Simplified accounting? Simplified reporting!

Small enterprises have the right not only to conduct simplified accounting, but also to prepare financial statements using a simplified system.

Simplified reporting involves the preparation of a simplified balance sheet, a simplified statement of financial results, and for non-profit organizations - a simplified report on the intended use of funds.

Small enterprises may not prepare other forms of financial statements at all if they consider that information in other forms will not be significant for assessing the financial position of a small enterprise or its financial results (clause 6 of Order of the Ministry of Finance dated July 2, 2010 No. 66n).

At the same time, when preparing simplified financial statements in 2018, small enterprises are guided by the following approach:

- the balance sheet, financial performance report, and report on the intended use of funds include indicators only for groups of items (without detailing the indicators for items);

- in the appendices to the balance sheet, financial results report, and report on the intended use of funds, only the most important information is provided, without knowledge of which it is impossible to assess the financial position of the organization or the financial results of its activities.

At the same time, the right to use simplified accounting does not deprive small enterprises of choice: they can conduct accounting like “large” ones, and also prepare annual reports in full.

There is a choice

Law “On Accounting” No. 402-FZ allows you to choose which forms of accounting statements a small enterprise will use in its work (Part 4, Article 6). Namely:

- standard general (extended), intended for reporting companies that the law does not classify as small businesses;

- forms simplified in structure and completion.

Of course, the vast majority of small businesses choose simplified accounting. In this case, this decision must be recorded in the accounting policy.

Simplified reporting forms

Simplified forms of the balance sheet, statement of financial results, report on the intended use of funds for small enterprises 2017-2018 were approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

We provide simplified accounting forms with the “Code” column in Excel format.

When submitting simplified reporting to the tax office on paper, you must use a machine-readable form of simplified accounting reporting (KND form 0710096). Previously, a form was used with the code according to KND 0710098. It had to be submitted for 2013 - 2014.

Forms in easy-to-fill PDF format can be found here.

When to submit simplified reporting

The law does not provide for specific deadlines for submitting annual financial statements for small enterprises. Like all organizations, no later than March 31, they are required to submit annual reports at their location:

If March 31 coincides with a weekend, you can submit reports no later than the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

For 2021, small businesses were required to submit annual reports no later than March 31, 2017.

Small businesses must submit annual financial statements for 2021 no later than 04/02/2018.

Accounting of small businesses for 2021 (special points)

The accounting records of a small enterprise for 2021 must be created taking into account certain rules, namely:

- in any of the three reports, indicators are entered in an aggregated form - without detailed division into items;

- in documents it is necessary to present only the most essential and significant information, without which it is impossible to analyze the financial position of the entity and the efficiency of its functioning.

Using simplified types of reports is not an obligation, but a right of small businesses, and therefore they can choose: to work according to a simplified procedure or to generate the financial statements of a small business for 2021 in full.

Simplified accounting reporting: who submits

Drawing up simplified financial statements is a kind of relaxation that is not available to everyone. Accountants periodically have questions about simplified financial statements, who submits them and under what conditions. However, in order to answer the question of who submits simplified financial statements, or rather, who has the right to submit simplified financial statements, it is necessary to decide who has the right to simplified accounting. And the connection here is direct: who can submit simplified financial statements, they can also conduct simplified accounting. But this does not mean that if you have the right to maintain simplified accounting, you must maintain it and are required to submit only simplified financial statements. You can still maintain full accounting records and, accordingly, submit a complete set of financial statements. And even if you use simplified accounting, no one can prohibit you from submitting the entire set of financial statements.

Which organizations submit simplified financial statements?

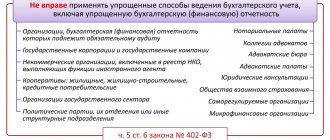

The persons listed in Part 4 of Art. have the right to conduct simplified accounting and prepare financial statements in a simplified format in 2021. 6 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”:

In Part 5 of Art. 6 of the Federal Law of December 6, 2011 No. 402-FZ indicates those business entities that are not entitled to conduct simplified accounting. These include:

- organizations whose financial statements are subject to mandatory audit;

- housing and housing construction cooperatives;

- credit consumer cooperatives;

- microfinance organizations;

- public sector organizations;

- political parties, their regional branches or other structural units;

- bar associations;

- law offices;

- lawyer consulting;

- bar and notary chambers;

- non-profit organizations included in the register of foreign agents.

