method. The exception is credit organizations and budgetary institutions. Individual entrepreneurs do not need PAS.

REFERENCE. Micro-enterprises and non-profit organizations that have the right to use simplified accounting methods and can submit simplified reporting can refuse the double entry method. This is stated in paragraph 6.1 of PBU 1/2008 “Accounting Policies of the Organization”.

Get a free sample accounting policy and do accounting in a web service for small LLCs and individual entrepreneurs

What does the instruction approved by Order No. 94n say?

Let's consider the main features of the “commercial” instructions for the chart of accounts introduced by Order No. 94n.

Based on this plan, organizations are required to form their own working chart of accounts. Its structure must contain the main synthetic accounts recorded in Order No. 94n.

Read more about the structure of the accounting work plan in the article “Working chart of accounts - sample 2017” .

As for subaccounts, as well as analytical accounts, the taxpayer can use both those proposed by the legislator and those developed independently.

One of the key goals of the instructions for the chart of accounts introduced by Order No. 94n is the establishment by the legislator of a standard correspondence scheme between various synthetic accounts. That is, a company, having made one or another entry on the debit of one account, should easily find a correspondence to it on the credit of another account available in the work plan. If accounting is organized by the company in accordance with the instructions, then solving this problem will not be difficult.

The Russian Ministry of Finance also gives the taxpayer the right to supplement the standard correspondence scheme with his own bundles of accounts, subject to the uniform approaches to the formation of such schemes approved by the above instructions.

Unified chart of accounts for state unitary enterprises and municipal unitary enterprises

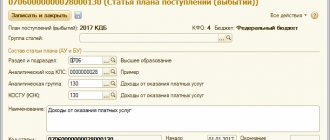

State and municipal institutions apply a unified chart of accounts, approved by order of the Ministry of Finance of Russia by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n. It is not similar to the PSBU for commercial companies. Budget accounting accounts 2021 have a different structure. They should be used differently than in “regular” accounting (for more details, see “Budget accounting: how accounting for “state employees” differs from “commercial” accounting”).

An accountant who has decided to change his field of activity and move to a budget organization should be advised to use a specialized program for maintaining budget accounting. This will allow him to quickly understand the differences and more easily master accounting in a new area.

What's new in the instructions from order No. 94n

Amendments to Order No. 94n, adopted in 2001, were made only 3 times: in 2003, 2006, and also in November 2010. This legal regulation has not been edited for quite some time, and to date, no amendments to it have been announced in the official media related to lawmaking. Thus, nothing new has appeared in Order No. 94n over the past few years.

Another thing is the legislator’s approach to regulating accounting activities in the public sector. Here the state takes less conservative approaches. How this is expressed, we will consider below.

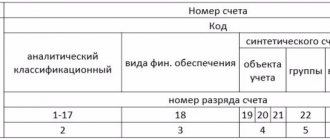

Chart of Accounts Structure

PAS for commercial organizations is a scheme that allows you to register and group facts of economic activity (assets, liabilities, financial and business transactions, etc.).

It contains accounts of the first order. They are called synthetic, and each has a name and number.

Three types of synthetic accounts:

- Active. Their balance can only be debit; an increase in funds is always reflected in a debit, a decrease in a credit.

- Passive. Their balance can only be credit; an increase in funds is always reflected as a credit, a decrease as a debit.

- Active-passive. Their balance can be either debit or credit; an increase (decrease) in funds is reflected either as a debit or as a credit.

Also, the PSBU contains second-order accounts. They are called subaccounts. Several subaccounts can be opened for one synthetic account.

Fill out and print your balance sheet using the current form for free

Section III. Production costs

Main production 20 Semi-finished products of own production 21 ……………………………………………………….. 22 Auxiliary production 23 ……………………………………………………….. 24 General production expenses 25 General business expenses expenses 26 ……………………………………………………….. 27 Defects in production 28 Service industries and farms 29 ……………………………………………………….. 30 ……… ……………………………….. 31 ……………………………………………………….. 32 ……………………………………………………….. 33 ……………………………………………………….. 34 ……………………………………………………….. 35 …………………………………… …….. 36 ……………………………………….. 37 ……………………………………………………….. 38 ……………………… ……………….. 39The principle of working with the chart of accounts

The organization must select the accounts that it will use in its work. You also need to think about which subaccounts need to be opened based on the specifics of the company’s activities.

