The property was received free of charge

Of course, tax authorities may suspect something is wrong and still try to attribute to your company the receipt of property free of charge. But you shouldn’t be seriously afraid of this: at any time you will be able to present a purchase and sale agreement, as well as documents confirming your intention to pay for the goods and the seller’s intention to receive your money (account reconciliation acts, letters of guarantee, etc.). In this case, officials will have no reason to collect tax on gratuitous income from your company. Arbitration courts in such situations, as a rule, support taxpayers (see, for example, Resolution of the FAS of the East Siberian District of September 27, 2001 N A33-4282/01-С3а-Ф02-2221/01-С1).

We recommend reading: How to pay a pension after death

Payment procedure and terms

The authorities of the constituent entities of the Russian Federation often pass various laws that slightly adjust the procedure and timing of tax collection.

Direct payment of tax by a citizen is carried out at a bank branch or using electronic resources.

Legislation undergoes periodic changes, therefore, when calculating the amount of tax, as well as when paying it, a citizen must be aware of the latest changes. To do this, you need to clarify the information on the website of the tax service or other government portals, as well as by personally contacting the tax office.

In some cases, the law partially or completely exempts a person from the obligation to pay this contribution. These cases are described in detail in the Tax and Civil Code of the Russian Federation.

How to avoid double taxation when accounting for property received free of charge

Clause 1 of Article 3 of the Tax Code of the Russian Federation contains a rule on the principle of equal taxation, which means that obtaining the same economic results entails the same burden. This principle is violated in a situation where one organization can include in expenses the costs incurred with funds received free of charge, while another cannot include in expenses the cost of property received free of charge. In this situation, the legislation placed taxpayers in an unequal position. In other words, the principle of equality is violated when legislation places one category of taxpayers in conditions that differ from the conditions provided for other taxpayers, in the absence of significant differences between them.

Let's talk about taxes

and property received free of charge, taxes are calculated depending on the chosen policy in the organization. So, with the general system, the rate is 20%, with the simplified taxation system there are 2 positions. The simplest formula works if the company operates on a system of paying 6% of various types of revenue, including unrealized income.

If a businessman uses a system in which 15% is paid on the difference between profits and costs, then the formula in this case becomes more complicated. The price of property acquired free of charge is added to other types of revenue. Documented costs are then deducted from the amount received and the tax is calculated based on a rate of 15%. If an organization receives property free of charge, the assessment of unrealized income is carried out based on the market value of such assets. The provisions corresponding to this procedure are prescribed in the Tax Code of the Russian Federation. In some cases, cost data must be officially confirmed (as an option for conducting an assessment when contacting independent experts).

Individuals have the right to transfer various types of property to each other, and if they do not want, then mandatory additional registration is not provided. For organizations this principle is not relevant; they are required to adhere to a regulated procedure at the legislative level.

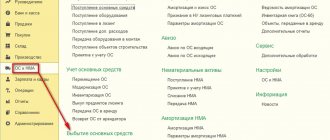

Free receipt of fixed assets

Also, organizations and entrepreneurs using the simplified tax system do not charge VAT on gratuitous transfers. Ordinary citizens do not do this either (Article 143 of the Tax Code of the Russian Federation). However, the tax will have to be paid by the donor, who is the payer of UTII. The fact is that this special regime applies to certain types of business activities. They are listed in clause 2 of Article 346.26 of the Tax Code of the Russian Federation. And with the gratuitous transfer of an object, a single tax does not arise. Thus, this operation falls under OSNO and the transferring organization (individual - individual entrepreneur) must calculate VAT from it. Similar explanations can be found in letters from the Ministry of Finance of Russia: dated 08/01/2007 No. 03-11-04/3/307, dated 07/27/2007 No. 03-11-04/3/298, dated 02/09/2007 No. 03-11-05/28, dated 03/27/2006 No. 03-11-04/3/155, dated 03/02/2006 No. 03-11-04/3/104, etc.

We recommend reading: How to remove a previously registered land plot from cadastral registration

How to calculate personal income tax when receiving real estate free of charge

When receiving real estate free of charge, personal income tax should be determined based on the cadastral value of the donated property. The Federal Tax Service warns about this based on the results of consideration of the taxpayer’s complaint.

Let us remind you that personal income tax is assessed on income in the form of real estate received as a gift from a person who is not a family member or close relative.

The Federal Tax Service supported the decision of the tax authorities to assess additional personal income tax to the taxpayer, who independently determined the tax base for personal income tax for 2015 based on the inventory value of donated objects. The taxpayer considered that the Tax Code of the Russian Federation does not have provisions establishing the procedure for calculating personal income tax based on the cadastral value of real estate received as a gift.

The tax authorities, based on the results of a desk audit of the declaration, indicated that the amount of income received in the form of real estate should be determined based on the cadastral value of the latter, reflected in the Unified State Register of Real Estate.

The Federal Tax Service supported this position and indicated that for a residential building received by an individual as a gift, the inventory value at the time of submission of the declaration could not be established, since from January 1, 2013, Federal Law No. 221-FZ of July 24, 2007 abolished its calculation on the state level. At the same time, the cadastral value of the disputed property was approved by a resolution of the regional government.

Thus, the tax base for personal income tax for objects received as a gift must be determined based on their cadastral value.

