What to record in the purchase ledger

The accountant fills out the purchase book as the right to tax deductions arises, that is, when:

- purchased assets (work, services) were acquired for operations subject to VAT, including for resale, and were capitalized;

- the invoice is drawn up in the prescribed form and filled out in accordance with the rules set out in Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. The invoice can be either on paper or in electronic form. Also, you should not be embarrassed that the document is filled out in a combined way, partly on a computer, partly by hand - this is not prohibited.

Read in the berator “Practical Encyclopedia of an Accountant”

How to fill out an invoice

Invoices can be:

- received from sellers when shipping goods, works, services;

- advance;

- adjustments to reduce the cost of shipment from the seller and increase it from the buyer;

- for construction and installation work for own consumption, when deducting VAT.

VAT can also be deducted when receiving an advance in non-monetary form. That is, you can also enter an invoice issued for such an advance into the purchase book.

The basis for deducting VAT may be other documents that also need to be registered in the purchase book to claim the deduction:

- strict reporting forms for travel expenses;

- customs declaration and payment documents for payment of import VAT upon import;

- application for the import of goods and payment of indirect taxes when importing goods from the EAEU;

- documents that formalize the transfer of property, intangible assets and property rights to the authorized capital of another organization.

Based on the entries in the purchase book, the accounting records reflect the transactions for accepting VAT for deduction. An entry is made Debit 68 Credit 19.

Registration of other documents

In addition to invoices, record in the purchase ledger:

- strict reporting forms (copies thereof) issued to employees when paying for rent and travel while on a business trip (clause 18, section II, appendix 4 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137);

- documents on the basis of which a shareholder (participant, shareholder) transfers property to the authorized capital of a commercial organization (if they contain the amount of tax recovered by the transferring party) (clause 14 of section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 , subparagraph 1, paragraph 3, article 170 of the Tax Code of the Russian Federation);

- customs declarations (statements on the import of goods and payment of indirect taxes) when importing goods into Russia (subparagraphs “e” and “p”, paragraph 6 of section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137);

- payment orders confirming the payment of VAT when importing goods into Russia (subparagraph “k”, paragraph 6 of section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137);

- invoices registered in the sales book for goods (works, services) that are subject to VAT at a rate of 0 percent - if the documents confirming the right to apply the zero rate are not collected on time (clause 23.1 of section II of Appendix 4 to the Government Resolution RF dated December 26, 2011 No. 1137);

- invoices on the basis of which the submitted VAT was accepted for deduction and then restored in connection with the use of purchased goods (works, services, property rights) in transactions subject to VAT at a zero rate (clause 23.2 of Section II of Annex 4 to the Government Resolution RF dated December 26, 2011 No. 1137).

Situation: how to register an electronic ticket in the purchase book, in which the VAT amount is highlighted? The ticket was purchased through an intermediary who is not a VAT payer.

In your shopping book, record your printed itinerary/air ticket receipt or train ticket control coupon. There is no need to indicate information about the intermediary in the purchase book.

The current rules allow you to deduct VAT on travel expenses on the basis of a strict reporting form, if the amount of tax is allocated in it (clause 7 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation). The types of BSO confirming payment for travel are named in orders of the Ministry of Transport of Russia dated November 8, 2006 No. 134, dated August 21, 2012 No. 322. These are the following forms:

- route/receipt of an electronic passenger air ticket and baggage receipt (extract from the automated information system for registration of air transportation);

- control coupon of an electronic travel document (ticket) (extract from the automated control system for passenger transportation in railway transport).

On the basis of such documents, you can deduct the amount of VAT allocated in them (. 18 of Section II of Appendix 4 to the Procedure approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137, letter of the Ministry of Finance of Russia dated January 30, 2015 No. 03-07- 11/3522, dated July 30, 2014 No. 03-07-11/37594, dated January 10, 2013 No. 03-07-11/01, dated January 12, 2011 No. 03-07-11/07).

You can take advantage of the deduction in the quarter in which the employee drew up an advance report for a business trip and indicated travel documents in it (letter of the Ministry of Finance of Russia dated May 20, 2008 No. 03-07-11/197).

