The dangers of incorrect entries

Incorrectly compiled invoices and incorrect entries in the purchase and sales books lead to VAT gaps (discrepancies).

They are identified by the tax authorities during a desk audit using the ASK VAT-2 PC system, which automatically compares the declarations of counterparties. Errors in accounting for advances lead to requests from the Federal Tax Service to explain the overstatement of the amount to be deducted. Gaps appear if the information about the transaction that the taxpayer reflected in Section 8 of the VAT return (purchase book) to confirm the right to apply a tax deduction does not coincide with the information that the taxpayer's supplier should have reflected in Section 9 of the VAT return (sales book). ). This could be an error in the details, submission of a zero declaration, or failure to submit at all. Another gap may be due to a discrepancy between the data in the taxpayer’s declaration and applications, including those from other periods.

Submit your VAT return online for free

When is an advance invoice issued?

The seller issues an advance invoice only upon receipt of advance payment. The algorithm is like this:

- The seller receives the advance and records the advance invoice in the sales ledger.

- Transfers the advance invoice to the buyer no later than five calendar days from the date of receipt of money (services/work on account of shipment).

- At the time of transfer of goods (performance of services), issues a shipment invoice for the full cost of goods or services, regardless of the size of the advance payment.

- Restores the advance amount in the purchase ledger.

If amounts are received from the customer more than once, then an invoice must be issued separately for each amount received.

Example . If the seller received an advance on the 10th and 13th, and the service was provided on the 28th of the same month, then the invoice must be issued twice when the amounts are received on the 10th and 13th, as well as when shipping on account this advance for the full cost.

The buyer, on the basis of any invoice for an advance payment, can exercise the right to deduct VAT.

Exchange invoices electronically

An advance invoice may not be issued in four cases:

- The supplier company receives money for goods whose production takes more than 6 months (Clause 13, Article 167 of the Tax Code of the Russian Federation);

- The buyer is not a VAT payer or is exempt from paying this tax (clause 3 of Article 169 of the Tax Code of the Russian Federation);

- Export of goods taxed at a zero rate (Letter of the Ministry of Finance dated January 10, 2018 No. 03-07-08/142);

- The advance and shipment occurred in the same quarter, and the break between them did not exceed five calendar days (Letter of the Ministry of Finance dated November 10, 2016 No. 03-07-14/65759).

In cases where an advance payment was received in one tax period (for example, December 31), and shipment against this advance took place in another tax period within five calendar days from the date of receipt of the advance payment (for example, January 2), the seller registers an invoice on the advance payment is in the sales book for the fourth quarter, and the invoice issued upon shipment is in the sales book for the first quarter.

Support and assistance

Receive articles by email

When concluding a contract, suppliers increasingly require buyers to make an advance payment. This is understandable, since prepayment is a kind of guarantee of fulfillment of the terms of the contract and at the same time confirmation of readiness to cooperate with the supplier.

Having received advance payment, the supplier has the obligation to issue an invoice to the buyer, as well as calculate and pay VAT to the budget. The document issuance period is 5 calendar days.

“Advance” invoice is a VAT tax accounting document in which the tax base is the amount of the advance payment received, and the tax is determined at the estimated rate (20/120% or 10/110%).

In the article we will look in detail at the methods of issuing and the features of filling out these documents, and will also share the secret of how in 1C 8.3 to carry out payment from the buyer and sales to him on the same day, without issuing an “advance” invoice.

Method 1

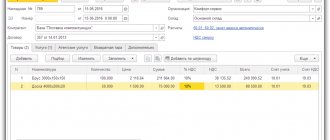

Go to the section “Receipt to the current account” (“Bank and cash desk” - “Bank statements”) (see Fig. 1).

Rice. 1. Section “Receipt to current account”

Based on this document, we create an “Invoice issued” (see Fig. 2).

Rice. 2. Creation of the document “Invoice issued”

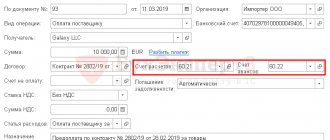

The easiest way to make sure that the payment is an advance is to go to “DT/CT” and look at the corresponding accounts (see Fig. 3).

Rice. 3. View offsetting accounts

The document is filled out automatically, but you should pay special attention to the line “Payment document No.” (see Fig. 4). After all, incorrectly filling out this line will deprive the buyer of the right to a deduction. It is in the “advance” invoice that the number and date of the payment document must be indicated. If a non-cash form was used for payment, then put a dash.

The name of the product in the document must be the same as specified in the contract. If there are many positions, then you should indicate the generic name of the goods. For example, office equipment. It would be incorrect to use the words “advance” or “advance payment.”

Rice. 4. Name of the product in the document and contract

We check that the lines in the printed form of the document are filled out correctly. If everything is filled out correctly, we hand over the original to the buyer.

Rice. 5. Checking the correctness of filling

Method 2

There is another way to issue advance invoices.

Go to “Bank and cash desk” - “Invoices for advance payments” (see Fig. 6).

Rice. 6. Invoices for advance payments

We get into the group processing “Registration of invoices for advance payments”. Here you can create VAT accounting documents for the period. Click the “Fill” button, then “Run”.

Using the hyperlink at the bottom of the screen, you can open a list of issued invoices, as well as set numbering and select a registration method.

Many people believe that “advance” invoices must have a separate numbering. But that's not true. These documents are numbered in general chronological order ( ). The prefix “A” should also not be added to line 1. Therefore, we choose a single numbering for all issued invoices.

