At the end of last year, further amendments were made to the Tax Code of the Russian Federation. One of the innovations of the Federal Law of December 30, 2006 N 268-FZ (hereinafter referred to as Law N 268-FZ) is to secure the right of the taxpayer to include in the tax base for corporate income tax the costs of acquiring the right to land plots. Since January 1, 2007, the issues of including expenses for the acquisition of state and municipal lands as expenses and the formation of a financial result upon their subsequent sale, as well as tax accounting of expenses for the acquisition of rights to conclude a land lease agreement, are regulated by Art. 264.1 Tax Code of the Russian Federation.

Acquisition of land plots

In accordance with Art. 264.1 of the Tax Code of the Russian Federation, expenses for the acquisition of land plots from lands in state or municipal ownership, on which buildings, structures, structures are located, or which are acquired for the purpose of capital construction of fixed assets, can now be included in expenses for corporate income tax when provided that the taxpayer entered into an agreement to purchase such plots during the period from January 1, 2007 to December 31, 2011. The innovation is largely related to the re-registration of land rights. Thus, Federal Law dated October 25, 2001 N 137-FZ “On the entry into force of the Land Code of the Russian Federation” establishes the obligation of legal entities, with the exception of those specified in paragraph 1 of Art. 20 of the Land Code of the Russian Federation, re-register the right of permanent (perpetual) use of land plots to the right to lease land plots or acquire land plots in ownership before January 1, 2008. Take advantage of the provisions of Art. 264.1 of the Tax Code of the Russian Federation will also be available to taxpayers purchasing land plots for construction in accordance with Art. Art. 30 - 32 Land Code of the Russian Federation.

The legislator provided the taxpayer with the opportunity to choose the option of writing off such expenses, which is subject to enshrinement in the accounting policy for tax accounting purposes.

First option. Expenses are recognized evenly over a period determined by the taxpayer independently, but not less than 5 years.

Second option. Expenses are recognized in the reporting (tax) period in an amount not exceeding 30% calculated in accordance with Art. 274 of the Tax Code of the Russian Federation of the tax base of the previous tax period until the full amount of these expenses is fully recognized. For calculation purposes, the tax base of the previous tax period is determined without taking into account the amount of expenses of the specified tax period for the acquisition of rights to land plots.

Regardless of the write-off options used when purchasing land plots on an installment plan, the period of which exceeds the (actual) write-off period determined by the taxpayer, such expenses are recognized as expenses of the reporting (tax) period evenly over the period established by the agreement (clause 1, clause 3, art. 264.1 Tax Code of the Russian Federation). Expenses for the acquisition of land are included in other expenses associated with production and (or) sale from the moment of documented submission of documents for state registration of the specified right. Such a document is a receipt of receipt by the body carrying out state registration of rights to real estate and transactions with it, documents for state registration of these rights (clause 2, clause 3, article 264.1 of the Tax Code of the Russian Federation).

Writing off expenses for the acquisition of land in tax accounting will lead to permanent differences in accounting, since, according to clause 17 of PBU 6/01 “Accounting for fixed assets,” land plots are not subject to depreciation.

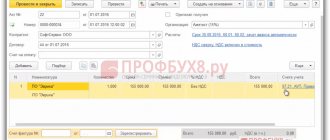

Example 1. Kraskor LLC purchased a plot of land from the city worth 500,000 rubles. In February 2007, the documents were submitted for state registration. The accounting policy for tax accounting purposes of Kraskor LLC stipulates that “expenses for the acquisition of land plots in municipal or state ownership are recognized in the reporting (tax) period in an amount not exceeding 30% of the calculated tax base of the previous tax period up to full recognition of the entire amount of these expenses.”

To reflect transactions in accounting, the following calculation is made (Table 1).