When registering electronic tickets in the purchase book, consider the following feature. Transport agents sell tickets on behalf of the carrier or carrier's representative. For example, railway tickets for passenger transportation are sold by the carrier JSC FPC. Intermediaries distributing air and rail tickets cannot act on their own behalf. Therefore, the names and details of such intermediaries are not reflected in tickets. Therefore, there is no need to indicate information about them in the purchase book.

The detailed procedure for filling out the relevant columns of the purchase book is given in the table.

| Purchase ledger column | What to indicate |

| Box 1 | Record serial number |

| Column 2 | Transaction code 23 “Purchase of services issued with strict reporting forms in cases provided for in paragraph 7 of Article 171 of the Tax Code of the Russian Federation” (appendix to the letter of the Federal Tax Service of Russia dated January 22, 2015 No. GD-4-3/794) |

| Column 3 | Electronic ticket number (also the number of a strict reporting document) and the date of its issue |

| Columns 4–6 | Not filled in |

| Column 7 | Number and date of the document confirming payment for the ticket |

| Column 8 | Date of approval of the advance report |

| Column 9 | Carrier company name |

| Box 10 | Carrier INN (if available). This detail is not among the mandatory details approved by orders of the Ministry of Transport of Russia dated November 8, 2006 No. 134, dated August 21, 2012 No. 322. As a rule, electronic tickets for trains have a TIN, but electronic tickets do not. If the TIN is not specified, column 10 need not be filled in (letters of the Ministry of Finance of Russia dated May 28, 2015 No. 03-07-11/30876, Federal Tax Service of Russia dated August 18, 2015 No. GD-4-3/14544) |

| Columns 11–12 | Not filled in |

| Box 13 | Not filled in |

| Box 14 | Currency code if the fare on the ticket is expressed in a foreign currency. If the fare on the ticket is indicated in rubles, do not fill out the column |

| Box 15 | Fare (including VAT). If the fare on the ticket is indicated in foreign currency, the indicator in column 15 is also indicated in foreign currency |

| Box 16 | The amount of VAT allocated on the ticket |

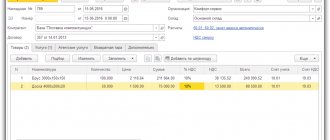

Example of registration in the e-ticket purchase book

Two employees of the organization were sent on business trips. A.S. Kondratiev - in Saratov, V.N. Volkov - in Yekaterinburg.

At the end of their business trips, employees submitted advance reports:

– A.S. Kondratiev - April 21. He attached to the advance report a control coupon for electronic ticket No. GP7655318 985322 dated 04/17/2016 in the amount of 5,600 rubles. (including VAT – 854.24 rubles). The ticket was purchased and paid for through the transport agent’s website. The ticket seller is JSC FPC;

– V.N. Volkov - April 23. He attached to the advance report the route/receipt for electronic passenger air ticket No. 262 24017991410 dated 04/18/2016 in the amount of 17,500 rubles. (including VAT - 2669.49 rubles). The ticket was purchased and paid for at the ticket office of the transport agent. The ticket seller is Ural Airlines JSC.

The accountant recorded these documents in the purchase book.

Situation: what documents confirming the transfer of fixed assets to the authorized capital must be registered in the purchase book of the receiving party (commercial organization)?

Tax legislation does not establish a list of such documents. In paragraph 15 of Appendix 3 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 it only says that these documents:

- must contain information about the amount of VAT recovered by the transferring party;

- are registered in the purchase book of the receiving party as its right to deduct VAT arises.

The financial department also does not specify the composition of these documents (letter of the Ministry of Finance of Russia dated November 21, 2011 No. 03-07-11/317).

In practice, the amount of VAT that is recovered by the founder (shareholder, participant) when transferring a fixed asset to the authorized capital of a subsidiary can be reflected in the acceptance and transfer certificates using forms No. OS-1 (No. OS-1a, No. OS-1b). If such data is available, the receiving party registers these acts or their notarized copies in the purchase book. The right to deduct VAT recovered by the transferring party arises when the received fixed assets are placed on the balance sheet (if the fixed assets will be used in activities subject to VAT).