The above list in relation to simplified financial statements 2017-2018 (who can submit them and who is not granted such a right) is closed. In this case, you must be guided by Part 4, taking into account the requirements of Part 5 of Art. 6 of the Federal Law of December 6, 2011 No. 402-FZ. This means that it is impossible to answer affirmatively to the question of whether an NPO can submit simplified financial statements, guided only by Part 4 of Art. 6 of Federal Law No. 402-FZ dated December 6, 2011, which states that non-profit organizations are among those who submit simplified accounting reports. In particular, it is necessary to check whether such an NPO belongs to non-profit organizations included in the register of NPOs performing the functions of a foreign agent. If it does, then it is impossible to maintain simplified accounting for such an organization.

Can a pawnshop submit simplified financial statements? Here you only need to know whether such an organization belongs to small businesses. After all, there is no direct prohibition on simplified reporting in relation to pawnshops in the Federal Law of December 6, 2011 No. 402-FZ.

Accounting statements of small businesses 2017 – time and place of presentation

The 2017 financial statements of a small enterprise are submitted to the following government agencies:

- to the federal tax service inspectorate at the place of registration of the business entity;

- to regional statistical bodies.

It must be remembered that you need to submit reports for 2021 once - no later than March 31, 2021. In terms of submission deadlines, there are no clarifications for small enterprises, and therefore they submit in the same period as large/medium-sized enterprises. Since March 31 falls on a non-working Saturday, the deadline for submitting accounting reports in 2021 is April 2.

Who submits simplified financial statements

The Law “On Accounting” dated December 6, 2011 No. 402-FZ provides for some organizations the right to use simplified methods of accounting, as well as to prepare simplified financial statements. In paragraph 4 of Art. 6 of this law lists the following subjects:

- organizations classified as small in terms of business volume;

- non-profit structures created in accordance with the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ;

- participants of the Skolkovo project, subject to the Law “On Innovation dated September 28, 2010 No. 244-FZ.

To determine whether an organization is classified as small, you need to correlate its indicators with the requirements of the law “On the development of small and medium-sized businesses in the Russian Federation” dated July 24, 2007 No. 209-FZ.

About the criteria that must be met in order to call an organization a small enterprise, read the article “Small enterprise - designation criteria” .

In addition, those wishing to simplify their accounting should check whether they are subject to the restrictions established by clause 5 of Art. 6 of Law No. 402-FZ. This clause prohibits the use of simplified accounting and reporting, for example, by government organizations, entities subject to mandatory audit, and some legal structures.

Composition of simplified financial statements for 2021

Let's start with the fact that, by virtue of paragraph 1 of Art. 14 of Law No. 402-FZ, accounting consists of:

The annexes, in turn, are (clauses 2, 4 of order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n):

- statement of changes in equity;

- cash flow statement;

- report on the intended use of funds;

- explanations for reporting.

For information on preparing appendices to financial statements, see the material “Filling out Forms 3, 4 and 6 of the Balance Sheet.”

Note that for non-profit organizations, a report on the intended use of funds is designated as a form of mandatory annual accounting reporting along with a balance sheet (clause 2 of Article 14 of Law No. 402-FZ). Not only NPOs, but also other companies if they received targeted funds must fill out this report.

As for those who apply simplified rules, Order No. 66n contains special relaxations. In mandatory forms, you can indicate aggregated indicators, combined by groups. These forms are:

For these three reports, legislators provided abbreviated forms in the mentioned order No. 66n; they can be found in Appendix 5. Those who have the right to simplify reporting have the opportunity to choose whether to use the forms given in the order or develop them themselves.

