Home / Taxes / What is VAT and when does it increase to 20 percent? / Book of purchases and sales

Back

Published: November 20, 2018

Reading time: 4 min

0

679

The purpose of maintaining a purchase ledger is to determine the amount of VAT that is subject to deduction. In it, buyers must register invoices issued by sellers, received on paper and electronic media.

- Transaction type code in the purchase book

- How to reflect the advance refund

- Filling out the declaration

It contains primary invoices, as well as adjustment and corrected invoices.

Transaction type code in the purchase book

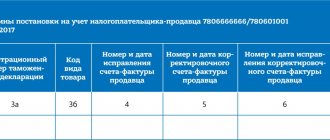

The purchase book is maintained quarterly and filled out by the taxpayer for each tax period. When filling it out, it is necessary to take into account Government Decree No. 1137 of 2011.

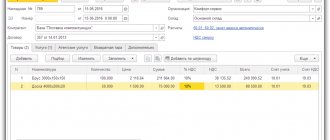

When returning an advance to a buyer, the seller must record this transaction in the purchase book and make all necessary adjustments in accounting and management reporting related to the return. This fact is reflected in column 7 of the purchase book. Here are the details of the document that confirms the return of this prepayment.

When maintaining a purchase book, you need to use the codes established by the Federal Tax Service for different types of transactions. When returning an advance, the seller indicates in the purchase book the details of the issued invoice for the advance received and puts the transaction code “22” in the second column (according to paragraphs e, clause 6, 22 of the Rules for maintaining the purchase book).

The seller is obliged to register the invoice in the purchase book no later than one year after the buyer refuses to supply. This is indicated in paragraph. 2 clause 22 of Appendix 4 to Government Decree No. 1137.

Additionally, the taxpayer should confirm the right to receive a deduction using documents that indicate termination of the contract (for example, an additional agreement or unilateral refusal to fulfill the contract) and the return of money to the buyer.

Transfer of VAT deduction

Clause 1.1 of Article 172 of the Tax Code of the Russian Federation allows for the transfer of tax deductions. The deduction can be claimed no later than three years after the taxpayer has registered purchased (imported) goods (work, services, property rights). This rule is provided for VAT deductions (clause 2 of Article 171 of the Tax Code of the Russian Federation):

- presented by suppliers when purchasing goods (works, services), property rights in the territory of the Russian Federation;

- paid when importing goods into the territory of the Russian Federation in the customs procedures of release for domestic consumption, processing for domestic consumption, temporary import and processing outside the customs territory;

- paid when importing goods into the Russian Federation that are moved across its customs border without customs clearance.

As for the remaining deductions not mentioned in paragraph 2 of Article 171 of the Tax Code of the Russian Federation, they cannot be transferred within a three-year period, since this is not provided for by the Tax Code.

In particular, it is impossible to transfer deductions of VAT transferred by the tax agent, paid on travel and entertainment expenses, advance VAT, VAT paid in the event of the return of goods, refusal of them, changes in conditions or termination of the contract.

The Ministry of Finance of Russia, in a letter dated April 10, 2019 No. 03-07-11/25201, recalled that the deduction of VAT on a “returned” advance is not subject to the three-year period established by paragraph 1.1 of Article 172 of the Tax Code of the Russian Federation.

How to reflect the advance refund

If the advance is returned to the buyer, the seller receives the right to receive a VAT deduction.

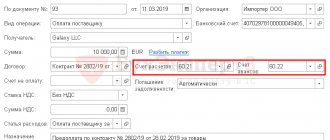

When receiving an advance, the seller charges VAT on the amount received . The following entry is recorded in the accounting for this operation: debit 62 (advance) and credit – 68.

When the advance is returned, the posting is indicated: debit 68 – credit 62 (advance). That is, a diametrically opposite posting is made in contrast to the one that was made when calculating VAT on the advance payment.

