Marginal profit. Definition

Marginal profit (analogues: MR, marginal revenue, marginal income, contribution to coverage, additional revenue, marginal revenue, gross profit) is the difference between income from sales of the company’s products and variable costs. Income refers to the revenue that an enterprise received from the sale of its products, excluding VAT. Variable costs include the following costs: materials and raw materials, wages of workers, fuel, electricity, etc.

Take our proprietary course on choosing stocks on the stock market → training course

It should be noted that variable costs, unlike constant ones, change nonlinearly depending on production volume. The larger the production volume, the lower the variable costs and the higher the marginal profit. This effect is also called “scale effect” in economics. It is explained by the fact that when setting up mass production, the cost of production is significantly reduced.

Take our proprietary course on choosing stocks on the stock market → training course

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

What is contribution margin

The term “margin” is used to denote a financial indicator that reflects the level of maximum revenue received from the sale of certain products or services. Thanks to this analysis tool, the profitability of production of a certain category of commercial products or services is revealed. Thanks to the use of such tools, entrepreneurs have the opportunity to obtain information about the profitability of the enterprise.

Profit is the difference between income from sales of the enterprise's products and production expenses.

In order to obtain data that truly reflects the current state of affairs, it is necessary to correctly compile a production cost item . Contribution margin is the result of the difference between revenue and variable costs. When the level of profit exceeds variable costs, the enterprise can be called successful. Otherwise, the production of commercial products is carried out at a loss to the company.

The economic meaning of marginal profit in simple words

In each coefficient or indicator, one should, first of all, see its basic economic meaning. Thus, marginal profit shows what maximum profit a company can generate. The higher the marginal profit, the higher the company's ability to cover its fixed costs/expenses. Marginal profit is sometimes called the contribution to coverage, and is understood as how it affects the formation of the enterprise’s net profit and the coverage (financing) of fixed costs. The marginal profit indicator is used to estimate the amount of profit covering production costs both in general and for each type (range) of goods.

How is contribution margin determined?

There are several ways to determine marginal income:

- All direct costs and related expenses are deducted from the profit received from the sale of products;

- The amount of the enterprise's profit is added to all fixed costs.

There is also such a definition as: the average value of marginal expenses. This refers to the difference between average variable costs and the direct price of products. This is an important indicator. Since it indicates how much each unit of production contributes to covering production costs and subsequent profits.

The purpose of determining marginal income is to determine whether production is able to cover its fixed costs and ultimately make a profit. Production will be profitable if revenues are greater than the total sum of variable and fixed costs.

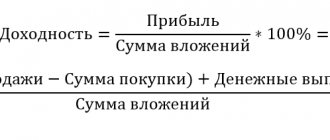

Formula for calculating the marginal profit of an enterprise

The formula for the gross marginal profit of an enterprise consists of two main indicators: revenue from sales of products and variable costs. Below is the calculation formula for the enterprise as a whole:

Contribution Margin = Revenue – Variable Costs;

In addition to calculating the marginal profit/income for the entire volume of production, the marginal profit of each type of product produced is also calculated. The marginal profit of each product is calculated as the difference between the sales/sales price and its cost.

Marginal profit nomencl. = Price – Cost;

Calculating the marginal profit for each product range produced allows you to exclude economically unprofitable products. Let's look at an example: we produce cement of various grades: M300, M400 and M500. Calculating the marginal profit for each brand allows you to highlight those that are not advisable to produce. The table below shows an example of comparison between different brands of cement.

| Cement brand | Selling price 50 kg. | Production cost 50 kg. | Marginal profit | conclusions |

| 300 rub. | 200 rub. | 100 rub. | Marginal profit is 100 rubles. | |

| 350 rub. | 300 rub. | 50 rub. | Marginal profit 50 rub. | |

| 400 rub. | 500 rub. | -100 rub. | Margin the profit is negative, it is not advisable to produce this product range. |

Take our proprietary course on choosing stocks on the stock market → training course

The marginal profit of an enterprise is formed by various groups of goods and products. This can be represented as a hierarchical diagram. Presentation in the form of such a diagram allows the analyst to conclude that the production of a product or group of products is inappropriate if their marginal profit is less than zero. The figure below shows the margin chart. profits for the enterprise as a whole, products that have a positive marginal profit are shown in green, and negative ones in red. This poses a task to the production and sales department about the need to change the income/cost of sales of this product/group.