According to sub. “b” clause 6 of Order No. 66n in the appendices to the main forms it is necessary to indicate only those data that may influence the opinion of users of the reporting on the results of the organization’s work or its financial condition. Accordingly, if such important information is not available, then it is not necessary to fill out the applications. This is confirmed by paragraph 17 of the information of the Ministry of Finance of the Russian Federation No. PZ-3/2015.

Accounting statements of small businesses 2017

A simplified form for preparing financial statements is used, regulated by Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. It is necessary to note the following main features of filling out reports:

- small enterprise accounting forms for 2017 must be encoded 0710001 (for the balance sheet), 0710002 (for the report on financial results), 0710006 (for the report on the use of funds);

- business entities can supplement the forms required for submission if this is necessary for the purpose of more complete disclosure of information, for example, create explanatory notes. The format of their presentation (text or table) is chosen by companies independently;

- No changes can be made to the approved form of financial statements of small businesses-2017. If the form is not sufficient for disclosing information due to its abbreviated version, it is necessary to use the usual type of reporting;

- If there are discrepancies between the forms and the established templates, government agencies have the right to return the completed reports for revision.

Developed and approved reporting forms for small businesses are designed to facilitate the procedure for generating and submitting documents. If they are filled out correctly, the reporting procedure is greatly simplified, but it is always necessary to check whether the business entity meets the criteria for being classified as small or not. We talked about the criteria for classifying enterprises as SMP in 2021 here. How to fill out a simplified balance, read our article.

Features of preparing simplified reporting

To address some issues related to the topic of our article, the Ministry of Finance of the Russian Federation issued information message No. PZ-3/2015. This message contains the main concessions for those using simplified reporting:

- The decision to disclose any information should be based on the materiality of the data to users (including the identification of individual items from groups of items in reporting forms).

- You don't have to write down the information:

- about related parties;

- segments;

- for discontinued activities.

- Events after the reporting date are shown in financial statements only if it makes rational sense.

- When changes are made to accounting policies, the significant consequences of this fact can be reflected in the financial statements prospectively.

- Significant errors from previous years can be corrected by affecting other income or expenses of the current period, without adjusting retained earnings/loss.

and simplified reporting forms can be found at the link below

Download the form

Types of taxes for preparing declarations and submitting reports under the simplified tax system and deadlines

According to the Tax Code of the Russian Federation, when applying the simplified tax system, depending on the selected object for calculation, the following taxes are replaced by the payment of a single tax at a rate of 6% or 15%: - income tax; - property tax; — VAT.

When submitting reports to the simplified tax system

tax rates of 6% are levied if the object of taxation is income; 15% - if the object of taxation is income reduced by the amount of expenses.

Taxes are paid and calculated quarterly under the simplified tax system based on the results of the reporting period.

Every year, declarations on land and transport taxes are submitted if a company is recognized as the payer.

Submitting reports under the simplified tax system requires the deadline for submitting reports once a year, since the tax period is a calendar year. But according to the laws of the constituent entities of the Russian Federation, differentiated tax rates can also be established ranging from 5% to 15%, depending on the category of taxpayer.

Filing a tax return for the simplified tax system for companies is carried out within the following deadlines:

— for LLC – until March 31;

- for individual entrepreneurs - April 30.

Every three months, reports are submitted to the Social Insurance Fund of the FSS and to the Pension Fund of Russia (PFR) on insurance contributions in forms RVS-1 and 4-FSS. Documents must be submitted to the Pension Fund by the 15th day of the second calendar month following the reporting period, to the Social Insurance Fund - no later than the 15th day of the month also following the reporting period. In addition, individual information about employees is submitted to the Pension Fund every quarter.

Reporting for the reporting periods consists of the following:

— calculation of advance payments for insurance premiums for compulsory pension insurance; — VAT return, if the organization is a tax agent for VAT; — tax calculation of advance payments for land tax (only for land tax taxpayers); — corporate income tax return.

Please note that since 2009, the declaration for the single tax under the simplified tax system, as well as transport and land taxes, has not been submitted based on the results of three, six and nine months. Such a declaration is provided only at the end of the tax period, that is, one calendar year.