Situation: what documents need to be registered in the purchase book when paying the buyer money for returned goods? The buyer returned an item previously purchased at retail.

The answer to this question depends on two factors:

- when the buyer returned the goods;

- how the goods were paid for.

In practice, the following situations are possible:

- the goods were returned on the day of purchase and the goods were paid for in cash;

- the goods were returned on the day of purchase, and the goods were paid for using a bank card;

- the return occurred later than the day of purchase, and the goods were paid for in cash;

- the return occurred later than the day of purchase, and the goods were paid for using a bank card.

If the buyer returned the product on the day of its purchase, then operations to return it are not reflected in the purchase book, regardless of the payment method (cash or bank card). It is explained this way.

As a general rule, VAT previously charged to the buyer on returned goods can be deducted by the seller. Moreover, if the buyer is not a VAT payer, the seller has the right to deduction if the following conditions are met:

- the returned goods are registered;

- an adjustment invoice compiled by the seller based on the primary invoice is registered in the purchase book;

- no more than a year has passed since the goods were returned.

This procedure follows from the provisions of paragraph 5 of Article 171, paragraphs 1 and 4 of Article 172, paragraph 1 of Article 169 of the Tax Code of the Russian Federation.

However, in this situation, since the returned item was sold at retail, these rules do not apply. When selling goods at retail, the seller does not issue invoices to customers, and in the sales book he registers either data from CCP control tapes (Z-reports) or strict reporting forms (clause 1 of Section II of Appendix 5 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

If the product is returned on the day it was purchased, then the amount of revenue for that day is reflected in the accounting and sales book minus the cost of the returned product. Accordingly, the amount of VAT charged to the buyer who returned the goods is not charged to the budget and is not recorded in the sales book. This procedure follows from sections 4 and 6 of the Model Rules approved by the Ministry of Finance of Russia on August 30, 1993 No. 104, instructions approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132, paragraph 1 of Section II of Appendix 5 to the Resolution of the Government of the Russian Federation of December 26 2011 No. 1137. This procedure applies regardless of how the goods were paid for: in cash or by bank card. Thus, when returning the goods on the day of purchase, there is no amount of VAT that could be deducted (the tax was not initially charged). This means that there is no need to adjust VAT or make any entries in the purchase book.

If the buyer pays for the goods in cash and returns it later than the day of purchase, then the money is given to him from the organization’s cash register on the basis of a cash receipt order (form KO-2) (clause 4.4 of the Methodological Recommendations approved by Roskomtorg letter dated July 10, 1996 No. 1-794 /32-5, clause 6 of Bank of Russia Directive No. 3210-U dated March 11, 2014). To justify the deduction in the purchase book, register the details of this document (transaction type code 17). VAT on returned goods can be deducted if other mandatory conditions are met. The legitimacy of this approach is confirmed by letter of the Ministry of Finance of Russia dated March 19, 2013 No. 03-07-15/8473.

If the buyer paid for the goods with a bank card and returns it later than the day of purchase, then a cash receipt order (form KO-2) is not issued to him. This is due to the fact that it is not possible to issue cash for goods previously paid for by card (clause 2 of Bank of Russia instructions dated October 7, 2013 No. 3073-U). Money for returned goods, previously paid for by card, is transferred to the buyer’s bank account. At the same time, the operation “Return of sale” is performed on the cash register, during which a return receipt is issued (clauses 3.6 and 4.8 of Appendix 5 to the minutes of the GMEC meeting dated December 19, 2002 No. 7/72-2002). By analogy with the procedure established for processing a cash refund, you can register the details of this receipt in the purchase book.