Formula for calculating the MD coefficient

To determine the marginal profit, you will need internal accounting information for revenue, as well as fixed and variable costs. Some of this can be taken from the public income statement, but it is difficult to separate out fixed and variable expenses in operating expenses.

In general, the formula for determining the MS indicator is easy to use:

MS = ВрР – PerZ, where

ВрР – revenue from product sales;

PerZ – variable costs.

Reference! Often, as part of marginal analysis, specific MD or MD per unit of production is calculated, which involves dividing MS by the number of units of goods produced in physical terms.

Calculation of marginal profit in Excel based on the balance sheet

In the domestic balance sheet, the term gross profit is used instead of marginal profit. To calculate it, you must subtract Cost of Sales from Revenue (excluding VAT).

Gross profit = line 2110 – line 2120;

Analysis of changes in gross profit over the years allows us to make a forecast about the situation in production and sales of products. In this example, the balance sheet of OJSC “Surgutneftekhim” was considered. You can notice the positive dynamics of gross profit growth over the past five years.

Take our proprietary course on choosing stocks on the stock market → training course

Specific marginal profit

Sometimes it makes sense to use unit indicators to compare the profitability of several products. Specific marginal profit is the contribution margin from one unit of product, that is, the margin from a volume equal to one unit of product.

Marginal profit ratio

All calculated values are absolute, that is, expressed in conventional monetary units (for example, in rubles). In cases where an enterprise produces more than one type of product, it may be more rational to use the marginal profit ratio , which expresses the ratio of margin to revenue and is relative.

Calculation examples

Let's give an example of calculating marginal profit.

Suppose that a plastic container production plant produces three types of products: 1 liter, 5 liters and 10. It is necessary to calculate the marginal profit and coefficient, knowing the sales income and variable costs for 1 unit of each type.

Let us recall that marginal profit is calculated as the difference between revenue and variable costs, that is, for the first product it is 15 rubles. minus 7 rubles, for the second - 25 rubles. minus 15 rub. and 40 rub. minus 27 rub. - for the third. Dividing the obtained data by revenue, we get the margin ratio.

As we can see, the third type of product gives the highest margin. However, in relation to the revenue received per unit of goods, this product provides only 33%, in contrast to the first type, which provides 53%. This means that by selling both types of goods for the same amount of revenue, we will receive more profit from the first type.

In this example, we calculated the specific margin because we took data for 1 unit of production.

Let us now consider the margin for one type of product, but for different volumes. At the same time, let’s assume that with an increase in production volume to certain values, variable costs per unit of production decrease (for example, a supplier of raw materials makes a discount when ordering a larger volume).

In this case, marginal profit is defined as revenue from the entire volume minus total variable costs from the same volume.

As can be seen from the table, as volume increases, profit also increases, but the relationship is not linear, since variable costs decrease as volume increases.

Another example.

Suppose our equipment allows us to produce one of two types of products per month (in our case, 1 liter and 5 liters). At the same time, for 1L containers the maximum production volume is 1500 pcs., and for 5L containers - 1000 pcs. Let's calculate what is more profitable for us to produce, taking into account the different costs required for the first and second types, and the different revenues they provide.

As is clear from the example, even taking into account the higher revenue from the second type of product, it is more profitable to produce the first, since the final margin is higher. This was previously shown by the contribution margin coefficient, which we calculated in the first example. Knowing it, you can determine in advance which products are more profitable to produce at known volumes. In other words, the contribution margin ratio represents the percentage of revenue that we will receive as margin.