When submitting reports to the simplified tax system, the following reports are submitted based on the results of the tax period (year):

— information on the average number of employees; — VAT return, if the organization is a tax agent for VAT; — individual information to the Pension Fund: statement of payment of insurance contributions for compulsory pension insurance in the form ADV-6-2, ADV-6-3, form SZV-4-2 and form SZV-4-1; — single tax declaration according to the simplified tax system; — information about the income of individuals in form 2-NDFL; — land tax declaration (only for land tax payers); — transport tax declaration; — corporate income tax return.

Entrepreneurs who apply the simplified tax system submit a tax return to the tax service, which is paid in connection with the application of the simplified tax system no later than April 30 of the year following the reporting year.

Criteria for classifying enterprises as small businesses

The conditions for classifying enterprises as small businesses are established by Art. 4 of the Law “On the Development of Small and Medium Enterprises in the Russian Federation” dated July 24, 2007 No. 209-FZ:

1. 25% maximum permissible share of participation in the authorized capital of the organization:

- Russian Federation, subject or municipality of the Russian Federation;

- public and religious organizations or associations;

- charitable or other foundations.

The exception is the assets of investment funds.

2. The total share of participation of foreign capital and one or more legal entities that are not small businesses should not exceed 49%. The exceptions are:

- business entities that use or implement the results of intellectual activity (computer programs, databases, utility models, industrial designs, selection achievements, know-how), the rights to which belong to the founders, who are budgetary or autonomous institutions: scientific institutions;

- educational organizations of higher professional education;

- legal entities whose participants belong to organizations receiving state support for innovative activities according to the list of the Government of the Russian Federation in the forms established by the law “On Science and State Scientific Policy” dated August 23, 1996 No. 127-FZ.

Small business: who is it?

Since we are considering such an issue as the financial statements of small businesses 2021, we must at least briefly remind the reader who small entrepreneurs are. Let us note that not long ago the criteria for classifying organizations as small businesses were changed: in particular, the amount of revenue was increased.

As of 2021, there are two types of small businesses: microenterprises and small entrepreneurship.

If we are talking about micro-enterprises, then the number of officially employed employees cannot be more than 15 people. The amount of total income received during the reporting period (we remind you that not so long ago, when determining the amount of income for small businesses, the indicator of total revenue from all types of activities, and not just from sales of products) should not exceed 120 million rubles.

Regarding small businesses, the amount of income should not exceed 800 million rubles, and the number of personnel should not exceed 120 people.

And what is common to both types of business is not to exceed the share of companies in the authorized capital of small businesses, which themselves are not small businesses. This share should not exceed 49%.

More details about which companies can qualify for small status and how this can be done are presented here.

Simplification of reporting

Simplification of reporting is reflected in a reduction in the number of mandatory forms. For small businesses, an income statement and balance sheet are required.

You can download current accounting forms for small businesses here.

Additional reporting forms - a statement of changes in capital, a statement of cash flows, a report on the intended use of funds - are presented if necessary, explaining additional information to conduct a detailed assessment of the financial position and results of the company's activities (information of the Ministry of Finance of Russia No. PZ-3/2012, letter of the Ministry of Finance dated 04/03/2012 No. 03-02-07/1-80).

Read about the rules for filling out additional forms in the article “Filling out forms 3, 4 and 6 of the balance sheet.”

Simplify reporting on volume of information

The order of data detailing is also simplified:

- The balance sheet and income statement may include combined measures; item-by-item detailing is optional (subparagraph “a”, paragraph 6 of the order of the Ministry of Finance of Russia “On the forms of financial statements of organizations” dated July 2, 2010 No. 66n).

- Small enterprises, non-profit organizations and participants in the Skolkovo project have the right to use special (less detailed) reporting forms approved by Order No. 66n (clause 6.1 of Order No. 66n, letter of the Ministry of Finance of Russia dated December 27, 2013 No. 07-01-06/57795 ).