When the down payment has been received, the seller issues an advance invoice and is required to register it in the sales ledger. The invoice registration date is the actual date of receipt of the prepayment to the recipient's account. This rule is stated in paragraphs. 2 p. 1 art. 167 Tax Code. According to the law, it does not matter when the final shipment of goods or provision of services occurs within the framework of the received advance payment. VAT on the advance received by the seller is calculated on the same day.

The advance invoice is displayed in the sales book for the quarter when the advance payment was received , according to paragraphs. 3.17 Rules for maintaining a sales book. One copy of the invoice is transferred to the buyer according to clause 3 of Art. 168 of the Tax Code. This is done within 5 calendar days after receipt of advance payment from the buyer.

In order to recover VAT when returning the advance to the buyer, this operation should be reflected in the VAT return. The advance payment is displayed in line 070 of section 3 of the VAT declaration in the quarter in which it was received (according to clause 38.4 of the Procedure for filling out the declaration).

When returning the advance payment to the buyer in order to deduct VAT, two important rules must be taken into account (according to paragraph 9 of Article 172 of the Tax Code):

- VAT can be refunded only if the refund is related to a change in contractual terms or termination of the contract.

- The seller has the right to accept VAT for deduction only on the date of actual return of the advance payment . The amount of tax to be deducted will be calculated as follows: the advance amount multiplied by the VAT rate: 10/110 or 18/118 (according to paragraph 5 of Article 171, paragraph 4 of Article 172 of the Tax Code).

Thus, these rules assume that an agreement must be concluded between the seller and the buyer, which involves the transfer of an advance payment. The buyer must also have a previously received invoice from the seller and a payment order for the transfer of the advance payment.

The deduction can only be applied directly in the quarter when the above conditions were met. This means that carryover of the deduction to later periods is not allowed. This position is explained in the letter of the Ministry of Finance dated 2015 No. 03-07-11/41908.

Exemption from VAT. Advance – before, shipment – after

The company worked with VAT until April 1, 2006. In December 2005, an advance was received from the buyer, from which VAT was paid to the budget. From April 1, 2006, it was decided to use the right to be exempt from fulfilling taxpayer obligations related to the calculation and payment of VAT, under Art. 145 Tax Code of the Russian Federation. The shipment to the buyer was made during the period of exercising the right to exemption from the taxpayer’s obligations related to the calculation and payment of VAT.

Do we have the right to a refund from the budget of the VAT paid on the advance payment, since the buyer was issued an invoice without VAT during the period of the exemption under Art. 145 of the Tax Code of the Russian Federation? If we do not have such a right, where should we write off VAT on the advance received?

Let us say right away that there is no unambiguously correct answer to the question you asked about calculating VAT.

The problem is that the Tax Code of the Russian Federation says absolutely nothing

regarding how to calculate VAT if the company accepted an advance from the buyer

before receiving

an exemption from the duties of a VAT payer, and the shipment of goods (work, services) occurred

after

the application of the exemption.

Therefore, all that remains for the taxpayer in this situation is to select bit by bit from the Tax Code of the Russian Federation information that can be applied in such cases and study judicial practice.

Let's consider what options for calculating VAT in this situation exist.

Option 1. Receive a deduction

According to paragraphs. 2 p. 1 art. 167 Tax Code of the Russian Federation

On the day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights,

the moment arises for determining the tax base

for VAT.

Clause 1 Art. 154 Tax Code of the Russian Federation

it is provided that when a taxpayer receives payment or partial payment for upcoming deliveries of goods (performance of work, provision of services), the VAT tax base is determined based on

the amount of payment received

, including VAT.

Consequently, for advances received before receiving VAT exemption, the taxpayer is obliged to calculate and pay VAT to the budget on the amount of the advance received.

After receiving the exemption, the company ships the goods.

In accordance with paragraph 8 of Art.

171 of the Tax Code of the Russian Federation

, VAT amounts calculated by the taxpayer from amounts of payment, partial payment received on account of upcoming supplies of goods (work, services) are subject to deductions .

Such deductions are made from the date of shipment

relevant goods (performance of work, provision of services).