Table 1

| Year | Tax base of the previous tax period, rub. | Recognized land expenses, rub. | Tax base of the current tax period, rub. | PNA amount, rub. |

| 2006 | — | — | 800 000 | — |

| 2007 | 800 000 | 240,000 (800,000 x 30%) | 500 000 | 57,600 (240,000 x 24%) |

| 2008 | 740 000 (500 000 + 240 000) | 222,000 (740,000 x 30%) | -300 000 | 53,280 (222,000 x 24%) |

| 2009 | 0 0 > (240 000 — 300 000) | 0 | 200 000 | 0 |

| 2010 | 200 000 | 38,000 200,000 x 30% > (500,000 - 240,000 - 222,000) | — | 9,120 (38,000 x 24%) |

| Total | X | 500 000 | X | 120 000 |

The ban on attributing expenses to the acquisition of privately owned land plots has never been lifted. As before, land and other environmental management facilities are not subject to depreciation (clause 2 of Article 256 of the Tax Code of the Russian Federation). At the same time, according to paragraphs. 3 p. 1 art. 254 of the Tax Code of the Russian Federation, the taxpayer’s expenses for the acquisition of property that is not depreciable are included in material expenses in the full amount as it is put into operation.

Conflicting judicial practice has developed on the issue of including land acquisition costs in the tax base. For example, in favor of taxpayers on the basis of paragraphs. 3 p. 1 art. 254 of the Tax Code of the Russian Federation, decisions were made by the FAS CO in Resolution dated 08/17/2004 N A08-2355/04-21-16, FAS ZSO in Resolution dated 07/13/2005 N F04-4368/2005(12952-A75-33); in favor of the tax authority - FAS UO in Resolutions dated March 15, 2005 N F09-756/05-AK, dated November 10, 2005 N F09-756/05-S7; FAS PO dated 08/10/2006 N A65-11934/2005-SA2-11 (ground: clause 2 of article 256 of the Tax Code of the Russian Federation).

To assess tax risks in the judicial resolution of a dispute, of indisputable interest is the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 14, 2006 N 14231/05, according to which the costs of acquiring land plots do not form the tax base, since on the basis of clause 2 of Art. 256 of the Tax Code of the Russian Federation, land is classified as objects not subject to depreciation. Absence in ch. 25 of the Tax Code of the Russian Federation, the rules on accounting for expenses for the acquisition of land plots by calculating depreciation amounts deprive the taxpayer of the opportunity to reduce the tax base for income tax by the corresponding amounts.

Except for the cases specified in Art. 264.1 of the Tax Code of the Russian Federation, current legislation provides the taxpayer with the opportunity to write off the cost of acquired land only at the time of its sale on the basis of paragraphs. 2 p. 1 art. 268 Tax Code of the Russian Federation.

Acquisition of property

A developer can obtain ownership of a land plot by purchasing it under a purchase and sale agreement, an exchange (barter) agreement, receiving it as a contribution to the authorized (share) capital, or receiving it free of charge.

In this case, the object of the transaction can only be those land plots that have undergone state cadastral registration (Clause 1, Article 37 of the Land Code of the Russian Federation).

The owner of a land plot has the right to use it in accordance with the type of permitted use of the land plot specified in the State Real Estate Cadastre (Clause 1, Article 263 of the Civil Code of the Russian Federation, Article 37 of the Town Planning Code of the Russian Federation). Types of permitted use of land plots for capital construction are established in relation to the territorial zone.

Owners should take into account that the type of permitted use of the land plot determines the possibility of reconstructing existing buildings, as well as new construction on the land plot. It influences which buildings (buildings of what functional purpose) can be created on a given land plot. So, for example, a production workshop located on a land plot with the type of permitted use “for industrial production” cannot be reconstructed into a shopping center without changing the type of permitted use of this land plot.

To summarize information on the costs of the paid acquisition of a land plot, use account 08 (sub-account 08-1 “Acquisition of land plots”) (clause 27 of the Methodological Recommendations approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

Otherwise, the procedure for recording the acquisition of a land plot in accounting depends on who finances the construction:

- attracted investor;

- developer who acts as an investor.