- To provide reports electronically, the format approved by the Federal Tax Service letter dated July 16, 2018 No. PA-4-6/ [email protected]

- If an organization needs to provide additional reporting forms (report on changes in capital, cash flow report, report on the intended use of funds), then it has the right to include in them only essential information important for assessing its financial condition (subparagraph “b”, paragraph. 6 of order No. 66n).

- To fully understand the features of the formation of balance sheet indicators and financial results statements, it is necessary to disclose in the application the provisions of the organization’s accounting policy (information of the Ministry of Finance of Russia No. PZ-3/2012).

At the same time, small enterprises have the right to decide on the choice of reporting form for submission: simplified or regular, drawn up in the generally established manner (clause 6 of Order No. 66n). The decision must be made by the management of the organization.

Read about the features of preparing accounting reports for small businesses in the following materials:

What reports should be submitted in 2021 under the simplified tax system and in what time frame?

Organizations and entrepreneurs using the simplified taxation system ( STS ), in addition to the single tax declaration, must submit several more reports to various funds. Let's take a closer look at what these documents are, where and when they should be submitted.

Single tax declaration

The tax return is always submitted to the tax office, even in the absence of income. The declaration form, electronic format and procedure for filling out were approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/99 .

The deadline for submitting a declaration to the tax office for organizations at the place of registration is no later than March 31, for entrepreneurs at the place of residence no later than April 30 ( Clause 1 of Article 346.23 of the Tax Code of the Russian Federation ).

If the right to use the simplified tax system , the declaration must be submitted no later than the 25th day of the month following the quarter in which this right was lost. The deadlines are the same for both companies and individual entrepreneurs .

In case of termination of an activity for which a simplified taxation system was applied, the tax office is notified within 15 working days. And the single tax declaration is submitted no later than the 25th day of the month following the one in which the activity on the simplified tax system was terminated ( Article 346.23 of the Tax Code of the Russian Federation ).

Financial statements

A simplified form of financial statements can be used by organizations using the simplified tax system ( Appendix No. 5 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010 ). Accounting statements for 2021 must be submitted by March 31, 2021 inclusive, not only to the Federal Tax Service, but also to the statistical authorities. Compilation of interim reporting during the year is not required, but can be prepared by the decision of the owners “for themselves”.

Employee income reporting

If there are employees, reports are submitted to the Federal Tax Service , Social Insurance Fund and Pension Fund .

The following are submitted to the tax office:

- form 6-NDFL;

- 2-NDFL certificates;

- calculation of insurance premiums

- information on the average number of employees

Form 6-NDFL is submitted in case of accrual of income subject to personal income tax. If such accruals and payments were not made, then there is no need to submit Form 6-NDFL ( letter of the Federal Tax Service of Russia dated May 4, 2016 No. BS-4-11/7928 ). In the latter case, it is enough to submit a letter to the Federal Tax Service stating that the organization or entrepreneur is not a tax agent. A delay of more than 10 days can result in serious consequences: inspectors of the Federal Tax Service may block the current account.

Form 6-NDFL and the rules for filling it out are regulated by Order of the Federal Tax Service of Russia dated October 14, 2015 No. MMV-7-11/450 .

The form is submitted no later than the last day of April, July and October, as well as April 1 of the following year ( paragraph 3, paragraph 2, article 230 of the Tax Code of the Russian Federation ).

Deadlines for submitting 6-NDFL in 2021:

- for the 1st quarter - no later than May 2 (April 30 - Sunday, May 1 - non-working Spring and Labor Day);

- for half a year - no later than July 31;

- for 9 months – no later than October 31;

- for the year - no later than April 2, 2021 (April 1 - Sunday).

A certificate in form 2-NDFL is submitted for each employee ( order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/485 ).

The deadline for submitting 2-NDFL certificates is April 1. In 2021 it falls on a weekend. Therefore, the expiration date will be April 3 ( clause 7, article 6.1 of the Tax Code of the Russian Federation ). In the event that an organization or entrepreneur was unable to withhold personal income tax for 2021 from payments to employees, it is necessary to submit certificates with sign 2 to the INFS. The deadline for submitting such a certificate is March 1.