From these norms we can conclude that a company that, being a taxpayer, has calculated and paid VAT to the budget on the prepayment amount, has the right to deduct the specified amount of VAT after shipment of the goods.

Moreover, the right to deduction is not conditional

whether the company charges VAT to the budget at the time of shipment.

However, by deducting the amount of VAT from the advance payment, the company will likely face disapproval from the tax authorities.

They believe that paragraph 1 of Art. 171 Tax Code of the Russian Federation

limits the circle of persons who have the right to deduct VAT to only

taxpayers

.

And since a company that has received an exemption from fulfilling its duties as a VAT payer is not

a VAT payer, then such a company does not have the right to deduct the amount of VAT from the advance payment.

But in paragraph 8 of Art. 171 Tax Code of the Russian Federation

it does not say that VAT amounts calculated from prepayment amounts are subject to deductions

from VAT taxpayers

.

This provision only says that “VAT amounts calculated by the taxpayer are subject to deductions...”, and does not specify whether the person claiming the deduction must be a VAT payer.

And at the time of calculating VAT on the prepayment amount, you were a VAT payer. That is, the conditions of clause 8 of Art. 171 Tax Code of the Russian Federation

You have complied.

Therefore, if a person, being a taxpayer, has calculated VAT on advances, then subsequently he has the right to accept this amount of VAT as a deduction.

There are court decisions confirming the legality of VAT deductions on advances in the event that the shipment of goods (performance of work, provision of services), for which an advance was previously accepted, was made during a period when the company was not a VAT payer (see the resolution of the Federal Antimonopoly Service of the Volga Region dated July 29, 2004 No. A55-902/2004-44, resolution of the Federal Antimonopoly Service of the West Siberian District dated April 27, 2006 No. F04-1484/2006(21849-A45-7), resolution of the Federal Antimonopoly Service of the Far Eastern District dated February 18, 2005. No. F03-A51/04-2/4441, Resolution of the Federal Antimonopoly Service of the Far Eastern District dated March 30, 2005 No. F03-A59/05-2/42, Resolution of the Federal Antimonopoly Service of the Northwestern District dated March 5, 2004 No. A13-8013/03 -14).

Let us immediately make a reservation that in most of the above court decisions, the dispute arose over the deduction of VAT paid on advances by companies that switched from the general tax regime to special tax regimes

.

But when switching to special regimes, companies are also not recognized as VAT payers. That is, these court cases can also be considered positive judicial practice for persons exempt from fulfilling the duties of a VAT taxpayer.

Note that sometimes the courts speak out against

the use by persons who are not VAT payers of VAT deductions on advances received during the period when they were still VAT payers. This conclusion is contained in the resolutions of the Federal Antimonopoly Service of the West Siberian District dated March 14, 2005 No. F04-995/2005(9027-A27-14) and the Federal Antimonopoly Service of the Northwestern District dated February 21, 2005 No. A05-12262/04-22.

Thus, if the taxpayer follows this option, he will almost certainly have disagreements with the inspectors. You will have to prove the legality of VAT deductions from advances in court.

And although the majority of court decisions indicate that taxpayers are right in such disputes, there is still a risk of losing the case, since in some decisions the courts agree with the tax authorities.

Option 2. Get a deduction by paying VAT upon shipment

This option can be classified as “bad advice”, since it is quite stupid.

It consists in issuing the buyer an invoice with the allocated amount of VAT after making the shipment.

According to paragraph 3 of Art. 173 Tax Code of the Russian Federation

the amount of VAT payable to the budget is calculated by persons who are not taxpayers, or taxpayers exempt from fulfilling taxpayer obligations related to the calculation and payment of tax, in the case of issuing an

invoice

with the allocation of the VAT amount.

That is, having made the shipment and issued an invoice with the allocation of the VAT amount, the seller (despite the fact that he is exempt from fulfilling the duties of a VAT taxpayer) pays VAT to the budget.