If the cost of a land plot acquired for the construction of an object is reimbursed at the expense of attracted investors (shareholders), the developer does not have the right to recognize it as an object of fixed assets, since in this case it does not comply with the conditions of paragraph 4 of PBU 6/01. Reflect the acquisition of land with the following entries:

Debit 08-1 Credit 60 – a plot of land was purchased for construction at the expense of investors (shareholders).

This procedure is established by the Instructions for the chart of accounts.

After completion of construction, the developer transfers this plot to investors or shareholders in accordance with the agreement and its cost is written off as settlements with them. For more information about this, see How to register and record the disposal of land for construction.

If the construction is financed by a developer and he is constructing an object for sale, then he also does not have the right to recognize the land plot as part of fixed assets. In this case, the site does not meet the conditions provided for in paragraph 4 of PBU 6/01. Reflect the acquisition of land with the following entries:

Debit 08-1 Credit 60 – a plot of land was purchased for construction for sale.

If the construction is financed by a developer who is building a facility for himself, then he includes the land plots received into ownership (except for lands acquired for resale) in accounting as part of fixed assets if all the necessary conditions are met (clauses 4, 5 of PBU 6/ 01). This operation is reflected by transactions:

Debit 08-1 Credit 60 – acquired land for construction;

Debit 01 Credit 08-1 – the acquired land plot is reflected as part of fixed assets.

The procedure for determining the initial cost, documentation and reflection in accounting depend on the method of obtaining ownership of land plots:

- for a fee;

- under a barter agreement;

- as a contribution to the authorized capital;

- free of charge.

At the same time, take into account the peculiarities of accounting for fixed assets that require state registration.

There are no special unified forms for registering land plots in the legislation. Therefore, use for this form No. OS-1, approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

The peculiarity of accounting for land plots is that they are not subject to depreciation, their original cost is not repaid (paragraph 5 of clause 17 of PBU 6/01).

Sales of land plots

Profit (loss) from the sale of previously acquired municipal or state land is defined as the difference between the sale price and the costs not reimbursed to the taxpayer associated with the acquisition of the right to this plot. Unreimbursed costs mean the difference between the taxpayer’s costs for acquiring the right to a land plot and the amount of expenses taken into account for tax purposes until the said right is exercised.

According to paragraphs. 3 clause 5 art. 264.1 of the Tax Code of the Russian Federation, the loss received by the taxpayer is included in other expenses in equal shares within the period established by the taxpayer, in accordance with paragraphs. 1 clause 3 art. 264.1 of the Tax Code of the Russian Federation (remember that this norm defines options for tax accounting of land expenses), and the actual period of ownership of this plot. A careful reading of this norm raises a number of questions.

Firstly, how can taxpayers who have adopted in their accounting policy the option of writing off expenses in an amount not exceeding 30% of the tax base of the previous period determine the write-off period? In this case, the taxpayer will not be able to comply with the requirement of uniform inclusion of losses in expenses.

Secondly, how to calculate the period for writing off a loss for taxpayers who have established in their accounting policies a uniform method of recognizing the costs of acquiring land: minus or taking into account the actual period of ownership of the land plot.

It can be assumed that in the first case, taxpayers will be able to write off the loss from sales in the amount of 30% of the tax base without tax risks in the same manner as the costs of its acquisition before sale. In turn, taxpayers using the first accounting option will be able to “safely” determine the period for writing off the loss as the difference, and not the sum of the terms.

If the sale of a land plot occurs together with the sale of buildings (structures) located on it, then the profit (loss) from the sale of such property is accepted for tax purposes in the general manner established by Chapter. 25 Tax Code of the Russian Federation.

Let us recall that operations for the sale of land plots (shares in them) are not recognized as subject to VAT (clause 6, clause 2, article 146 of the Tax Code of the Russian Federation).

Example 2. We take the data from example 1 as a basis. Let us assume that at the end of 2007, Kraskor LLC decided to sell a land plot at a price of 600,000 rubles. The financial result from the sale of a land plot for tax purposes will be determined by the formula:

Sales price - (Acquisition costs - Accounted expenses in tax accounting before sale). Its amount will be 340,000 rubles. [600,000 - (500,000 - 240,000)].