If we talk about setting up the registration method, then in the Tax Code of the Russian Federation there are no rules that exempt the supplier from drawing up an “advance” invoice. Therefore, in order to avoid claims from the Federal Tax Service, it is necessary to draw up a tax document, even if the shipment occurred within 5 days (,). Therefore, the setting “Always registered when receiving an advance” will comply with the requirements of the Tax Code of the Russian Federation.

Rice. 7. Registration of invoices for advance payments

A notification about registering invoices appears on the screen.

Rice. 8. Notice of registration of invoices

We will check the availability of documents generated by the program, as well as the correctness of their completion. To do this, let’s go to “Sales” - “Invoices issued”.

Rice. 9. Section "Sales"

Our invoice appeared in the list of issued invoices.

Rice. 10. Invoices issued

Method 3

Another method, implemented in 1C 8.3, can be found in the VAT accounting assistant.

Let’s move on to “Reports” - “VAT reporting”.

Rice. 11. VAT reporting

Items of regulatory operations are required to be completed before drawing up a VAT return. Among others, there is the already familiar group processing “Registration of invoices for advance payments”.

Rice. 12. Group processing “Registration of invoices for advance payments”

After we have considered all possible methods for issuing an “advance” document for VAT accounting, let’s move on to the promised secret.

For advance payments received on the day of shipment, you do not have to issue invoices and do not have to charge VAT. The Federal Tax Service does not consider such receipts as an advance. But you need to correctly reflect this in 1C.

To do this, the “Realization” document must be posted at the time specified in the document, at least one second earlier than the “Receipt to the current account” document.

How can a seller reflect advances?

The seller is obliged to register an invoice in the period in which he received the advance payment (clause 3 of the Rules for maintaining the sales book, approved by Resolution No. 1137 of December 26, 2011).

| Prepaid expense | Shipment of goods/services | Settlement of advance payment | |

| Book (registration SF) | Sales book | Sales book | Book of purchases |

| Mandatory registration of the Federation Council | Mandatory | Mandatory | Mandatory |

| Moment of registration of the Federation Council | On the day of receiving the advance | On the day of shipment | On the day of shipment or any day within three years |

| KVO for Northern Fleet (most used) | 02 | 01 | 22 |

| Indication of the counterparty in the Federation Council | Buyer | Buyer | Themselves |

| Section and line of VAT amounts in the declaration | Section 3, page 070 | Section 3, pp. 010-050 | Section 3, page 170 |

We have prepared an overview of common mistakes when preparing advance invoices

How can a buyer reflect advances?

Unlike the seller, the buyer is not obliged to register an invoice for the advance payment and accept VAT for deduction (Article 171 and Article 172 of the Tax Code of the Russian Federation). To take advantage of the deduction, the buyer must have supporting documents: an invoice, a payment document and an agreement that states the prepayment condition.

| Prepaid expense | Receiving goods/services | Settlement of advance payment | |

| Book (registration SF) | Book of purchases | Book of purchases | Sales book |

| Mandatory registration of the Federation Council | Not required | Not required | If there is no registration of the SF for the advance, there is no restoration |

| Moment of registration of the Federation Council | At the time of receipt of the SF for advance | Any day for three years | At the time of registration of the Federation Council upon receipt of goods (services) |

| KVO for Northern Fleet (most used) | 02 | 01 | 21 |

| Indication of the counterparty in the Federation Council | Salesman | Salesman | Themselves |

| Section and line of VAT amounts in the declaration | Section 3, page 130 | Section 3, page 120 | Section 3, page 080 |

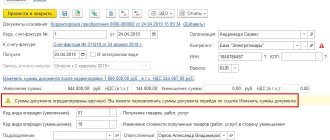

Error No. 3. Offsetting the advance payment from entering balances.

The advance entered through entering balances is read out a little differently. it is immediately visible in the report, due to the lack of order document parameters

in the transcript we see that as of 01/01/2013 the supplier had a debt to us, and he made payment to us

When entering balances, unposted documents are automatically created, which can be used to offset balances; open the payment receipt document.

Apparently, you need to set the advance sign to “no” and select a pseudo shipment document (please note that this document has no amount and has not been posted, since it was created automatically by the document for entering balances)

we see that the debt has been offset

An important note: it happens that the total amount of debt entered when entering balances contains several transactions. are then closed with several payments, in this case, you need to go to the document for entering balances and divide the total amount of debt into amounts corresponding to these transactions by entering them on different lines, accordingly, in the receipt of money documents, then select different pseudo invoices.

How to terminate a transaction and return the advance payment

When the buyer and seller terminate the contract under which an advance payment was previously made, the seller returns the advance payment to the buyer.

The seller needs to register an advance invoice in the purchase book with KVO 22. In column 7 “Number and date of the document confirming payment of tax,” he should indicate the details of the documents that confirm the return of the advance payment. Then the seller has the right to deduct the VAT accrued upon receipt of the advance payment (clause 4 of Article 172 of the Tax Code of the Russian Federation).

The buyer is obliged to recover and pay VAT to the budget if the advance payment was accepted for deduction. At the same time, he must register an advance invoice in the sales book with KVO 21.

Author: Svetlana Ognevskaya, Kontur.Externa VAT expert Prepared by Elizaveta Kobrina, editor

Use of cash register systems when crediting advance payments and prepayments at an online cash register

The second check will need to be issued when the buyer has received what he paid for in advance. Here you also need to use the “calculation method attribute” attribute.

Important! When registering an advance or prepayment at an online checkout, you should always indicate “full payment” in the “payment method indication” column. Otherwise, if the final payment amount differs from the preliminary payment, problems will arise with making additional payments in other ways.

Further, in the settlement amount for the check, it is indicated that the payment was not made in cash or non-cash, but by offsetting an advance (prepayment). When you issue a check, the online cash register will understand that you need to write off the prepayment made to it for the completed shipment.