And the amount of VAT calculated from the advance payment received before the release is deducted by the seller.

to object in this case too.

against deductions of VAT from advances, however,

the courts

in such situations support taxpayers, saying that if the taxpayer does not deduct the amount of VAT from advances, then there will be a fact of double taxation of the same turnover (see, for example, the FAS resolution Ural District dated January 13, 2006, No. F09-6044/05-S2).

However, from an economic point of view, this option is not practical. After all, upon shipment, the company will pay the same amount of VAT to the budget, which it will accept as a deduction (or even if the prepayment was not 100%, it will pay more to the budget than it will accept as a deduction). And at the same time, you will still have to argue with the tax authorities (possibly even in court) about the right to deduction.

In other words, the accountant will have a lot of fuss, and the result will be zero or negative economic effect.

So we do not recommend acting on this option.

Option 3. Get a deduction by recalculating

This option is being promoted by officials.

True, their explanations relate to deductions of VAT paid on advances when switching to special regimes

(USN, UTII). But, as we noted above, the logic of reasoning is the same both when exempting from VAT and when switching to special regimes.

In letter dated September 10, 2001 No. 04-03-11/125, the Ministry of Finance expressed the opinion that recalculations with the budget for VAT

, paid to the budget on advances received in the tax period in which the company was a VAT payer, are possible after

recalculations with customers

(customers should return the VAT amounts on advances received paid to the budget).

Later, in a letter dated June 22, 2004 No. 03-02-05/2/41, officials also indicated that the VAT amounts paid to the budget from prepayment amounts are subject to refund based on the results of recalculations with the buyer

.

And two years ago the Federal Tax Service of the Russian Federation spoke on this topic.

According to tax authorities, if persons who are VAT taxpayers received advance payments in the corresponding tax period, from which the amount of VAT was calculated and paid to the budget in the prescribed manner, and goods were shipped (work performed, services provided) on account of these advance payments after the transition to a simplified taxation system or to the payment of UTII (i.e. in the period when they were not VAT payers), then the right to deduct VAT amounts calculated and paid from advance payments does not arise

.

But if changes

into the relevant agreement and refund of VAT amounts to buyers, VAT amounts calculated by sellers (who are VAT taxpayers) and reflected in the VAT return from the amounts of advance or other payments for the supply of goods (performance of work, provision of services) carried out in the period after the sellers switched to simplified taxation system or for payment of UTII, are accepted for deduction

in the last tax period

before the transition to a simplified taxation system or for payment of UTII (see letter of the Federal Tax Service of the Russian Federation dated November 24, 2005 No. MM-6-03 / [email protected] ).

That is, the tax authorities, in essence, offer to return

to the buyer part of the advance payment and indicate in the contract that the new price of the goods (excluding VAT) is equal to the price originally established in the contract

minus VAT

(for example, old price = 118 rubles (including VAT 18 rubles), new price = 100 rub.).

Let us remind you that the possibility of deducting VAT amounts calculated and paid by sellers from advance payment amounts, in cases of changes in conditions or termination of the relevant contract and the return of the corresponding amounts of advance payments, is provided for in clause 5 of Art. 171 Tax Code of the Russian Federation

.

Thus, tax authorities believe that recalculations with the buyer and tax deduction for the amount of VAT from the prepayment should be made by the seller before the transition to the simplified tax system, UTII

(and equally -

until the moment of release

from the duties of a VAT payer).

Your company did not make such recalculations and did not declare VAT on the advance for deduction in the last period before receiving the exemption.

Therefore, this option is not applicable in your case.

By the way, the Federal Antimonopoly Service of the Ural District, in resolution dated November 29, 2004 No. F09-5089/04-AK, recognized that a company has the right to receive a deduction of the amount of VAT from an advance payment even if the recalculation with the buyer and the deduction of VAT were made after the company switched to the simplified tax system

(that is, it ceased to be a VAT payer).

However, firstly, this solution is the only one that we were able to find, and secondly, the economic effect of all these operations will be zero

(the company will deduct the amount of VAT that it gives to the buyer).