A unified calculation of contributions must contain information on pension, medical and social contributions in case of illness and maternity for payments to employees ( Federal Tax Service of Russia dated October 10, 2021 No. ММВ-7-11/551 ). Must be submitted no later than the 30th day of the calendar month following the reporting period. If this day is a weekend, the payment must be submitted on the next working day following it.

Information on the average number of employees is submitted regardless of whether there are hired workers or not ( Order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/174 ) no later than January 20 of the following year.

Reporting to the Pension Fund and the Social Insurance Fund

The following are submitted to the Pension Fund:

- SZV-M

- SZV-STAZH

A report on insured persons in the SZV-M form must be submitted monthly no later than the 15th day of each month in paper or electronic form ( Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 No. 83p) . If the last day falls on a weekend or holiday, then SZV-M is handed over on the next working day following it ( PFR letter dated December 28, 2016 No. 08-19/19045 ). For example, a report for March can be submitted on April 17.

Based on the results of 2021, organizations and individual entrepreneurs on the simplified tax system will for the first time submit a new report on the length of service of employees in the form SZV-STAZH ( Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p ), which must be submitted before March 1, 2021.

Social Insurance Fund

It is necessary to submit calculations for contributions for injuries to the Social Insurance Fund in form 4 - FSS ( Order of the Federal Social Insurance Fund of Russia dated September 26, 2016 No. 381 ) quarterly no later than the 20th day of the month following the reporting period, and in electronic form no later than the 25th numbers.

Reporting to the simplified tax system. Due date in 2021

| Report name | Due dates | Document approving the report | At what number of employees should the report be submitted electronically? |

| REPORTING UNDER THE STS IN 2021 TO THE IFTS | |||

| Declaration according to the simplified tax system | Based on the results of 2021, organizations submit a declaration on March 31, 2017, individual entrepreneurs – on May 2, 2021 (postponement from April 30) | Order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/99 | Organizations and individual entrepreneurs can submit a declaration both on paper and electronically. The number limit does not apply to them. |

| Help 2-NDFL | For 2021, a certificate with attribute “1” is due by March 1, 2017, with attribute “2” - until April 3, 2021 | Order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/485 | Over 25 people |

| Calculation of 6-NDFL | For 2021 - April 3, 2021 For the 1st quarter of 2021 - May 2, 2017 For the first half of 2021 - July 31, 2021 For 9 months of 2017 - October 31, 2021 | Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450 | Over 25 people |

| Unified calculation of insurance premiums | For the 1st quarter – May 2, 2021 For the half year – July 31 of the year For 9 months – October 30, 2021 | Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/511 | Over 25 people |

| Information on the number of employees | Based on the results of 2021 - no later than January 20 | Order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/174 | No limits |

| Financial statements | Based on the results of 2021 - no later than March 31, 2021 | Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n | No limits |

| REPORTING UNDER THE STS IN 2021 TO THE PFR | |||

| SZV-M | For December 2021 – January 16 For January 2021 – February 15 For February 2021 – March 15 For March 2021 – April 17 For April 2021 – May 15 For May 2021 – June 15 For June 2021 – July 17 For July 2021 – August 15 For August 2017 – September 15 For September 2021 – October 16 For October 2021 – November 15 For November 2021 – December 15 | Resolution of the Board of the Pension Fund of 01.02.2016 No. 83p | 25 people or more |

| REPORTING UNDER THE STS IN 2021 TO THE FSS | |||

| Form 4-FSS | For 2021 on paper - January 20, 2021, in electronic form - January 25, 2021 For the 1st quarter of 2021 on paper - April 20, 2021, in electronic form - April 25, 2021 For the 2nd quarter of 2021 (half year) on on paper - July 20, 2021, electronically - July 25, 2021 For the 3rd quarter of 2021 (9 months) on paper - October 20, 2021, electronically - October 25, 2021 | Order of the FSS of Russia dated September 26, 2016 No. 381 | Over 25 people |

With you

Filling out form 6-NDFL in 2021