Rent

The procedure for transferring land plots for lease is regulated by Article 22 of the Land Code of the Russian Federation.

A developer can lease land for construction:

- under a lease agreement with the owner of the land plot (including lands from state and municipal property);

- through the assignment of lease rights by the primary tenant (including lands from state and municipal property).

A land lease agreement concluded for a period of one year or more is subject to mandatory state registration (clause 1 of Article 164 and clause 2 of Article 609 of the Civil Code of the Russian Federation, clause 2 of Article 25 and clause 2 of Article 26 of the Land Code of the Russian Federation) . For registration of such transactions, organizations are charged a state duty of 15,000 rubles. (Subclause 22, Clause 1, Article 333.33 of the Tax Code of the Russian Federation).

Situation: is it necessary to register an agreement on the assignment of the rights of a tenant of a land plot to a third party? The lease agreement under which the rights were transferred has undergone mandatory state registration.

Yes need.

The transfer of the tenant's rights to a third party does not require the conclusion of a new lease agreement. Such a concession can be formalized, for example, by a lease agreement. This conclusion follows from paragraph 5 of Article 22 of the Land Code of the Russian Federation and paragraph 2 of Article 615 of the Civil Code of the Russian Federation.

According to paragraph 1 of Article 164 of the Civil Code of the Russian Federation, transactions with land and other real estate are subject to state registration in the cases and in the manner provided for in Article 131 of the Civil Code of the Russian Federation and Law No. 122-FZ of July 21, 1997.

The Civil Code provides that assignment of claims and transfer of debt, which are based on transactions subject to state registration, are also subject to state registration (clause 2 of Article 389 and clause 2 of Article 391 of the Civil Code of the Russian Federation).

Thus, if the lease agreement was subject to mandatory state registration, then the agreement on the assignment of the rights of the tenant of the land plot under such an agreement to a third party must also be registered. At the same time, for registering the transfer of lease rights, the organization must pay a state duty in the amount of 15,000 rubles. (Subclause 22, Clause 1, Article 333.33 of the Tax Code of the Russian Federation).

A similar point of view is expressed in the letter of the Ministry of Finance of Russia dated October 12, 2009 No. 03-05-05-03/12.

Documentation and recording of the receipt of land plots under a lease agreement occurs in the same way as for any other property. For more information about this, see How a tenant can reflect the receipt of property under a lease agreement in accounting.

The developer may enter into a lease agreement for lands that are in municipal (state) ownership. He receives this right at an auction. In this case, he bears the costs of acquiring the right to conclude such an agreement (Article 30.1 of the Land Code of the Russian Federation).

The costs of acquiring the right to conclude a lease agreement for a land plot intended for construction are included in the cost of construction as a debit to account 08 (clause 1.2 of the Regulations on Accounting for Long-Term Investments, clause 8 of PBU 6/01).

Free urgent use

The transfer of land for free, fixed-term use is regulated by Article 24 of the Land Code of the Russian Federation.

As a rule, on this basis, land plots are transferred for the following purposes:

- for the construction of infrastructure facilities;

- for housing construction;

- for the construction of real estate at the expense of budget funds under a state (municipal) contract.

If an agreement for free, fixed-term use of a land plot is concluded for a period of one year or more, then such a transaction is subject to mandatory state registration (clause 1 of Article 164 and clause 2 of Article 609 of the Civil Code of the Russian Federation, clause 2 of Article 25 and clause 2 of Art. 26 of the Land Code of the Russian Federation). For registration of such transactions, organizations are charged a state duty of 15,000 rubles. (Subclause 22, Clause 1, Article 333.33 of the Tax Code of the Russian Federation).

Reflect and formalize the operation of obtaining land plots for free use in accounting in the same way as for any other property. For more information about this, see How to record the receipt of property for free use in accounting.