IMPORTANT. The organization is not required to strictly adhere to the list of subaccounts. They can be renamed, refined, combined and excluded. The main thing is that it is convenient to work with them.

The result will be a working PSBU. It should be included in your accounting policies. If the organization’s activities have changed during the year, the changed version can be approved for the next year.

If any business transaction is specific, and there is no suitable synthetic account for it, it is permissible, with the permission of the Ministry of Finance, to enter a new account for yourself. For this purpose, numbers not used in the plan are used.

Maintain accounting and tax records for free in the web service

Results

Charts of accounts approved by law for private firms and government agencies in 2021 are mandatory for use by the accounting departments of the relevant organizations. On their basis, working charts of accounts of business entities are created.

You can learn more about the use of charts of accounts in the following articles:

- “Working chart of accounts - sample 2015”;

- “We are preparing a chart of accounts for budget accounting - sample 2015.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is it possible to handle it yourself without an accountant?

Organizations using the simplified tax system do not have many operations, so the director himself can handle accounting. To formalize this from the point of view of the law, you need to issue an order to assign such responsibilities to yourself. in Elba on the “Employees” tab.

Accounting is strictly regulated by law. Accountants spend several years to learn all the rules and standards. The director cannot afford this. We tried to find a way out and made accessible accounting in Elbe without special knowledge of postings, accounts and other accounting things.

In Elba, you reflect clear transactions from the life of an LLC; based on this, the service independently generates transactions without overloading you with complex accounting terms. When you download a bank statement, you see the usual receipts and debits of money from the account, but at this moment Elba has already reflected the necessary entry in accounting. The type of posting depends on the type of cash transaction. For example, if this is payment for services from clients, then the posting will be Debit 51 “Current Accounts” - Credit 62 “Settlements with Customers”.

The same thing happens when you generate documents for clients, receive incoming documents from suppliers, issue salaries to employees, pay taxes and fees, receive and repay a loan. Elba takes care of the postings herself and does the accounting for you.

In Elba you will not find postings, accounts, balance sheets and other tools that professionals use every day. Only when preparing financial statements for the year can you see all the turnover and account balances. If you truly love accounting with all its components, take a look at our friends - the Kontur.Accounting service.

Section IV. Finished products and goods

Output of products (works, services) 40 Goods 41 1. Goods in warehouses 2. Goods in retail trade 3. Containers under goods and empty 4. Purchased items Trade margin 42 Finished goods 43 Selling expenses 44 Goods shipped 45 Completed stages of work in progress 46 ……………………………………………………….. 47 ……………………………………………………….. 48 …………………………………… …….. 49Off-balance sheet accounts

Leased fixed assets 001 Inventory assets accepted for safekeeping 002 Materials accepted for processing 003 Goods accepted on commission 004 Equipment accepted for installation 005 Strict reporting forms 006 Debt of insolvent debtors written off at a loss 007 Security for obligations and payments received 008 Security obligations and payments issued 009 Depreciation of fixed assets 010 Fixed assets leased 011Simplified magazine

Post:

What is accounting

Accounting is an accounting system that collects information about the activities of an organization and its financial position.

Every action in the life of the LLC is taken into account, and at the end of the year the data is summarized into one report, which is called “accounting statements.” This report is primarily needed by the tax authorities and Rosstat; it is submitted every year by March 31. Banks also look at the report when issuing a loan to assess the financial condition of the borrower, and investors to determine how attractive it is to invest in a business.

Even LLC owners benefit from accounting. For example, it helps to make decisions about the further development of the organization or calculate dividends.

Where to record this accounting

There are different documents to record all transactions, turnover and account balances. They are called accounting registers. Experienced accountants use a huge variety of forms, but to get started, it’s enough to know about the most necessary ones.

The balance sheet is the main document, which is a large table with data: what balances were at the beginning of the period, what amount of transactions occurred and what was left at the end. Accountants have the ability to find all discrepancies using such a table, which is why they love this document very much.

An account card is another popular document that stores the history of all transactions for each account. Helps you understand where a specific transaction came from and how it affected the state of a specific account.

Accounting reporting is for many the main purpose for which accounting is carried out. These are several forms of reports that contain information in monetary terms about property, debts, revenue, profit, expenses and financial results. Accounting reports are compiled and approved at the end of each year and submitted to the tax office and Rosstat by March 31.