However, this approach may lead to disagreements with inspectors. The fact is that the procedure for documenting deductions when returning goods sold at retail and paid for with bank cards is not regulated by law. There are also no official explanations from regulatory agencies on this issue. Therefore, to avoid disputes, when returning goods, please prepare a corrective invoice and record it in your purchase ledger. And since an adjustment invoice can only be issued to an existing initial invoice, it is advisable for a retail organization that accepts bank cards for payment to prepare general invoices on a daily basis indicating the total revenue for goods sold at retail. The basis for such invoices can be Z-reports, which record total revenue broken down into cash receipts and receipts from bank cards.

What does not need to be recorded in the purchase book

Invoices compiled by:

- when transferring goods (work, services) free of charge;

- for the amount of prepayment for goods purchased for VAT-free transactions;

- Advance invoices generated or received after the seller has received shipping invoices.

Invoices are not recorded in the purchase book by commission agents:

- for goods received from the principal (work, services, property rights) that are transferred for sale;

- when receiving advances from buyers for upcoming deliveries;

- for goods received from sellers (works, services, property rights) purchased for the principal;

- on the listed advances to sellers of goods (works, services, property rights).

You cannot include invoices in the purchase book that do not comply with the requirements of Article 169 of the Tax Code of the Russian Federation or the established form.

Who should sign the sales book in 2017-2018? - all about taxes

The purchase book is a collection of documents that confirm payment of VAT when making purchases and payments for services provided.

This book is maintained in order to determine the amount of taxes paid, which can subsequently be compensated in accordance with tax legislation. The sales book is essentially the same financial register, but it includes documents that relate to the profit of the enterprise, namely invoices, which will entail the obligation to calculate VAT.

This book allows you to determine the success of a company’s activities in a particular month and the dynamics of the main final indicators of its functioning. Based on the information indicated in the book of purchases and sales, we can conclude that it is intended for maintaining tax records and taking advantage of the possibility of applying a tax deduction.

In order for the book of purchases and sales to be properly prepared, you need to know a fairly large number of rules that are regulated by modern legislation. Let’s try to understand the legal aspect of this issue in more detail and consider the main legal acts:

- If the book is kept in electronic form, you need to rely on Order of the Federal Tax Service of Russia dated March 5, 2012 No. ММВ-7-6/138.

- According to Federal Law No. 137, a quarter is a tax period, which is why the book must be compiled quarterly.

- At the end of the tax period, the amount of VAT payable to the budget is calculated (clause 1 of Article 55 of the Tax Code of the Russian Federation).

- VAT must be paid to the budget strictly before the 20th day after the end of the tax period, reporting is submitted within the same time frame (Article 174 of the Tax Code of the Russian Federation).

When working with such registers, you should also pay attention to such documents as: It is very important to monitor changes in legislation, since all financial statements must be prepared in accordance with the modern requirements that apply to them.

The supplier has changed its name

It happens that the supplier changes its name, and even in the middle of the quarter. In the current period, the buyer has already received invoices from him, which are recorded in the purchase ledger. How to register the documents that he will exhibit after the name change?

In this situation, remember that in the purchase book, along with the name of the seller, his tax identification number and checkpoint are indicated.

If only the name of the company has changed, then the tax identification number and checkpoint remain the same. Therefore, in the purchase book you will have two different supplier names with the same TIN and KPP.

The inspection will identify the seller using the TIN and KPP. But to be on the safe side, ask the seller for certified copies of documents confirming the name change. Attach them to your shopping book.

But as for the declaration, where the data from the purchase book is transferred, there is no need to worry about this fee. Purchase data is transferred to section 8 without indicating the name of the seller. Only the TIN and KPP are reflected there.

How to create purchase and sales books

Motroy Alena Author PPT.RU February 22, 2021 Purchase and sales books are accounting documents that are necessary to calculate the amount of value added tax. Their data is completely transferred to the relevant sections of the VAT return, so errors in filling out each entry are critical. ConsultantPlus TRY FOR FREE Changes are often made to the forms - so let’s look at a sample of filling out the 2021 purchase book.

From 04/01/2021 Government Decree No. 15 of 01/19/2021 comes into force. This regulatory legal act introduced further changes to the current one, which defines the unified forms of the purchase and sales book, as well as additional sheets to them. The innovations have adjusted the forms that were in effect in the previous edition.