BUKHPROSVET

As a general rule, income in cash and in kind received from individuals as a gift is exempt from personal income tax. The exception is cases of donation of real estate, vehicles, shares, shares and shares.

Donated real estate is not subject to personal income tax if the donor and recipient are family members or close relatives. For example, if the donor and donee are spouses, parents and children, including adoptive parents and adopted children, grandparents and grandchildren, full and half brothers and sisters.

Also, the following income of an individual (within 4,000 rubles) is not subject to personal income tax:

- the cost of gifts received by individuals from organizations or individual entrepreneurs;

- the cost of prizes in cash and in kind received at competitions and competitions;

- the cost of any winnings and prizes received in competitions, games and other events for the purpose of advertising goods (works, services);

- the value of winnings received by gambling and lottery participants.

Free property and income tax

First of all, it is worth noting that for tax purposes it is necessary to distinguish between concepts such as “free receipt of property” and “free receipt of property for use.” In the first case, the property is transferred free of charge into the ownership of the receiving party forever. But in the second case, the transfer of ownership of the transferred object does not occur, and the transfer is carried out only for a certain period. That is, after a certain period of time, the receiving party will have to return the property to its owner.

Details

Let's talk about the differences between the donation and donation procedures

In accordance with the gift agreement, one party transfers (or undertakes to transfer) property free of charge. The main feature of this deal is that it is free of charge. Moreover, such a transfer may include certain restrictions on the use of the donated property by the new owner. For example, this may be a requirement regarding the use of property for certain general purposes. In this case, the transfer of property will most likely be recognized as a donation.

The concept of “donation” is much narrower than the transaction of gift.

These legal relations are not typical for business. Through such transactions, property (state or municipal) is mainly transferred in favor of a specific non-profit organization. It must be said that the agreement for the transfer of property free of charge as part of a gift means that the owner of the object of the gift directly transfers to the recipient the property and a certain assignment or right (for example, the release of an existing debt). If we talk about an agreement within the framework of a donation, granting concessions, as defined by lawyers, is impossible in this case. The basis of such a transaction is only the object or the preemptive right to it.

In addition, the difference lies in the status of the subject to whom the property is transferred free of charge. The circle of persons in respect of whom a transaction is made within the framework of a donation agreement is much narrower than in another case. According to the current legislation, the main subjects of legal relations within the framework of a donation as persons accepting property are recognized only as non-profit organizations, including government agencies, to which state property is transferred. Accordingly, it is impossible to make a donation to commercial organizations.

Let's consider the nuances of taxation when transferring property free of charge

Since a participant who owns 50% of the assets of an enterprise can transfer property to his company free of charge, in this case it will not be counted as non-operating income. At the same time, assets received by an organization free of charge are still subject to taxation. In the case of a transfer in the form of a donation, the transferred assets are not subject to tax, but we must remember that this procedure only applies to non-profit organizations.

So, non-operating income does not include:

— transfer of property free of charge, provided that the founder has 50% ownership of the company;

- if the subject of the transaction is a donation, which is possible if the party receiving the property is a non-profit organization.

In other cases, tax on the received property must be paid.

It is important to note that the property of an enterprise acquired free of charge will not be taxed if the company operates under a single tax on imputed income. In this case, no income plays a role in the organization’s work - it pays fixed contributions as tax.

Russian legislation provides for such a concept as a loan (transfer of property for free use). Transferring property for rent free of charge is a very popular type of transaction in modern business. The main advantage of such legal relations is the absence of obligations to pay taxes both to the owner and to the user of property received in the form of free acquisition for rent.

Accounting and tax accounting of property received free of charge

Property received under gratuitous use agreements and not accounted for on the organization’s balance sheet is not subject to property tax. When receiving an item of fixed assets under an agreement for gratuitous use, the borrowing organization takes it into account in off-balance sheet account 001 “Leased fixed assets” in the assessment specified in the agreement (Instructions for using the Chart of Accounts). Analytical accounting for this account is carried out by lessor, for each object of leased fixed assets (according to the lessor's inventory numbers).

General information

The fact is that, in accordance with Article 575 of the Civil Code of the Russian Federation, one commercial organization cannot give property (if its value is above 3,000 rubles) to another, as an official transaction.

At the same time, she can accept gifts from individuals, non-profit organizations, state and municipal structures.

In reality, this means that the founders of companies, who are individuals, have the right to transfer property free of charge in favor of their own commercial organizations. According to Article 251 of the Tax Code, property received by a company free of charge may not be included in unrealized income; accordingly, this type of asset does not increase the size of the tax base provided that the citizen owns more than half of the authorized capital of the enterprise. An important indicator is that the donor must have the above-mentioned share in the property of the company alone.

For example, if one citizen owns 30% of an enterprise, another – 40%, and they jointly own equipment, then the law prohibits them from donating it to their company without taxation. When drawing up a gift agreement, they need to pay income tax, in accordance with Article 250 of the Tax Code of the Russian Federation.

If the object of donation costs more than 3,000 rubles, then the receiving party is obliged to formalize the transfer of property as a purchase. In this case, the transfer of real estate free of charge is impossible, because the cost of the building cannot be less than 3,000 rubles. In fact, in the practice of doing business, there are schemes according to which it is actually possible to implement the gratuitous principle of transferring property, even if its value is greater than the established limit. For example, there is no restriction if the concern transfers property free of charge to one of its subsidiaries.