Analysis of the enterprise's marginal profit

Marginal profit analysis is carried out in order to determine the critical volume of production and sales of goods to cover variable costs. The analysis of marginal profit is similar to the analysis of the break-even point of an enterprise and is based on similar restrictions:

- Enterprise income and costs have a linear relationship.

- Prices for sold products do not change. Only under this condition can the amount of cash receipts from sales be determined in the future.

- The productivity of the enterprise does not change.

- Inventories of finished goods are small, as a result they do not affect future sales volumes. All products produced at the enterprise are immediately sold (sold).

- Stability of the external and internal environment. External macroeconomic factors have a sustainable impact. External factors include: the state’s financial policy towards enterprises, tax deductions, Central Bank interest rates, demand for products in the region and industry, etc. Internal factors within the enterprise itself do not have a dramatic impact on productivity. Internal factors include: production technology, wage rates, etc.

Take our proprietary course on choosing stocks on the stock market → training course

Relationship between break-even point and marginal profit

The break-even point is an important financial indicator of the enterprise, characterizing the critical level of production at zero profit; let us analyze its connection with marginal profit. The figure below shows this connection. At the break-even point, the amount of losses and profits are equal, while the marginal profit (margin) is equal to the cost of the cost of production (fixed costs), and the net profit is equal to zero. You can read more about the break-even point at an enterprise in my article “Break-even point. Formula. Example of model calculation in Excel. Advantages and disadvantages".

Graphical analysis of marginal profit includes the following areas:

- estimation of break-even volume of production/sales of products;

- determination of the profitability/loss zone of the enterprise,

- forecasting profit margins for various sales volumes;

- calculation of the critical level of fixed costs for the selected amount of marginal profit;

- minimum acceptable sales prices for products at a given volume of production, variable and fixed costs.

The problems with using this model are that in the future, production volumes are influenced by many factors, which distorts the linear relationship between production volume and sales.

Contribution Margin Analysis

Marginal profit and its calculation form the basis of break-even analysis. Break-even analysis can be carried out both for the enterprise as a whole and for individual products and types of work.

The idea of break-even analysis is to calculate the volume of output (number of goods) at which the sum of fixed and variable costs will be equal to sales revenue.

The volume of production that will ensure break-even can be calculated using the following formula:

V × C = V × Rper + Rpost,

V = Rpost / (C – Rper),

Where:

V is the volume of production or the number of goods;

P — selling price of 1 unit of product or product;

Rper - variable costs for the production of 1 unit of production or the cost of 1 unit of goods;

Rpost is the total amount of fixed expenses.

As can be seen from the above formula, the production volume that ensures break-even production and sales of products is equal to fixed costs divided by the marginal profit from 1 unit of production.

Service companies, as well as manufacturing companies, can use break-even analysis to improve business management efficiency.

For example, if an organization provides accounting services or software configuration, the unit of service delivery will be man-hour. The price of 1 man-hour is determined in the contract with the client. Variable expenses will be the salary for 1 hour of work of a specialist providing services. To ensure break-even, you need to calculate how many man-hours will cover all fixed costs, incl. expenses for renting an office, paying administrative staff, etc.:

Kch/h = Rpost / (C - Zch),

Where:

Kch/h - number of man-hours;

Rpost - the total amount of fixed expenses;

P — the price of 1 man-hour, established in the contract with the client;

Zch is the salary of a specialist who directly provides the service.

The principles of break-even analysis form the basis for calculating the payback of various projects.

Break-even analysis is not the only type of analysis that uses contribution margin.

Calculation of margin is necessary for making management decisions when determining the range of products produced and goods sold. Analysis of marginal profitability and demand for various product groups helps companies forecast their activities. The industry average marginal profit, as well as the marginal profit of competitors, is a source of information for forming the company's pricing policy.

Are there recommended contribution margins and how can you improve your gross margin?