It is mandatory to use the new forms only from the second quarter of 2021 (from 04/01/2019). However, there is no prohibition on maintaining new forms. Therefore, if the company starts using the updated sales book before April 1, it will not be an error.

What exactly has changed in the form, how to work with updates, what innovations will take effect on April 1 - our innovation memo will help you understand all this. The register has been brought into line with changes in tax legislation. Namely, new columns have been introduced to reflect VAT amounts at the new rate of 20%.

Now in columns 14 and 17 of the book you should enter the information calculated at the new rate. Please note that the calculation procedure has not changed. Only a higher tax rate is used.

We recommend reading: Is it possible to register an inheritance with the MFC for one of the heirs?

New columns 14a and 17a have been added - they are used to calculate value added tax at the old rates.

Column 14a should indicate the cost of sales taxed at a rate of 18%, excluding VAT. Column 17a indicates the amount of tax calculated at the rate of 18% or 18/118. Similar changes have been made to the header of the tabular part of the document: the name and content of columns 14 and 17 have been changed.

New columns 14a and 17a have been introduced, which should contain information about the 18% tax rate.

What is VAT on imports?

According to current Russian laws, all imported goods, works, and services are subject to value added tax. The taxpayer does not provide exceptions by category. The following are required to calculate and pay the value added tax to the treasury:

- VAT payers are firms and businessmen on OSNO;

- tax agents and entities exempt from VAT in Russia;

- taxpayers applying preferential tax regimes.

Exemption is provided only for categories of imported products. For example, medical products are completely exempt from import tax. Medical products imported into Russia are not subject to VAT under clause 2 of Art. 150 Tax Code of the Russian Federation.

Imports are subject to general tax rates. Is it 10% or 20%. It is not difficult to determine indirect taxes when importing goods. If imported products are sold within our country at a VAT rate of 20%, then the import tax is calculated at a rate of 20%.

The amount of import VAT can be taken as a deduction. Only companies and individual entrepreneurs who pay tax in Russia have the right to apply for a tax reduction. If a company does not pay a fee within our country (special regime or exemption), then it is not allowed to claim a deduction.

The procedure for recording import VAT largely depends on the country of the importing supplier. The purpose of input goods also plays a significant role. That is, operations for which the taxpayer purchases imported products are important.

VAT on goods from EAEU countries

If the supplier-importer belongs to the EAEU countries, then the recipient of the import VAT is the local tax office. The calculated tax is paid to the treasury no later than the date of submission of the special declaration.

Calculate the tax on imports from EAEU countries using the formula:

Amount = tax base × tax rate,

Where:

- tax base - the cost of imported products, taking into account all excise taxes.

Take into account excise surcharges if you import excisable goods. Determine the basis for calculation at the time the goods are accepted for accounting.

The tax rate is either 10% or 20%.

For reference: as of January 1, 2015, the EAEU includes: Russia, Belarus, Kazakhstan, Kyrgyzstan, and Armenia.

VAT on goods from other countries

If importers are not part of the EAEU zone, then the import tax will have to be transferred to the customs authority. The tax is calculated using the same formula. It is necessary to multiply the tax base by the current VAT rate. But in this case, the tax base is determined differently.

Tax base for calculating VAT when importing from other countries:

NB = TS + TP + AS,

Where:

- CU is the customs value of goods or products imported from countries outside the EAEU. Determined based on information from the customs declaration.

- TP is the amount of customs duties paid for the import of products into the territory of our country. The amount of taxation is established by regulations.

- AC - the amount of excise taxes and contributions that were included in the cost of products. Provided that excisable goods are imported.

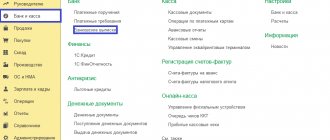

Transfer of an advance to a foreign supplier

List the advance payment using the document Write-off from the current account, transaction type Payment to supplier in the Bank and cash desk section – Bank – Bank statements.

Please indicate:

- Bank account - foreign currency bank account in EUR;

- VAT rate - Without VAT .

Postings