It is advisable to use the third option only for those companies that are switching to the simplified tax system (then the amount of the advance payment will be taken into account when calculating the tax base for the single tax without VAT

).

In your situation, it is not advisable to act on this option.

Option 4. Leave everything as is

That is, do not claim VAT for deduction, do not make recalculations with the buyer, etc.

As we saw above (see option 3), in letter dated November 24, 2005 No. MM-6-03 / [email protected] the Federal Tax Service of the Russian Federation explains that those sellers who did not recalculate with buyers have the right to deduct VAT No.

So, leaving everything as it is, you will not arouse the suspicions of the tax authorities.

In accounting, the amount of VAT on the advance received will be reflected in the following entries.

For example, the advance amount is 118 rubles.

18 rubles was charged and paid to the budget on the amount of the advance received.

. (118 RUR: 118 x 18).

After receiving VAT exemption, goods were shipped in the amount of 118 rubles.

DEBIT 51 CREDIT 62, subaccount “Advances received”

– 118 rub.

– advance payment has been received from the buyer;

DEBIT 62, subaccount “Advances received” CREDIT 68, subaccount “VAT”

– 18 rub.

– VAT is charged to the budget on the advance;

DEBIT 68, subaccount “VAT” CREDIT 51

– 18 rub.

– VAT was paid to the budget on the advance;

DEBIT 62 CREDIT 90

– 118 rub.

– goods are shipped to the buyer;

DEBIT 91 CREDIT 62, subaccount “Advances received”

– 18 rub.

– VAT previously calculated on the amount of the prepayment received is written off as expenses;

DEBIT 62, subaccount “Advances received” CREDIT 62

– 118 rub.

– the advance amount is offset against payment for goods.

If you calculate VAT on advances received by entering: DEBIT 76, subaccount “VAT on advances” CREDIT 68

, then your entries will be like this:

DEBIT 51 CREDIT 62, subaccount “Advances received”

– 118 rub.

– advance payment has been received from the buyer;

DEBIT 76, subaccount “VAT on advances” CREDIT 68, subaccount VAT

– 18 rub.

– VAT is charged to the budget on prepayment;

DEBIT 68, subaccount “VAT” CREDIT 51

– 18 rub.

– VAT was paid to the budget on the advance;

DEBIT 62 CREDIT 90

– 118 rub.

– goods are shipped to the buyer;

DEBIT 91 CREDIT 76, subaccount “VAT on advances”

– 18 rub.

– VAT previously calculated on the amount of the prepayment received is written off as expenses;

DEBIT 62, subaccount “Advances received” CREDIT 62

– 118 rub.

– the advance amount is offset against payment for goods.

For profit tax purposes , other expenses related to production and sales

, include the amounts

of taxes

and fees, customs duties and fees accrued in the manner established by the legislation of the Russian Federation, with the exception of those listed in

Art.

270 (

clause 1, clause 1, article 264 of the Tax Code of the Russian Federation

).

According to paragraph 19 of Art. 270 Tax Code of the Russian Federation

When determining the tax base

, expenses in the form of taxes presented by the taxpayer

to the buyer

(acquirer) of goods (work, services, property rights) are not taken into account

Your company did not submit

, as evidenced by shipping documents (invoices marked “Excluding tax (VAT)”).

If you are not too lazy to also adjust the purchase and sale agreement concluded with the buyer, so that under the agreement the price of goods does not include VAT, then you can take into account the amount of VAT calculated on the advance received in other expenses on the basis of clause . 1 clause 1 art. 264 Tax Code of the Russian Federation

.

What to choose

Despite the fact that in the accounting literature you can find recommendations to act according to option No. 2 or No. 3, applying them, as we found out above, is inappropriate.

First option

beneficial for the company, but fraught with disagreements with tax authorities. It can be used if the amount of benefit (that is, VAT accepted for deduction, previously calculated on the prepayment amount) is large enough, but only on the condition that the company is ready to defend its interests in court.

If you doubt that you can win in court, leave everything as it is

(option 4), this is the least labor-intensive and safest option.